Seven years of ups and downs, OpenSea still chose to launch a token

TechFlow Selected TechFlow Selected

Seven years of ups and downs, OpenSea still chose to launch a token

OpenSea's SEA token could be the key to the platform's self-rescue and might also become a driving force in pushing the NFT market out of its downturn.

Authors: Babywhale, Glendon, Techub News

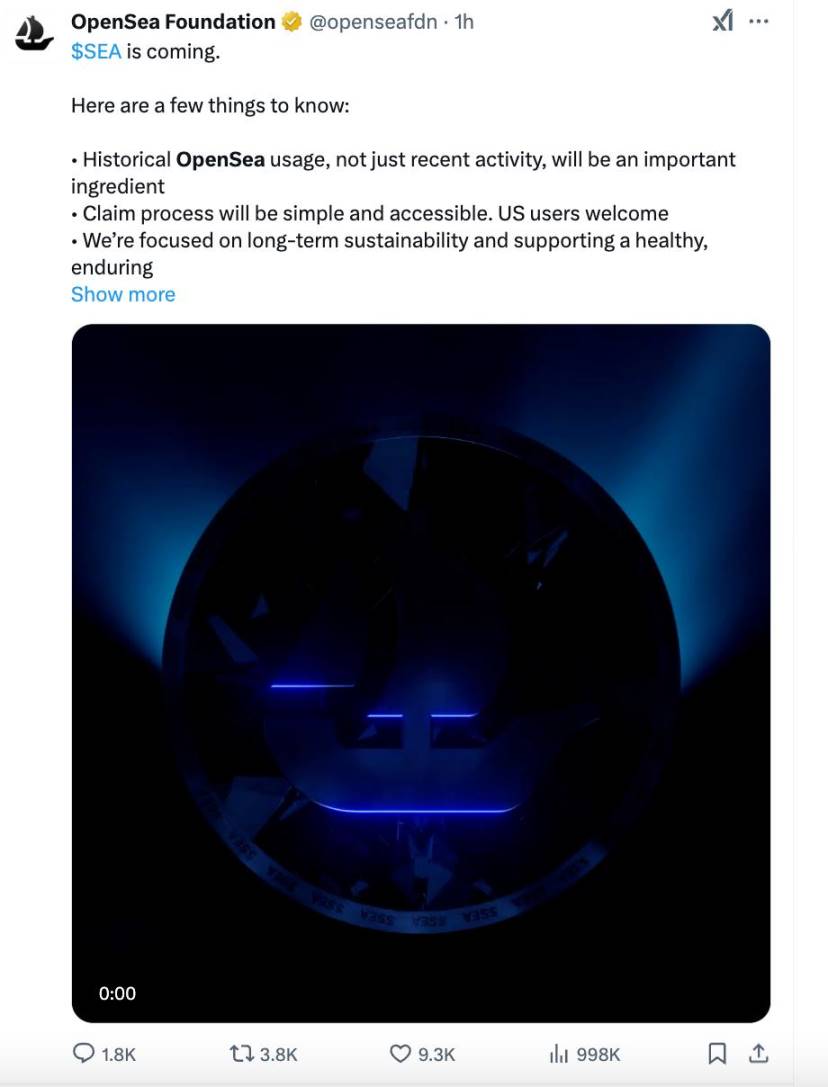

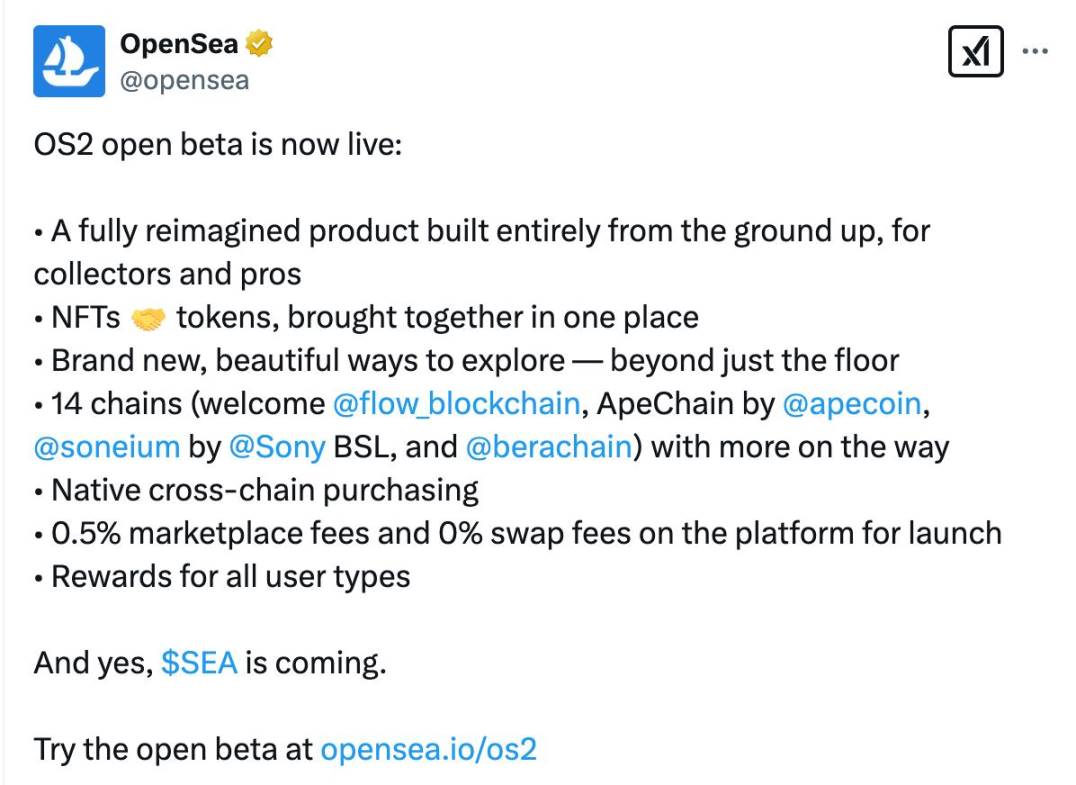

On the evening of February 13, OpenSea announced on X the launch of the OS2 public beta version, the introduction of its platform token SEA, and hinted at an upcoming airdrop. Although specific timelines and details have not yet been released, this announcement immediately stirred significant excitement among seasoned crypto users. Within just one hour, comments and reposts on the post surpassed a thousand, with community discussions surging.

OpenSea CEO Devin Finzer also tweeted, "The OS2 we're launching isn't just a new product, and SEA isn't just another token—it's an entirely new OpenSea built from the ground up." There had previously been rumors that OpenSea’s new version would adopt a trading-centric UI inspired by Blur.

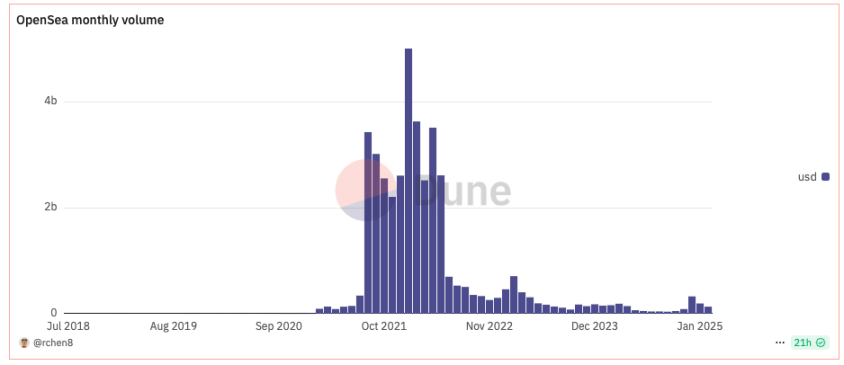

OpenSea is finally issuing a token. If this had happened three years ago, it would have undoubtedly sparked massive celebration across the crypto world. But times have changed. Today’s crypto market is dominated by MemeCoins, and NFTs are already considered “outdated.” More disheartening still, even within the NFT space alone, OpenSea no longer holds its former glory. According to Dune data, OpenSea’s trading volume in January was only $195 million—down 96% from its peak of $5 billion in early 2022—and its annual revenue has shrunk to approximately $33.26 million.

Additionally, according to nftpulse data, as of this writing, OpenSea’s market share over the past 30 days has plummeted from 95% in December 2021 to just 29%. Meanwhile, OpenSea’s valuation has declined from a peak of $13.3 billion in early 2023 to around $1.5 billion, and at one point, it was even forced into considering a sale.

So how did OpenSea, once the dominant leader in the NFT marketplace, reach such a state?

Let us review OpenSea’s brief history to understand how it rose rapidly and then fell from dominance in the competitive NFT market. Finally, let’s discuss what impact OpenSea’s decision to issue a token now might have on the overall NFT market landscape.

Early Days: Surviving in the NFT Wilderness

Undoubtedly, among Web3 startups, OpenSea stands out as a legendary company that started from zero. Particularly between 2021 and 2022, it grew at an astonishing pace from obscurity to a $13.3 billion “unicorn,” firmly securing its position as the top NFT marketplace. However, behind this success lies a dramatic tale of market ups and downs. Therefore, I believe OpenSea’s rise and fall can also be seen as a microcosm of the NFT industry’s journey from chaotic growth to rational competition.

In September 2017, Devin Finzer and Alex Atallah secured seed funding from the renowned startup accelerator Y Combinator for their innovative project “Wificoin,” which aimed to use cryptocurrency to pay for shared WiFi access—unrelated to the NFT space.

However, in November 2017, Dapper Labs officially launched CryptoKitties, an Ethereum-based digital cat game, sparking a speculative frenzy. Fierce bidding drove prices of CryptoKitties NFT collectibles as high as 247 ETH—worth about $118,000 at the time.

That same year, CryptoKitties’ founder and CTO Dieter Shirley introduced the concept of NFTs (Non-Fungible Tokens), leading to the proposal of EIP-721, the standard defining NFTs. (Techub News note: After discussion and refinement, EIP-721 was formally adopted in 2018, becoming today’s ERC-721 protocol standard.)

The emergence of this standard shifted Devin Finzer and his co-founder’s entrepreneurial direction. They decided to abandon the “Wificoin” project and founded the NFT marketplace Opensea in February 2018.

According to The Generalist, Devin Finzer said: “We saw the potential in the NFT market because there was now a standard for digital items, and everything emerging after CryptoKitties would follow this standard.”

At that time, blockchain and cryptocurrencies were still in their early stages. The concept of NFTs had not yet gained widespread recognition, and the entire NFT market was virtually barren.

Even so, Opensea wasn’t the only NFT marketplace at the time. Rare Bits, launched almost simultaneously on Product Hunt and branding itself as a “zero-fee eBay-like marketplace for crypto assets,” emerged as a stronger competitor. Interestingly, OpenSea similarly described itself as “the eBay for crypto goods.” (Techub News note: eBay is an online auction and shopping website allowing people worldwide to buy and sell items.)

In May 2018, OpenSea raised $2 million from investors including 1confirmation, Founders Fund, Coinbase Ventures, and Blockchain Capital. However, Rare Bits had secured $6 million in funding a month earlier, backed by Spark, First Round, and Craft.

From a VC perspective, OpenSea appeared disadvantaged. Yet Richard Chen, partner at 1confirmation, favored OpenSea, stating: “Rare Bits didn’t understand NFTs as well as OpenSea did. OpenSea’s team was leaner and more combat-ready. Devin and Alex excelled at discovering new NFT projects and getting them listed on OpenSea. And when we invested in April 2018, OpenSea’s trading volume was already four times that of Rare Bits.”

Beyond funding, the two companies pursued different sales strategies. OpenSea maintained a 1% transaction fee (later gradually increased to 2.5%), ensuring stable revenue to sustain operations. In contrast, Rare Bits adopted a “zero-fee” model in 2018, even promising to refund users' gas fees, aiming to attract traffic by lowering user costs. This strategy initially drew attention and seemed more user-friendly, but proved unsustainable due to high operating costs—especially as the “crypto winter of 2018” set in.

During this period, to expand its user base and boost trading volume, Rare Bits attempted to extend its business beyond NFTs into broader virtual goods, such as launching “digital stickers” with anime platform Crunchyroll and exploring non-NFT assets like gaming items.

Unlike Rare Bits’ diversification, OpenSea remained focused, concentrating solely on improving its NFT trading business.

Yet before dawn broke, OpenSea also struggled. Its early trading volume remained low, limited to only a few NFT projects like CryptoKitties and CryptoPunks.

According to Titanium Media, by March 2020, the team consisted of just five members, with monthly trading volume around $1 million. With a 2.5% commission rate, OpenSea earned only about $28,000 per month. Without a $2.1 million strategic investment from Animoca Brands and others at the end of 2019—a literal lifeline—the startup might have vanished during the industry’s winter. As for Rare Bits, it showed signs of collapse as early as 2019 and completely exited the market by 2020.

In hindsight, OpenSea’s rise to dominance was largely due to its focus on core business and lean operations. Devin Finzer once said in an interview: “We’re committed to long-term development in this field, regardless of short-term growth. We want to build a decentralized marketplace for NFTs and hope it lasts three to four years.”

By late 2020, the dawn was near. This year marked a turning point for OpenSea. As the crypto market began recovering, OpenSea leveraged its first-mover advantage in the NFT space and reaped early benefits, with trading volume climbing rapidly. Dune data shows that in October 2020, OpenSea’s monthly trading volume reached about $4.18 million—up 66% from $2.46 million in September.

To offer more diverse NFT assets and attract broader liquidity, OpenSea fully embraced an “open marketplace” product strategy.

In December 2020, OpenSea launched a new feature called “Collection Manager,” allowing users to mint NFTs without fees (gas fees borne by buyers). The platform dubbed this “lazy minting,” decoupling on-chain issuance from metadata. Users could upload item metadata to OpenSea for free, and the NFT would only be minted as an on-chain ERC-1155 token upon its first sale.

This feature significantly lowered the barrier for creators. Combined with OpenSea’s no-review listing policy, every user could directly mint and issue NFTs on the platform. Beyond this advantage, OpenSea offered the widest range of trading categories among similar platforms—including avatars, music, domains, virtual worlds, trading cards, art, and more—maximizing creator supply and attracting growing numbers of primary and secondary market users.

Objectively speaking, the pent-up potential of the NFT market contributed to OpenSea’s later success, but OpenSea itself played a crucial role in accelerating the sector’s explosive growth.

In 2021, the crypto market entered a full-blown “bull run,” and OpenSea, after two years of dormancy, finally began to shine.

NFTs Go Viral: OpenSea Ascends the Throne with Billions in Monthly Trading Volume

According to Dune data, OpenSea experienced explosive growth for the first time in February 2021. On February 2, daily trading volume exceeded $5 million, while the entire month of January totaled just over $7.5 million. By the end of February, OpenSea’s monthly trading volume neared $95 million—an over tenfold increase month-on-month.

Starting in early 2021, numerous commemorative NFTs began launching on OpenSea. Bands, celebrities, athletes, and renowned artists started releasing their own NFTs, and many major brands either issued commemorative NFTs or used them for customer loyalty programs. For the first time since CryptoKitties, NFTs bridged Web3 with traditional industries, introducing many unfamiliar with crypto to this new “species.”

Budweiser's NFT series

As the largest NFT marketplace, OpenSea had finally caught the wind. Data shows that in March 2021, OpenSea’s trading volume surpassed $100 million for the first time, exceeded $300 million in July, and surged over tenfold in August to $3.44 billion. It was also in March that OpenSea secured a $23 million Series A round led by a16z, with angel investors including Mark Cuban participating.

Although NFTs began rapid development from early 2021—with CryptoPunks floor prices rising from single-digit ETH at year-start to 10–20 ETH by mid-year—the first half of 2021 was still dominated by DeFi narratives. Attention hadn’t fully shifted to NFTs yet. Besides DeFi’s ongoing popularity, the NFT space lacked hype-worthy assets or concepts.

In the second half of the year, the arrival of PFP projects like BAYC ignited market enthusiasm, positioning NFTs as the next viral phenomenon after DeFi. As NFT trading heated up, OpenSea’s monthly trading volume consistently stayed in the billions. In January 2022, it even exceeded $5 billion. OpenSea product lead Nate Chastain tweeted at the end of August 2021 that the company had only 37 employees, yet monthly fee revenue surpassed $80 million—over $2 million per employee, an extraordinary figure in any industry.

Until the end of 2021, OpenSea continuously accelerated its growth. Aside from Nate Chastain’s departure due to an insider trading scandal, OpenSea faced almost no negative news. Other NFT marketplaces, despite securing large funding rounds, couldn’t challenge OpenSea’s dominance. In fact, nearly all NFT platforms copied OpenSea’s design to some extent.

Challengers Lurk: Did OpenSea “Betray” Web3 by Pursuing an IPO?

Beneath the prosperity, a quiet shift began—one that traces back to rumors of OpenSea going public…

In early December 2021, Bloomberg reported that Brian Roberts, CFO of U.S. ride-hailing company Lyft, would join OpenSea as CFO and was planning an IPO. While seemingly routine, this news sparked debate in the Web3 community. Many argued that OpenSea should instead issue a token to reward its users—a move more aligned with Web3 principles.

Perhaps feeling pressure, Brian Roberts clarified two days later, stating there was currently no IPO plan: “There’s a big difference between thinking about what an IPO might look like and actively planning one. We aren’t planning an IPO, and if we were, we’d seek community input.”

This ambiguous statement failed to ease community concerns. Instead, it reinforced beliefs that OpenSea would eventually go public—especially since he never mentioned issuing a token.

If OpenSea had chosen to issue a token at that moment, the story of NFT marketplaces might have ended there. But by opting for an IPO—a move perceived as self-serving—it cracked open its previously impenetrable wall.

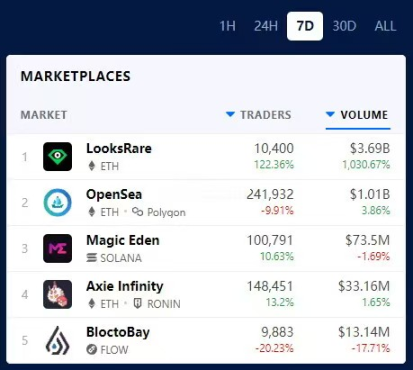

At the time, OpenSea held over 90% of Ethereum’s NFT trading market. Once its refusal to issue a token became known, entrepreneurs seized the opportunity and quickly launched NFT marketplaces with their own tokens. LooksRare was one such project—not the first to launch a “vampire attack” on OpenSea, but clearly impactful after OpenSea’s IPO plans surfaced.

On January 10, 2022, LooksRare officially launched. The team stated that any user with over 3 ETH in trading volume on OpenSea could receive an airdrop by simply listing one NFT on LooksRare. Additionally, users could stake their LOOKS tokens to earn a share of all platform trading fees. Two days after launch, LooksRare’s daily trading volume surpassed OpenSea’s. By January 19, 2022, its seven-day trading volume was over three times that of OpenSea.

Once the crack appeared and the market realized OpenSea wasn’t invincible, everyone began competing fiercely. Platforms like X2Y2 (launched February 2022), Element (focused on BNB Chain), Zora (high-end, art-focused), and Magic Eden (dominant in Solana NFTs) steadily eroded OpenSea’s existing and potential markets. While calling it arrogance may be harsh, failing to prepare for risks during its peak was undoubtedly a major strategic misstep by OpenSea.

Nevertheless, OpenSea’s market influence remained strong. Entering Q2 2022, with Yuga Labs preparing to launch the APE token and blue-chip NFTs like Moonbirds and Doodles still actively traded, OpenSea—still the most liquid NFT marketplace—retained control over the sector’s lifeline.

But the main force that would reshape—or crash—the entire NFT sector quietly emerged, fundamentally changing perceptions of what an NFT market should look like.

Blur Emerges: The New King Takes the Top Spot

Late March 2022, Blur announced an $11 million funding round. Many at the time wondered why a new NFT marketplace would appear then. But by late October, when Blur officially launched, it shocked everyone.

A completely different UI, where listings, bids, and trades all qualified for airdrops—though the airdropped “treasure boxes” contained uncertain amounts of tokens. With a UI purely designed for trading and airdrops that were both clear and mysterious, Blur maximized product and gameplay innovation. Though many initially criticized Blur’s UI as difficult to use, once accustomed, users found it far superior to OpenSea for buying and selling. To put it simply: if OpenSea is an NFT e-commerce platform, Blur is an NFT exchange.

Prices listed from low to high, with real-time trade activity and price distribution shown on the right. This trader-friendly UI, combined with airdrop incentives, attracted massive capital inflows into Blur. Previous NFT platforms had briefly drawn traffic via tokens, but OpenSea’s market share in trading volume had never been seriously challenged on a monthly or quarterly basis—until Blur’s emergence caused OpenSea’s share to drop below 50% until just one week ago.

But precisely because of this, large players gained power to manipulate the market, aggressively buying and selling. Combined with the crypto market entering a deep bear phase, seeing whales blindly farming airdrops regardless of cost crushed NFT prices. Retail investors lost interest in NFTs, and as Bitcoin dropped to around $20,000, even crypto’s “last defenders” quietly left. The collapse of the NFT market and Blur’s coronation left OpenSea as collateral damage.

In early 2022, OpenSea completed a $300 million Series C round at a $13.3 billion valuation. Just two years later, in early 2024, OpenSea’s CEO admitted they were considering being acquired. During this Bitcoin “one-man bull market,” aside from Pudgy Penguins—which had airdrop expectations—most former blue-chip NFTs saw floor prices collapse. For OpenSea, failure to act meant risking losing years of effort. That outcome was clearly unacceptable.

Therefore, OpenSea’s current decision to launch its token SEA is both a survival move amid declining business and perhaps a sign of不甘心 (unwillingness to accept defeat) and ambition to reclaim its throne. So the question arises: Can OpenSea change the competitive landscape of the NFT market after issuing its token?

Recent Surge in Trading Volume: Can OpenSea Reshape the NFT Market Competition?

Undoubtedly, the biggest potential victim of OpenSea’s token launch and OS2 beta release is Blur. Despite Blur’s own decline amid worsening crypto market conditions, as of this writing, it still holds over 44% market share in the past 30 days, firmly seated as the top NFT marketplace.

Besides its unique UI and innovative mechanics, Blur initially attracted users with Bid Airdrops (token rewards for placing bids) and a zero-fee model. It conducted multiple airdrops in 2023 to capture market share:

On February 15, 2023, Blur distributed 360 million BLUR tokens in its first season—12% of initial supply, immediately unlocked. According to Glassnode, after the airdrop, Blur’s market share surged, with its NFT trading volume share jumping from 48% to 78%, while OpenSea dropped 21%.

On February 23, 2023, Blur launched its second season with a 300 million BLUR airdrop. This directly propelled Blur’s trading volume far beyond OpenSea. DappRadar data shows that on February 22, 2023, BLUR’s trading volume reached about $108 million, compared to OpenSea’s $19.27 million.

To some extent, Blur’s two large token airdrops were instrumental in breaching OpenSea’s “moat.” As the saying goes, fight fire with fire. With the NFT market still unheated, if OpenSea uses SEA token airdrops or staking rewards to attract users, it could replicate this strategy—and even emulate past “OpenSea killers” like LooksRare and X2Y2 to launch a “vampire attack” on Blur, reclaiming its core users.

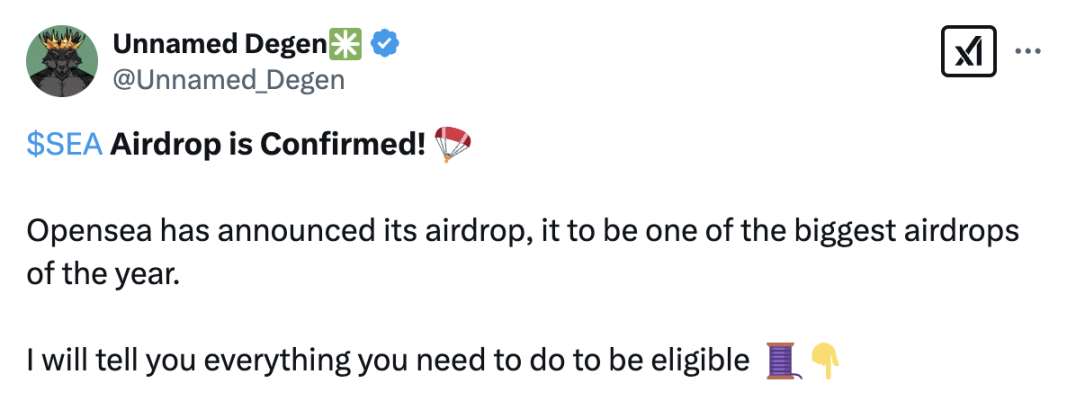

In fact, since OpenSea confirmed the airdrop, many Twitter users have expressed anticipation and excitement, with some calling it potentially the biggest airdrop of the year.

Additionally, in terms of fees, OpenSea’s recently launched OS2 testnet reduced marketplace fees to 0.5% and transaction fees to 0%, directly matching Blur’s zero-fee model. Once SEA launches, OS2 could leverage a combination of “low fees + token incentives” to form highly flexible competitive strategies.

Objectively, most users are profit-driven. If SEA’s reward mechanism proves more attractive, and given that part of Blur’s user base originally came from OpenSea, a return flow to OpenSea is certainly possible. However, Blur’s “moat” lies in faster trade execution and higher gas efficiency, giving it a technological edge in the short term.

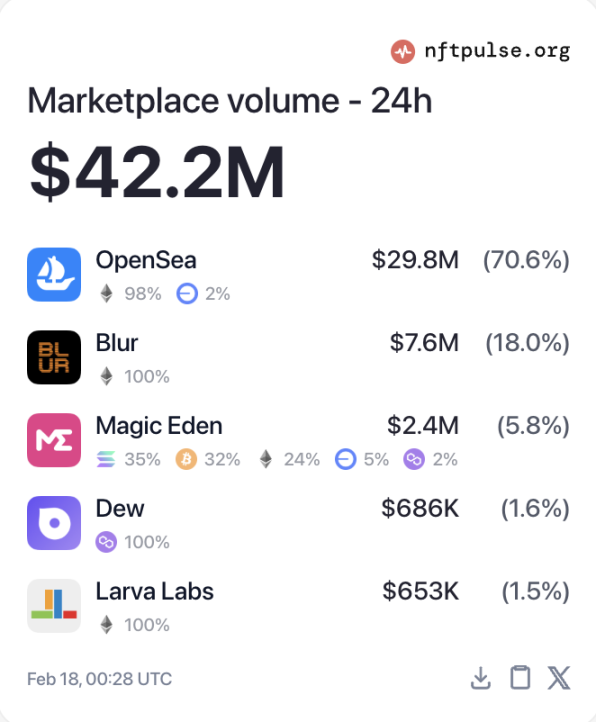

Market reactions have already begun following the token announcement. According to nftpulse data, as of this writing, OpenSea’s daily trading volume has reached approximately $29.8 million, with its share surging to 70.6% of total daily volume.

For the broader NFT market, OpenSea’s launch of the SEA token is undoubtedly positive. Beyond stimulating a short-term surge in NFT trading volume, OpenSea tweeted that OS2 now supports cross-chain trading across 14 blockchains including Flow, ApeChain, and Soneium. Could SEA become a universal token across multi-chain NFT ecosystems, thereby boosting NFT markets on non-Ethereum chains like Solana? This is worth watching.

On the other hand, the intensifying competition between OpenSea and Blur will further squeeze second-tier platforms like LooksRare and X2Y2. Blur won’t passively watch its former rival return; it may introduce more token utility or enhanced rewards to boost user loyalty. Moreover, Magic Eden, another rising star, cannot be overlooked. With dominant positions on Bitcoin and Solana, its total platform trading volume reached $3.2 billion over the past year—over 30% market share—second only to Blur’s $3.8 billion (about 36%). OpenSea’s annual trading volume was merely $1.2 billion, less than 12%.

In short, I believe OpenSea’s SEA token is not only key to its self-rescue but may also drive the NFT market out of its downturn. In the long run, the rivalry between OpenSea and Blur could push the NFT space toward greater financialization and multi-chain integration. Whether OpenSea can reclaim its throne, whether we’ll see a two-power standoff or continued dominance by Blur, depends on SEA’s performance after launch. Let’s wait and see!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News