Will OpenSea, in its arrogance, regret the evaporated $10 billion market cap?

TechFlow Selected TechFlow Selected

Will OpenSea, in its arrogance, regret the evaporated $10 billion market cap?

OpenSea: A unicorn once valued at over $1 billion, now facing a "toe-cutting" moment.

Author: Terry

In just two years, rising from obscurity to a valuation exceeding $13 billion—then within another two years, losing 90% of that peak value and even considering selling itself—what would it feel like to experience such a rollercoaster rise and fall?

This is precisely the reality OpenSea has lived through over the past four years. Just recently, Devin Finzer, CEO and co-founder of OpenSea, revealed that the company has received acquisition interest and remains open to potential deals, though he did not specify when or by whom.

As the once-dominant "unicorn" in the NFT marketplace space, how did OpenSea rise so quickly? How did it lose its leading position amid intensifying competition in the NFT market? And who might be the next disruptive players reshaping the future landscape of NFTs?

01 OpenSea: From a $10 Billion Valuation Unicorn to a "Toothbrush Cut"

Like Uniswap and Dune, OpenSea is one of Web3’s entrepreneurial success stories that grew from zero to prominence—especially between 2021 and 2023, when its valuation surged from near-irrelevance to $13 billion, firmly establishing itself as the dominant player in the NFT market.

But the story began much earlier, back in January 2018, when OpenSea's two co-founders, Devin Finzer and Alex Atallah, launched the platform for users to buy and sell NFTs.

However, aside from the short-lived hype around Cryptokitties, the broader NFT market remained barren. As a result, user activity and trading volume on OpenSea stayed consistently low.

By March 2020, OpenSea had only five employees, with monthly trading volumes hovering around $1 million. With a 2.5% commission rate, this translated into roughly $28,000 in monthly revenue. The company barely stayed afloat thanks to a $2.1 million investment from Animoca Brands at the end of 2019.

OpenSea’s real takeoff began in 2020. The co-founders aimed to double business volume by year-end, but fueled by the crypto market recovery starting in mid-2020, OpenSea exceeded expectations—achieving their target as early as September 2020.

Starting in 2021, the NFT bull market fully kicked off. OpenSea’s active users and transaction volumes skyrocketed. By July 2021, monthly trading volume hit $350 million, and the company secured a $100 million Series B funding round led by a16z, pushing its post-money valuation to $1.5 billion.

Just one month later, in August 2021, OpenSea’s trading volume surged tenfold to $3.4 billion, generating over $85 million in fee revenue.

From then until January 2022, OpenSea remained unchallenged—recording monthly trading volumes exceeding $3.5 billion, capturing 90% of the NFT market share, and reaching a peak valuation above $13.3 billion. In data terms, OpenSea was undeniably the “too big to fail” giant of the NFT world, surpassing even Uniswap’s dominance in the DEX sector.

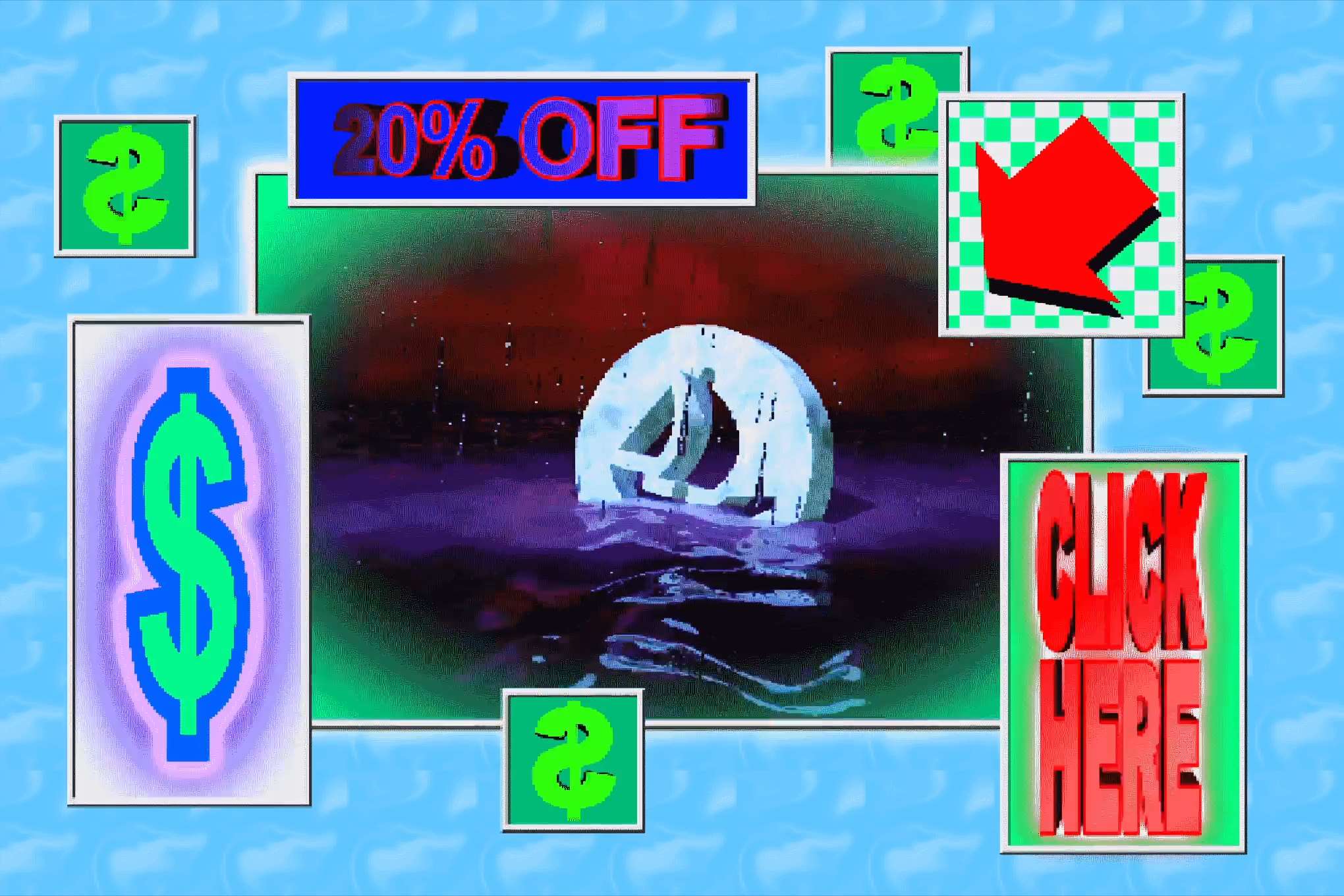

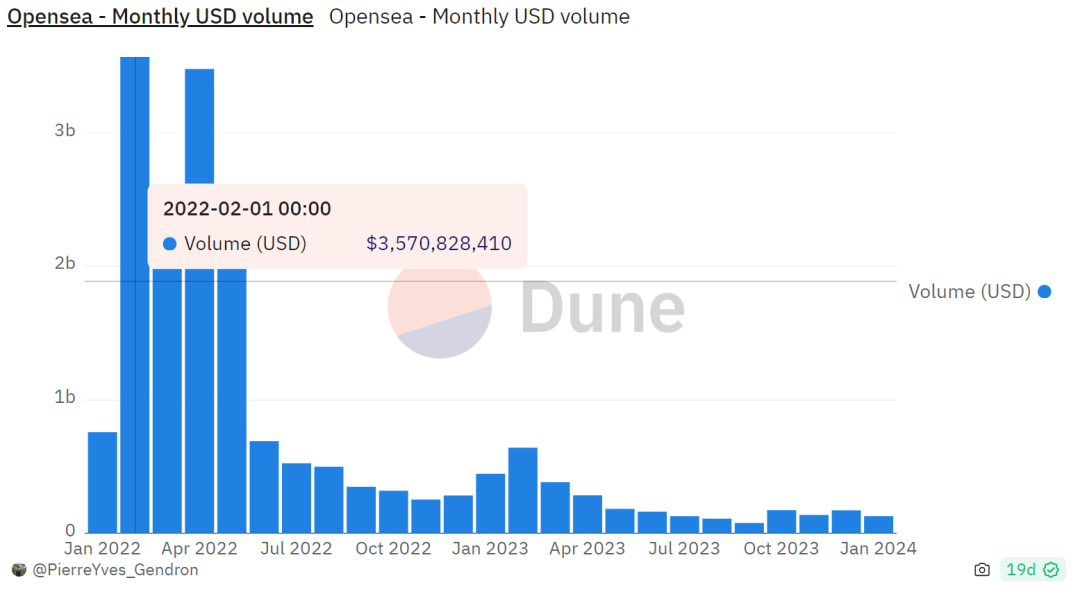

OpenSea Monthly Trading Volume (2022–2024)

And this marked the high point—the swan song of OpenSea’s reign over the NFT trading market. As the earliest mover in NFT trading to fully capture the explosive growth phase, OpenSea saw its transaction volume plummet sharply in June 2022:

It dropped from nearly $2.6 billion in May to less than $700 million in June. Today, OpenSea’s monthly trading volume has dwindled to about $120 million—down more than 95% from its January 2022 peak.

According to Bloomberg, citing insiders, Tiger Global Management has written down the value of its OpenSea stake by 94%, while Coatue has slashed the valuation of its holdings by 90%—to just $13 million. These are essentially “toothbrush cuts.”

02 The Evolution of the NFT Landscape

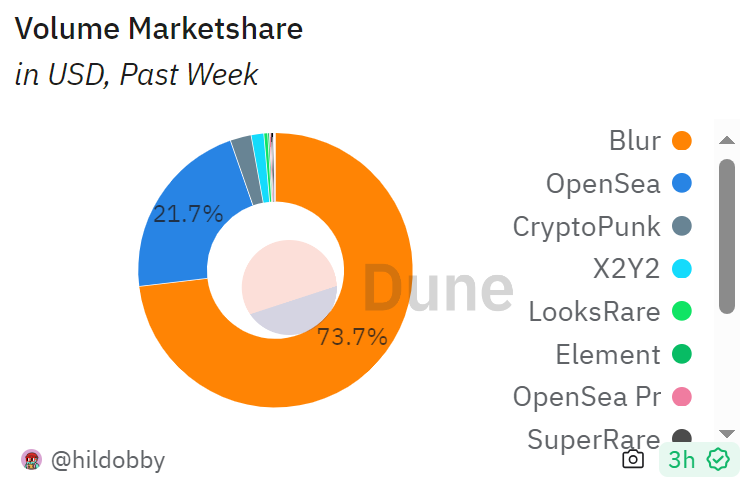

The heaviest blow to OpenSea came from Blur, the new market leader now controlling over 70% of NFT trading volume, a platform launched at the end of 2022 that rapidly surpassed OpenSea through token airdrops and became the largest NFT marketplace in under a year.

Data from Dune shows that as of this writing, Blur holds a staggering 73.7% market share over the past week—ranking first—while OpenSea trails with 21.7%, falling to second place.

Market Share Distribution Among NFT Trading Platforms

Looking back at the evolution of the NFT landscape and Blur’s powerful disruption, these shifts were perhaps inevitable.

-

LooksRare and x2y2: The "Vampire Attacks"

First, OpenSea’s rise benefited significantly from its early-mover advantage, having persisted through the lean years. But after the NFT bull market took off, competitors launched repeated product-level battles and “vampire attacks” against OpenSea’s monopoly.

It’s widely recognized that Web3 and the crypto world exhibit a clear trend: whether in DeFi, NFTs, blockchain gaming, or infrastructure, projects are increasingly similar, with fierce homogenization—differences often limited to names, UI design, token incentives, and trading fees.

“In competitive markets, it doesn’t matter who copied whom—only who came first.” This has been repeatedly proven in Web3, ever since Sushi launched its vampire attack on Uniswap.

So starting in 2022, platforms like LooksRare and x2y2—dubbed “OpenSea killers”—leveraged OpenSea’s long delay in launching a native token, gaining temporary advantages through token distribution incentives. Yet despite intense airdrop competition, they ultimately failed to truly challenge OpenSea’s dominance.

Their reward mechanisms triggered massive fake trading, leading to brief bursts of activity before quickly fading into silence—no serious contender emerged to take significant market share from OpenSea.

-

Blur: The True Game-Changer in the NFT Space

At the end of 2022, Blur arrived, introducing Bid Airdrop—a marketing strategy where tokens are distributed based on participation in auctions or bids—taking incentive models a step further and solving the longstanding issue of shallow market depth in NFTs:

It incentivizes bidding ("make offer"): the closer your bid is to the floor price, the higher the reward. Essentially, retail buyers holding the platform’s token are subsidizing bidders—a model similar to Aave’s rise: protocols that help large holders offload assets tend to succeed.

Looking at its trajectory over the past year, Blur and its founder Solareum have proven to be top-tier disruptors across multiple established sectors:

-

NFT Trading: Blur dethroned the once-unassailable OpenSea, slashing its valuation from $13.3 billion to around $1.4 billion;

-

NFT Lending: Blend has facilitated over $4.6 billion in loan volume, becoming the market leader;

-

L2 Sector: Blast has achieved a TVL exceeding $1.78 billion. According to L2Beat data, it ranks third among L2s—behind only Arbitrum ($12.34 billion) and Optimism ($6.6 billion), and ahead of Base, zkSync, and others.

03 Emerging Trends in the NFT Market

Since 2023, beyond Blur overtaking OpenSea, several new variables have begun to emerge.

First is the rise of Bitcoin-based NFTs, represented by Ordinals, which have sparked a new wave of "BitcoinFi" and driven unprecedented levels of activity within the Bitcoin ecosystem.

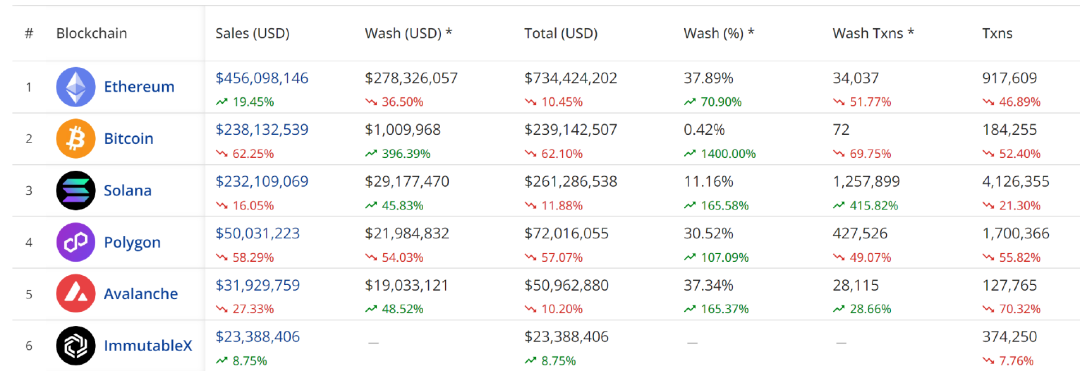

According to data from Cryptoslam shown below, Bitcoin NFT sales reached $238 million over the past 30 days—making it the second-largest blockchain for NFT sales, behind Ethereum ($456 million) and ahead of Solana ($232 million) and Polygon ($50 million).

Latest data from Dune indicates that as of February 16, cumulative fees paid for Ordinal inscriptions have exceeded 6,150 BTC—worth over $320 million.

This has catalyzed the rise of Bitcoin-native NFT marketplaces such as the OKX Web3 Wallet Ordinals Marketplace and UniSat NFT Marketplace. As of last week, the OKX Web3 Wallet Ordinals Marketplace has already surpassed $1.3 billion in total trading volume.

Additionally, starting in the second half of 2023, the NFT market appears to be gradually stabilizing, with floor prices of many blue-chip NFTs rebounding or surging. The Solana ecosystem has also entered a new speculative cycle in its NFT sector.

Meanwhile, hybrid NFT-like assets such as ERC404 have re-emerged—acting as dual-nature "new assets" that can be traded both on OpenSea and Uniswap. These innovations could bring further disruption to the NFT market landscape in the future.

Notably, Uniswap previously acquired Genie, an NFT marketplace aggregator, signaling a clear intent to enter the NFT trading space—where Genie aggregates listings from various NFT platforms while Uniswap provides liquidity.

Overall, competition in the NFT market continues along two key dimensions: product innovation and asset evolution:

In the first half of 2023, Blur used innovative liquidity incentives to outcompete legacy platforms like OpenSea and x2y2;

Then in late 2023, OKX and UniSat capitalized on the emergence of inscription-based assets to carve out new territory;

Now, in early 2024, will the rising momentum behind ERC404 as a new asset class grant traditional token trading protocols like Uniswap a fresh entry ticket into the NFT arena—and reshape the NFT landscape in 2024? That remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News