Arkstream Capital: Blur and OpenSea's Cliff Race

TechFlow Selected TechFlow Selected

Arkstream Capital: Blur and OpenSea's Cliff Race

The traffic jam at the cliff between Blur and OpenSea is merely the first chapter of the prologue to this infinite war in NFTfi.

The State of the NFT Market

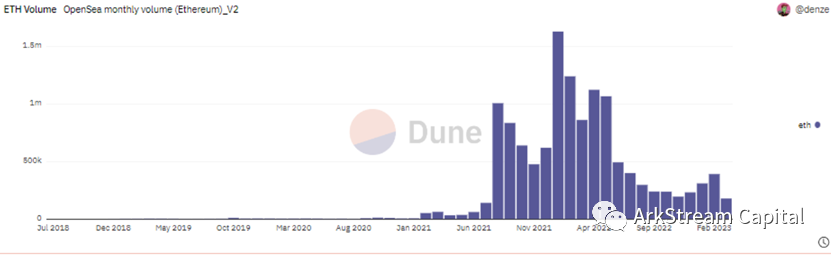

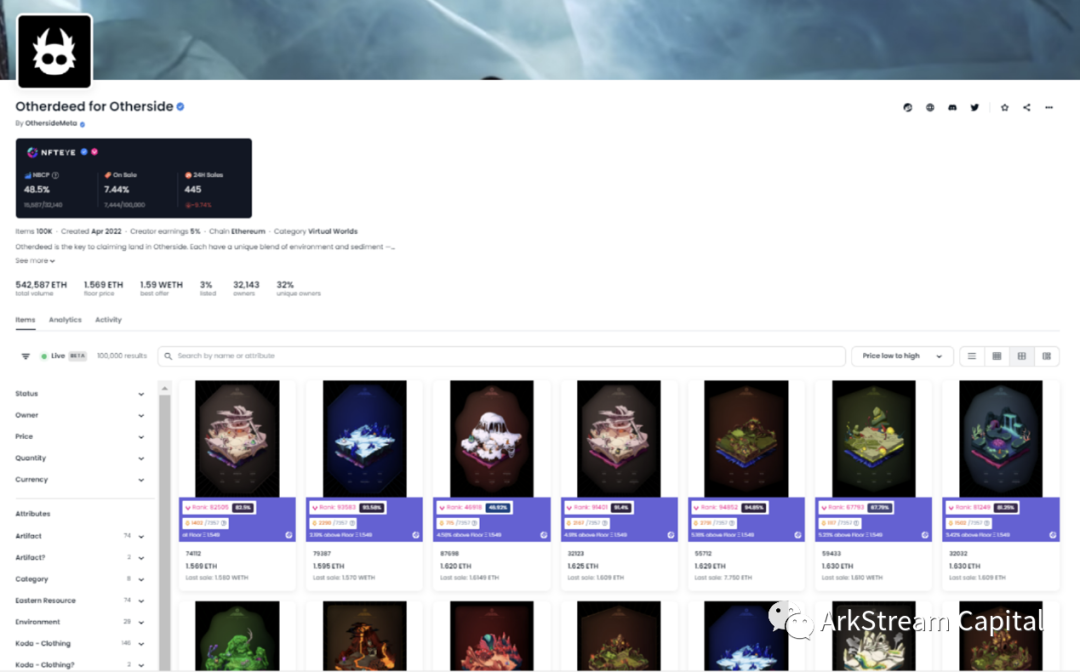

The second half of 2022 marked the winter of NFTs. With the launch of Otherdeed for Otherside draining the last bit of market liquidity, the speculative frenzy in the NFT market officially collapsed.

OpenSea Monthly Trading Volume (Dune)

Blur, as an excellent NFT marketplace, brought some incremental activity to the market due to expectations around its token launch. When Blur finally issued its $BLUR token, the massive airdrop rewards further boosted market participation.

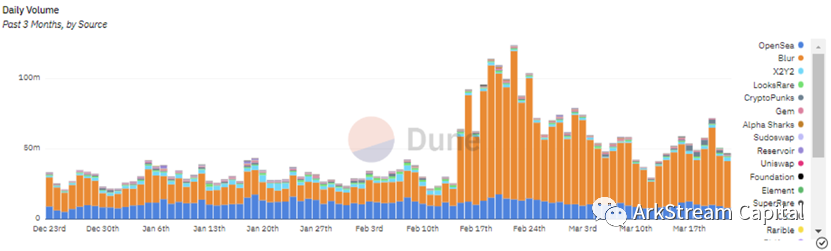

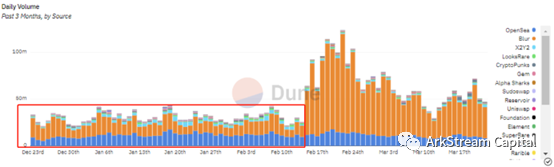

Daily Trading Volume of NFT Marketplaces (Dune)

From the trading data of NFT marketplaces, we can clearly draw several conclusions:

1. Art-focused NFT marketplaces have been completely overtaken by general-purpose NFT marketplaces (essentially PFPs).

2. Blur had already surpassed OpenSea in trading volume before its February 15 airdrop.

3. After the hype and subsequent crash of 2022, the NFT market returned to a healthy state in Q1 2023.

Arkstream has consistently maintained attention on NFTfi, believing that NFTs, as proof of ownership, hold long-term value that remains unaffected even during periods of overall market downturn.

Before diving into our main discussion, we'd like to first explore some fundamental thoughts on NFT value.

Discussion on NFT Value

Consistency vs. Non-Consistency in NFTs

As the name suggests, NFT stands for Non-Fungible Token. Compared to FTs (Fungible Tokens), which are purely consistent, NFTs embody both consistency and non-consistency.

Currently, active NFT markets primarily consist of two categories: NFT art and NFT PFPs. As humans become increasingly intertwined with the internet, PFPs are better suited as avatars for online identities. This explains why PFPs are more significant than NFT art in the current landscape.

NFT art possesses only non-consistency. In contrast, NFT PFPs are usually part of a series, combining both consistency and non-consistency. NFT PFPs represent pop art in Web3, built on the logic of repeated themes plus random variables.

Industrial repetition creates commonality, and commonality fosters community—this is consistency. The scarcity introduced by variables artificially creates inequality, marking social status. For humans inherently drawn to "inequality," class-based hierarchies fulfill a deep psychological need. I believe consistency precedes non-consistency in importance; only through consistency can PFPs create fertile ground for value, enabling the emergence of socially discriminatory value based on rarity. The value of PFPs is proportional to community energy.

This blend of consistency and non-consistency presents the biggest challenge every NFTfi project must confront, resulting in a split in liquidity solutions into two major directions: ***P2P (CLOB) and P2Pool (AMM)***. Each approach excels at handling one type of contradiction but fails to resolve both, forming a fundamental bottleneck in NFTfi development.

NFT Royalties

The much-debated issue of royalties becomes clearer when viewed through the lens of consistency and non-consistency.

NFT art carries artistic value and unique expression. It does not require high turnover; rather, its value lies in collectibility. Over time, NFT art appreciates—just as Van Gogh lived in poverty and obscurity, only gaining recognition posthumously. High royalty rates prevent such tragedies, ensuring artists benefit earlier from the time value of their work. Thus, high royalties align well with the nature of NFT art.

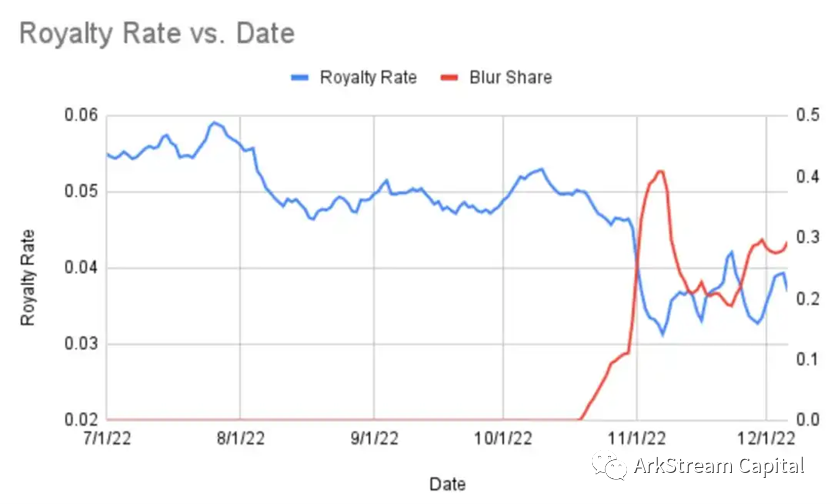

Initially, NFT PFPs adopted the same high royalty model from NFT art. However, I believe this industry inertia is deeply flawed. As previously discussed, since consistency comes before non-consistency in PFPs—and because PFP value heavily depends on community energy—high circulation actually benefits PFP value growth. PFPs need lower friction and better liquidity to capture broader community value. I originally thought royalty rates would be competed down among PFP projects themselves, but instead, it was the liquidity war between Blur and OpenSea that accomplished this.

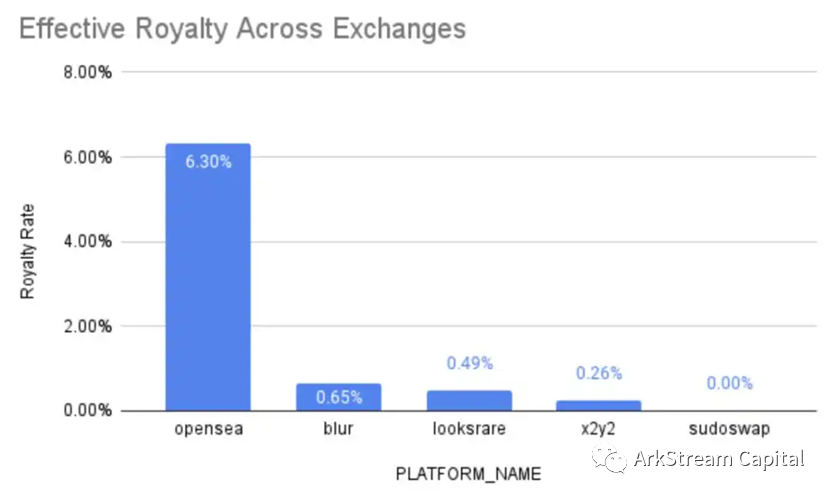

According to data from Proof’s research director NFTstatistics.eth, Blur’s average royalty rate is only 0.65%, driving down royalty rates across the entire NFT market.

Many NFT project teams complain bitterly about this shift. But I ask: how dare they treat profits from a bull market as entitlement? Take Phantabear, a project I'm familiar with: total sales of 35,735 ETH, 7.5% royalty, generating 2,680 ETH in royalties (~$4.5 million at $1,700 per ETH). These funds were not reinvested into the project but instead divided among founders. Not to mention mint revenue. Phantabear is just one example among many irresponsible NFT projects.

By: Phantabear was a money-grab project launched by founders Mark and Will using Jay Chou's fame. Later, Jay Chou, concerned about his reputation, wanted to take over the project, but couldn't reach agreement with the founders on responsibility and control, leading to the project's de facto failure.

Only when NFT projects earn money through genuine community building will users truly respect a healthy NFT market.

Competitive Landscape of NFT Marketplaces

Strictly speaking, NFT marketplaces can be further divided into three types: CLOB Marketplaces, AMM Protocols, and Aggregators.

Early aggregators include Gem and Genie, both later acquired by OpenSea and Uniswap respectively. Calling them aggregators might be generous—they were essentially batch operation tools for OpenSea.

Aggregators originated with Genie, but Gem entered the market afterward with a more user-friendly product, stronger marketing, and better capital backing, securing an early lead. However, Gem didn’t enjoy it for long. As challengers to OpenSea emerged, a stronger aggregator—Blur—appeared. Yet Blur seemed more focused on funneling traffic to its own marketplace. An aggregator that doesn’t want to run a marketplace isn’t a good aggregator.

By: X2Y2 also has aggregator features, but its “aggregator” is little more than offering bulk trading across LooksRare and OpenSea.

Currently, Reservoir is arguably the only true dedicated aggregator, though overshadowed by the dominance of Blur and OpenSea. The aggregator niche may only thrive when the market fragments further.

Trading Experience and Liquidity Wars

One competitive dimension among NFT marketplaces is trading convenience. From the UI perspective, Blur caters to professional traders and wholesale markets, while OpenSea targets regular users and retail markets. Most other marketplaces follow OpenSea’s design.

Blur trading interface

OpenSea trading interface

Blur’s superior trading experience helped attract early adopters and motivated numerous airdrop hunters to invest time and resources even before the token launch.

However, when discussing CLOB marketplaces, I’d like to focus specifically on liquidity. For any marketplace, the greatest value lies in providing optimal liquidity. In DeFi, Uni’s original LP design and GMX’s zero-slippage betting and GLP model on Arbitrum exemplify relentless efforts to enhance liquidity.

As the first NFT marketplace, OpenSea allows listing sell orders and offers buy orders (Offers). However, the Offer function lacks usability and batch processing, limiting buyer-side liquidity. Selling off a large holding of a single collection is frustrating. I once suspected OpenSea intentionally weakened this feature to maintain overall NFT price stability—after all, building a better order book isn’t technically difficult.

When LooksRare launched, we analyzed its tokenomics. It initially adopted a transaction mining model—a concept dating back to 2018, though the market widely embraced liquidity mining only after the DeFi boom.

In our analysis of Compound’s liquidity mining in 2020, we highlighted key differences from the 2019 DApp craze and earlier transaction mining schemes like Fcoin and Longbit.

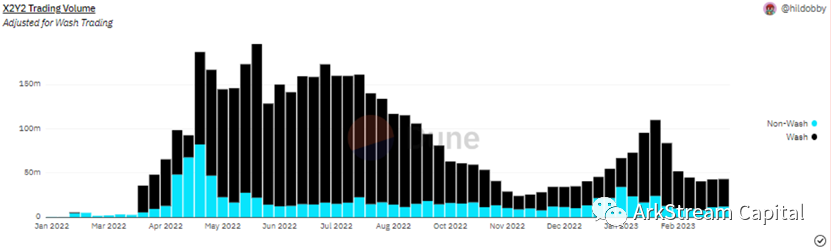

Transaction mining leads to wash trading—regardless of execution, participants generate meaningless trades solely for token incentives. These trades add no lasting value and don’t improve real liquidity. For users who must actively place orders (rather than low-cost bots), their participation is transient, lacking “inertia.” Once emissions halve, liquidity rapidly collapses. This results in high costs and low efficiency for mining subsidies.

In contrast, liquidity mining has two advantages: first, it provides real liquidity, and LPs bear risk; second, it exhibits inertia—most LPs don’t frequently switch positions. In DeFi, we’ve seen dead projects still holding hundreds of thousands in farming capital. Plus, LPs earn trading fee revenue alongside mining rewards, enhancing retention.

In Arkstream’s view on tokenomics, effective token design must satisfy three criteria:

1. Project teams must recognize token incentives as debt and carefully manage emission schedules.

2. Token incentives must reward behaviors that positively contribute to the protocol’s long-term value.

3. Token incentives should apply only to protocols with strong network effects.

All three are essential.

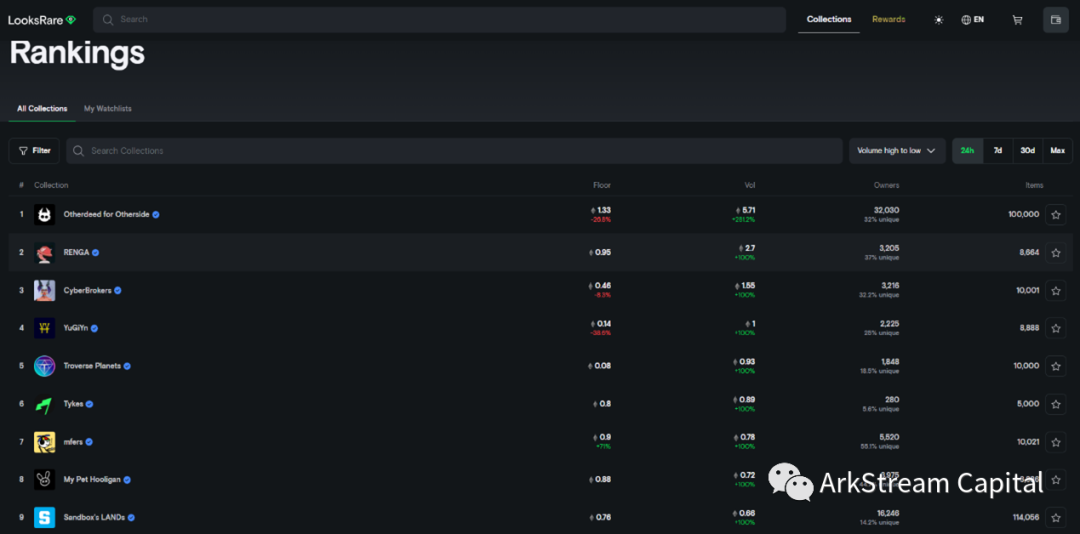

LooksRare’s subsequent performance in price and trading volume demonstrates the failure of transaction mining.

LOOKS Price (CoinMarketCap)

LooksRare Trading Volume Rank (Official Site)

Later, LooksRare added listing rewards. X2Y2 included listing rewards from day one. However, X2Y2 reverted to transaction mining after updating its tokenomics to version 2.0 on March 30, 2022—an actual step backward.

X2Y2 Wash Trading (Dune)

Liquidity is bidirectional. In NFT markets, the core problem isn’t lack of sellers—it’s insufficient buyers to absorb selling pressure. On this front, Blur demonstrated deeper thinking than LooksRare or X2Y2.

Blur used listing mining in Airdrop 2, then introduced bid mining in Airdrop 3—targeting both sides of liquidity.

Daily Trading Volume of NFT Marketplaces (Dune)

Even before $BLUR’s official launch, this two-sided liquidity strategy significantly boosted Blur’s trading volume—an undeniably successful airdrop design.

This is why I pay close attention to Blur—it’s the first NFT marketplace to proactively tackle NFT liquidity through aggressive strategies (including bid-focused product design and token incentives).

Flaws in Blur’s Liquidity Model

However, I believe Blur’s liquidity solution is still suboptimal. Compared to Uniswap’s LP design, Blur’s BID mechanism lacks sufficient inertia.

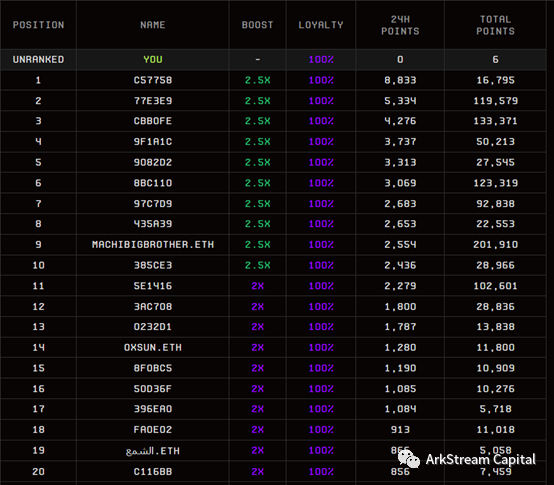

Anecdotally, over half of the top 20 on Blur’s BID leaderboard are Chinese—many well-known whales, researchers, and studios. Most capital in the BID pool lacks loyalty.

Blur BID Points Leaderboard

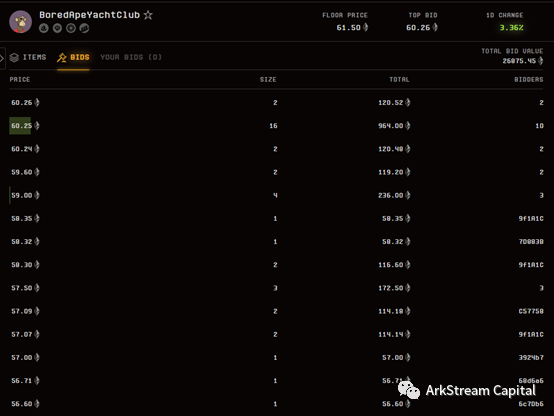

The BID walls for BAYC and MAYC clearly illustrate this point.

BAYC BID Wall

MAYC BID Wall

Due to MACHI’s massive holdings, everyone fears a dump, so no large players bid at the 1st/2nd/3rd tiers for BAYC.

For MAYC, however, there’s heavy bidding at the 2nd and 3rd tiers. These obvious bid walls exist purely for earning BID points. Strip them away, and few genuine market makers remain.

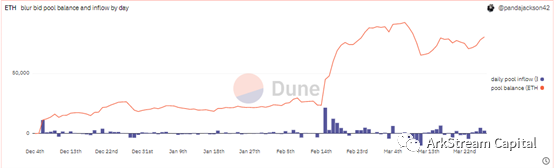

On the day of the Silicon Valley Bank crisis, much ETH was withdrawn from Blur’s BID pool. Alongside the broader market crash, NFT prices were severely compressed—the total BID pool dropped from 30,000 ETH to 10,000 ETH across most collections.

Blur BID Pool Balance (Dune)

Moreover, Blur currently operates with 0 fees. Without token incentives, it cannot reward LPs via trading fees like Uniswap. A healthy system should still incentivize LPs even after removing token rewards. When $BLUR launched on Uniswap, many users immediately provided liquidity to earn trading fees—one friend reportedly recovered 50% of their cost in fees on the first day.

Once Blur removes its liquidity incentives, these BID walls will likely collapse instantly.

Liquidity-Driven Collapse in NFTs

While Blur’s liquidity mining injects much-needed liquidity into the NFT market, it also accelerates market collapse. Previously, illiquidity prevented whales from cashing out quickly. Now, thanks to Blur’s BID walls, whales can exit freely.

Many small NFT projects exploit Blur’s mechanism to dump inventory. In Blur’s early days, project teams would first inflate trading volume on OpenSea, establish a floor price, then gradually raise BIDs on Blur to earn points. Some would simultaneously list a few NFTs—if their BID got filled, they’d recoup partial losses. Others held most of a collection, allowing them to arbitrarily raise BIDs without fear of being taken.

If no competitors bid against them, teams might happily farm points. But if retail users or bots start bidding and build up depth, the team pulls their bids and dumps NFTs directly onto those unsuspecting bidders.

In this frenzy, NFT teams and whales gain valuable liquidity, while market makers earn “valuable” $BLUR tokens.

I believe Blur needs to upgrade its tokenomics to increase the cost for such arbitrageurs, who ultimately harm the system.

Although this liquidity is a double-edged sword in the short term, in the long run, liquidity is beneficial. If we believe in NFTs’ long-term value, then crashes in highly liquid environments simply accelerate price discovery.

Future Outlook

Since Blur’s current tokenomics ignore NFT non-consistency, I suggest adopting Uni-style LP pairing for mining to enhance market maker inertia and durability.

This is essentially an AMM approach, combined with frontend aggregation of rare and floor items. Blur has experimented with similar ideas—when blocked by Seaport contracts, it used frontend routing to bypass restrictions.

Additionally, CLOB marketplaces should evolve toward greater specialization—exemplified by platforms like Tensor.Trade.

Tensor trading interface

Tensor integrates Tensor Trade (Aggregator) and Tensor Swap (AMM Protocol). Like Blur, it focuses on delivering richer information (e.g., NFT floor price charts) and enhanced trading features (advanced order functions).

I also hope Blur enhances its BID functionality—adding stop-loss/take-profit features and batch-managed offer tools.

Blur vs. OpenSea: A Cliffside Race

Under pressure from Blur, OpenSea slashed fees to zero on February 22 to compete. But this failed to meaningfully boost trading volume—more a defensive move than a winning strategy.

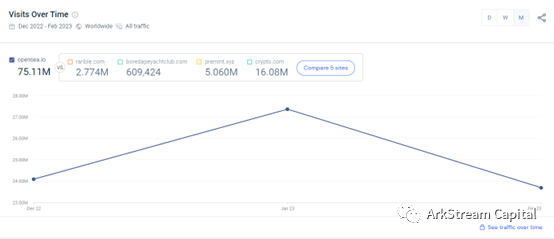

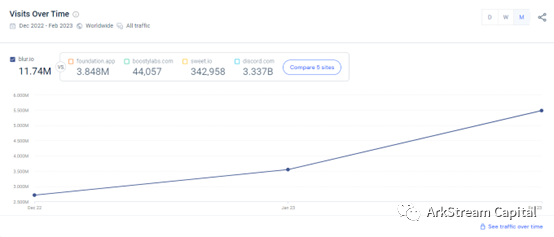

OpenSea’s Last 3 Months Traffic (Similarweb)

Blur’s Last 3 Months Traffic (Similarweb)

Traffic-wise, OpenSea has suffered greatly due to Blur’s token launch.

But Blur isn’t unscathed. OpenSea, despite layoffs in 2022, still employs around 230 people and raised $300 million in its latest round—giving it deep pockets. Blur has disclosed only $14 million in funding. While its costs are lower, its runway is shorter. Operating at zero fees, Blur cannot generate revenue through fees—nor can it meaningfully empower $BLUR. Essentially, Blur has dragged itself and OpenSea into a cliffside race where death is the only end.

This war will inevitably end with one side eliminated. But in the process, secondary players like X2Y2 and LooksRare face even harsher pressure—and may collapse first.

Status of AMM Protocols

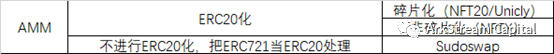

In the AMM space, besides Sudoswap, there were earlier attempts like NFT20 and Unicly—though these often involved fractionalization or ERC20 conversion.

These approaches did little to improve NFT liquidity. In contrast, Sudoswap’s approach feels more grounded.

Standard AMMs can only handle NFT consistency. Sudoswap tackles non-consistency by using multiple pools, allowing users and markets to self-sort different rarity levels into appropriately priced pools, then aggregating them via frontend. It’s a clever design, but in practice, such layering fails to handle complex rarity structures—leaving the core issue unresolved.

I once had high hopes for Sudoswap and closely followed its airdrop progress. But unlike DeFi’s early days, NFTfi competition today is fierce. Uniswap benefited from the 2018–2019 bear market, giving it time to grow.

Sudoswap had no such luxury—inaction meant death. Web3, in many ways, amplifies Web2 dynamics—especially the Matthew effect, which runs on turbocharged network effects. Anyone following DeFi knows that since 2022, Uni has captured nearly all long-tail token volume on Ethereum, with only 1inch and Curve maintaining distinct niches—other DEXs suffering severe pressure in both market cap and volume.

Unfortunately, Sudoswap’s airdrop alienated farmers, Tier 1, and Tier 2 users alike. I even suspect the team never intended to seriously develop the project. The airdrop seemed designed only to benefit Xmon holders—or really, the team itself, since they held most Xmon—completely ignoring long-term positive incentives for Sudoswap.

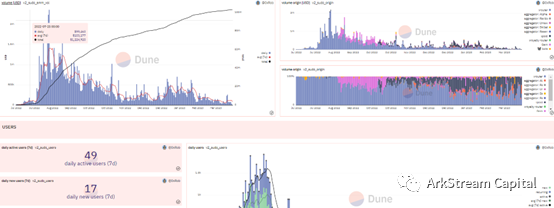

Sudoswap Dashboard (Dune)

Contrary to Blur, Sudoswap effectively killed itself with its airdrop—followed by no coherent token incentive plan to support its AMM’s liquidity.

Yet as previously stated, given how poorly CLOB marketplaces handle floor pricing, AMMs still have vast potential. Given the tension between consistency and non-consistency in NFTs, neither P2P (CLOB) nor P2Pool (AMM) models fully solve liquidity. Therefore, a hybrid approach—blending both, with one dominant—might be the right path forward.

Conclusion

Despite Blur’s many flaws—and despite $BLUR’s weak price performance and community criticism over its utility—I believe Blur’s relentless focus on improving NFT market liquidity positions it critically within the ecosystem at this moment. Only with sufficient liquidity can the next chapter of NFTfi unfold—just as YFI and 1inch could only emerge after foundational DeFi protocols like Uniswap and Aave paved the way.

The cliffside race between Blur and OpenSea is merely the opening chapter of an endless war in NFTfi. Let us continue to monitor NFTfi closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News