CAKE Tokenomics 3.0: Centralized Governance Overturning DAO?

TechFlow Selected TechFlow Selected

CAKE Tokenomics 3.0: Centralized Governance Overturning DAO?

A single "imperial decree" from CZ swiftly nationalized power, ending the apparent self-governance of the DAO. Faced with strong capital intervention, the community seemed powerless.

By Alex Liu, Foresight News

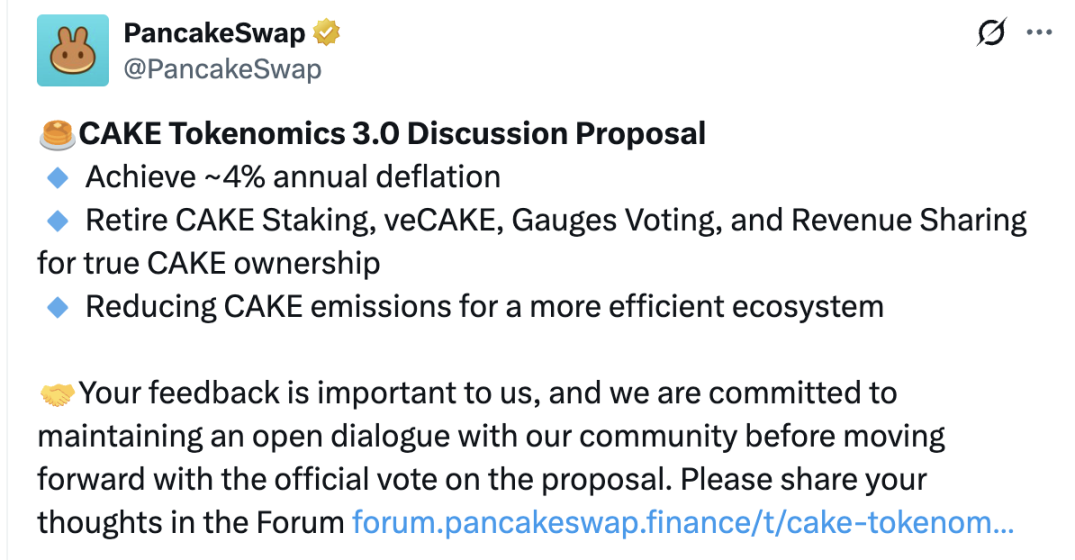

On April 8, PancakeSwap announced its CAKE Tokenomics 3.0 proposal on X, aiming to comprehensively restructure the issuance, inflation mechanism, and governance model of the CAKE token.

Since its release, the proposal has sparked widespread attention and intense debate within the market and community. From the background and specifics of the proposal to its impact on various stakeholders, core controversies, and diverse community perspectives, the unfolding event has been marked by complexity and drama.

Background of the Event

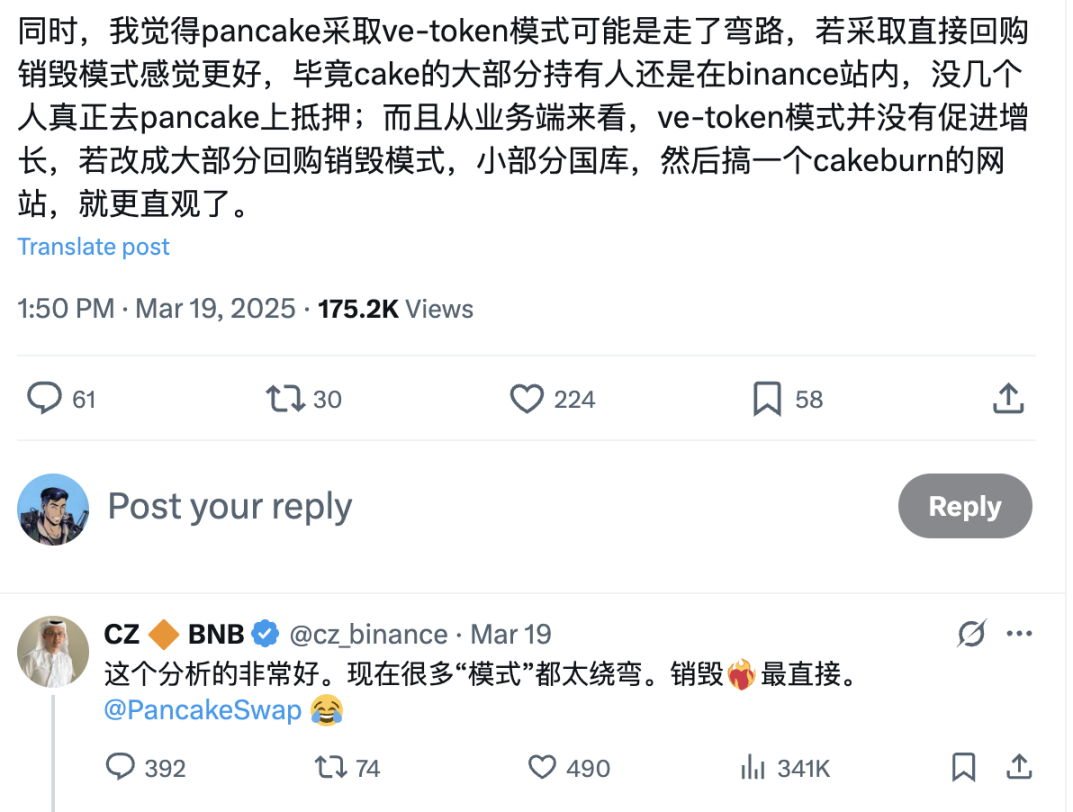

On March 19, an industry insider posted on X criticizing PancakeSwap's current veCAKE locking mechanism as overly complex, raising barriers for user participation and disrupting the balance between long-term governance rights and short-term incentives. CZ, co-founder of Binance, commented in support, stating that "PancakeSwap should adopt a buyback-and-burn model instead of the ve-token model," adding, "Many current 'models' are too convoluted—burning is the most straightforward." He also tagged the official PancakeSwap account.

Within less than 20 days of this “imperial decree,” PancakeSwap unveiled a new tokenomics proposal to replace its long-standing ve-model.

Key Elements of the Proposal

The Tokenomics 3.0 proposal includes several core components:

First, the proposal targets approximately 4% annual deflation, projecting a 20% reduction in the total CAKE supply by 2030. To achieve this, PancakeSwap plans to reduce the daily emission from about 40,000 CAKE to 22,500. This adjustment aims to enhance CAKE’s scarcity and long-term value by decreasing new token supply.

Second, the proposal explicitly calls for the elimination of existing CAKE staking, veCAKE, Weighted Voting (Gauges Voting), and revenue-sharing mechanisms. The stated goal is to “simplify” governance, ensuring CAKE truly belongs to holders and preventing marginalization caused by complex lock-up and distribution systems. Supporters argue this would reduce governance costs and improve system transparency and operational efficiency.

Additionally, to offset potential incentive gaps from these changes, the proposal introduces a new buyback and burn mechanism. A portion of trading fees and other revenues will be used regularly to repurchase and burn CAKE, further driving deflation and providing long-term price support.

Impact on Key Stakeholders

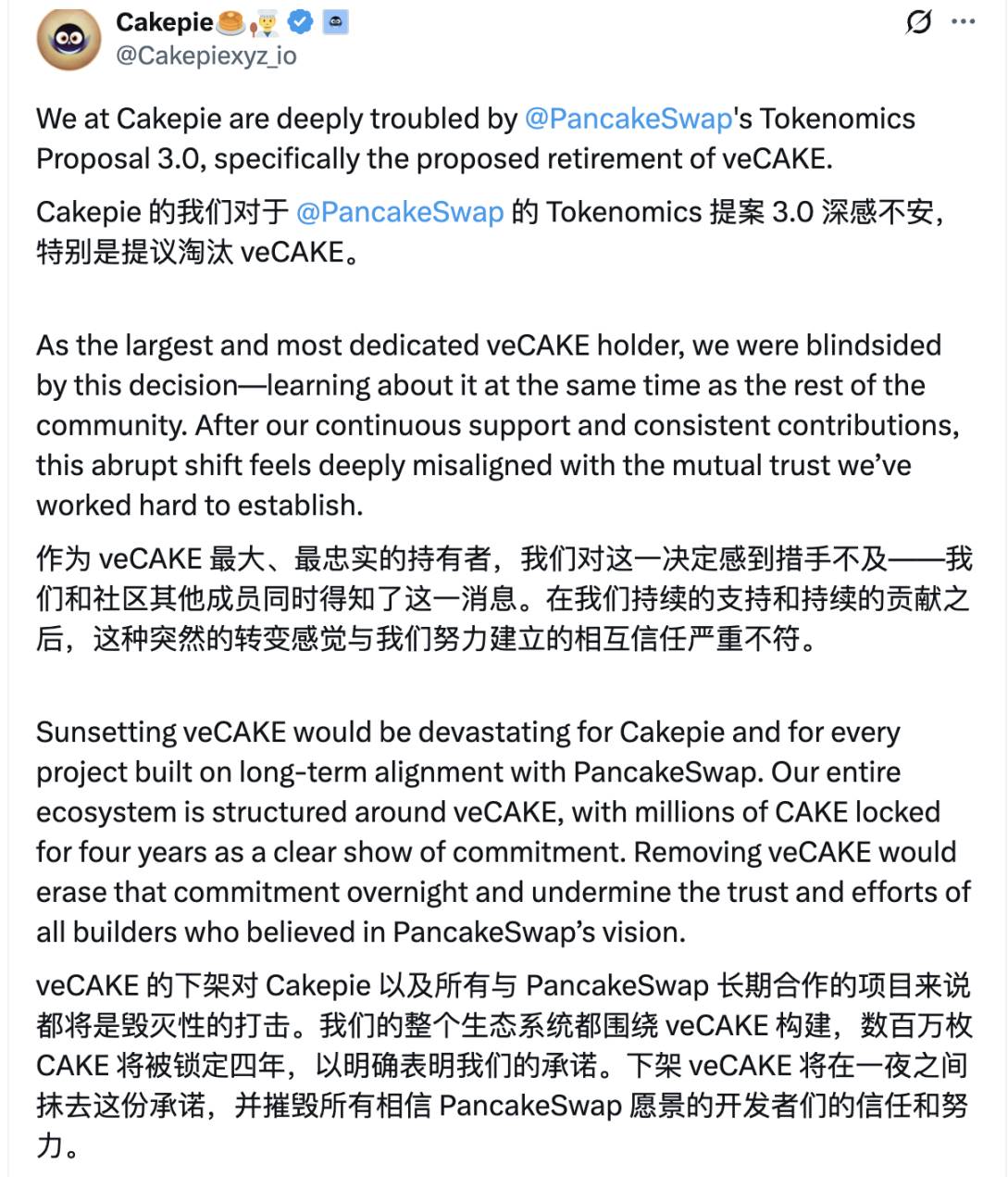

For core participants and long-term supporters within the ecosystem, this proposal is nothing short of devastating. Cakepie, the primary beneficiary of the veCAKE mechanism, has locked up tens of millions of CAKE over recent years, securing stable governance rights and dividend income through this model. If the proposal passes, Cakepie DAO could face severe consequences:

The removal of veCAKE and associated revenue-sharing means the dismantling of Cakepie DAO’s established governance framework. Its core asset, CKP—which relies heavily on dividends and governance rewards tied to this mechanism—would lose its foundational value. (The relationship between CKP and CAKE is similar to that of PNP and PENDLE; recommended reading:

Revisiting Penpie’s Protocol Mechanics: The Impact of the Hack Should Not Be Overstated)

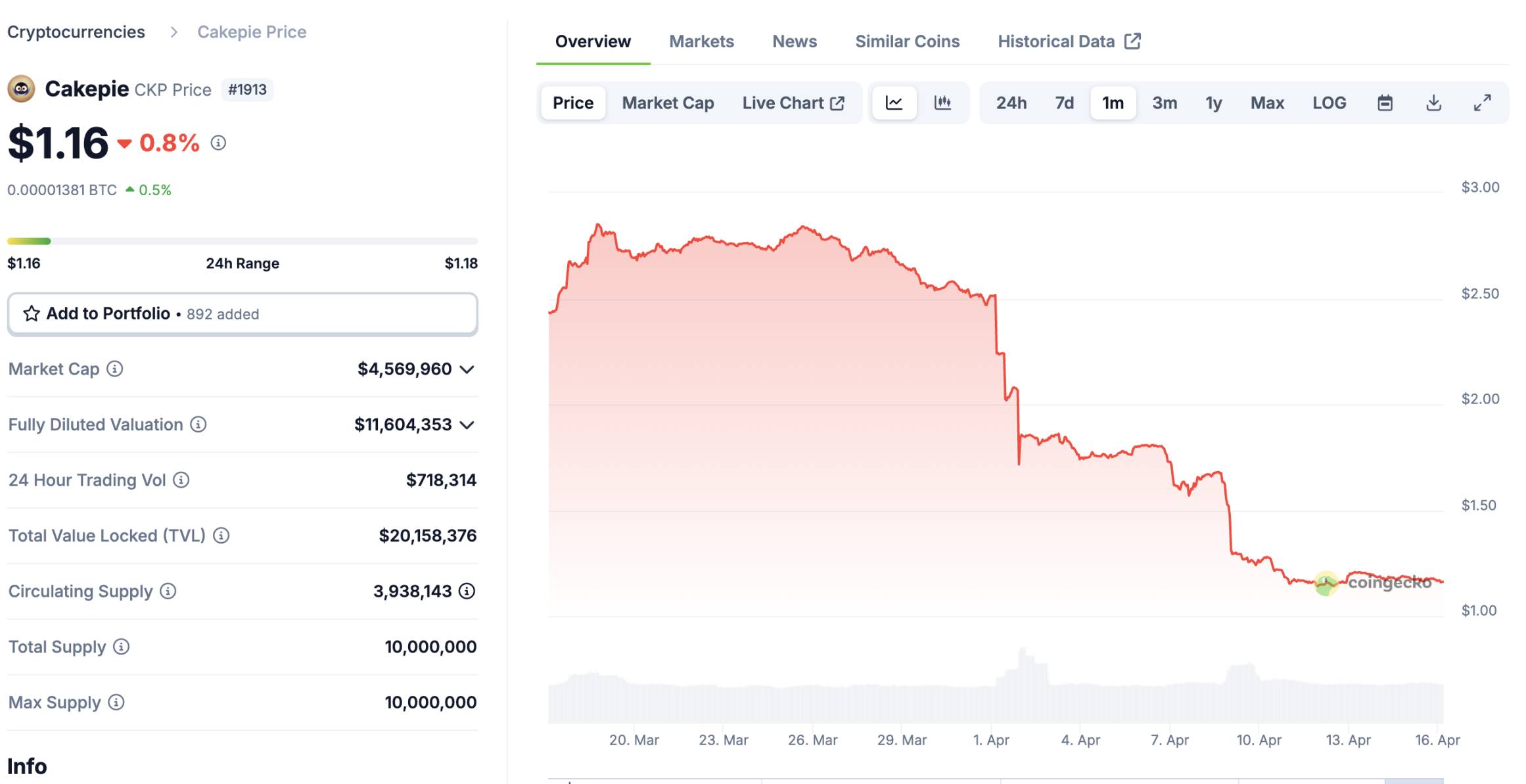

Following PancakeSwap’s announcement, the CKP token plummeted in value

Core Controversy Around On-Chain Operations

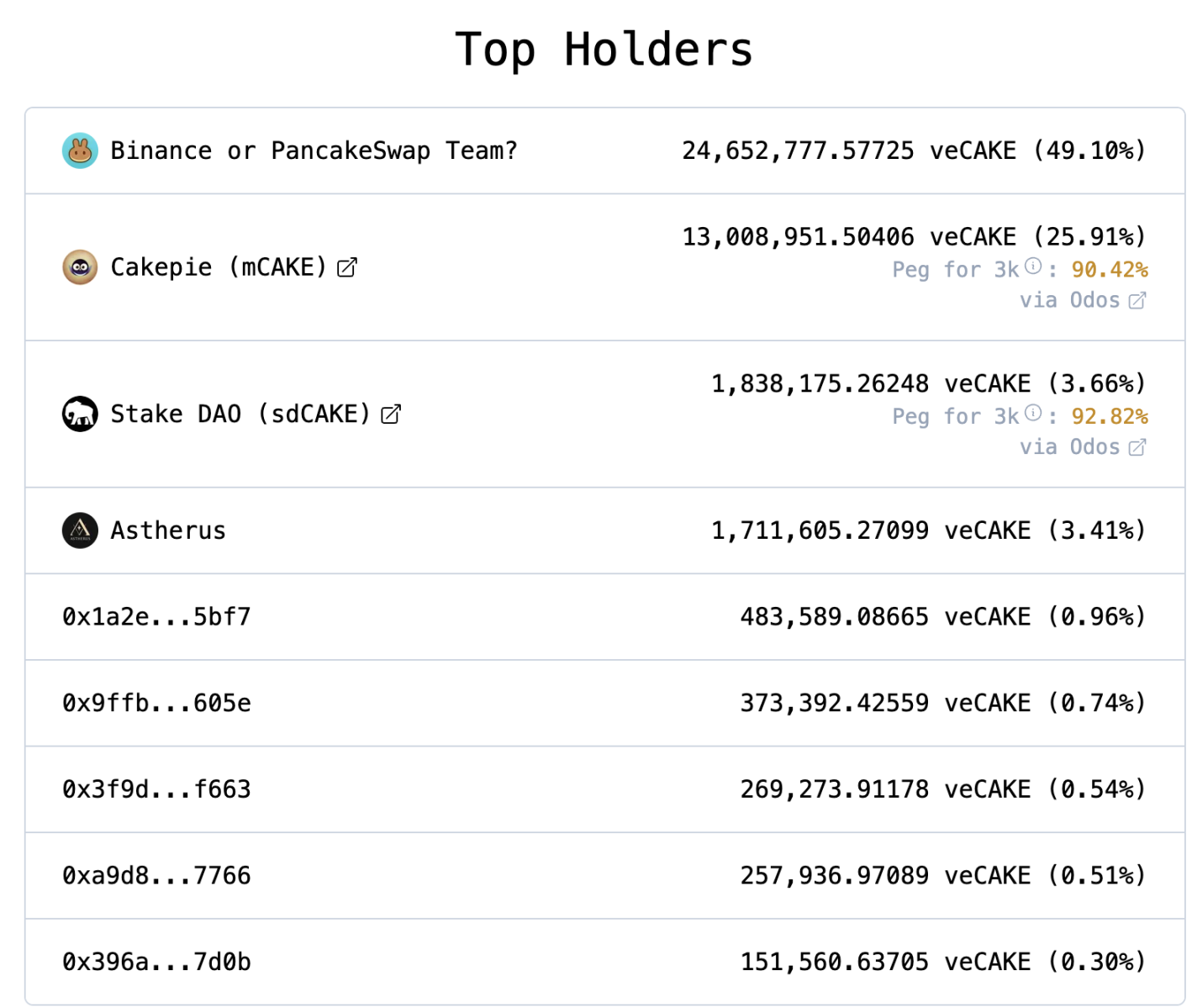

The controversy extends beyond economic design to irregularities in on-chain actions during the governance process. According to multiple blockchain data trackers, shortly before and after the formal discussion of the proposal, several large addresses linked to Binance or PancakeSwap suddenly locked up a massive amount of CAKE—25 million tokens, nearly 50% of the total locked supply. These addresses can unlock their holdings immediately after the vote concludes, enabling them to reclaim governance control at low cost and reconfigure incentive distributions.

This “vote-and-exit” behavior has drawn widespread criticism. Critics argue it undermines fair governance, allowing a small number of whales and centralized entities to manipulate outcomes through short-term maneuvers, harming retail investors. Others point out that such actions exemplify the recurring phenomenon of “on-chain coups” in crypto, exposing vulnerabilities and risks in decentralized governance in practice.

Divergent Community Views and Expert Opinions

Amid the heated debate, voices from different groups vary significantly. Cakepie DAO launched strong protests on social media, accusing the reform of “betraying the original vision of long-term incentives and community-driven growth.” They proposed alternative solutions, including partial adjustments rather than complete abolition of veCAKE. The DAO emphasized that the governance rights and revenue streams built on long-term locking have been key drivers of PancakeSwap’s sustained development. Removing them, they argue, would not only cause financial losses but also deliver a fatal blow to trust across the ecosystem.

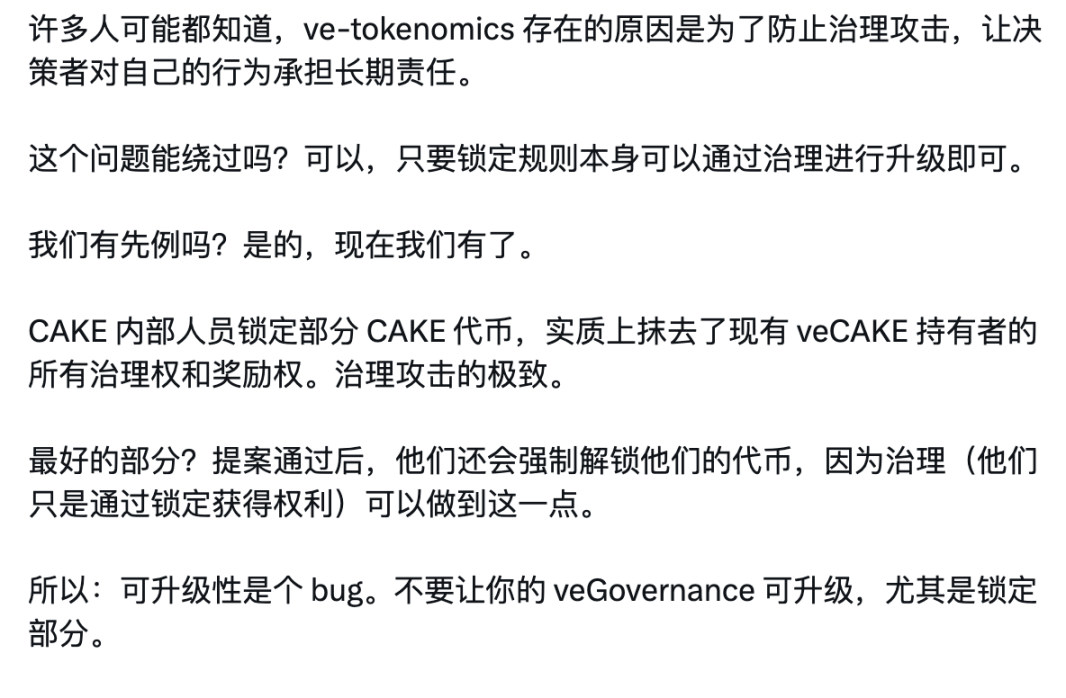

Meanwhile, some industry experts have voiced contrasting opinions. For instance, the founder of Curve noted that while decentralized governance requires continuous optimization, early contributors’ interests and incentive structures must be respected. Abruptly dismantling mature mechanisms carries significant risks and could lead to the collapse of long-term value systems within the ecosystem. He labeled this proposal a “governance attack” and advised that veGovernance contracts should not be upgradeable.

Latest Developments and Ongoing Dynamics

On April 16, a PancakeSwap team member revealed they are engaging in close discussions with Cakepie DAO and offered $1.5 million in compensation to CKP holders—a post met with a clapping emoji reply from CZ. However, even after its sharp decline, CKP’s FDV remains above $10 million, and its circulating market cap of $4 million still exceeds the proposed $1.5 million compensation.

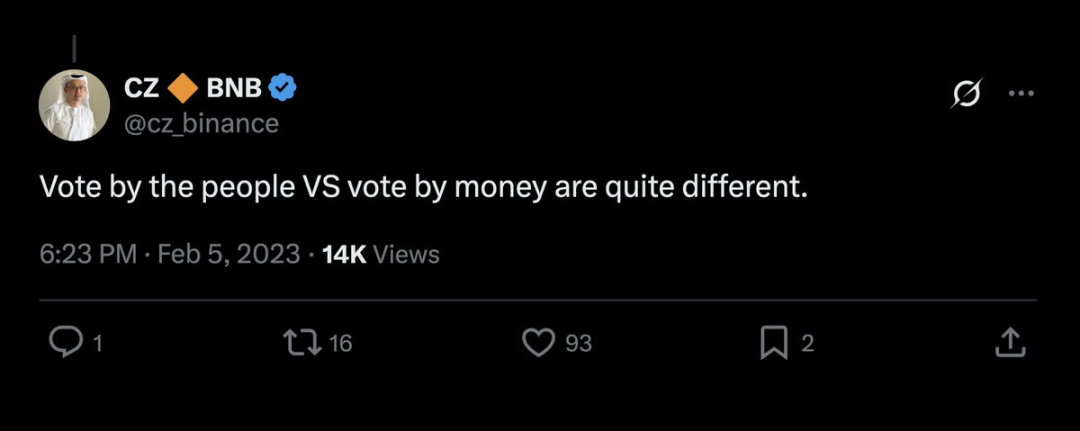

The voting on the proposal is now live, with supporters holding over 70% of votes—an overwhelming lead. Even if Cakepie DAO and retail users oppose the proposal, they appear powerless against the “whales” who recently acquired nearly 50% of voting power through last-minute lockups. Two years ago, CZ remarked, “Letting the public vote is not the same as letting capital vote.” This time, however, he seems to have sided with capital—one word from him may decide the fate of an entire community project.

Conclusion

In summary, PancakeSwap’s Tokenomics 3.0 proposal remains highly controversial, reflecting deep-seated tensions and transformation needs in DeFi governance today. Striking a balance between simplifying mechanisms, reducing complexity, and preserving long-term incentives has become a pressing challenge for the entire blockchain industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News