Why can HEMI bypass the exchange "newbie village"?

TechFlow Selected TechFlow Selected

Why can HEMI bypass the exchange "newbie village"?

HEMI, the token of Hemi Network co-led by YZi Labs in two funding rounds, has officially launched on Binance exchange.

By: Nicky, Foresight News

On September 23, 2025, Binance officially announced that the modular Layer2 protocol Hemi Network (HEMI) has joined the Binance HODLer airdrop program and opened spot trading at 8:00 PM that evening.

Although HEMI had previously launched on Binance Alpha and futures markets on August 29, spot trading was only available on platforms such as Gate and MEXC. Market data shows that the HEMI token price rose from $0.0148 on August 29 to $0.12 on September 21, representing a 710% increase within 30 days.

According to official project data, the total value locked (TVL) in the Hemi Network now exceeds $1.2 billion, with Bitcoin-secured transactions reaching 6.9 million. The community has 411,000 members, including 100,000 verified real users, and hosts over 90 ecosystem protocols.

Funding History

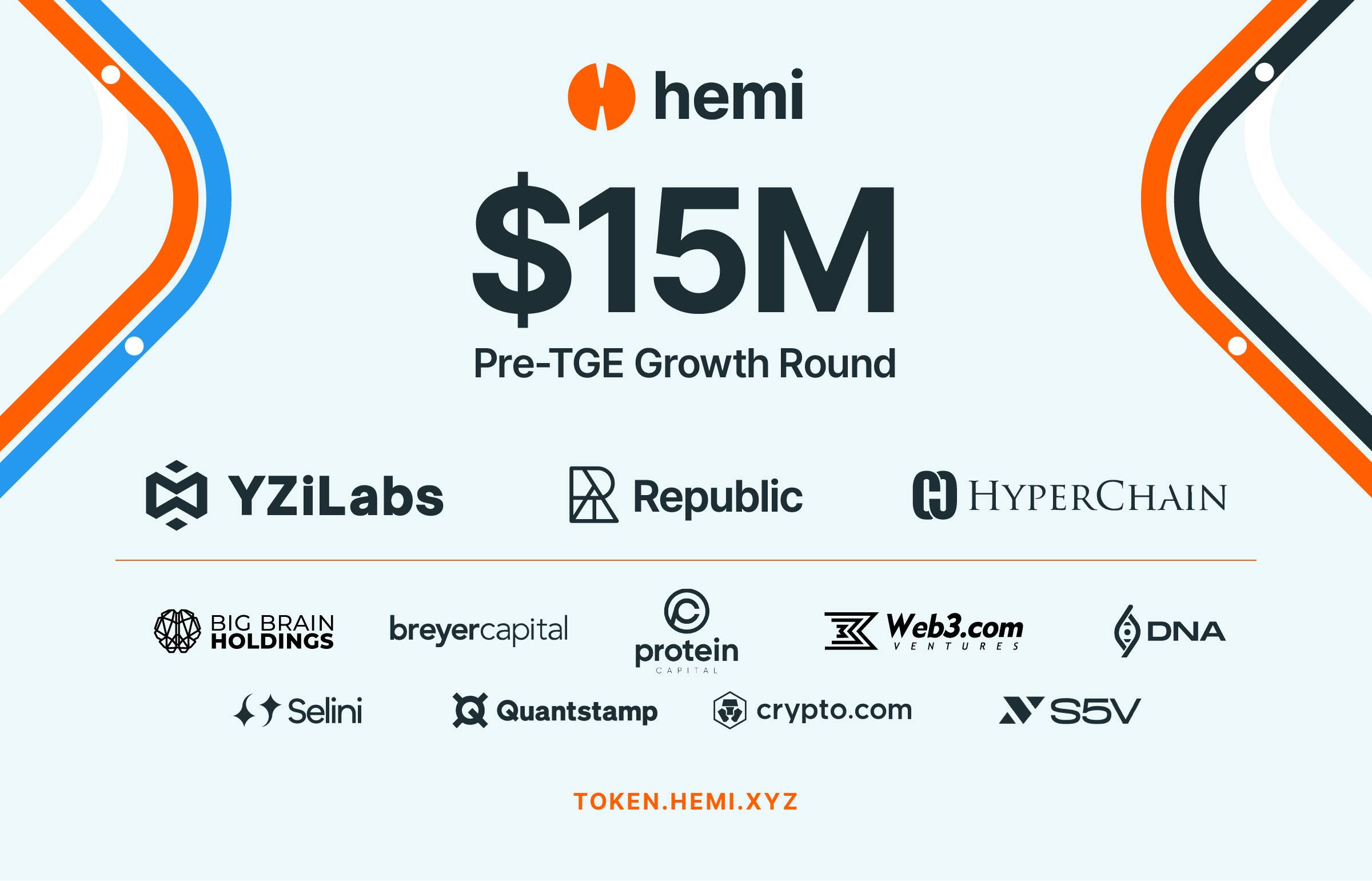

Hemi Network has completed two major funding rounds. In September 2024, the project raised $15 million in funding co-led by Binance Labs, Breyer Capital, and Big Brain Holdings, with participation from multiple cryptocurrency industry investment firms.

In August 2025, the project secured another $15 million in funding led by YZi Labs (formerly Binance Labs), Republic Digital, and HyperChain Capital, with other existing investors continuing their participation. The total funding across both rounds reached $30 million.

Notably, YZi Labs (formerly Binance Labs) served as lead investor in both funding rounds.

Technical Architecture

Hemi Network positions itself as a modular protocol designed to integrate the core capabilities of both Bitcoin and Ethereum blockchains, treating them as components of a unified system rather than separate ecosystems.

The core of the protocol is the Hemi Virtual Machine (hVM), a technical solution that embeds a full Bitcoin node within the Ethereum Virtual Machine, enabling smart contracts to directly access on-chain Bitcoin data (including UTXOs, Ordinals inscriptions, etc.). This design eliminates the security risks associated with synthetic assets in traditional cross-chain solutions. Through the Hemi Bitcoin Toolkit (hBK), developers can access hVM's Bitcoin interoperability features while maintaining familiarity with Ethereum development environments.

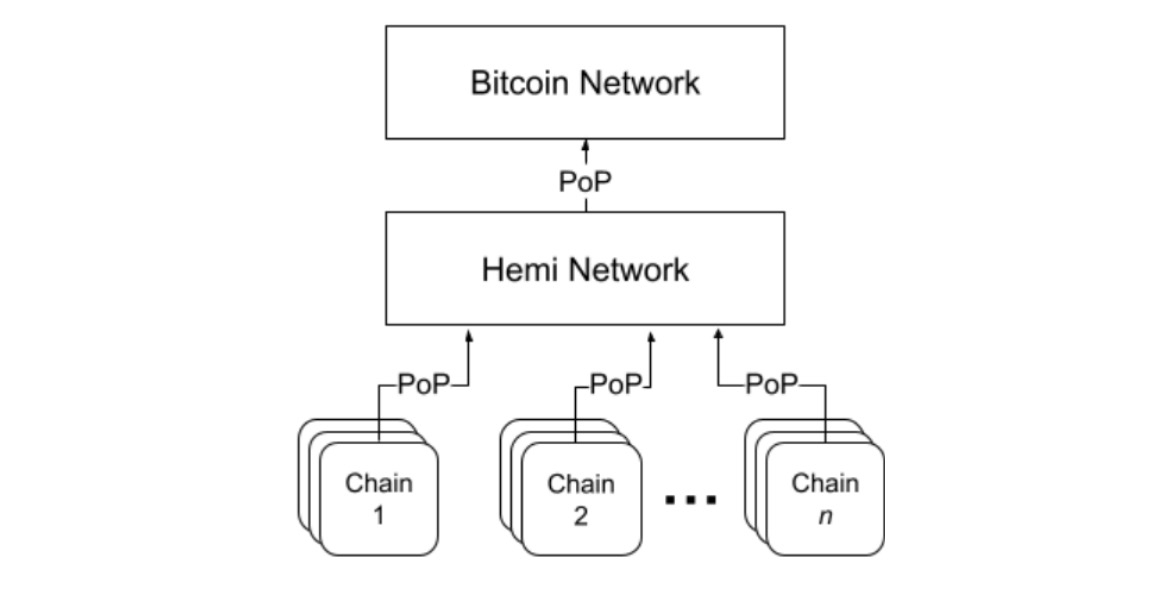

The consensus layer adopts the Proof-of-Proof (PoP) mechanism designed by co-founder Maxwell Sanchez: lightweight miners anchor HEMI state data onto the Bitcoin chain, achieving irreversible finality after nine Bitcoin block confirmations (approximately 90 minutes). An attacker would need to simultaneously control 51% of Bitcoin’s hash power and the HEMI network to enable reorganization, a cost far exceeding any potential gains.

Unlike traditional wrapped Bitcoin solutions, Hemi enables secure transfer of Bitcoin assets across different chains through a tunneling system, without relying on intermediaries or wrapped tokens.

Team Composition

Hemi Network is led by three founders with deep experience in the blockchain field. Jeff Garzik, co-founder and Chief Engineering Officer, was a core Bitcoin developer who contributed five years to Bitcoin’s early development. He also spent ten years at Red Hat, making significant contributions to Linux kernel development.

Co-founder Maxwell Sanchez serves as Chief Architect and is the co-inventor of the Proof-of-Proof consensus protocol, bringing extensive blockchain security expertise. He entered the blockchain space as early as 2011 and launched a testnet using post-quantum cryptography.

The third co-founder, Matthew Roszak, is a blockchain investor and entrepreneur who, as Chairman of Bloq, made early investments in Ethereum, Coinbase, and Kraken. At Hemi, he leads strategy and ecosystem development.

The team currently consists of around 30 members, most of whom have technical backgrounds in Bitcoin, Ethereum, and DeFi, spanning engineering, consensus protocol innovation, and investment domains.

Token Economics

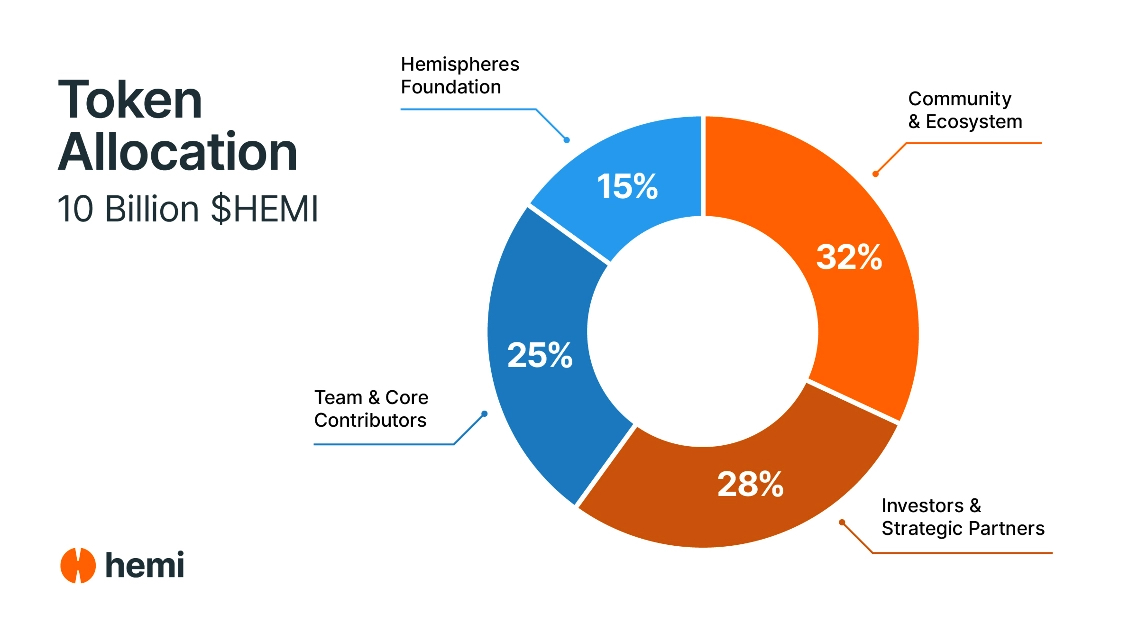

The total supply of HEMI tokens is 10 billion, allocated as follows: 25% to the team and core contributors, 15% to the Hemispheres Foundation, 32% to the community and ecosystem, and 28% to investors and strategic partners. The token is primarily used for staking, governance, transaction fees, and securing network safety via the PoP consensus.

Community Discussion

The price resilience of HEMI has sparked widespread discussion within the community. On September 22, 2025, when major cryptocurrencies generally pulled back, HEMI strongly rebounded after dropping over 20%, closing the day down only 2.12%. On the same day, HEMI's trading volume on Binance Alpha hit a record high, with daily trading exceeding $1.47 billion.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News