DeFi Revival Wave: Why SynFutures, Base's Leading Derivatives Project, Stands Out

TechFlow Selected TechFlow Selected

DeFi Revival Wave: Why SynFutures, Base's Leading Derivatives Project, Stands Out

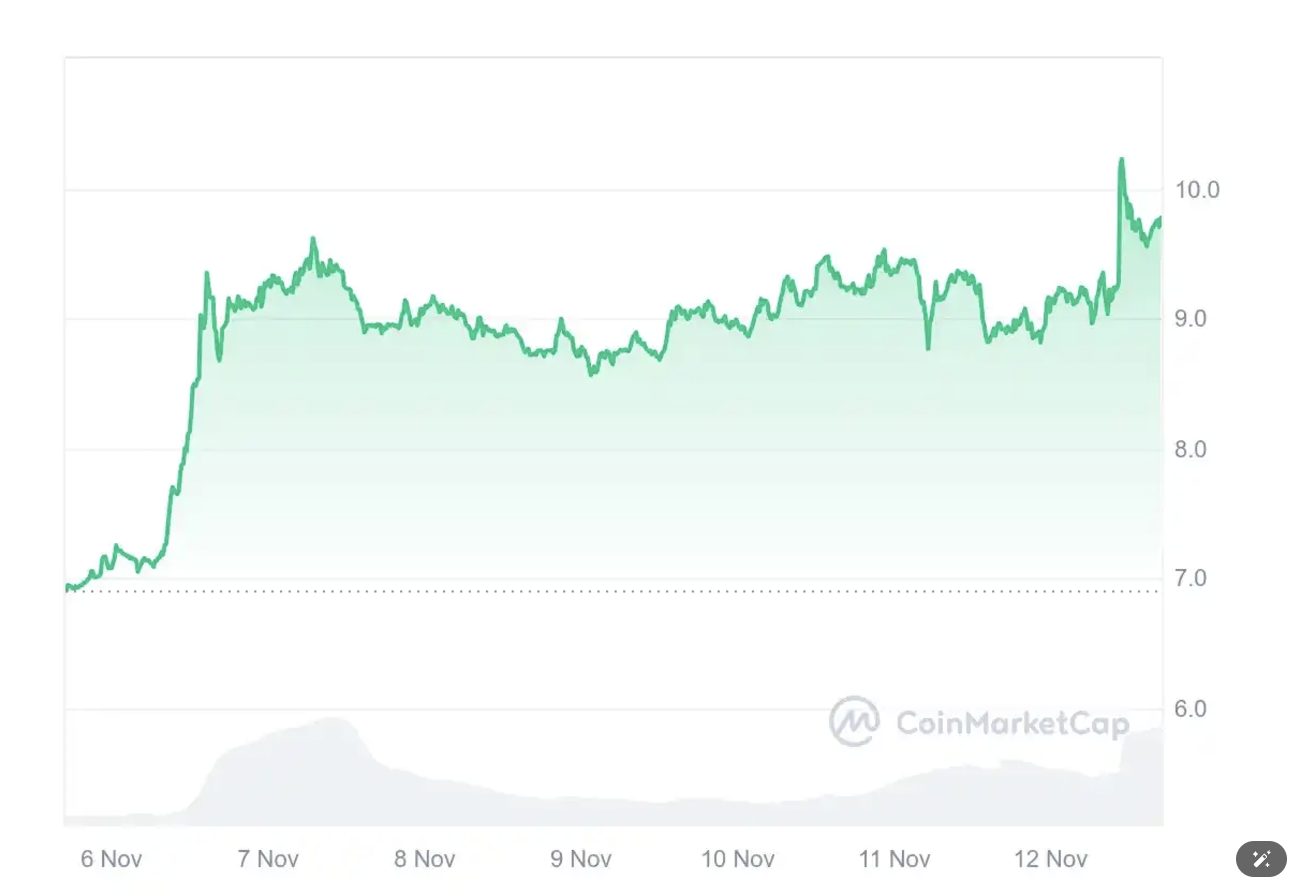

Bitcoin hits new highs and drives DeFi market activity, with SynFutures emerging as a focal point in the derivatives sector on the Base network.

Author: Sha

1. When DeFi Becomes a Hotspot Again

Bitcoin finally hit its long-awaited new high in November, getting close to the $100K mark. Meanwhile, the previously dormant altcoin market has erupted, with leading DeFi projects like Uniswap, Aave, Compound, and MakerDAO all seeing strong gains recently. Looking back from the 2020 DeFi boom to today, despite persistent skepticism, the DeFi ecosystem continues to grow steadily, gradually eating into the market share of centralized exchanges. This remains a highly innovative sector full of potential, offering countless opportunities yet to be explored. Today, I want to discuss one of the most promising projects in the recent DeFi landscape—SynFutures, Base's leading derivatives platform. We'll explore how it leverages its strengths to lead a new wave of DeFi innovation, shake up the decentralized derivatives space, and examine the reasons behind its rapid growth and future potential.

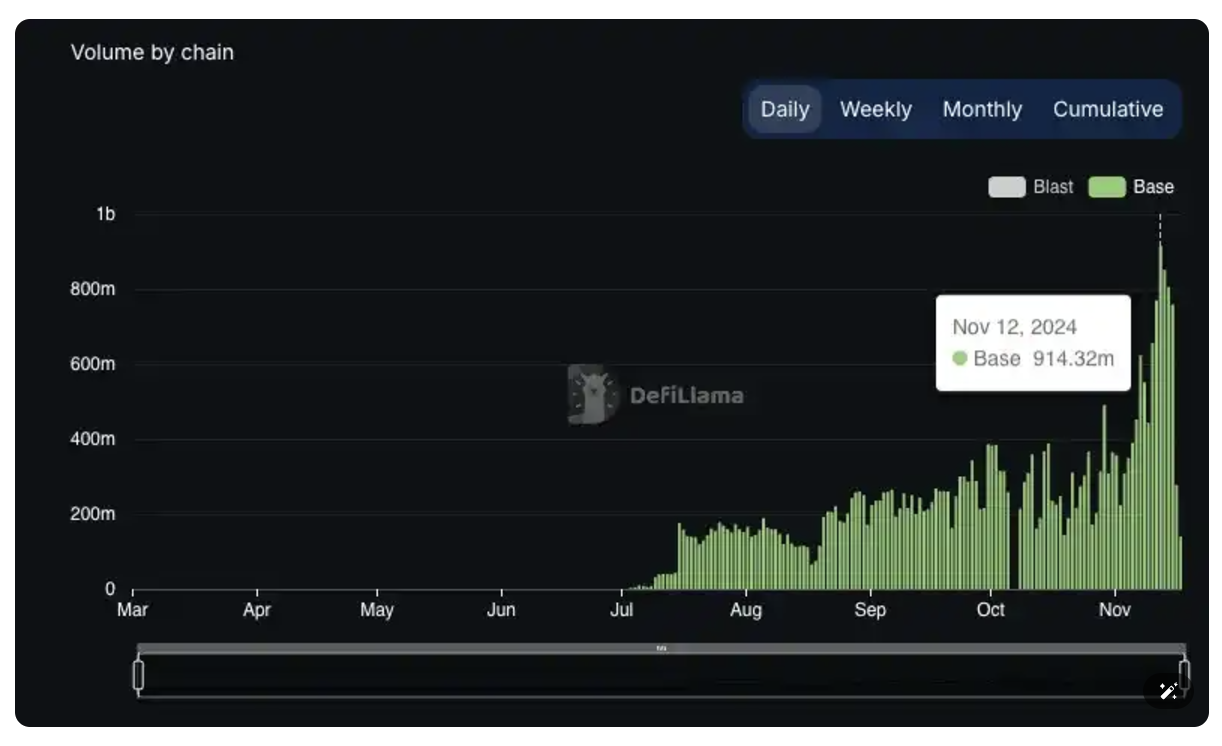

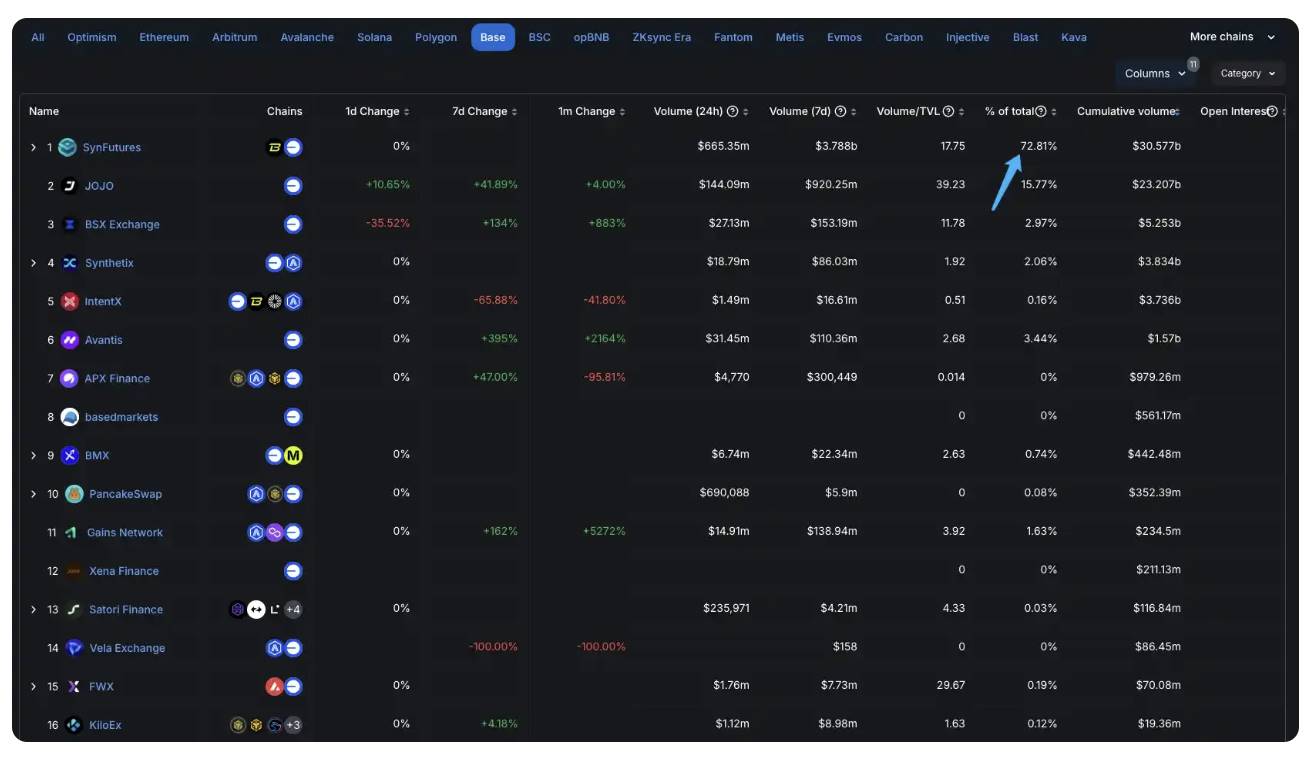

2. SynFutures on Base: Capturing 50% Market Share, Ranking #3 in Protocol Fee Revenue

Let’s first look at SynFutures’ performance data in the Base derivatives sector:

-

Launched on Base on July 1st; transaction volume surpassed $100 million within just 10 days

-

Daily trading volume exceeded $910 million on November 12th

-

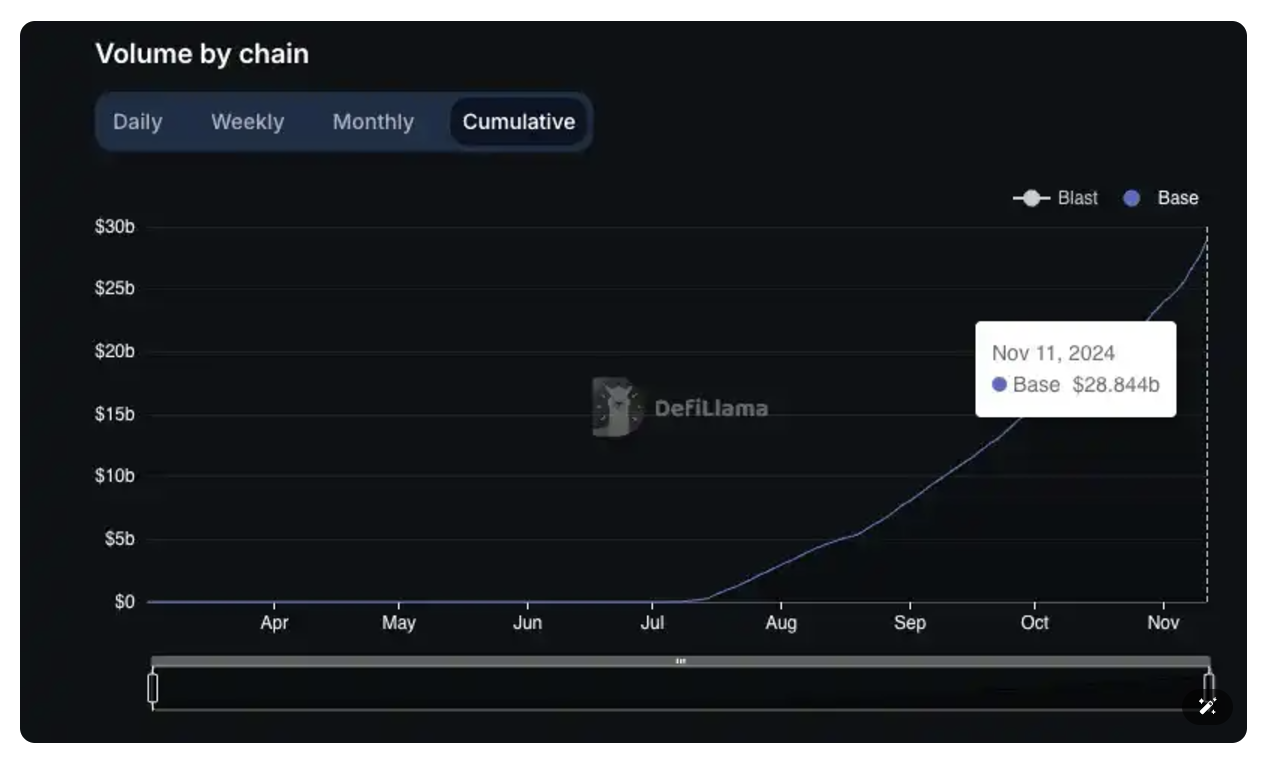

Cumulative trading volume approaching $30 billion, averaging $210 million per day

-

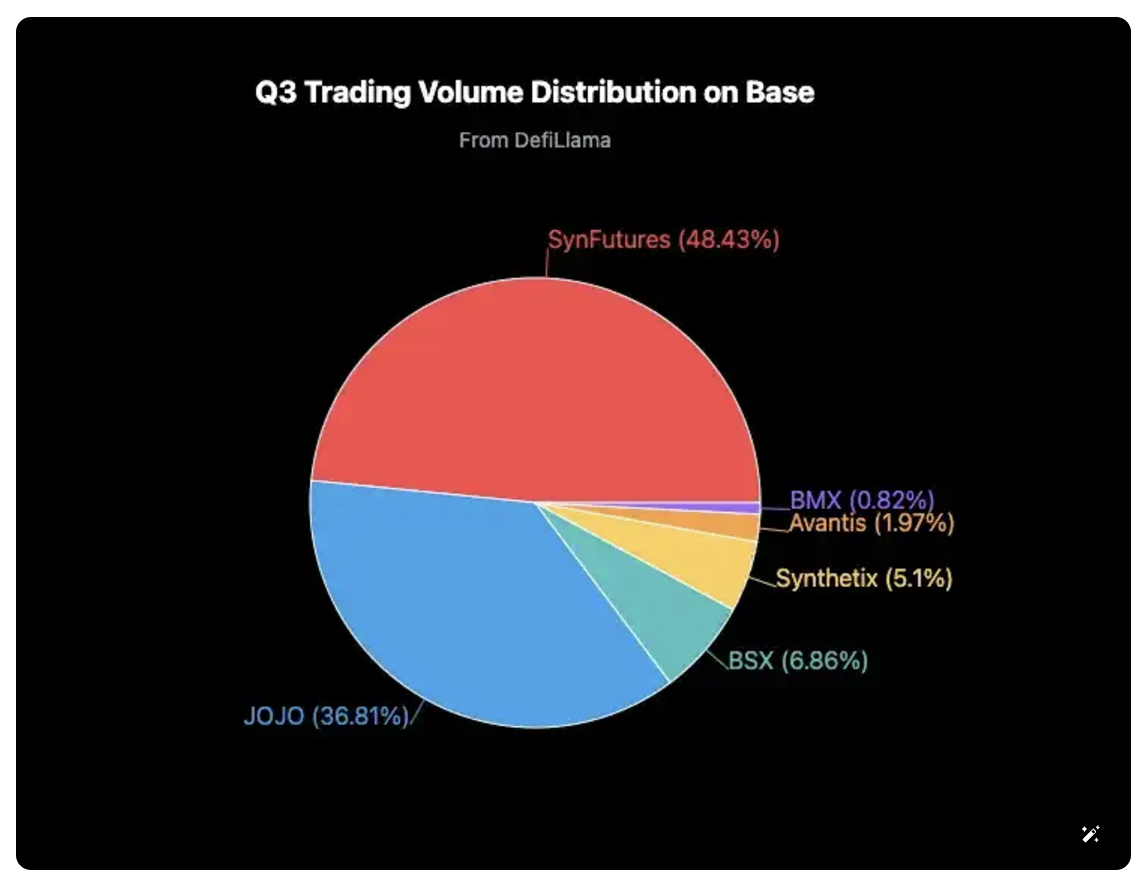

Accounted for nearly 50% of total trading volume on Base network in Q3

-

In the past 24 hours, accounted for 72% of Base’s derivative trading volume—nearly five times that of the second-place platform

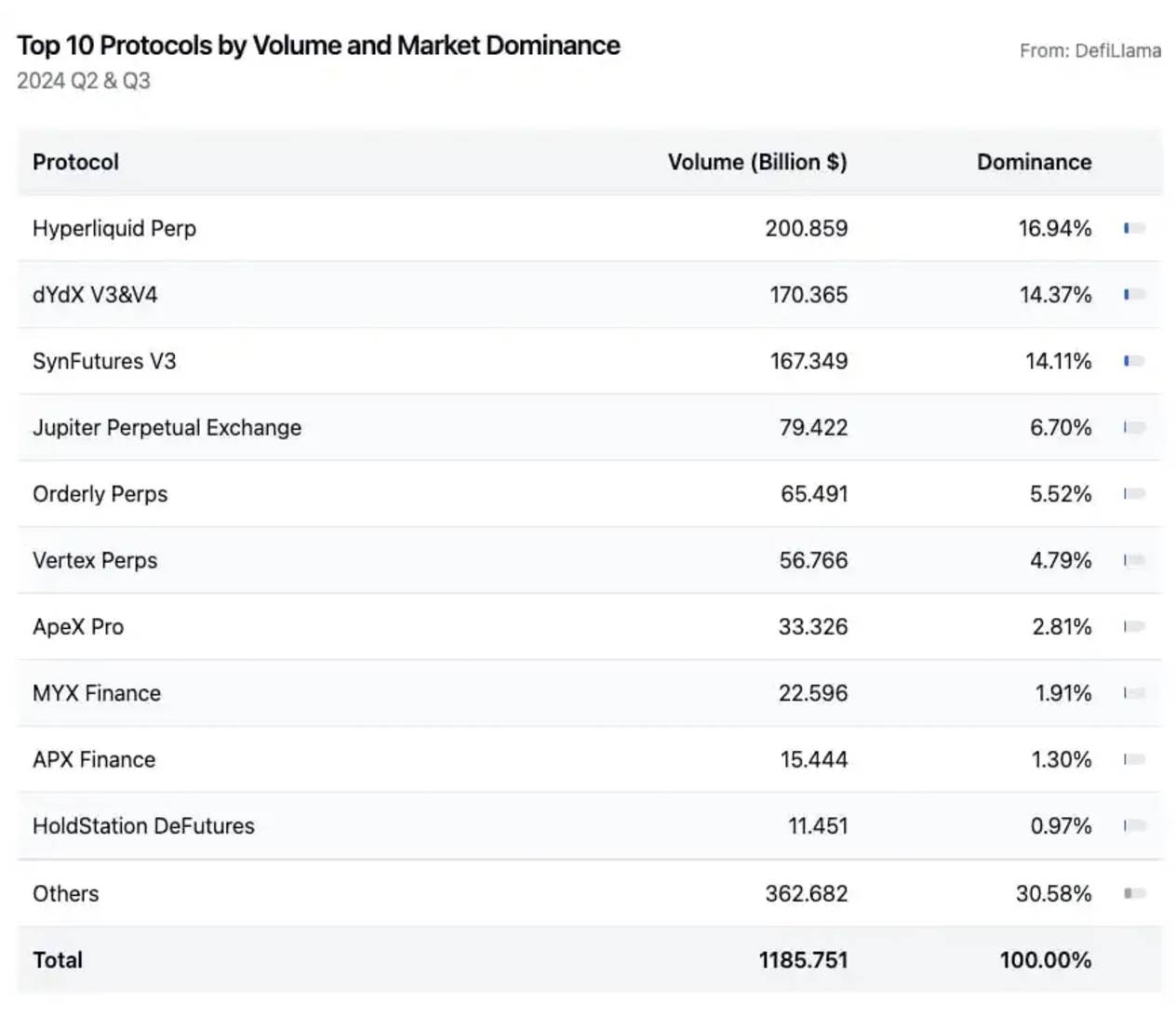

Zooming out to the broader industry, SynFutures V3 has shown remarkable growth since launch, standing tall alongside projects like Hyperliquid, dYdX, and Jupiter. According to DefiLlama data, the on-chain perpetual contract trading volume reached $118.57 billion in Q2 and Q3. The top three platforms captured over 45% of this volume: Hyperliquid (16.94%), dYdX V3 & V4 (14.37%), and SynFutures (14.11%).

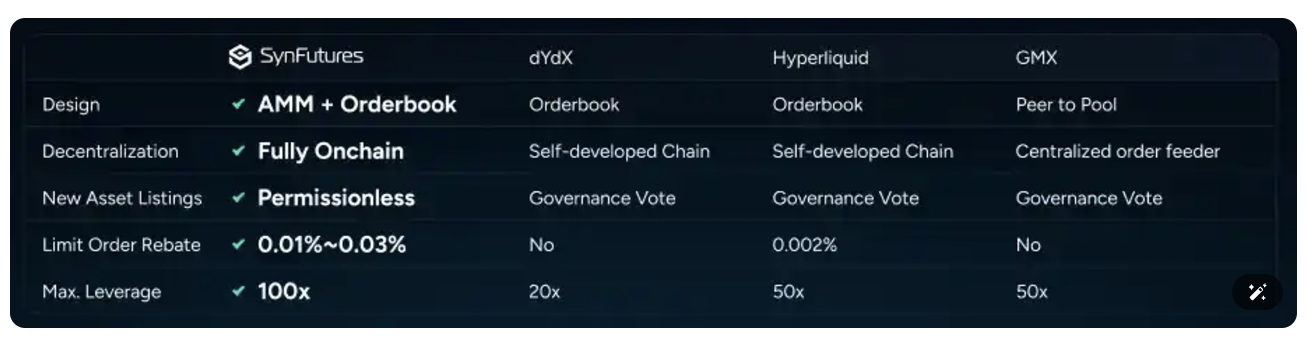

These impressive results naturally raise questions: Why SynFutures? What makes it stand out compared to other derivatives platforms?

3. SynFutures: A Game-Changer in Derivatives – Concentrated Liquidity + Pure On-Chain Order Book Model

Looking back at the past few years in the derivatives space, there are three dominant models:

-

Vault model represented by GMX — LPs act as counterparties to traders, using oracles for pricing. Leading examples include GMX and Jupiter. While GMX supports more assets, Jupiter benefits from SOL’s popularity, maintaining high yields and TVL, making it a hot project. However, oracle-related risks remain a significant concern. Additionally, because prices are determined via oracles, these platforms cannot serve as true price discovery venues, limiting their ability to challenge centralized exchanges;

-

Derivatives app-chains led by dYdX and Hyperliquid — Offering high performance and user experience comparable to CEXs, they have gained favor among market makers and secured a solid market position. However, their off-chain order books are overly centralized, and liquidity fragmentation poses ongoing challenges for both traders and projects;

-

The quieter but increasingly successful on-chain AMM model, exemplified by SynFutures — Inspired by Uniswap V3’s concentrated liquidity design, it introduces an on-chain order book to further enhance capital efficiency and trade matching. As seen in the Q2–Q3 rankings, SynFutures has already achieved over twice the trading volume of Jupiter (a Vault-model platform). This momentum shows no sign of slowing—recent data suggests it’s only a matter of time before SynFutures surpasses veteran decentralized derivatives exchange dYdX in total volume.

So why has SynFutures’ on-chain AMM model achieved such rapid breakthroughs? What advantages does it offer over the two mainstream models?

3.1 Concentrated Liquidity — Boosting Capital Efficiency

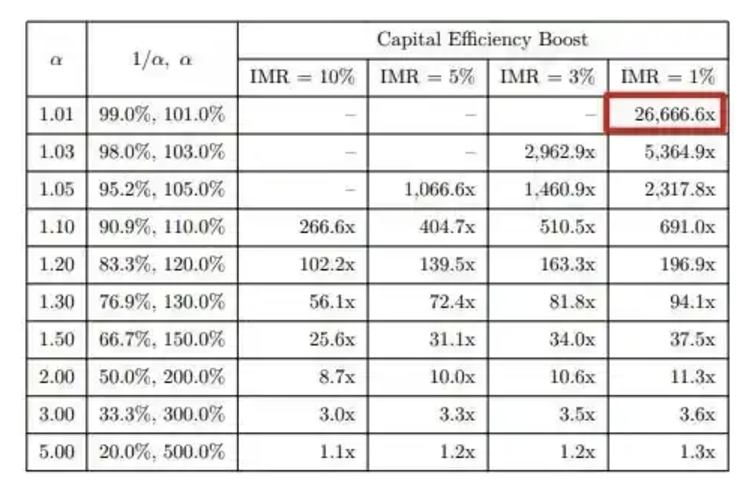

SynFutures’ oAMM allows LPs to allocate liquidity within specific price ranges, significantly improving AMM depth and capital utilization. This enables larger and more frequent trades while generating higher fee income for LPs. According to documentation, capital efficiency can be increased by up to 26,666.6x compared to traditional models.

3.2 Pure On-Chain Order Book — High Efficiency with Full Transparency

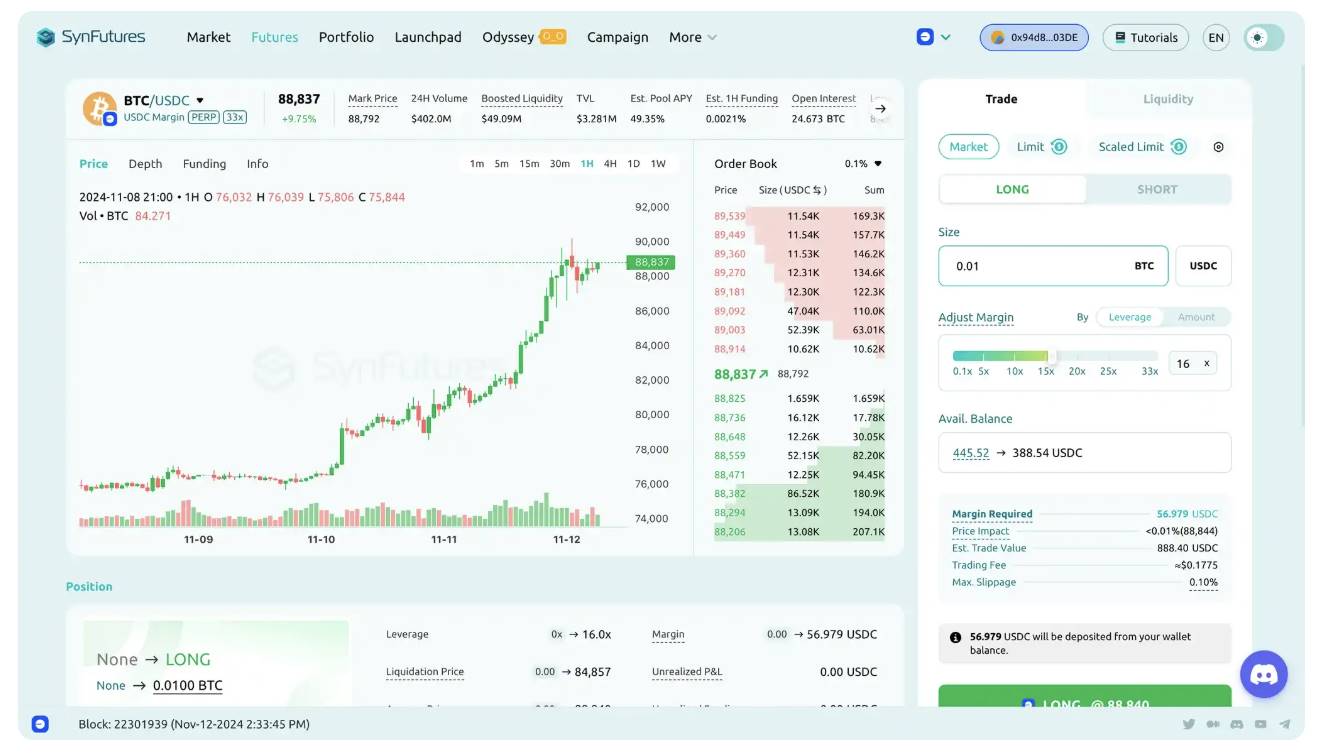

In oAMM, liquidity is distributed across designated price intervals, each composed of discrete price points. For example, if an LP provides liquidity in the BTC-USDC-PERP pair between [80,000, 90,000], that range is divided into multiple price points, each receiving equal liquidity. You might immediately recognize this structure—it’s essentially an order book!

By allowing users to provide liquidity at specific price points, oAMM simulates limit orders on-chain, effectively creating an order book mechanism that further improves capital efficiency. Compared to traditional AMM market-making, professional market makers—accustomed to limit-order strategies—are far more inclined to participate. Thus, oAMM attracts active market makers more effectively, enhancing trading efficiency and depth, delivering a user experience rivaling centralized exchanges.

Unlike dYdX’s off-chain order book, oAMM operates entirely on-chain through smart contracts. All data is recorded transparently and verifiably on the blockchain, ensuring full decentralization. Users don’t need to worry about manipulation or fake trading activities by the platform.

When comparing across models, SynFutures effectively bridges the gaps of both GMX-style vaults and app-chains like dYdX, combining high efficiency with robust decentralization. Its seamless integration with native assets across base-layer blockchains gives it a natural edge within the broader DeFi ecosystem—an advantage that will only grow stronger as underlying chains evolve technologically.

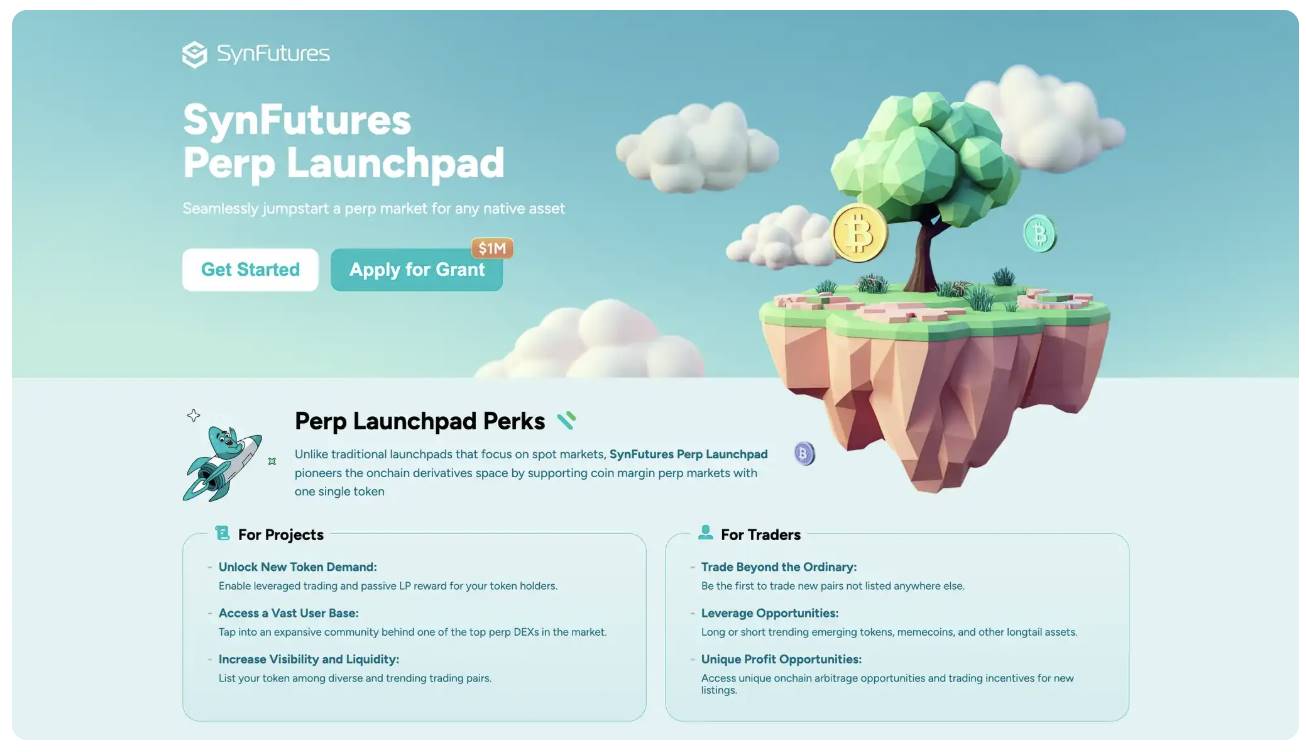

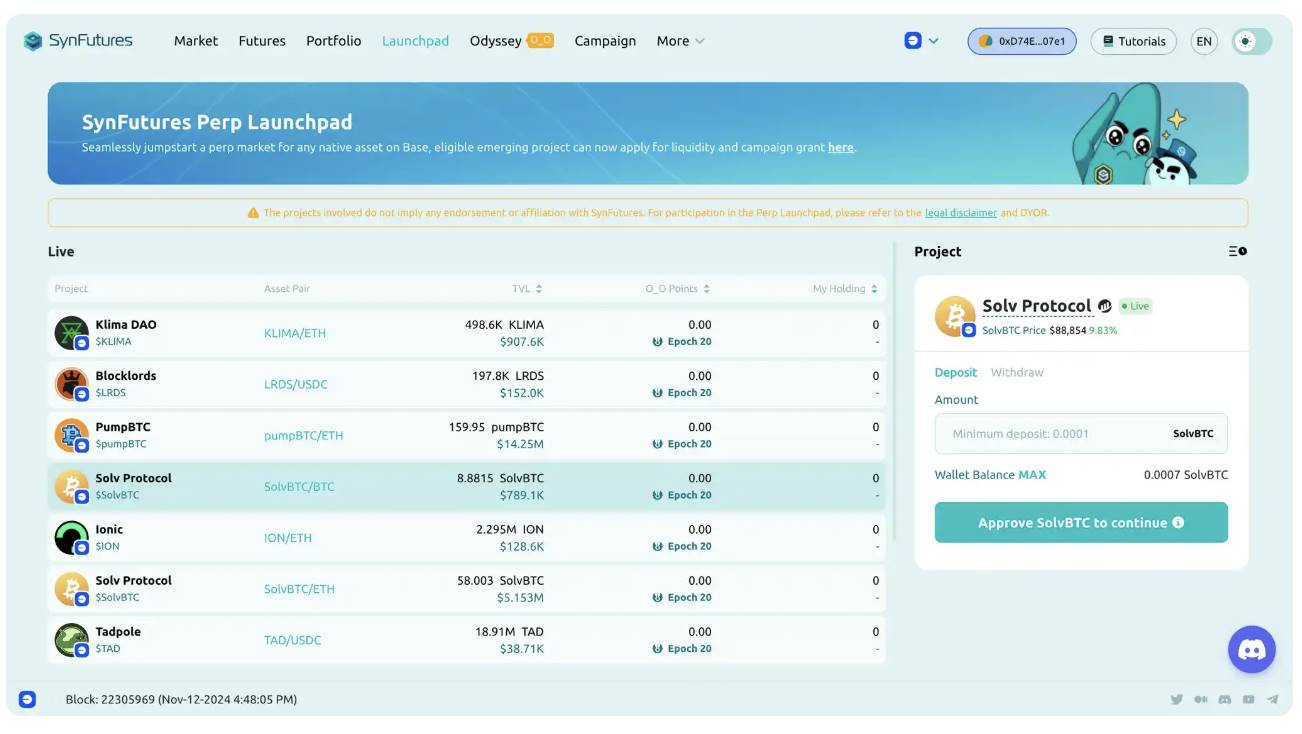

4. The Flywheel Effect Driven by Perp Launchpad

Beyond its core model innovations, SynFutures has introduced the industry’s first perpetual contract launch platform, inspired by Pump.fun. Over the past year, asset issuance has arguably been the most profitable segment—from runes and inscriptions to Pump.Fun and DAO.FUN—all continuously generating wealth effects and drawing in users. While this may feel hollow to those focused solely on intrinsic value, it reflects the current reality of the industry: whoever controls asset issuance, captures attention, and generates wealth effects, rises to prominence. Solana’s success and Pump.Fun’s tens of millions in revenue are prime examples. SynFutures’ newly launched Perp Launchpad builds upon its innovative model and introduces a novel approach to asset issuance, unlocking new gameplay possibilities for degens across the chain.

Imagine a meme token reaching a $100 million valuation. With Perp Launchpad, it could use its own project token to bootstrap liquidity and instantly launch a futures market. Wouldn’t that make things more exciting? If "truth of terminals" had used its $GOAT tokens early on to create a perpetual market, aggressive traders could leverage positions for amplified gains—whether buying the dip or shorting the peak. Once a futures market exists, trading becomes more complex and presents more opportunities. During periods of high volatility, price discrepancies between spot and futures open arbitrage windows, increasing the token’s visibility and expanding its holder base.

Building on this example, if "truth of terminals" actually launched a Perp Market with $GOAT, a new narrative—"AI launches its own derivatives market"—could sustain hype and potentially push $GOAT’s market cap even higher. After all, this market thrives on dopamine, fun, and excitement—and perpetual trading delivers exactly that.

You might ask: Who provides the liquidity? The answer: project teams and their supporters, who earn additional tokens as rewards. As holders accumulate more tokens, the project moves toward healthier, more sustainable growth. More importantly, why should centralized exchanges control whether a futures market gets listed—and capture most of the profits generated? Why shouldn’t projects and communities maintain ownership of their own markets? This is precisely what Perp Launchpad aims to achieve: returning control of perpetual markets to the community.

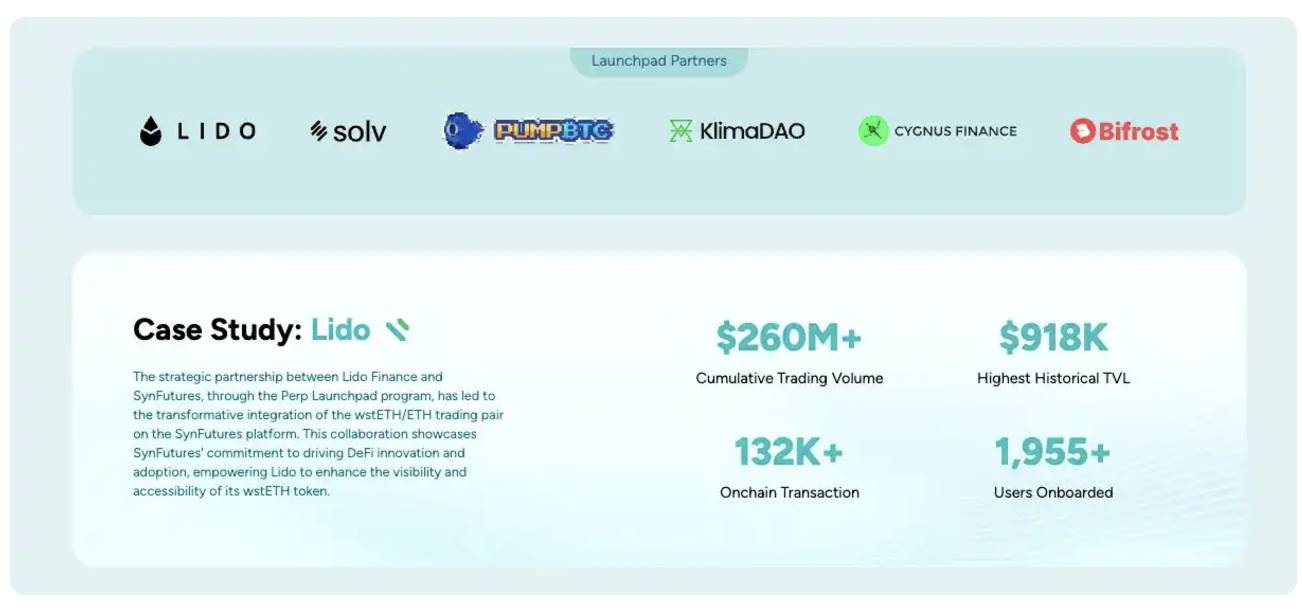

In recent years, we’ve seen listing power shift from CEXs to communities—on-chain liquidity pools now set the starting point, especially evident in meme trading. In the coming years, the same shift will happen in derivatives listings. It sounds radical—but it’s already happening, and accelerating. According to SynFutures’ recent announcement, Perp Launchpad surpassed $100 million in trading volume within its first week alone, and growth continues to accelerate.

We’ll soon see more projects launching their own derivative markets after establishing spot listings, capturing liquidity and reinvesting trading profits into development or distributing them back to holders—creating a healthier, self-sustaining cycle. “Margin trading” becomes a utility of the token; “revenue sharing” becomes standard. All of this is unfolding rapidly under SynFutures’ leadership.

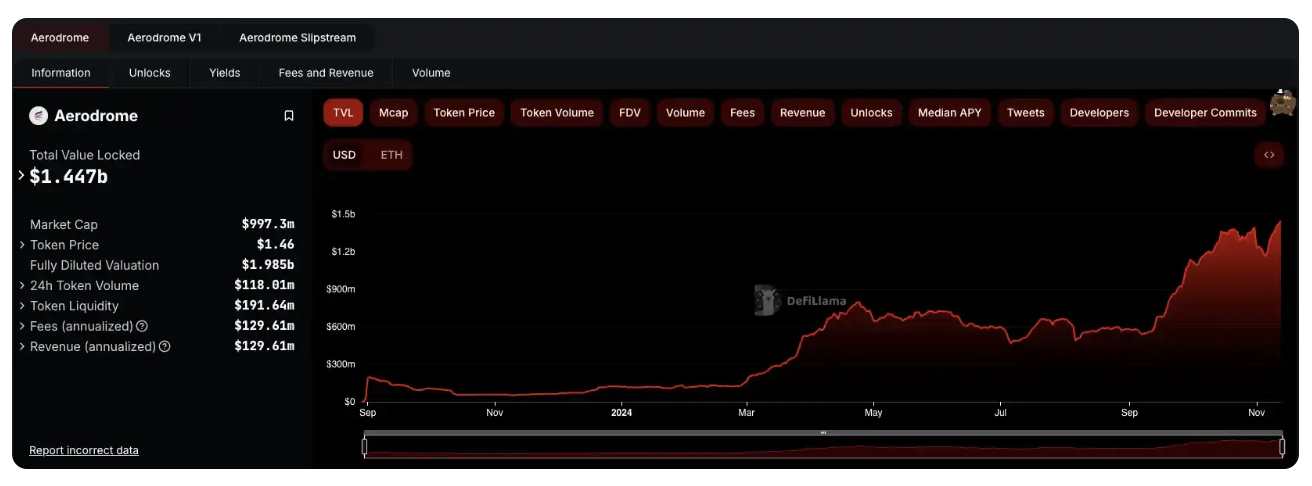

As this wildfire spreads, SynFutures stands to gain enormously—a massive tailwind driving explosive growth in both TVL and trading volume, bringing it ever closer to becoming the dominant player in decentralized derivatives. Returning perpetual market control to the chain and to communities represents a market opportunity worth at least $1 billion. Take Base network alone: Aerodrome currently holds $1.4 billion in TVL. Even if just 1/10 of that capital opts to create its own derivatives market, that’s still ~$150 million in new TVL. And this is just one protocol on one network. Across the entire ecosystem, SynFutures is currently the only platform capable of enabling this shift. Its purpose-built oAMM for contract trading positions it as the primary beneficiary of this trend.

On the revenue front, SynFutures is on track to rival top-tier protocols like Aave and MakerDAO. Even excluding Launchpad contributions, it generated over $2 million in fees over the past 30 days—ranking #3 across all protocols (only behind Base’s Sequencer).

This growing revenue stream enables SynFutures to aggressively expand Perp Launchpad’s market share and establish dominance in this emerging category. In its initial grant round, SynFutures has allocated a $1 million fund to support emerging projects with listing assistance, promotional campaigns, and enhanced on-chain visibility and engagement.

More participating projects mean stronger community backing for SynFutures, attracting more users and generating more revenue—fueling a positive feedback loop that expands its market influence. And this doesn’t even account for potential incentives from its tokenomics. Remember, SynFutures has raised $38 million from renowned firms including Pantera, Polychain, Dragonfly, Standard Crypto, and Framework. Future token incentives could supercharge this flywheel effect to astonishing levels.

5. SynFutures Will Lead the Next Wave of Innovation in Decentralized Derivatives

If you’ve made it this far, you likely sense my enthusiasm and optimism for SynFutures’ trajectory. To me, the DeFi derivatives space hasn’t seen a truly fresh narrative or direction in a long time. We’re aware of the oracle risks in vault models and the centralization issues of app-chains—but where are the solutions? This sector has stagnated, needing new energy to compete with centralized exchanges. In my view, SynFutures stands out as the most innovative and market-responsive derivatives project today. From its purpose-built AMM model to the recently launched Perp Launchpad, every move pushes the boundaries of decentralized derivatives innovation, steering the sector toward better, more sustainable evolution. In this new phase of the DeFi cycle, SynFutures is the disruptor—driving the entire derivatives space toward renewed innovation and healthier growth!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News