On-Chain Alpha Hunting P1: Decoding SynFutures' Perp Launchpad

TechFlow Selected TechFlow Selected

On-Chain Alpha Hunting P1: Decoding SynFutures' Perp Launchpad

SynFutures' innovation is essentially reshaping the issuance paradigm of perpetual contracts.

Author: NingNing

In July, Base—the "digital American West"—welcomed a major new player: SynFutures. As of today, SynFutures has accumulated $26 billion in trading volume on Base, capturing over half of the PerpDEX market share within the Base ecosystem.

Recently, SynFutures launched its Perp Launchpad platform on Base, pioneering an entirely new model for perpetual contract issuance.

But before deconstructing this new tool, we must first confront a harsh reality: under current market conditions, growth in the PerpDEX sector has hit a bottleneck. Leading players such as dYdX, Hyperliquid, GMX, and SynFutures have already divided up the most profitable perpetual contract offerings. What remains are either contracts with so little volume they can barely sustain operations or instruments with such poor pricing efficiency that they’ve become mere arbitrage tools.

Faced with such a saturated landscape, SynFutures has chosen to chart a different course in search of new growth opportunities.

1. Innovation of Perp Launchpad: A One-Stop Perpetual Contract Launcher

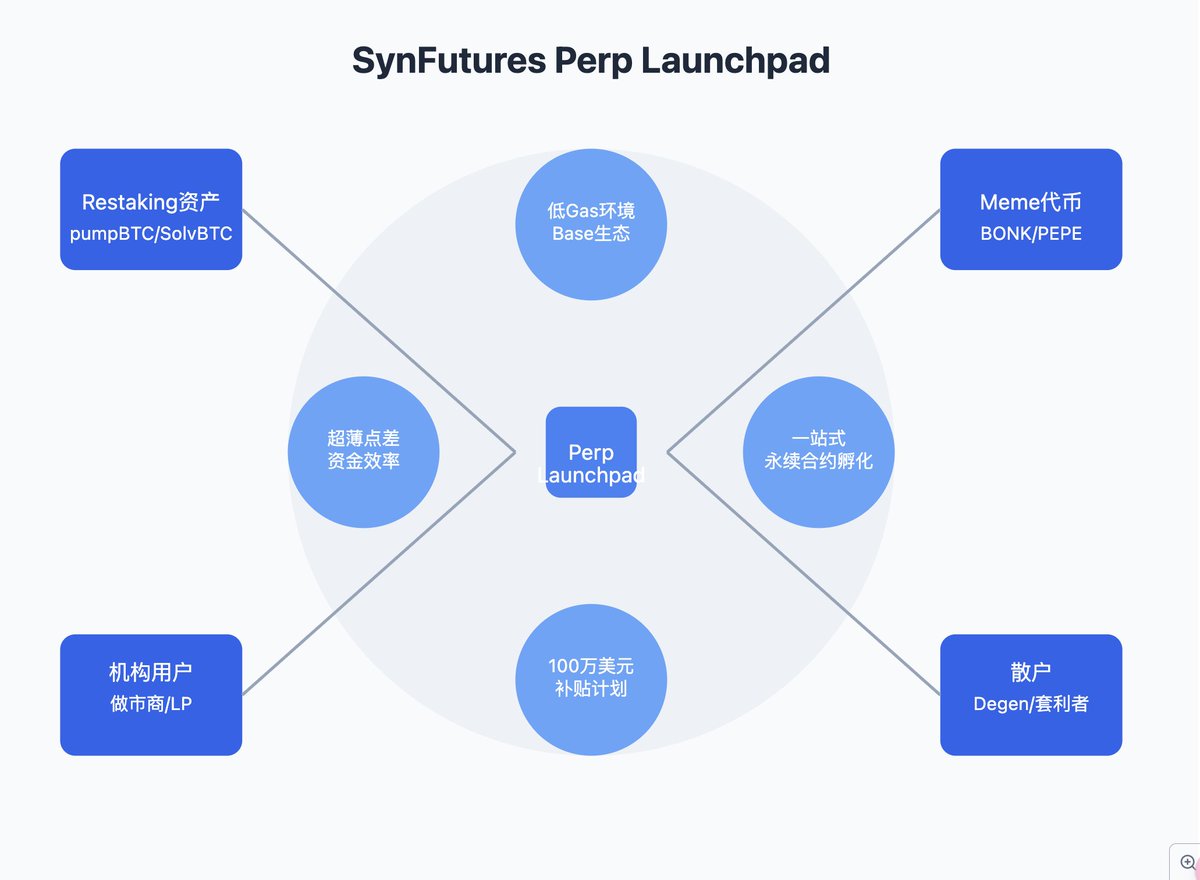

The Perp Launchpad leverages a low-Gas environment, ultra-thin spread capital efficiency, and a $1 million subsidy program to provide liquidity depth and price discovery channels for the Restaking and Meme sectors. It aims to capture the attention of on-chain degens—its target user base—and position itself as the Pump.fun of the PerpDEX space.

With just one token, users can permissionlessly launch a perpetual contract pair.

The key advantages of this model include:

-

Dramatically lowering the entry barrier to the perpetual contracts market

-

Quickly establishing deep liquidity via LP incentive mechanisms

-

Leveraging Base’s low Gas fees for rapid deployment

Take Lido’s case as an example: The wstETH/ETH perpetual contract achieved the following within just two months of launch:

-

Cumulative trading volume: $260 million

-

Peak TVL: $918,000 — On-chain transactions: 132,000

-

Number of users: 1,955+

2. Investor Perspective: New Sources of Yield and Risk Management Tools

For on-chain degens, SynFutures offers three layers of earning opportunities:

-

LP market-making yields (annualized returns potentially exceeding 50%+) — plus community revenue sharing

-

Future token airdrop expectations and points rewards

At the same time, it enables degens to hedge risks associated with Restaking assets and Meme coins.

However, several risks should be noted:

-

Liquidity in the perpetual contracts market often exhibits strong cyclicality

-

The price discovery process for newly launched pairs may lead to significant volatility

-

LPs face impermanent loss risk

3. A New Toy for Restaking Enthusiasts

By partnering with Liquid Staking leaders like Lido, SynFutures is effectively creating a new monetization channel for Restaking assets. We can anticipate:

-

More Restaking assets being introduced into the perpetual contracts market

-

Further improved liquidity for LRT tokens

-

The emergence of novel derivative strategies around Restaking

SynFutures’ data reveals an interesting trend: BTC Restaking assets are becoming the new darlings of the perpetual contracts market.

The performance of pumpBTC/ETH and SolvBTC/ETH perpetual contracts stands out particularly:

-

pumpBTC/ETH: 24h trading volume of $429.3K, TVL of $12M

-

SolvBTC/ETH: 24h trading volume of $341.8K, TVL of $5M

The TVL of these two pairs is approaching that of mainstream pairs like ETH/USDC. Why is this happening?

-

The BTC Restaking sector is heating up, creating demand for hedging instruments

-

The high price correlation between native BTC and ETH provides a natural pricing benchmark for these pairs

-

Intensifying competition among Restaking protocols fuels greater speculative demand

4. Long-Tail Meme Coin Perpetual Contracts

Surprisingly, perpetual contracts for Meme coins have performed relatively poorly, failing to attract the same level of market enthusiasm seen in spot Meme coin trading. The numbers are underwhelming:

-

BONK/USDC perpetual contract: 24h volume of $7.7K, market-making depth of $405.3K

-

PEPE perpetual contract: average daily volume fluctuates between $5K–$10K, market-making depth maintained between $300K–$500K

-

Other Meme tokens perform even worse

Possible reasons for this phenomenon include:

-

The combination of high leverage and high volatility poses excessive risk, deterring traders

-

The speculative nature of Meme coin spot markets frequently causes funding rates to become unbalanced, making them less trader-friendly

-

The probability and magnitude of impermanent loss are higher, requiring LPs to carefully manage their risk exposure

Conclusion

SynFutures’ latest innovation fundamentally redefines the paradigm of perpetual contract issuance. It no longer focuses solely on mainstream assets but opens the derivatives market to any token.

The significance of SynFutures' innovation lies not only in lowering the barriers to launching perpetual contracts, but more importantly, in unlocking a crucial channel for value discovery: from "blue-chip" assets like Restaking tokens to retail favorites like Meme coins, all can now find their market price here.

This inclusive strategy may be risky, but it could well be the necessary path for perpetual contracts to enter the mainstream. After all, in a bear market, sometimes the wildest ideas end up creating the greatest value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News