Derivatives veteran "ramps up," can SynFutures ignite a "Blast Summer" for on-chain derivatives?

TechFlow Selected TechFlow Selected

Derivatives veteran "ramps up," can SynFutures ignite a "Blast Summer" for on-chain derivatives?

Trading volume surged over 90x within the month, bringing SynFutures to the surface as a seed contender in "Blast Summer."

Launched less than a month ago, trading volume surged over 90x, TVL跻身Blast derivatives leader—these are the three most visible labels for SynFutures recently.

The derivatives sector has always been one of the most compelling on-chain narratives. As a version launched simultaneously with the Blast mainnet, SynFutures V3 has surged forward in the past four weeks, with trading volume growth exceeding 9400%, leaving established leaders like dYdX and GMX far behind.

This article will deeply analyze why SynFutures has attracted significant market attention and capital inflow, whether it can leverage the dual narrative of "derivatives" + "Blast Summer" to unlock new valuation potential, and explore its underlying opportunities.

Behind Surpassing GMX in Daily Trading Volume: The Rise of Synfutures

In some sense, SynFutures has long been a battle-tested "veteran" in the DeFi derivatives space:

As early as 2021, when the industry was still confused about which paradigm on-chain derivatives should follow, SynFutures pioneered a permissionless contract market model, allowing anyone to list tokens within 30 seconds by adding single-token liquidity—a standard now widely adopted across many on-chain derivative platforms.

This stems from the team’s diverse background, including top-tier international investment banks, internet companies, and crypto OGs. Additionally, in October 2023, it completed a $22 million funding round featuring elite investors such as Pantera Capital, SIG, and HashKey Capital.

Its earlier $14 million Series A round in June 2021 included participation from leading VCs including Polychain Capital, Framework Ventures, Bybit, Wintermute, CMS, Kronos, and IOSG Ventures. To date, total fundraising exceeds $38 million, making it a unique standout in the decentralized derivatives landscape.

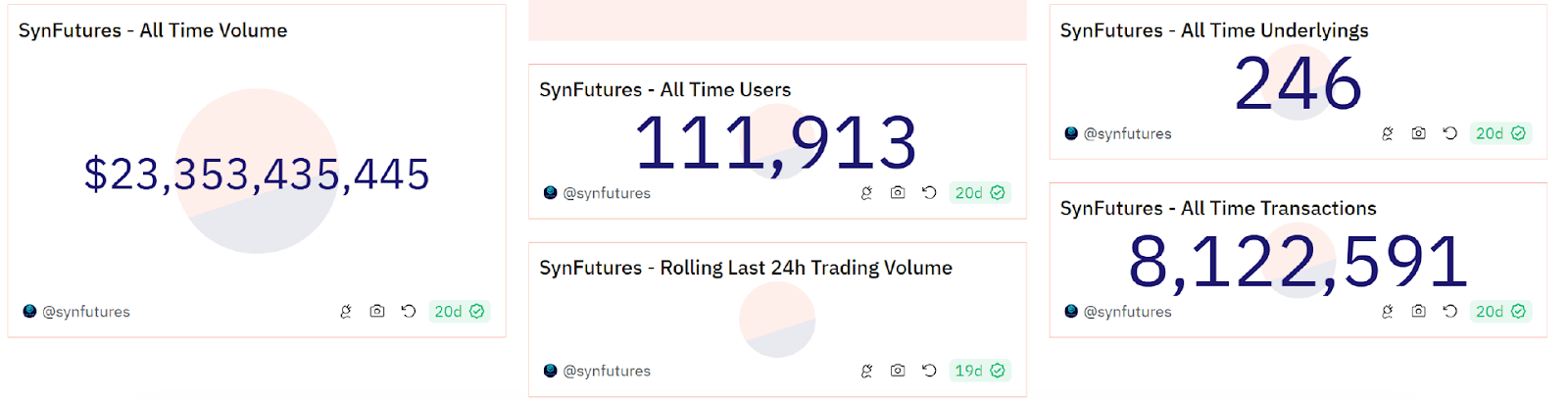

Dune analytics show that as of March 26, 2024, SynFutures has operated stably for over two years, serving more than 110,000 users, with cumulative trading volume surpassing $23 billion (V1+V2), and over 8.12 million total trades—consistently ranking among the top decentralized derivatives exchanges.

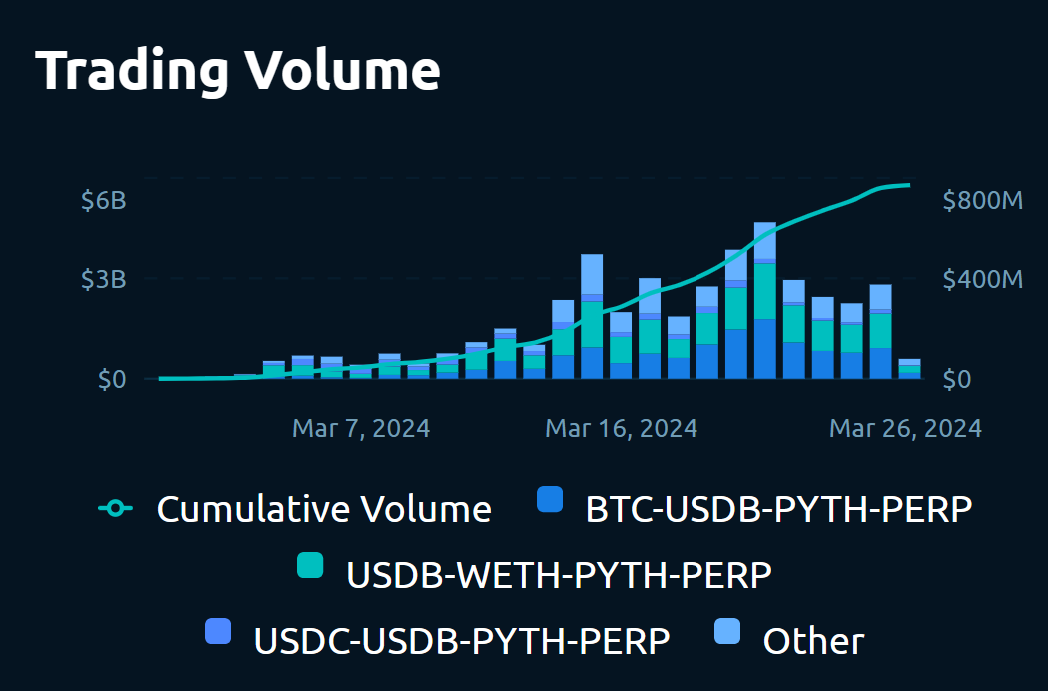

On March 1, SynFutures V3 officially launched on the Blast mainnet, with trading volume rising steadily. On March 21, it set a record high of $623 million in daily volume. As of March 26, cumulative trading volume on just the V3 version approached $5.8 billion.

In other words, within less than a month since launching on Blast, V3's trading volume already reached 25% of the combined V1+V2 volume accumulated over more than two years.

A comparison better illustrates how aggressively fast SynFutures V3 is growing:

It’s well known that GMX is the largest DeFi protocol in the Arbitrum ecosystem and currently holds the highest TVL among all on-chain derivatives markets (per DeFiLlama). Yet its daily trading volume now lags behind SynFutures—at the time of writing, GMX’s 24-hour trading volume stands at $270 million, while SynFutures V3 reaches approximately $375 million.

Among all on-chain derivatives protocols, Synfutures leads by at least an order of magnitude in growth rate during the same period:

- Over the past 7 days, growth rates for leaders dYdX and Hyperliquid were -18% and -42% respectively, whereas Synfutures grew by 67%;

- Over the monthly timeframe, growth rates for dYdX and Hyperliquid were 77% and 91%, while Synfutures exceeded 9400%.

From this perspective, after launching V3 on Blast, Synfutures’ momentum is extremely fierce—surpassing nearly every other decentralized derivatives protocol and seemingly entering its long-awaited breakout moment.

Can Synfutures V3 Usher Derivatives into the Next Phase?

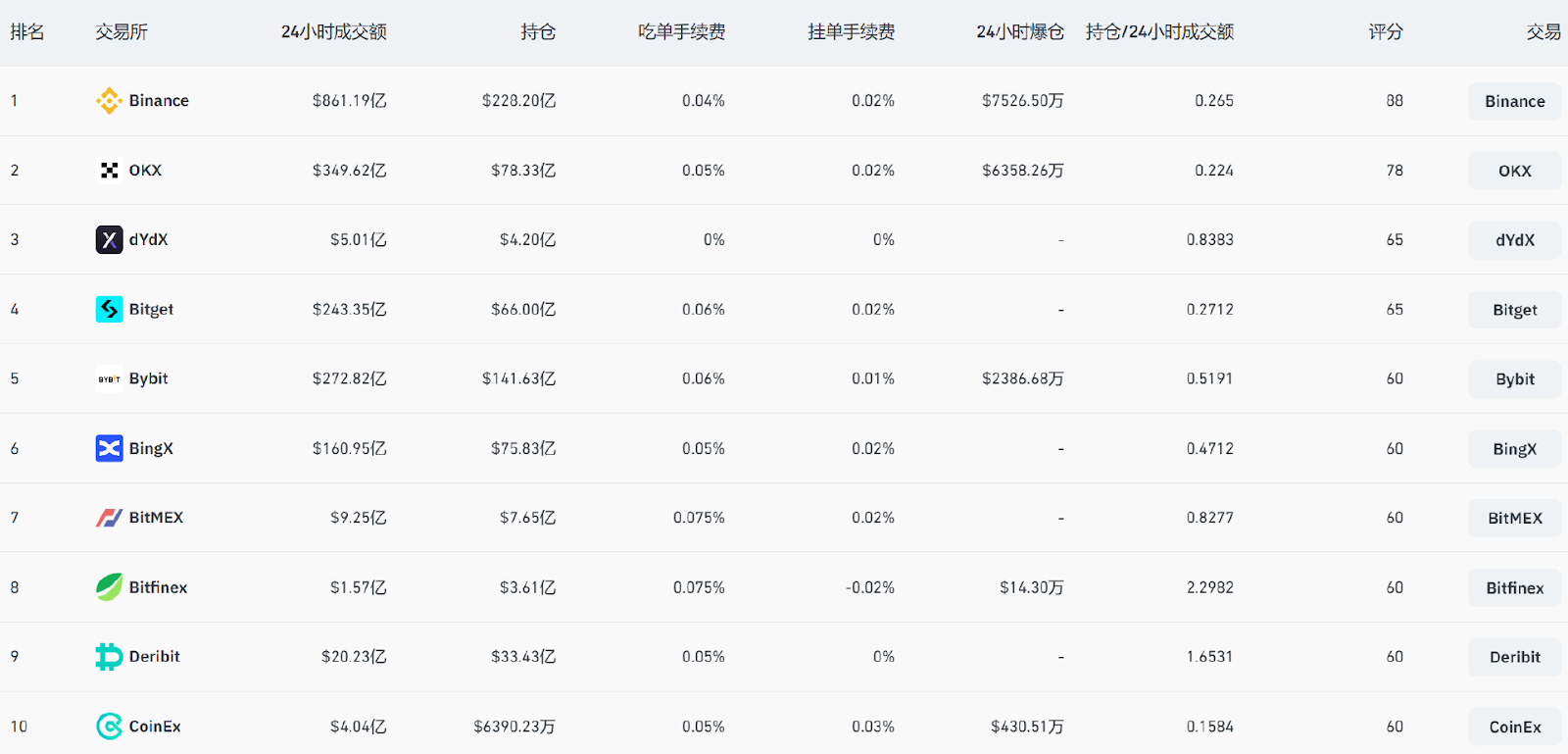

In traditional financial markets, derivative trading typically surpasses spot trading in terms of liquidity, capital size, and transaction scale. This pattern also holds true in the crypto world, especially on centralized exchanges (CEX):

As early as 2020, derivative products like futures contracts began replacing spot trading as the dominant force in CEX markets. According to Coinglass data, the past 24 hours saw the top five CEXs each achieve daily futures trading volumes in the tens of billions of dollars, with Binance alone exceeding $80 billion.

CEX derivatives daily trading volume rivals a full week of spot trading—according to The Block, Binance derivatives’ daily volume equaled 16% of its February spot monthly volume ($506.2 billion).

However, on-chain, spot trading volume on DEXs like Uniswap still vastly outpaces that of decentralized derivatives protocols like dYdX. Even GMX, considered a “legacy leader” in on-chain derivatives, has a TVL under $750 million and ranks around 40th among all DeFi protocols by value locked.

Ultimately, leading on-chain derivatives protocols like GMX and dYdX have failed to keep pace with evolving narratives. Per DeFiLlama, as of March 12, 2024, total DeFi value surpassed $100 billion, yet derivatives protocols collectively accounted for less than $30 billion—under 30%.

Therefore, as one of the most promising narratives in on-chain DeFi, the derivatives market urgently needs a new breakthrough approach.

For today’s Blast ecosystem, SynFutures—with its explosive trading volume growth—may serve as a prime example showing that leveraging L2 performance and cost advantages, along with Blast’s inherent traffic effect, many use cases previously constrained by Ethereum’s base layer can now gradually become feasible.

Thus, fueled by the anticipated Blast airdrop wave, the on-chain derivatives narrative appears to have arrived at a timely development inflection point. Among these opportunities, which early-stage projects should we prioritize?

From a product standpoint, veteran DeFi protocols like SynFutures hold distinct advantages:

- First, SynFutures developed Oyster AMM (oAMM) in V3, combining the strengths of order books and AMMs to maximize capital efficiency; as Blast’s ecosystem TVL rises post-airdrop, it will be better positioned to absorb incoming capital;

- Second, as an established on-chain protocol, SynFutures has not yet launched a token, allowing users to access derivative trading services while accumulating potential airdrop eligibility—enabling them to share in future growth dividends from both Blast and the broader on-chain derivatives sector.

Looking back at the data, Synfutures’ trading volume to TVL ratio over the past 30 days reached 12.7—one of the most undervalued projects in the on-chain derivatives space. Compared to issued tokens like GMX and dYdX, with ratios of just 0.43 and 3.03 respectively, SynFutures stands out as the most cost-effective contender.

How to Maximize Opportunities via SynFutures in the Blast Ecosystem?

For ordinary users, what opportunities exist to “eat multiple meals from one fish” through SynFutures in the Blast ecosystem and maximize early gains from both SynFutures (V3) and Blast?

On the same day V3 launched—March 1—SynFutures introduced a triple points campaign (Blast Points + Blast Big Bang Champion Points + SynFutures O_O Points), expected to last 3–4 months.

In short, users interacting with SynFutures V3 now can earn triple rewards: Blast Points, Blast Gold, and SynFutures Points.

Rumors suggest that Blast Gold is the most valuable asset on the Blast chain. In the first official distribution last Saturday, SynFutures received the second-largest amount of Gold incentives in the entire ecosystem—nearly 500,000 tokens. Market estimates price each Blast Gold between $5 and $10. SynFutures previously announced that 100% of received Blast Gold will be distributed to users. Thus, the first round of Blast Gold rewards alone could be worth $2.5 million to $5 million. At the time of writing, SynFutures’ TVL stands at $32 million, with daily trading volume reaching $380 million. Officially, 50% of Blast Gold rewards will go to liquidity providers (makers), and 50% to traders (takers). We will continue monitoring the project’s detailed reward distribution plans.

Moreover, the allocation of Blast Gold is directly proportional to the quantity of SynFutures O_O Points earned. In short: the more SynFutures O_O Points you accumulate, the more Blast Gold you receive.

Interestingly, on March 12, SynFutures launched a $500,000 prize pool Trading Grand Prix competition. Around the same time as launching the Blast points campaign and trading contest, the team indicated they are actively researching token issuance, noting the points program will run for 3–4 months and hinting at upcoming token launches and airdrops.

Latest updates indicate the project will conduct its first contract snapshot on April 9, potentially signaling that token airdrop-related developments are imminent, meaning the window for participation is rapidly closing—prompt interaction is advised.

Conclusion

In 2020, we witnessed the explosive growth of the DeFi world, where the derivatives sector (futures, options, synthetic assets, etc.) was once seen as the most promising successor to lead the next phase of DeFi and the broader industry. However, due to limitations like Ethereum’s performance constraints, the expected tailwinds never fully materialized.

Now, as the clock turns to early 2024, the recently activated Dencun upgrade improving L2 fee efficiency gives the impression that something has shifted in the decentralized derivatives space.

Especially as the strongest disruptive force in the new L2 race, if Blast, with increasing capital inflows and rising market attention, can bring incremental value to the derivatives sector and expand the overall pie, then on-chain derivatives may finally be just one spark away from a “Cambrian explosion.”

From this angle, Synfutures—bridging the identity of a seasoned player and emerging leader—is gradually building momentum through its aggressive growth trajectory and backing from top-tier institutions like HashKey Capital, likely setting itself apart from the pack.

In 2024, whether we believe in the potential of the Blast ecosystem or the vast imagination space of the derivatives sector, projects like SynFutures deserve close attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News