Understanding SynFutures, the crown jewel of the Base ecosystem

TechFlow Selected TechFlow Selected

Understanding SynFutures, the crown jewel of the Base ecosystem

SynFutures values not the trading volume of spot aggregation business, but rather the customer acquisition capability of the spot aggregator赛道.

SynFutures is currently the leading derivatives project in the Base ecosystem. Recently, it released its post-TGE roadmap, revealing that beyond its core derivatives business, it will also expand into the spot aggregator sector. In my view, this represents a bold yet highly imaginative strategic move by the team—drawing clear parallels to Jupiter, the dominant player in the Solana ecosystem.

The Rise of Jupiter

If you've used Solana, you've almost certainly used Jupiter. For most users, Jupiter serves as their entry point into the Solana ecosystem—an effective gateway. Here, users can trade spot assets, engage in perpetual contracts, purchase JLP tokens, perform cross-chain swaps, and participate in launchpad events. Those familiar with Jupiter know that it originally started solely as a spot aggregator. After achieving success in that domain, it launched its derivatives trading platform just before TGE, then leveraged the impact of its token airdrop and attractive JLP yields to achieve massive success in perpetuals, ultimately becoming today’s dominant multi-sector giant across the Solana ecosystem.

Why has Jupiter achieved such remarkable success? A major reason lies in its "diversification strategy"—not being confined to success in just one sector, but instead leveraging its strengths, resources, brand, and traffic from its original domain to expand horizontally into new areas. Thanks to its strong first-mover advantage within the Solana ecosystem, it was able to rapidly become a leader in each new field it entered.

SynFutures: At the Heart of the Base Ecosystem

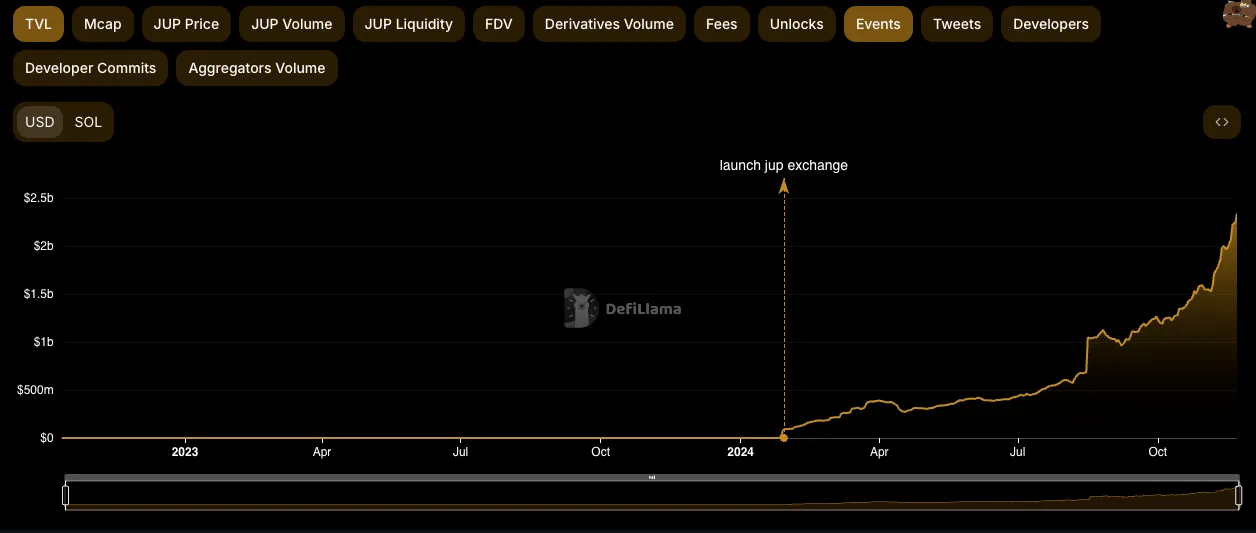

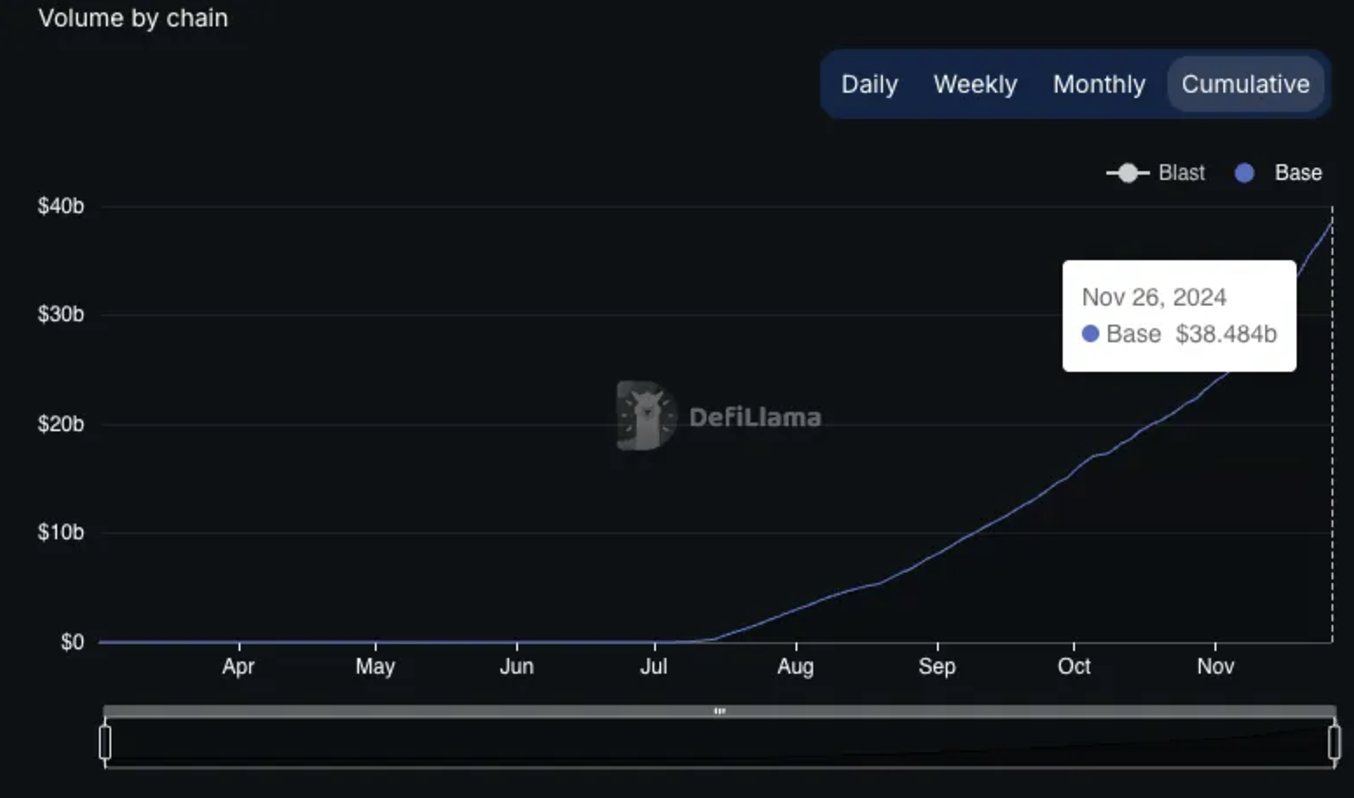

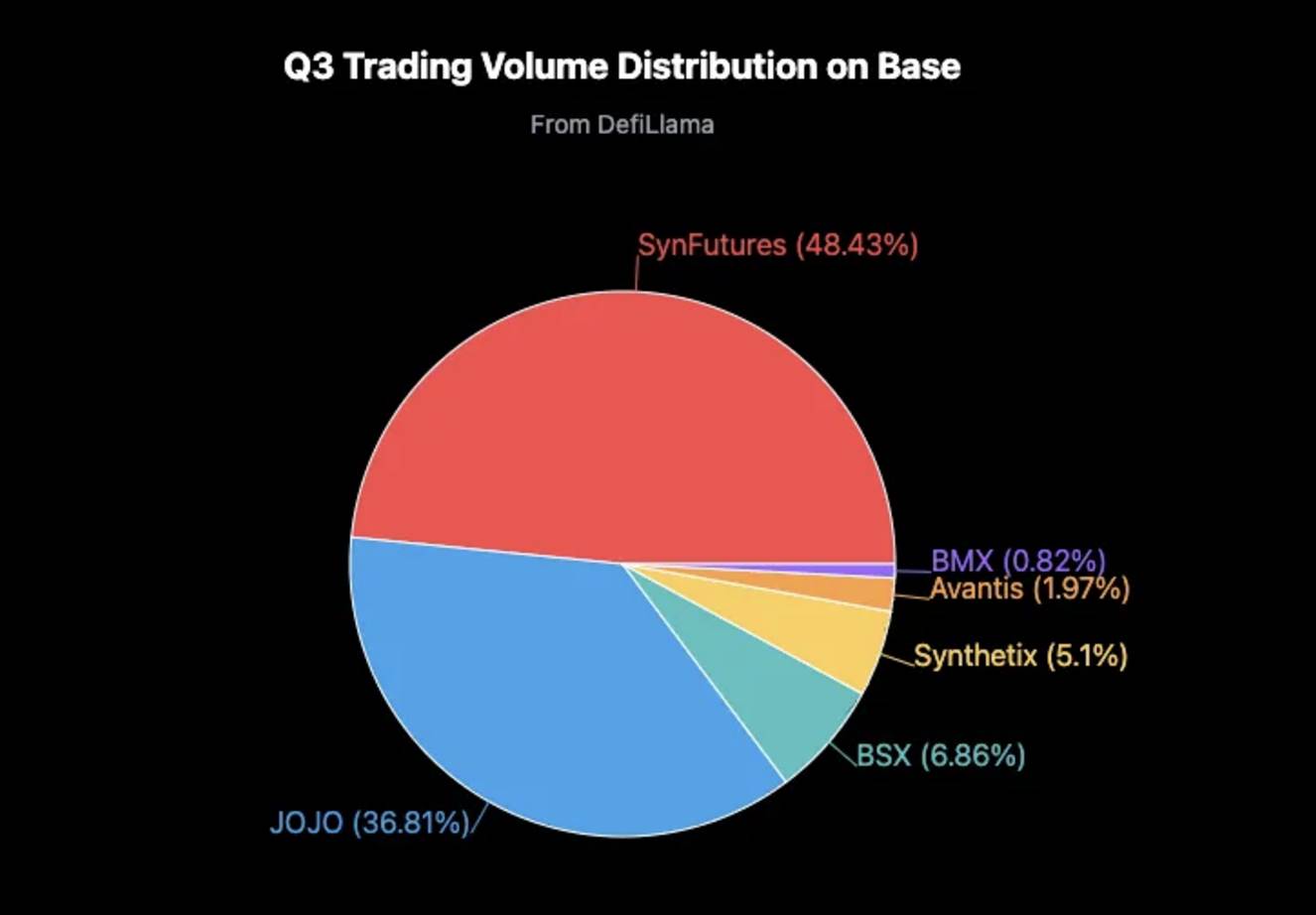

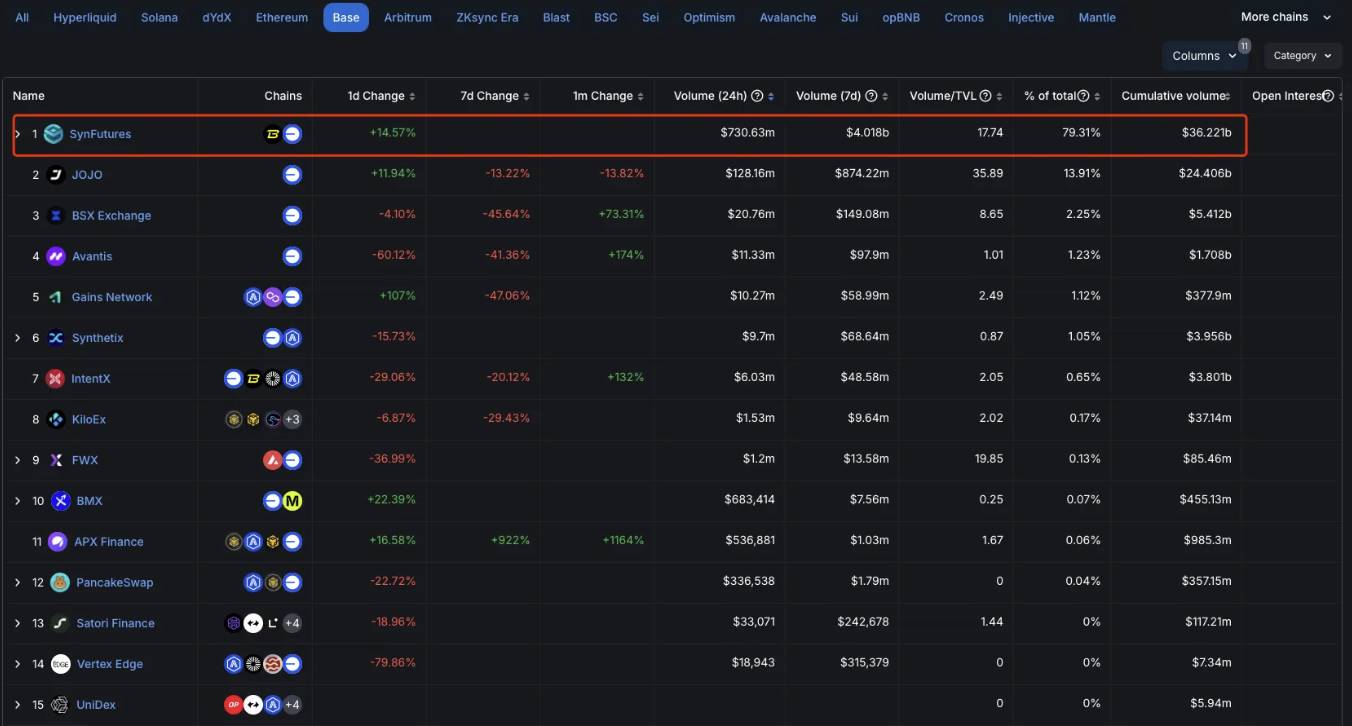

Looking at SynFutures’ recently announced roadmap, there are many similarities between its current market position and post-TGE development strategy compared to Jupiter. First, SynFutures is currently the leading derivatives platform in the Base ecosystem, while Base itself is arguably the hottest L2 ecosystem today, attracting the most capital, user traffic, and attention. As the top derivatives platform, alongside Aerodrome as the leading spot DEX, SynFutures is undoubtedly one of the two primary beneficiaries of the spillover momentum from the underlying chain, effectively acting as reservoirs for Base's ecosystem resources. Data since SynFutures launched on Base clearly demonstrates its rapid growth and critical role within the ecosystem:

-

Launched on Base on July 1st; transaction volume surpassed $100 million within 10 days

-

Total trading volume approaching $35 billion, with an average daily volume of $230 million

-

Accounted for nearly 50% of Base network trading volume in Q3

-

Past 24-hour trading volume captured 72% of Base network activity—six times higher than the second-place protocol

Becoming Base’s Super App

Thanks to its early leadership in users, community, and market presence, SynFutures stands a strong chance of succeeding in the spot aggregation space on Base. In my opinion, what SynFutures values isn't just the trading volume from spot aggregation, but rather the user acquisition power inherent in this sector. Most users don’t interact directly with spot DEXs—they rely on aggregators to execute trades. Spot aggregators are essential tools for on-chain participants and natural hubs for traffic and users. Success in this area would further boost user growth, trading volume, and TVL across its derivatives business—after all, derivatives remain the most profitable segment.

Similar to Jupiter’s Launchpad, SynFutures has its own Perp Launchpad offering. As more projects seek listings, SynFutures may receive token incentives from these teams and distribute them via airdrops to users who stake the SynFutures token. This could create a positive feedback loop: more staking drives greater participation in the Perp Launchpad, attracting even more projects.

To date, SynFutures has successfully piloted its Perp Launchpad with high-profile projects including major LST/LRT protocols like Lido, Solv Protocol, PumpBTC, top-tier meme coins such as cat in a dogs world ($MEW) and Degen, and the trending AI + meme project on Base, Virtual Protocol. These collaborations have helped partner projects expand their user base and visibility on Base, while SynFutures received meaningful rewards to redistribute to its users. Additionally, SynFutures has launched a $1 million Perp Launchpad grant program, offering listing support, marketing assistance, and other resources to emerging projects to increase their on-chain exposure, user count, and engagement.

The Value Capture Black Hole of the Base Ecosystem

As SynFutures becomes the most important reservoir for traffic, users, and capital in the Base ecosystem, its value capture potential will reach extraordinary levels. Even with only its perpetuals business active today, it has already generated over $3.3 million in fees over the past 30 days, ranking third among all protocols (only behind Base’s own Sequencer). As additional revenue streams like Perp Launchpad mature, SynFutures is well-positioned to rival top-tier protocols such as AAVE and MakerDAO in terms of income—and will likely have stronger incentives than others to buy back and burn its tokens.

We know that due to regulatory considerations, Base is unlikely to issue its own token. However, this is actually beneficial for projects within the Base ecosystem, as valuation premiums will be channeled toward native ecosystem participants instead. As the flagship project on Base, if SynFutures’ token were listed on Coinbase similarly to $AERO, it could become one of the biggest beneficiaries. After all, Base’s growth heavily depends on Coinbase’s support, and during this process, having a key anchor within the ecosystem becomes crucial. With its dual status as the leading derivatives platform and essential spot trading hub, SynFutures’ importance to Base is self-evident—making it a prime candidate for resource allocation and strategic backing from Coinbase, potentially evolving into Base’s killer app.

SynFutures: The Crown Jewel of the Base Ecosystem

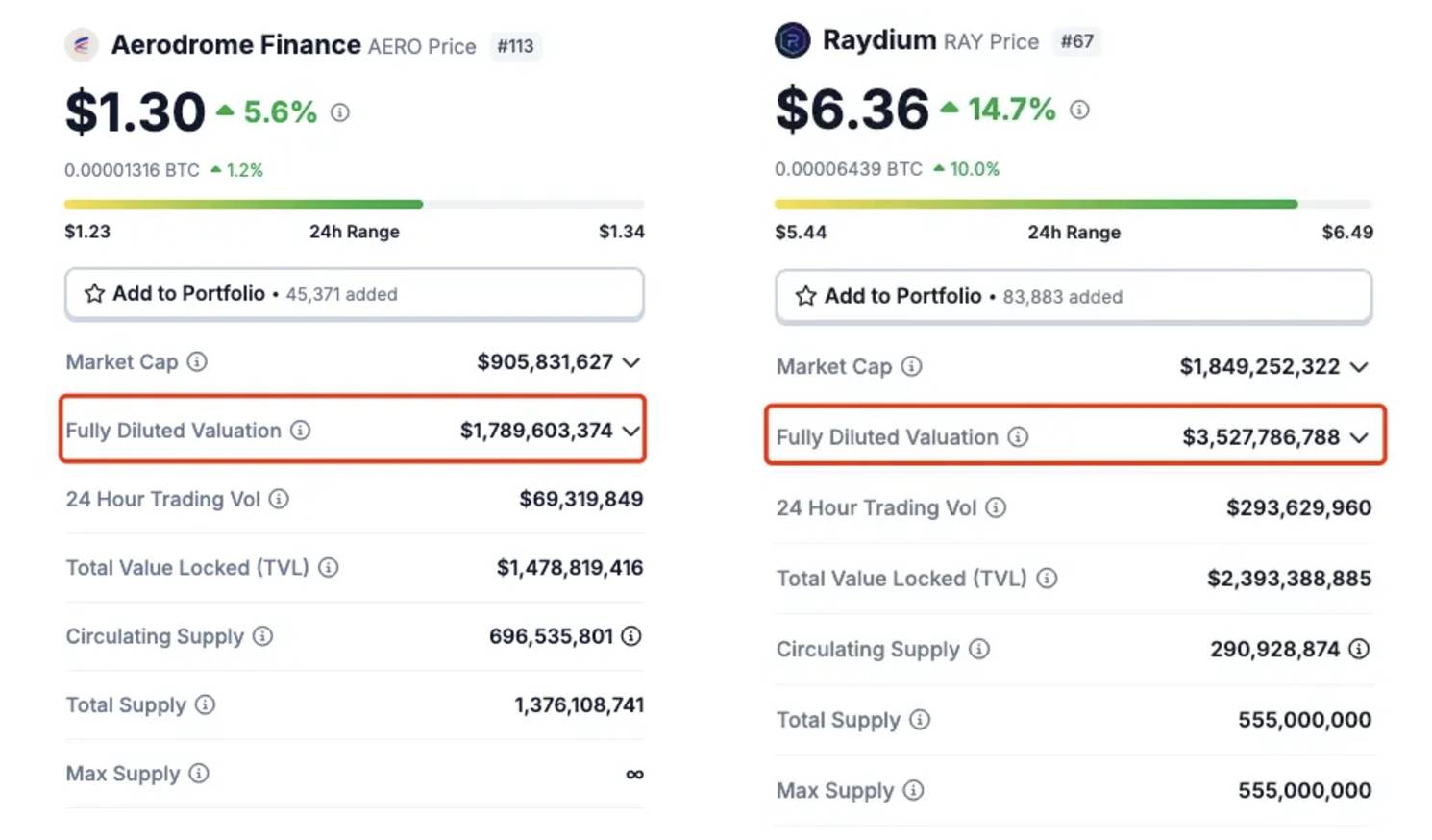

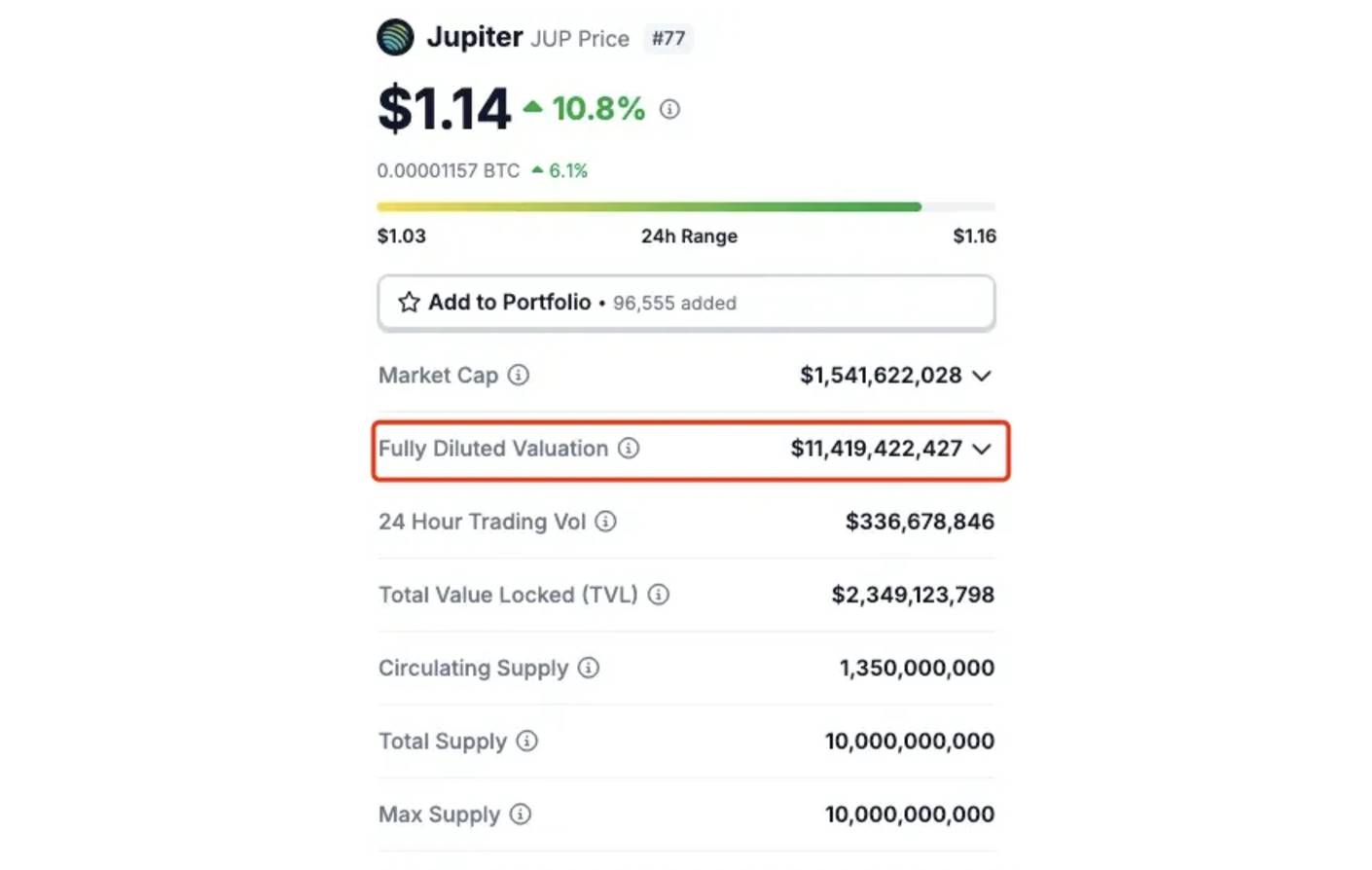

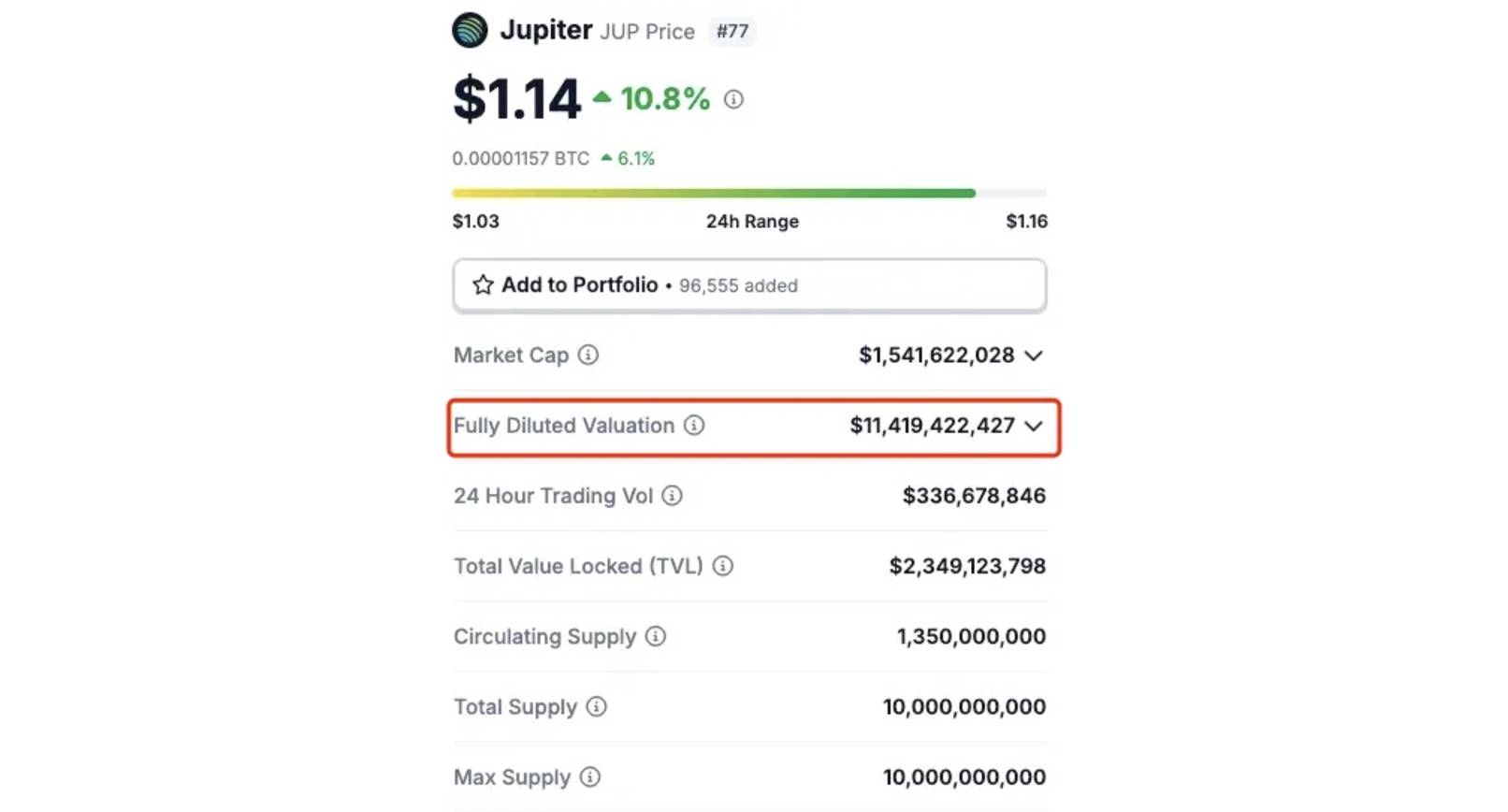

Under these circumstances, as the Jupiter of the Base ecosystem, what might SynFutures be worth? Given hints on its official site suggesting an upcoming TGE, this is a fascinating question. Taking spot DEX valuations as an example, projects in the Solana ecosystem are valued at roughly twice those in the Base ecosystem.

Based on this comparison, a reasonable valuation for SynFutures on Base would be about half of Jupiter’s current valuation—approximately $5.5 billion.

However, considering some of SynFutures’ initiatives are still in early stages and carry certain uncertainties, pricing it based on Jupiter’s initial listing price might be more appropriate. Moreover, given we’re at the beginning of a bull market with elevated investor sentiment, $3 billion may represent a more realistic valuation.

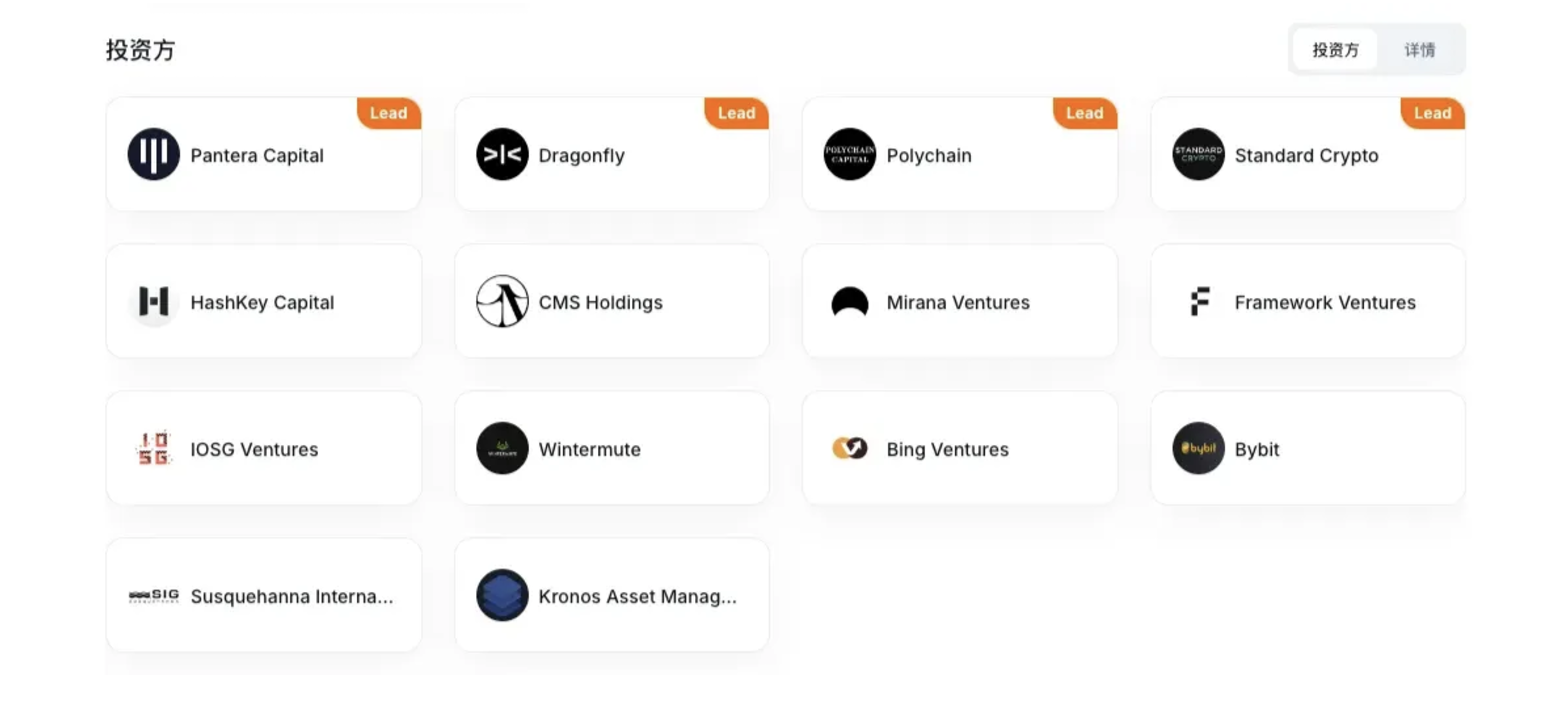

Notably, SynFutures' Discord shows an exceptionally active Korean community. As a project backed by prominent Eastern and Western investors including Pantera, Polychain, Dragonfly, and SIG, having raised over $37.4 million in funding, if SynFutures gains access to Korean exchanges like Upbit in the future, its valuation could climb even higher—especially since we're only at the very start of what promises to be a raging bull market.

Conclusion: As We Witness $100,000 Bitcoin Together

Bitcoin has finally reached this historic milestone—slowly, quietly, the future has begun to unfold. The spillover liquidity from Bitcoin and inflow of new capital will reshape structural dynamics in the altcoin market, ushering in a new alt season. In this cycle, the most promising opportunities lie with category leaders generating real revenue—especially those that have clearly defined their positioning, possess coherent strategies, and are experiencing rapid growth. Projects like today’s subject—the Jupiter of Base, the derivatives leader 'SynFutures'—are exactly where our attention should be.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News