Airdrop Imminent: A Complete Guide to SynFutures, the Leading Protocol in the Derivatives Sector

TechFlow Selected TechFlow Selected

Airdrop Imminent: A Complete Guide to SynFutures, the Leading Protocol in the Derivatives Sector

SynFutures will officially conduct its TGE and community airdrop on December 6 at 6 PM Singapore time.

Author: Sha

SynFutures will officially launch its TGE and distribute community airdrops today (December 6) at 6 PM Singapore time. This article reviews SynFutures' development journey and ecosystem highlights. Over the past year, only two standout projects have emerged in the decentralized derivatives space: Hyperliquid and SynFutures. **Hyperliquid completed its TGE and airdrop last week, setting a record for the largest airdrop in history—this has raised high expectations for SynFutures, another major player in the derivatives sector. Today’s article aims to help readers understand SynFutures’ evolution, current industry standing, and potential future challenges.

1. SynFutures: Deepening Its Focus on Decentralized Derivatives

The SynFutures team has been dedicated to the decentralized derivatives space since 2021, continuously iterating through three versions of its platform.

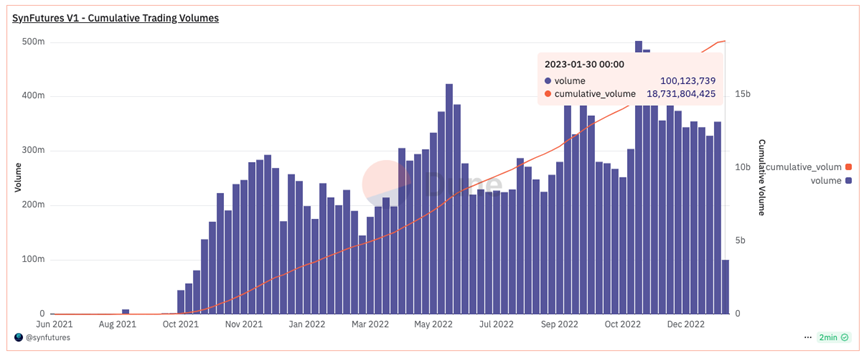

Its first version was an AMM supporting futures trading (expiring contracts), launched on Polygon in 2021. Users could trade with up to 10x leverage. The team also developed the world's first BTC mining difficulty settlement contract, allowing miners to go long or short on Bitcoin mining difficulty based on their predictions. During its one-and-a-half-year run, this initial version achieved $18.7 billion in trading volume—an impressive feat at a time when most DEXs were spot-only and perpetual DEXs were still conceptual.

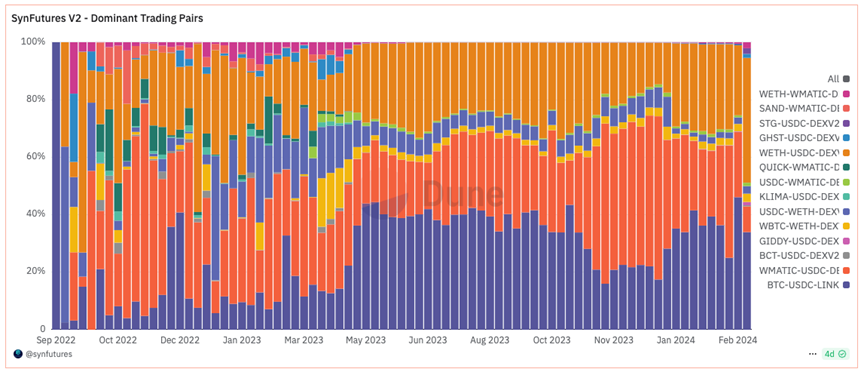

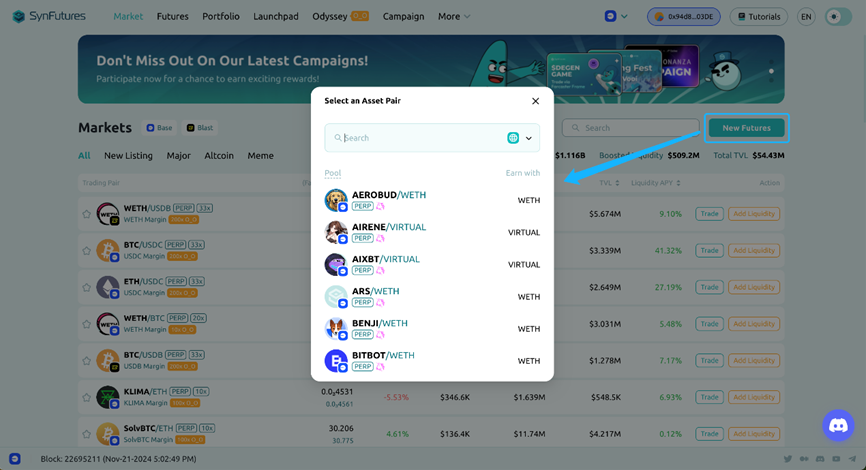

If the first version served as SynFutures’ MVP, the second represented a deeper exploration into the decentralized derivatives market. Targeting the larger perpetual contracts market—which enjoys broader adoption and higher volumes than expiring contracts—SynFutures launched the industry’s first fully on-chain decentralized futures and perpetuals trading platform. It also enabled permissionless creation of derivative markets. This version significantly expanded supported trading pairs, including not just BTC and ETH but nearly all major assets on Polygon, helping SynFutures become one of the highest-volume decentralized derivatives exchanges on the network.

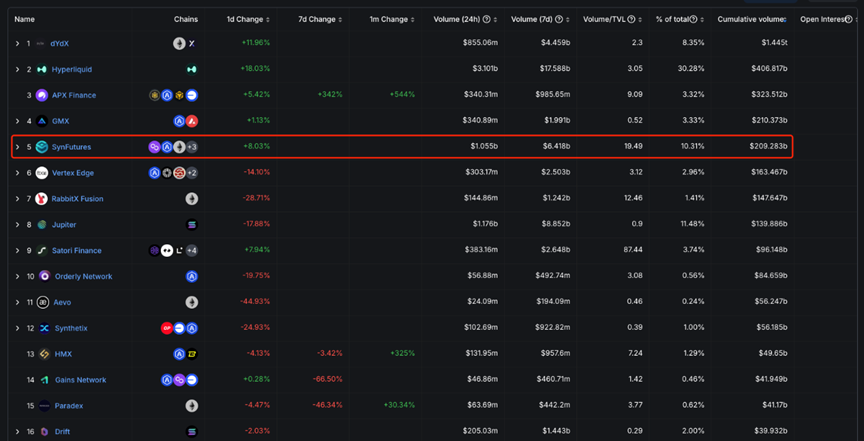

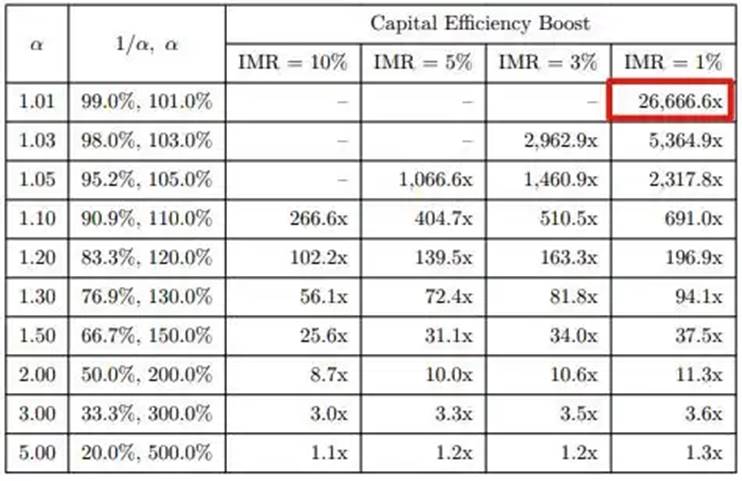

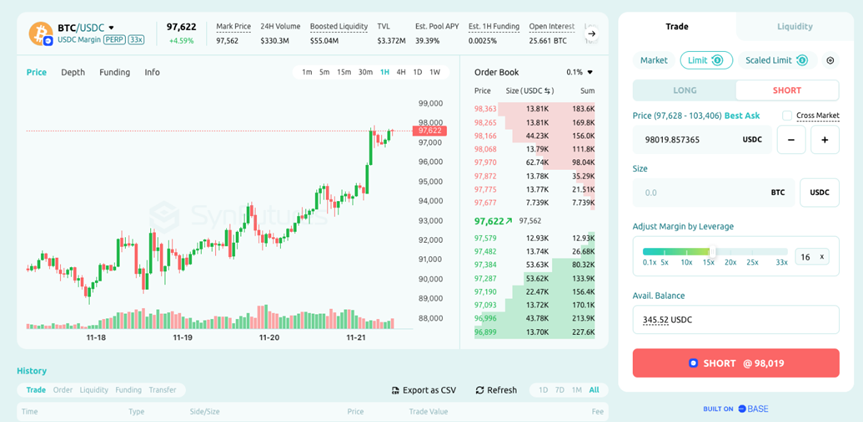

Leveraging operational experience from these two earlier versions and aiming to further improve capital efficiency, SynFutures introduced Oyster AMM this year—a new AMM model purpose-built for derivatives trading, capable of increasing capital efficiency by up to 26,666x. Since launch, this version has generated over $200 billion in cumulative trading volume, ranking fifth among all perpetual DEXs by total volume—rivaling established protocols like GMX and Hyperliquid.

2. Aiming to Be the Uniswap of Derivatives

SynFutures V3 introduces Oyster AMM (oAMM), inspired by Uniswap V3’s concentrated liquidity model. oAMM allows liquidity providers (LPs) to concentrate liquidity within specific price ranges, maximizing capital efficiency and liquidity depth while delivering a superior trading experience with minimal slippage—all while maintaining full decentralization.

Concentrated Liquidity — By enabling LPs to allocate liquidity within defined price intervals, oAMM dramatically increases AMM liquidity depth and capital utilization. As stated in their documentation, capital efficiency can reach up to 26,666.6 times that of traditional models.

Fully On-Chain Order Book — oAMM implements a fully on-chain order book without relying on centralized servers. Market makers can place limit orders directly and receive one-third of the trading fees, making it easier for centralized exchange market makers to participate on-chain and enhancing overall trading quality.

Permissionless Listing — Similar to Uniswap V3, oAMM supports permissionless listing, allowing any ERC-20 token to be used as collateral and enabling new markets to go live within 30 seconds. This means any project can create a perpetual market for its own token on SynFutures.

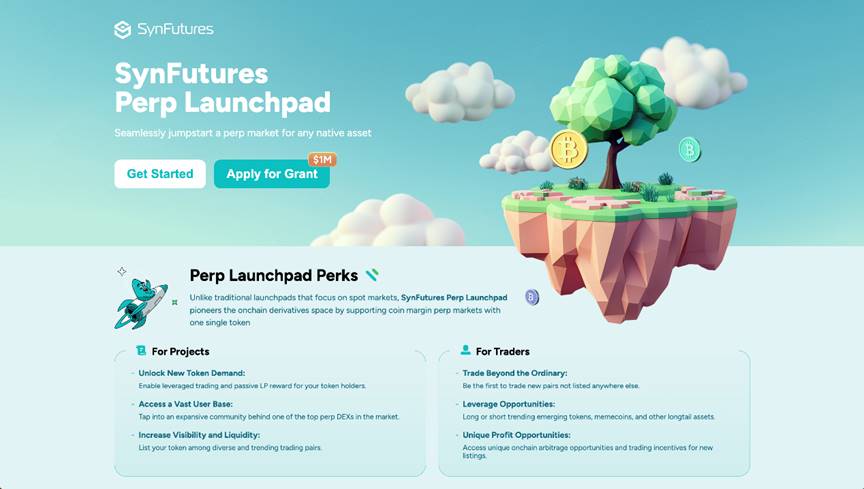

Perp Launchpad — Leveraging its permissionless listing capability, SynFutures recently launched the industry’s first perpetual contract issuance platform, modeled after Pump.fun. Projects can bootstrap their own perpetual markets using their native tokens as liquidity and earn trading fee revenue from user activity.

3. Performance Metrics

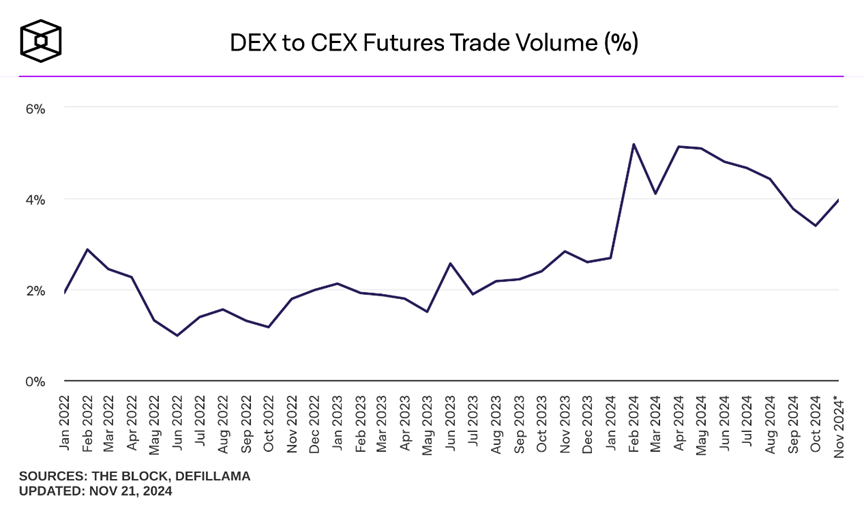

Looking back at the evolution of decentralized derivatives over recent years, new projects are emerging while older ones fade away. Despite progress, the sector’s market share remains negligible compared to centralized exchanges—less than 5%. This is partly due to阶段性 bottlenecks in DeFi development and the inherent speed requirements of derivatives trading, where underlying blockchains still face significant limitations that hinder innovation.

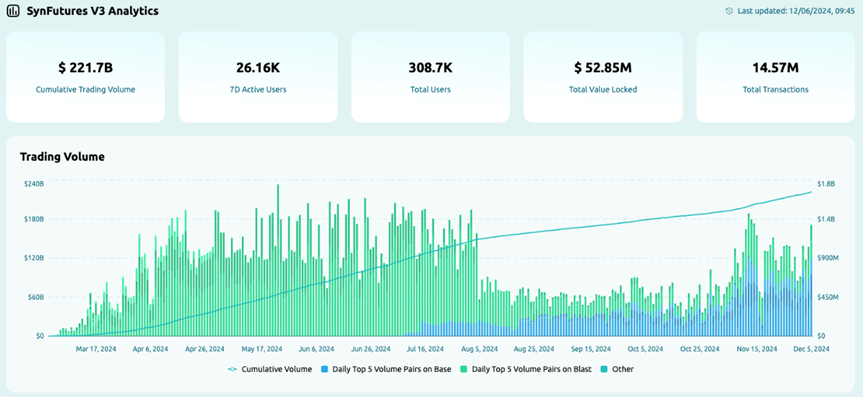

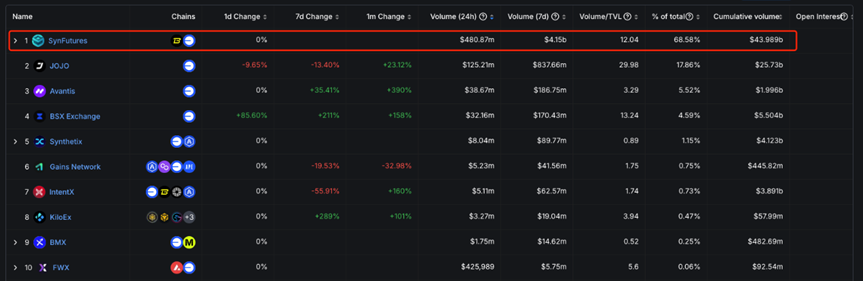

SynFutures has generated over $220 billion in trading volume within nine months—an outstanding performance.

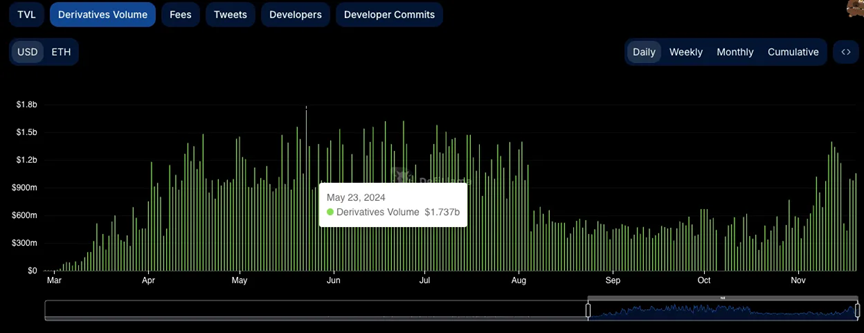

Daily peak trading volume reached $1.7 billion.

On Base blockchain, key metrics include:

-

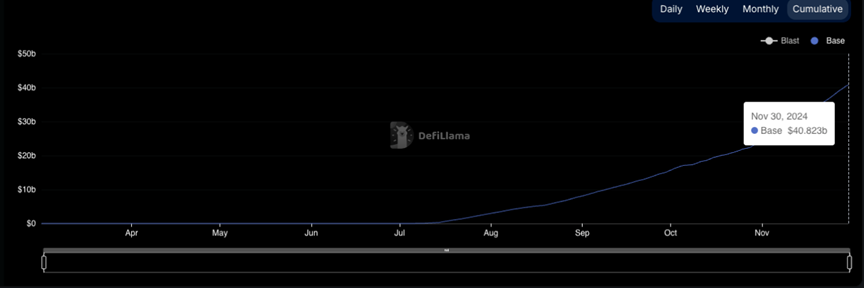

Launched on Base on July 1; surpassed $100 million in trading volume within 10 days.

-

Cumulative trading volume nears $40 billion, with average daily volume at $240 million.

-

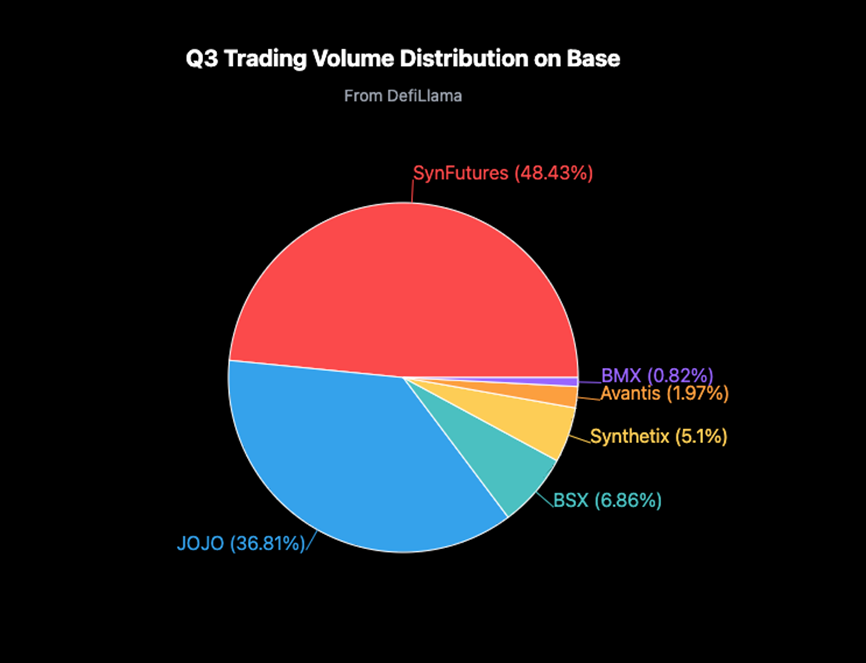

Accounted for nearly 50% of Base’s total trading volume in Q3.

-

Past 24-hour trading volume accounted for 68% of Base’s total, four times more than the second-place protocol.

-

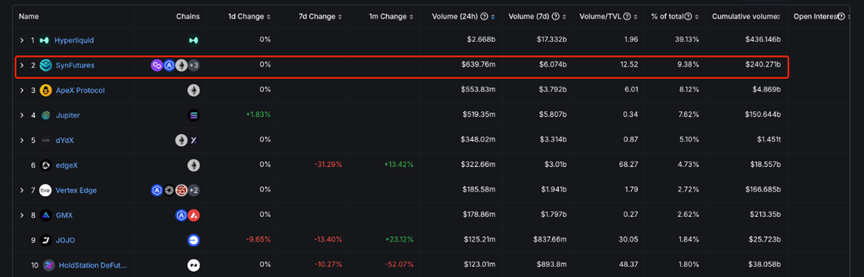

Ranked #2 across all platforms in past 24-hour trading volume, behind only Hyperliquid.

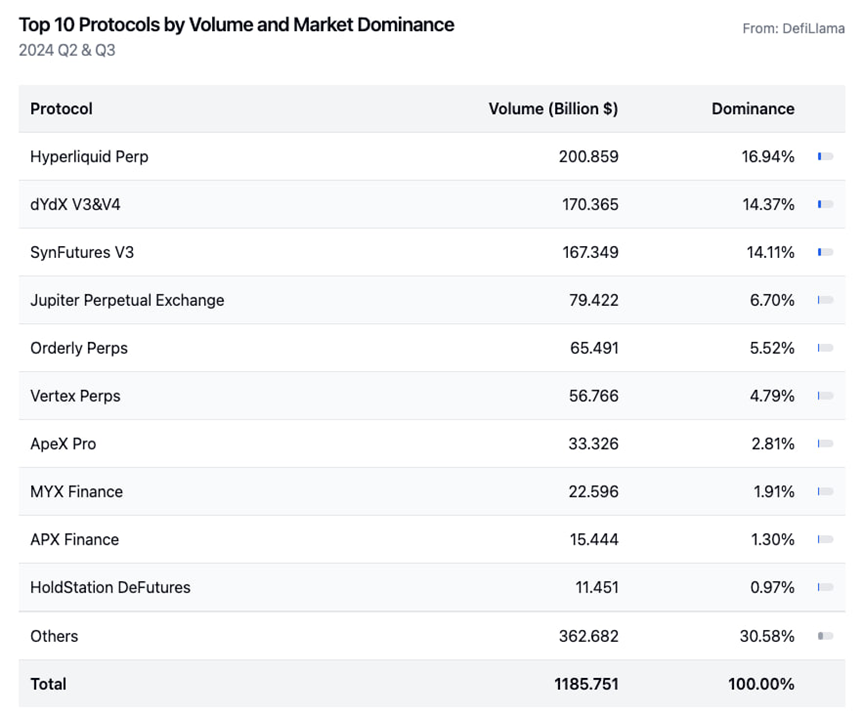

According to DefiLlama data, total on-chain perpetual contract volume in Q2 and Q3 was $1.1857 trillion, with the top three protocols accounting for over 45%. These were Hyperliquid (16.94%), dYdX V3 & V4 (14.37%), and SynFutures (14.11%).

4. Team

The SynFutures team brings extensive experience in finance, derivatives, TradFi, and DeFi—combining seasoned traditional finance professionals with DeFi degens.

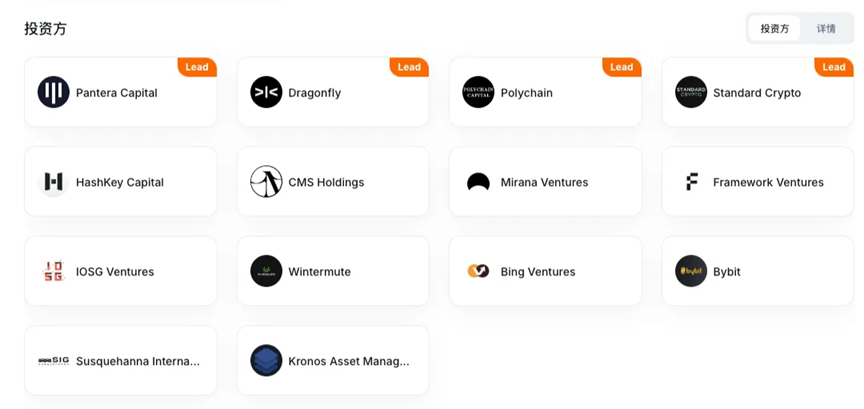

As seen on Rootdata, founder Rachel joined Bitmain in 2018 and co-founded Matrixport. Driven by her interest in DeFi, she founded SynFutures in early 2021. The project has received backing from prominent Eastern and Western investors including Pantera, Polychain, Dragonfly, and SIG, raising over $37.4 million in funding to date.

5. Tokenomics

Last week, SynFutures announced the establishment of the SynFutures Foundation and the launch of its native token, F, with details on airdrop distribution and TGE to be released soon.

Per the announcement, the SynFutures Foundation will drive long-term protocol growth and enable collective decision-making via community governance proposals. F token holders will enjoy governance rights, fee rebates, staking rewards, and enhanced eligibility for Q2 airdrop incentives.

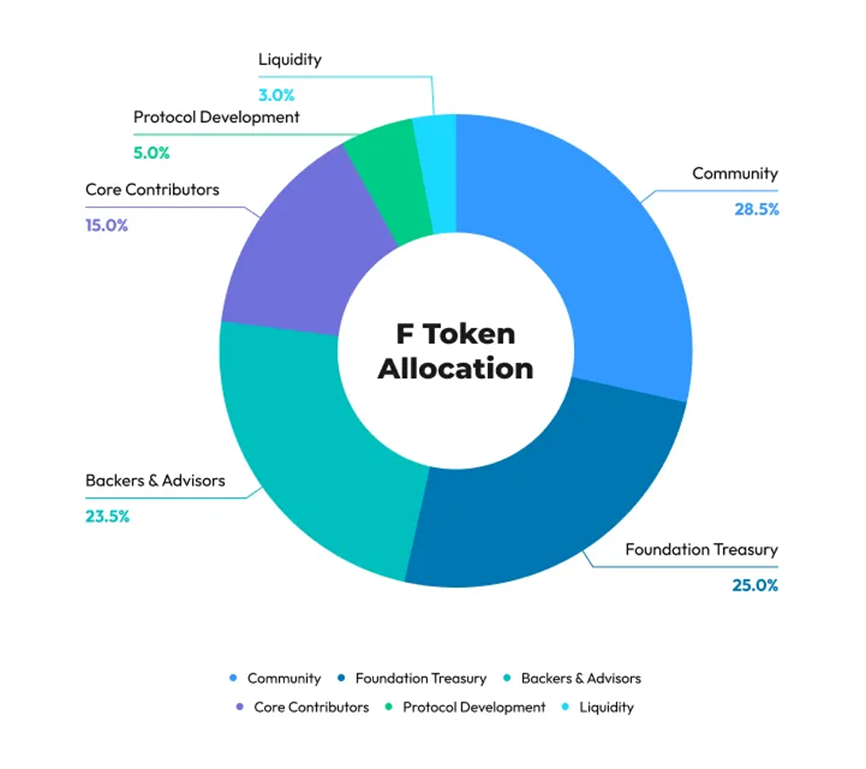

Total supply of F token is 10 billion, allocated as follows:

-

28.5% to community;

-

23.5% to early supporters and advisors;

-

15% to foundation treasury;

-

15% to future protocol development;

-

3% to liquidity programs.

Initial circulating supply is 12%, with 7.5% allocated to airdrops.

6. Launch Timeline

-

Listed on Bybit Launchpool on December 2, ending December 5;

-

Bybit primary listing on December 6 (Friday) at 6 PM Singapore time;

-

Community airdrop claim opens simultaneously on December 6 (Friday) at 6 PM Singapore time.

Conclusion

The decentralized derivatives space still has vast room for growth, and the industry urgently needs innovators to deliver better solutions. SynFutures, which launched and gained prominence this year, has delivered strong performance and introduced new possibilities to the sector. We look forward to its continued innovation and further advancement of the industry. TechFlow

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News