Can SynFutures Lead the DeFi Perp Race Amid V3 Trading Volume Surge?

TechFlow Selected TechFlow Selected

Can SynFutures Lead the DeFi Perp Race Amid V3 Trading Volume Surge?

TVL, trading volume, and other hard metrics surge—could Blast's ecosystem give rise to an underdog challenger in the derivatives sector?

Author: Frank, Foresight News

On March 1st UTC, Blast launched its mainnet as scheduled. SynFutures, a veteran player in the decentralized derivatives space, simultaneously rolled out its V3 version on Blast and introduced the Oyster Odyssey points rewards program, hinting at plans to launch its token later this year.

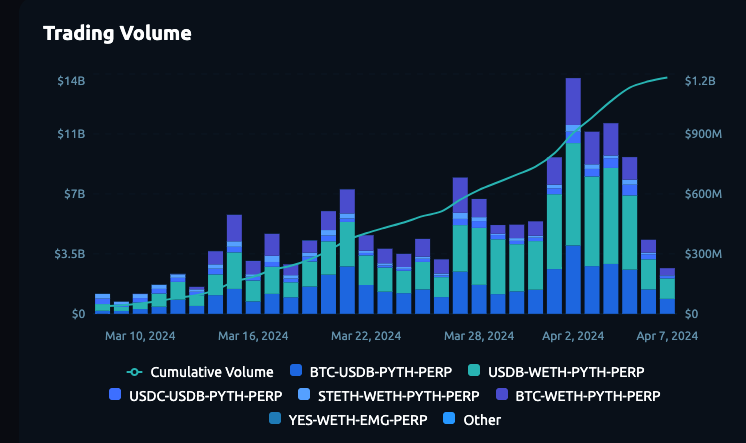

Over the past month, SynFutures V3 has delivered impressive results—both in terms of TVL and trading volume. Trading volume steadily increased, surpassing $1 billion on April 2nd, rivaling established derivatives leaders like GMX and dYdX. By April 7th, cumulative trading volume exceeded $13 billion, with TVL surpassing $50 million and nearly 40,000 active users in the past week.

If dYdX and GMX are considered blue-chip leaders in the derivatives sector, then SynFutures launching its V3 on Blast is more akin to a high-momentum, fast-rising "newcomer" with strong potential. This article will briefly introduce SynFutures' fundamentals, the real trading experience on V3, and how users can achieve "multiple benefits from one asset" within the Blast ecosystem via SynFutures.

SynFutures V3: Interval Liquidity and Fully On-Chain Order Book via oAMM

As an established derivatives platform, SynFutures has previously deployed on Ethereum, Polygon, Arbitrum, and BNB Chain, iterating through two major versions over more than two years. After a year of development and rigorous security audits, the latest V3 version has finally launched on Blast.

Building upon the proven sAMM model that operated stably for the past two years, SynFutures V3 introduces the Oyster AMM (oAMM), combining the strengths of order books and AMMs. It manages risk effectively while maximizing capital efficiency for liquidity providers (LPs) and enhancing the overall trading experience.

Key features of Oyster AMM (oAMM) include:

-

Interval liquidity (similar to Uniswap V3)

-

Fully on-chain order book (limit orders earn rebates)

-

Permissionless listing

-

Risk management mechanisms focused on user fund safety

Interval Liquidity

Interval liquidity means oAMM concentrates liquidity within specific price ranges and leverages the unique leverage of derivatives to enhance capital efficiency.

Unlike spot-centric models such as Uniswap v3, oAMM allows LPs to provide liquidity using only a single token, significantly reducing portfolio drag during liquidity provision.

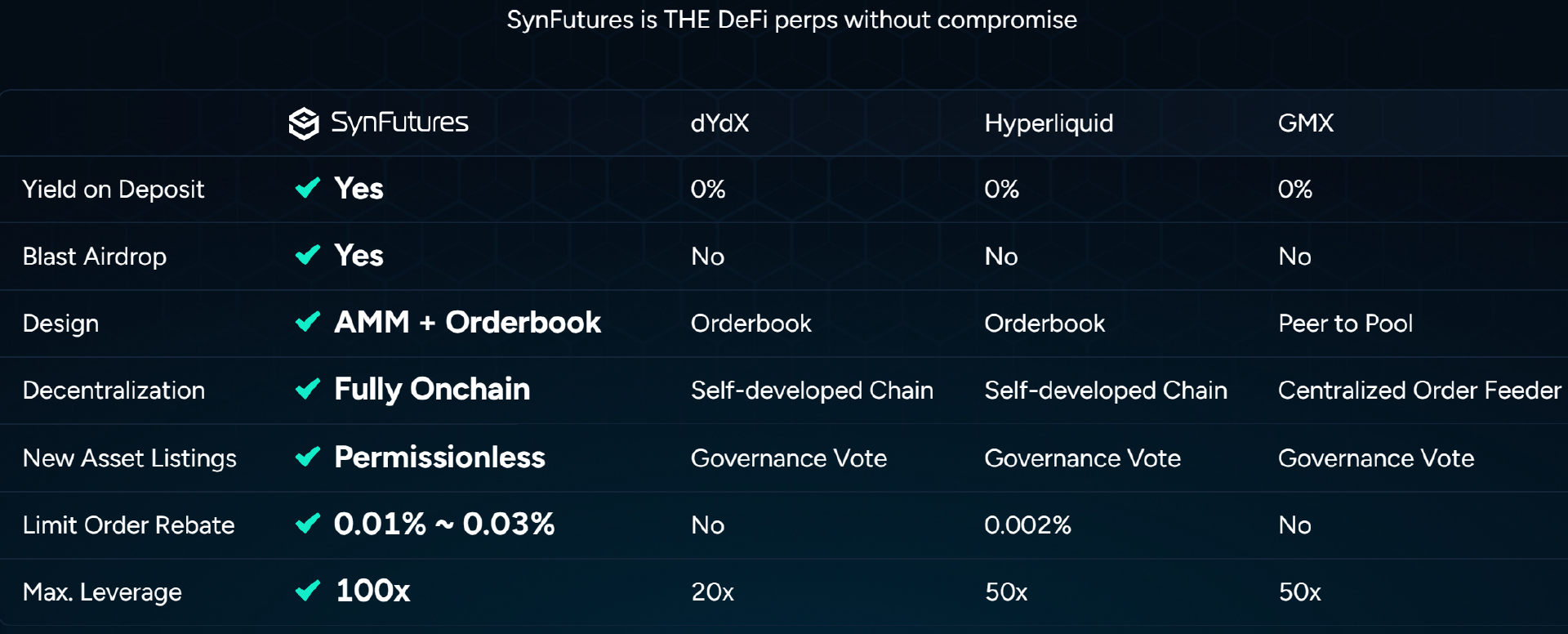

As shown above, with the same $1, top-tier derivatives protocols like dYdX/GMX support up to $20–50 in position size, whereas SynFutures supports up to $100. This enhanced capital capacity means SynFutures can dramatically increase LP returns per unit of capital deployed.

Fully On-Chain Order Book

Unlike platforms like dYdX or AEVO that settle trades on-chain but match off-chain, SynFutures V3 implements a fully on-chain order book via oAMM. On-chain order books are inherently complex and face significant performance challenges due to blockchain limitations. SynFutures V3 innovatively uses AMM ticks to enable limit orders, seamlessly integrating AMM and order book mechanics into a single model. Each tick acts like an oyster containing a pearl—hence the name Oyster AMM.

Since placing limit orders effectively provides liquidity to the AMM, traders receive what may be the industry’s highest rebate rate—an unparalleled enhancement to the trading experience.

Permissionless Listing

We all know much of DeFi Summer's momentum came from permissionless listings and associated liquidity mining. SynFutures is currently the only platform that combines a decentralized order book and interval liquidity with permissionless listing. This effectively attracts and empowers DAOs, communities, LPs, and market makers to create new trading pairs and earn trading fees.

For example, a meme coin spotted on Solana just 10 minutes ago could already be tradable as a perpetual contract on SynFutures the next minute.

Risk Management for User Fund Safety

After two iterations of oAMM and drawing on the team’s TradeFi expertise, SynFutures has developed a comprehensive risk control system to protect user funds and maintain market stability.

This includes a dynamic penalty fee that penalizes significant deviations between trade prices and mark prices to deter manipulation and balance LP risk-reward profiles. Another key mechanism is the stable mark price mechanism, which uses an exponential moving average to reduce risks from sudden price swings and mass liquidations.

Combined with Blast’s early-stage ecosystem incentives and triple-point campaign (see below), SynFutures V3 has achieved remarkable results in under a month:

Beyond the explosive growth in trading volume mentioned earlier, another notable metric is that according to DeFiLlama, SynFutures’ trading volume / TVL ratio over the past 30 days reached 11.5, compared to 0.38 for GMX and 3.02 for dYdX. This clearly demonstrates that V3 has elevated capital efficiency and user activity to a new level.

Funding and Roadmap

From a team and funding perspective, SynFutures comprises members from top-tier investment banks, tech firms, and crypto OGs—blending the advantages seen in projects backed by Wall Street veterans and Web3 pioneers like Solana.

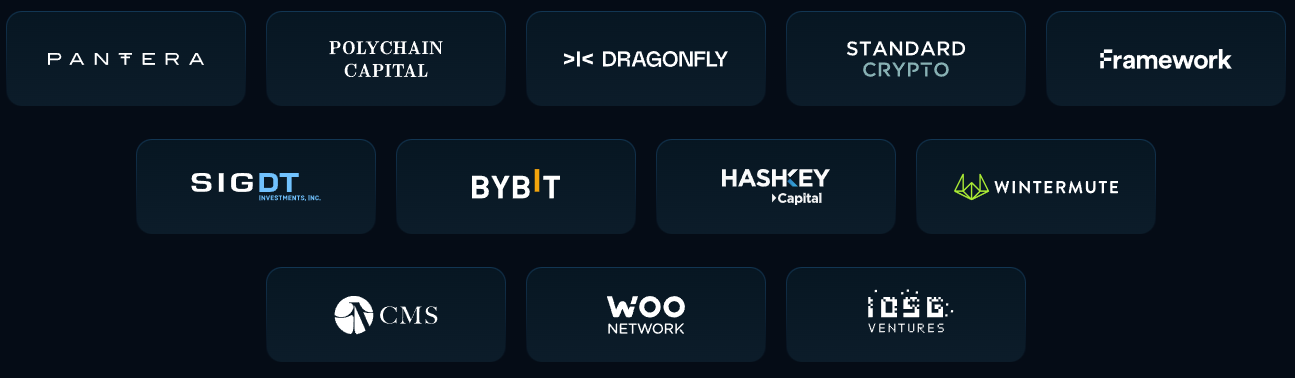

To date, SynFutures has raised over $38 million. Most recently, in October 2023, it secured $22 million in a new round led by top-tier investors including Pantera Capital, SIG, and HashKey Capital.

Its earlier $14 million Series A in June 2021 included leading VCs such as Polychain Capital, Framework Ventures, Bybit, Wintermute, CMS, Kronos, and IOSG Ventures.

On March 1st, coinciding with the V3 launch, SynFutures launched a triple-points campaign (Blast Points + Blast Big Bang Champion Points + SynFutures Points), airdropping SynFutures Points to users of Blast, dYdX, GMX, and Pudgy Penguins NFT holders. The campaign is expected to last 3–4 months.

The team has also indicated it is exploring token issuance, suggesting that after the 3–4 month points program, a token launch and additional airdrop may follow. Latest updates suggest the first contract snapshot will occur on April 9th—potentially signaling that good news is imminent.

Hands-On Trading Experience with SynFutures

Specifically, SynFutures’ rewards program consists of three components:

-

Day One Airdrop of SynFutures O_O Points: Blast users, dYdX/GMX users, and Pudgy Penguins NFT holders can directly claim SynFutures O_O Points during registration on the O_O event page on launch day;

-

LP (including Maker and AMM LP) Airdrop Rewards: Users can earn triple points (Blast Points, Blast Gold, and SynFutures Points) by providing liquidity to designated pools (placing limit orders or adding AMM LP), using referral links, opening mystery boxes, or spinning. (This LP activity is named O_O; participation requires prior registration);

-

Taker Rewards: Triple incentives for traders, including Blast-native token points based on trading volume (volume-only), 50% of the Blast Big Bang Winner airdrop, and a $500,000 prize pool trading competition (based on profitability).

Now let’s walk through a hands-on test of the V3 trading experience and explore how to achieve “multiple benefits from one asset” within the Blast ecosystem via SynFutures.

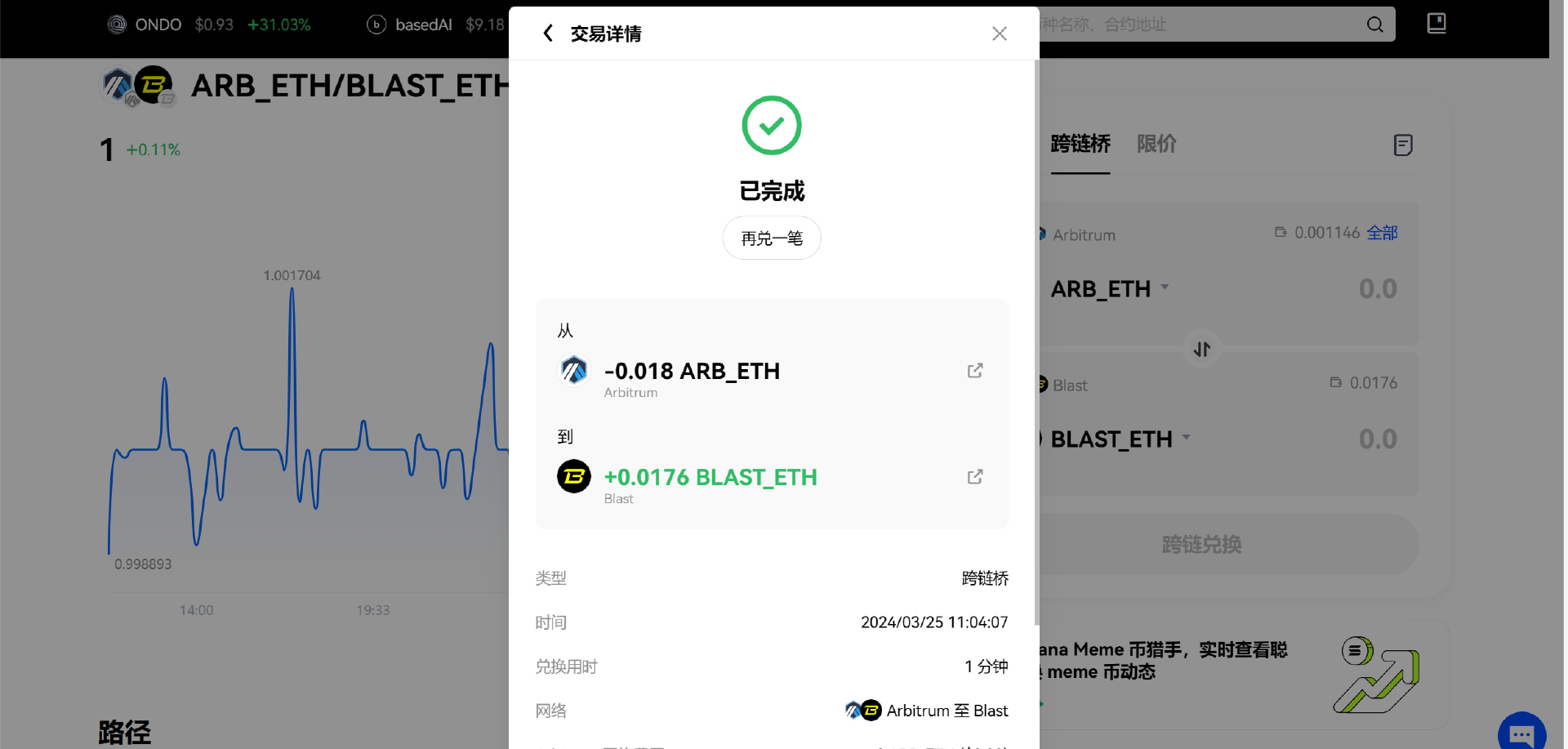

First, use a cross-chain bridge to transfer ETH or other assets from Ethereum/L2s to the Blast network.

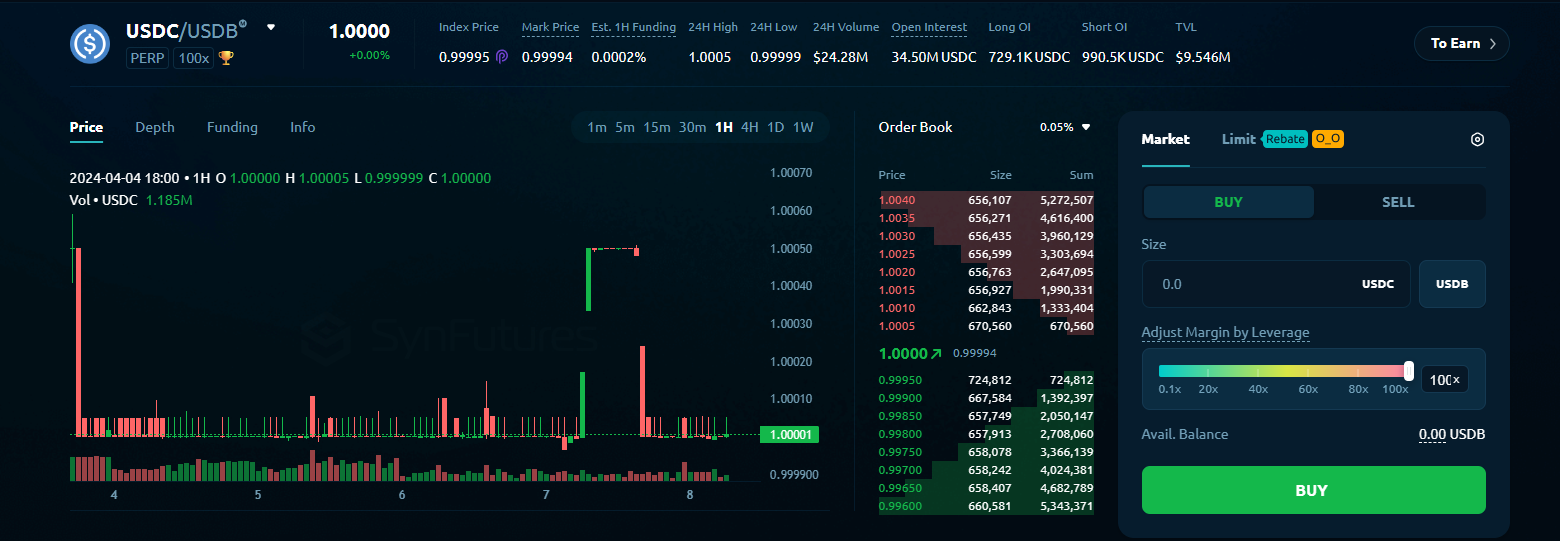

Then, visit the SynFutures V3 official website, connect your wallet, and select the "Trade" module to begin.

Note that apart from stablecoins like USDC and USDB, most trading pairs on V3 are ETH-based, specifically WETH. You can wrap ETH via the "Wrap ETH" function on the site, though it requires 0.005 ETH in gas.

Alternatively, you can swap ETH/WETH on DEXs like Thruster within the Blast ecosystem at lower cost, then return to SynFutures for derivatives trading—expanding the scope of "one fish, multiple meals."

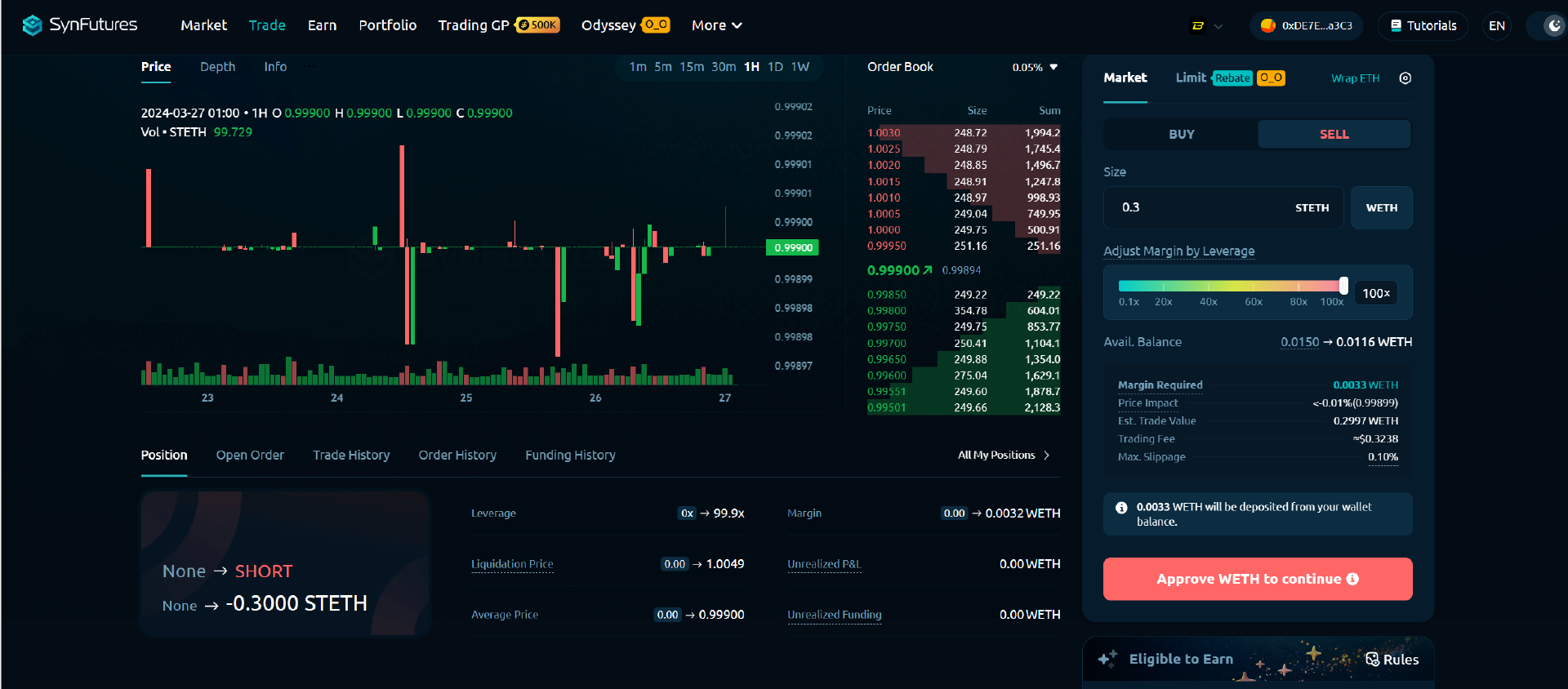

Take the STETH/WETH pair as an example, which supports up to 100x leverage. "BUY" and "SELL" represent long and short positions respectively.

Here, we choose maximum 100x leverage and place a market sell order for 0.3 STETH. As shown, the required margin is approximately 0.0033 WETH, with trading fees around $0.3238.

Approve WETH spending once, confirm in wallet, click "SELL", confirm again, and the 0.3 STETH short position is successfully opened.

As shown above, the actual leverage is about 90.7x, with a margin of 0.0033 WETH. This qualifies for the third category—"Taker Rewards"—eligible for Blast points and trading competition prizes based on volume and final profit.

Potential Arbitrage Opportunities

Using on-chain derivatives protocols like SynFutures, traders can execute several potential DeFi arbitrage strategies to meet diverse profit objectives.

High-Leverage STETH Trading

As illustrated above, long/short STETH pairs are uncommon on centralized exchanges (CEX), especially with up to 100x leverage, yet trading STETH against ETH remains a genuine need—since STETH does not always trade at a perfect 1:1 peg with ETH, fluctuating due to short-term supply-demand imbalances or Lido protocol risks.

Thus, whether premium or discount, SynFutures enables high-leverage trading opportunities to profit from these divergences.

DEX-CEX Arbitrage

For newly launched DeFi projects on Blast, certain trading pairs may exhibit price discrepancies with CEX due to shallow liquidity, but current withdrawal channels on Blast do not support rapid arbitrage ("bricking").

In such cases, users can buy spot tokens on a DEX and simultaneously short them on SynFutures to lock in profits.

For instance, if token A trades at a 10% discount on a Blast DEX compared to CEX, you could buy A on the DEX and short A on SynFutures to secure a 10% gain:

Short 11,000 USD worth of A on SynFutures while buying 10,000 USD of A on the DEX, locking in a $1,000 profit (excluding fees), giving you ample time to realize gains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News