SynFutures Potential Airdrop Value Analysis and Interaction Strategy

TechFlow Selected TechFlow Selected

SynFutures Potential Airdrop Value Analysis and Interaction Strategy

If the valuation is aligned with $AEVO, it would be calculated at $300 million; with a 5%–10% airdrop ratio, the total airdrop distribution would amount to approximately $15–30 million.

1. Project Introduction

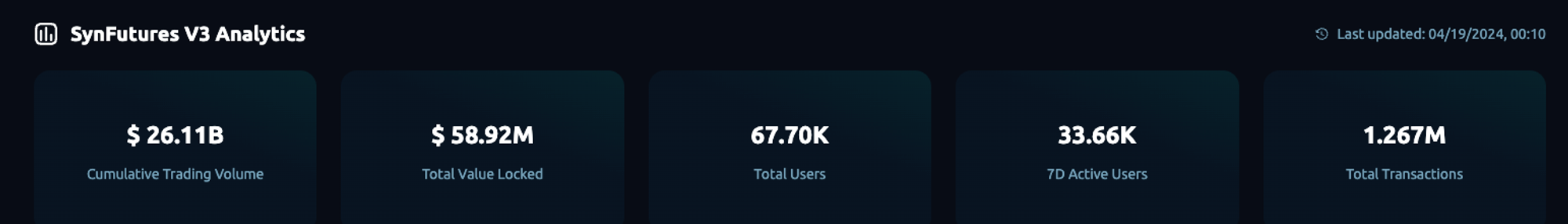

SynFutures is currently the standout decentralized perpetual contracts protocol on Blast. With a TVL exceeding $58 million, total trading volume surpassing $26 billion, and a stable daily trading volume of $1 billion, all its key metrics are highly impressive.

Data source:https://info.synfutures.com/

The team has raised $38 million across two funding rounds, backed by prominent institutions including Pantera, Polychain, and Dragonfly. The protocol has been audited by Quantstamp.

2. Airdrop Return Analysis

SynFutures Airdrop Reward: SynFutures is participating in the Blast Big Bang campaign, publicly committing to allocate a portion of its tokens for airdrops—making it a transparent "known" airdrop opportunity. Currently in Epoch 3, users can earn points through inviting friends, adding liquidity, market-making via limit orders, or conducting trades, all contributing toward future SynFutures token airdrops.

Blast Points Reward: Depositing ETH or USDB into SynFutures earns Blast Points, granting access to 50% of future Blast airdrops. Additionally, as a supported project in the Blast Multiplier program, new users interacting with SynFutures receive double Blast Points rewards.

Blast Gold Reward: Trading and providing liquidity on SynFutures earns Blast Gold, which also shares in 50% of future Blast airdrops.

Blast Native Yield: ETH deposited on SynFutures earns a 4% annual yield, while USDB earns 15% annually.

Based on my experience farming Vertex, derivative protocols that reward trading volume with points typically offer first-round returns around 10x trading fees, though realistically averaging around 4–5x overall. Vertex initially attracted little attention, making early interaction easy—a window I later regretted not fully capitalizing on with larger positions.

If valuing SynFutures comparably to $AEVO at a $3 billion valuation, with an expected 5–10% airdrop allocation, the total airdrop could amount to $150–300 million. Combined with Blast’s own rewards, a conservative estimate suggests 3–5x returns are very achievable.

3. Interaction Strategies

1. Establish Referral Relationships

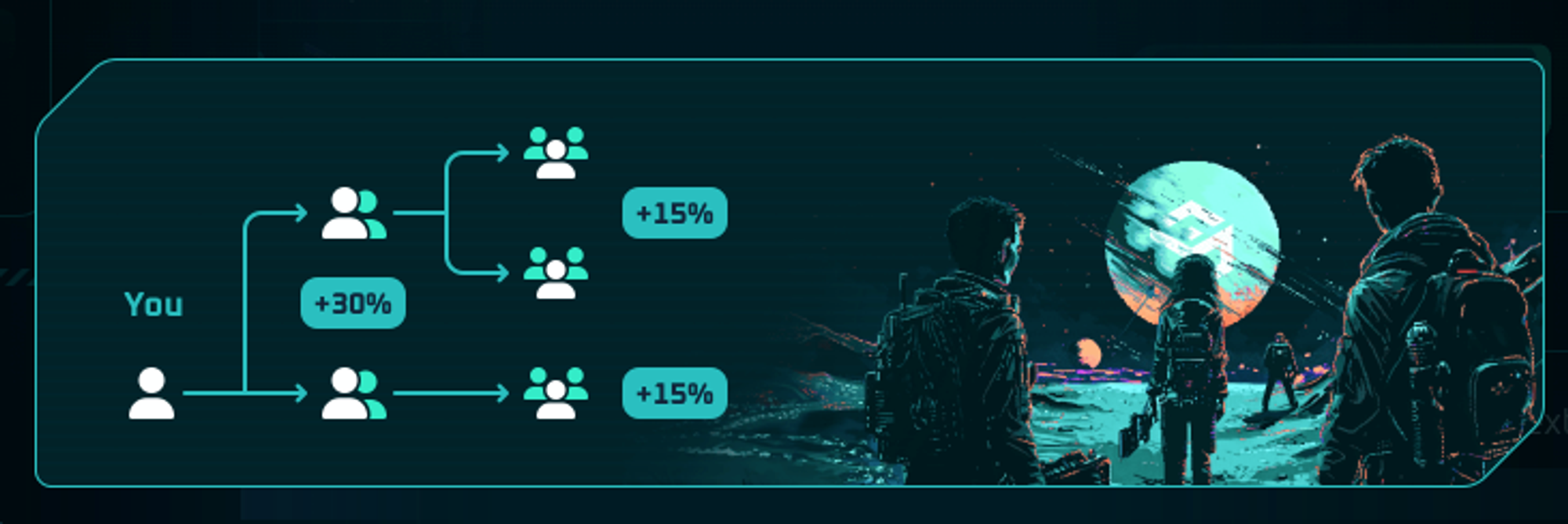

Create two small accounts and bind them together to maximize your Points earnings. Use my referral link for your first account to receive a 30% bonus for the first seven days.

Link:

https://oyster.synfutures.com/#/odyssey/44Q2P

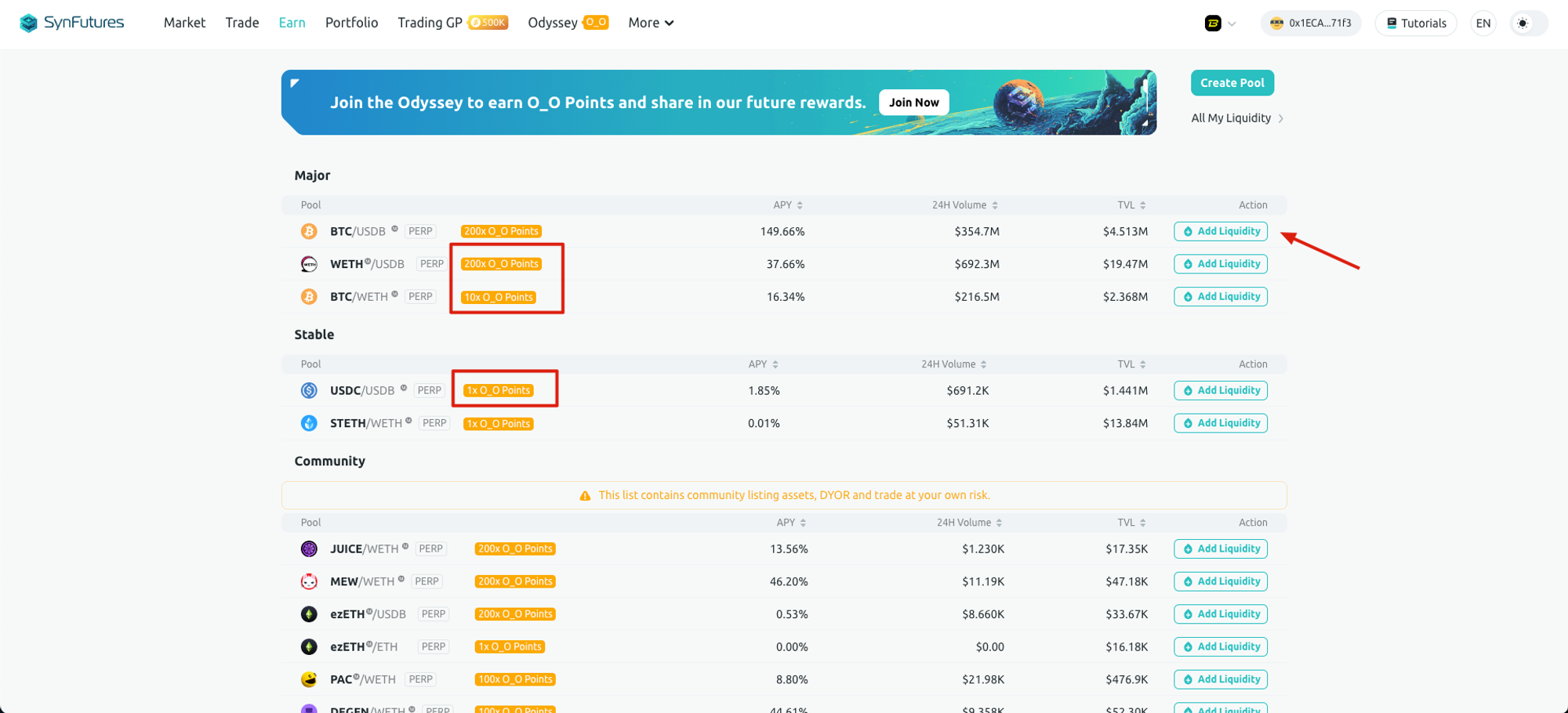

2. Earn Points by Providing Liquidity

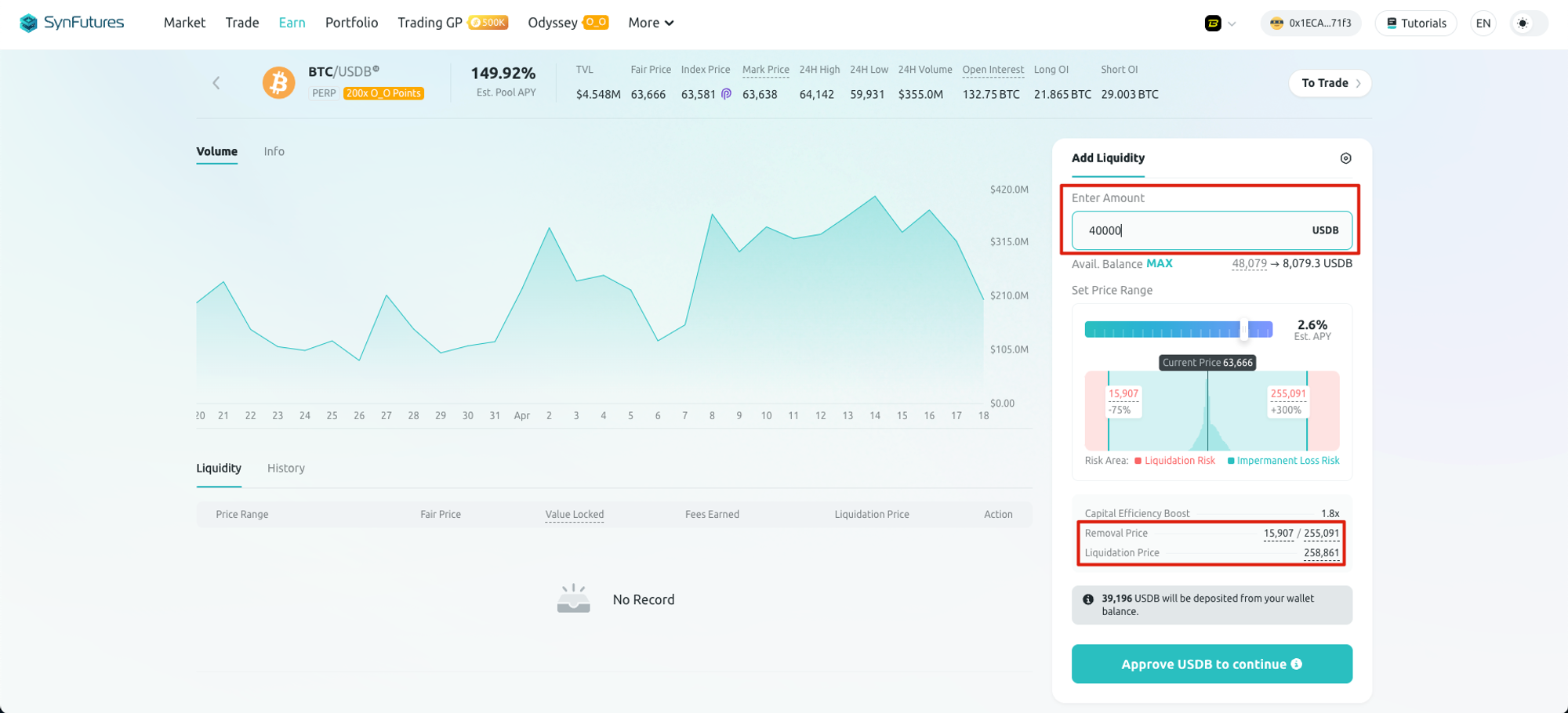

Similar to providing liquidity on UniSwap V3, adding liquidity on SynFutures requires selecting a price range. The narrower the range, the higher the fees and points earned—but also the greater the impermanent loss. As indicated in the second red box, if the market price moves outside your set range, your liquidity will be removed and subject to liquidation. To avoid this, choose a wider price range. For example, in the image above, I selected a range of 15,907 ~ 255,091—so wide that the probability of being liquidated is negligible. Even in extreme downturns, this range allows time to safely remove liquidity before liquidation occurs.

Moreover, market-making over a broad range makes it easier for earned fees to offset impermanent loss and generate net profits—especially given the current surge in user activity driven by point farming.

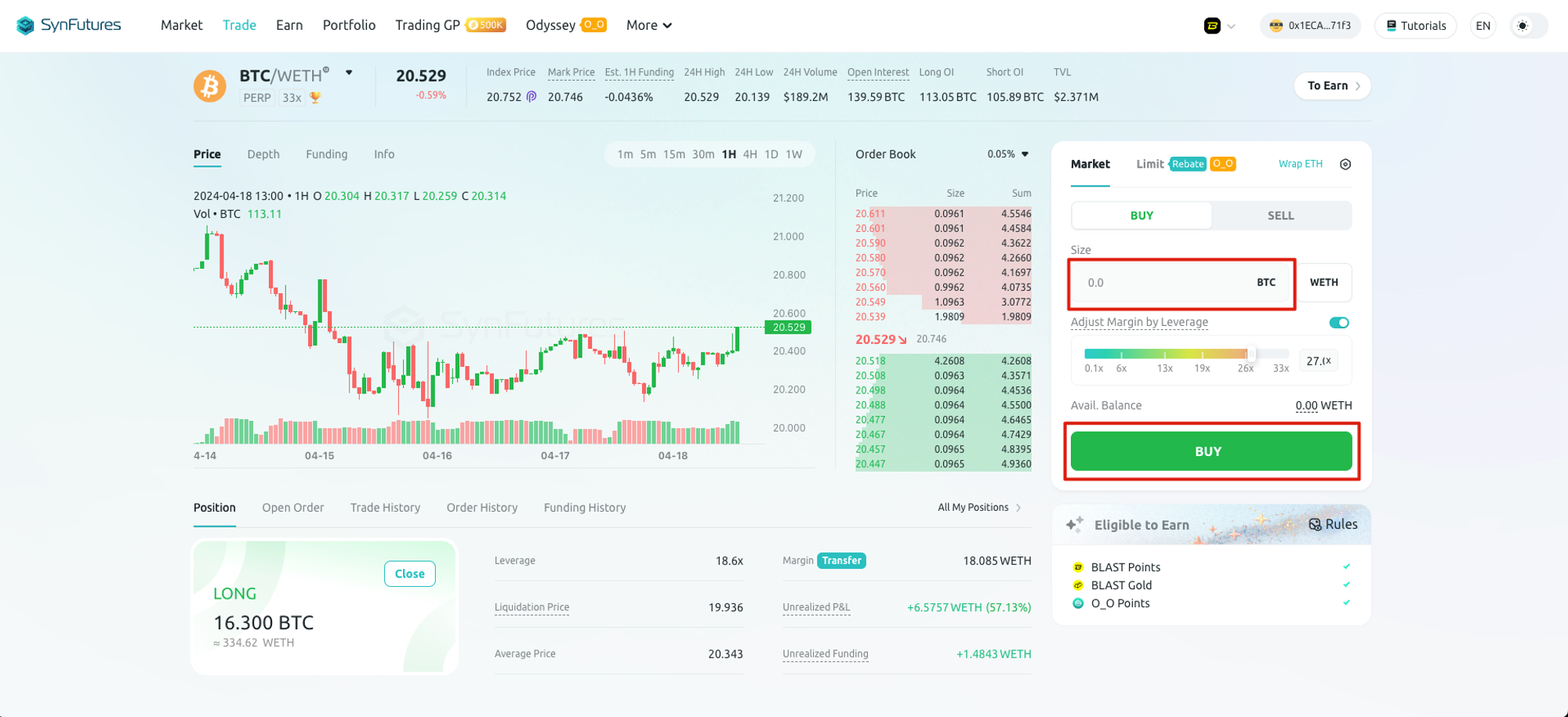

3. Earn Points Through Trading

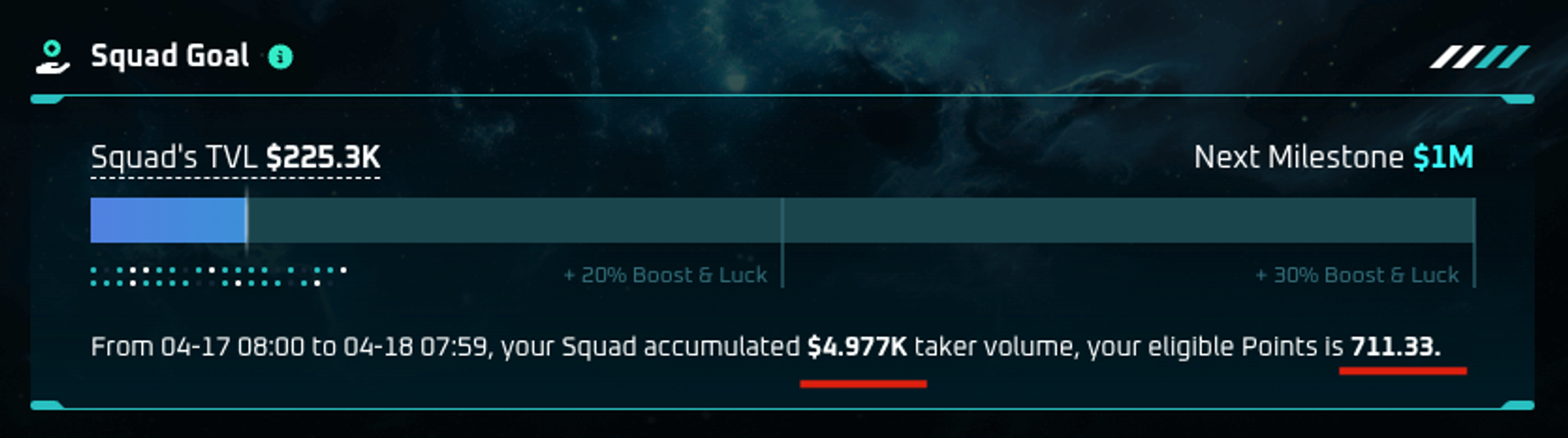

Given the referral setup, you only need to interact with the protocol using the last invited account—this way, all three accounts accumulate points. Points from trading volume are settled once every 24 hours, and you can check yesterday's trading volume and points earned under the "Squad" section.

Earning points via trading is simple and cost-effective. Just repeatedly place market buy/sell orders. Before large trades, test with small amounts to understand the mechanics and avoid losses.

If manually operating, here's a pro tip: open two browsers. On Browser A, open a long position and click Buy—MetaMask will pop up for confirmation; do not confirm yet. Then on the other browser, open a short position and click Sell—MetaMask will again prompt for confirmation; leave it unconfirmed too. Once both are ready, first confirm the Buy transaction, then immediately confirm the Sell. This ensures your closing trade follows right after opening, minimizing front-running risk. Set higher slippage to prevent failed transactions.

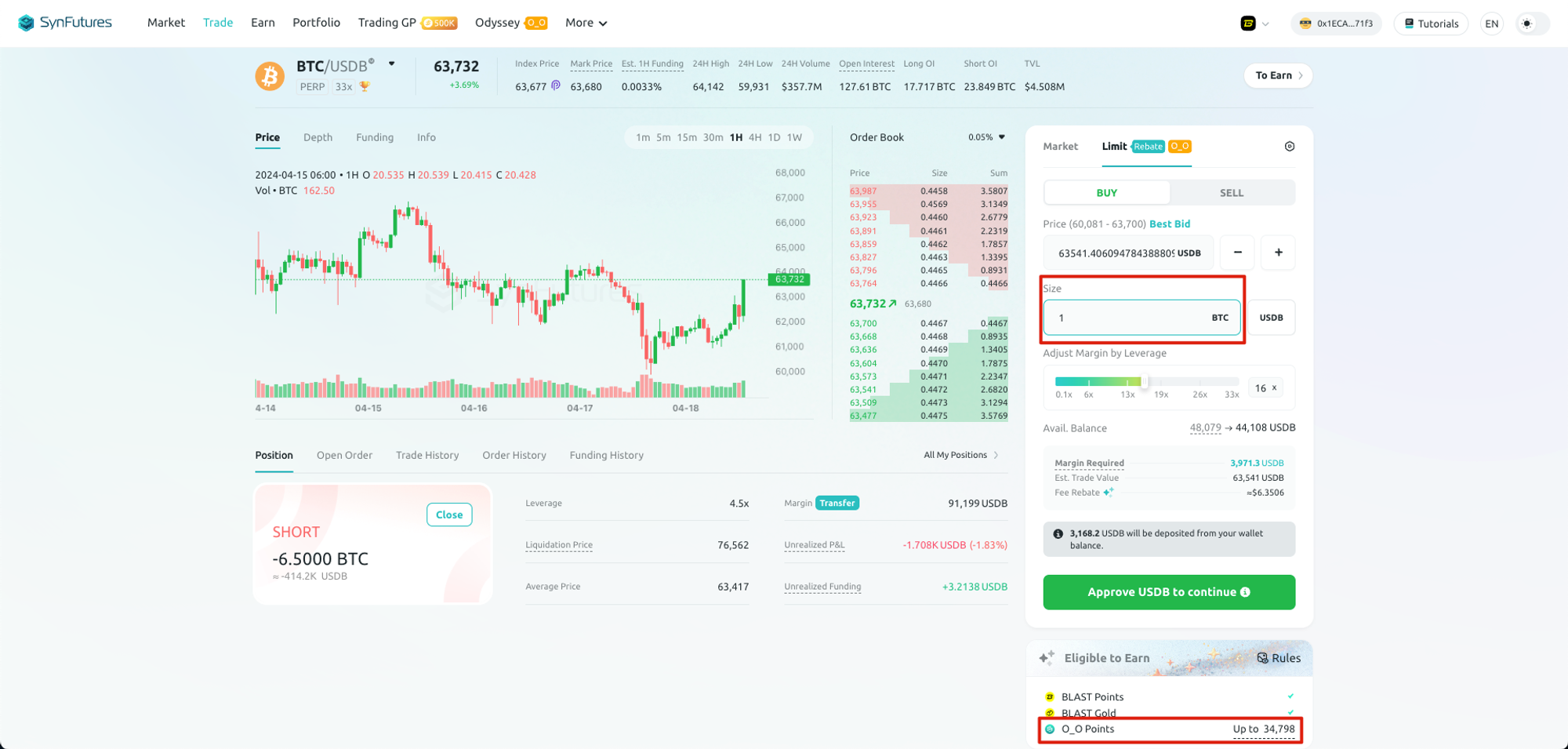

4. Earn Points Through Market Making

Just like on centralized exchanges, input price and quantity, then confirm the order. The second red box shows the maximum points your limit order can earn. Larger order sizes yield more points. Note: if your order is filled within 12 hours, points are calculated based on a full 12-hour period; if filled after 12 hours, points are calculated proportionally based on actual duration, capped at 7 days.

Note there's a 0.01% rebate on limit orders—meaning for every $10,000 traded, you earn $1 back. Also, your own market orders can fill your limit orders. Combined with Strategy 2, this enables a lower-cost method to farm points efficiently.

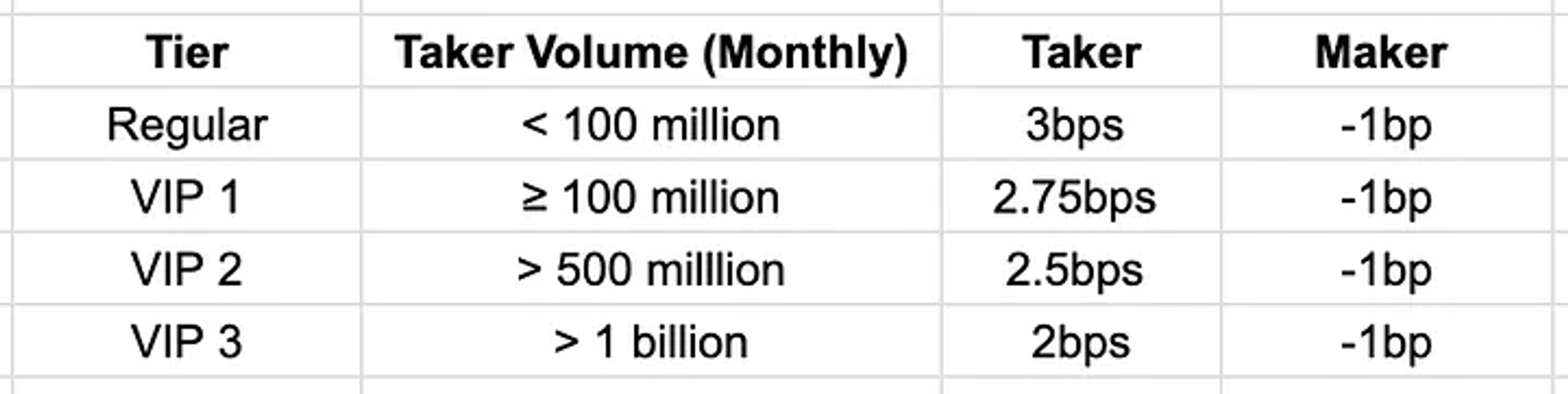

5. Enjoy VIP Trading Fee Discounts

No need for much explanation here—combined with Strategy 2, this further reduces costs. Discounted fees will be directly credited to your wallet address next month.

For more details, see the official article (link)

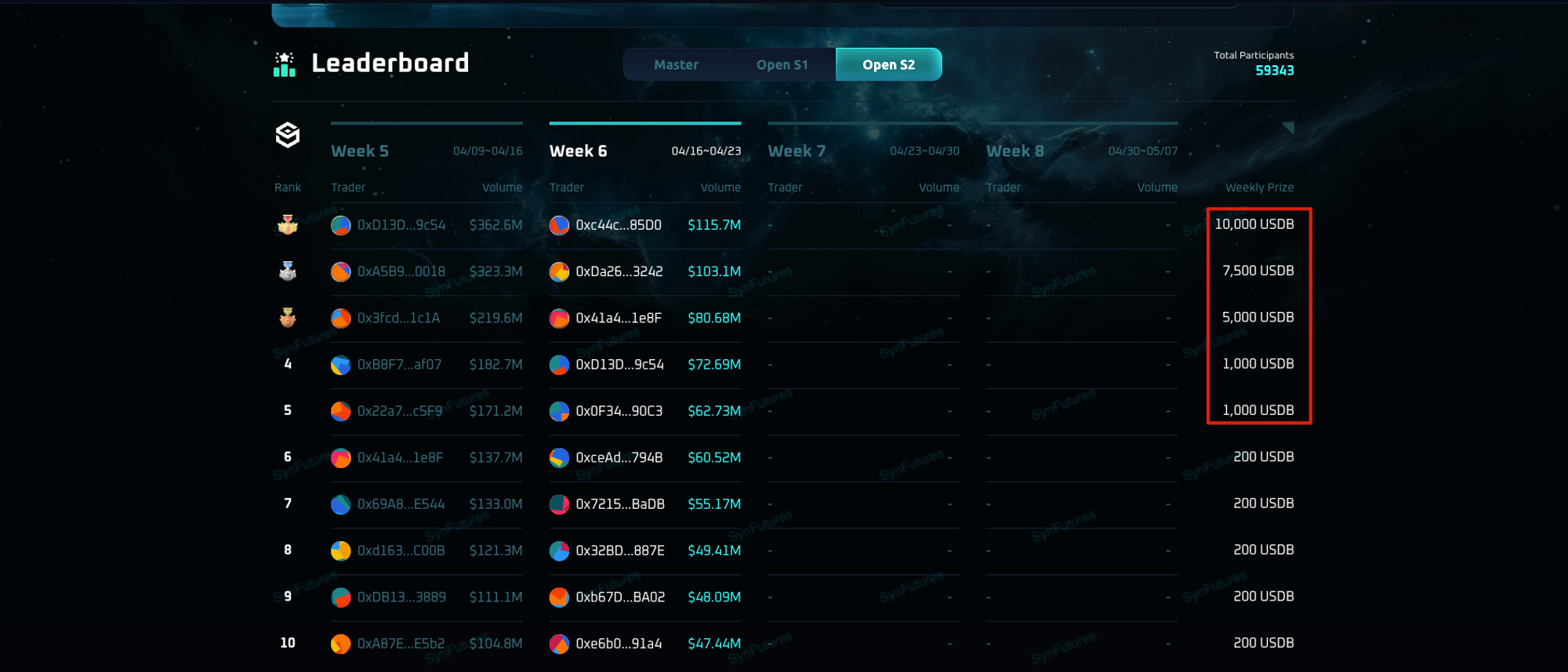

Worth noting: their current trading competition ranks participants weekly. Top 3 winners receive $10,000, $7,500, and $5,000 respectively. High-volume traders can leverage this event to further reduce interaction costs.

6. Trade and Arbitrage Using SDK

The official SDK is now available (see here)

If you have technical skills and experience, use their SDK to automate arbitrage and trading—it's efficient and hassle-free. Prices on SynFutures often diverge slightly from centralized exchanges; during sharp market moves, I've captured spreads of 3–5%. Based on tracking several market maker addresses, returns appear solid—though manual traders simply can't compete with bots.

4. Conclusion

This is probably the most comprehensive guide to the SynFutures airdrop available online!

I'm particularly interested in decentralized derivatives projects, so whenever I find a credible and promising one, I shift part of my trading activity there—often reaping nice rewards. In my view, SynFutures is currently undervalued, with significant room for TVL growth—reaching $100–200 million seems entirely feasible. When others overlook such opportunities, that's when heavy positioning pays off—something Wormhole taught me the hard way.

If this article helped you, feel free to use my referral link to get a 30% boost.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News