Deep Dive into Native Lend: Achieving Both Capital Efficiency and Yield Maximization, the Pioneer of DeFi's Supply-Side Reform

TechFlow Selected TechFlow Selected

Deep Dive into Native Lend: Achieving Both Capital Efficiency and Yield Maximization, the Pioneer of DeFi's Supply-Side Reform

What Native Lend aims to do is achieve better pricing by directly connecting buyers and sellers, enabling more efficient capital utilization and narrower spreads.

Author: TechFlow

The current crypto market is witnessing frequent hotspots and surging on-chain trading demand.

L1s and L2s are competing fiercely for liquidity and attention. The constant rise and fall of AI and MEME sectors across different ecosystems serve as the best proof.

In contrast, however, the DeFi sector appears to be falling behind.

Lacking paradigm innovation, this once-pillar of the crypto world is gradually stagnating in user growth and user experience:

A multitude of blockchains means fragmented liquidity. On-chain DeFi has yet to achieve a cross-chain aggregated trading experience where “one hub enables access to all chains”;

On-chain traders suffer from MEV and poor pricing, worrying about transaction costs; while LPs (liquidity providers) are trapped in a vicious cycle—providing more liquidity only leads to greater losses...

Poor experience and low returns naturally lead to weak demand.

As with any economic issue, sluggish demand often stems from supply-side problems — and DeFi’s lifeline lies in liquidity provision.

We urgently need a better market-making mechanism that improves capital efficiency on the liquidity supply side, so that traders can receive better prices and liquidity conditions, and LPs can earn higher returns.

Some projects have already identified this critical pain point. Native Lend is a pioneer in driving this "DeFi supply-side reform".

Building upon cross-chain aggregation, it introduces private market makers and credit-line-based trading mechanisms, creating a new paradigm where liquidity providers and market makers collaborate—revitalizing market makers’ capacity and efficiency at the source, while ensuring LP fund security and boosting their returns.

Ordinary users may not easily perceive or understand these supply-side optimizations—but they still benefit from them.

Precisely because Native Lend's product advantages are subtle and hard to notice, this article will use an accessible, educational approach to highlight the current gaps in the DeFi market, reveal how this product fills those gaps, and analyze its value and potential.

AMM: A Long-Standing Illness

Where exactly does today’s DeFi problem lie?

Why do traders often fail to get better quotes and lower transaction costs? Why do LPs consistently lose money when providing liquidity?

The Automated Market Maker (AMM) mechanism—the cornerstone of DeFi—might be the root cause.

While widely adopted, AMMs play a crucial role in offering decentralized, permissionless, and continuous liquidity—but being useful doesn’t mean being flawless:

When traders interact with AMM pools, high slippage easily occurs under low liquidity or sudden large-volume trades. Additionally, trade orders are typically public and wait for execution on-chain, making them vulnerable to frontrunning or exploitation during the delay, leading to MEV-related cost increases;

For liquidity providers (LPs), capital efficiency is too low—AMMs statically allocate funds across the entire price curve, resulting in poor utilization;

Moreover, their probability of losing money remains high, largely due to impermanent loss—an enduring flaw inherent to AMMs.

When the asset prices in an AMM pool change significantly, impermanent loss arises, and LPs may end up withdrawing less than if they had simply held the assets.

A prior study from the University of Orléans showed that impermanent loss in Uniswap and other AMMs is consistently permanent—and even under optimistic assumptions, it erodes returns compared to equivalent holding strategies.

So what exactly are we missing in the DeFi world?

A better liquidity supply and integration mechanism beyond simple AMMs—enabling traders to enjoy better pricing and lower costs, and allowing LPs to achieve higher capital efficiency and returns.

With this understanding, Native Lend’s design becomes much clearer.

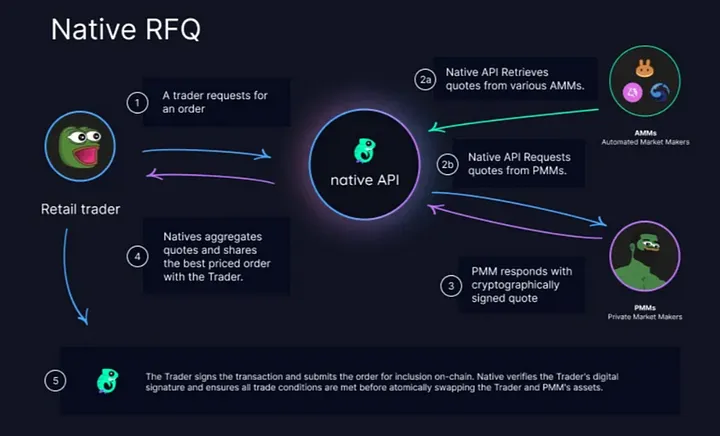

Simply put, Native Lend aims to cure AMM’s ailments using private market makers (PMM) and a Request-for-Quote (RFQ) model.

Under the private market maker model, users request quotes from specific market maker entities instead of relying on AMM smart contract algorithms. Pricing and capital allocation are dynamically adjusted based on real-time market conditions.

In this setup, traders directly request quotes from market makers for specific trades, then choose whether to accept or reject them—this is the aforementioned “Request-for-Quote (RFQ)” model.

What are the immediate benefits of PMM and RFQ?

-

No MEV: Fixed-price quotes provided by market makers settle directly with traders. Since pricing is determined off-chain and not based on on-chain state, there’s no uncertainty or slippage, drastically reducing MEV opportunities.

-

Better pricing: When traders request a quote, the market maker offers a fixed price unaffected by subsequent market movements. Unlike AMM pricing—which fluctuates based on trade size and pool ratios—RFQ provides price certainty.

-

Solves impermanent loss: PMMs dynamically adjust bid/ask prices using external market data and internal risk models rather than rigid formulas. This allows better inventory risk management and mitigates potential losses caused by market volatility.

Compared to traditional AMMs, Native Lend aims to achieve superior pricing by enabling direct connections between buyers and sellers—using higher capital efficiency and tighter spreads.

This overarching vision sounds promising, but how exactly is it executed?

How can PMM market-making efficiency be maximized while safeguarding LP interests, ensuring the system runs smoothly?

Programmable Liquidity Layer: Targeted Solutions

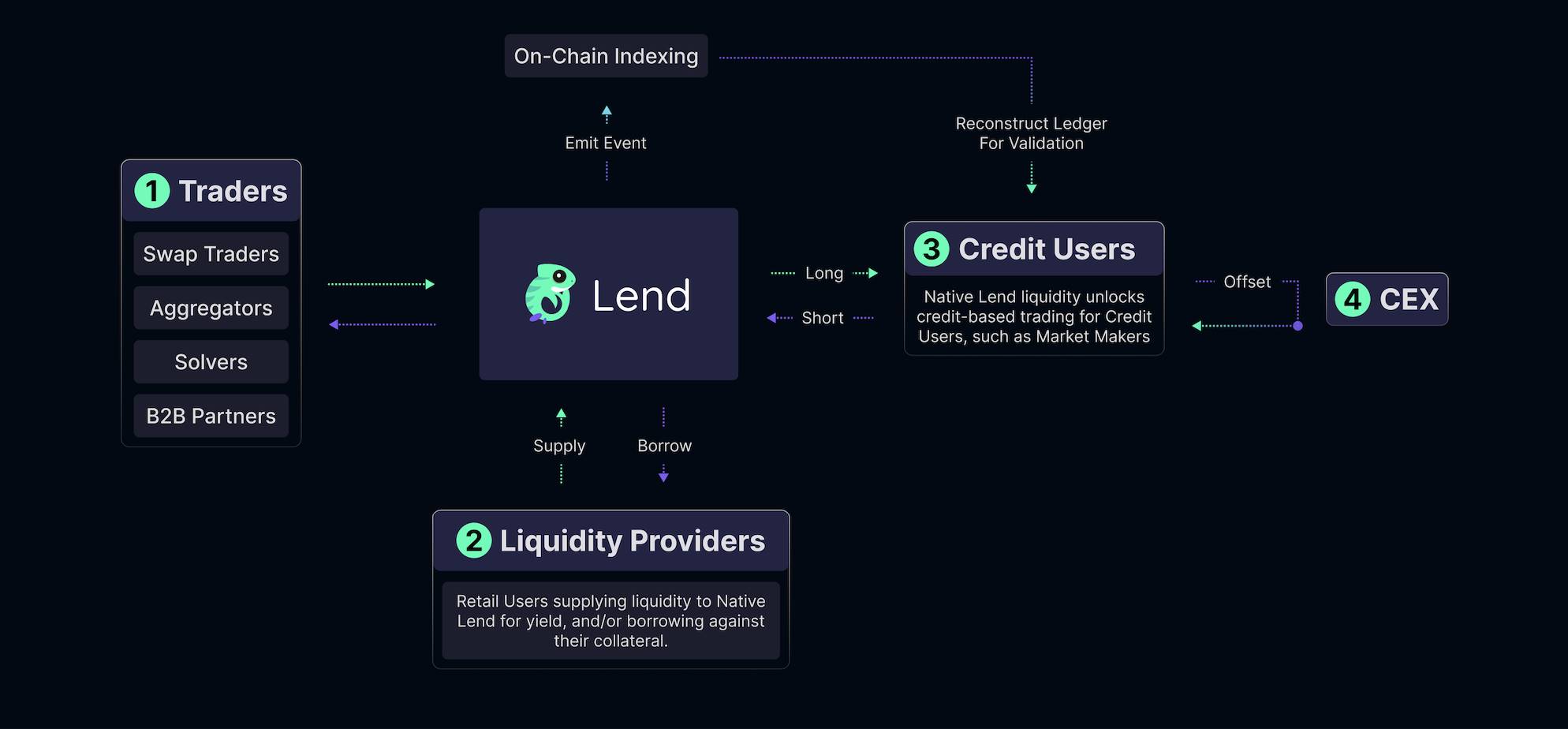

Native Lend’s concrete answer is to provide a “programmable liquidity layer,” establishing a new collaborative paradigm between LPs and PMMs.

Don’t rush to grasp the abstract idea of “programmable liquidity.” Let’s start from the most fundamental needs of DeFi participants.

If you were a liquidity provider or market maker, what would you want most?

Clearly, LPs want their deposited assets to be maximally utilized, while PMMs always seek more capital to deploy for market making.

These two desires open the door to collaboration.

Native Lend innovatively introduces a “credit-line-based” design: market makers can pledge collateral and borrow LP-provided funds via a defined credit limit (Credit), leveraging their positions to expand market-making scope and boost capital efficiency.

If this still seems unclear, consider the most common real-world analogy—bank deposits and loans.

You deposit money into a bank; someone else needs funds. The bank requires collateral and grants a credit line, allowing them to borrow your deposited money for productive use.

Native Lend works similarly—market makers leverage their positions to borrow LP funds for market making, maximizing DeFi capital efficiency.

More importantly, market makers no longer need to worry about which chain their collateral resides on. Credit limits are determined solely by collateral value—meaning the same set of collateral can access liquidity pools across all supported chains, vastly expanding market-making reach.

But what if a market maker borrows funds and runs away?

Note: The term “borrowing” here does not mean LP funds are physically taken away.

LPs don’t need to worry about the safety of their funds in the pool. The PMM’s “borrowed” capital isn’t actually transferred—it stays within Native Lend’s smart contracts. Instead, “borrowing” and “repayment” are represented through long and short positions, settled or liquidated according to predefined conditions. The LP’s principal remains untouched.

In essence, Native Lend replaces actual fund transfers with borrowing positions—these positions represent temporary control rights over LP assets, enabling maximum capital utilization for market making.

The benefits are clear.

Before this mechanism: Cross-chain liquidity fragmentation limits market makers—they can only operate with the capital they hold on each chain, unable to conduct cross-chain market making. Both market-making range and capital efficiency remain low.

After this mechanism: It no longer matters which chain the market maker’s assets are deployed on. By breaking free from capital inventory constraints and intelligently applying leverage, market makers can mobilize multiples of their own capital, maximizing market-making efficiency.

Because of this design, you should now understand the meaning of “programmable liquidity layer”:

-

Dynamic and Customizable: Allows market makers to “program” or customize their liquidity usage strategies to maximize profit and efficiency.

-

Enables Complex Strategies: By combining PMM and credit-based trading, Native Lend supports sophisticated trading and liquidity strategies that are difficult or impossible on traditional DeFi platforms. Managing and executing such complexity—via algorithms and logic—can be seen as “programming” liquidity to achieve desired market outcomes.

-

Adaptive and Responsive Liquidity: On the Native Lend platform, liquidity can self-adjust based on market demand and conditions. This adaptability resembles event-driven programming, where the system reacts to external events (e.g., price changes) and adjusts behavior accordingly.

Still unclear? Consider this real-world-like example:

-

Traders: Alice wants to buy USDT with ETH on the Native Lend platform. She submits her request via DEXs, aggregators, or other frontends;

-

Liquidity Providers (LPs): Bob has extra USDT and wants to earn yield. He deposits USDT into Native Lend to provide liquidity, possibly leveraging his position for higher returns.

-

Credit Users: Carol is a market maker who wants to quote prices and trade without locking all her capital into a single asset or chain. She pledges collateral on Native Lend and uses her credit line to operate—effectively borrowing Bob’s USDT (via Native Lend) to provide liquidity and pricing for Alice.

-

Finally, Alice successfully buys USDT—made possible by the joint efforts of LPs and market makers.

Each party gains value:

Alice (trader) receives fast, low-cost trading with better pricing, free from slippage and MEV concerns;

Bob (LP) earns more interest by lending his funds, achieves higher capital utilization, and doesn’t worry about fund safety;

Carol (market maker) uses borrowed capital to serve Alice, while gaining opportunities to profit from market dynamics.

By integrating diverse participants and designing robust mechanisms, Native Lend ensures smooth transactions and mutual satisfaction.

Thus, the stubborn ailments of traditional DeFi’s AMM model are finally cured.

Cross-Chain Aggregation: A Natural Evolution

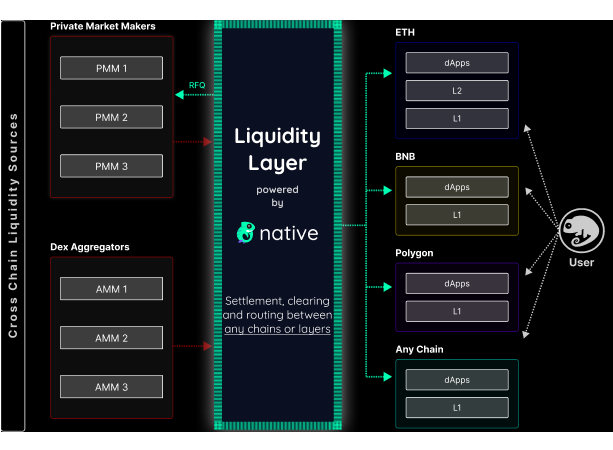

Implementing this solution requires solving cross-chain trading, liquidity aggregation, multi-chain assets, and market maker coordination.

Coordinating multiple parties isn’t easy—why can Native Lend pull this off?

In fact, before launching Native Lend, the team already had specialized expertise in liquidity aggregation—through earlier products: Native and Native Swap.

Think of the former as an API that various projects can integrate to enable cross-chain aggregation;

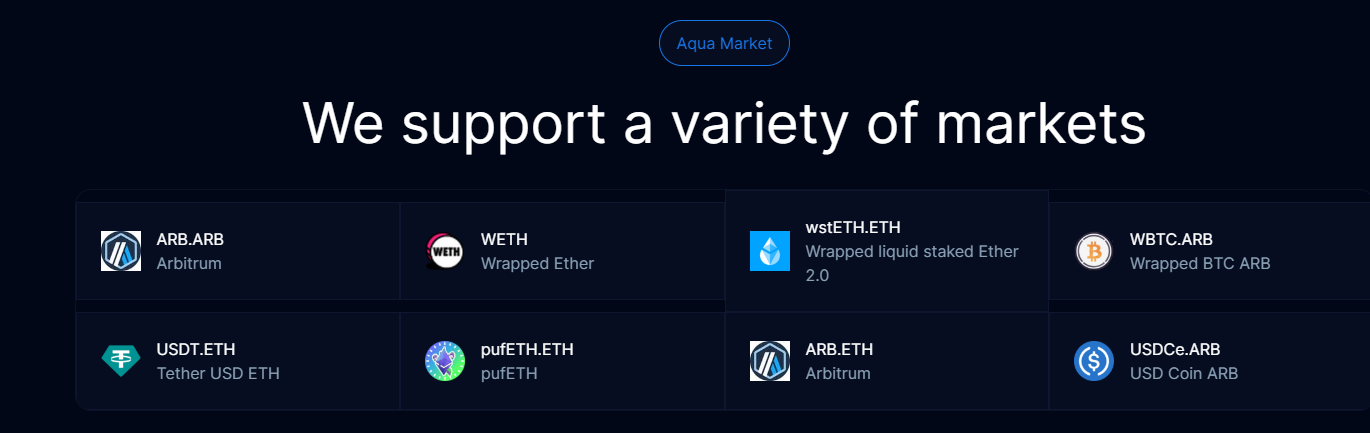

The latter is a standalone cross-chain aggregation product, already live and operating successfully for 10 months, achieving strong volume metrics and supporting cross-chain swaps across ETH/BSC/Polygon/Arbitrum/Avalanche/Zeta/Mantle.

Public data shows Native Swap is already top-tier in cross-chain aggregation, integrating substantial liquidity and a wide network of market makers, capturing over 70% of DeFi order flow.

Therefore, launching Native Lend was a natural next step.

With existing liquidity and market maker resources, why not maximize both sides—helping LPs achieve peak capital efficiency and returns, giving users better pricing, and offering market makers a larger stage?

Additionally, Native Lend benefits from an experienced team and solid funding.

The CEO holds a Master’s in Data Science from NYU, with over 8 years of leadership experience in data science teams, and extensive expertise in machine learning, data mining, and project management;

An advisor previously served as CTO at Altonomy, a crypto trading firm, and CEO at Tokka Labs;

The CTO is a seasoned full-stack engineer with deep knowledge of EVM-compatible smart contracts.

Moreover, Nomad led a $2 million seed round for Native. In March 2023, Nomad Capital received investment from Binance, and the following month invested in its first project, Native. In December 2023, Native secured another strategic investment from Nomad Capital.

What makes Native Lend worth watching for regular users?

First, the project token hasn’t launched yet, positioning it as a promising alpha opportunity in the DeFi liquidity optimization space.

Native Lend builds logically on previous Native products, backed by a strong team and funding. With no direct competitors in DeFi and support for major assets across multiple chains, it deserves early attention.

Furthermore, its business model naturally fosters a “picks-and-shovels” effect.

The more liquidity it aggregates and the more L1/L2s it partners with, the more it becomes a key infrastructure player—increasing the likelihood that future projects will airdrop tokens to users who’ve used Native Lend.

Currently, Native Lend’s beta testing has begun. Interested users can already access the product via zkLink, start earning points, and await future rewards.

Future Outlook

As mentioned at the beginning, this bull market is filled with explosive moments—you’re likely noticing constant hotspots and surprises across different ecosystems.

This also reveals a latent opportunity in DeFi—when attention and capital are limited, standalone DeFi products struggle to gain market share. Only those that form alliances and aggregate assets and trades across ecosystems can truly capture the market.

If Native Swap is the key driver of such alliances, then Native Lend is the essential lubricant connecting all parties:

It integrates fragmented liquidity on the supply side, enabling better collaboration between market makers and LPs—boosting market-making efficiency and capital utilization—ultimately benefiting traders on the demand side.

Even though cross-chain aggregation remains a relatively niche segment, products that create win-win outcomes always carve out unique narrative space.

The underlying product design may go unnoticed, but its future potential should not be underestimated.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News