Hyperliquid stablecoin decision imminent: Why did the new team Native Markets win USDH?

TechFlow Selected TechFlow Selected

Hyperliquid stablecoin decision imminent: Why did the new team Native Markets win USDH?

PayPal arriving won't help either.

Author: kkk,律动

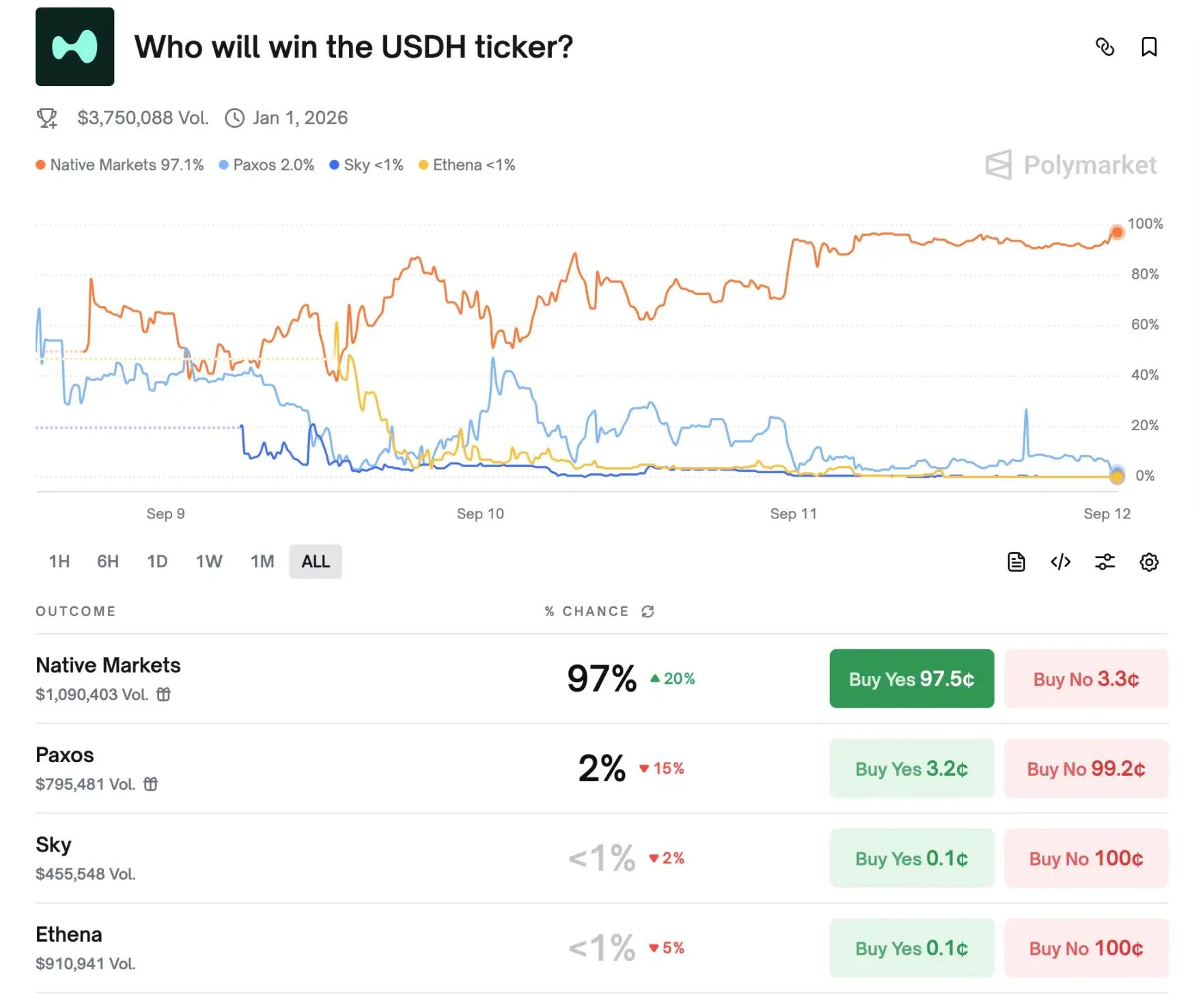

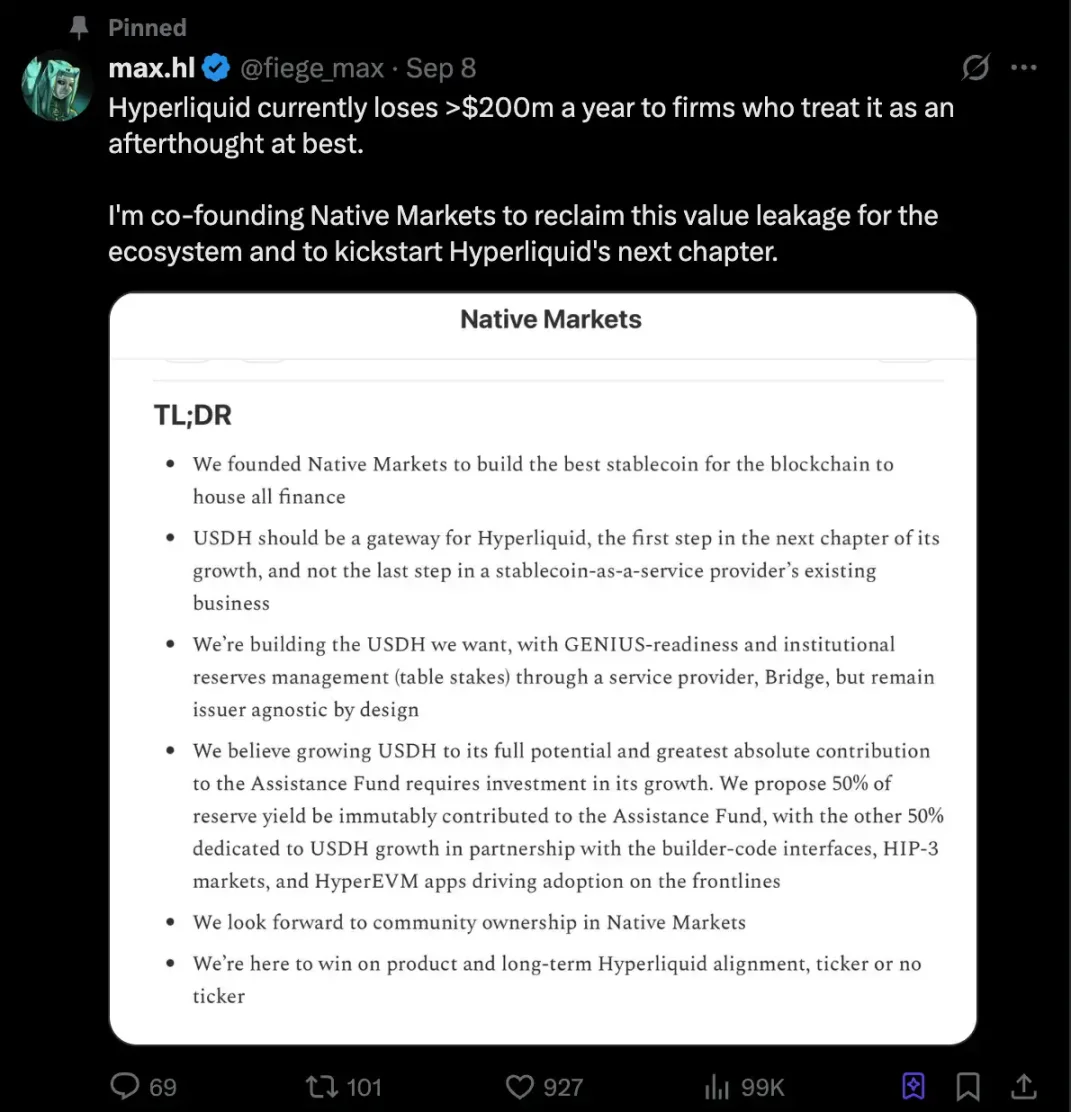

Recently, a highly watched stablecoin battle has unfolded on Hyperliquid, a decentralized derivatives trading platform. On September 5, the team announced an auction for the ticker of its native stablecoin USDH, instantly igniting market interest. Multiple institutions including Paxos, Ethena, Frax, Agora, and Native Markets submitted proposals to compete for the right to issue USDH. As a leading player in the popular perp DEX sector, Hyperliquid has become a strategic opportunity that institutions must enter—even if it's not immediately profitable. Currently, Native Markets leads with a staggering 97% advantage, all but securing victory.

Native Markets' Strategy

Native Markets proposes that USDH reserves be jointly managed by BlackRock (off-chain) and Superstate (on-chain), ensuring both regulatory compliance and issuer neutrality. Its mechanism is unique: reserve interest is split evenly—half flowing into an Assistance Fund for HYPE buybacks, the other half invested into ecosystem development, including HIP-3 markets and HyperEVM applications.

Users can mint or redeem USDH via Bridge, with more fiat on-ramps planned in the future. The protocol’s core component, CoreRouter, has been audited and open-sourced, encouraging direct community participation in development. Native Markets also commits that USDH will comply with U.S. GENIUS regulatory standards and inherit Bridge’s global compliance credentials and fiat infrastructure. Notably, Bridge was acquired last year by payments giant Stripe, and Native plans to leverage this network for deep integration between stablecoins and fiat systems.

Although Native Markets is the least well-known among the major bidders, it has emerged as the frontrunner thanks to the team’s long-standing involvement in the Hyperliquid chain and the addition of several heavyweight figures from industry leaders such as Paradigm and Uniswap.

Founding Team

@fiege_max

Over the past year, Max has been deeply involved in the Hyperliquid ecosystem, driving approximately $2.5 billion in HyperEVM total value locked and $15 billion in HyperCore trading volume as an investor and advisor. He previously led product and strategy at Liquity and Barnbridge, focusing on stablecoins and fixed-rate instruments. As a community leader at Hyperion, he also spearheaded the establishment of Hyperliquid DAT’s listed entity.

@Mclader

Mary-Catherine Lader served as President and COO of Uniswap Labs (2021–2025). She pioneered BlackRock’s digital asset initiatives as early as 2015 and later served as Managing Director at Goldman Sachs investing in fintech. She is now poised to guide USDH and Hyperliquid’s development in the post-GENIUS era.

@_anishagnihotri

Anish is a blockchain researcher and software engineer with over a decade of experience. He was the first employee at Ritual, briefly served as Paradigm’s youngest researcher, and worked as a proprietary DeFi trader at Polychain. Additionally, he has made lasting contributions and maintained influence in MEV and DeFi tooling open-source projects.

Community Controversy

Naturally, there has been significant skepticism around this community vote. Hasib Qureshi, Managing Partner at prominent VC Dragonfly, wrote Tuesday that he “is starting to feel like the USDH RFP is kind of absurd,” claiming validators appear unwilling to seriously consider any team besides Native Markets.

He added that Native Markets’ bid appeared almost immediately after the RFP was released, “suggesting they had prior notice,” while other bidders were still preparing their submissions. He argued that despite stronger proposals from more established players like Paxos, Ethena, and Agora, the process seems “tailor-made” for Native Markets.

However, Nansen CEO @ASvanevik rejected this speculation, stating that as one of the largest validator operators on Hyperliquid, they and the @hypurr_co team invested substantial effort reviewing proposals and engaging with bidders to identify the optimal stablecoin solution. They ultimately chose to support Native Markets.

After recognizing the outcome was sealed, Ethena Labs withdrew from the USDH bidding race, noting that while some question Native Markets’ credibility, their success perfectly reflects Hyperliquid and its community’s essence: a fair playing field where emerging participants can earn community backing and achieve legitimate success.

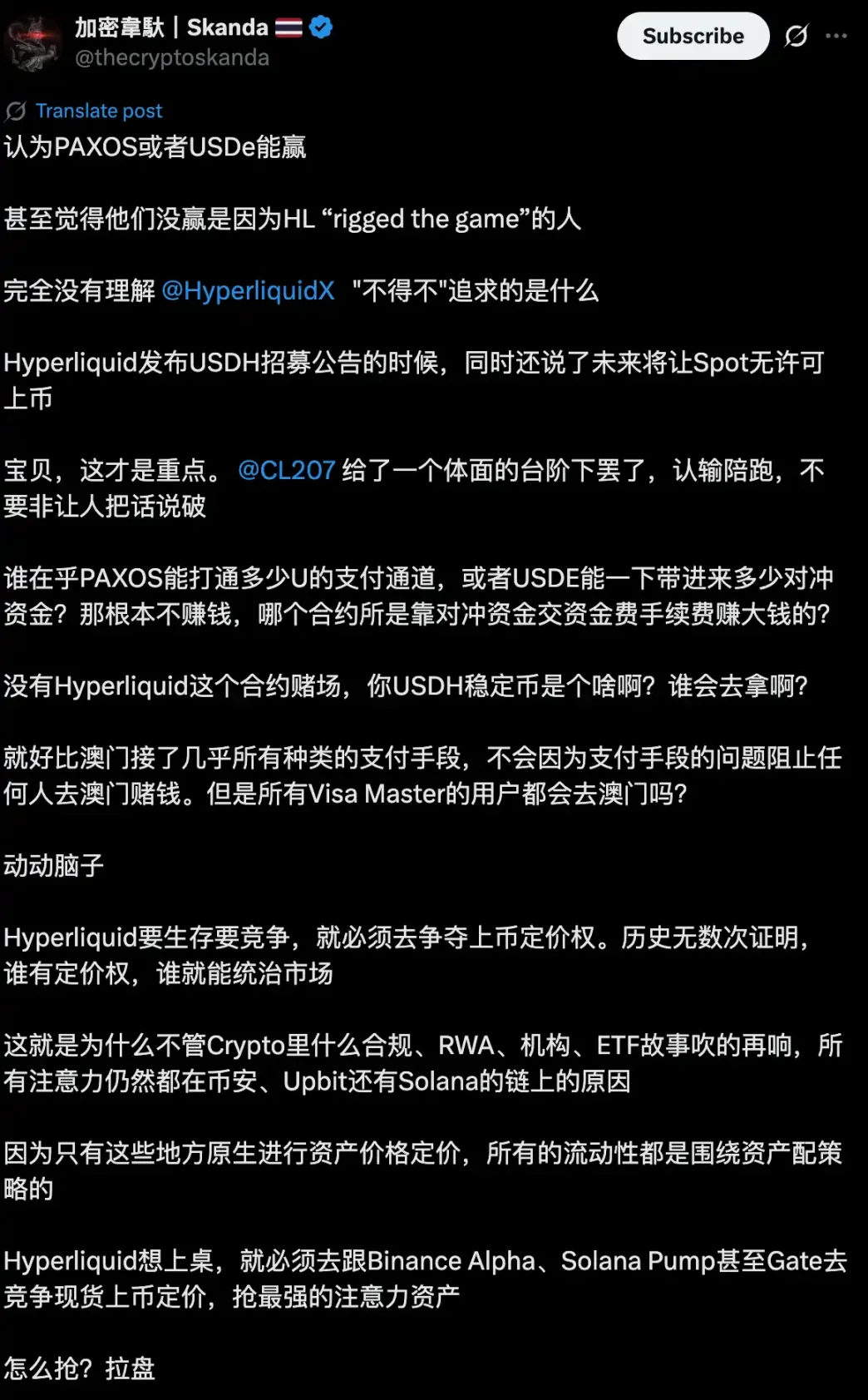

KOL Crypto韦陀 @thecryptoskanda stated that Native Market’s selection was inevitable, as exchange platforms fundamentally prioritize listing and pricing mechanisms—needs that no other team could fulfill as clearly for Hyperliquid.

On Hyperliquid, dollar liquidity has long relied on external stablecoins like USDC, circulating at volumes reaching up to $5.7 billion—accounting for 7.8% of USDC’s total supply. Hyperliquid’s current decision effectively means redirecting potentially hundreds of millions in annual interest income directly to the community.

Because of this, control over USDH issuance is not just about capturing market share—it’s about gaining authority over massive potential revenue. In Hyperliquid’s case, we see a stablecoin issuer willing to give up nearly all yield simply to gain distribution within this ecosystem—a scenario nearly unimaginable in the past. It is foreseeable that once USDH launches successfully and proves the virtuous cycle of “returning yields to the community and reinvesting value into the ecosystem,” other exchanges or public chains will rush to replicate this model, triggering a fundamental shift in industry-wide stablecoin strategies. At that point, the “Stablecoin 2.0 era” may truly begin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News