Analyzing Native, a programmable liquidity layer and cross-chain transaction aggregation product that empowers users to trade more efficiently

TechFlow Selected TechFlow Selected

Analyzing Native, a programmable liquidity layer and cross-chain transaction aggregation product that empowers users to trade more efficiently

Native enables project teams to launch trading functionality on their own websites, providing protocol users with a more seamless interactive experience.

Author: Toude Cang

Native positions itself as the liquidity layer for blockchains and includes three products: Native, a liquidity interface that can be integrated into projects; NativeX, an aggregator for trading and cross-chain swaps; and Aqua, a novel lending tool. NativeX integrates multiple decentralized exchanges and cross-chain bridges as sources of liquidity, and further collaborates with select private market makers to offer users zero-slippage and seamless trading experiences. Its core product, Aqua, enables market makers to borrow funds from depositors for market making, solving the issue of insufficient liquidity for market makers. Since settlements are executed using liquidity from Aqua and funds remain within the Aqua smart contract at all times, the risk is significantly lower than traditional institutional lending. Aqua simultaneously enhances capital efficiency and yield while maintaining strong risk control.

Project Overview

Native is positioned as a programmable liquidity layer and currently offers three products: Native, a protocol-facing liquidity interface; NativeX, a cross-chain trading aggregator; and Aqua, a new lending tool designed for market makers. Native allows project teams to directly integrate Native’s liquidity into their own websites. NativeX is already a leading player in the cross-chain aggregation space—although overall demand in this niche remains limited, it demonstrates the team's operational capabilities. The design of its new lending product, Aqua, greatly improves market makers’ capital efficiency while tightly controlling risks, representing a significant innovation. Native has raised two rounds of funding from Nomad Capital and is now launching its flagship product, Aqua.

Native enables projects to launch trading functionality directly on their websites, offering protocol users a more convenient interaction experience. Protocols can easily integrate Native's liquidity into their own sites using Native tools and customize trading fees.

Cross-chain trading aggregation, though currently underutilized, holds growth potential. Users have substantial demand for both cross-chain bridges and trade aggregation, but often perform these actions separately, with few opting for direct cross-chain trading aggregation. While cross-chain aggregation offers convenience, adoption has been limited due to liquidity constraints and user habits. NativeX is already among the top-tier platforms in this field, aggregating substantial liquidity and cultivating extensive relationships with market makers, capturing over 70% of DeFi order flow—advantages that support the rollout of Aqua. As major L1s and L2s grow in popularity, demand for cross-chain transactions is rising, potentially increasing user adoption of cross-chain aggregation.

Aqua, as a novel lending instrument, enhances market makers’ capital efficiency while minimizing depositor risk. Institutional credit protocols often operate without collateral—approved institutions can borrow user funds directly, with little transparency regarding fund usage or destination, exposing users to high counterparty risk. In contrast, market makers borrowing through Aqua are fully over-collateralized and do not withdraw funds; instead, they use liquidity within the Aqua pool solely for transaction settlement. Settlement occurs via a bilateral exchange between the user and the Aqua pool. Market makers then generate corresponding long and short positions within the pool, which they can hedge by taking offsetting positions on centralized exchanges to profit from price spreads. For depositors, the funds used as collateral remain securely within the Aqua pool at all times, minimizing default risk and enabling sustainable, low-risk returns. For institutions, Aqua provides access to liquidity on blockchains where they lack assets, allowing them to open larger positions and maximize capital efficiency.

Native, NativeX, and Aqua function as interconnected products, sharing pricing data, order flow, and liquidity to create a synergistic competitive advantage.

Overall, Native has accumulated significant resources in cross-chain trading aggregation, providing a solid foundation for the expansion of its new product, Aqua. This synergy among Native, NativeX, and Aqua creates a powerful network effect. As Native’s flagship innovation, Aqua establishes a new paradigm for collaboration between liquidity providers and market makers. It ensures the safety of depositor funds while granting market makers greater capital efficiency and convenience, creating a win-win scenario. As a rare innovation in the DeFi space with no direct competitors, Native warrants close attention.

1. Basic Information

1.1 Project Introduction

Native defines itself as a programmable liquidity layer, currently offering a protocol-facing liquidity interface (Native) and a cross-chain trading aggregation product (NativeX) to deliver a smoother trading experience. Native has launched its new lending protocol, Aqua, aimed at users and market makers, on testnet. Aqua enables market makers to gain borrowing capacity through collateralization and settle user trades using funds from the Aqua pool, enhancing capital efficiency while minimizing default risk.

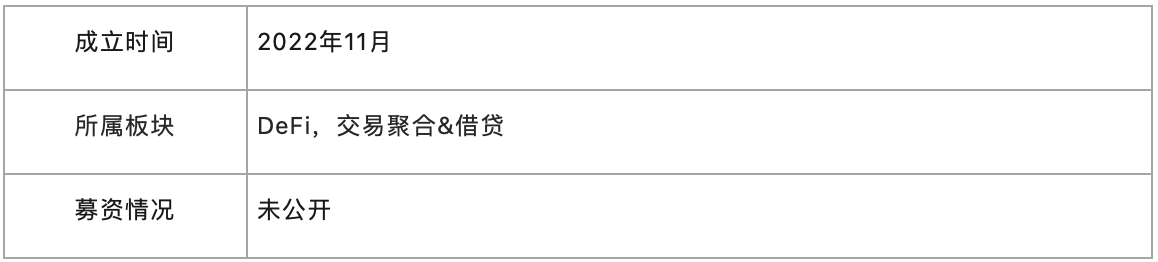

1.2 Basic Data

2. Project Details

2.1 Team

According to LinkedIn data, the team consists of 3–10 members. Key team members are introduced below:

Meina Zhou, CEO of Native. She holds a Master’s degree in Data Science from New York University and has over eight years of experience leading data science teams, with deep expertise in machine learning, data mining, and project management. Meina Zhou is also the founder and host of the CryptoMeina podcast.

Wee Howe Ang, Advisor to Native. He holds a Bachelor’s degree in Electrical Engineering from the National University of Singapore. Formerly Software Development Manager (Assistant Vice President) at Deutsche Bank. Served as CTO at cryptocurrency trading firms Altonomy and Tokka Labs.

Hung, Technical Lead at Native. Entered the crypto industry in March 2019. A full-stack engineer experienced in EVM-compatible smart contracts.

Although Native has a small team, roles are clearly defined, covering technical development, trading operations, and marketing with relevant industry experience.

2.2 Funding

In April 2023, Nomad led a $2 million seed round. Nomad Capital received investment from Binance in March 2023 and invested in Native, its first portfolio project, the following month. In December 2023, Native secured a strategic investment from Nomad Capital.

Table 2-1 Dapper Labs Funding History

2.3 Products

2.3.1 Aqua

Early decentralized exchanges (DEXs) primarily used order books and RFQ (Request for Quotation)—a mechanism where traders directly request quotes from market makers, differing slightly from traditional order books. However, implementing order book models on Ethereum proved costly, inefficient, and suffered from poor depth and matching issues. Consequently, automated market maker (AMM) models became dominant. For example, Uniswap uses a constant product model, enabling self-discovery of prices but suffers from low capital efficiency, requiring large liquidity pools to minimize price impact. Liquidity providers still face impermanent loss, and returns often fail to outperform simply holding tokens.

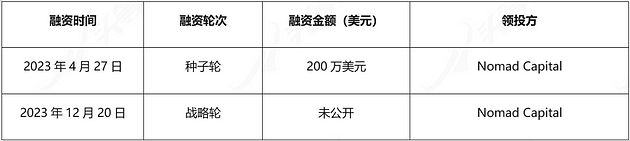

Native is introducing a new trading paradigm with Aqua, a novel lending product targeting retail users and market makers that combines features of DEXs and lending protocols. It aims to enhance market makers’ capital efficiency and depositor yields while ensuring fund security. Typically, market makers keep funds on centralized exchanges or specific blockchains. If there is market-making demand on a new blockchain, they must allocate capital and assume associated security risks, possibly forfeiting profitable opportunities.

With Aqua, market makers can collateralize assets to borrow and conduct market making on new blockchain networks (collateral can reside on other chains), typically using RFQ mechanisms. This approach achieves high capital efficiency without drawbacks like slippage or MEV. Funds originate from depositors / liquidity providers (who may also gain borrowing capacity). For instance, when a user sells ETH for USDT, the market maker provides a quote and settles using funds from the Aqua pool (originally deposited by users). After settlement, the market maker holds a short position in USDT and a long position in ETH (equivalent to having borrowed USDT and deposited ETH into the pool, with all funds remaining in the Aqua contract). Within their borrowing limits, market makers can maintain multiple positions, maximizing liquidity and capital efficiency.

Aqua not only boosts market makers’ capital efficiency but also addresses liquidity shortages on certain blockchains. A key advantage is that borrowed funds remain locked in the Aqua contract, represented as long and short positions. This makes market makers’ balance sheets more transparent and prevents misuse of funds, resulting in significantly lower risk compared to traditional institutional lending protocols.

For lenders, yields combine interest from traditional lending plus additional fees generated by market makers using funds (interest from opening positions). Deposited funds unlock more lending use cases, generating higher yields than traditional lending protocols, without exposure to market maker credit risk (since funds stay in the Aqua contract). Moreover, market makers consistently need settlement services, meaning depositors enjoy relatively stable and sustainable returns.

Figure 2-5 Aqua Operational Logic

Aqua market makers are fully over-collateralized, and collateral and settlement funds need not exist on the same blockchain. Aqua employs a fixed-rate lending model, adjustable based on market conditions and utilization rates. Interest is calculated off-chain (based on blocks passed and position changes) and periodically submitted on-chain. Aqua uses off-chain quoting; if a market maker exceeds their borrowing limit, whitelisted liquidators can submit liquidation proposals, which Aqua validates and signs before being executed on-chain.

2.3.2 Native & NativeX

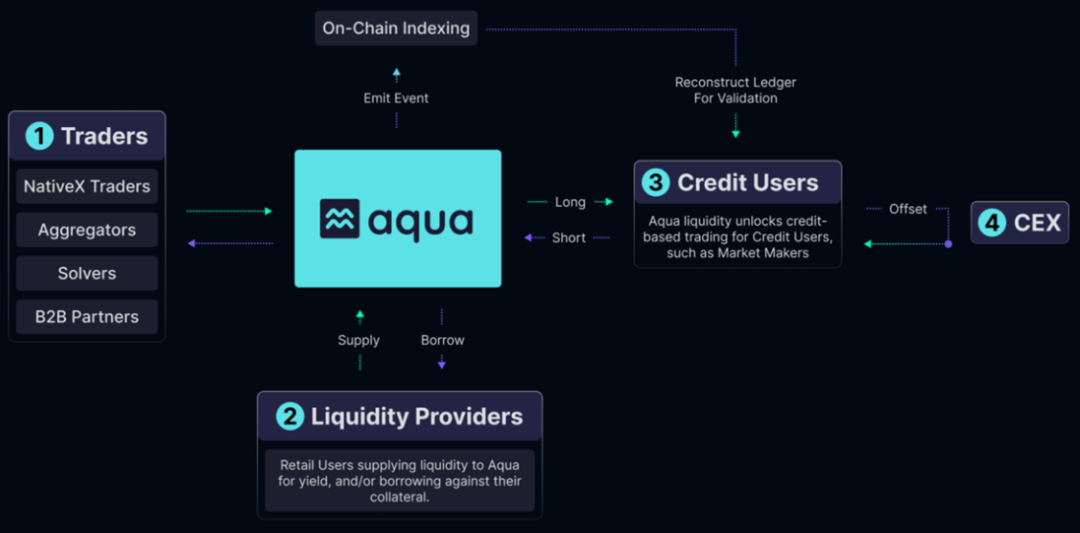

Since Ethereum’s gas fee issues became widely criticized, the crypto market has gradually shifted toward a multi-chain landscape. In terms of TVL, Ethereum has maintained around 58% of total value locked over the past two years, indicating other blockchains have gained competitiveness and retained meaningful liquidity. From a narrative perspective, Ethereum now focuses on serving Layer 2 networks, with future capital expected to migrate increasingly to L2s. Thus, the future crypto ecosystem will likely feature multiple coexisting chains rather than Ethereum dominance alone.

Figure 2-1 Ethereum TVL Share [1]

As more blockchains emerge, liquidity becomes fragmented. Both L1s like Solana and Aptos and Ethereum L2s have massive liquidity demands.

For traders, centralized exchanges offer limit-order book models with deep liquidity, reducing trading costs—but require surrendering asset custody and exclude non-listed tokens. On DEXs, users retain custody but suffer slippage, price impact, and MEV losses due to on-chain liquidity limitations.

Native is a solution that aggregates liquidity across multiple chains. Its product Native helps projects integrate Native’s liquidity and launch trading functions directly on their websites. Another product, NativeX, combines cross-chain bridge and trading aggregation, enabling users to perform cross-chain swaps. As of March 18, 2024, NativeX supports 10 EVM-compatible chains including Ethereum, Arbitrum, Polygon, BNB Chain, and Base, with more chains being added.

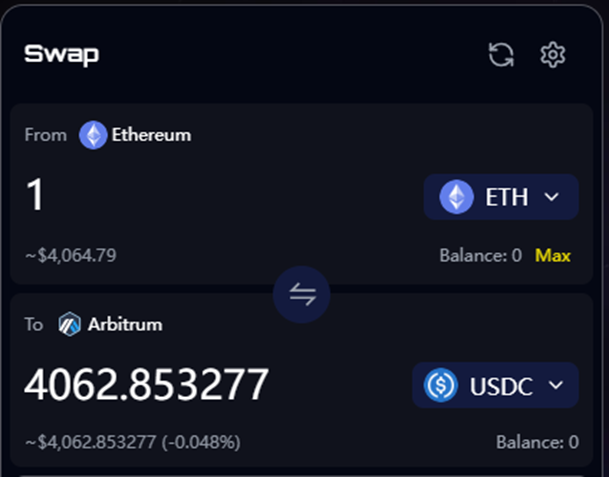

Figure 2-2 NativeX Swap Interface

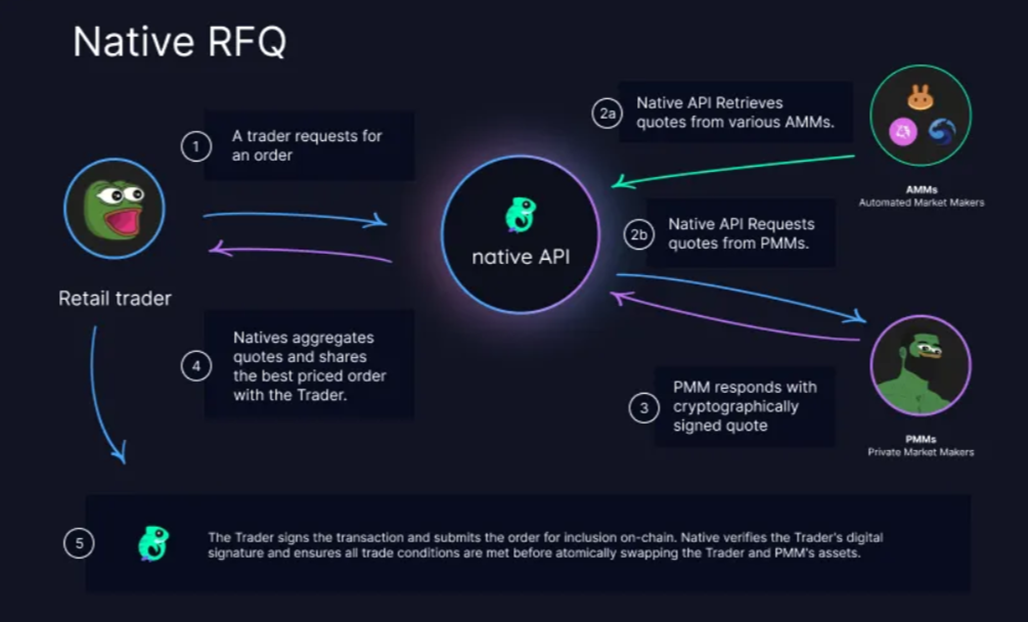

Building on aggregated liquidity from multiple DEXs (including aggregators) and cross-chain bridges, NativeX partners with several private market makers to offer better pricing. Unlike traditional AMMs, private market makers are individual entities that provide quotation-based (RFQ) liquidity similar to centralized exchange limit orders. They use proprietary algorithms and pricing models to supply liquidity to partners such as trading aggregators. Compared to AMMs, the RFQ mechanism offers greater flexibility and superior capital efficiency.

When a user places an order, Native fetches quotes from multiple DEXs and simultaneously requests quotes from private market makers. These market makers return cryptographically signed quotes, preventing frontrunning, price impact, and slippage losses. Native aggregates these quotes and delivers the optimal price strategy. If matched with a private market maker, Native verifies the user’s digital signature. Upon meeting conditions, an atomic swap occurs between trader and maker; otherwise, the order is canceled—ensuring fund security for both parties.

Figure 2-3 Native Quoting Aggregation Mechanism

Users trading with private market makers incur no fees, price impact, or slippage losses. Thus, Native reduces trading costs while preserving user asset ownership.

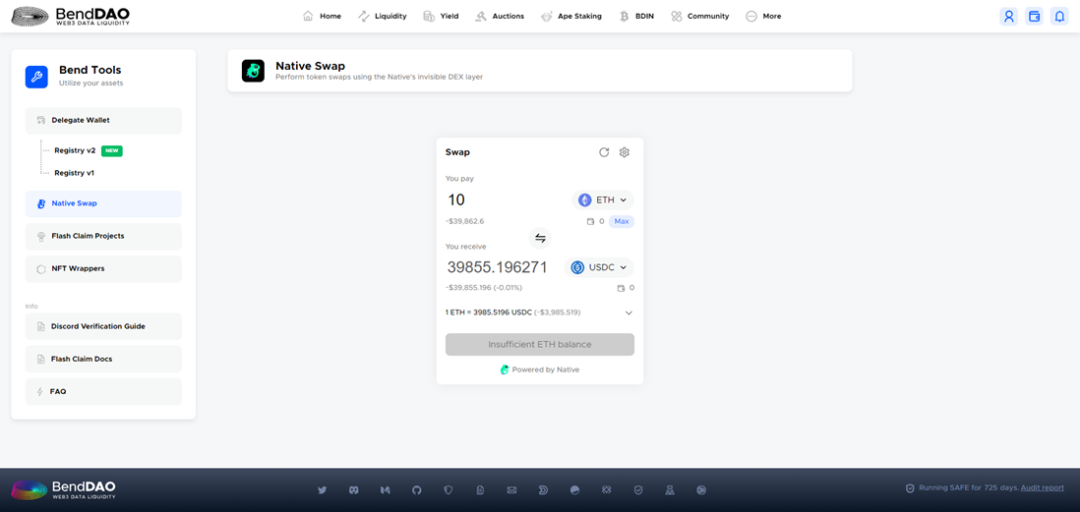

While NativeX serves traders, for project teams, integrating the Native SDK allows access to Native’s liquidity sources, enabling them to add trading functionality. Projects can choose to charge trading fees (default 0%) and offer additional token incentives to liquidity providers. Currently, BendDAO, Aboard, Range Protocol, and Velo have embedded Native for enhanced trading experiences, while ZetaSwap is built entirely on Native.

Figure 2-4 BendDAO Native Trading Interface [2]

For market makers, connecting to Native’s liquidity opens access to more order flow. Aggregators integrating Native gain additional quote sources, enabling further price optimization.

Summary

Native’s advisors come from executive roles at two crypto trading firms, bringing rich market-making experience. The protocol includes two main products: NativeX and Aqua. NativeX functions as a cross-chain bridge and trading aggregator, facilitating easier trading. Aqua, the team’s new product, pioneers a new collaboration model between liquidity providers and market makers, addressing liquidity shortages on certain blockchains while improving capital efficiency. Simultaneously, depositors gain more lending demand, increasing yield while maximizing fund security.

3. Development

3.1 History

Table 3-1 Native Major Milestones

From Native’s development timeline, product delivery and addition of supported networks have been rapid, achieving notable market traction in a short period.

3.2 Current Status

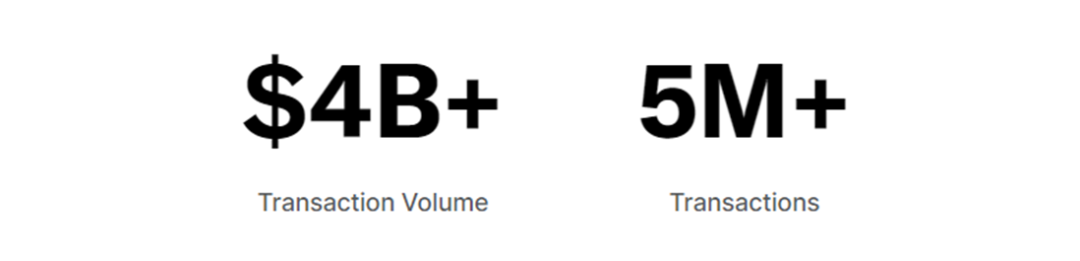

Since launching in April 2023, Native has achieved a cumulative trading volume of $2.45 billion, totaling 3 million trades, with partner private market makers managing over $100 million in assets.

Figure 3-1 Native Cumulative Data [3]

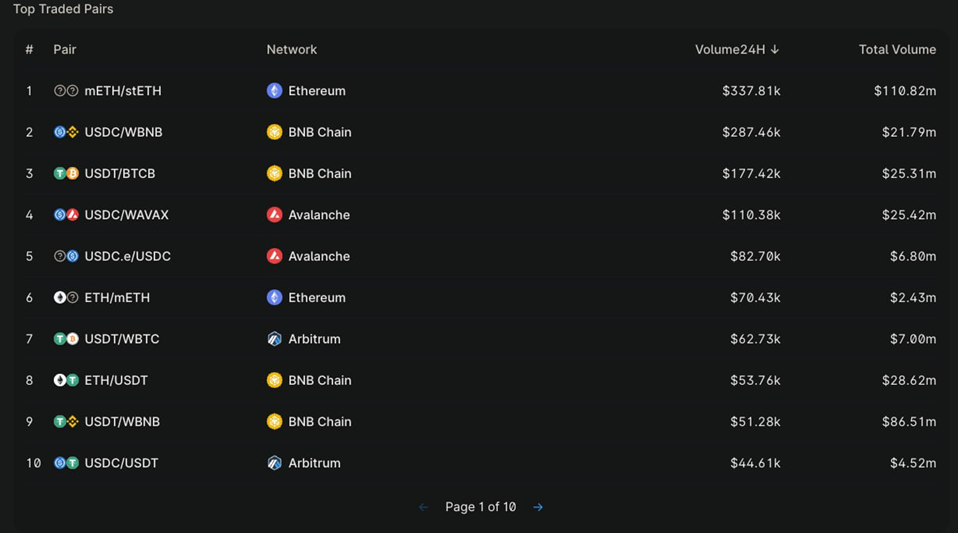

The protocol’s primary trading volume comes from Ethereum, Avalanche, and BNB Chain, mainly involving WAVAX, USDT, and ETH. Assuming users consider slippage and other factors, Native’s key competitive pairs are those listed above. Native’s partnered private market makers primarily provide liquidity for mETH, AVAX, and BTC on Ethereum and BNB Chain.

Figure 3-2 Native Top 10 Trading Pairs

3.3 Future Outlook

Native is finalizing testing for Aqua (including on-chain contract audits and off-chain structural execution). Following completion, Native will deploy Aqua on mainnet and progressively support RFQ for perpetual contracts and on-chain credit mechanisms powered by zero-knowledge proofs.

Summary

The Native team has demonstrated fast product delivery and captured a meaningful market share. The team is now launching Aqua, its market-maker-focused lending product, and plans to expand into perpetual contracts and introduce on-chain zero-knowledge proof-based credit mechanisms. As Aqua becomes the team’s flagship offering, its post-launch performance and metrics will be critical for Native’s trajectory.

4. Economic Model

Native has not launched a token and has not disclosed its economic model.

5. Competition

5.1 Industry Overview

Native currently offers two products: cross-chain trading aggregator NativeX and Aqua, a lending protocol for market makers. Cross-chain trading aggregation remains a niche segment, while institutional lending protocols often grant uncollateralized loans to KYC-approved entities. Post-loan transparency is minimal, fund usage is unrestricted, and user fund safety cannot be guaranteed.

Demand for trading aggregation remains strong—for example, on March 18, 2024, trades routed through aggregators accounted for 36.7% of total DEX volume. Despite consistent user demand, the sub-segment of cross-chain trading aggregation has struggled to gain mainstream traction. Among the top ten trading aggregators by volume, only Jumper Exchange (a LI.FI product) ranks tenth as a cross-chain aggregator. Overall, cross-chain trading aggregation remains niche, with users preferring well-known platforms like 1inch, Jupiter, and CowSwap.

Figure 5-1 Aggregator Trading Volume Ranking

Institutional lending protocols often require no full collateral, allowing approved institutions to lend uncollaterized. Fund destinations and holdings lack transparency—depositors may not even know how much was lent or to whom. This exposes lenders to high default risk and low fund security. Take RWA protocol Goldfinch: despite being considered cautious within its sector, it faced two security incidents between September and October 2023, highlighting inadequate disclosures. Thus, institutional lending protocols suffer from severe opacity and high counterparty risk, resulting in consistently low TVL.

5.2 Competitive Analysis

5.2.1 Aqua

Native’s new product Aqua exhibits strong product innovation. Combining features of DEXs and lending protocols, Aqua pioneers a new collaboration model between market makers and liquidity providers. Deposited funds remain secured within the Aqua contract. Market makers, after over-collateralizing, can utilize funds from the Aqua pool for market making. When executing a trade, settlement occurs using funds from the Aqua pool—effectively creating a long and short position within the pool (rather than withdrawing funds for off-contract operations). Market makers can then take offsetting positions on centralized exchanges to capture spread profits.

Traditional lending protocols like Compound and Aave primarily serve leveraged positions, shorting, and rate arbitrage—use cases dependent on market volatility (e.g., rising stablecoin yields during bull markets or increased ETH staking rewards). Compared to Compound, funds deposited into Aqua face stronger and more diverse lending demand, resulting in higher yields. Additionally, lending rates on traditional platforms fluctuate with market cycles, whereas demand from market makers is more stable—yielding steadier, sustainable returns for users. Throughout the process, user funds remain in the Aqua contract, market makers are over-collateralized, and positions are transparent. Compared to transferring funds directly to market makers or institutions, Aqua’s lending model is significantly safer.

For market makers, settling via Aqua allows opening more positions simultaneously, maximizing capital efficiency far beyond direct fund borrowing. Furthermore, they gain liquidity across multiple blockchains through collateral, vastly expanding market-making opportunities. Aqua represents a true DeFi innovation. By enabling private market makers to leverage user-deposited liquidity via RFQ, Aqua could surpass AMMs in per-unit liquidity effectiveness and potentially disrupt the current DEX landscape dominated by AMMs.

5.2.2 Native & NativeX

In the cross-chain trading aggregation space, NativeX’s $3.5 million daily trading volume places it among the leaders (ranked 12th among all aggregators), second only to Jumper Exchange in its category. Jumper Exchange, developed by LI.FI, raised $5.5 million in July 2022 and $17.5 million in March 2023, with its seed round led by 1kx, making it the strongest competitor in this space. Meanwhile, Nomad, a newly established fund backed by Binance, enjoys a solid reputation in DeFi—placing Native’s funding pedigree among the top tier.

The logic behind cross-chain trading aggregation is straightforward: protocols aggregate liquidity from various DEXs and cross-chain bridges, collaborate with select private market makers to enrich liquidity sources, then consolidate quotes and deliver the best execution path—offering users a seamless and efficient trading experience. Similar to NativeX, LI.FI promotes integration by enabling other protocols to embed its services. LI.FI offers pre-built UI components, allowing projects to integrate Jumper Exchange’s swap service directly into their websites, delivering one-stop cross-chain aggregation.

Since launching in April 2023, as of March 19, 2024, Native has processed 3 million trades and $2.45 billion in volume. LI.FI has aggregated 5 million trades and $4 billion in volume. Although Native launched later, its total transaction data stands at about 60% of LI.FI’s, with daily volume (~$3.5M) at approximately 53% of LI.FI’s.

Figure 5-2 LI.FI Aggregation Data

Currently, NativeX supports 10 EVM chains—fewer than LI.FI—but covers most major EVM networks and is rapidly expanding. In terms of performance, NativeX is already a top-tier player in cross-chain trading aggregation.

Figure 5-3 LI.FI Multi-chain Liquidity

Summary

Native’s product NativeX has achieved top-tier metrics in the cross-chain trading aggregation space, demonstrating strong competitiveness. However, the segment remains niche with limited overall demand. Its new product Aqua introduces multiple innovations—using a unified pool to manage funds, enabling market makers to settle trades using pool liquidity. It dramatically increases market maker capital efficiency, expands their access to liquidity across chains, and maximizes depositor fund safety.

6. Risks

1) Code Risk

Native’s code has been audited by Salus, Veridise, and Halborn. Its Immunefi bug bounty program is also即将 launching, but code risks remain.

2) Delayed Liquidations

Aqua’s liquidations are handled periodically by whitelisted liquidators. If a market maker has significant token exposure and faces extreme market movements, delayed liquidation could result in losses for liquidity providers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News