Top 5 Promising Early-Stage Projects: From zkEVM to Omnichain Stablecoins

TechFlow Selected TechFlow Selected

Top 5 Promising Early-Stage Projects: From zkEVM to Omnichain Stablecoins

5 early-stage projects to watch: Linea, Native, Conduit, Econia Labs, and YamaFinance.

Written by: Surf

Translated by: TechFlow

The crypto world is growing rapidly, but most early-stage projects remain shrouded in uncertainty, making it difficult to uncover true gems.

Crypto researcher Surf has reviewed and summarized five early-stage projects that show significant potential and could deliver substantial alpha returns.

If you're also searching for promising early projects, the following insights may offer valuable guidance.

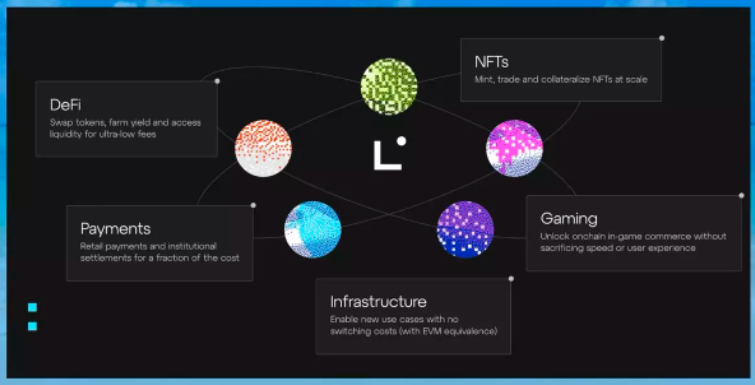

1. Linea: A zkEVM-powered L2 developed by ConsenSys

Linea is an Ethereum Layer 2 solution developed by ConsenSys aimed at enhancing Ethereum's scalability and efficiency. Leveraging zero-knowledge proof technology with EVM equivalence, Linea enables developers to easily build scalable dApps or migrate existing ones.

Linea integrates with popular Web3 tools such as MetaMask and Truffle to provide a seamless developer experience. Its testnet is now open to developers, users, and protocols, having processed over 1.5 million transactions within just a few weeks.

One of Linea’s core strengths lies in its developer-friendliness—developers do not need to be zk experts to build applications on its zkEVM platform.

By offering all developers a simple way to utilize zero-knowledge proof technology, Linea aims to scale the Ethereum ecosystem and improve application scalability.

Linea’s potential centers around zkEVM. Any smart contract or development tool from Ethereum can operate seamlessly on this EVM-equivalent network. Other leading players in this space include Polygon, Scroll, and zkSync.

Project link: https://twitter.com/LineaBuild

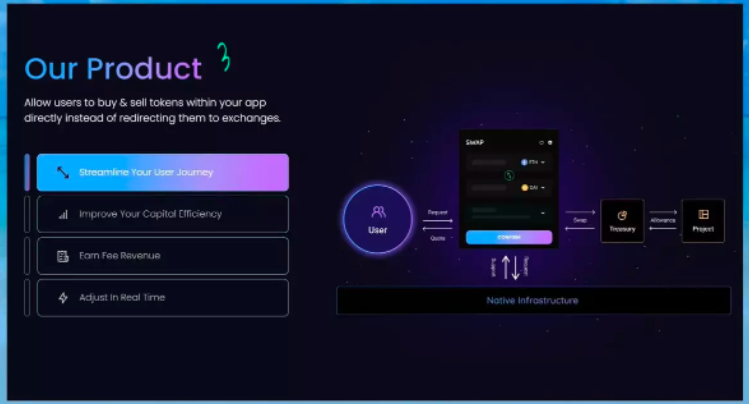

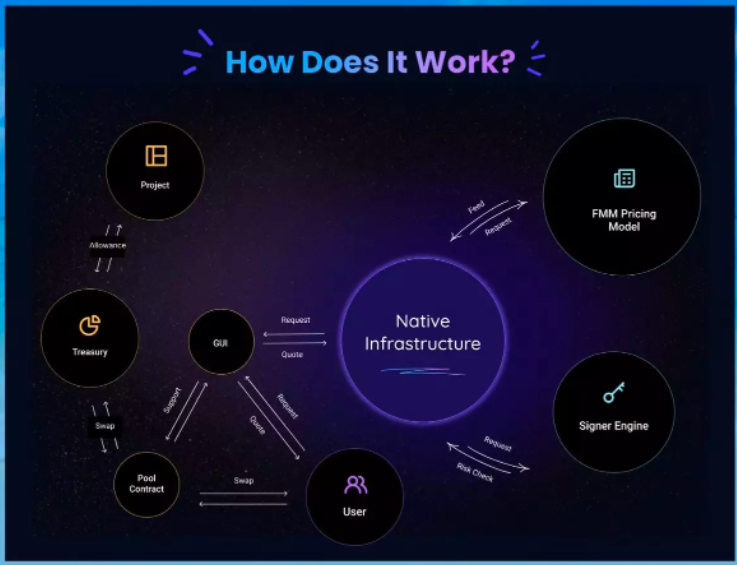

2. Native: An easy-to-use toolkit integrating DEX functionality

Native is a toolkit enabling any project to easily integrate decentralized exchange (DEX) capabilities into their interface. This allows projects to:

• Earn fees from trades;

• Improve user experience (reducing transaction friction);

• Achieve better capital efficiency;

• Utilize more flexible pricing models.

Native aims to simplify the user journey—from the complex path of "user → dApp → third-party exchange → dApp"—to a direct flow of "user → dApp".

When projects use Native’s product, users can trade directly within the project’s interface instead of being redirected to a third-party exchange.

Native employs a unique “flexible market making” strategy, combining on-chain (e.g., AMMs) and off-chain pricing sources (e.g., professional market makers, RFQ models) to generate quotes.

This approach is similar to 0x’s aggregator model.

Project link: https://twitter.com/native_fi

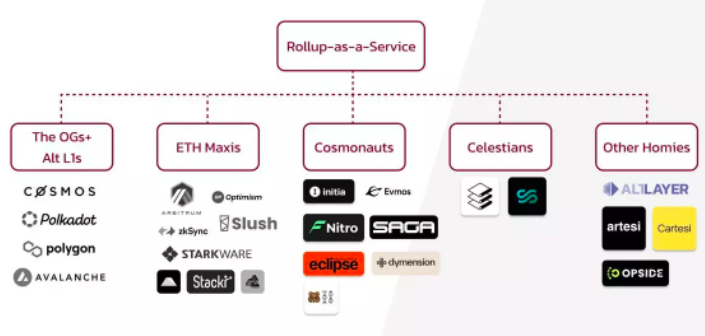

3. Conduit: Enabling projects to launch dedicated Rollups

Conduit is a Rollup-as-a-Service (RaaS) project that provides production-grade Rollup solutions based on the OP stack, allowing teams to quickly scale their dApps with Rollup capabilities.

It aims to offer accessible and cost-effective solutions for projects seeking their own dedicated Rollup on Ethereum.

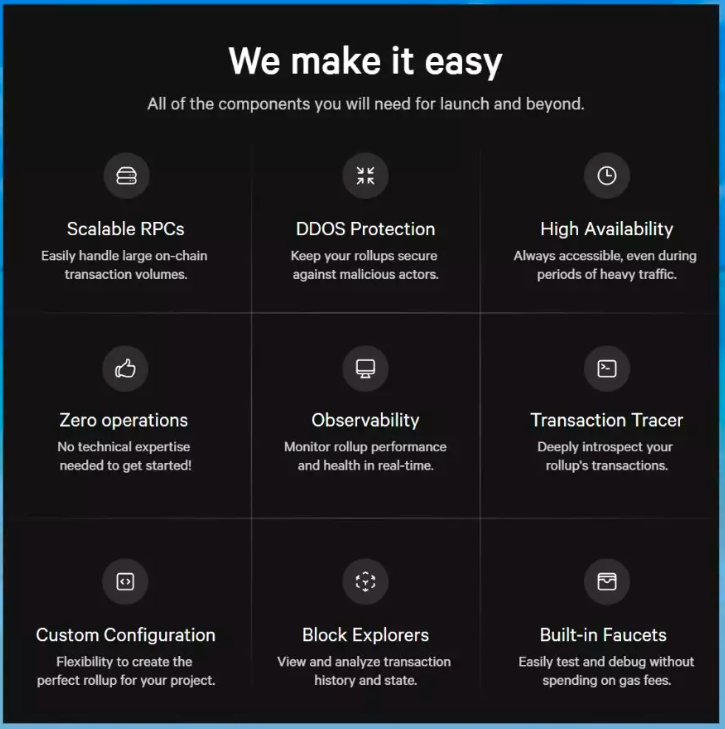

A complete Conduit Rollup solution includes essential components such as:

• Block explorer;

• Auto-scalable RPC;

• Performance metrics;

• Transaction tracker.

These components allow project teams to run infrastructure using the same technology as the OP mainnet while maintaining Ethereum-level security.

In addition to raising a $7 million seed round from Paradigm, Conduit recently announced a collaboration with the OP Foundation to support the Superchain vision, making it more widely accessible to projects across other ecosystems.

Conduit’s potential lies in its Rollup-as-a-Service model. RaaS has the potential to become the AWS of Web3—deploying a Rollup-enabled application could soon be as simple as deploying a website.

Project link: https://twitter.com/conduitxyz

4. Econia Labs

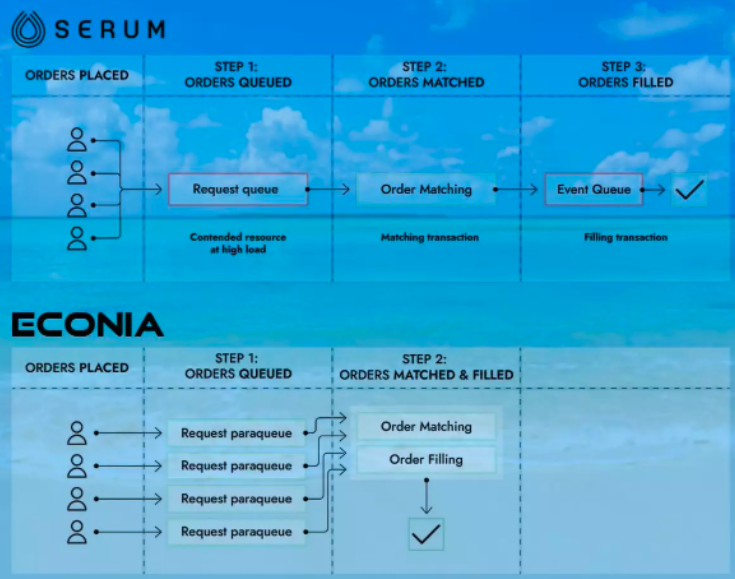

Econia is an innovative on-chain order book platform built on Aptos, aiming to become a powerful economic engine for DeFi. The project seeks to scale on-chain trading by addressing performance bottlenecks faced by DEXs like Serum.

One of Econia’s key technologies is its parallelized on-chain order book. In a parallel transaction system, different transactions can be executed concurrently without waiting for prior transactions to complete.

Econia’s advanced parallelized order book enables high-performance trade execution. As the foundation of the platform, the order book supports efficient and scalable asset trading.

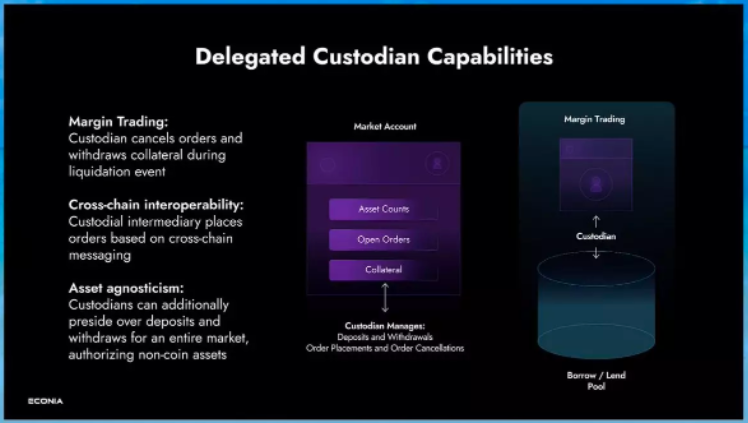

Econia also features custodial capabilities, allowing users to delegate parts of their trading activity to third parties. This opens up broader use cases for leveraged trading, cross-chain solutions, and derivatives, significantly expanding the platform’s functionality.

Econia’s potential lies in providing Aptos with a robust, efficient, and composable backend. Developers can build and deploy various trading applications and user interfaces atop its infrastructure.

Econia recently closed a $6.5 million funding round led by Dragonfly Capital, with participation from Lightspeed, Wintermute, and Aptos Labs, among others.

Project link: https://twitter.com/EconiaLabs

5. YamaFinance

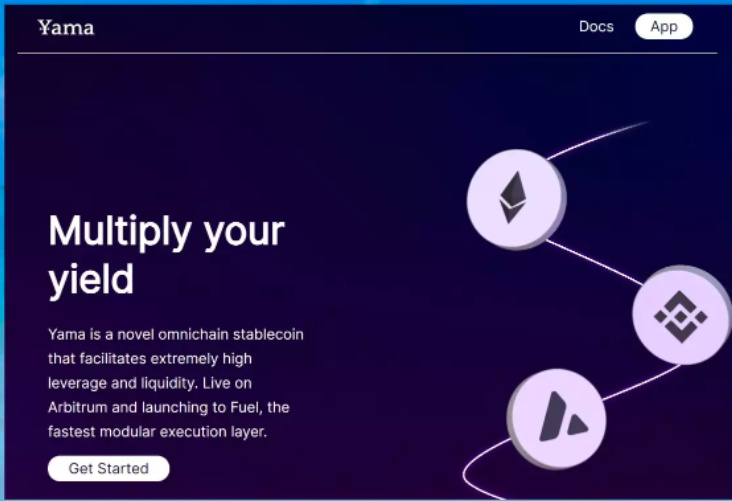

Yama Finance is a cross-chain stablecoin project focused on maximizing the efficiency and utility of CDPs (Collateralized Debt Positions). Initially deployed on Arbitrum, it plans to expand to Fuel and Eclipse in the future.

(Note: CDP, or Collateralized Debt Position, is a common design in stablecoins, typically implemented as a Vault.)

Yama’s primary innovation is its PSM (Peg Stabilization Module), which introduces several unique features to its stablecoin. The PSM smart contract allows anyone to swap Yama for USDT at a 1:1 ratio with zero slippage and no fees.

Users depositing USDC into the PSM receive a share of borrower interest, enhancing buy-side liquidity and supporting leverage. Users can borrow Yama against collateral and withdraw at any time.

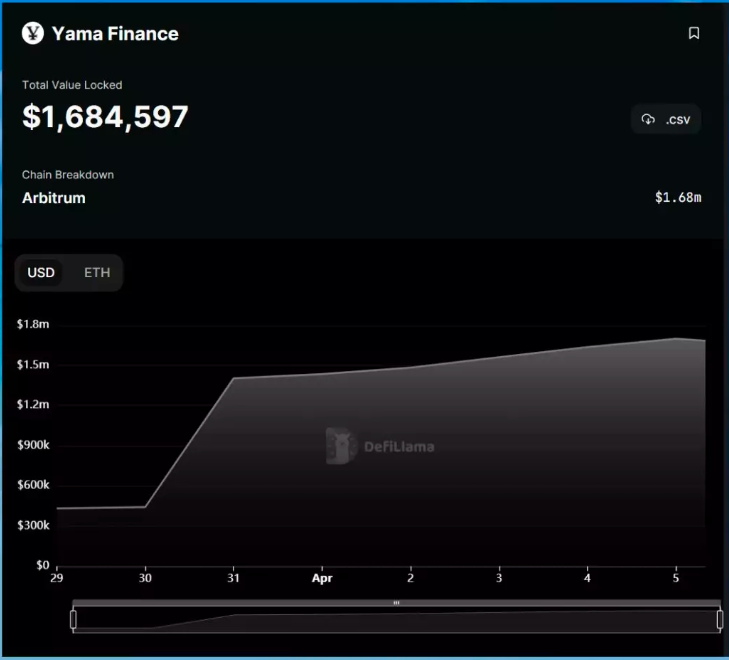

Data shows that Yama Finance, having just launched recently, has already attracted $1.6 million in TVL:

Project link: https://twitter.com/YamaFinance

Disclaimer: The author did not receive sponsorship from any of the projects listed above. Digital asset trading involves high risk. Please carefully assess your risk tolerance and take necessary measures to protect your digital assets. All projects mentioned here require your own research (DYOR).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News