Understanding SynFutures: A Derivatives Exchange Combining On-Chain Order Book and AMM

TechFlow Selected TechFlow Selected

Understanding SynFutures: A Derivatives Exchange Combining On-Chain Order Book and AMM

This article provides an in-depth analysis of its project background, incentive program, and the latest model oAMM.

The latest version of decentralized derivatives platform SynFutures has recently launched on the Blast mainnet, signaling an upcoming token airdrop and launching a series of initiatives including the O_O points incentive program, Blast's Big Bang airdrop rewards, and a $500,000 prize trading competition, making it a focal point in the market. This article provides an in-depth analysis of the project’s background, incentive programs, and its new oAMM model.

1. Project Background

SynFutures is a decentralized derivatives exchange that pioneered a permissionless contract market model, enabling anyone to list a new trading pair within 30 seconds by providing single-token liquidity. It supports both expiry-based and perpetual contracts. Since late 2021, the platform has iterated through two versions, achieving a cumulative trading volume of $2.3 billion, serving 110,000 users, and supporting over 240 trading pairs—truly returning the power of DeFi contract listing decisions to the community.

The latest version, Oyster AMM (oAMM), for the first time integrates fully on-chain order book matching with on-chain settlement and AMM mechanisms, combining the high capital efficiency of CeFi with the permissionless and decentralized nature of DeFi. The contracts have already been audited by QuantStamp.

SynFutures' founding team comprises professionals from top-tier international investment banks, internet companies, and crypto OGs. The project has attracted investments from prominent backers including Pantera, Polychain, Standard Crypto, Dragonfly, Framework, SIG, Hashkey, IOSG, Bybit, Wintermute, CMS, and Woo, raising over $38 million to date.

(SynFutures V1/V2 data dashboard)

2. Latest oAMM Mainnet Incentive Program (Triple Airdrop Opportunities + $500K USDC Trading Competition)

With the launch of its mainnet, SynFutures announced its exploration into decentralization and introduced the O_O points incentive program. The project stated that all Blast points, Blast yield, and additional developer token airdrops from Blast will be passed 100% to users, and it will soon launch a trading competition with a prize pool of up to $500,000.

A key context is that Blast, a popular Layer 2 network, has announced that 50% of its future token airdrops will go directly to projects for distribution, and teams that won its Big Bang contest during the testnet phase will receive additional airdrops. SynFutures previously emerged as champion among over 3,000 participating teams in the Big Bang competition, qualifying it for these extra token rewards.

Specifically, SynFutures’ current Phase 1 activities revolve around three perpetual contract pairs: BTC-USDB (using USDB as margin), WETH-USDB inverse (using WETH as margin), and USDT-USDB (using USDB as margin).

2.1 Day-One SynFutures O_O Points Airdrop

Blast users, dYdX/GMX users, and Pudgy Penguin NFT holders can directly claim SynFutures O_O points upon registration during the first day of SynFutures’ launch. Participation details are available at this link.

2.2 Liquidity Provider (LP) Airdrop Rewards

LPs can receive triple airdrop opportunities: native Blast token points + 50% of the Blast Big Bang Winner airdrop allocation + SynFutures O_O points.

Qualifying actions: Providing funds in designated AMM pools or placing limit orders during trading are both considered liquidity provision. Additionally, inviting friends grants a portion of their earned points. Higher rewards are given for larger amounts, longer durations, and effective liquidity closer to the fair price.

How to participate: The LP incentive program is named O_O.

Registration is required via this link.

Detailed rules can be found on the official blog.

2.3 Trader Rewards

Traders can also earn triple rewards: native Blast token points airdrop + 50% of the Blast Big Bang Winner airdrop + entry into the $500,000 prize trading competition.

Reward criteria: Notably, Blast points are based solely on trading volume, while cash prizes in the trading competition are awarded purely based on profitability—regardless of trade size. The top 50 profitable traders each week will win prizes for eight consecutive weeks, demonstrating strong commitment. The competition also features renowned DeFi trading KOLs and institutions (including keyboardmonkey, Awawat, CL, jez, jae C, CMS Trading, Kronos Research, and over ten other degen traders and firms), adding excitement and credibility.

Participation: Points rewards require no registration—simply interact on the dApp.

The Grand Prix trading competition is expected to begin in the first week of March.

Full rules are available at this link.

2.3 Rewards for Loyal Users of V1 and V2 Versions

For previous users of SynFutures’ older versions and participants in past events, the official team has indicated they will also receive corresponding rewards in the future.

2.4 Wen Token?

While launching this Blast points campaign and trading competition, the team mentioned they are actively exploring token issuance. The points program will last 3–4 months, strongly hinting at a future token launch and airdrop.

3. Deep Dive into SynFutures’ oAMM Model

SynFutures’ oAMM combines fully on-chain order book matching with AMM, bringing true decentralization and innovation to the industry. Its key features include:

3.1 Single-Token Concentrated Liquidity Model for Enhanced Capital Efficiency

SynFutures’ earlier sAMM model revolutionized on-chain derivatives by allowing anyone to create new trading pairs using just one token. The new Oyster AMM builds on this by introducing a range-limited concentrated liquidity mechanism, enabling liquidity to be concentrated around the current price on the constant product curve. This allows users to provide deeper liquidity with the same asset value and earn higher returns.

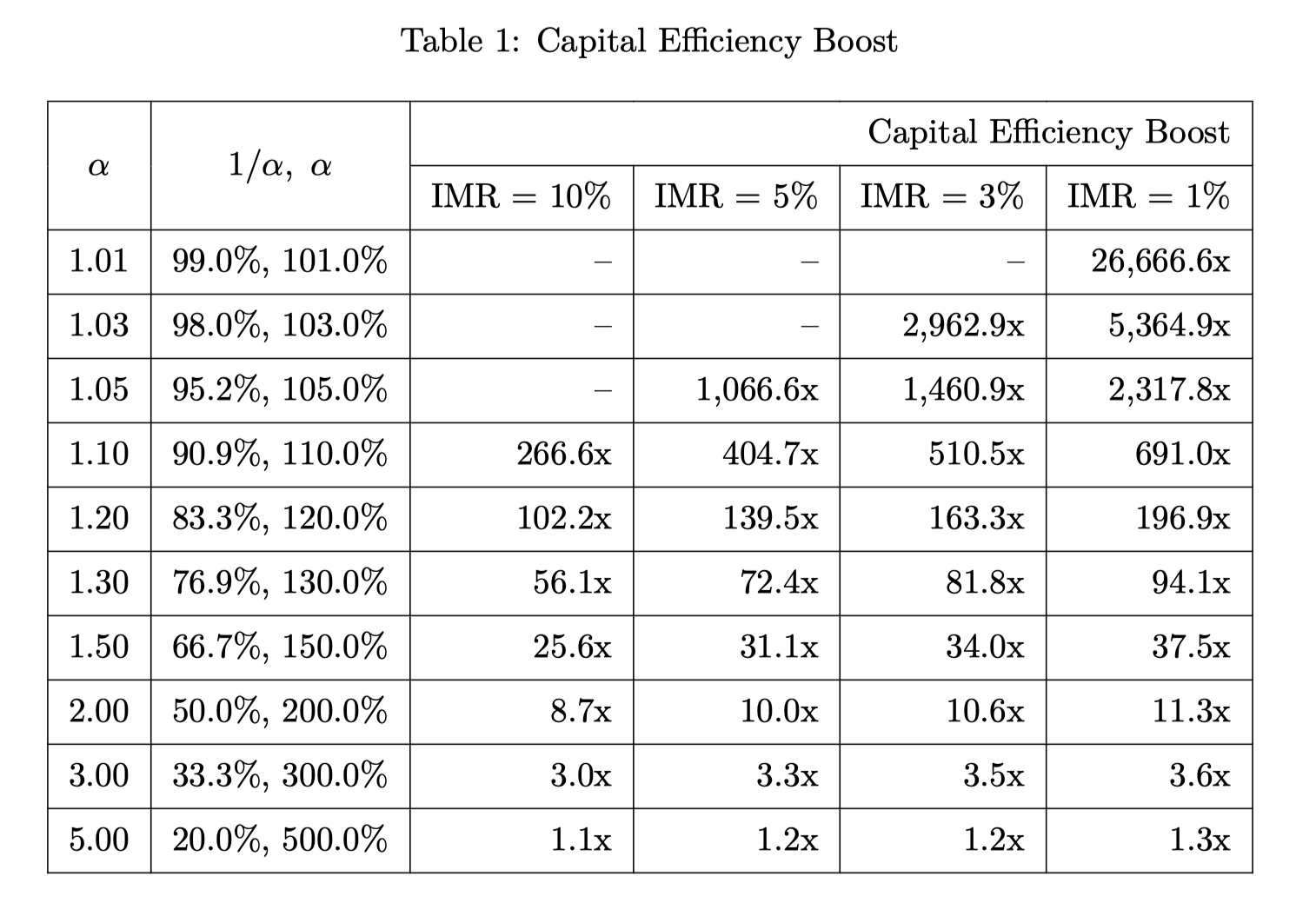

Unlike conventional spot market liquidity models, it incorporates a derivatives-specific margin management and liquidation framework, simplifying the trading ecosystem with single-token usage. Unlike other concentrated liquidity models, SynFutures requires LPs only to define the desired range width via a parameter, after which the Oyster AMM automatically sets the upper and lower price bounds. For example, when adding liquidity to the ETH-USDC pool at a base price of $1,000 with a 300% range, liquidity is provided between $333.33 (1,000 / 300%) and $3,000 (1,000 × 300%), effectively increasing capital efficiency by over 3x (depending on IMR).

Under current parameter settings, the maximum capital efficiency boost reaches 26,666.6x—meaning $1,000 in liquidity can be equivalent to $26,666,666 across the full range.

To protect single-token liquidity providers from exposure to the other asset in the pair, the model creates long and short positions so that the net exposure to the underlying asset is zero, with leverage determined by the selected range. While narrowing the range increases fee earnings for the same amount of capital, it also introduces directional position risk if the price moves outside the range. LPs act as risk-taking market makers, aiming to earn sufficient trading fees and incentives to offset impermanent loss and directional risks.

3.2 On-Chain Matching and Settlement: Industry-First Fully Decentralized Derivatives Order Book

Although AMMs democratize market access, they still require significantly more liquidity than order books to achieve comparable slippage. To address this, SynFutures V3 introduces an order book model.

SynFutures pioneers a “on-chain matching, on-chain settlement” decentralized order book model for derivatives markets. Previously, most platforms claiming to offer DeFi derivatives with order books performed matching centrally, settling only on-chain. Even dYdX V4, which runs on its own chain, performs off-chain order book matching.

By conducting full on-chain matching, SynFutures achieves unmatched transparency, fairness, and security. Off-chain matching could allow backdoors like those seen in FTX, where execution is controlled by centralized teams who may prioritize certain orders—a black-box equivalent of MEV attacks. Moreover, cross-system coordination between on-chain and off-chain components increases failure risks, especially during volatile markets, potentially leading to the criticized scenario of centralized servers unilaterally halting operations or “pulling the plug.”

3.3 Atomic Transactions Combining Order Book and AMM for Unified Liquidity

Unlike traditional centralized limit order books that follow a first-in-first-out principle, Oyster AMM introduces a matching process optimized for coexistence with AMM liquidity. The logic is as follows:

-

Since AMM prices form a curve rather than discrete points, any limit order at a given price will execute before tapping into AMM liquidity

-

Trading volume is proportionally distributed among multiple limit orders at the same price

-

If there are no limit orders or insufficient depth at a price level, traders begin utilizing the nearest AMM liquidity

This synergistic approach significantly reduces system performance requirements and gas costs, lowers overall slippage, and ensures predictable atomic transactions. Furthermore, if a trader’s order stays within existing limit order depth, capital efficiency can match that of centralized exchanges, further closing the gap between on-chain and centralized systems.

3.4 Stable Pricing Mechanism and Dynamic Fees for Enhanced Risk Protection

Finally, the SynFutures team has incorporated advanced financial risk management frameworks from leading international investment banks and fintech firms to enhance user protection and price stability. These include a dynamic penalty fee system to deter price manipulation and balance risk-return profiles for liquidity providers, delayed withdrawal mechanisms during abnormal activity, and more. The smart contracts have also passed an audit by Quantstamp.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News