Osmosis Innovation Path: Achieving Concentrated Liquidity and Launching Super Pools

TechFlow Selected TechFlow Selected

Osmosis Innovation Path: Achieving Concentrated Liquidity and Launching Super Pools

Crypto researcher Emperor Osmo will detail all aspects of this upgrade in this article, including the rollout plan, concentrated liquidity, Super Pool, incentive model, and more.

Author: Emperor Osmo

Compiled by: TechFlow

Osmosis DEX has迎来 a long-anticipated upgrade, as Osmosis prepares to migrate to Supercharged Pools mode and enter the era of concentrated liquidity. This is one of the most significant changes for Osmosis since 2021, bringing users far greater flexibility in providing liquidity. In this article, crypto researcher Emperor Osmo details everything about this upgrade, including rollout plans, concentrated liquidity, super pools, incentive models, and more.

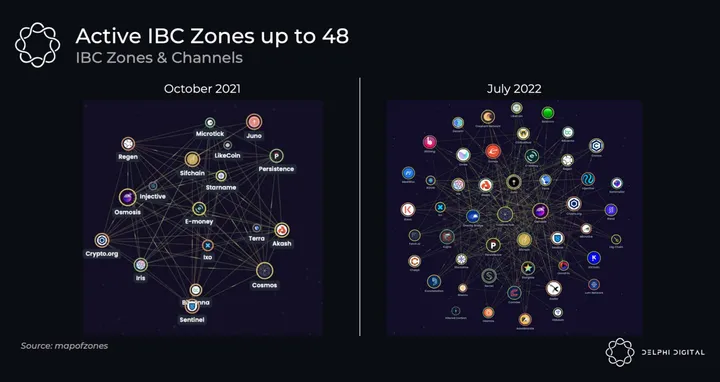

When Osmosis launched, IBC was still in its infancy, and liquidity across ecosystems was extremely limited during that period.

To ignite Cosmos and bring liquidity into the ecosystem, Osmosis launched its DEX using Balancer-style pools, leveraging incentives to attract substantial liquidity to Cosmos.

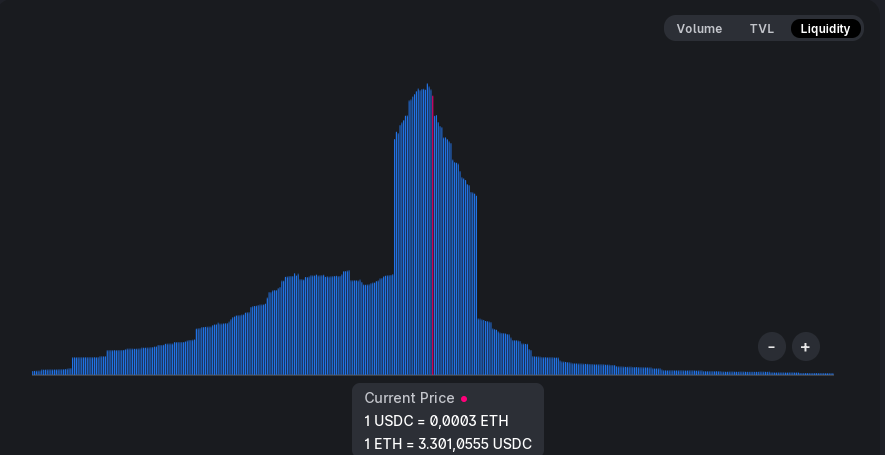

However, traditional pools are capital inefficient—much of the liquidity remains unused because they force traders to deposit liquidity positions against $OSMO ranging from 0 to infinity. This means much of the liquidity is scattered across the entire price curve and thus underutilized.

Concentrated liquidity was created to revolutionize the concept of "market making," allowing liquidity providers to choose specific price ranges for depositing liquidity. This enables users to be more strategic when deploying LP positions. At the same time, Osmosis can handle the same trading volume with significantly less liquidity, increasing capital efficiency by an estimated 100–300 times.

To successfully migrate Osmosis to this new model, two major changes will occur:

-

Liquidity incentives will be updated;

-

Pools will be migrated to the new model.

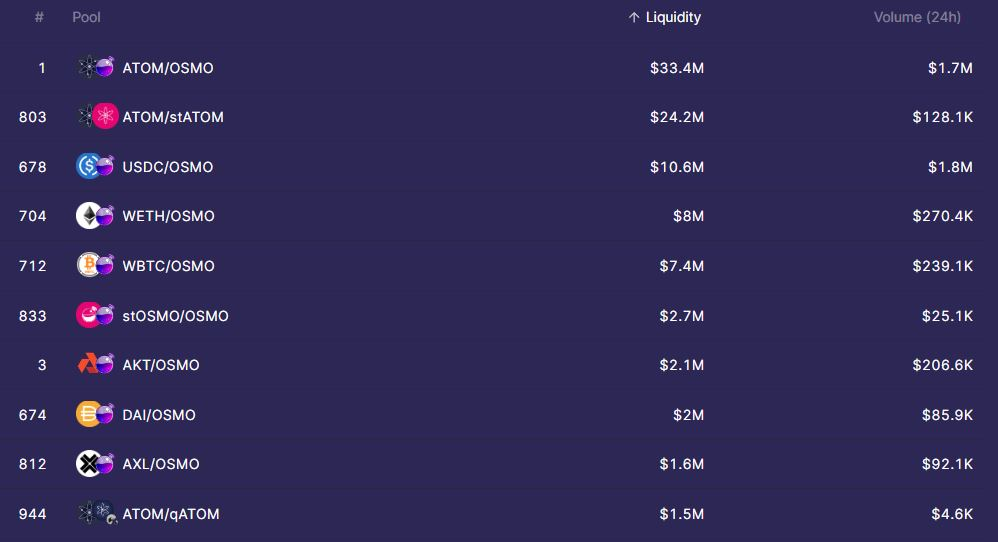

Osmosis will begin migrating to concentrated liquidity through the existing $OSMO/$DAI pool, which currently holds $2 million in TVL. The $OSMO/$DAI LP was selected due to its high trading volume on Osmosis.

In short:

-

No lock-up period for active participants;

-

Full-range superfluid staking;

-

Same incentives as traditional pools;

-

Users gain access to full-range concentrated liquidity.

Supercharged pools will bring significant improvements in capital efficiency to Osmosis, meaning the current incentive model must be upgraded to align with the new structure. The newly proposed incentive model aims to shift the focus toward:

-

Pool usage and liquidity;

-

Rewards can be claimed at any time instead of being distributed over fixed periods;

-

No mandatory bonding when entering a pool;

-

Users who wish to earn premium rewards must voluntarily lock their assets.

Since Supercharged pools will launch alongside traditional pools, they will initially share the same incentives. To encourage migration to the new model, a proposal suggests applying an initial 5% discount on liquidity rewards for traditional pools.

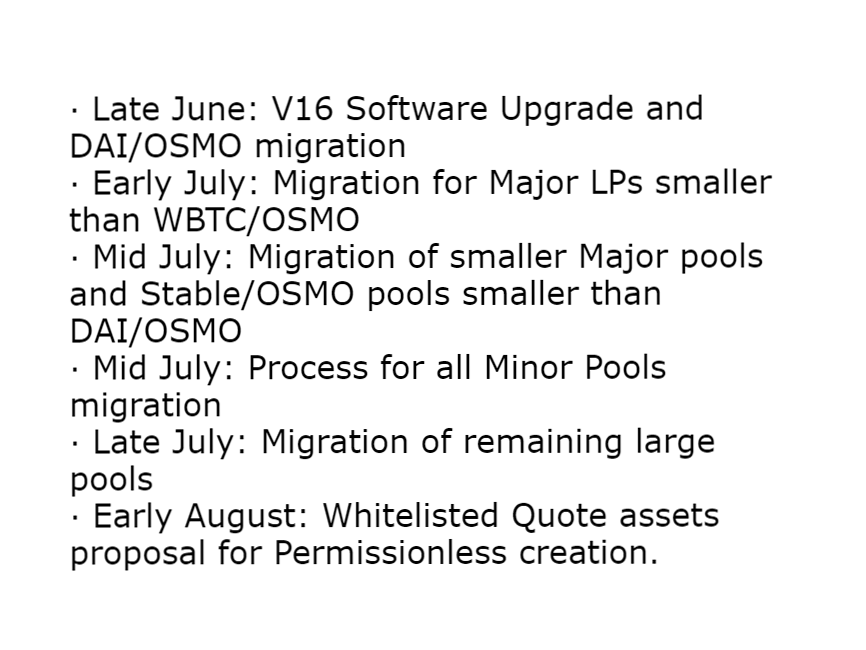

Osmosis will initially begin migrating to concentrated liquidity via the $OSMO/$DAI pool, which currently holds $2 million in TVL. The full migration to the new model is expected to complete within 30–60 days.

At that point, users will benefit from fully flexible liquidity—all integrated into an easy-to-use and intuitive UX interface.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News