Delphi Digital: The Rise of the Cosmos Ecosystem

TechFlow Selected TechFlow Selected

Delphi Digital: The Rise of the Cosmos Ecosystem

As more and more applications continue to grow, Cosmos' appeal and user engagement are gradually increasing.

Authors: Genevieve Yeoh and Joo Kian

Translation: Alex, TechFlow

Surging Interest in Cosmos

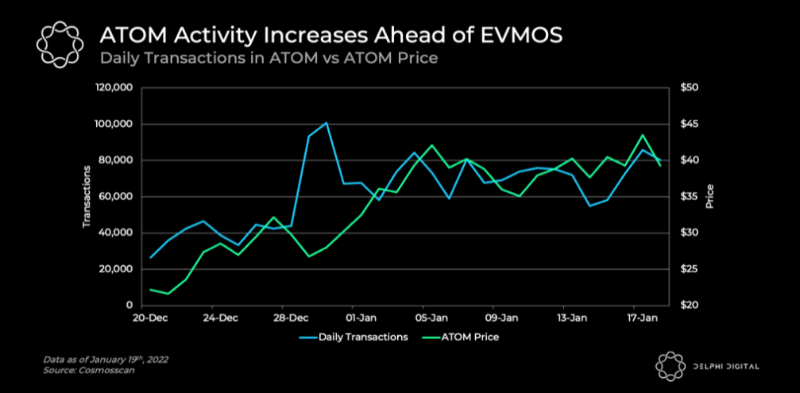

As more applications join the ecosystem, we continue to observe growing interest and user engagement within Cosmos. Today, daily transaction volume associated with ATOM has increased from 26k to 80k.

Cosmos has recently become a hot topic in the crypto industry, with EVMOS launching this month drawing particular attention.

EVMOS (formerly Ethermint) will enable EVM-compatible applications to integrate into the Cosmos ecosystem. EVMOS brings greater interoperability to Cosmos, serving as a gateway for Ethereum assets to enter the Cosmos ecosystem. Bridge solutions such as Connext and Nomad will also provide support.

Additionally, EVMOS is conducting a rektdrop, distributing its tokens to ATOM and Osmosis stakers, gas consumers on Ethereum, and users who suffered losses due to exploits or MEV. Visit the link for more details!

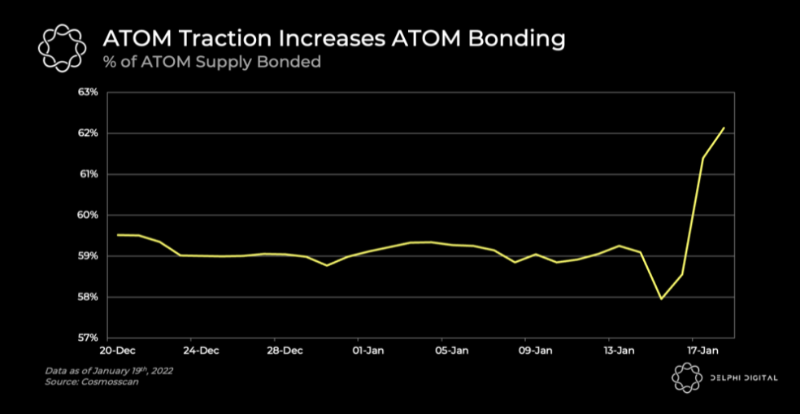

Growing Interest in ATOM Staking

ATOM staking works similarly to LUNA staking, where users delegate their tokens to validators. This allows those delegating to non-CEX validators to potentially receive airdrops from projects in the Cosmos ecosystem. Notable past airdrops include $OSMO and $XPRT.

ATOM staking currently yields an annual return of approximately 13%, which is relatively high compared to other proof-of-stake options.

The increase in ATOM bonding may not be highly significant or indicative of whether it's driven by just one or a few entities delegating large amounts of ATOM; we observed a one-day spike in delegated ATOM, which appears to have been a major driver. However, from that peak onward, most validators have seen more inflows than outflows of staked ATOM.

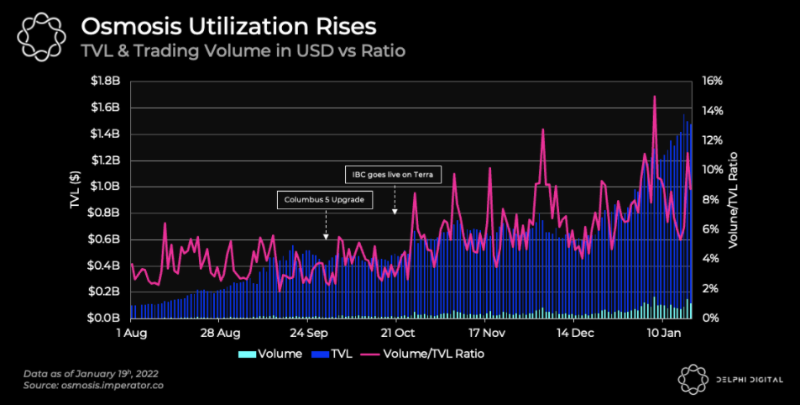

Osmosis Trading Volume Surges

In our September research report on the Cosmos ecosystem last year, we noted that despite rising TVL, utilization rates remained flat. Since then, utilization has grown alongside TVL, driven by higher daily trading volumes, more users (recently around 23k DAU), and a broader range of tradable assets.

The launch of IBC on Terra (as part of Terra’s Columbus 5 upgrade) was likely a key catalyst behind these improved metrics, enabling capital flows from the Terra ecosystem into Osmosis. Crucially, it also supports the UST stablecoin, which remains the only USD-pegged stablecoin on Osmosis today. As a result of this integration, LUNA and UST rank as the third and fourth largest assets on Osmosis by TVL and trading volume, respectively.

Stablecoins play an essential role on DEXs—for example, most trades on Uni v3 occur between stablecoin pairs. On Osmosis, UST trading volume has averaged 30.7% of total volume since the beginning of this year.

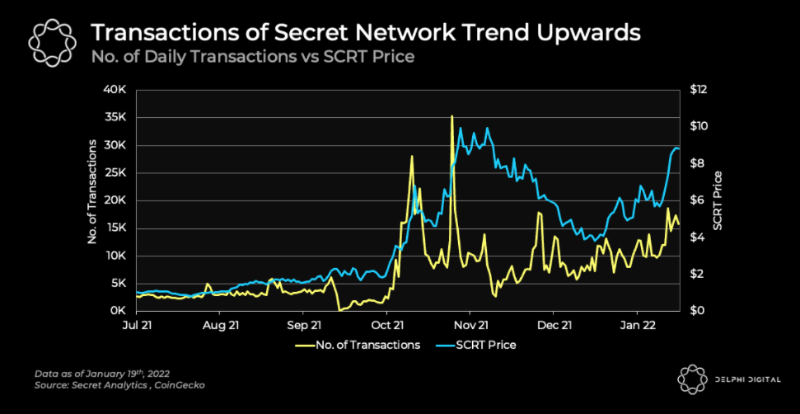

Rising Activity on Secret Network

For starters, Secret Network is a Cosmos SDK-built Layer 1 blockchain featuring privacy-preserving smart contracts, allowing users to maintain privacy over on-chain transactions.

Transaction activity on Secret Network has shown an upward trend since mid-last year, with two notable peaks in October linked to the launch of new protocols.

Last week, the Secret team announced their "Shockwave" initiative to further accelerate development of the Secret Network ecosystem. Key measures include improving developer tools, expanding grants, and securing external investments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News