Cosmos Ecosystem Potential Protocols Overview (Part 1): NFTs, Liquidity Competition, and Modularity

TechFlow Selected TechFlow Selected

Cosmos Ecosystem Potential Protocols Overview (Part 1): NFTs, Liquidity Competition, and Modularity

7 Promising Protocols in the Cosmos Ecosystem

By Morty

With the release of the Cosmos 2.0 whitepaper, more market attention has turned to the future utility and development of Cosmos’ native token ATOM. By introducing Interchain Security (ICS), liquid staking, Interchain Scheduler, and Interchain Allocator, ATOM is poised for greater growth potential alongside the expansion of the broader Cosmos ecosystem.

Therefore, how the Cosmos ecosystem will evolve has become a key focus for the market. In this article, we’ll share 15 promising protocols within the Cosmos ecosystem from the perspective of core competitiveness.

This is part one.

Osmosis

Osmosis is a liquidity exchange—i.e., a DEX—within the Cosmos ecosystem that supports cross-chain communication via the IBC protocol, enabling investors to trade and provide LP liquidity.

When providing liquidity using Osmosis’ native token OSMO, investors can stake their LP tokens (GAMM) to earn OSMO rewards. This enhances yield while simultaneously securing the Osmosis protocol.

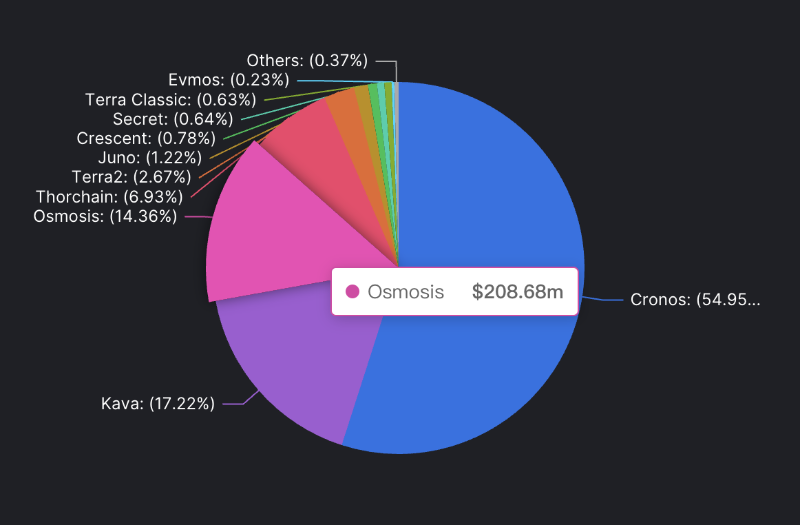

Additionally, investors can utilize Osmosis’ native token OSMO. According to DeFiLlama data, Osmosis ranks third in TVL (Total Value Locked).

Osmosis’ core competitive advantage lies in the strong liquidity moat created by its first-mover advantage. After the release of the ATOM 2.0 whitepaper, the Osmosis team ambitiously proposed a new model aiming to receive security from ATOM while simultaneously providing security back to the Cosmos Hub through Osmosis.

Celestia

Celestia is a modular blockchain built using the Cosmos SDK, focused exclusively on providing data availability (DA). It lacks an execution layer and serves Rollup layers by handling only consensus and security—this is why Celestia is referred to as a modular blockchain.

Celestia’s core competitive advantage lies in the lightweight and cost-effective security enabled by modularity—the very vision Cosmos itself aims to achieve. Prior to Cosmos introducing Interchain Security in its ATOM 2.0 whitepaper, “cost-effective security” was one of Celestia’s key advantages over Cosmos.

Today, Celestia announced a $55 million funding round at a $1 billion valuation. According to Celestia’s co-founders, the mainnet is set to launch in 2023.

GNO Land

GNO Land is a blockchain founded by Cosmos creator Jae Kwon, designed to fully leverage multi-core processors to create a network capable of hosting multi-threaded smart contracts. The benefit of this design is that it allows the network to process thousands of contracts in parallel by optimizing the consensus process among validators.

GNO Land’s core competitive advantage lies in its compelling vision—a blockchain capable of multi-threaded smart contract execution—and the custom programming language "gnoland" introduced by Jae Kwon, ultimately achieving parallelism, security, and speed in blockchain operations.

Stargaze

Stargaze is an NFT-dedicated chain built using the Cosmos SDK, with two primary functions:

-

NFT marketplace

-

Creator economy platform

Stargaze’s core competitive advantage is filling the gap in the Cosmos ecosystem for NFT infrastructure. As the Cosmos ecosystem grows and more NFT and gaming projects emerge, Stargaze’s strengths are expected to become increasingly evident.

Thorchain

Thorchain is a decentralized cross-chain exchange built using the Cosmos SDK. Its distinguishing feature is that when providing liquidity, assets must be paired with RUNE.

Currently, Thorchain supports asset swaps across eight blockchains: Bitcoin, Ethereum, BNB Chain, Avalanche, Cosmos, Dogecoin, Litecoin, and BCH.

Thorchain’s core competitive advantage lies in its cross-chain trading services and the financial applications built on top of it. Additionally, Thorchain allows more developers to deploy their own protocols on its network to leverage its multi-chain liquidity.

Kujira

Kujira is a new Layer 1 launched in August this year, introducing $USK, a native stablecoin for the Cosmos ecosystem. $USK is over-collateralized and minted using ATOM. Built on its Layer 1 and $USK, Kujira has launched applications including Blue (cross-chain platform), FIN (multi-chain order book trading platform), and Orca (liquid staking platform).

Kujira’s core competitive advantage is the cross-chain DeFi ecosystem built around its over-collateralized stablecoin $USK. Notably, the team has a clear roadmap for Kujira’s future development and continues to actively drive protocol innovation.

Berachain

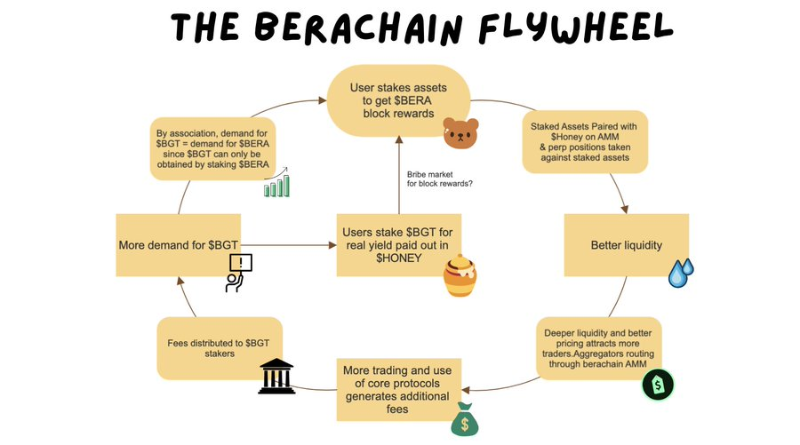

Berachain is a Layer 1 built on the Cosmos SDK that operates via three distinct tokens.

The three tokens are BERA, BGT, and HONEY:

-

BERA serves as the protocol’s gas token,

-

BGT functions as the governance token,

-

HONEY is a stablecoin used for protocol transactions and yield settlements.

Here’s how the system works: Users stake assets such as BERA, ETH, BTC, or stablecoins with validators—providing liquidity to the protocol. All liquidity pools require pairing with HONEY—users earn BGT rewards in return. BGT is non-transferable and cannot be traded—holders of BGT receive protocol revenues, paid out in HONEY.

Berachain’s core competitive advantage lies in its innovative three-token economic model and the Bear-themed meme culture derived from the name "Bera".

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News