Down 92%, Celestia's New Proposal Aims to Revolutionize "POS"

TechFlow Selected TechFlow Selected

Down 92%, Celestia's New Proposal Aims to Revolutionize "POS"

Is it for the long-term value of TIA, or a system safeguard after the team cashed out at the peak?

By shushu, Ryo, BlockBeats

The once-overlooked "pickaxe play" TIA has once again plunged into a community governance crisis. Amid prolonged price declines and fading narratives, Celestia's network revenue has remained stagnant while the viability of the data availability (DA) sector faces mounting scrutiny. Against this backdrop, co-founder John Adler has unveiled a radical governance proposal.

End Staking: Celestia’s Rebellion Against PoS

John Adler recently introduced a disruptive governance proposal advocating for the complete abandonment of the current Proof-of-Stake (PoS) mechanism in favor of a new "Proof-of-Governance" (PoG) model. The suggestion immediately ignited debate across the crypto community, challenging core assumptions about blockchain governance structures.

If adopted, Celestia would undergo sweeping structural changes: first, TIA token issuance would be reduced by approximately 20x, slashing circulating inflation with a 95% cut in emissions. Second, delegated staking and liquid staking derivatives (LSDs) would be fully eliminated, and on-chain governance mechanisms would be terminated.

All newly issued TIA tokens would instead be allocated off-chain as incentives for validators running nodes. Validators would no longer be elected via token-weighted voting but determined through off-chain governance processes. Additionally, Celestia would implement a fee-burning mechanism to benefit token holders, using roughly $100–300 daily in protocol revenue to directly support TIA’s value.

Adler even proposes eliminating the concept of "staking" altogether. He argues that without emission rewards or staking-based validator elections, staking becomes redundant—and so do liquid staking tokens (LSTs). In this framework, TIA itself becomes the direct vehicle for value accrual.

At its core, Adler’s proposal aims to alleviate persistent downward pressure on TIA’s price by establishing a tighter, scarcer tokenomics model—laying foundational logic for long-term network value.

Yet, the plan also challenges several assumptions taken as gospel within Ethereum-centric consensus design: whether blockchain economic security truly depends on slashing penalties; whether PoS is effectively a permissioned variant of Proof-of-Authority (PoA); and whether blockchain systems can sustainably operate under a "non-governed profit model." If implemented, this shift could not only reshape Celestia’s economics but also pose a fundamental challenge to Ethereum-dominated staking governance paradigms.

Source: Blockworks Research.

However, just as this ambitious effort to “rebuild tokenomic foundations” remains unimplemented, the community has unearthed evidence of massive team sell-offs—sparking divergent interpretations of the proposal’s true intent. While the project claims PoG could curb inflation, fix broken tokenomics, and restore market confidence, on-chain data reveals key team members rapidly cashed out large holdings immediately after vesting unlocks, collectively selling over $100 million worth of TIA, raising serious red flags.

Is this deflationary overhaul genuinely aimed at securing TIA’s long-term value—or merely institutional cover for a post-exit dump? With TIA down 92% from its peak and user trust eroding, Celestia’s modular vision now faces an unprecedented crisis of credibility.

Sell First, Explain Later?

Community member @0xCircusLover accused Celestia’s core team of severe opacity across multiple fronts—token unlocks, capital operations, and marketing campaigns. Some observers described the revelations as exposing Celestia’s “crime pattern,” triggering intense skepticism about internal governance and ethical conduct.

According to the allegations, Celestia executives completed TIA token unlocks as early as October 2024, followed closely by other team members. Over subsequent months, multiple insiders were reportedly seen conducting large off-ramp transactions via OTC deals or resource swaps. For example, co-founder Mustafa allegedly cashed out more than $25 million via OTC channels and relocated to Dubai. Another figure, Andy, was accused of being paid to promote TIA, while Yaz was said to have been dismissed due to sexual harassment allegations and subsequently exited the crypto space. The accuser claims to possess victim testimonies and transaction records, promising full disclosure soon.

It was further alleged that Celestia paid a seven-figure sum to prominent entity Abstract to sever ties with rival Eigen, and made payments to influencers like Jon Charb and Bankless to maintain positive media coverage. These financial maneuvers were labeled textbook examples of “paid promotion.”

Another flashpoint centers on Bankless host David, whose repeated endorsements of TIA drew suspicion given his lack of hands-on experience with Celestia’s DA services or protocol development. Worse, he gave contradictory statements about whether he held TIA, undermining perceived impartiality and fueling widespread doubts about his integrity.

Though the team has yet to officially respond, the allegations have already triggered a credibility crisis—especially amid ongoing price pressure and visible employee dumping. Once celebrated for its “modular data availability” narrative, Celestia now finds itself mired in cascading accusations around leadership governance, media manipulation, and capital flows—an existential public relations disaster for a once high-flying project.

“There’s evidence everywhere in crypto, but nobody wants to talk because they’re ‘too big.’”

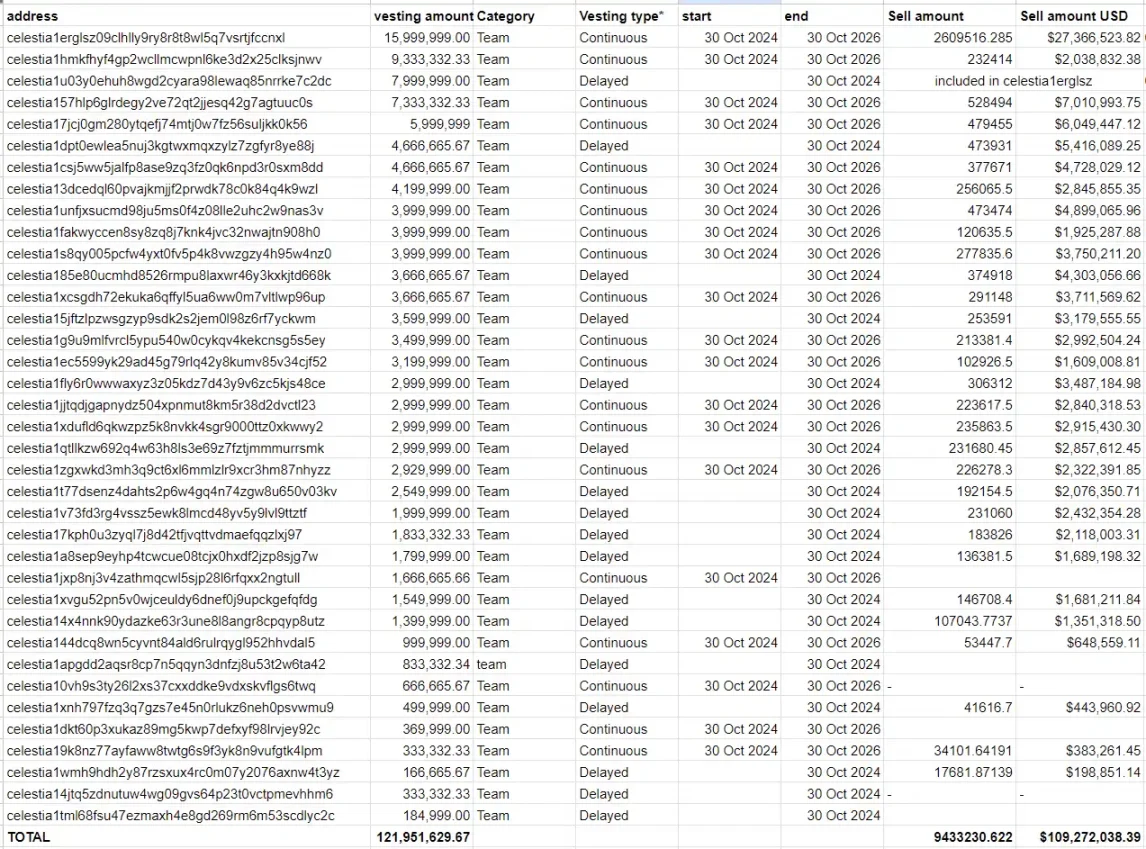

Prior to this, KOL Mosi published a breakdown of internal team token distribution and sales, showing team members had sold around 9.43 million TIA tokens—valued at approximately $109 million at prevailing prices. These tokens belonged to the “Team” allocation, distributed among early contributors and core personnel.

The largest selling address, celestia1erglsz..., offloaded 2,609,516.29 TIA for $27,368,523.82. Multiple addresses recorded sales exceeding $1 million each, indicating aggressive team exits shortly after unlock eligibility.

Beneath that tweet, users mocked a quote from Celestia COO Nick White: “I’ve never sold a single TIA”—a stark contrast to the $100 million sell-off depicted above.

Last October, just before a major unlock, Celestia announced a “$100 million funding round,” briefly boosting community optimism about its financial strength. However, investor Sisyphus later revealed the deal was actually an OTC transaction finalized months earlier, with tokens scheduled to unlock in October. This practice was criticized by some as classic information manipulation: “Dump OTC first, repackage as good news, then pump ahead of unlocks to lure retail buyers.”

Despite an external valuation of $3.5 billion, Celestia’s actual revenue falls far short of justifying such a premium. Public data shows average daily protocol income below $100, with annualized potential hovering around $5 million. Industry experts widely agree that TIA’s pricing reflects speculative premium on future narratives—not real usage metrics or sustainable business models. As such, when sentiment sours, the valuation bubble becomes highly vulnerable to collapse.

In response to mounting accusations and reputational damage, Celestia’s founders stated that despite growing FUD, all founding members, early employees, and core engineers remain actively involved. They added that Celestia currently holds over $100 million in reserves—enough cash flow to sustain operations for more than six years.

“To survive in this industry, every project must weather storms. Nearly every token will experience a 95% drawdown during its lifecycle—that’s normal, not exceptional,” wrote Mustafa on X. Today, TIA is already down 92% from its all-time high.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News