Technical Synergy and Market Advancement: A Strategic Analysis of Aevo and Celestia's Collaboration

TechFlow Selected TechFlow Selected

Technical Synergy and Market Advancement: A Strategic Analysis of Aevo and Celestia's Collaboration

Aevo's decision to choose Celestia as its infrastructure marks a significant turning point in the DeFi space.

By DerivaResearch

On January 24, 2024, Aevo, a decentralized Layer 2 derivatives trading protocol, announced on X (formerly Twitter) that it had migrated its L2 solution to the Celestia platform, marking a new exploration in the decentralized finance (DeFi) space. One of the key outcomes of this collaboration is a significant reduction in data availability costs, bringing substantial economic benefits to Aevo and successfully transforming these gains into user value. This strategic shift not only enhances the profitability of Aevo’s exchange and sequencer but also lays a solid foundation for further expanding its DeFi protocol and application ecosystem.

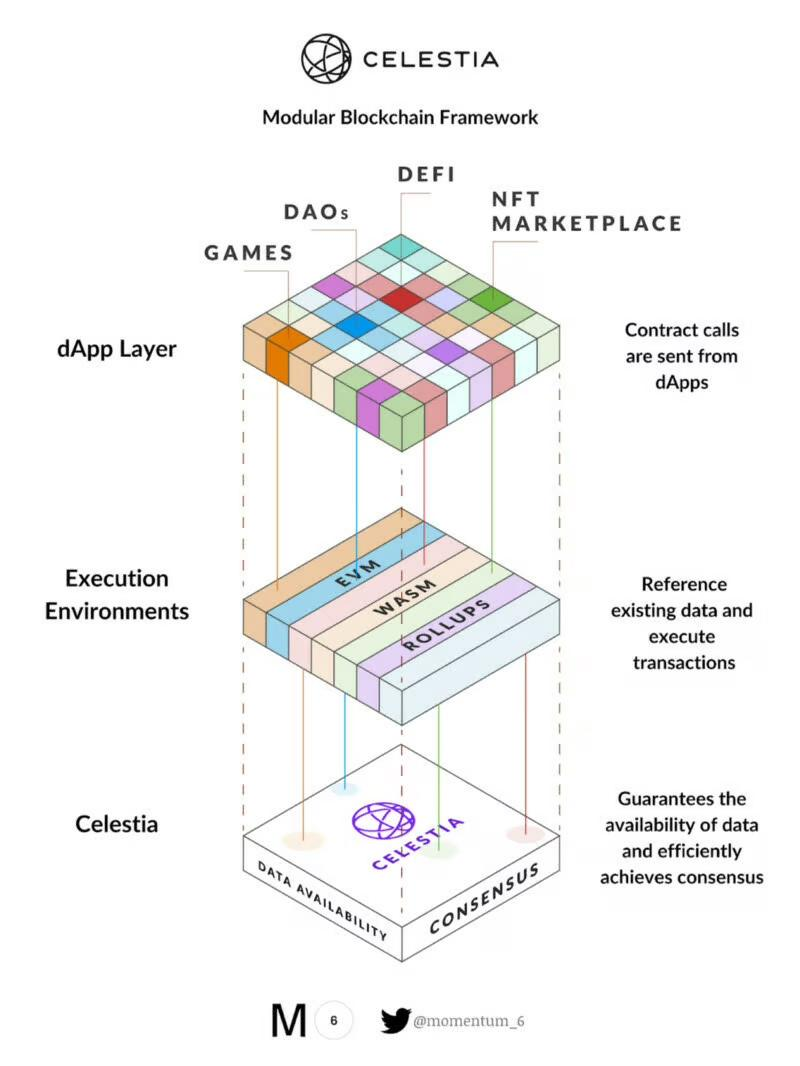

1. Celestia's Modular Blockchain Architecture

As a leader in modular data availability, Celestia offers a unique and innovative blockchain solution. Its modular architecture enables more flexible data processing and storage methods, significantly improving the performance and scalability of blockchain applications. Celestia’s core advantage lies in its high-throughput, low-cost data availability layer, which not only improves data processing efficiency but also delivers greater security and reliability. These features make Celestia an ideal infrastructure choice for Aevo’s L2 solution.

2. Background and Products of Aevo

Since its inception, Aevo has been a major player in the DeFi sector, focusing on providing decentralized derivatives trading services. By innovatively combining off-chain order matching with on-chain settlement, Aevo delivers an efficient and secure trading experience for users. As one of the first platforms to adopt the OP Stack L2 technology, Aevo aims to build a high-performance, user-friendly decentralized trading platform. Its products and services continue to expand in response to rapidly evolving market demands.

3. What Does the Celestia-Aevo Collaboration Bring?

Aevo announced the successful migration of its L2 solution to run on Celestia as infrastructure—a significant milestone. This partnership marks a crucial step forward for Aevo toward becoming part of a broader, open DeFi protocol and application ecosystem. By reducing data availability (DA) costs by 100x, Aevo L2 can significantly boost the profitability of its exchange and sequencer, scale user acquisition, accelerate growth, and pass cost savings back to users. This transformation is critical for Aevo, as previously all Rollup data was posted directly to the Ethereum mainnet, costing 50–100 ETH per month. Leveraging Celestia’s high-throughput data availability layer, Aevo can improve its chain’s own scalability, increase block size, and reduce block time—enhancing the overall user experience.

4. Synergy Between Aevo and Celestia

The collaboration between Aevo and Celestia goes beyond a technical integration—it represents a major evolution in DeFi services. By fully leveraging Celestia’s data availability layer, Aevo achieves dramatic reductions in operational costs, which is especially critical in the DeFi space. Furthermore, this partnership increases the profitability of Aevo’s exchange and sequencer by over 90%, substantially improving the platform’s overall economics. This benefits not only Aevo but also provides Celestia with a prominent stage to showcase its technological capabilities, jointly advancing the development of DeFi services. This synergy manifests not just in mutual economic gains, but also in collaborative momentum that pushes the entire DeFi industry forward.

5. Impact on Scalability and Transaction Throughput

Celestia’s integration grants Aevo’s chain significantly enhanced scalability, essential for handling large transaction volumes. By increasing block size and reducing block intervals, Aevo can process transactions more efficiently, thereby improving user experience. This means Aevo can support more users and larger-scale trading while maintaining low latency and high throughput—key factors for staying competitive and attracting new users. Celestia’s technological strengths provide Aevo with a sustainable development foundation, offering robust support for future business expansion and innovation.

6. Innovation and Market Flexibility

This collaboration unlocks unprecedented innovation opportunities for Aevo. With Celestia’s support, Aevo can launch new products and services faster and respond flexibly to market changes. Such innovation extends beyond refining existing offerings and may include developing entirely new DeFi tools, further expanding its market influence. This agility is vital for maintaining competitiveness in the fast-evolving DeFi landscape. The partnership will act as a catalyst for Aevo to accelerate innovation and broaden its product lines, offering users more diverse options while potentially driving broader progress across the DeFi ecosystem.

7. Cost Efficiency and User Impact

By adopting Celestia, Aevo has achieved a dramatic reduction in data availability costs—improving profitability and enabling it to pass savings on to users. Lower transaction fees and more efficient processing directly enhance user experience and attract greater participation. This improved cost efficiency also makes Aevo more competitive in the crowded DeFi market. By transferring these economic advantages to users, Aevo is poised to strengthen brand recognition and user loyalty, further solidifying its leadership position in the DeFi space.

8. Future Outlook and Ecosystem Growth

The partnership between Aevo and Celestia is more than a technical upgrade—it’s a catalyst for ecosystem development. As Aevo evolves into a broader DeFi ecosystem, Celestia’s technology will facilitate the deployment of new protocols and drive ecosystem expansion. This collaboration opens doors to future innovations, potentially leading to a wave of new DeFi products and services. Their joint efforts are expected to propel the entire industry forward, offering users more choices and injecting fresh vitality into the healthy growth of the DeFi ecosystem. This partnership holds strategic significance not only for Aevo and Celestia but also promises a more vibrant future for the entire DeFi ecosystem.

9. Conclusion

Overall, Aevo’s decision to adopt Celestia as its infrastructure marks a pivotal moment in the DeFi sector. This collaboration not only enhances Aevo’s trading efficiency and economic viability but also brings new innovation and growth opportunities to the DeFi market. As Aevo and Celestia advance together, the DeFi space is likely to witness even greater innovation and expansion. This partnership drives progress at the technical level while injecting renewed energy into the entire DeFi ecosystem, delivering more advanced and efficient trading experiences for users. This strategic move could have far-reaching implications across the industry, encouraging more projects to pursue similar collaborations and pushing DeFi toward a more open and innovative future.

About Celestia

Celestia is a modular data availability (DA) network capable of securely scaling with user growth, enabling anyone to easily launch their own blockchain. Rollups and L2s use Celestia as a network to publish and source transaction data, which anyone can download. For them, Celestia provides a high-throughput DA layer that can be easily verified via light nodes. By modularizing the blockchain stack, Celestia allows anyone to launch their own blockchain without needing a validator set.

For more information, visit Celestia’s official website.

About Aevo

Aevo is the first Layer 2 derivatives platform focused on options and perpetual contracts trading. Aevo Exchange is a highly robust, decentralized CLOB (central limit order book) exchange for options and perps, built on top of the Aevo L2 rollup and Optimism stack, with Aevo Strategies (automated strategies) built on top. This architecture enables low gas fees and low latency while significantly enhancing liquidity and capital efficiency.

For more information, visit Aevo’s official website.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News