What is a reasonable price range for Aevo tokens upon listing on Binance Launchpool?

TechFlow Selected TechFlow Selected

What is a reasonable price range for Aevo tokens upon listing on Binance Launchpool?

This article introduces Aevo's main business and features, Launchpool information, and token price predictions.

Author: Nan Zhi

Today, Binance announced the launch of the 48th project on its New Coin Mining platform—Aevo (AEVO). Meanwhile, the Aevo airdrop farming activity is currently in full swing and will end in 36 hours.

This article introduces Aevo's core business and features, Launchpool details, and token price projections.

Core Business and Features

Options and Perpetual Contracts Trading

On April 7, 2023, options trading platform Aevo officially launched its mainnet, enabling users to trade using USDC with real settlement. Initially, users could trade ETH options on the options chain, supporting daily, weekly, monthly, and quarterly settlement cycles.

The Aevo Exchange is built on top of Aevo Chain, allowing users to directly transfer funds from the Exchange interface into Aevo Chain. Initially, Aevo only supported cross-chain transfers of USDC. Launched by structured products platform Ribbon Finance, Aevo operates on a customized Ethereum Rollup developed by Ribbon Finance, utilizing an order book and margin-based model.

In addition to Ethereum, Aevo has since expanded to Optimism and Arbitrum. Most importantly, Aevo introduced a Perpetual Futures module.

Key technical characteristics and architecture include:

-

Off-chain order book and risk control engine: Orders are matched off-chain; only after successful matching are they submitted to Aevo smart contracts. A risk engine checks for standard or portfolio margin compliance before on-chain submission.

-

On-chain settlement: User funds and positions remain on-chain, meaning all fund movements occur within smart contracts.

-

Layer 2 architecture: Contracts run on the Aevo Rollup, which batches transactions and submits them to the mainnet every hour.

-

Liquidation: Risk engine performs liquidation checks, while a dedicated liquidation engine executes the process.

Thanks to this design, Aevo achieves efficient matching and low-cost on-chain contract and options trading, securing a strong position in the derivatives market.

Pre-Launch Token Futures

On August 9, Aevo announced the launch of Pre-Launch token futures, offering perpetual contract trading services for upcoming tokens. These contracts have no index price or funding rate initially. However, once the token launches on the spot market, it will immediately reference the index price and enforce funding rates. Due to the experimental and high-risk nature of this product, Aevo enforces strict position limits and open interest caps. The first token listed under this program was SEI.

Previously, early trading before official token listings often occurred via OTC markets, typically involving double deposits, high fees, and significant capital lock-up. Aevo’s solution provides a secure, efficient, and low-fee alternative, addressing these issues. But how accurate is its market pricing?

On August 15, 2023, at 20:00 UTC+8, SEI officially launched on Binance with an opening hourly closing price of 0.1734 USDT, while Aevo’s closing price one hour prior was 0.3946 USDT—a deviation of 117%.

Performance of other previously launched tokens:

-

TIA: Exchange hourly closing price 2.243 USDT, Aevo’s prior hourly closing price 2.2932 USDT, deviation +2%;

-

JTO: Exchange hourly closing price 2.144 USDT, Aevo’s prior hourly closing price 1.264 USDT, deviation -41%;

-

STRK: Exchange hourly closing price 2.75 USDT, Aevo’s prior hourly closing price 1.8 USDT, deviation -35%;

The data above shows that Aevo’s pre-listing prices are not reliable predictors of actual market prices upon official launch. However, the product still serves as a viable alternative for certain OTC use cases.

Interest-Bearing Asset aeUSD

Aevo allows users to convert their stablecoins into aeUSD, an ERC-4626 asset built on the L2 Aevo network, composed of 5% USDC and 95% sDAI. By depositing stablecoins into MakerDAO’s DSR module, Aevo enables users, market makers, and strategy providers to earn an additional 4.75% APY while holding stablecoins (similar to Lido’s stETH yield mechanism for ETH). This feature improves capital efficiency and contributes potential liquidity reserves to the protocol. According to Aevo, it is the only DEX with such a yield-bearing mechanism, and over one-third of user funds have been converted into aeUSD.

Launchpool and Token Data

-

Launchpool start time: March 8, 2024, 08:00 (UTC+8), lasting 5 days

-

Maximum token supply: 1,000,000,000 AEVO

-

Initial circulating supply: 110,000,000 AEVO (11% of maximum supply)

-

Mining allocation: 45,000,000 AEVO (4.5% of maximum supply), including 36,000,000 in the BNB pool and 9,000,000 in the FDUSD pool

According to Binance, Aevo has raised $16.6 million across three funding rounds:

-

Seed round: 10% of total supply, valued at $18.5 million;

-

Series A: 4.62% of total supply, valued at $130 million;

-

Series A+: 3.5% of total supply, valued at $250 million.

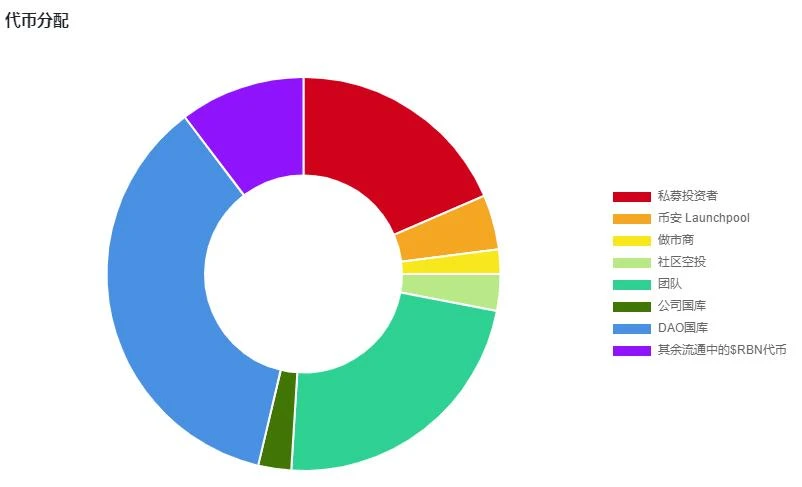

Notably, prior to Ribbon Finance merging into its derivatives platform Aevo, Ribbon Finance had its own token, RBN. RBN holders can exchange their RBN for AEVO at a 1:1 ratio, subject to a 2-month lock-up period. Remaining RBN unlock schedules continue as originally planned. The token release schedule is as follows:

-

Private investors (seed and Series A) and team RBN tokens will be fully unlocked by May 2024;

-

RBN holders can convert RBN to AEVO at a 1:1 ratio with a 2-month lock-up;

-

AEVO currently has no ongoing unlocks, but the DAO has allocated 16% for future user and ecosystem incentives, expected to be distributed over four years or more.

Currently, RBN trades on-chain at approximately 1.4 USDT.

Token Price Estimation

Aevo itself does not list AEVO tokens on its Pre-Launch market. However, Whales Market does offer AEVO on its Pre-Market, albeit with limited order depth. The current floor price stands at 3.84 USDT per token.

Based on historical performance of previous BNB pools, the average annualized yield for the first eight projects was 135%. Assuming the same 135% annualized return for this mining event over the 5-day period, the implied token price would be 3.71 USDT—close to the Whales Market price. If calculated using the minimum historical yield of 70%, the floor price would be approximately 1.92 USDT. Based on an initial circulation of 110 million tokens, this implies a minimum market cap of 211 million USD, approaching the $250 million valuation from the Series A+ round.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News