Rollup Summer Narrative Deduction: Besides ZKFair and Manta, What Other Investment Opportunities Exist?

TechFlow Selected TechFlow Selected

Rollup Summer Narrative Deduction: Besides ZKFair and Manta, What Other Investment Opportunities Exist?

The characteristic of this new wave of Rollups is: brand-new projects with tokens, modular architecture, and generous incentives that accelerate the initial flywheel effect between project growth and token price.

This article presents the author's observations and analysis on emerging trends in the Rollup market, its future development, and potential opportunities. It attempts to explore the following topics:

- What is Rollup Summer?

- New Rollup Case Studies: ZKFair and Manta

- Projection of Rollup Summer’s Development

- Opportunities in the Secondary Market: Assets Related to the Rollup Summer Narrative

The views expressed below are the author's opinions at the time of publication, primarily analyzed from a business perspective with limited technical details about Rollups. There may be factual inaccuracies, biases, or errors in this article, which is intended solely for discussion purposes. Feedback and corrections from fellow researchers and investors are welcome.

I. What is Rollup Summer?

Similar to DeFi Summer starting in 2020 or the Ordinals Summer in 2023, "Rollup Summer" refers to the anticipated surge in the number of new Rollup projects and their operational metrics—such as Total Value Locked (TVL), active users, and ecosystem applications. Although still speculative and only beginning to show early signs, it represents a projected phase of explosive growth across multiple dimensions.

Key manifestations of Rollup Summer include:

- A large number of new Rollups or app-specific chains being initiated and launched on mainnet

- Accelerated inflow of users, capital, and developers into the Rollup ecosystem compared to previous years

- Mutual reinforcement between business data and asset prices, leading to rapid expansion in market capitalization for the Rollup sector and related projects

Rollup Summer could begin at the end of 2023 or early 2024 and may become a dominant narrative lasting half a year or even the entire year.

The primary drivers behind Rollup Summer are:

1. Flywheel Effect of New Rollups

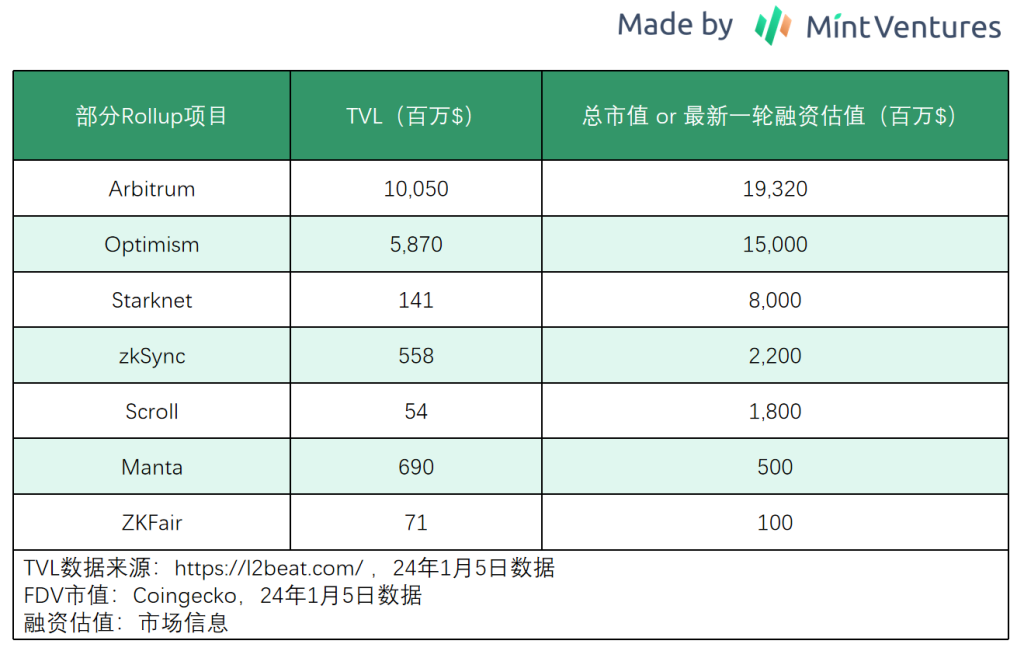

Rollups themselves are not new; established ones like Arbitrum and Optimism already have massive valuations and significant operations. Other ZKRollups such as Starknet and zkSync have also been running for some time.

However, the protagonists of this Rollup Summer will be newly emerged projects from the current cycle because:

- Modular blockchain concepts have gained widespread acceptance, and infrastructure components for Rollups—such as OP Stack, Celestia as the Data Availability (DA) layer, decentralized sequencers, and various RaaS providers—are maturing rapidly. The barrier to developing and maintaining a Rollup using modular principles is decreasing quickly.

- New Rollups come with native tokens, generous budgets for cold starts and incentives, more aggressive token distribution models, and stronger appeal to users and capital.

- Low initial market cap offers greater room for imagination and upside.

- Bullish market sentiment further accelerates momentum.

In short, the defining features of these new Rollups are: novelty, presence of a token, modularity, and generous incentive structures that accelerate the flywheel effect between early adoption and token price appreciation.

The initial stage of the Rollup Summer flywheel might unfold as follows: token airdrop plans → attract user assets → increase core metrics like TVL → grow project valuation.

The second phase could evolve into: ecosystem token airdrops → direct subsidies to dApps within the ecosystem, indirectly benefiting users → further attract user assets, boosting TVL, active user count, and gas fees → further expand project valuation → rising calls for newer Rollups surpassing older ones → intensified market FOMO (fear of missing out).

2. The Dencun Upgrade

Beyond the flywheel effect of new Rollups, another key backdrop is the anticipated Ethereum Dencun upgrade expected in February. While the upgrade directly benefits Arbitrum and Optimism by significantly reducing their Layer-1 costs and expanding profit margins on Layer-2, it also increases overall market attention toward the Rollup sector, drawing attention and capital to emerging Rollup projects.

II. Case Study of New Rollups: ZKFair and Manta

The author analyzes two recently high-profile Rollups to illustrate the operational models and characteristics of the new generation of Rollups driving Rollup Summer.

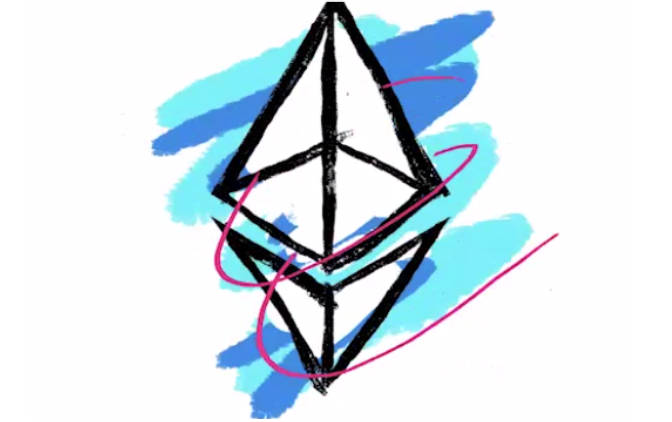

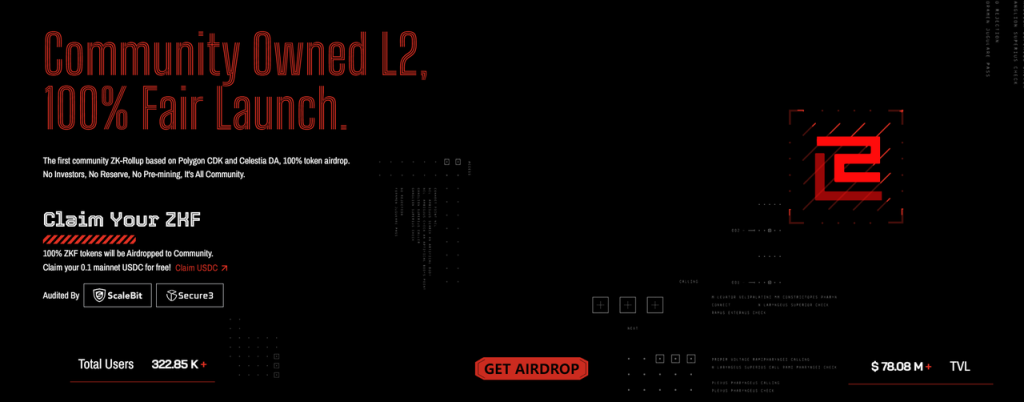

1. ZKFair

Website: https://ZKFair.io/

Key features of ZKFair as a Rollup:

- Built on Polygon CDK, uses Celestia for DA layer (currently maintained by an internal data committee), EVM-compatible

- Uses USDC as gas fee currency

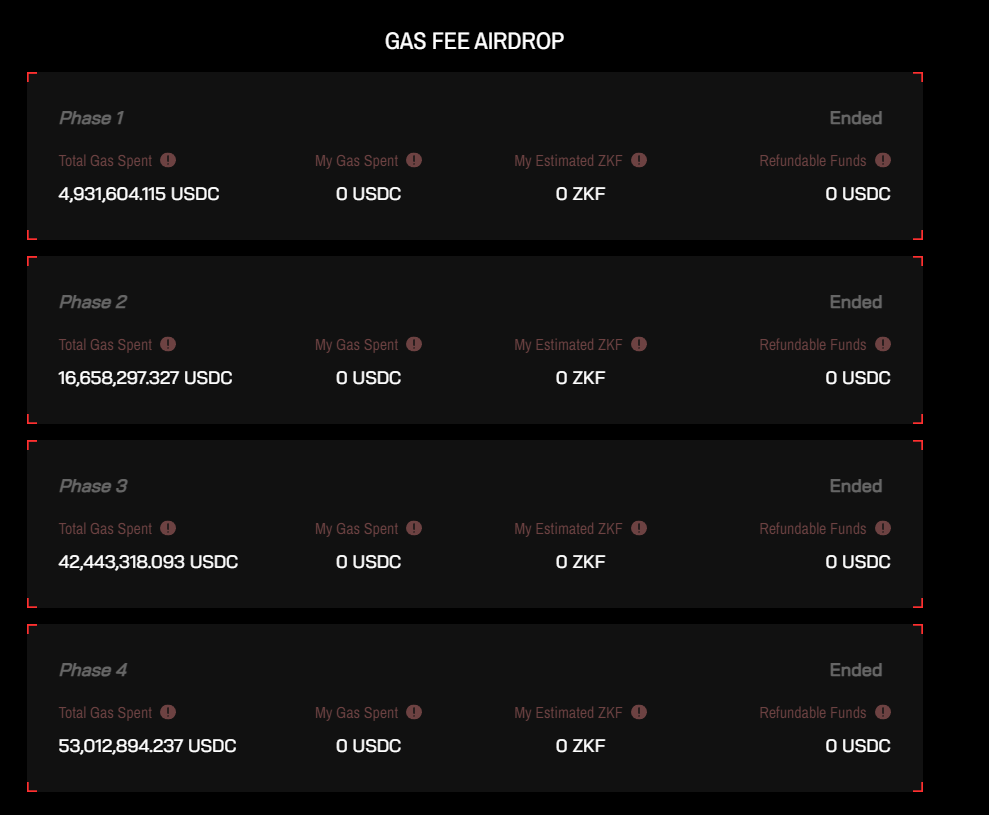

- Rollup token ZKF is 100% community-distributed. 75% of tokens are distributed over four phases within 48 hours to participants who consume gas, effectively allowing users to participate in the primary market sale by paying gas to the official sequencer. The implied primary market valuation is only $4 million

ZKFair attracted over $110 million in funding during the event. Image source: https://ZKFair.io/airdrop

The operating profits of the Rollup are committed to be 100% returned to the community: 75% distributed to ZKF LP stakers and 25% allocated to qualified dApp deployers. Profit here equals total fees minus operational costs (infrastructure such as block explorer, oracle services, etc.).

Since ZKF allocation is based on each participant’s share of total gas consumption during the event, the token distribution becomes a “capital competition,” prompting many users to bridge USDC to the ZKFair mainnet. During the airdrop campaign, ZKFair’s on-chain funds surged from zero to approximately $140 million within two to three days—comparable to top ZKRollup projects like Starknet at the time. Even after the airdrop concluded, ZKFair’s TVL remained above $70 million, surpassing Scroll, an earlier-launched ZKRollup.

Advantages of ZKFair’s approach:

- Rapid cold start and user acquisition: Achieved one of the fastest-growing Rollups, reaching over $100 million TVL in three days (still maintains over $70 million), with 334,000 unique addresses

- Direct token utility: Sequencer fees are directly redistributed to users and developers, providing intrinsic value to the Rollup’s token

Currently, ZKF’s Fully Diluted Valuation (FDV) is around $100 million. For a Rollup, this remains relatively low when compared horizontally with other Rollups.

2. Manta

Website: https://Manta.network/

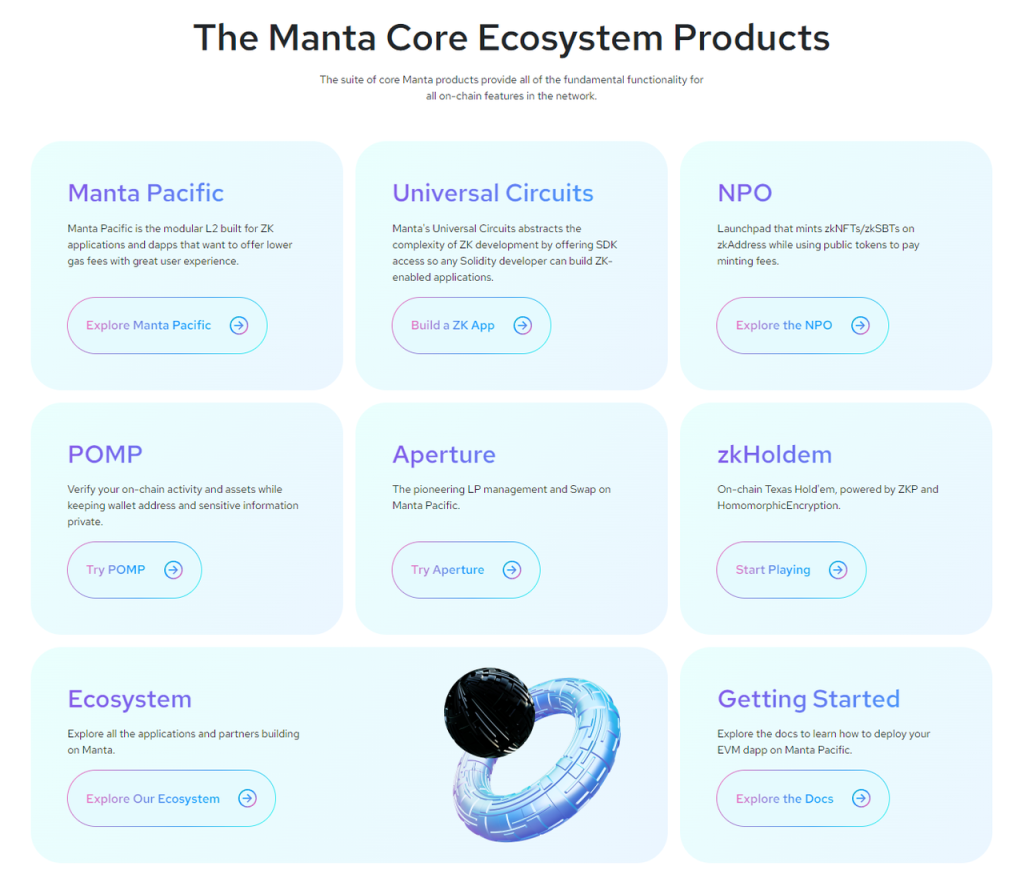

Key features of Manta Rollup:

- Built on Celestia DA + Polygon zkEVM, EVM-compatible

- Beyond the Rollup, offers a rich product suite, especially numerous ZK-based toolkits and services

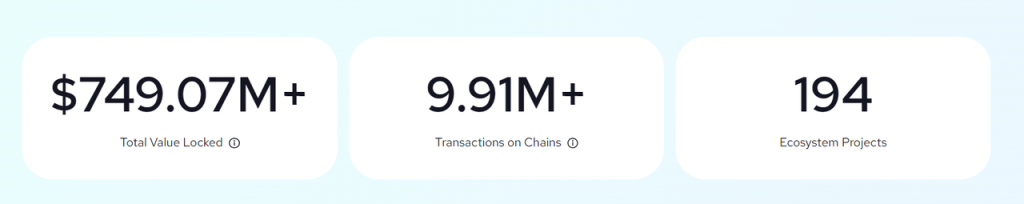

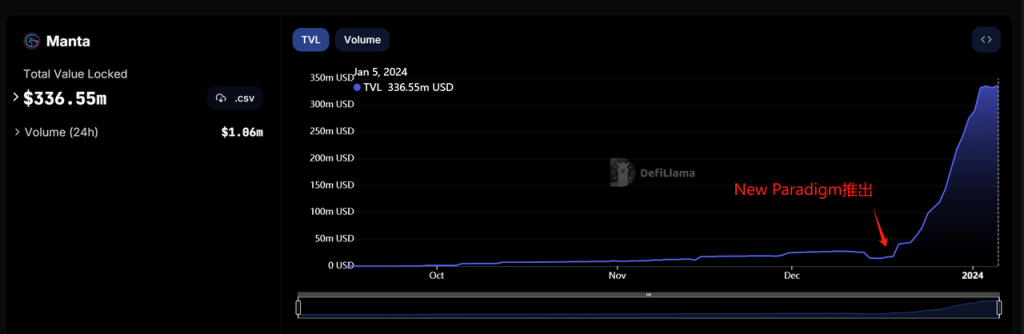

Manta Rollup officially launched in September 2023, but its business data took off after the launch of the “New Paradigm” campaign in mid-December. Chain deposits have now reached nearly $750 million according to official figures.

The chart below shows the Defi TVL trend on Manta, clearly showing a sharp inflection point following the New Paradigm launch.

Manta also boasts a prestigious investor lineup, with a previous funding round valuing the project at $500 million:

Image source: https://www.rootdata.com/

The logic behind the New Paradigm campaign is simple—an evolved version of Blur’s Blast model:

- Distribute the Rollup’s native token based on bridged capital volume to rapidly increase on-chain deposits

- Ensure bridged assets earn base yields (e.g., ETH staking rewards + stablecoin treasury yields), reducing opportunity cost for users

- Set up airdrop expectations tied to dApp interactions, encouraging post-bridge engagement and boosting developer confidence

The New Paradigm campaign will distribute 45 million Manta tokens to NFT holders, representing 4.5% of the total supply. Based on secondary market NFT data as of January 5, 2024, the author estimates Manta’s FDV upon token launch will fall between $1.5 billion and $2.5 billion.

Besides ZKFair and Manta, other similar new Rollups are emerging rapidly—such as the earlier Blast, and more recent hybrids like Layer X combining aspects of both ZKFair and Manta.

Additionally, considering that major ZKRollups like Scroll and zkSync have yet to launch their tokens, these earlier-maturing platforms could similarly adopt strategies akin to ZKFair and Manta—leveraging clear token incentive mechanisms to directly attract users and capital to their ecosystems.

III. Projection of Rollup Summer’s Future Evolution

Next, we can project potential development paths for Rollup Summer:

- New Rollups launch, quickly scaling through token airdrops and engagement campaigns. Rapidly growing data and superior mechanisms generate strong market expectations (already underway);

- Rollup projects launch or list their tokens, creating visible wealth effects (e.g., ZKFair achieving 25–30x gains), attracting more players and capital;

- Incentives shift from pure TVL accumulation toward fostering ecosystem activity, gas consumption, and dApp integration. Market focus moves from TVL to sustainability of ecosystem growth (challenges intensify here);

- Massive wave of new Rollups launching simultaneously leads to diluted attention and capital. Token wealth effects diminish, project quality declines sharply, and scam projects (draining funds or rug-pulling) emerge, damaging market confidence;

- Rollup Summer fades, competition stabilizes. However, future Rollup token distribution methods may inherit patterns established in this cycle—addressing the challenge of business cold starts.

We can thus see that the greatest challenge facing new Rollups and the Rollup Summer narrative after initial success lies in transitioning from token distribution to sustaining long-term ecosystem growth—how to foster applications and services that retain users and capital, generate wealth effects, whether through Memes, DeFi, additional airdrops, or sophisticated Ponzi-like mechanisms.

IV. Secondary Market Opportunities: Assets Linked to the Rollup Summer Narrative

Which secondary market assets stand to benefit from Rollup Summer? From this overarching narrative, several sub-narratives may emerge:

Sub-Narrative Hypothesis 1: “Celestia is the Ethereum of the Rollup Era”

ZKFair, Manta, and many other new Rollups are adopting Celestia’s DA solution, moving Celestia from concept to real-world use. As successful implementations gain market traction, more new Rollups are likely to follow suit. Using Celestia as the DA layer could become standard for new Rollups, establishing Celestia as a new consensus layer and core infrastructure of the Rollup era.

This could give rise to the sub-narrative that “Celestia is the Ethereum of the Rollup era.” Whether this story holds long-term may not matter immediately—given Celestia’s current circulating market cap of just $230 million, it has two orders of magnitude room to grow compared to Ethereum’s $270 billion.

Data source: https://www.coingecko.com/

Sub-Narrative Hypothesis 2: Yield-Bearing Assets Become Standard

Yield-bearing assets, particularly yield-generating stablecoins like sDAI replacing mainstream stablecoins, have historically seen slow adoption. However, during campaigns like those of Blast and Manta, yield-bearing ETH and stablecoins have become native assets on these new Rollups. If more Rollups adopt similar approaches, it would directly drive user base expansion and habit formation. This trend strongly benefits issuers of yield-bearing assets capable of securing partnerships with leading Rollups—for example, Blast chose Lido and MakerDAO, while Manta partnered with Stakestone and Mountain Protocol.

Sub-Narrative Hypothesis 3: Rollups Consume L1 Market Share

From a user experience standpoint, there is no meaningful difference between Rollups and L1s. The L1 chain boom of the last cycle may reappear this cycle as a sovereign Rollup boom. As Rollups compete among themselves, they will also directly compete with L1s for users and capital. Additionally, native dApps on fast-growing Rollups present notable opportunities—for instance, LayerBank on Manta has surpassed $300 million in total deposits, approaching the scale of Radiant, a top lending protocol on Arbitrum.

Nevertheless, while optimistic about the rapid growth of numerous Rollups, we must also consider the risk of narrative failure.

Risks of the Rollup Summer Narrative

The core challenge for new Rollups is successfully transitioning from the launch phase to sustainable growth. Attracting capital via token airdrops is relatively straightforward, but retaining users and capital long-term poses far greater complexity. In fact, during the previous cycle, various L1 blockchains attempted similar strategies—launching multi-hundred-million-dollar incentive programs to lure top Ethereum DeFi protocols to migrate. These protocols then passed incentives to their users to boost metrics. Such measures worked well initially, but effectiveness diminished as every chain adopted similar policies.

Even established Rollups like Arbitrum and Optimism continue distributing token subsidies to ecosystem projects, which in turn pass them to users to maintain activity and capital retention. Arbitrum’s latest round of incentives alone exceeds 70 million ARB tokens (worth over $140 million at current prices).

Therefore, as Rollup Summer remains an emerging narrative, its future trajectory depends critically on the next steps taken by new Rollup projects. Close observation is warranted.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News