Blockworks Research: Ethereum Rebounds – What Opportunities and Challenges Will Based Rollups Bring?

TechFlow Selected TechFlow Selected

Blockworks Research: Ethereum Rebounds – What Opportunities and Challenges Will Based Rollups Bring?

Based Rollup's advantages bring the Ethereum user experience back to its original state.

Author: Donovan Choy

Translation: TechFlow

Ethereum loves Rollups. Lately, "based" Rollups have been gaining attention.

What makes based Rollups special? The key lies in their sequencer.

Traditional Layer-2 networks use centralized sequencers to process user transactions and submit them to Layer-1 for settlement. Based Rollups, however, delegate the sequencing task to Ethereum’s Layer-1 validators—a mechanism known as "based sequencing."

This design offers two major advantages: censorship resistance and enhanced interoperability.

By using Layer-1 as the sequencer, based Rollups inherit the same liveness guarantees as the Ethereum mainnet while avoiding censorship risks associated with centralized sequencers.

Read more: MagicBlock open-sources a16z-backed 'ephemeral rollup' tech

Another significant benefit is greatly improved interoperability. Advocates of based Rollups (such as Justin Drake) refer to this as "synchronous composability"—meaning transactions on Ethereum can be synchronously ordered or bridged across different Layer-2 chains.

In simple terms, smart contracts on a based Rollup can almost instantly invoke other contracts on Layer-1 within the same block, as if they were all on the same chain.

This idea of synchronicity and "money legos" is not new—it has always been a core part of Ethereum’s original vision.

Read more: Rethinking Ethereum consensus with Beam Chain

However, the current fragmented state of Rollups results in asynchronous transactions between Arbitrum and Optimism, leading to fee uncertainty. This is further exacerbated by gas fees being calculated at different times rather than uniformly within Ethereum’s 12-second slot duration.

Beyond improving Ethereum's interoperability, this mechanism also enables significant cost savings. Ahmad Mazen Bitar, Technical Lead at Nethermind, explained:

"Users can initiate a transaction on Layer-1, leverage deep liquidity pools on Layer-2 to complete an operation, and then return to Layer-1. Synchronous composability makes this entire process much more efficient."

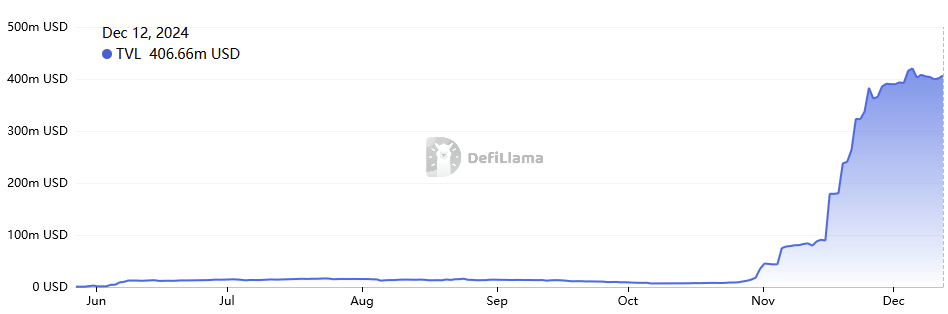

Currently, the largest based Rollup is Taiko, which has seen substantial growth in both TVL and daily transaction volume this month.

Source: DefiLlama

Other early-stage based Rollup projects are also in development, such as Surge by the Nethermind team and UniFi by Puffer Finance—all forked from Taiko.

Nonetheless, based Rollups face certain challenges. Since sequencing relies on Layer-1 validators, performance is constrained by Layer-1’s 12-second block time.

As a result, the benefits of based Rollups—like synchronous composability—may be difficult to fully realize in practice. It requires generating real-time zero-knowledge proofs within a single 12-second slot; otherwise, composable transactions cannot execute quickly.

To address this, Taiko has introduced multiple technologies, including zk-proofs from Risc Zero and Succinct Labs, along with Trusted Execution Environments (TEE) based on Intel SGX. This makes Taiko the first based Rollup to implement multi-proof systems in production without relying on a single trusted party.

"Prover performance is improving rapidly. We’re seeing increased adoption of trusted execution environments (TEEs), more efficient and lower-cost zkVMs, and AVS (Actively Verified Services). We believe zk technology is progressing well, and generating proofs within sub-slot latency is within reach," said Brecht Devos, co-founder of Taiko, in an interview with Blockworks.

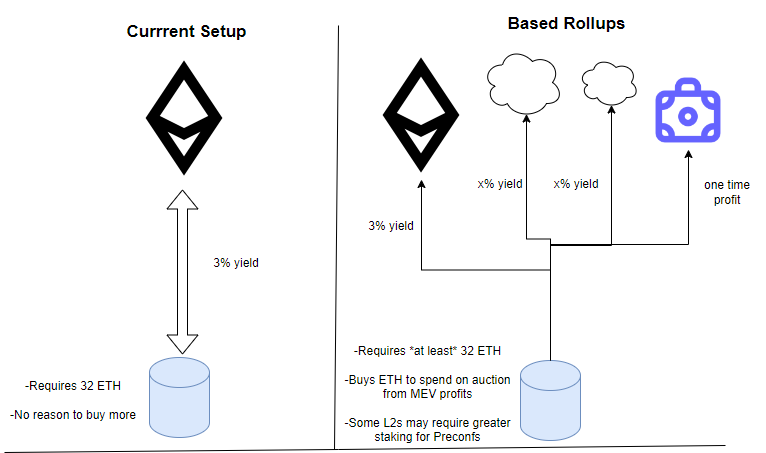

However, based Rollups also face other challenges. For example, without a centralized sequencer, they may lose MEV (Maximal Extractable Value), an important revenue source. But Devos says this issue can be addressed through innovative approaches.

"In the Taiko network, MEV can be captured by auctioning 'execution tickets' to Layer-1 block proposers," Devos explained to Blockworks.

Therefore, although based Rollups default to delegating sequencing to Layer-1 validators, that isn't the only solution.

Matthew Edelen, co-founder of Spire Labs—a company focused on Rollup infrastructure—shared a similar view on a recent Bell Curve podcast: "Auctioning isn’t the only way to allocate sequencing rights. We could auction off 99% of sequencing rights while allocating the remaining 1% to friends or independent stakers to improve our appearance on L2Beat."

In the long run, MEV might not be a major concern. This perspective stems from a simple cost-benefit analysis: currently, most blockchain revenue comes from congestion fees, which far exceed MEV income. Moreover, as more efficient MEV solutions emerge, the share of revenue from MEV continues to decline.

Thus, for Rollups, a better revenue model is to benefit from congestion fees driven by network effects enabled by synchronous composability, rather than relying on MEV fees.

As Justin Drake noted in The Rollup podcast:

"Right now, the ratio of congestion fees to MEV is roughly 80:20. On Ethereum Layer-1, about 80% of revenue comes from congestion fees—around 3,200 ETH per day since EIP-1559. Since The Merge, MEV has averaged about 800 ETH per day. I believe this ratio will become even more skewed, possibly shifting from 80:20 to 99:1."

In summary, the advantages of based Rollups bring the Ethereum user experience back to its original state.

Interestingly, this return echoes characteristics inherent to blockchains since their inception. Synchronous composability and Layer-1-level transaction ordering have been fundamental features since Bitcoin’s creation.

The division of execution responsibilities emerged mainly due to the recent trend toward centralized Rollup architectures (as well as the multi-chain designs of Polkadot, Cosmos, and Avalanche). Now, based Rollup solutions are ready to reclaim that original vision.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News