Adam Cochran: Based Rollups rethinks staking incentives

TechFlow Selected TechFlow Selected

Adam Cochran: Based Rollups rethinks staking incentives

We will fundamentally transform Ethereum's economic model through Based Rollups.

Author: Adam Cochran

Translation: Pzai, Foresight News

Based Rollups fundamentally alter the incentive structure, directly impacting ETH monetization—which could easily increase long-term demand for ETH by 100x.

Here's how it works:

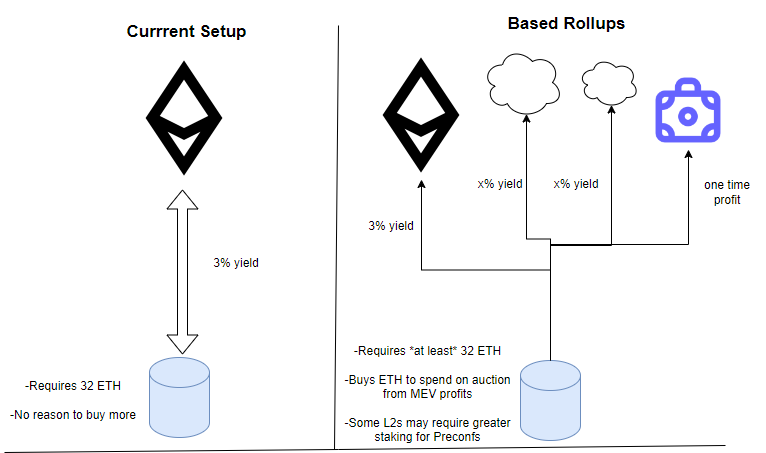

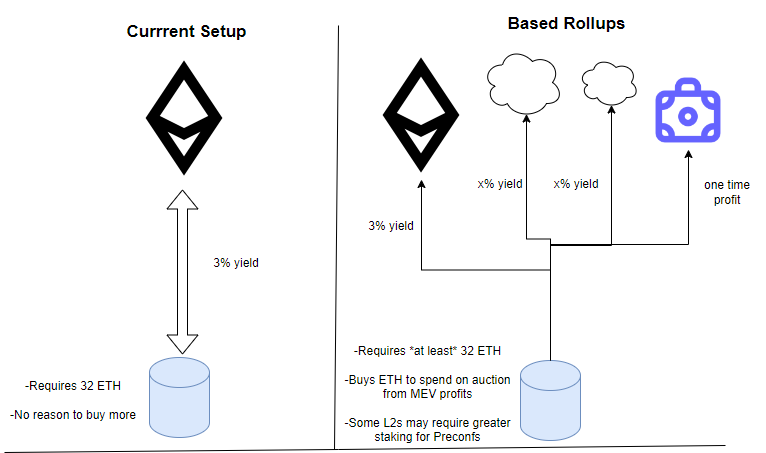

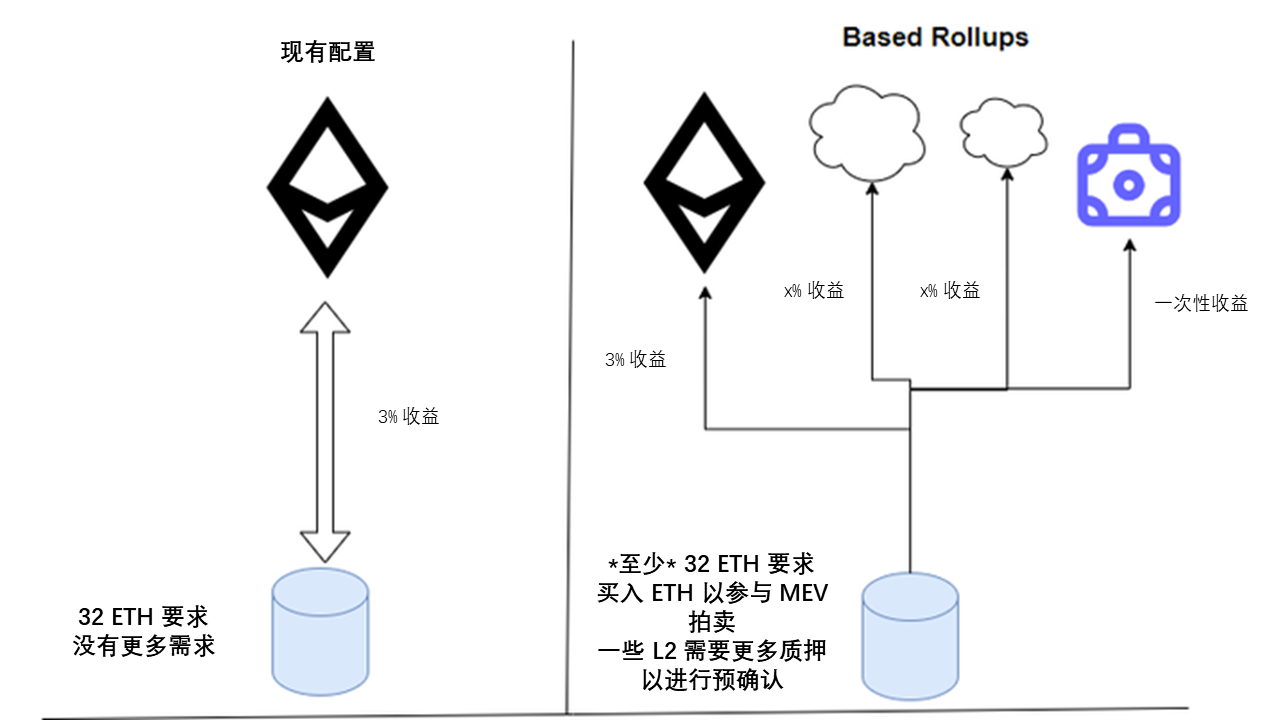

While different Based Rollups will have varying models (such as random selection, auctions, pre-commit slashing, etc.), the core idea remains the same: L2s no longer simply pay for data availability (DA), but instead leverage existing L1 validators for transaction processing.

One key insight we’re gaining about blockchain economics is that execution is by far the most profitable part of the process.

Although I believe ETH’s DA value is significantly underestimated, I can’t deny that this execution revenue stream is more lucrative.

Validators who choose to help verify and process these Based Rollups will earn additional rewards on top of standard network inflation rewards.

This achieves two important things:

1) It increases the value of staking in a way that is independent of the total amount of staked ETH.

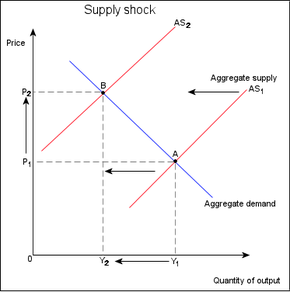

If there are many Based Rollups, validators could still achieve 15% yields even if massive amounts of ETH are locked up, mitigating supply shock concerns.

2) It opens new avenues for ETH monetization and value capture.

For example, MEV auctions require validators to bid in ETH to become block proposers, capturing one-time profits.

We don’t see such competitive mechanisms in current L2 DA solutions.

Other potential models include:

-

Preconfirmation staking: A validator’s preconfirmations are only valid if their staked ETH exceeds the value of the transactions they preconfirm.

-

Burn proofs: Burning ETH is required to select new L2 validators.

Moreover, because Based Rollups enable cross-rollup interoperability, they increase liquidity access and the volume of cross-market settlement transactions, thereby increasing total gas demand.

Thus, Based Rollups enhance ETH’s value in two fundamental ways:

-

They make regular ETH staking more valuable, increasing demand for ETH.

-

They allow competitive bidding for idle processes within the Ethereum network without increasing L1 gas usage.

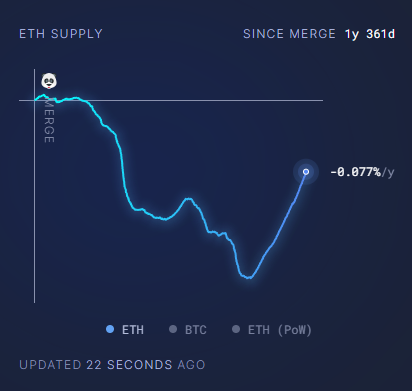

When combined with Ethereum’s deflationary mechanism, this creates a particularly compelling scenario.

Ethereum’s minimum viable issuance could reach 0%, while validator yields might still range from 4% to 8% thanks to Based Rollups and MEV value capture.

If newly issued supply drops to 0%, yet your yield from staking ETH still exceeds that of U.S. Treasuries, how do you think Ultrasound Money will perform?

We're not only improving Ethereum’s user experience and L2 modularity—we're eliminating liquidity fragmentation via Based Rollups. And we’re fundamentally reshaping Ethereum’s economic model without requiring any protocol-level changes, simply by adjusting incentives between L2s and L1 validators.

This will be the first time that staking incentives for Ethereum are driven by overall EVM utilization rather than by ETH issuance rates.

This fundamental decoupling could make $100,000 ETH a reality within the next decade.

While there remains a critical economic challenge around value capture to solve, we’re already halfway there—simply by improving usability in a way that aligns incentives across every ecosystem participant.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News