Based Rollup: A New Approach to Addressing L2 Sequencer Centralization Risks

TechFlow Selected TechFlow Selected

Based Rollup: A New Approach to Addressing L2 Sequencer Centralization Risks

"Based Rollups can achieve tokenless decentralization." — Justin Drake

Author: 100y

Translation: TechFlow

Key Takeaways

-

Current Rollup networks face the risk of centralized sequencers, prompting the emergence of various sequencing layer projects to address this issue.

-

Justin Drake, a researcher at the Ethereum Foundation, has proposed an idea called Based Rollups to solve the sequencing problem in Rollups. In this setup, searchers, builders, and proposers on the Ethereum network all participate in transaction ordering for the Rollup network.

-

While Based Rollups are highly decentralized and directly benefit from Ethereum's activity, they may face challenges related to lack of economic incentives and potential scalability limitations.

1. Introduction

Undoubtedly, the period from 2022 to 2023 marked the rise of Ethereum Layer 2 technologies, during which various Rollup networks flourished. In the Optimistic Rollup space, Arbitrum and Optimism have firmly secured positions among the top ten in terms of total value locked (TVL). Meanwhile, in the zk Rollup domain, the second wave of Layer 2 solutions is approaching, particularly with Polygon’s zkEVM launch and the mainnet release of zkSync Era.

1.1 Risks in Rollups

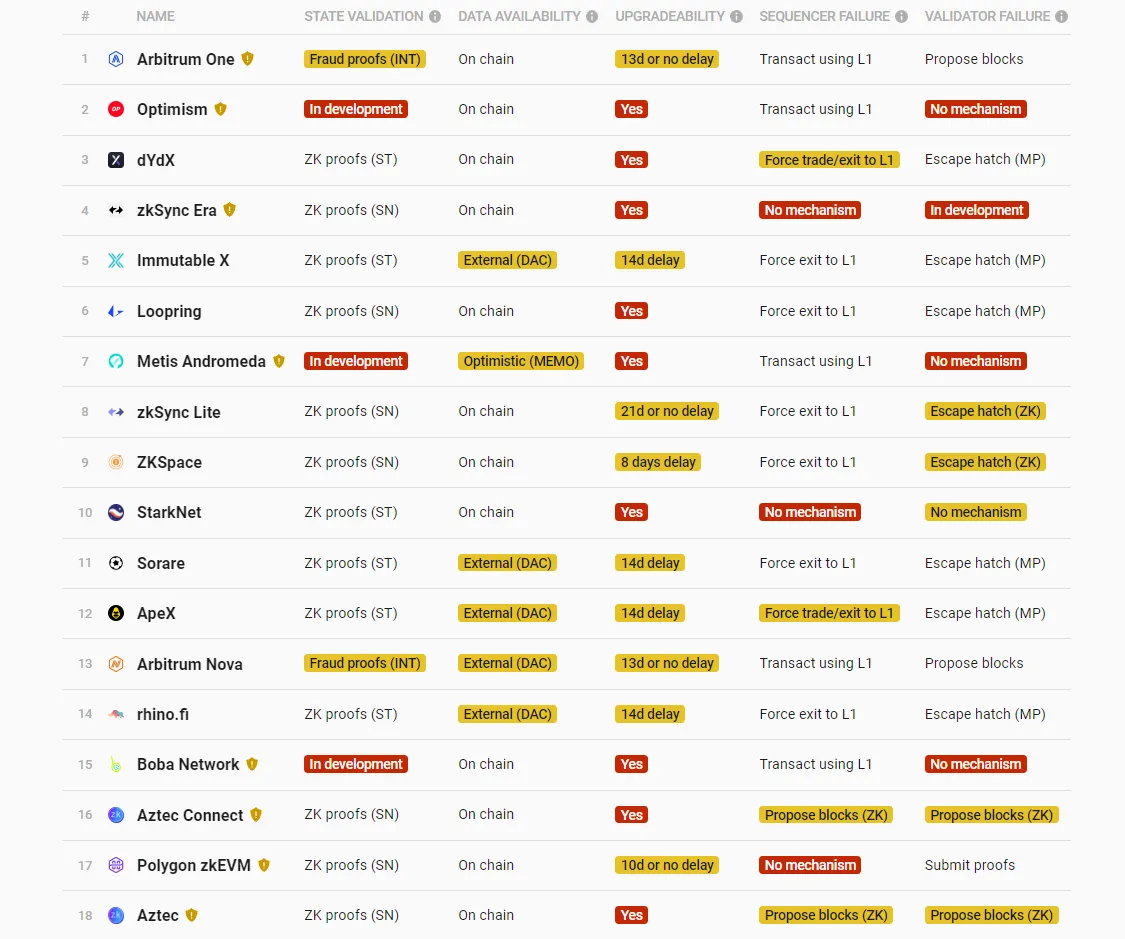

However, due to the rapid growth of various Ethereum Layer 2 networks, not all meet proper Rollup standards. The table above analyzes the risks present in existing Rollup networks. Each item describes the approach taken by a Rollup network, with yellow indicating minor risk and red indicating significant risk.

-

State Validation: Since Rollups perform computation off-chain, they must prove the validity of their results to Ethereum. This category classifies based on how validation is implemented. For zk-Rollups, validity can be proven via zero-knowledge proofs (zk-SNARKs, zk-STARKs). For Optimistic Rollups, at least one honest party should be capable of submitting fraud proofs, but many networks have yet to implement such systems. Even when systems exist, progress remains limited, as only whitelisted entities can currently submit fraud proofs.

-

Data Availability: Classified based on where transaction data used in computation is stored. On-chain storage on Ethereum is the most secure. For external DAC (Data Availability Committee), transaction data is managed off-chain by designated entities; in the Optimistic (MEMO) case, transaction data is managed by a decentralized storage network—this is the method adopted by Metis Andromeda.

-

Upgradability: Rollup networks have a smart contract on Ethereum, classified based on whether it is upgradeable. Non-upgradeable means the code is immutable—the safest approach. Some contracts allow upgrades after a delay (typically several days), while in the worst-case scenario, a single entity can upgrade the Rollup contract without approval. In that last case, the entity could theoretically steal all funds (though the likelihood is extremely low).

-

Sequencer Failure: Sequencers determine the order of user transactions on the Rollup. This category examines what happens if all sequencers go offline or engage in censorship. "Using L1 for transactions" means users can submit transactions directly through Ethereum to be included in the Rollup. "Force exit to L1" allows users to force the sequencer to include withdrawal transactions. The worst case is no mechanism—meaning users have no recourse if the sequencer goes down or censors.

-

Prover/Verifier Failure: Verifiers are responsible for submitting the Rollup’s state to Ethereum (and ZKPs in the case of zkRollups). This category assesses contingency measures when verifiers go offline. "Propose block" allows anyone to become a verifier after a timeout, while emergency exit (MP) lets users securely withdraw assets by submitting a Merkle Proof—both very secure. Emergency exit (ZK) requires users to submit a ZKP, which is difficult for individuals. Propose block (ZK) also requires nodes to execute and generate ZKPs. Again, the worst case is no mechanism—meaning if the verifier fails, all user assets are frozen.

1.2 Importance of the Sequencer

So far, we've discussed various risks, but as Rollup networks grow larger, failures of sequencers and verifiers have become hot topics. The Optimism network has grown into the sixth-largest network by TVL, but if its whitelisted verifier goes offline, user funds could be frozen. In the recently launched zkSync Era, there is no mechanism to respond to sequencer or verifier downtime.

This concern arises because most existing Rollup networks use centralized sequencers. Let's examine how major Rollup networks operate their sequencers:

-

Optimism: Both the sequencer and verifier are centrally operated by the foundation (sequencer address: 0x68...2985, verifier address: 0x47...3A33). Even if the centralized sequencer goes offline or engages in censorship, users can still force transactions onto L2 via L1, since the “using L1 for transactions” option is available. However, if the verifier goes offline, users cannot withdraw from L2 to L1. Optimism plans to decentralize its sequencer in the future using economic game theory and governance mechanisms to address this issue.

-

Arbitrum: The sequencer is centrally operated by the foundation (sequencer address: 0xC1...47cc), while verifiers consist of 13 whitelisted entities. Even if the centralized sequencer goes offline or censors, users can still force transactions onto L2 via L1. Unlike Optimism, Arbitrum has established a fraud proof system, though only accessible to whitelisted verifiers. If all verifiers go offline for more than 7 days, anyone can step in as a verifier and initiate withdrawals. Arbitrum plans to decentralize its sequencer in the future.

-

zkSync Era: There is a single centralized operator acting as both sequencer and verifier (operator address: 0x11...2211). The project is still in early stages, so there is no way to fix issues arising from operator failure. zkSync Era plans to decentralize the operator in the future by creating roles such as verifiers and guardians.

-

Polygon zkEVM: The sequencer is centrally operated by the foundation (sequencer address: 0x14...2800), and the verifier (called the aggregator in Polygon zkEVM) is also centralized (aggregator address: 0xdA...86eA). If the sequencer fails, user funds are frozen. However, if the aggregator fails, anyone can still submit a ZKP to withdraw from L2 to L1. Polygon zkEVM will later use a consensus algorithm called PoE to decentralize both the sequencer and aggregator.

Due to the centralization of sequencers and verifiers, recent efforts have emerged to decentralize the sequencing operations of Rollup networks. Projects such as Astria, Espresso, Radius, OP Stack, and Suave aim to provide their own sequencing networks for Rollups, allowing Rollup nodes to focus solely on computation while these networks handle transaction ordering and relay them to the Rollup. In contrast, Justin Drake, a researcher at the Ethereum Foundation, has proposed a different approach called Based Rollups.

2. Based Rollups

“Based Rollups enable tokenless decentralization.” — Justin Drake

This was the closing statement by Ethereum Foundation researcher Justin Drake when introducing Based Rollups. Could this mean Coinbase’s newly launched Rollup network leverage Based Rollups to achieve tokenless decentralization? (Note: Based Rollups and Coinbase’s Base are unrelated beyond the similar name.)

2.1 Introduction

Based Rollups (also known as L1-ordered Rollups) refer to Rollup networks whose transaction ordering occurs on their underlying L1—in most cases, Ethereum. More specifically, in Ethereum’s context, this means searchers, builders, and proposers on the Ethereum network all participate in ordering transactions for the Rollup.

2.2 Participants in Block Building

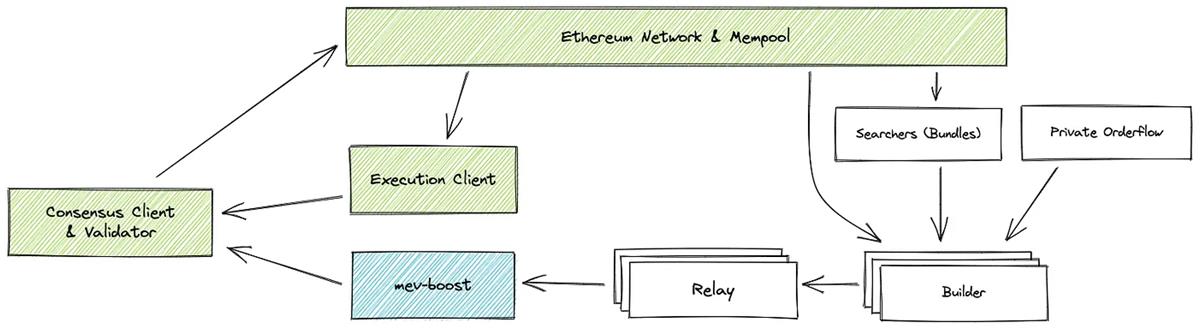

Currently, most Ethereum blocks are built via the MEV-Boost middleware. In the future, this process will be integrated directly into the Ethereum protocol through proposer-builder separation (PBS). In this model, searchers first monitor the mempool, identify MEV opportunities, bundle transactions accordingly, and submit these bundles to builders. Builders then take transactions from the mempool and bundles from searchers, use proprietary algorithms to construct full blocks that maximize MEV revenue, and pass them to proposers for inclusion on Ethereum.

In this process, searchers and builders bid nearly equal to the MEV they can extract to increase their chances of having their bundles and transactions selected, thereby channeling MEV revenue from searchers to builders, and from builders to proposers.

2.3 Advantages of Based Rollups

Compared to traditional Rollups that handle sequencing independently, Based Rollups offer several advantages. First, they rely on Ethereum for transaction ordering and thus benefit from Ethereum’s robustness. As previously discussed, many issues arise in traditional Rollups if sequencers or verifiers fail—but for Based Rollups, such risks do not exist unless Ethereum itself encounters problems.

Second is decentralization. Based Rollups can still leverage the diverse set of participants involved in Ethereum block production. Anyone can join the sequencing process permissionlessly upon spotting MEV opportunities in the Based Rollup’s mempool.

Third is economic alignment with Ethereum. If an MEV opportunity arises within a Based Rollup, searchers and builders on Ethereum will submit bids to capture it, causing the MEV value generated by the Rollup to naturally flow back to Ethereum L1.

Fourth is simplicity. Rollup networks built as Based Rollups are simpler than those with centralized sequencers. They do not need to validate sequencer signatures, implement emergency exits (systems allowing users to safely withdraw funds when verifiers go offline), or later introduce new algorithms for sequencer decentralization.

Fifth, they require no native token. Traditional Rollups typically need a token to eventually decentralize their sequencers. However, since sequencing in Based Rollups occurs on Ethereum, no additional token is necessary.

2.4 Disadvantages of Based Rollups

Based Rollups also come with drawbacks. First, the MEV revenue generated by the Rollup flows entirely to Ethereum L1 instead of being retained on L2. However, base fees from transaction submissions can still accumulate on the L2 side.

Second is sequencing constraints. Because Based Rollups fully depend on Ethereum for ordering, it is difficult to introduce custom sequencing logic. Additionally, relying on Ethereum for finality inherits Ethereum’s finality timeline, which may lead to suboptimal user experience. However, many researchers are actively exploring ways to achieve faster finality through EigenLayer, inclusion lists, builder deposits, and similar mechanisms.

3. Example

Although it's uncertain whether Based Rollups will be widely adopted, there is a research post on Ethresearch published by Taiko, a well-known Layer 2 zkEVM project.

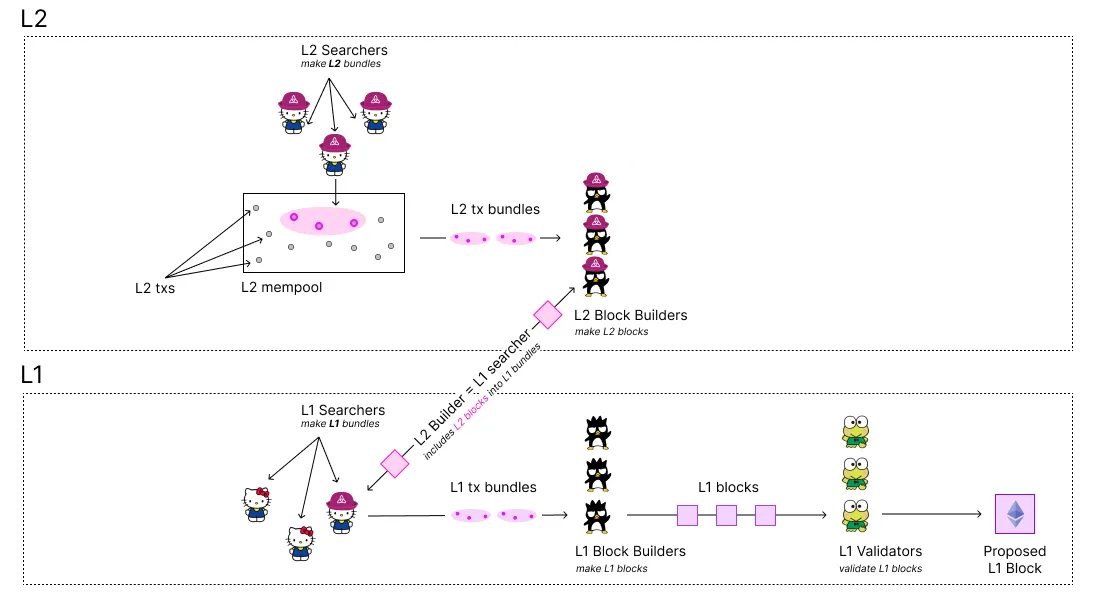

If an L2 network implements Based Rollups, the MEV flow would work as follows:

-

L2 searchers bundle L2 transactions and send them to L2 block builders.

-

L2 block builders create L2 blocks and forward them to L1 searchers, who can include them as part of an L1 bundle.

-

It’s important to note that when L2 blocks are sent to L1, they must be transmitted via private order flow; otherwise, MEV could be stolen.

In summary, if L1 searchers simultaneously monitor both L2 and L1 mempools, they can extract cross-layer MEV between Ethereum and L2 via Based Rollups, enabling the MEV value from L2 to accumulate within Ethereum.

4. Conclusion

As various Rollup networks evolve, growing concerns about sequencer centralization persist. While numerous projects aim to solve this, Justin Drake’s Based Rollups presents a refreshingly novel approach.

I’ve outlined some disadvantages above, but in my view, the greatest weaknesses of Based Rollups are profitability and slow finality. The sole incentive for Ethereum block producers to participate in Based Rollup sequencing is MEV revenue, which may not be sufficiently lucrative. While handling current centralized sequencer issues via Ethereum brings us closer to a true Rollup ideal, further research into incentive mechanisms and pre-confirmations is needed before Based Rollups can see widespread adoption.

Coinbase, the largest cryptocurrency exchange in the U.S., has launched its own Rollup network—Base—with two design goals: 1) no native token, and 2) decentralization. Base aims to achieve these through Optimism’s OP Stack, but both objectives could be more easily fulfilled by adopting the similarly named Based Rollups approach. If you're building a blockchain network and seeking high scalability and decentralization without issuing a token, Based Rollups may be an excellent choice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News