Celestia On-Chain Data Analysis: Only 0.1% of Data Capacity Utilized, Potentially Generating $5 Million Annual Fee Revenue at Full Capacity

TechFlow Selected TechFlow Selected

Celestia On-Chain Data Analysis: Only 0.1% of Data Capacity Utilized, Potentially Generating $5 Million Annual Fee Revenue at Full Capacity

This article discusses Celestia's fees, user demand, and pricing model.

Author: Dan Smith

Translation: TechFlow

In today's crypto landscape, modular blockchains have become a major narrative. Crypto researcher Dan Smith conducted an in-depth analysis of Celestia’s data usage and authored this detailed piece on Celestia's fees, user demand, and fee mechanisms. Below is TechFlow’s full translation.

Summary

-

Current user demand is very low, but that's not an issue. The team has successfully achieved RaaS integration.

-

Fees could be a long-term concern—where will sustainable demand come from?

-

First-price auctions are inefficient—Manta has proven this.

Background

Celestia is designed specifically as a data availability (DA) network. Compared to Ethereum—the current dominant DA layer—it can reduce data costs by 99.9%.

Users can publish arbitrary data into "blobs" under designated "namespaces." A blob contains the data itself and other key information, including the namespace acting as the blob ID.

Then, users can access the data by querying Celestia’s "blobspace" and filtering for specific namespaces.

Namespaces can be hex-encoded, base64-encoded, or plain text strings.

App developers, please use plain text strings without hesitation—this way we won’t have to guess which namespace your rollup is publishing to!

Current On-chain Activity

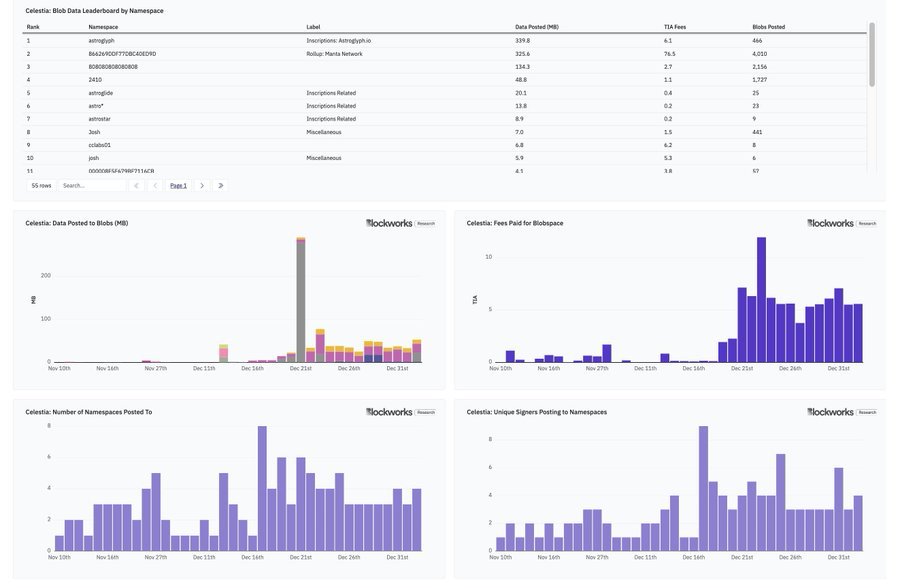

Celestia launched just two months ago. To date, users have published data into a total of 56 namespaces. We typically observe users publishing 30–50 MB of data daily across 3–6 namespaces.

87% of all data published to Celestia goes to just three namespaces:

-

Astroglyph—a铭文 service allowing users to post arbitrary data onto Celestia

-

MantaNetwork—an OP Stack Rollup launched alongside Caldera

-

808080808080808—an unknown namespace, but appears to belong to a rollup

By comparison, Ethereum currently hosts about 15 rollups publishing around 700 MB of data per day, with Arbitrum and OP Mainnet contributing approximately 120 MB and 80 MB per day respectively.

After EIP-4844 activation, Ethereum will support up to 5,400 MB of data per day.

Ethereum prioritizes scarce blockspace, while Celestia builds on abundant blockspace.

With 15-second block times and 8 MB blocks, Celestia’s network can currently support up to 46,080 MB of data per day. In other words, Celestia is currently using only 0.1% of its data capacity.

A mere 0.1% utilization, despite Celestia being only two months old. I don’t interpret this as a signal of insufficient demand.

Fees

Given the current 0.1% data utilization, total fees are clearly low. Celestia generates approximately 5 TIA (about $65) in daily fees.

This means Celestia users are paying between 0.024–0.24 TIA (or $0.31–$3.12) per MB of data published.

Fees are low now—but what about the future? If Celestia achieves full 46,080 MB daily data capacity at a TIA price of $13, the network would generate around $5.2 million in annual fees—65 times more than what is currently posted to Ethereum.

As usage grows, users may be forced into bidding wars, causing fees to rise along with users’ willingness to pay.

The network could vote to increase block size beyond 8 MB, but limitations from light node counts and the Cosmos SDK constrain maximum block size.

User Demand

So where will this 65x demand come from? High-TPS general-purpose chains, app-specific chains, or gaming?

It's hard to say, but even then, these projected fees remain negligible relative to the current valuation.

You can't point to clear sources of demand today, nor definitively state this as the driver of Celestia’s future growth—but that doesn't mean it won't happen.

My bet is on gaming + high-TPS rollups making the difference. EIP-4844 doesn't seem to enable L2s to achieve sub-cent transaction costs, but Celestia does.

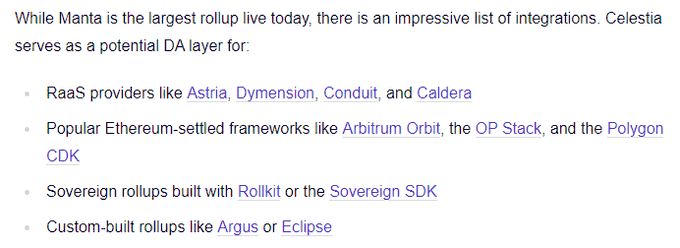

I believe it's evident that in the coming months, we’ll see a wave of new chains leveraging Celestia’s RaaS entering the market.

The Celestia team has done exceptionally well in integrations and marketing. Anyone building a rollup knows about Celestia and has the option to use it.

However, judging from early trends, most RaaS-built rollups may not offer users much long-term value.

So where will sustainable DA demand come from?

Fee Mechanism

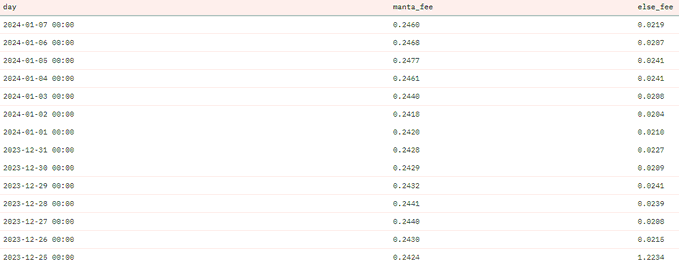

You may have noticed the wide variation in fees paid by users for publishing data—this is entirely driven by Manta Network, which pays 10x more than others!

Celestia uses a simple first-price auction fee mechanism, similar to Ethereum pre-EIP-1559. This design fails to provide users with a straightforward way to bid a fair price, leading to bidding wars and overpayment for blockspace.

(TechFlow note: "First-price auctions" are an auction format where the highest bidder wins the item and pays exactly their bid amount. This contrasts with the more common "second-price auction"—like those used on eBay—where the highest bidder wins but only pays the second-highest bid.)

In first-price auctions, bidders must be cautious—they need to balance placing a high enough bid to win against the risk of overpaying. This type of auction often requires bidders to speculate on others’ bids, increasing strategic complexity.

Since Celestia is built exclusively for DA, there are no competing transaction types or high-value DeFi transactions that could inflate DA posting gas costs, mitigating most concerns around the fee model.

Once existing data capacity reaches its limit, more sophisticated mechanisms can be prioritized.

All in all, I’m excited about what Celestia is doing. They have a strong team, a compelling vision, and a solid product. I’m not worried about low fees today, but I do think they need to iterate further on this. Integrating improved fee mechanisms might make more sense going forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News