LD Capital: Celestia Short-Term Liquidity Analysis

TechFlow Selected TechFlow Selected

LD Capital: Celestia Short-Term Liquidity Analysis

Although the unlock for other portions, such as TIA investors, won't occur until one year later, there is inflationary selling pressure on TIA.

Author: Lisa, LD Capital

I. Project Overview

Celestia is a modular blockchain project focused on data availability. Unlike monolithic blockchains that independently handle execution, settlement, consensus, and data availability, modular blockchains decouple these functions across multiple specialized layers as part of a modular stack—similar to LEGO blocks—offering greater flexibility and scalability for each module. Celestia’s base layer consists of consensus and data availability, referred to by the team as the DA Layer.

Celestia is a PoS blockchain built on CometBFT and the Cosmos SDK. The two key features of its DA Layer are Data Availability Sampling (DAS) and Namespaced Merkle Trees (NMT).

DAS enables light nodes to verify data availability without downloading entire blocks. Since light nodes only download block headers, they cannot natively verify data availability. To address this, Celestia uses a 2-dimensional Reed-Solomon erasure coding scheme to re-encode block data, enabling DAS for light nodes. DAS works by having light nodes perform multiple rounds of random sampling on small portions of block data. As more sampling rounds are completed, confidence in data availability increases. Once a light node reaches a predefined confidence threshold (e.g., 99%), the data is considered available.

NMT allows execution and settlement layers on Celestia to download only transactions relevant to them. Celestia divides block data into multiple namespaces, with each namespace corresponding to applications such as rollups built on Celestia. This way, each application only downloads its related data, improving network efficiency.

II. Funding Information

III. Economic Model

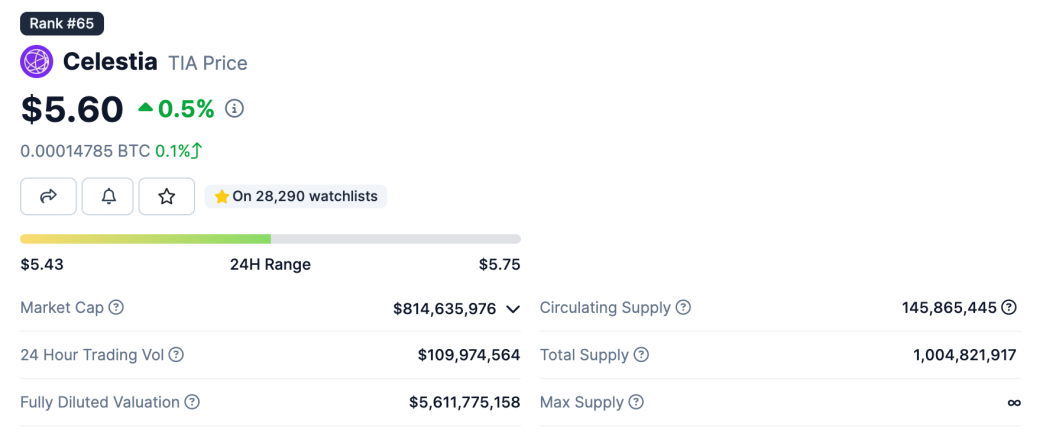

TIA is Celestia's native token with a total supply of 1 billion. The inflation rate is 8% in the first year, decreasing by 10% annually until it stabilizes at an annual inflation rate of 1.5%.

(1) Use Cases

1. Rollup developers must pay fees for using Celestia’s DA in TIA;

2. Similar to Ethereum, rollups built on Celestia will use TIA as gas fees;

3. Staking;

4. Governance.

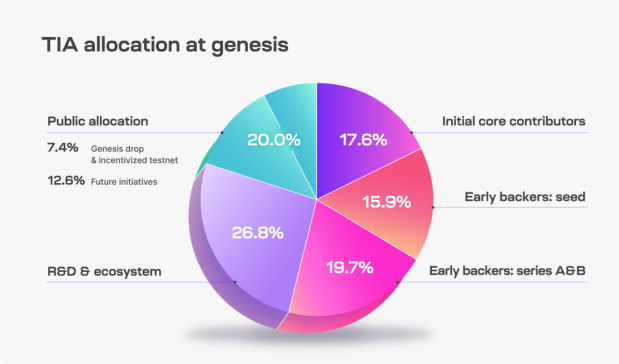

(2) Token Distribution and Vesting Schedule

On September 26, 2023, Celestia announced the launch of the Genesis Drop, allowing eligible participants to claim up to 60 million TIA starting October 17, 2023.

-

One-third of the Genesis Drop, or 20 million TIA, was allocated to 7,579 developers and researchers;

-

The remaining two-thirds were distributed to 576,653 on-chain addresses, including 20 million awarded to the most active users of Ethereum rollups and 20 million allocated to stakers and relayers of Cosmos Hub and Osmosis.

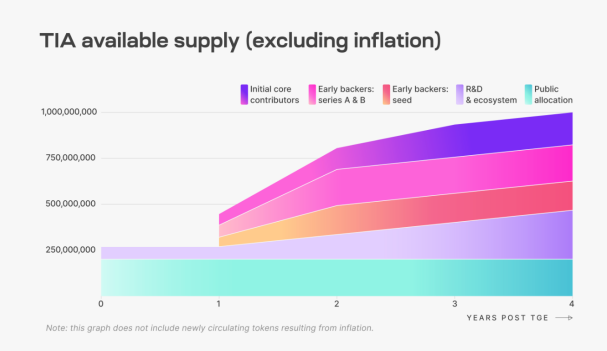

On October 31, 2023, Celestia deployed its testnet mainnet and distributed airdrops, marking the official launch of its modular network. Initial token circulation included 25% from research & development and ecosystem allocations plus 100% from public distribution, totaling 26.7% (=26.8%*25% + 20%). However, excluding the 12.6% designated for future initiatives within the public allocation, the effective circulating supply was 14.1%

(=26.7% - 12.6%), equivalent to 141 million tokens. Including inflation, this aligns with CoinGecko’s reported current circulating supply of 145 million TIA.

Although investor and other token allocations won’t unlock until one year after launch, there is selling pressure from inflation. The 8% annual inflation applies to the total supply of 1 billion, meaning 80 million new tokens will be issued within the first year—accounting for 56.7% of the initial circulating supply of 141 million. If distributed evenly over the year, this could result in daily selling pressure of approximately $1.227 million (at a price of $5.6), a factor often overlooked.

IV. Spot Market Data

TIA launched directly on major exchanges including Binance and OKX. Within the first 10 days post-listing, prices fluctuated slightly around $2.5. On November 11, the price surged strongly, initiating an upward trend and reaching a high of $7.4.

The concentration of holdings is centered at $2.47, followed by $5.9.

Recent trading volume has declined, returning to levels seen during the early consolidation phase after listing.

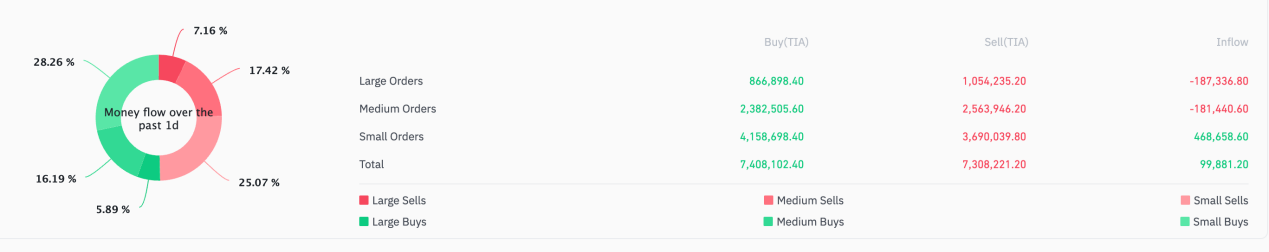

The current price sits at the Fibonacci retracement level of 0.618. On Binance, large traders have net sold 187,000 TIA, while retail investors have net bought 100,000 TIA.

V. Derivatives Market Data

OI/MC = 13.6%

Since prices began retreating from their peak, both CVD and open interest have declined simultaneously. The long-to-short ratio among holders and the large-account long-to-short ratio have both increased, now exceeding 1. There is a slight divergence between active buy/sell volumes and transaction counts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News