Detailed Analysis of AAVE V4 Upgrade: Restructuring Lending with Modularity, Can Old Tokens Welcome Another Spring?

TechFlow Selected TechFlow Selected

Detailed Analysis of AAVE V4 Upgrade: Restructuring Lending with Modularity, Can Old Tokens Welcome Another Spring?

This V4 update may help us understand its strong competitiveness in the DeFi space and the root cause behind its continuously growing transaction volume.

Author: San, TechFlow

On the evening of the 25th, AAVE founder Stani's announcement about the upcoming launch of AAVE V4 quickly drew significant attention and discussion. Meanwhile, the recent controversy between AAVE and WLFI over a 7% token allocation proposal has stirred widespread debate in the market.

For a time, market attention has converged on AAVE, this veteran lending protocol.

Although the dispute between AAVE and WLFI has yet to reach a final conclusion, behind this "farce" appears a different picture—"fleeting new tokens, enduring AAVE."

With an increasing number of new tokens emerging, and driven by stable on-chain demand for tokenized lending, AAVE undoubtedly possesses strong fundamentals and catalysts.

This V4 upgrade may help us understand its future competitiveness in the DeFi space and uncover the root causes behind its continuously growing transaction volume.

From Lending Protocol to DeFi Infrastructure

When discussing AAVE V4, we must first address a key question: why does the market have expectations for this upgrade?

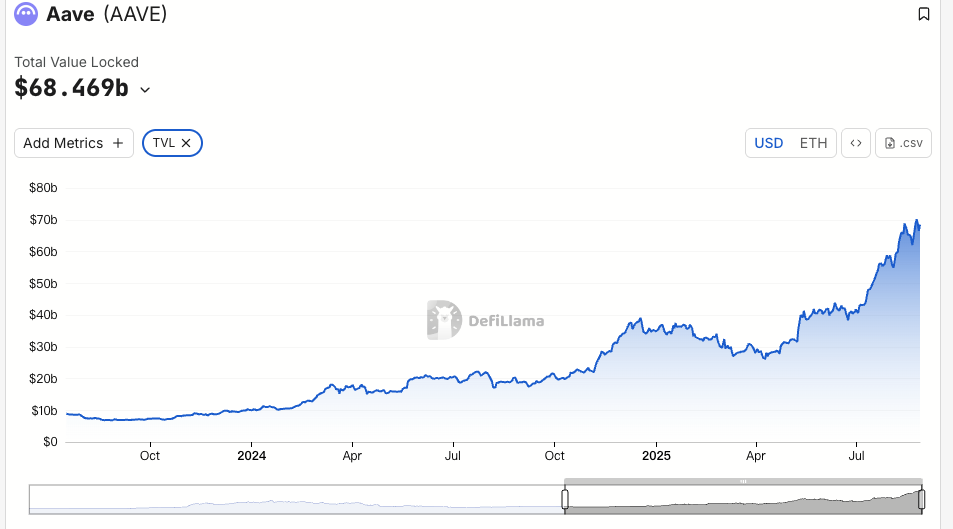

From ETHLend in 2017 to today’s DeFi giant with $38.6 billion in TVL, as a veteran protocol, each version update of AAVE has focused on optimization—and has不同程度 influenced the liquidity and usage patterns of on-chain assets.

The version history of AAVE is essentially the evolution of DeFi lending.

In early 2020, when V1 launched, total DeFi locked value was less than $1 billion. AAVE adopted liquidity pools instead of P2P models, transforming lending from "waiting for matching" into "instant execution." This change helped AAVE rapidly gain market share.

V2, released at the end of 2020, introduced core innovations: flash loans and debt tokenization. Flash loans fostered arbitrage and liquidation ecosystems, becoming a major revenue source for the protocol. Debt tokenization enabled position transfers, paving the way for yield aggregators. In 2022, V3 emphasized cross-chain interoperability, enabling more on-chain assets to enter AAVE and positioning it as a connector of multi-chain liquidity.

More importantly, AAVE has become a pricing benchmark. When designing interest rates, DeFi protocols refer to AAVE's supply-demand curves. New projects also benchmark against AAVE’s parameters when setting collateral ratios.

However, despite being infrastructure, V3's architectural limitations are becoming increasingly evident.

The biggest issue is fragmented liquidity. Currently, AAVE holds $60 billion in TVL on Ethereum, only $4.4 billion on Arbitrum, and even less on Base. Each chain operates as an isolated kingdom, preventing efficient capital flow. This not only reduces capital efficiency but also hinders the development of smaller chains.

The second issue is innovation bottlenecks. Any new feature requires going through the full governance process, which often takes months from proposal to implementation. In DeFi’s fast-iterating environment, this pace clearly lags behind market demands.

The third issue is unmet customization needs. RWA projects require KYC, GameFi needs NFT collateral, institutions need isolated pools. But V3’s uniform architecture struggles to meet these diverse requirements. It’s either all-inclusive or entirely restrictive—no middle ground.

These are the core problems V4 aims to solve: how to transform AAVE from a powerful yet rigid product into a flexible, open platform.

V4 Upgrade

Based on publicly available information, V4’s core improvement involves introducing a "Unified Liquidity Layer," adopting a Hub-Spoke model to fundamentally change existing technical designs and even business models.

Image source @Eli5DeFi

Hub-Spoke: Solving the “Both-And” Dilemma

In simple terms, the Hub aggregates all liquidity, while Spokes handle specific operations. Users always interact through Spokes, and each Spoke can have its own rules and risk parameters.

What does this mean? It means AAVE no longer needs one-size-fits-all rules. Instead, different Spokes can serve different needs.

For example, Frax Finance could create a dedicated Spoke that only accepts frxETH and FRAX as collateral, with more aggressive parameters; meanwhile, an "institutional Spoke" might only accept BTC and ETH, require KYC, but offer lower interest rates.

Two Spokes share liquidity from the same Hub but maintain risk isolation from each other.

The elegance of this architecture lies in solving the “both-and” dilemma: both deep liquidity and risk isolation; both centralized management and flexible customization. These were previously contradictory within AAVE, but the Hub-Spoke model allows them to coexist.

Dynamic Risk Premium Mechanism

Besides the Hub-Spoke architecture, V4 introduces a dynamic risk premium mechanism, revolutionizing how lending rates are set.

Unlike V3’s uniform rate model, V4 dynamically adjusts rates based on collateral quality and market liquidity. For instance, highly liquid assets like WETH enjoy base rates, while more volatile assets like LINK incur additional premiums. This mechanism is automatically executed via smart contracts, enhancing protocol security and making borrowing costs fairer.

Smart Accounts

V4’s smart account functionality makes user operations more efficient. Previously, users had to switch wallets across different chains or markets, making complex position management time-consuming and laborious. Now, smart accounts allow users to manage multi-chain assets and lending strategies through a single wallet, reducing operational steps.

A user can now adjust WETH collateral on Ethereum and borrow on Aptos within the same interface, without manual cross-chain transfers. This simplified experience enables both retail users and professional traders to participate in DeFi more easily.

Cross-Chain and RWA: Expanding the Boundaries of DeFi

V4 enables near-instant cross-chain interactions via Chainlink CCIP and supports non-EVM chains like Aptos, allowing more assets to seamlessly connect to AAVE. For example, a user can collateralize assets on Polygon and borrow on Arbitrum—all within a single transaction. Additionally, V4 integrates real-world assets (RWA), such as tokenized government bonds, opening new pathways for institutional capital to enter DeFi. This not only expands AAVE’s asset coverage but also makes the lending market more inclusive.

Market Reaction

Although AAVE followed the broader crypto market decline this week, its rebound strength today is明显 stronger than other top DeFi assets.

After this week’s market crash, AAVE tokens saw a 24-hour trading volume of up to $18.72 million, far exceeding Uni’s $7.2 million and Ldo’s $3.65 million, reflecting investors’ positive response to protocol innovation. Increased trading activity further enhances liquidity.

TVL provides a more direct measure of market recognition. Compared to early August, AAVE’s TVL surged 19% this month, approaching nearly $70 billion—a record high—and currently ranks first in TVL on the Ethereum chain. This growth significantly outpaces the average DeFi market performance. The rise in TVL also validates the effectiveness of AAVE’s V4 multi-asset support strategy, possibly indicating quiet institutional inflows.

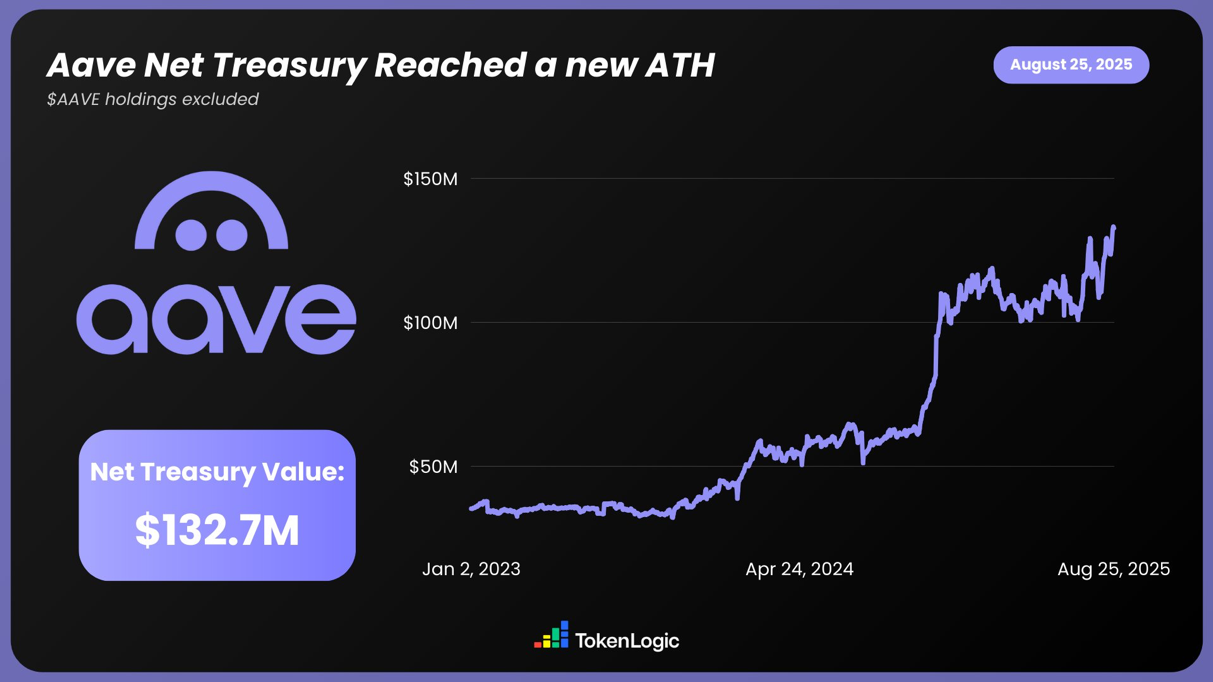

According to TokenLogic data, AAVE’s net asset value has reached a new high of $132.7 million (excluding AAVE token holdings), growing approximately 130% over the past year.

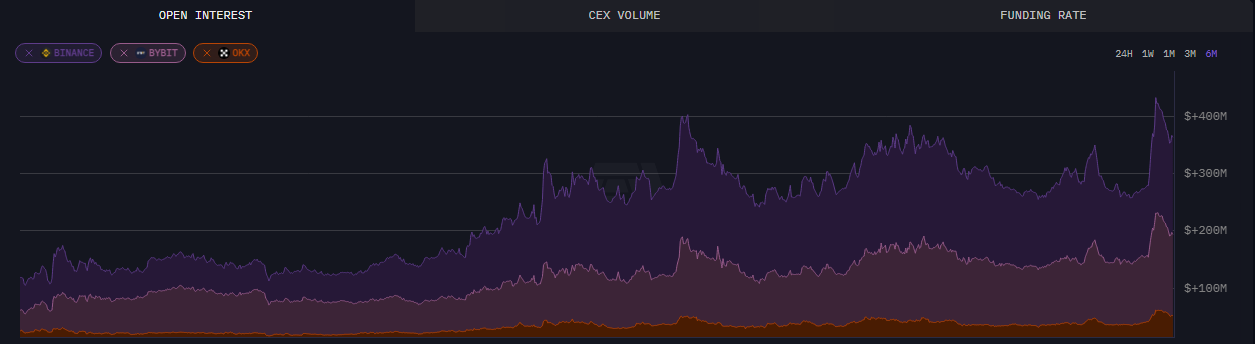

On-chain data shows that as of August 24, outstanding contracts on AAVE exceeded $430 million, hitting a six-month high.

Beyond raw numbers, AAVE’s upgrade has sparked extensive community discussion. The preliminary information released about V4 has received substantial support and approval, especially regarding capital utilization and composable DeFi, revealing greater possibilities and potential to the market.

Make DeFi Great Again

Considering the disclosed updates, AAVE’s upgrade could very well elevate the DeFi market to a new level. Modular architecture, cross-chain expansion, and RWA integration—not only ignite market enthusiasm but also drive price and TVL increases.

Its founder Stani also appears confident about V4’s impact on the DeFi sector post-upgrade.

Perhaps in the near future, AAVE will soar with the tailwinds of rising liquidity from the coming crypto bull market, unlocking infinite possibilities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News