Top Lending Protocol +ETH/SOL Staking Leader's Financial Statements Fully Dissected: Has a Certain Project Not Been Profitable for Five Years?

TechFlow Selected TechFlow Selected

Top Lending Protocol +ETH/SOL Staking Leader's Financial Statements Fully Dissected: Has a Certain Project Not Been Profitable for Five Years?

A deep dive into the financial statements of a leading lending protocol and the +ETH/SOL staking leader, revealing the truth behind the project's operations from a data perspective.

Author: @chingchalong02

TL;DR

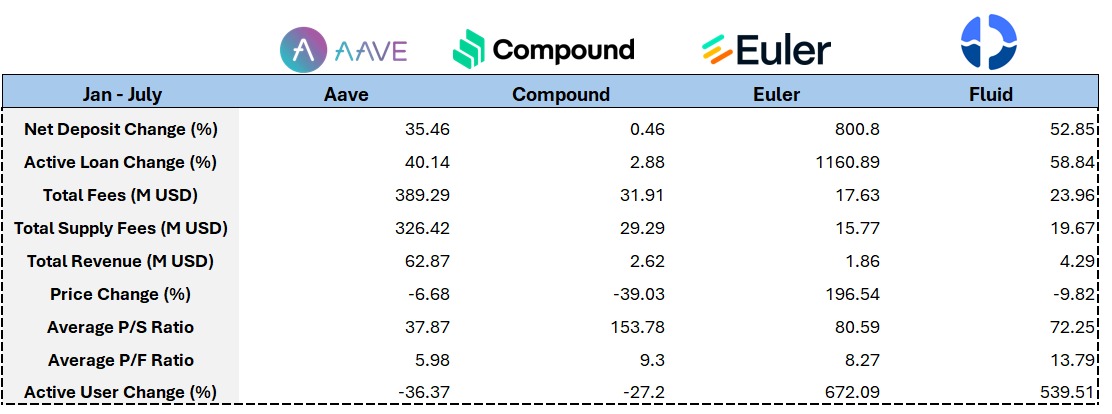

- Circular lending has become a mainstream DeFi activity, driving fundamentals of underlying lending platforms while phasing out protocols that fail to keep up with trends.

- Euler Finance surged ahead with its EVK framework enabling anyone to deploy lending vaults, resulting in explosive growth in both fundamentals and token price. Future deployment of RWA asset lending could serve as another catalyst.

- Aave benefited from the launch of USDe + PT-USDe, the Umbrella mechanism, and cross-chain issuance of GHO, leading to steady data growth in the first half of the year.

- Lido Finance’s revenue model creates an illusion of success, but long-term sector potential will be unlocked by Wall Street’s demand for ETH staking yields.

- Jito demonstrated strong performance starting Q2 2025, driven by its MEV infrastructure capabilities, dominant jitoSOL position, and future developments in restaking applications on Jito.

Where do lending protocols earn fees?

Fees primarily come from total interest paid across all borrowing positions—whether open, closed, or liquidated. This interest income is distributed proportionally between liquidity providers and the DAO treasury.

In addition, when a borrowing position exceeds its predefined LTV threshold, the protocol allows liquidators to execute liquidation. Each asset type carries a specific liquidation penalty, and the protocol seizes collateral assets and auctions them off—or uses Fluid’s "liquidity clearing" mechanism.

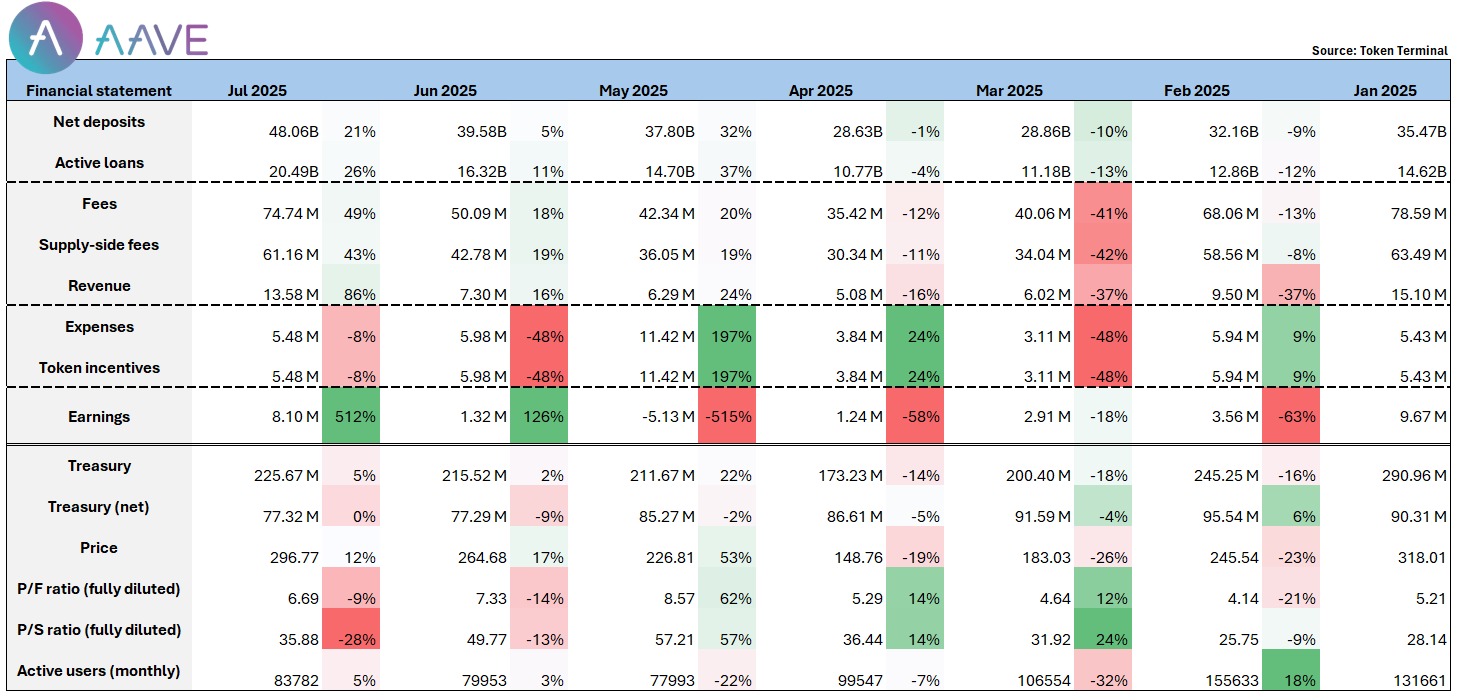

What can we learn from Aave's financial statements?

@aave's protocol fees and revenue peaked at the beginning of the year, then gradually declined alongside broader market corrections. In my view, the rebound in data after May was largely driven by the launch of USDe and PT-USDe, as the largest-scale circular lending demand this cycle stems from PT-type assets offered by Pendle and the stablecoin launched by Ethena.

Data shows that shortly after PT-sUSDe launched, nearly $100 million in supply was rapidly deposited into Aave markets.

Additionally, the Umbrella mechanism officially went live in June and has since attracted ~$300M in deposits under protection. Meanwhile, the cross-chain issuance of Aave’s native stablecoin GHO continues to expand (current circulating supply ~$200M), broadening its multi-chain use cases.

Driven by multiple positive catalysts, Aave achieved a comprehensive breakthrough in July:

- Net deposits surpassed $4.8B, ranking first across all platforms;

- Protocol net profit surged nearly fivefold month-on-month in June, reaching ~$8M;

- Based on P/S and P/E ratios, Aave remains undervalued within its sector.

Given current growth momentum and product maturity, more traditional institutions are expected to adopt Aave as their DeFi platform. Across fee income, TVL, and protocol profitability, Aave is well-positioned to set new records and solidify its leadership in DeFi.

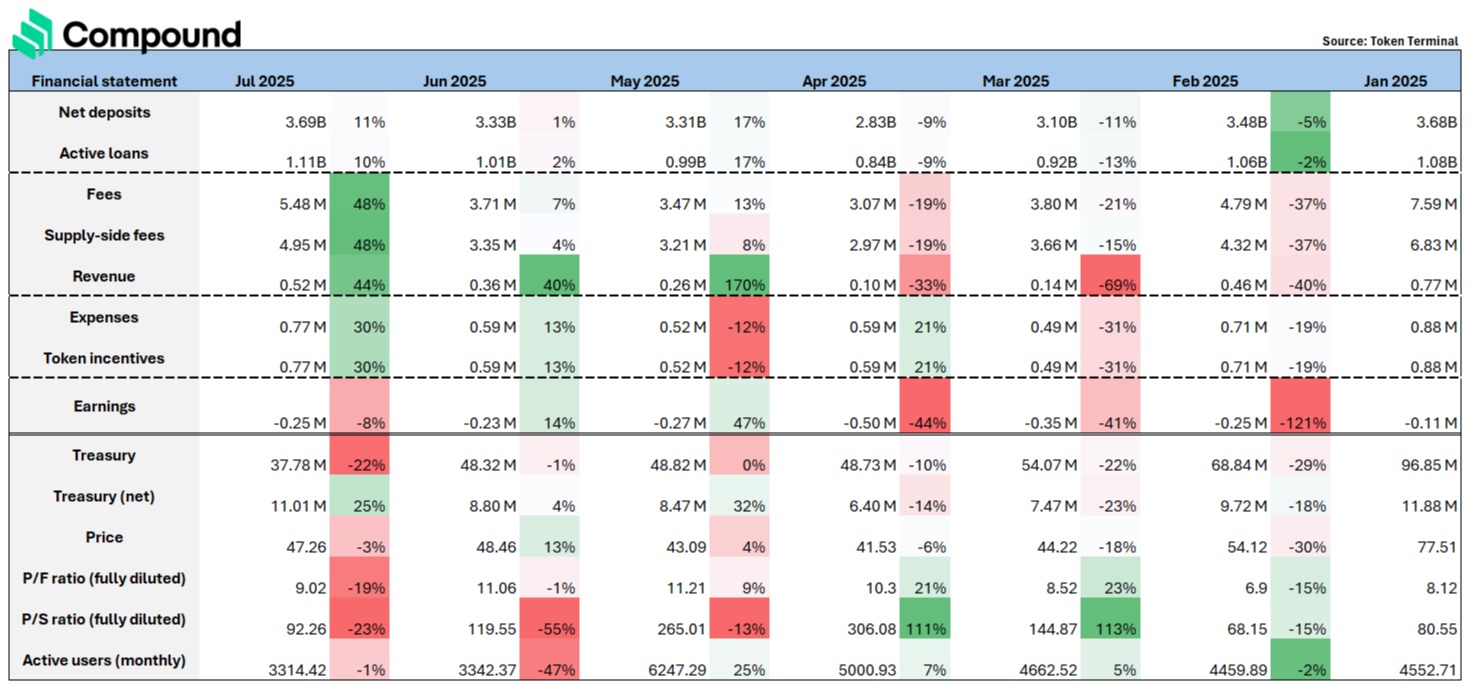

Are there signs of decline visible in Compound's financial statements?

@compoundfinance, despite being a veteran lending protocol, clearly lags behind Aave in asset diversity and market responsiveness. Aave closely follows market trends and supports various re-staked ETH assets (e.g., rETH, ETHx, cbETH), staked BTC (e.g., lBTC, tBTC), and Pendle’s PT-type assets—all of which remain unsupported on Compound.

Limited asset support restricts Compound’s lending strategies, leaving it without viable circular lending use cases or composability, resulting in low user retention and capital utilization. Financially, Compound has recorded continuous losses since the start of 2025, with protocol net earnings remaining in the –$0.11M to –$0.25M range, while its token price has dropped approximately 40% cumulatively.

In today’s DeFi ecosystem, circular lending has become foundational, giving rise to specialized base-layer lending protocols such as @EulerFinance, @MorphoLabs, and @SiloFinance, which focus on supporting complex leverage structures and composability. The absence of such functionalities means Compound is gradually losing mainstream circular lending users.

Financial reports also show Compound’s TVL grew only marginally (+0.46%) over the past six months, with no significant improvement in revenue. Its performance gap relative to @Aave continues to widen, highlighting delays in product evolution and ecosystem integration. Without accelerated progress in asset support and feature expansion, Compound risks further marginalization in the DeFi lending space.

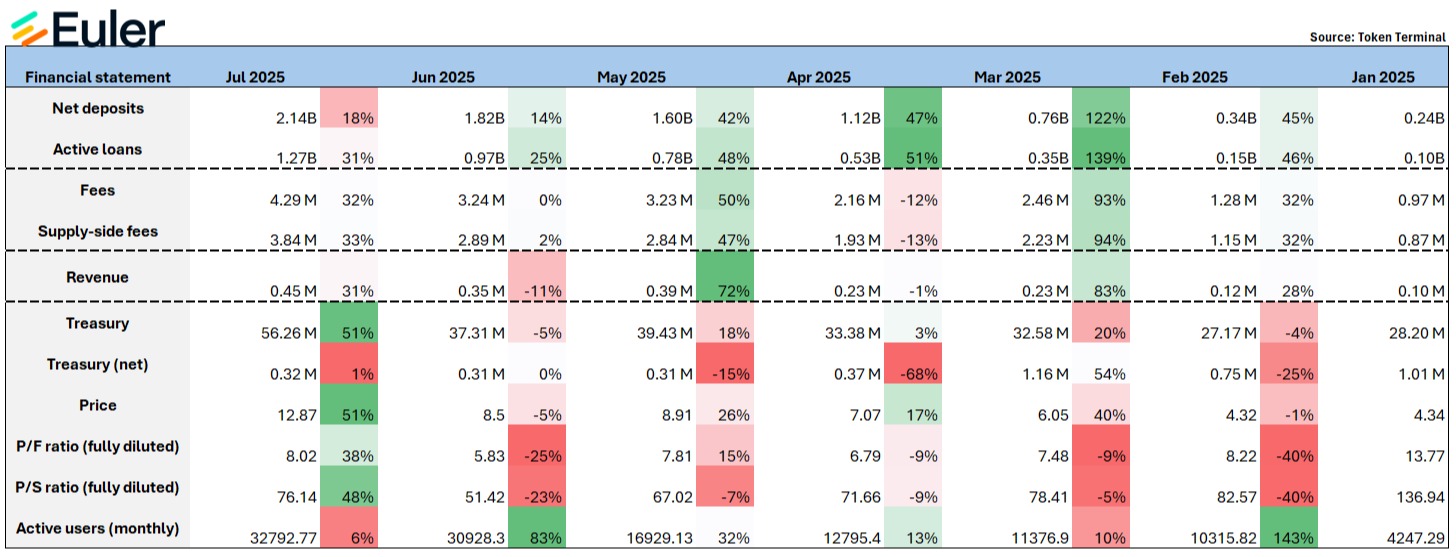

Euler’s TVL / revenue / token price all show significant increases

A key feature of @eulerfinance is allowing any developer or protocol to build custom vaults using EVK (Euler Vault Kit) and integrate them into Euler’s credit ecosystem. This functionality perfectly aligns with the current cycle’s dominant lending practices, enabling lending for various long-tail assets. This greatly expands revenue sources for project teams and enhances user engagement in lending activities.

Similar to Aave, after launching PT-USDe—the largest-scale circular lending asset in the current market—in April, Euler recorded approximately 72% growth in monthly revenue and 42% growth in TVL, demonstrating strong performance.

Across H1, Euler ranked among the fastest-growing protocols in terms of TVL and active lending volume, with TVL increasing by 800% and active borrowing surging 1160%, breaking through strongly in the lending sector.

The project actively collaborates with projects running airdrop campaigns and incentive platforms (e.g., @TurtleDotXYZ, @Merkl_XYZ), aligning closely with another major trend this cycle—points and airdrop economics—using incentive mechanisms to boost user deposit and borrowing activity on the platform.

This strategy has proven highly effective: protocol fees rose from $0.1M to $0.45M, and the token price increased by ~200% during the same period.

As a modular, composable, and permissionless credit infrastructure, EVK’s potential extends far beyond its current state. If the team successfully integrates another major market trend—RWA assets—into Euler’s lending framework, its TVL could experience exponential growth.

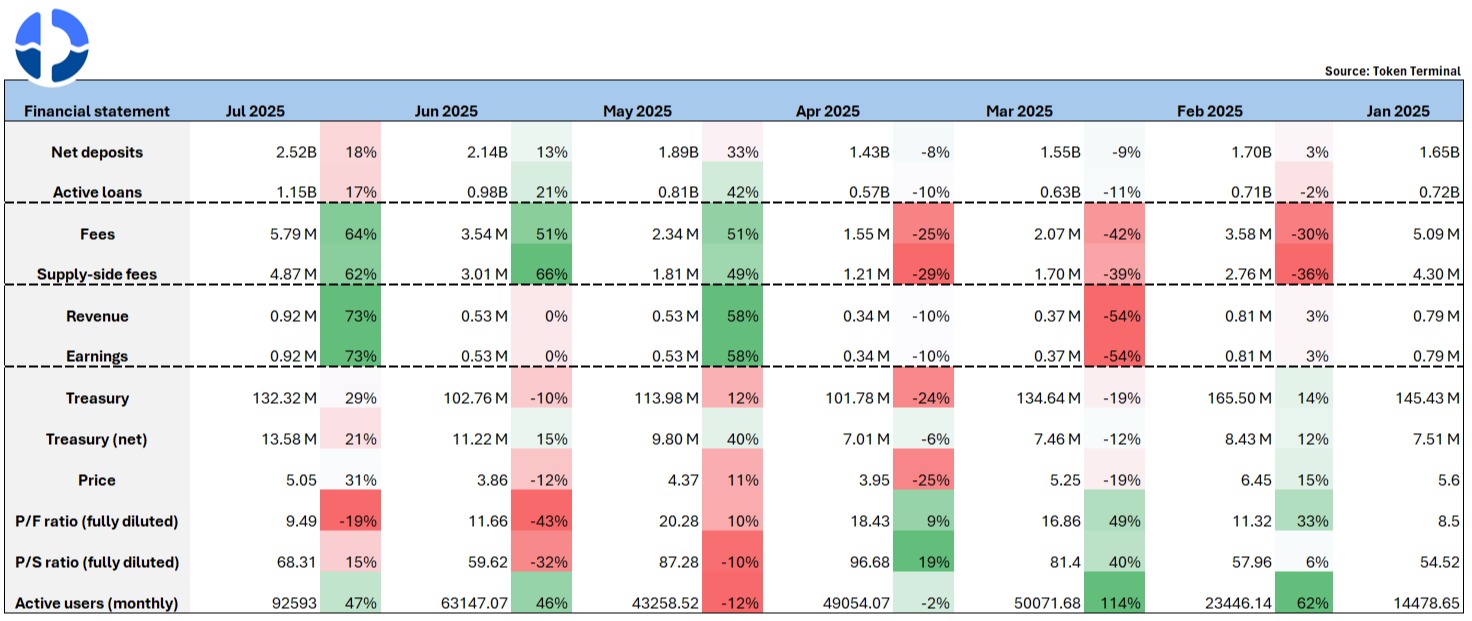

Fluid’s technical moat drives optimistic fundamental growth

@0xFluid is the second-fastest growing lending protocol after Euler, with TVL rising ~53% since the beginning of the year and now roughly matching Euler’s locked value. Its rapid rise stems from innovative lending mechanism design and superior capital efficiency.

Smart collateral and smart debt represent the project’s core technical advantages, allowing direct collateralization of LP assets (e.g., ETH/wstETH, USDT/USDC). Moreover, borrowed debt isn’t a single asset but automatically rebalanced LP pairs. After borrowing, these debts are deployed into liquidity markets to generate trading revenue—effectively reducing the borrower’s net borrowing cost.

This design optimizes borrowers’ interest expenses, offering generally lower rates than traditional models. Additionally, Fluid supports higher average LTV limits than Aave and charges only a 3% liquidation penalty (compared to Aave’s 5%), achieving capital efficiency comparable to Aave’s e-mode.

Fluid also natively supports “one-click circular lending,” with the feature built into the frontend for operations like pledging ETH, borrowing stablecoins, and re-pledging. Given relatively attractive deposit yields, even large holders opt to keep substantial funds deposited long-term for stable annualized returns.

Aave participated early in Fluid’s token investment, purchasing FUID tokens with $4M and promoting the integration of its native stablecoin GHO into Fluid’s pools. This move reflects recognition of Fluid’s product model and represents a positive bet by a competitor on its growth potential.

Protocol revenue increased modestly from $790K to $930K in H1, showing stable financial improvement. However, the token slightly declined during the same period, mainly due to insufficient token utility and lack of a clear buyback mechanism. Despite strong protocol performance, value capture for the token remains an area needing improvement.

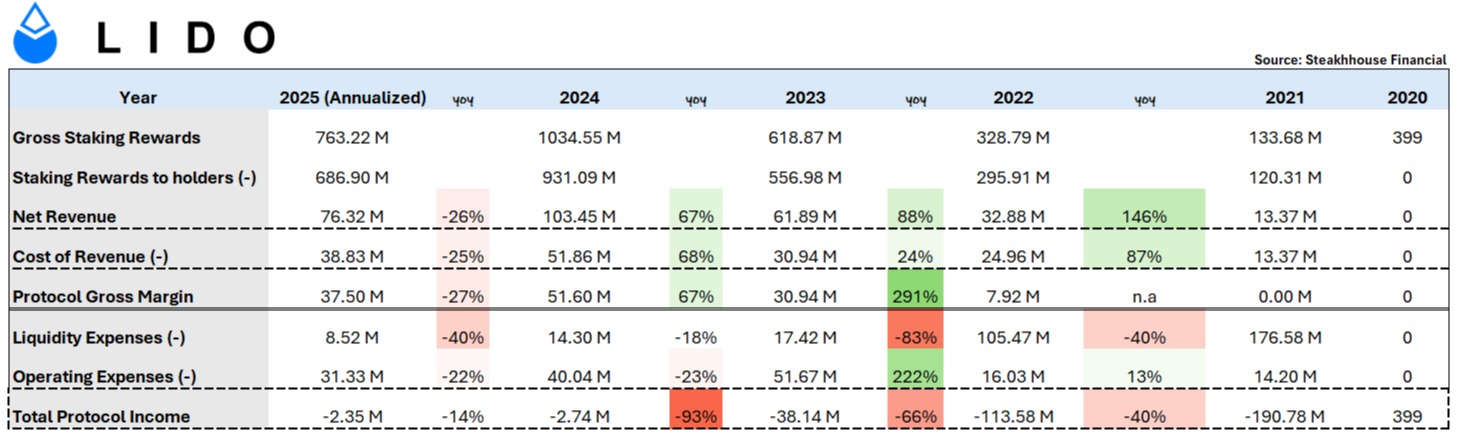

How does the financial statement of Lido, hailed as ETH Beta, look?

@LidoFinance currently has ~8.8M ETH staked, valued at ~$33B, representing ~25% of total ETH staking and 7% of all ETH. It effectively holds more ETH than any other project in the space (sharplink: ~440K ETH; bitmine ~833K ETH).

"Leader in ETH staking"—this narrative inevitably ties Lido to ETH Beta. However, the project has faced a persistent issue since inception: it has never been profitable over its five-year lifespan.

To understand why, we must examine the line items in its financial statements.

Staking Rewards to holders: Lido acts merely as an aggregator of retail ETH, setting up validator nodes and distributing staking rewards proportionally to participants.

Thus, a significant portion of the rewards earned are not retained by Lido. For example, in 2024, Lido earned $1.034B in staking rewards, of which $931M was distributed to stakers—consistent with its fee structure allocating rewards to stakers (90%), node operators (5%), and the Lido DAO treasury (5%).

-

Cost of Revenue: Includes node rewards and slashing penalties, costs borne by Lido

-

Liquidity Expense: Costs associated with providing LP liquidity

-

Operational Expense: LEGO Grant and TRP (Token Rewards Plan) are two ecosystem funding and incentive frameworks. The former is an external grant program supporting community or developer proposals beneficial to Lido; the latter is an internal token incentive plan rewarding core contributors to the DAO

On the positive side, Lido has improved cost control in recent years. Liquidity Expense has steadily decreased, reaching ~$8.5M in 2025, while Operating Expense has declined by ~20% annually since 2023. Combined with significant revenue growth in 2023/2024 (88%/67%) and falling costs, project-level losses have sharply reduced (-66%/-93%), narrowing to just ~$2M this year.

What’s next for Lido?

It may seem harsh to criticize Lido’s revenue level given its status as “leader in ETH staking,” yet losses persist despite declining costs. The primary constraint? The 10% fee rate is an industry standard and unlikely to change.

The only variable factor is market size—specifically, the amount of ETH staked. Compared to Solana, Sui, Avax, or ADA, ETH’s staking ratio remains relatively low. A key macro catalyst will be Wall Street’s growing demand for ETH staking yield. Blackrock, for instance, has already applied to add staking functionality to its iShares ETH ETF.

Once this precedent is set, ETH staking will become a new yield source for institutions. Holding ETH reserves that also generate yield provides an additional cash flow. If institutions prefer the largest provider—Lido (or possibly Coinbase, or institution-backed staking projects like Puffer)—it would mark a pivotal moment in unlocking the sector’s ceiling. Of course, as staking rates rise, ETH issuance rewards will eventually be diluted.

There are also DAO proposals to introduce revenue-sharing for staking LDO, aiming to enhance token utility and long-term value accrual. However, this approach clearly risks further weakening project-level income, undermining sustainable development. Alternatively, the “excess surplus sharing mechanism” proposed by some DAO members appears more reasonable.

Jito’s unique revenue model - MEV tips

@jito_sol, the leader in SOL staking, shows significantly better financial performance compared to Lido analyzed earlier—at least on the surface. Jito currently manages ~16M SOL in staked assets (jitoSOL), accounting for ~23% of the network total.

The ceiling for the sector—SOL’s staking ratio—is already relatively high among L1s (67.18%). Notably, since October last year, Jito has provided foundational infrastructure services for liquid restaking, enabling various restaking solutions. Providers of VRT (Vault Receipt Tokens), such as @fragmetric140 and @RenzoProtocol, operate atop Jito’s infrastructure.

I believe liquid restaking will be Jito’s primary growth vector moving forward. Currently, only ~1.1M SOL are restaked—about 6% of Jito’s staked SOL and 2% of total network staked SOL. By comparison, ETH’s restaking-to-staking ratio stands at ~26%, indicating ample room for growth and a segment Jito must capture.

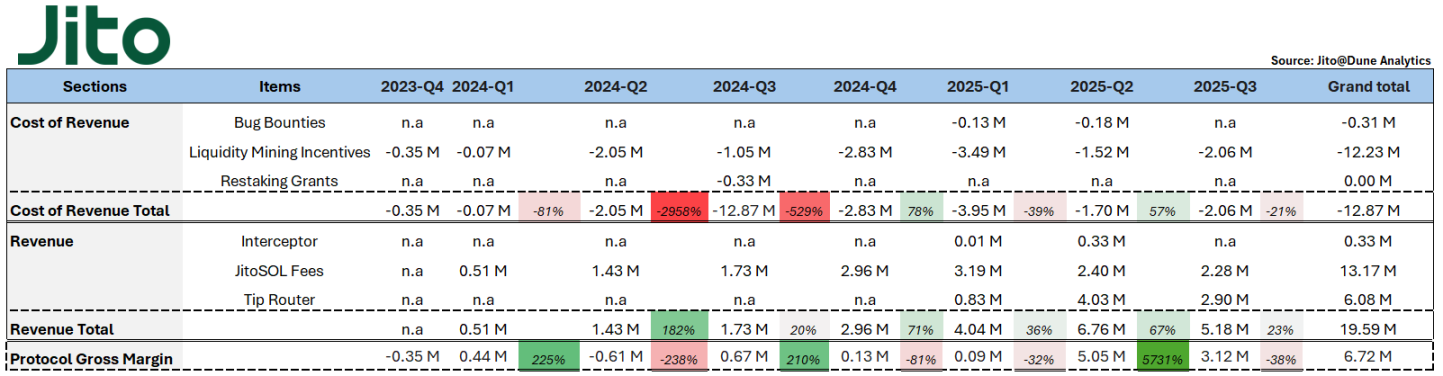

Returning to Jito’s financial report, here’s an explanation of its expense and revenue items:

-

Bug Bounties: Expenses to incentivize discovery and reporting of protocol vulnerabilities. Valid bugs submitted by white-hat hackers receive rewards

-

Liquidity Mining Incentives: Rewards for users providing liquidity for JitoSOL or VRT trading pairs on DeFi platforms like Orca and Jupiter

-

Restaking Grants: Funding distributed to Node Consensus Network (NCN) developers to support the development, deployment, and operation of restaking infrastructure

-

Interceptor Fees: A mechanism preventing short-term arbitrage by holders of other liquid staking tokens against JitoSOL. Affected JitoSOL holdings are temporarily frozen for 10 hours; users can bypass the freeze by paying a 10% fee

-

JitoSOL Fees: JitoSOL charges a 4% management fee on staking rewards and MEV gains (calculated after validator commissions). This equates to an annual management cost of ~0.3% (7% APY * 4%) on user-deposited SOL

-

Tip Routers: MEV accumulates as tips each epoch and is distributed via TipRouter. The protocol takes 3% of MEV transaction tips as fees—2.7% goes to the DAO treasury, 0.15% to JTO stakers, and 0.15% to JitoSOL holders

So... what strategies can we observe from the foundation based on Jito’s financial statements?

First, examining expenses: Liquidity Incentives have consistently been Jito’s largest expense. Costs spiked starting Q2 2024 and have remained around $1M–$3M per quarter since.

This surge stems from foundation-proposed JIP-2 and JIP-13, which allocate $JTO to incentivize usage across various DeFi applications (primarily on @KaminoFinance). Since Q2 2024, JitoSOL revenue has visibly increased. I interpret this as higher efficiency in using JitoSOL for DeFi looping → greater incentive to stake SOL as JitoSOL → more JitoSOL → higher staking revenue.

Starting in 2025, the foundation proposed allocating another 14M JTO (~$24M) toward continued incentives, particularly targeting emerging restaking assets and related DeFi activities, aiming to boost VRT adoption.

By Q3 2025, ~7.7M JTO had already been disbursed as incentives. The impact has been significant: quarterly revenues rose by 36%, 67%, and 23% respectively—outpacing the rate of incentive distribution—proving this to be a positive EV proposal.

On the revenue side, JitoSOL Fees and Tip Router constitute Jito’s two main income streams. Starting Q4 2024, fueled by the meme coin boom in the Solana ecosystem, network transaction volume surged, making Jito the top beneficiary.

At its peak, Jito’s tips accounted for 41.6% to 66% of Solana’s REV (Real Economic Value). Since Q2 2025, Tip Router revenue has surpassed JitoSOL Fees, underscoring Jito’s technical moat in MEV infrastructure. Solana users and arbitrageurs willingly pay tips to prioritize transactions—an economic model rarely seen on other blockchains.

The combination of rising Solana transaction volume, operational strength in MEV infrastructure, jitoSOL’s market-leading position, and future growth in restaking applications on Jito propelled the project’s net profit into a breakout phase in Q2 2025, increasing 57-fold quarter-on-quarter to ~$5M. Although the current meme hype isn't as intense as the 2024 pump.fun frenzy, I believe that if Solana’s restaking ecosystem matures further, it could become Jito’s next major catalyst.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News