Lido lays off 15% as Ethereum staking war enters second half

TechFlow Selected TechFlow Selected

Lido lays off 15% as Ethereum staking war enters second half

As ETH continues to flow from retail investors to institutions, the survival space for decentralized staking platforms is being continuously squeezed.

Author: TechFlow

On August 4, Vasiliy Shapovalov, co-founder of decentralized staking platform Lido, announced a 15% workforce reduction.

This news clearly defies expectations at a time when nearly everyone believes an institutional-driven ETH bull market is imminent, and the SEC has shown signs of approving ETH spot ETF staking applications.

As one of the leading projects in the ETH staking sector, Lido might be seen by many as the biggest beneficiary should the SEC approve ETH staking ETFs—but is that really the case?

Lido’s recent layoffs are not just a simple organizational adjustment; they resemble a microcosm of the entire decentralized staking sector facing a turning point.

The official explanation is “long-term sustainability and cost control,” but what it reflects is a deeper industry shift:

As ETH continues flowing from retail investors into institutional hands, the survival space for decentralized staking platforms is shrinking.

Let’s rewind to 2020, when Lido had just launched and ETH2.0 staking was in its infancy. The 32-ETH staking threshold deterred most retail users, but Lido’s innovation—liquid staking tokens (stETH)—allowed anyone to participate in staking while maintaining liquidity. This simple yet elegant solution enabled Lido to grow rapidly into a staking giant with over $32 billion in TVL within just a few years.

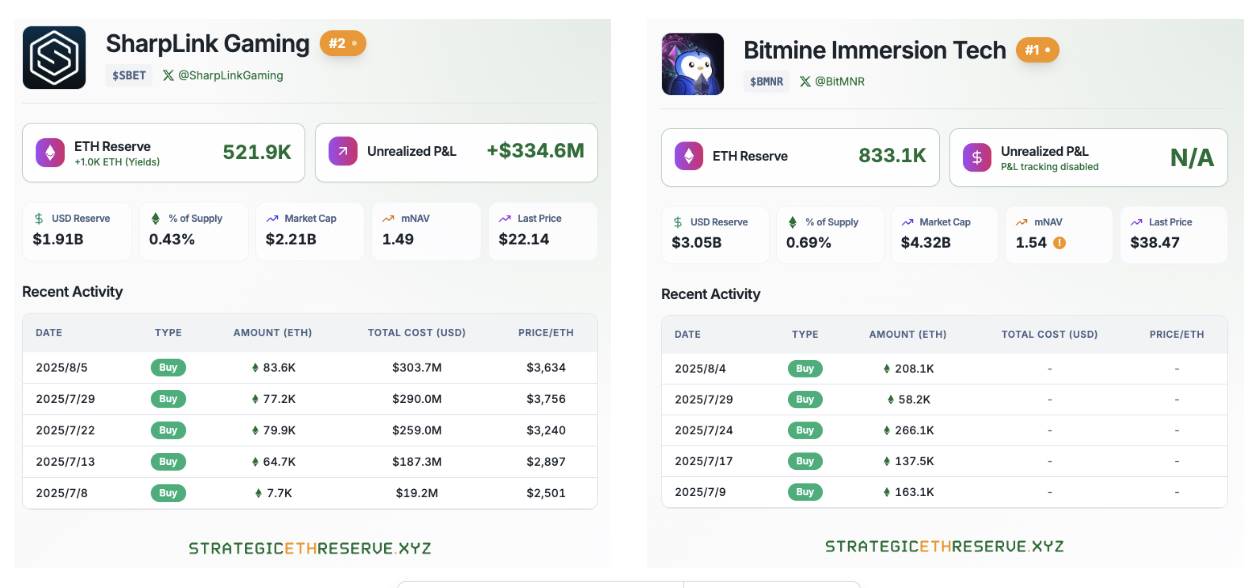

However, changes in the crypto market over the past two years have shattered Lido’s growth narrative. As traditional financial giants like BlackRock begin entering ETH staking, institutional investors are reshaping the market using their familiar frameworks. The key players in this institution-led ETH bull run have each chosen their own approach: BMNR opted for Anchorage, SBET chose Coinbase Custody, and BlackRock and other ETFs all adopted offline staking.

Without exception, they favor centralized staking solutions over decentralized ones. Behind these choices lie considerations around compliance and risk appetite, but the end result is the same: the growth engine of decentralized staking platforms is “sputtering out.”

Institutions Turn Left, Decentralized Staking Turns Right

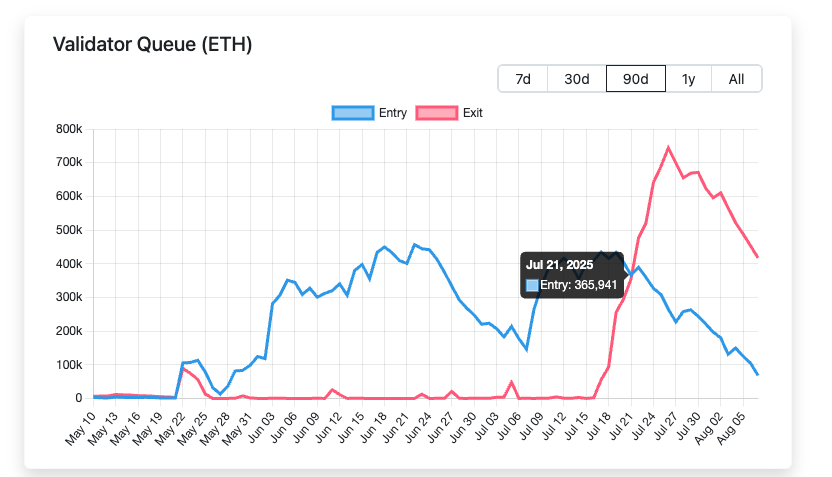

To understand institutional decision-making, consider this data: starting July 21, 2025, the number of ETH queued for unstaking began significantly exceeding new staking deposits, with the peak difference reaching as high as 500,000 ETH.

Meanwhile, ETH strategic reserve firms led by BitMine and SharpLink are continuously purchasing ETH in bulk. Currently, these two companies alone hold over 1.35 million ETH combined.

Wall Street institutions like BlackRock are also steadily accumulating ETH following the SEC's approval of ETH spot ETFs.

Based on this data, one conclusion is undeniable: ETH is steadily moving from retail holders into institutional hands. This dramatic shift in ownership structure is redefining the rules of the entire staking market.

For institutions managing billions in assets, compliance is always the top priority. When reviewing BlackRock’s ETH staking ETF application, the SEC explicitly required proof that the staking service provider met standards for compliance, transparency, and auditability.

This directly exposes the weak spot of decentralized staking platforms. Node operators on platforms like Lido are scattered globally. While this decentralized structure enhances censorship resistance, it makes regulatory compliance extremely complex. Imagine regulators demanding KYC information for every validator node—how would a decentralized protocol respond?

In contrast, centralized solutions like Coinbase Custody are much simpler. They have clear legal entities, established compliance procedures, traceable fund flows, and even insurance coverage. For institutional investors accountable to LPs, the choice is obvious.

When assessing staking options, institutional risk management teams focus on one core question: Who takes responsibility when something goes wrong?

In Lido’s model, losses caused by operator errors are shared among all stETH holders, making accountability difficult. In centralized staking, the service provider assumes clear liability and often offers additional insurance protection.

More importantly, institutions need more than just technical security—they demand operational stability. When Lido replaces node operators via DAO voting, such “popular voting” appears unpredictable to institutions. They prefer predictable, controllable partners.

Regulatory Relief, But Not Entirely Positive

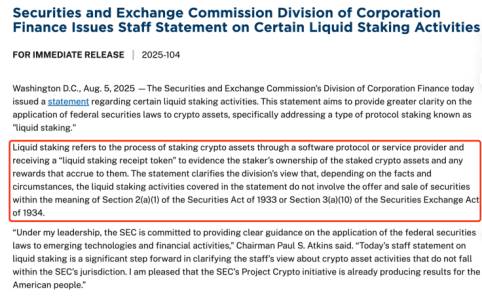

On July 30, the SEC acknowledged receipt of BlackRock’s ETH staking ETF filing. Then on August 5, the SEC issued new guidance stating that certain liquid staking activities fall outside the scope of securities regulation.

Everything seems to be trending positively. On the surface, this is the long-awaited利好 for decentralized staking platforms. Yet upon closer examination, it may also be a sword of Damocles hanging over them.

The short-term benefits of regulatory easing are evident. Immediately after the announcement, tokens of major decentralized staking platforms like Lido and ETHFI surged over 3%. As of August 7, PRL, a liquid staking asset, rose 19.2% in 24 hours, while SWELL gained 18.5%. These price increases reflect market optimism about the LSD sector and, more importantly, signal that the SEC’s stance removes compliance barriers for institutional investors.

Historically, traditional financial institutions hesitated to engage in staking due to potential securities law risks. Now that much of this uncertainty has lifted, SEC approval of ETH staking ETFs appears increasingly inevitable.

Yet beneath this flourishing landscape lies a deeper crisis for the sector.

Regulatory easing doesn’t just open doors for decentralized platforms—it paves the way for traditional financial titans. When asset managers like BlackRock launch their own staking ETFs, decentralized platforms will face unprecedented competitive pressure.

The asymmetry lies in resource and channel disparities. Traditional financial institutions possess mature sales networks, brand trust, and compliance expertise—advantages decentralized platforms cannot match in the short term.

Crucially, ETF products offer standardization and convenience that naturally appeal to average investors. When investors can buy staking ETFs with one click through familiar brokerage accounts, why go through the trouble of learning how to use decentralized protocols?

The core value proposition of decentralized staking—decentralization and censorship resistance—appears weak against the tide of institutionalization. For institutions focused on maximizing returns, decentralization is more of a cost than an advantage. They care most about yield, liquidity, and ease of use—precisely where centralized solutions excel.

In the long run, regulatory easing could accelerate the "Matthew effect" in the staking market. Capital will concentrate in a few large platforms, leaving smaller decentralized projects struggling to survive.

An even deeper threat comes from business model disruption. Traditional financial institutions can leverage cross-selling and economies of scale to reduce fees—even offering zero-cost staking. Decentralized platforms, reliant on protocol fees, are at a natural disadvantage in price wars. How can single-revenue-model decentralized platforms compete when rivals can subsidize staking through other business lines?

Thus, while SEC regulatory relief brings short-term market expansion opportunities for decentralized staking platforms, in the long term, it may be unleashing Pandora’s box.

The entry of traditional finance will fundamentally change the game. Before being marginalized, decentralized platforms must find new paths to survival. This may require more aggressive innovation, deeper DeFi integration, or—ironically—some degree of centralization compromise.

At this moment of regulatory spring, decentralized staking platforms may not be celebrating—they may be facing a make-or-break turning point.

Crisis and Opportunity in the Ethereum Staking Ecosystem

At this pivotal moment in 2025, the Ethereum staking ecosystem is undergoing unprecedented transformation. Vitalik’s concerns, regulatory shifts, and institutional influx—these seemingly contradictory forces are reshaping the entire industry landscape.

The challenges are real: the shadow of centralization, intensifying competition, and business model disruption—each could be the final straw breaking the back of decentralized ideals. Yet history shows true innovation often emerges from crisis.

For decentralized staking platforms, the institutional wave is both a threat and a catalyst for innovation. When traditional giants offer standardized products, decentralized platforms can focus on deep integration within the DeFi ecosystem. When price wars become unavoidable, differentiated services and community governance can become new moats. And when regulations open doors for all, technological innovation and user experience will become even more critical.

More importantly, market expansion means the overall pie is growing. When staking becomes a mainstream investment choice, even niche markets can support multiple thriving platforms. Decentralization and centralization don’t have to be zero-sum; they can serve different user groups and meet diverse needs.

Ethereum’s future won’t be determined by any single force, but shaped collectively by all participants.

Tides rise and fall—only the adaptable survive. In crypto, the definition of “the adaptable” is far more diverse than in traditional markets. Perhaps that’s exactly why we should remain optimistic.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News