A protocol collapses, three major lending platforms get "locked in"

TechFlow Selected TechFlow Selected

A protocol collapses, three major lending platforms get "locked in"

Don't put all your eggs in one basket.

Author: thedefinvestor

Translation: Baihua Blockchain

Last week was a terrible week for DeFi.

It wasn't just because of the market crash. Last week:

-

Balancer, a top-tier DeFi protocol, was exploited, losing $128 million

-

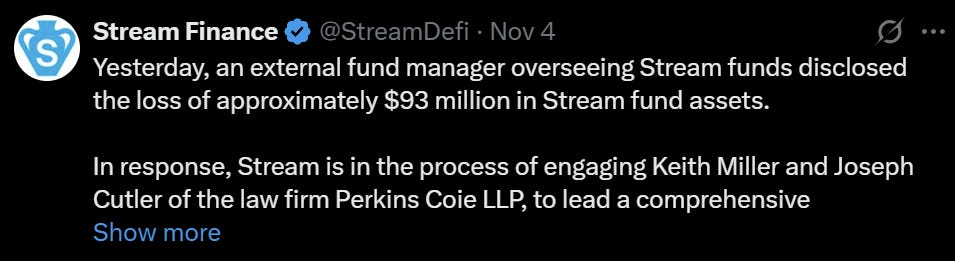

Stream Finance, a protocol primarily generating yield through stablecoins, announced the loss of $93 million in user assets and is preparing to declare bankruptcy

-

Moonwell lost $1 million in an attack

-

Peapods' Pod LP TVL (Total Value Locked) dropped from $32 million to $0 due to liquidations

So far, the most devastating has been Stream Finance's collapse.

Because it didn't just affect its depositors—it also impacted stablecoin lenders on some of the largest lending protocols in the space, including Morpho, Silo, and Euler.

In short, here’s what happened:

CBB, a well-known figure on CT (Crypto Twitter), started advising people to withdraw from Stream due to its lack of transparency.

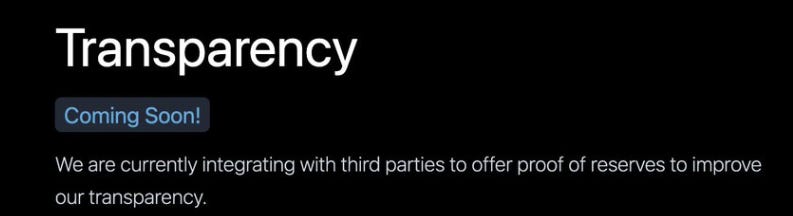

Stream claimed to be running a "DeFi market-neutral strategy," but users couldn't monitor its positions, and its transparency page remained "coming soon."

This triggered a bank run, with massive withdrawals attempted simultaneously.

Stream Finance halted withdrawals because it had secretly lost a significant amount of user funds ($92 million) shortly before and could no longer meet withdrawal demands.

This caused the price of xUSD—the interest-bearing "stablecoin" issued by Stream—to collapse.

This already sounds bad, but the story doesn’t end there.

A major issue is that xUSD was listed as collateral on money markets like Euler, Morpho, and Silo.

Worse, Stream had been using its own so-called stablecoin, xUSD, as collateral to borrow funds from these money markets to execute its yield strategies.

Now that xUSD’s price has collapsed, many lenders who supplied USDC/USDT on Euler, Morpho, and Silo—lending against xUSD collateral—can no longer withdraw their funds.

According to DeFi user coalition YAM, at least $284 million in DeFi debt across major money markets is tied to Stream Finance!

Unfortunately, a large portion of this money may be unrecoverable.

And just like that, many stablecoin lenders have suffered severe losses.

What can we learn from this?

For the past 2-3 years, I’ve been deeply involved in farming DeFi protocols.

But after these recent events, I plan to reevaluate my DeFi portfolio positions and become more risk-averse.

Yield farming can be highly profitable. I’ve earned substantial returns over the past few years, but incidents like this can lead to massive losses.

I have several suggestions:

Always verify the exact source of yields

Stream isn’t the only DeFi protocol claiming to generate returns via a "market-neutral strategy." Always look for transparency dashboards or proof-of-reserves reports where you can clearly see the team isn’t gambling with your assets.

Don’t blindly trust a protocol just because its team appears reputable.

Consider whether the risk-reward ratio is good enough

Some stablecoin protocols offer 5–7% APR (Annual Percentage Rate). Others may offer over 10%. My advice: don’t blindly deposit funds into the highest-yielding protocol without proper research.

If the strategy lacks transparency or the yield generation process seems too risky, it’s not worth risking your capital for double-digit annual returns.

Or if the yield is too low (e.g., 4–5% APR), ask yourself whether it’s worth it.

No smart contract is zero-risk—we've even seen established applications like Balancer get hacked. Is it worth taking the risk for a low APY?

Don’t put all your eggs in one basket

As a general rule, I never deposit more than 10% of my portfolio into a single dApp.

No matter how attractive the yield or potential airdrop may seem. That way, if a hack occurs, the impact on my financial situation remains limited.

In summary, when building your portfolio, prioritize survival over profits.

Better safe than sorry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News