From Store of Value to Economic Engine: How Bitcoin-backed Lending Could Spark the Next Crypto Boom?

TechFlow Selected TechFlow Selected

From Store of Value to Economic Engine: How Bitcoin-backed Lending Could Spark the Next Crypto Boom?

BTC lending is not about turning Bitcoin into a speculative yield engine, but rather aims to unlock the utility of high-value assets.

Author: arndxt

Translation: Block unicorn

Introduction

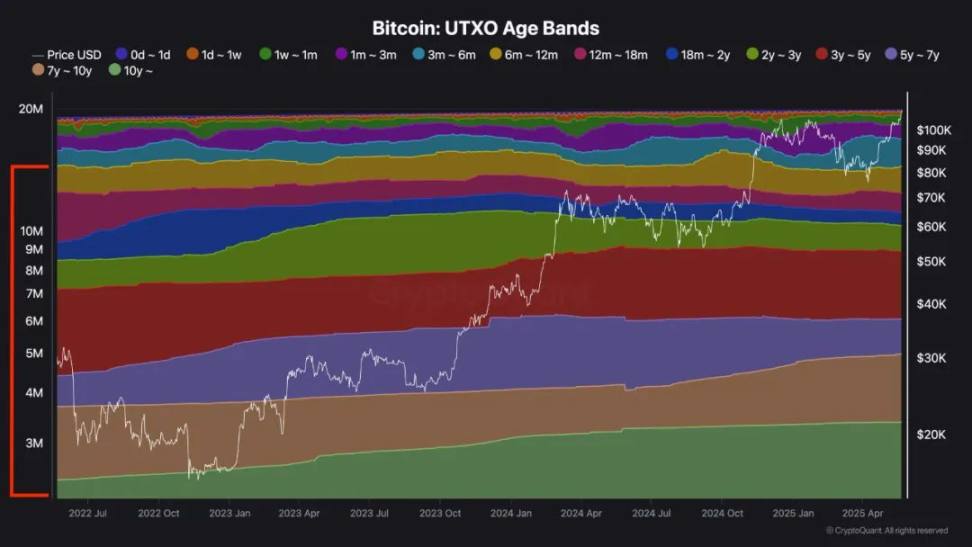

Over the past six months, more than 63% of the Bitcoin supply has remained unchanged.

Chart source: @cryptoquant_com

This represents a massive pool of idle capital.

Such high holding rates reflect strong confidence in the asset, but also indicate inefficiency.

Bitcoin shares these two characteristics with another traditional store of value—gold.

When I previously wrote about BTCfi, some pointed out that, like gold, Bitcoin struggles to support an ecosystem built upon it.

Their argument is that stores of value are meant to be held, not used. Therefore, BTCfi will hit a bottleneck and demand will significantly decline.

Despite its long history, gold's liquidity remains largely static.

Most gold is held by central banks and institutions, sitting idle in vaults with extremely low yields. Additionally, access to the gold market is typically limited to large participants, and the costs of storing, transferring, and verifying gold are high.

Gold is a physical asset; moving it is costly and lacks composability required by the modern digital economy.

In contrast, Bitcoin is inherently digital and programmable.

It can be instantly verified, transferred, or locked on-chain, offering full transparency. Unlike gold, Bitcoin can seamlessly integrate into both decentralized and traditional financial systems.

With this in mind, we will now explore one of the most effective ways to unlock Bitcoin’s idle capital and make it productive.

Bitcoin-backed lending.

BTC lending does not aim to turn Bitcoin into a speculative yield engine, but rather to unlock the utility of a high-value asset. With $BTC trading around $110,000, over $1.37 trillion worth of BTC is currently idle and waiting to be utilized.

The industry is flourishing, supported by the rise of regulated custodians in the U.S. and Canada, who hold spot Bitcoin on behalf of investors.

Bitcoin ETFs currently hold $129.2 billion worth of BTC, representing 6% of the total supply (source: @SoSoValueCrypto).

Beyond liquidity, interest in Bitcoin lending is growing due to tax advantages for holders seeking yield (see next section).

Individual and institutional borrowers are increasingly using these tools as part of their capital management. As Bitcoin becomes a core asset in institutional portfolios, these players are looking for better ways to unlock its value without selling it.

Now, let’s dive into why institutional players favor BTC lending and how big this opportunity truly is.

Advantages of Bitcoin-Backed Lending

1. Access liquidity while maintaining long exposure

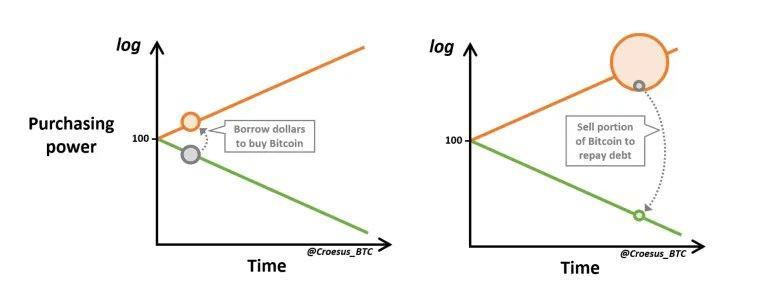

The core advantage of Bitcoin-backed lending is simple: they allow investors to unlock liquidity without selling BTC.

Borrowers retain potential upside from Bitcoin while gaining cash to meet immediate financial needs.

Image source: @Croesus_BTC

Bitcoin’s appeal to various investors is evident. Over the past 5 years, Bitcoin’s compound annual growth rate (CAGR) has been 63%, compared to 14% for gold and 14% for the S&P 500.

For example, in the chart below, you can see $ANFI (a 73%-27% combination of gold and Bitcoin) created by @NEX_Protocol, which outperforms traditional assets while eliminating Bitcoin-specific volatility.

Chart source: @NEX_Protocol

2. Tax advantages

Bitcoin-backed lending can offer significant tax benefits in jurisdictions like the United States.

In this context, the IRS classifies cryptocurrency as property, meaning that selling Bitcoin typically triggers capital gains taxes on any appreciated value.

However, when Bitcoin is used as collateral for a loan, holders can gain liquidity without triggering a taxable event, thus deferring capital gains taxes.

Moreover, if borrowed funds are used for investment or business purposes, interest payments may also be tax-deductible.

In short, Bitcoin-backed lending allows investors to maintain long exposure, defer taxes, and in some cases, reduce taxable income through deductible interest expenses.

3. Deep liquidity

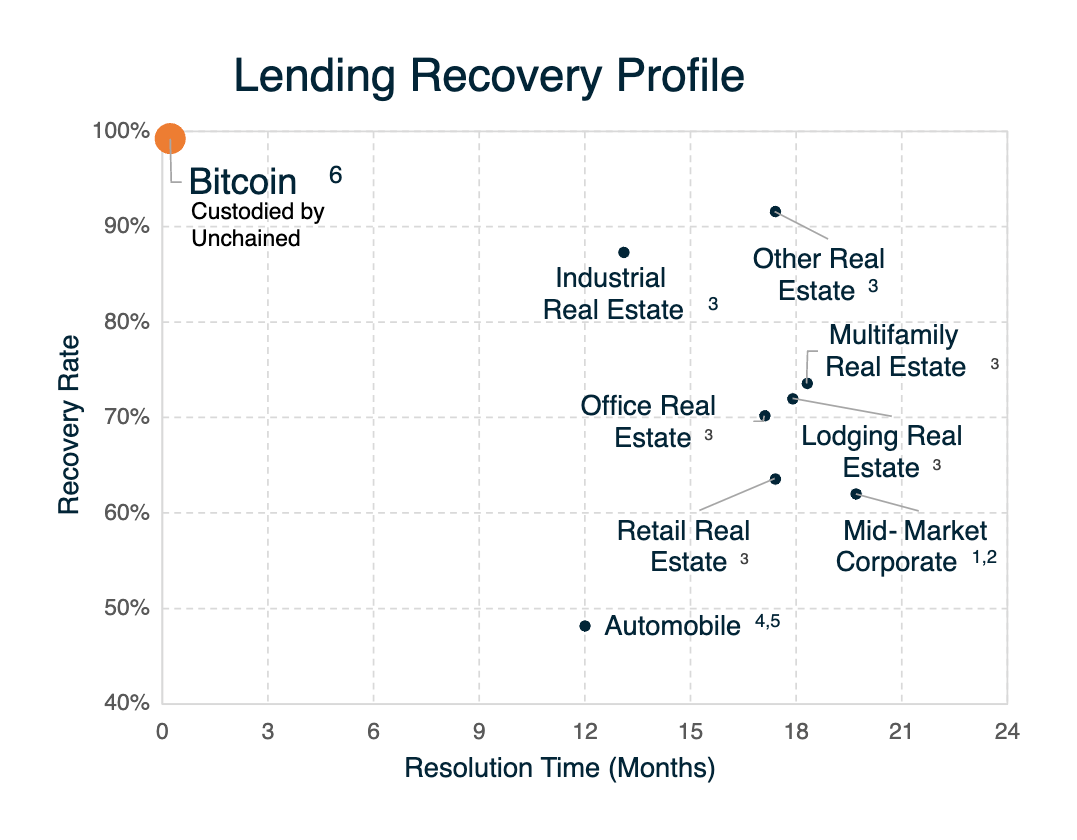

Bitcoin’s deep market liquidity distinguishes it from other assets used as loan collateral, especially crypto-native assets.

Borrowers can access funds without significant slippage, while lenders have backing in an asset that maintains high liquidity even during periods of increased volatility.

4. Importance of decentralization

The Bitcoin network has proven its immunity to attacks, disruptions, and failures over more than a decade of uninterrupted operation—issues that have affected other blockchain ecosystems and traditional banks, such as:

-

Silicon Valley Bank collapsed in 2023, wiping out over $200 billion in assets.

-

Terra ($LUNA) imploded in 2022, vaporizing over $60 billion in capital.

-

Solana has experienced over seven network outages since 2021.

This resilience builds trust among borrowers, lenders, and institutions relying on Bitcoin as collateral.

5. Borderless collateral

Unlike traditional assets such as stocks or real estate, which are constrained by local market dynamics and regional risks, Bitcoin holds globally interchangeable value.

Whether you're in New York, Sydney, or Bangkok, 1 BTC always equals 1 BTC.

This global fungibility eliminates friction from currency conversion, jurisdictional restrictions, and geographic premiums, making it an ideal cross-border collateral asset.

6. 24/7 management

Bitcoin trades 24 hours a day, 7 days a week, year-round. This ensures collateral valuation is always accessible and loans can be managed at any time.

This is a clear distinction from traditional assets, which rely on market trading hours and may experience valuation gaps over weekends or after market closures.

7. Risk diversification

Bitcoin-backed lending offers institutional players a way to diversify their lending portfolios, potentially hedging against traditional market risks.

As with any lending, the quality and liquidity of collateral are crucial.

Bitcoin’s characteristics enable institutions to act swiftly in case of default, enabling faster capital recovery and maintaining a robust risk profile.

Unlocking Latent Capital

As of May 2025, approximately 63% of Bitcoin has not moved in the past six months. With a total market cap of about $2.2 trillion, this means $1.4 trillion in capital is idle.

To put this in perspective, $1.4 trillion exceeds the combined value of:

-

Total Value Locked (TVL) across all DeFi chains - $119 billion

-

All circulating stablecoins - $244 billion

-

Ethereum's market cap - $319 billion

-

JPMorgan Chase's market cap - $724 billion

Releasing just 5–10% of this idle Bitcoin would inject $70–140 billion into the crypto space, enough to reshape lending markets, fuel DeFi growth, and unlock liquidity for tokenized assets and new financial primitives.

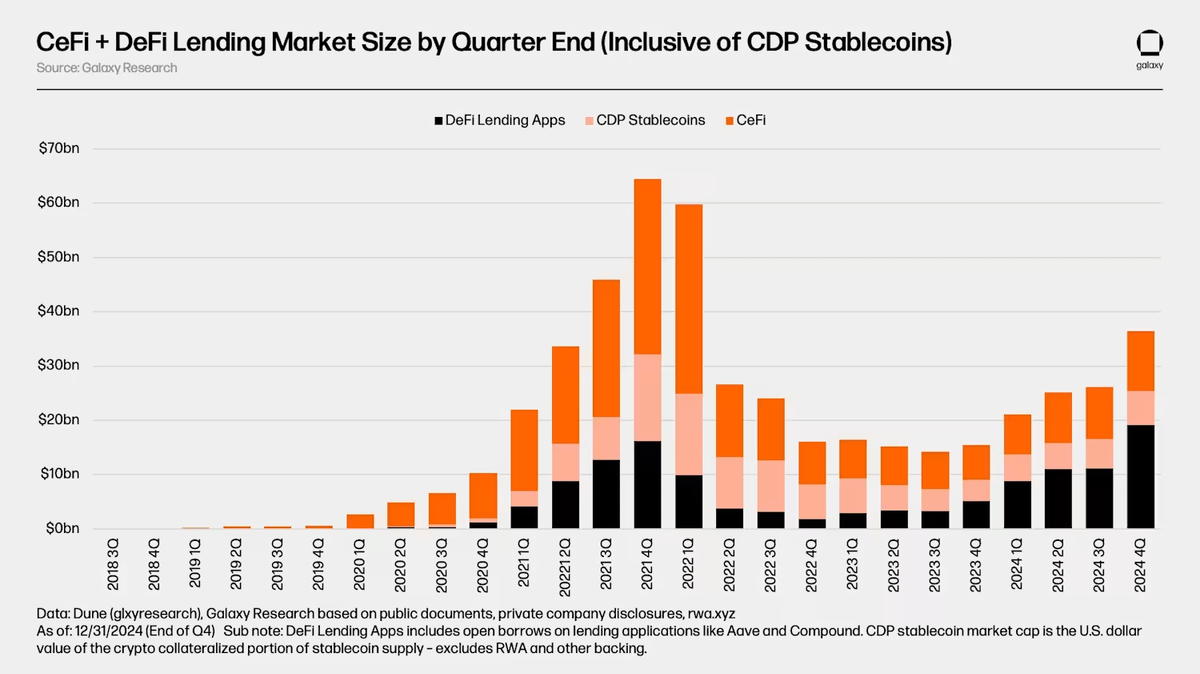

@galaxyhq highlighted another point: CeFi and DeFi lending markets peaked at around $64 billion in Q4 2021.

Source: “State of Crypto Lending” – @galaxyhq

This means that unlocking even 5% of idle Bitcoin capital would surpass historical highs, injecting over $70 billion into the sector.

At this scale, Bitcoin-backed lending would rival the credit divisions of most major U.S. national banks and even exceed the entire banking sectors of smaller countries.

Finally, on this topic, Bitcoin also has the potential to fill a larger gap: the global credit gap for micro, small, and medium enterprises (MSMEs).

The World Bank estimates this gap exceeds $5 trillion, particularly in emerging markets across Africa, Southeast Asia, and Latin America.

Many businesses and individuals in these regions struggle to access affordable lending due to:

-

Weak banking infrastructure

-

High inflation or currency instability

-

Lack of formal credit history

-

Overcollateralization requirements

-

Limited access to international capital

Even a small portion of this $5 trillion gap being addressed using Bitcoin as collateral could create massive ripple effects.

Having discussed the advantages and opportunities, fairness demands we also examine potential risks associated with using Bitcoin as collateral.

Challenges to Be Aware Of

1. Hidden taxes

Many lending protocols require users to use wrapped versions of BTC as collateral. However, this process may trigger a taxable event. In certain jurisdictions, wrapping is considered a disposal of the original asset (treated as a taxable sale), thereby incurring capital gains tax.

This complexity, combined with technical friction introduced by wrapping technology, may deter many users from using DeFi lending platforms, pushing them toward CeFi solutions, which often support native BTC.

It should also be noted that wrapped BTC relies on custodians or bridging mechanisms, introducing smart contract and custody risks. If the protocol holding the original BTC is compromised (as seen in numerous bridge hacks), wrapped BTC could lose its peg, become unbacked, or worthless.

2. Volatility management

Bitcoin’s price volatility poses a significant challenge to collateral valuation.

Institutions need robust real-time monitoring systems to track collateral value and establish clear margin call and liquidation protocols.

Additionally, this volatility introduces inefficiencies not typically seen in fiat lending. Since Bitcoin’s price can fluctuate sharply in short periods, lending platforms are forced to require high overcollateralization.

This reduces capital efficiency and makes these loans more complex compared to fiat or stablecoin-backed lending, where relatively stable valuations allow lower collateral ratios, longer repayment terms, and more predictable risk profiles.

3. Centralization

While CeFi lending is not directly tied to Bitcoin’s essence, the risks it introduces have repeatedly harmed users.

The collapses of major platforms like Celsius, BlockFi, and Voyager demonstrate how user funds can quickly be frozen or lost due to bankruptcy or mismanagement.

These failures have made many investors more cautious, accelerating the shift toward non-custodial, decentralized alternatives—though these too have limitations (e.g., requiring wrapped BTC).

As a result, DeFi lending protocols have steadily captured market share from CeFi platforms and now represent over 60% of the market.

Bitcoin Capital Markets

With more investors seeking ways to access liquidity, lending volumes have surged, making Bitcoin-backed lending a key pillar of BTCFi—and in my view, it will eventually become a core component of DeFi as well.

Both CeFi and DeFi lending models will shape the future of the industry. CeFi platforms offer stability, regulatory clarity, and user-friendly experiences, making them the preferred choice for users prioritizing predictable loan terms and legal protections.

On the other hand, DeFi lending brings innovation through programmability and composability, though it still needs improvement in risk management. Nevertheless, DeFi holds a clear edge in global scalability, making it easier than CeFi platforms to serve underserved or emerging markets and gain market share faster.

In conclusion, for those still skeptical, the opportunity here isn’t about changing Bitcoin’s properties, but about building better infrastructure around it.

With the development of more secure platforms and native infrastructure, it is now possible to unlock latent capital without compromising Bitcoin’s integrity.

All of this also benefits Bitcoin. When holders gain liquidity, they no longer need to sell their assets, reducing selling pressure and reinforcing Bitcoin’s position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News