What does the Federal Reserve's rate cut mean for on-chain lending?

TechFlow Selected TechFlow Selected

What does the Federal Reserve's rate cut mean for on-chain lending?

Liquidity enhancement does not imply a bullish crypto market.

Author: Ethan Chan & Hannah Zhang

Translation: TechFlow

The Fed cut interest rates this week and signaled further easing ahead. Almost every major crypto news headline is conveying the same message:

Lower cost of capital → More liquidity → Bullish for crypto.

But reality is more complex. Markets had already priced in rate cuts, and inflows into BTC and ETH have not surged immediately.

So instead of staying at surface level, let's examine how rate cuts impact a segment of DeFi—lending.

On-chain lending markets like Aave and Morpho dynamically price risk rather than rely on regulatory mandates. Yet, Fed policy provides an important backdrop.

When the Fed cuts rates, two opposing forces come into play:

1) Reverse effect: Falling Fed rates → Higher on-chain yields, as investors seek uncorrelated assets

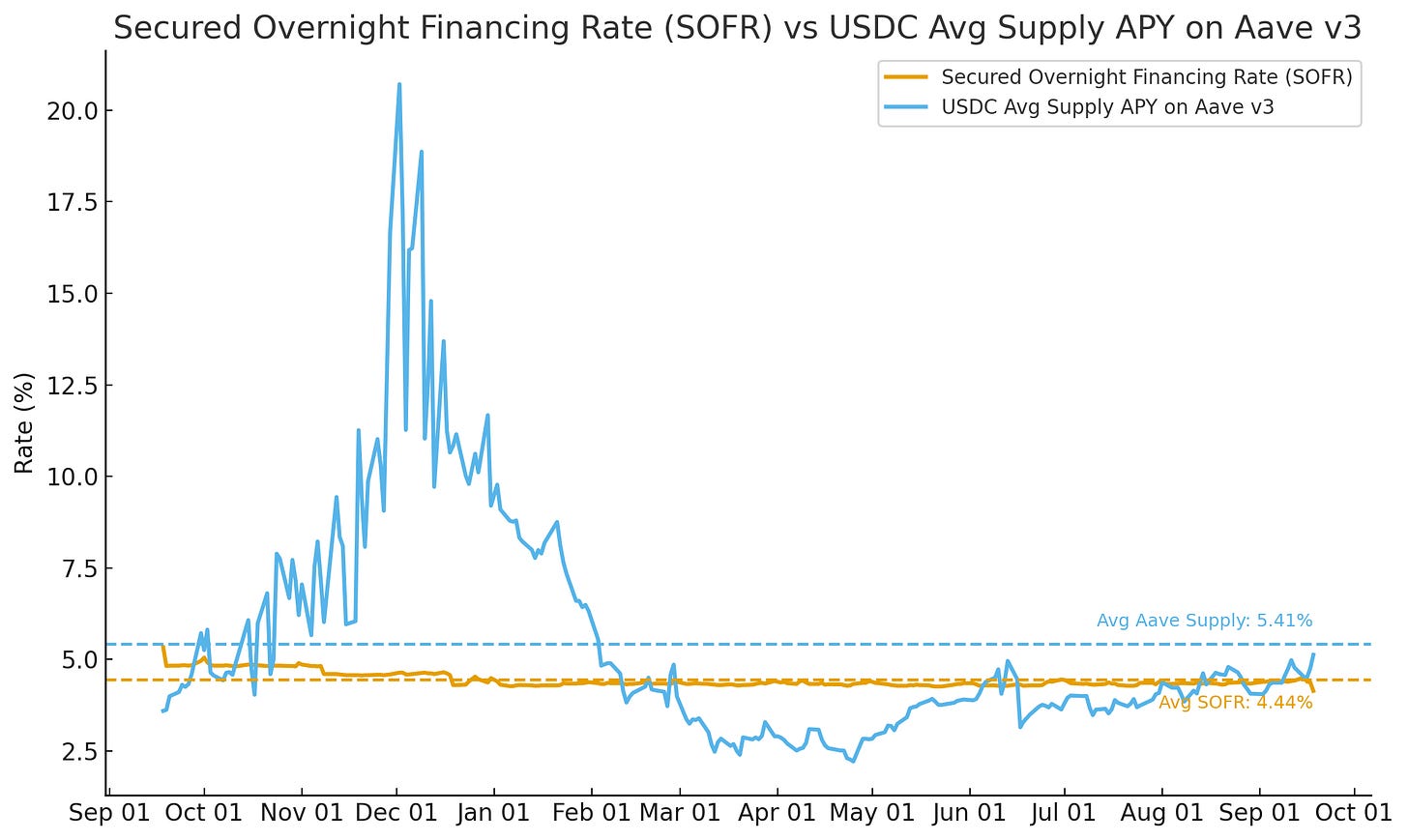

As capital searches for yield beyond traditional Treasuries and money market funds, it may flow into DeFi, increasing utilization and pushing up on-chain interest rates. We can observe this trend emerging before the Fed’s September rate cut by comparing the annual percentage yield (Supply APY) of USDC on Aave with SOFR (Secured Overnight Financing Rate).

Source: Allium

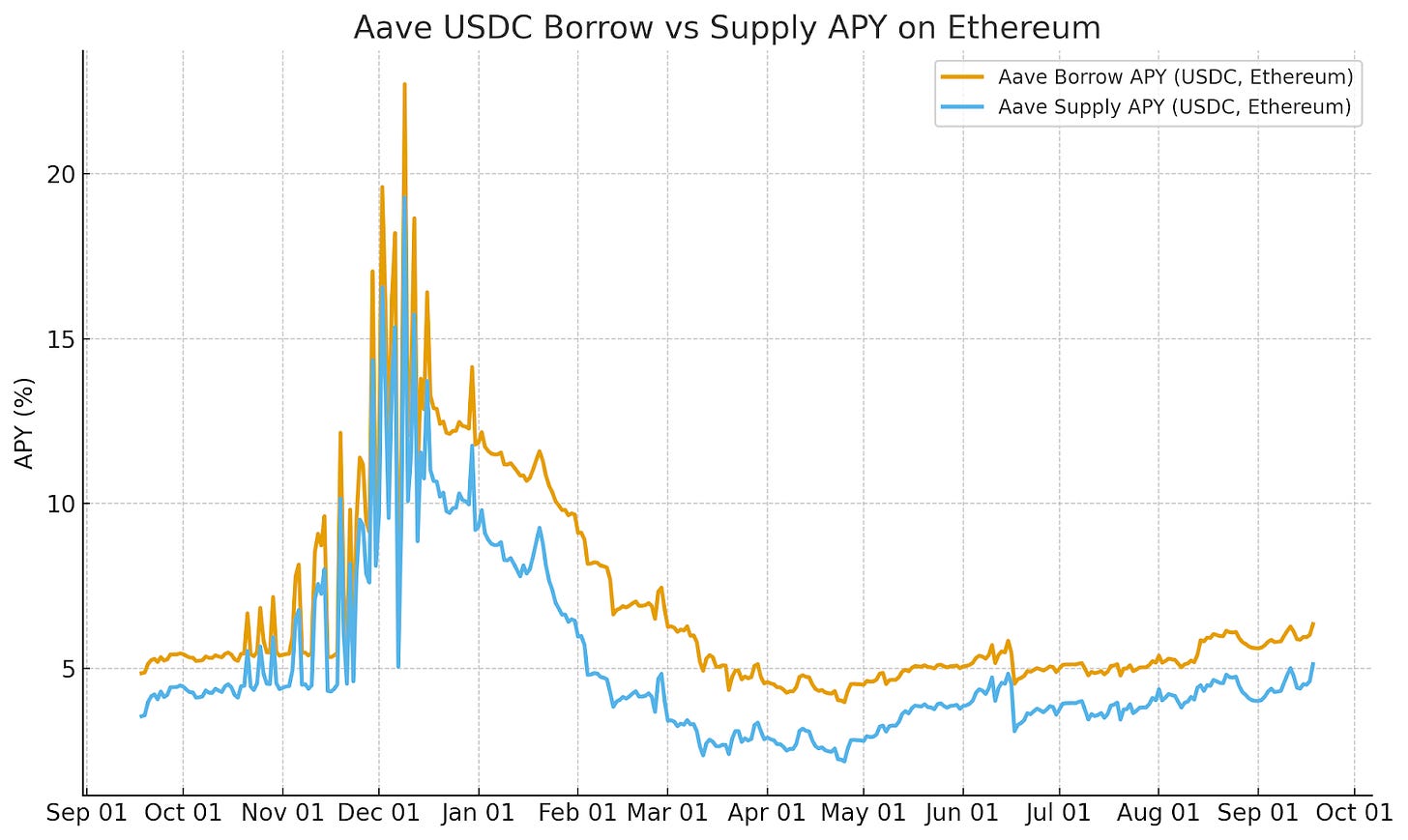

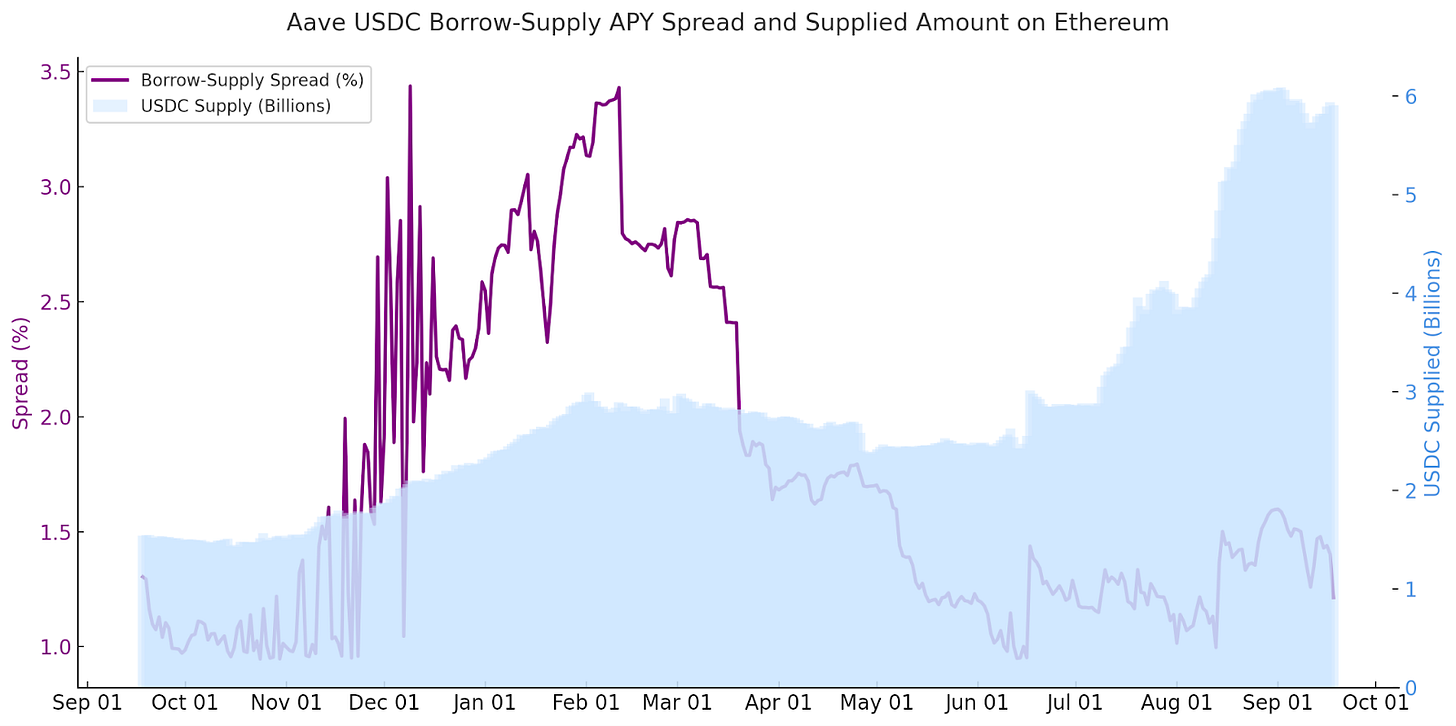

We also see this reflected in narrowing DeFi lending-supply yield spreads.

Take USDC lending on Aave on Ethereum—as the Fed announcement approached, the lending-supply yield spread gradually narrowed. This was primarily driven by more capital chasing yield, supporting a short-term reverse effect.

Source: Allium

2) Direct linkage: Falling Fed rates → Lower on-chain yields, as alternative sources of liquidity become cheaper

As risk-free rates fall, the cost of alternative liquidity sources such as crypto also declines. Borrowers can refinance or lever up at lower costs, driving down both on-chain and off-chain lending rates. This dynamic tends to persist over medium to long-term horizons.

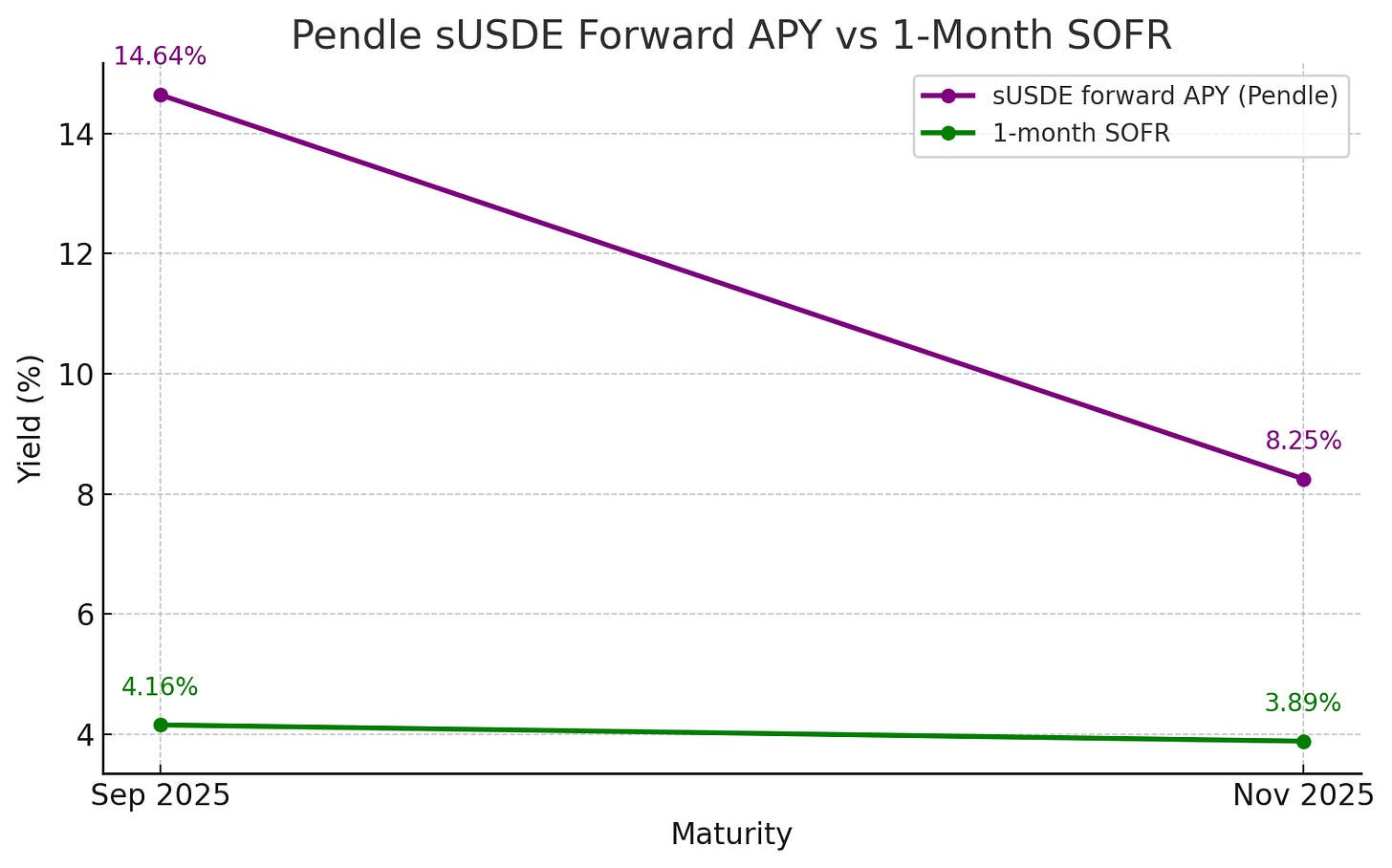

We can spot early signs of this in forward yield market data.

Pendle is DeFi’s forward yield market, where traders can lock in or speculate on future DeFi APYs. While Pendle maturities don’t perfectly align with traditional benchmark rates, they are close enough to SOFR to allow meaningful comparisons—such as late September and late November.

At those points, 1-month SOFR stood around 4.2% (September) and 3.9% (November). Pendle’s implied sUSDe yields for similar tenors were significantly higher in absolute terms (14.6% and 8.3%, respectively). But the shape of the yield curve tells the story. Like SOFR, Pendle’s forward yields declined as expectations of further Fed easing were absorbed.

Source: Allium

Key takeaway: Pendle’s movements align directionally with traditional rate markets—but from a higher base. Traders expect on-chain yields to decline as macro policy shifts.

Conclusion: The impact of Fed rate cuts on crypto markets is not as simple as headlines suggest

Rate cuts don't just affect crypto markets in a one-way manner (as they often do equities in traditional capital markets). They trigger various ripple effects—declining on-chain yields, narrowing rate spreads, and shifting forward yield curves—that ultimately shape liquidity conditions.

Beyond lending, we can further explore how Fed easing affects crypto—for example, how declining issuer yields or real yields could increase ETH staking inflows, or how stablecoin circulating supply might change.

By combining real on-chain data, we can move beyond headlines and truly understand how macro policy permeates into crypto markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News