Three Key Changes: Analyzing the Impact of New Fed Chair Kevin Warsh on the Crypto Market

TechFlow Selected TechFlow Selected

Three Key Changes: Analyzing the Impact of New Fed Chair Kevin Warsh on the Crypto Market

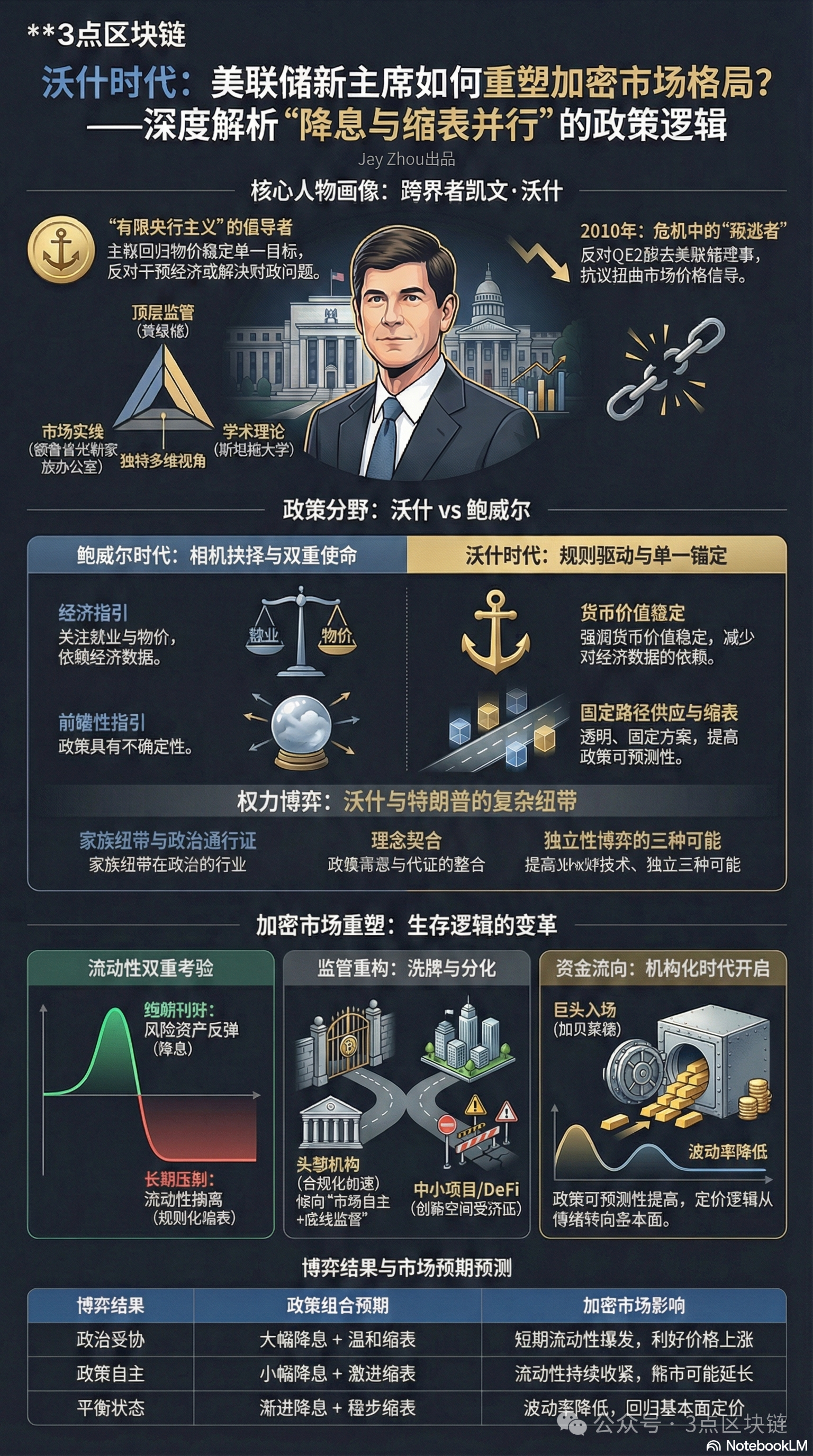

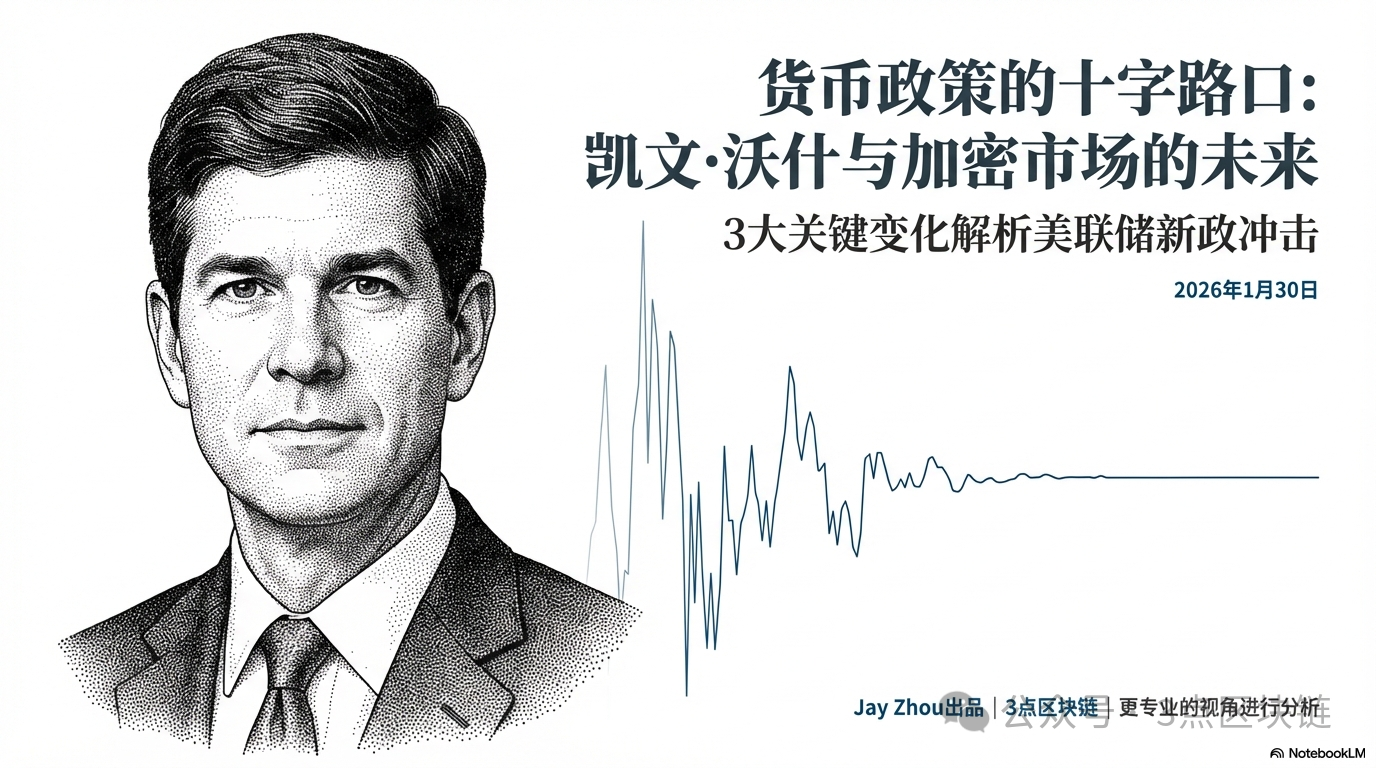

On January 30, 2026, Donald Trump formally nominated former Federal Reserve Governor Kevin Warsh to serve as Chair of the Federal Reserve. This nomination not only signals a pivotal shift in U.S. monetary policy but will also exert profound influence on the cryptocurrency market—a sector highly dependent on global liquidity. Warsh’s distinctive policy stance—pursuing interest-rate cuts and balance-sheet reduction simultaneously—stands in sharp contrast to the monetary-policy logic under Jerome Powell’s leadership. Against the backdrop of a 2026 crypto bear market and Bitcoin hitting a new annual low, this “cross-sector figure,” whose career spans academia, financial regulation, and investment, is poised to become a critical variable reshaping the cryptocurrency market landscape. This article begins by examining Warsh’s professional background and core policy philosophy, compares his monetary-policy approach with Powell’s, deeply analyzes Warsh’s complex relationship with Trump and its implications for the cryptocurrency market, and ultimately reveals the underlying survival logic governing the cryptocurrency market amid this monetary-policy transformation.

Author: JayZhou, 3 Point Blockchain

Original Link: https://mp.weixin.qq.com/s/G9d8zhrbwUtGpOzNrWXcHg

I. Kevin Warsh’s Professional Background: From Crisis Witness to Policy Critic

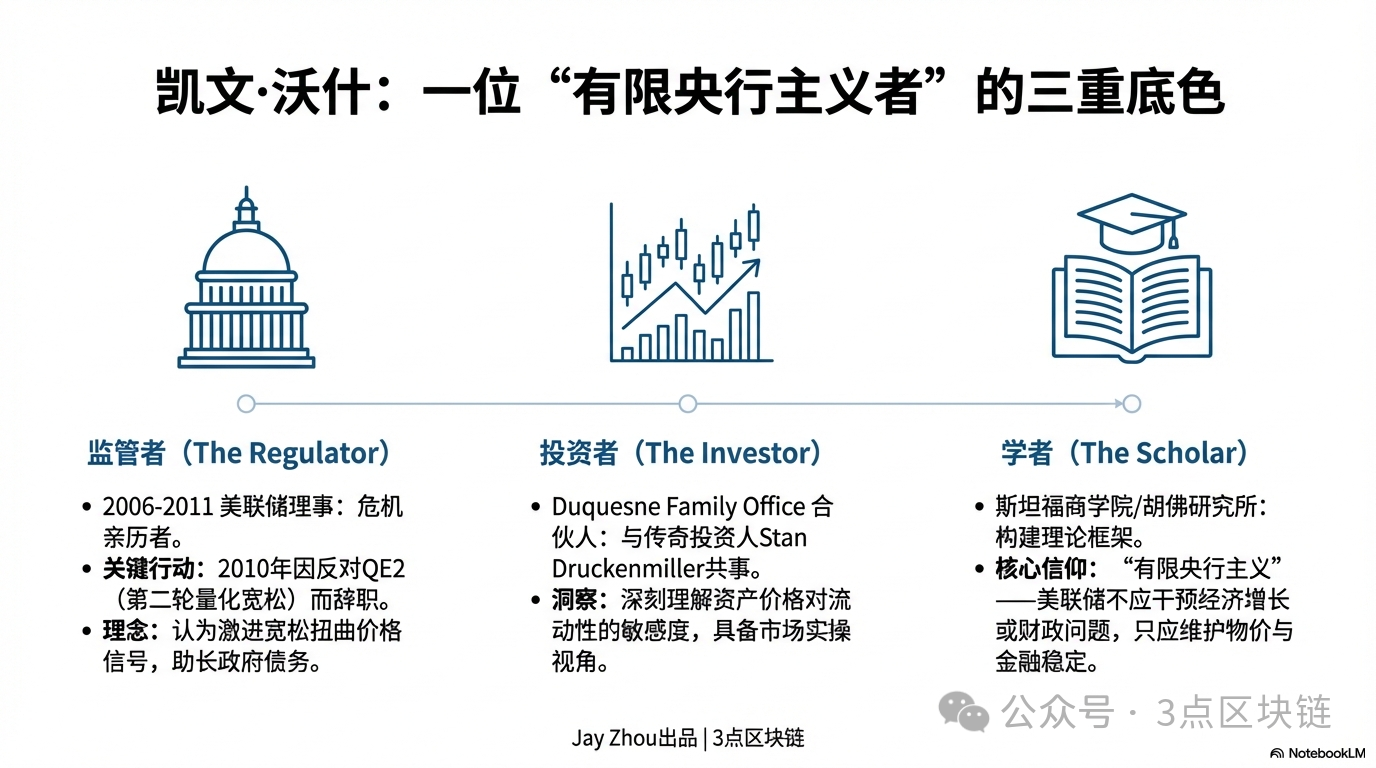

Kevin Warsh’s career has consistently straddled the intersection of public policy and private markets—a unique trajectory that shaped his critical perspective on monetary policy and his pragmatic approach. To understand Warsh’s policy positions, one must examine his triple identity spanning regulation, academia, and investment.

1.1 Fed Governor During Crisis: The “Defector” from Quantitative Easing

From 2006 to 2011, Warsh served as a member of the Federal Reserve Board throughout the global financial crisis. During this period, the Fed shifted from conventional interest-rate management to large-scale asset purchases (QE), expanding its balance sheet from $900 billion to $2.9 trillion. As the Fed’s liaison with markets, Warsh played a central role in formulating crisis-response policies—but also became one of the earliest core members to publicly oppose QE.

In 2010, as the Fed prepared for its second round of quantitative easing (QE2), Warsh voiced public opposition. He argued that further expansion of asset purchases—amid emerging signs of economic recovery—would draw the Fed into the political quagmire of fiscal policy and distort market price signals. After QE2 was formally launched, Warsh resigned in protest—an act of “defection” that became a defining moment in his career.

This experience cemented Warsh’s core belief in “limited central banking”: the Fed’s primary mandate is price stability and financial stability—not manipulating economic growth or resolving fiscal issues via balance-sheet operations. He sharply criticizes the Fed’s aggressive policies over the past 15 years, arguing that sustained QE has ushered in an era of “monetary dominance.” Artificially suppressing interest rates has not only inflated asset bubbles but also fueled U.S. government debt accumulation. As of 2026, total U.S. federal debt has exceeded $38 trillion, while net interest expenses approach defense spending—a direct consequence Warsh long warned against.

1.2 The Multifaceted Perspective of a Cross-Disciplinary Practitioner: From Family Office to Stanford Classroom

After leaving the Fed, Warsh entered a “cross-disciplinary phase.” He joined legendary investor Stanley Druckenmiller’s family office, Duquesne, as a partner, deeply engaging in global macro investment decisions. Simultaneously, he served as a Distinguished Visiting Fellow at the Hoover Institution and a lecturer at Stanford Graduate School of Business, building a policy-analysis framework that bridges theory and practice.

This cross-sectoral experience—spanning regulatory institutions, investment firms, and academia—endows Warsh’s policy views with dual attributes: “top-level design” and “market-level execution.” From a regulator’s vantage point, he fully grasps the spillover effects of Fed policy on financial markets; as an investor, he understands asset prices’ sensitivity to liquidity shifts; and as a scholar, he can transcend short-term policy cycles to assess the long-term logic of monetary policy.

Notably, Warsh’s personal network adds a political dimension to his nomination—his father-in-law is Ronald Lauder, chairman of Estée Lauder and a close friend of Donald Trump. This connection fuels market concerns that Warsh may struggle to resist political pressure from Trump—especially given the latter’s explicit demand for “aggressive rate cuts.” Yet Warsh’s career trajectory consistently emphasizes “policy independence”—making the tension between “political affiliation” and “policy autonomy” a central storyline of his potential Fed leadership.

1.3 Core Policy Proposition: The “Paradoxical” Dual-Track Approach of Rate Cuts and Balance-Sheet Reduction

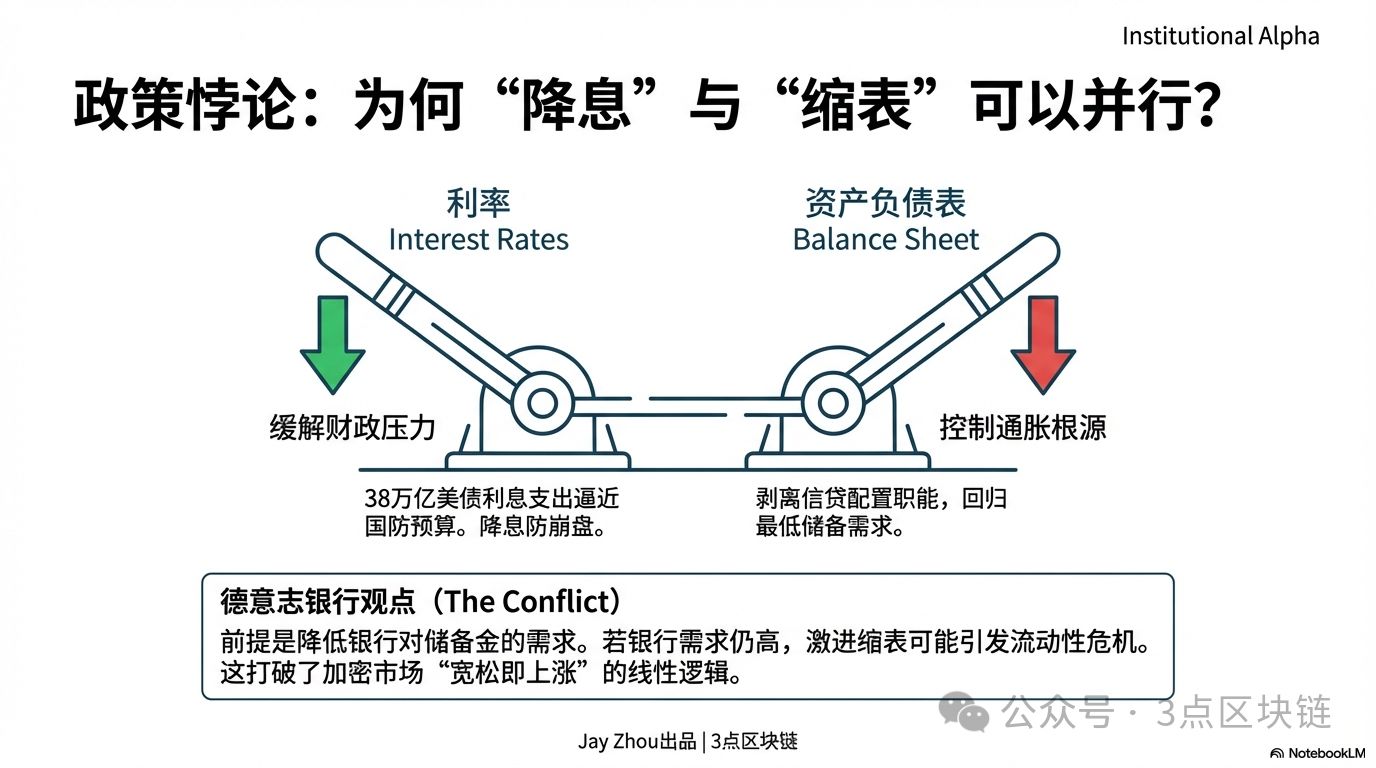

A Deutsche Bank research report by Matthew Luzzetti’s team accurately captures Warsh’s policy framework: “rate cuts alongside balance-sheet reduction.” Though seemingly contradictory, this combination directly addresses the Fed’s core dilemma—simultaneously alleviating high-rate pressures on government debt while avoiding inflationary rebounds triggered by excessive liquidity.

Warsh’s policy logic unfolds across three layers:

- Underlying rationale for rate cuts: Amid slowing growth and mounting debt burdens, modestly lowering the policy rate would ease government interest payments and relieve corporate financing pressures. Yet Warsh explicitly opposes “unbounded rate cuts”—he stated he did not support the Fed’s September 2025 decision to cut rates by 50 basis points, warning that excessive easing would undermine hard-won inflation-control gains.

- Core objective of balance-sheet reduction: By shrinking its balance sheet, the Fed should shed the “credit allocation” function it assumed post-financial crisis and return to a traditional monetary policy framework. Warsh believes the Fed’s balance sheet should be maintained at the “minimum level required to meet banking system reserve needs,” rather than serving as the dominant force shaping market liquidity.

- Prerequisite for implementation: The key to executing concurrent rate cuts and balance-sheet reduction lies in regulatory reforms that lower banks’ reserve requirements. Only when banks no longer need to hold large excess reserves can balance-sheet reduction avoid triggering a market liquidity crisis. Yet Deutsche Bank’s report notes this prerequisite remains questionable in the near term—the Fed recently resumed its Reserve Management Purchase Program, and banking system demand for reserves remains elevated.

This “paradoxical” approach diverges sharply from crypto markets’ familiar linear logic—“loose = up, tight = down”—adding a layer of uncertainty to crypto’s future trajectory.

II. Warsh and Trump: A Complex Relationship Network—from “Old Acquaintance” to “Allied Partner”

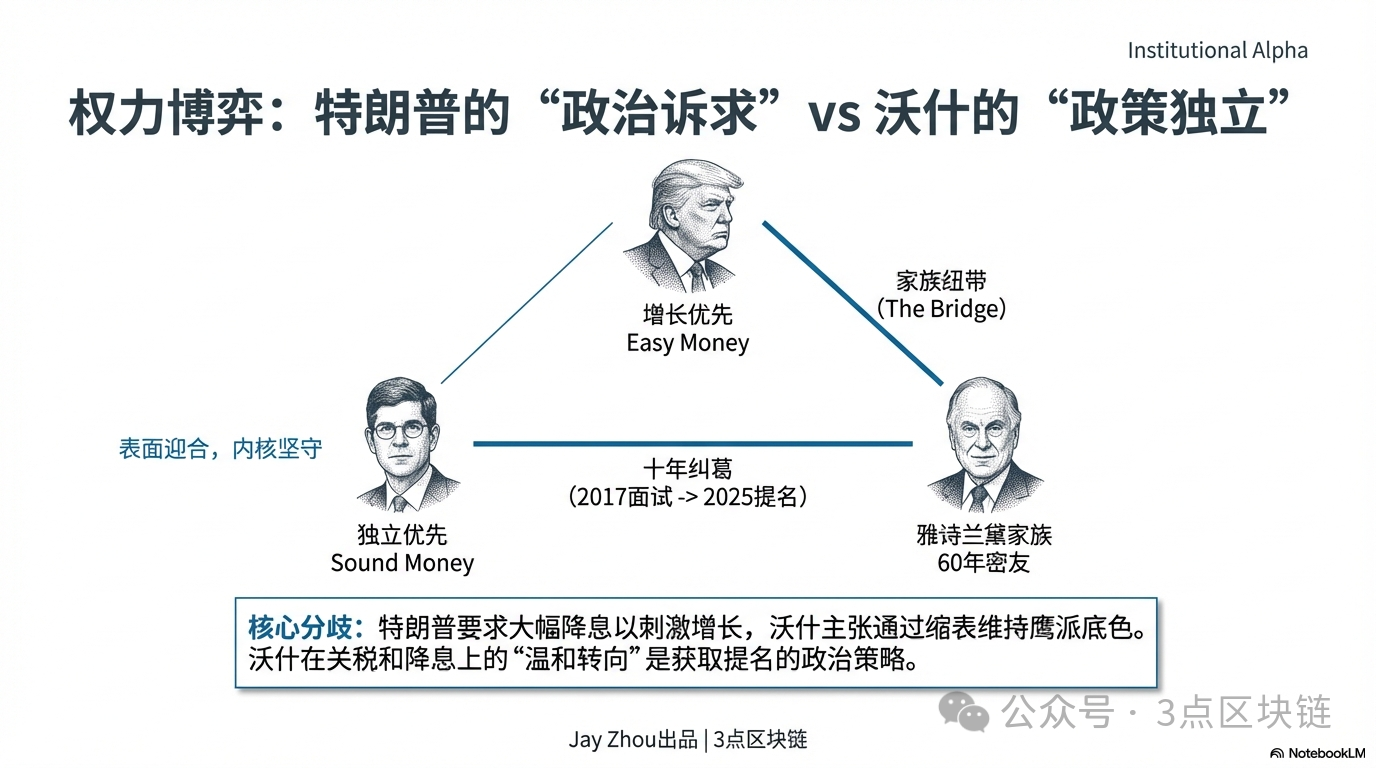

The relationship between Kevin Warsh and Donald Trump is the pivotal thread for understanding his nomination as Fed Chair—and the core variable for forecasting his policy direction. Their ties predate the 2026 nomination, forming a decade-long web of political and personal connections interwoven with family networks, shared policy views, and power dynamics.

2.1 Familial Ties: The Estée Lauder Family as a “Political Bridge”

The most direct link between Warsh and Trump stems from marriage: Warsh’s wife, Jane Lauder, is an heir to the Estée Lauder Group, while his father-in-law, Ronald Lauder, is Trump’s close friend and key political ally—with a friendship spanning six decades.

Lauder and Trump met at the New York Military Academy, becoming classmates, long-time business partners, and mutual political supporters. Lauder was a major financier behind Trump’s 2016 and 2024 presidential campaigns—and reportedly first proposed Trump’s controversial idea to “acquire Greenland,” which later became a signature initiative of Trump’s first term. Tim O’Brien, author of Trump’s biography, bluntly stated: “For Trump, anyone connected to powerful or famous people matters immensely.” Lauder’s family background thus provided Warsh with a de facto “political passport” into Trump’s inner circle.

This familial trust constitutes Warsh’s unique advantage over other candidates. Within Trump’s political logic, “personal referrals” and “family connections” often outweigh professional credentials in appointment decisions. In December 2025, Trump explicitly named Warsh as his “top candidate” for Fed Chair during an interview with The Wall Street Journal—a statement where Lauder’s influence was unmistakable.

2.2 A Decade of Negotiation: From “Interview Rejection” to “Handpicked Nominee”

Warsh and Trump’s policy interactions trace back to Trump’s first term in 2017. That year, Trump personally interviewed Warsh for the Fed Chair position—but ultimately selected then-Fed Governor Jerome Powell. Trump later called this decision a “regret”: In a private 2020 meeting, he told Warsh, “Kevin, I really should have used you more. If you wanted the job, why weren’t you more forceful back then?”

Upon Trump’s return to the White House in 2025, their interactions intensified. Warsh advised Trump’s transition team on economic policy and was even considered a potential Treasury Secretary. Crucially, Warsh’s “moderate policy shift” increasingly aligned with Trump’s core demands. Though known as a “hawk” during his Fed tenure, Warsh has recently voiced public support for Trump’s tariff policies and begun calling for accelerated Fed rate cuts—a stance widely interpreted by markets as “political calculus” aimed at securing the Fed Chair position.

On January 29, 2026, after meeting Warsh at the White House, Trump advanced the announcement of his Fed Chair nomination to the following morning—a rushed scheduling change underscoring the closeness and efficiency of their relationship. On Truth Social, Trump declared: “I’ve known Kevin for many years. He is a true genius who will go down in history.” This effusive praise stands in stark contrast to his ongoing criticism of Powell.

2.3 Ideological Alignment: From “Policy Disagreement” to “Shared Objectives”

The Warsh-Trump relationship is not mere “political subservience,” but a “strategic alliance” grounded in partial ideological convergence. Their core consensus manifests in three areas:

- Shared critique of Powell’s policies: Trump has long criticized Powell’s “excessive money printing” for fueling inflation, while Warsh academically faults Powell-era Fed “mission creep”—overextending focus to non-core issues like employment, climate, and inclusion, thereby eroding monetary policy independence. This shared view of “Powell’s policy failure” forms the foundation of their cooperation.

- Shared demand for rate cuts: Since returning to office in early 2025, Trump has repeatedly pressured the Fed to cut rates, arguing high rates cost the U.S. hundreds of billions annually in extra debt interest, dragging down growth. Warsh’s “rate cuts alongside balance-sheet reduction” framework directly responds to Trump’s rate-cut demand—while preserving his own “hawkish credibility” through balance-sheet reduction—striking a balance between “political correctness” and “academic rigor.”

- Divergent interpretations of “Fed independence”: Though Warsh stresses that “Fed independence is a valuable cause,” both he and Trump believe the Fed should rely less on economic data and abandon “forward guidance”—a policy tool Trump dismisses as “meaningless.” This shared pursuit of “policy simplification” creates alignment on operational monetary policy.

Notably, Warsh’s stance shift is not purely “accommodating” Trump. X. Cui, Senior U.S. Economist at Pictet Wealth Management, observes that Warsh “has recently been very eager to secure the Fed Chair position,” prompting his dovish turn on rates—but his core policy framework—“limited central banking” and “balance-sheet reduction first”—remains unchanged. This strategy of “surface accommodation, core adherence” will be key to balancing political pressure and policy independence.

2.4 Power Balancing: The Classic Tension Between “Political Subservience” and “Policy Autonomy”

The Warsh-Trump dynamic embodies the classic tension between “political appointment” and “central bank independence.” For crypto markets, the outcome of this contest will directly determine Fed policy direction—and thus shape global liquidity conditions.

From Trump’s perspective, nominating Warsh aims squarely at “controlling monetary policy.” Since early 2025, Trump has repeatedly criticized Powell for “acting too slowly” and blamed high rates for harming the U.S. economy and fiscal health. He needs a Fed Chair who “can cut rates and will listen”—to achieve his political goal of “growth-first” economics. Warsh’s family ties and policy pivot convince Trump he can “control” this new Fed Chair.

Yet Warsh’s career consistently centers on “policy independence.” His 2010 resignation in protest against QE2—a “resignation-as-resistance” act—demonstrates unwavering commitment to central bank independence. Deutsche Bank’s report notes markets will closely watch whether Warsh maintains policy autonomy under Trump’s pressure—a decisive factor for market confidence.

This power-balancing contest could yield three outcomes:

For crypto investors, the core indicators to monitor are: Warsh’s first FOMC statement after taking office, concrete details of the balance-sheet reduction plan, and his public comments on Trump’s policies. These signals will directly determine crypto’s short-term price action and long-term structural evolution.

III. Powell vs. Warsh: Policy Divergence Between Two Generations of Fed Chairs

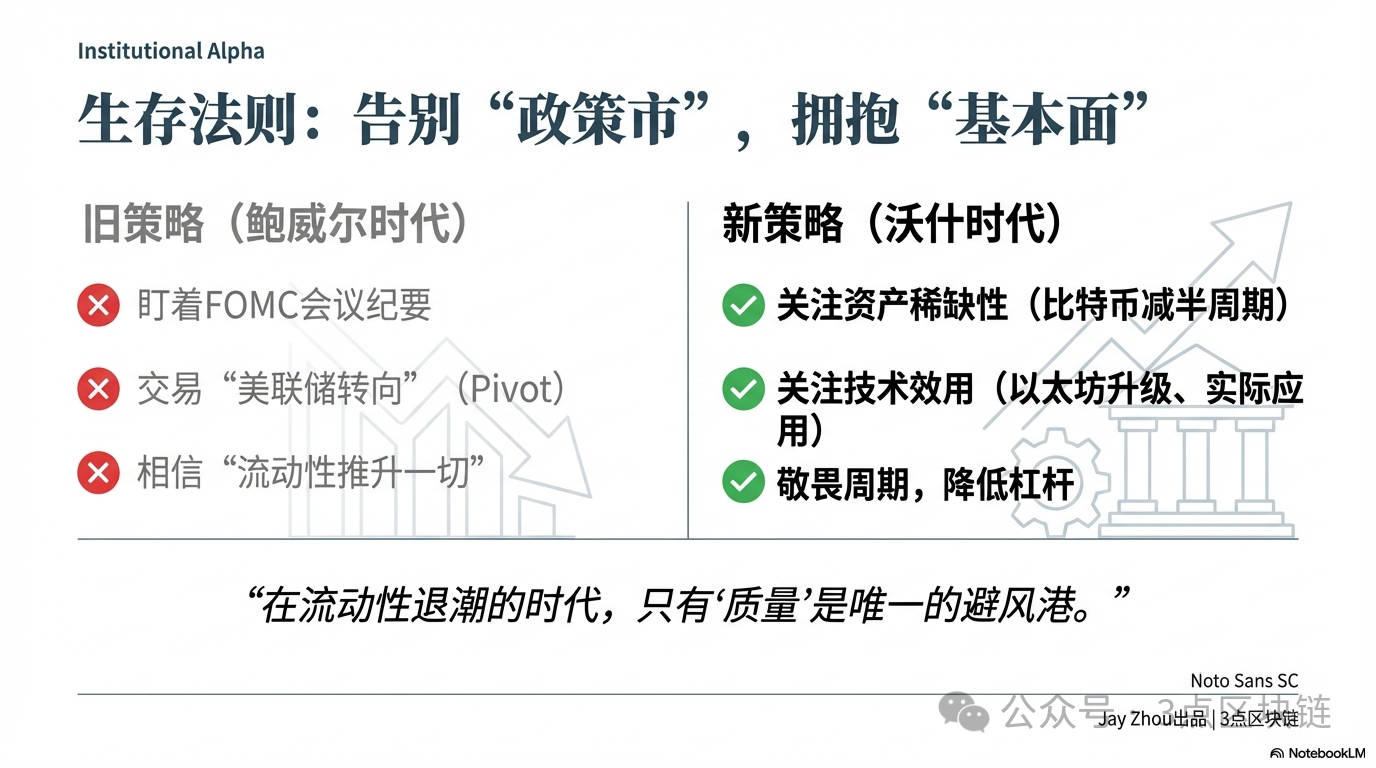

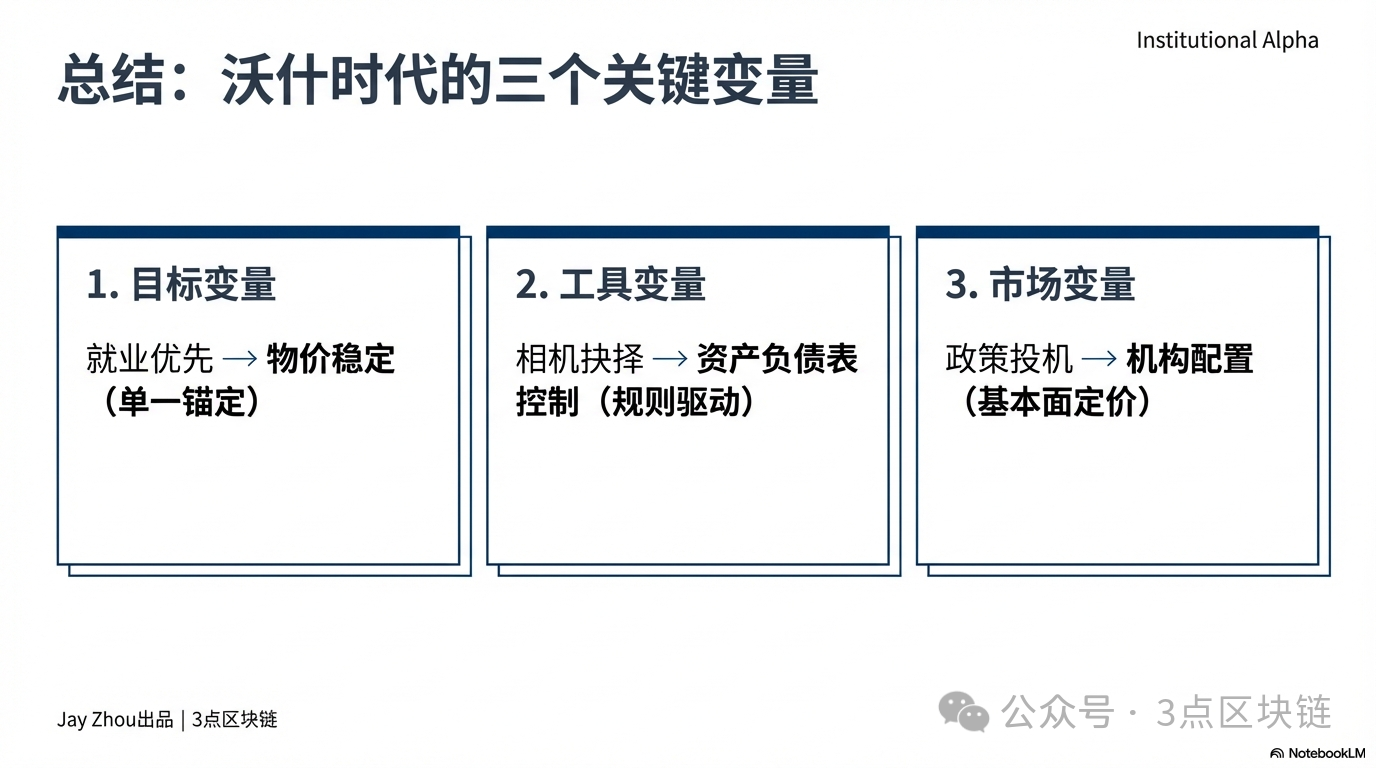

To grasp Warsh’s impact on crypto markets, we must first clarify how his monetary policy diverges from his predecessor Powell’s. Powell’s Fed era—defined by “discretionary policy”—saw its policy cycle tightly coupled with crypto’s bull-bear transitions; Warsh’s framework, emphasizing “rule-based policy” and “central bank independence,” will reshape crypto’s pricing logic.

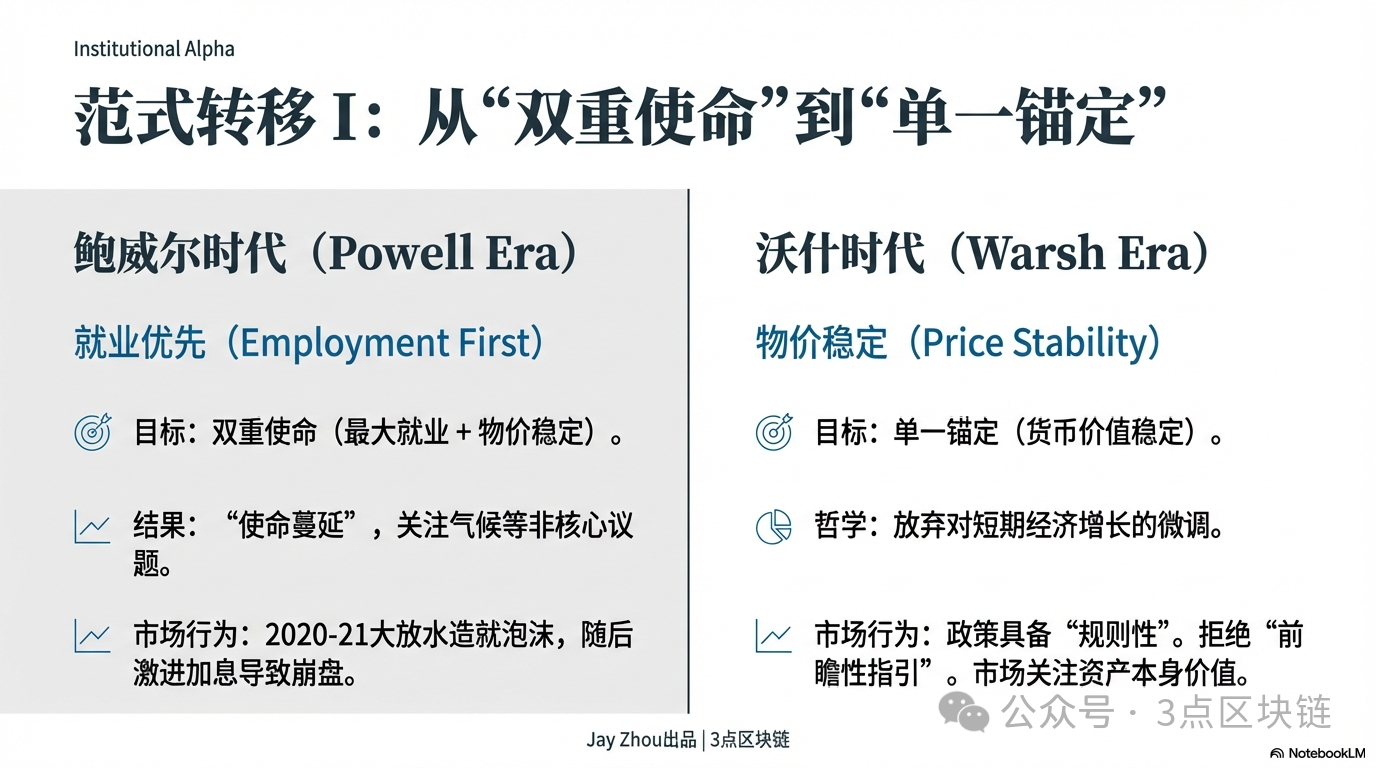

3.1 Divergent Policy Objectives: From “Dual Mandate” to “Single Anchor”

Over his eight-year tenure, Powell pursued the Fed’s “dual mandate” of maximum employment and price stability. Following the 2020 pandemic outbreak, Powell rapidly slashed the federal funds rate to 0–0.25% and launched unlimited quantitative easing, expanding the Fed’s balance sheet by nearly $4 trillion within 18 months to a peak of $9 trillion.

This “employment-first” orientation delivered unprecedented liquidity to crypto markets. From 2020–2021, Bitcoin surged from under $10,000 to $69,000; Ethereum rose from $200 to $4,891; and total crypto market cap surpassed $3 trillion. At the time, markets viewed the Fed’s loose policy as the primary catalyst for crypto asset appreciation—Bitcoin acquired the “digital gold” moniker as an inflation hedge.

But as inflation spiked to a 40-year high in late 2021, Powell pivoted toward “price stability.” In March 2022, the Fed launched its most aggressive hiking cycle since the 1980s—raising rates by 525 basis points over 17 months while simultaneously reducing its balance sheet by $95 billion monthly. This policy reversal triggered a crypto market collapse: In 2022, crypto market cap shrank by $1.45 trillion; Bitcoin fell to $15,000; Ethereum dropped below $900; and major firms—including Three Arrows Capital and FTX—collapsed, plunging crypto into a prolonged bear market.

By contrast, Warsh’s policy objectives align more closely with a “single anchor”—refocusing the Fed’s core mission on “preserving currency value stability.” He sharply criticizes Powell-era Fed “mission creep,” arguing excessive attention to non-core issues like employment, climate, and inclusivity weakened monetary policy independence and effectiveness. Warsh explicitly proposes the Fed reduce reliance on economic data and abandon forward guidance—a tool he calls “nearly useless in normal times”—instead prioritizing control over money supply and balance-sheet size to ensure long-term price stability.

This divergence in objectives implies Warsh-era Fed policy will be more “rule-based” and “predictable,” but potentially at the expense of short-term growth and employment stability. For crypto markets, this means the “policy-driven market” logic will weaken, and crypto asset pricing will hinge more on fundamentals—not Fed policy pivots.

3.2 Divergent Policy Tools: From “Discretionary” to “Rule-Driven”

Powell’s Fed excelled at combining “forward guidance” and “data dependence” to steer market expectations and capital flows. For example, Powell’s 2020 pledge to “maintain low rates until 2023” and his 2022 declaration that “hiking would continue until inflation falls to the 2% target” gave markets clear signals to adjust portfolios ahead of time.

Warsh, however, deems forward guidance “a crisis-era tool unsuitable for normal economic conditions.” He criticizes Powell-era Fed overreliance on “black-box DSGE models,” ignoring the core impact of money supply and balance-sheet size on inflation. Warsh advocates for more transparent, rule-based tools—for instance, fixing money supply growth rates or setting predetermined balance-sheet reduction paths—to minimize market speculation.

This divergence in policy tools will directly affect crypto volatility. Powell-era Fed policy frequently triggered sharp crypto swings: In November 2025, Powell’s announcement pausing balance-sheet reduction and cutting rates by 25 bps sent Bitcoin prices oscillating—first down, then up—with over 5% volatility; in January 2026, Powell’s comment that “rate cuts before June are unlikely” left crypto markets range-bound, pushing Bitcoin’s volatility to historic lows.

Another key difference between Powell and Warsh lies in handling political pressure. Throughout his tenure, Powell repeatedly resisted Trump’s rate-cut demands, holding firm on anti-inflation hikes and safeguarding Fed independence. Yet in 2025, with U.S. federal debt surpassing $38 trillion and net interest expenses nearing defense spending, Powell’s policy bent to fiscal pressure—pausing balance-sheet reduction and enacting modest rate cuts to ease government debt servicing.

Warsh will face far greater political pressure than Powell. Upon nominating Warsh, Trump explicitly stated he expects “substantial rate cuts” to stimulate growth and lower government debt costs. Yet Warsh has repeatedly emphasized Fed independence as “a valuable cause,” pledging not to succumb to political pressure. Deutsche Bank’s report notes markets will closely watch whether Warsh preserves policy independence under Trump—a decisive factor for market confidence.

For crypto markets, if Warsh yields to political pressure and implements “large rate cuts + moderate balance-sheet reduction,” short-term liquidity will surge—boosting crypto asset prices. But if he sticks to “modest rate cuts + aggressive balance-sheet reduction,” market liquidity will remain persistently tight—prolonging the crypto bear market.

IV. The Warsh Era: Restructuring Crypto’s Landscape and Survival Logic

Kevin Warsh’s policy proposals will reshape crypto markets across three dimensions: liquidity, regulation, and capital flows. Under the “rate cuts alongside balance-sheet reduction” framework, crypto markets will move beyond Powell’s “policy-driven” logic into a new “fundamentals-driven” phase. For investors, understanding and adapting to this structural shift will be crucial to navigating the bear market.

4.1 Liquidity Dynamics: Dual Tests of Short-Term Upside and Long-Term Downside

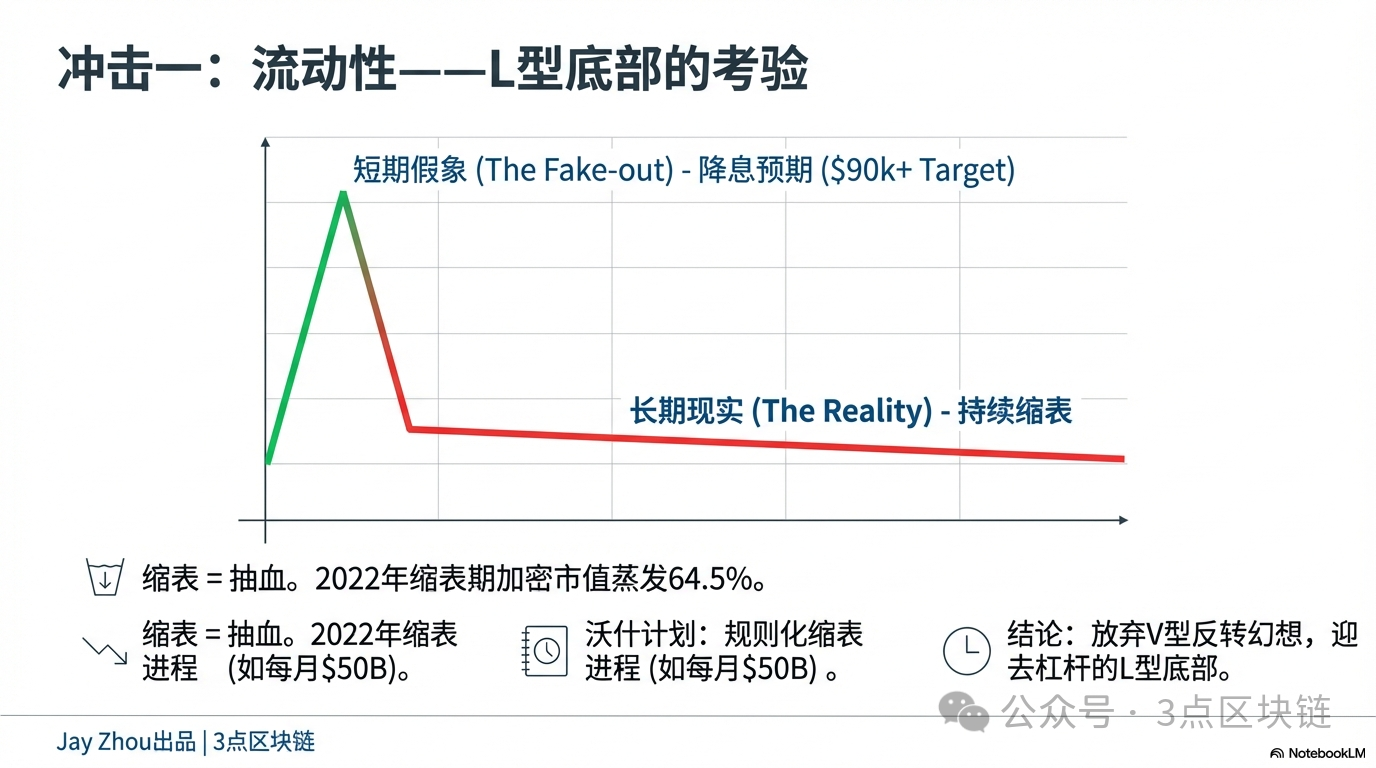

Warsh’s dual-track “rate cuts alongside balance-sheet reduction” policy will deliver both short-term positive shocks and long-term negative pressure on crypto market liquidity.

In the short term, rate cuts will lower USD funding costs and ease global dollar liquidity stress. Historical data shows Fed rate cuts often drive capital out of USD assets into risk assets. After Powell’s 2020 rate cuts, crypto entered a major bull run; in November 2025, Powell’s pause in balance-sheet reduction and 25-bps rate cut pushed Bitcoin from $85,000 to $92,000. If Warsh launches rate cuts after officially assuming office in June 2026, crypto may see a short-term rally—Bitcoin could break above $90,000, and Ethereum may reclaim $3,000.

Long term, however, balance-sheet reduction will continuously drain market liquidity, pressuring crypto valuations. The Fed’s balance-sheet reduction process essentially withdraws liquidity injected during the financial crisis—reducing global USD supply and lowering valuation anchors for risk assets. During the Fed’s 2022 balance-sheet reduction, crypto market cap shrank by 64.5%, demonstrating that balance-sheet reduction exerts far stronger downside pressure on crypto than rate hikes alone.

More critically, Warsh’s balance-sheet reduction won’t be a “one-off” operation but a “rule-based process.” Per Deutsche Bank’s forecast, Warsh may set a fixed path—e.g., reducing $50 billion monthly until the Fed’s balance sheet reaches ~20% of GDP. This predictable reduction path will let markets absorb liquidity tightening in advance—so crypto’s decline may lack the 2022 crash’s intensity, but instead manifest as persistent “slow bleed.”

For crypto investors, this drastically raises the difficulty of “bottom-fishing.” Under Powell, investors could anticipate Fed hiking peaks or rate-cut starts to time crypto bottoms. Under Warsh, the long-term, predictable nature of balance-sheet reduction will likely produce an “L-shaped” bottom—requiring investors to abandon speculative “buy-the-dip-and-rebound” thinking in favor of assessing crypto assets’ long-term intrinsic value.

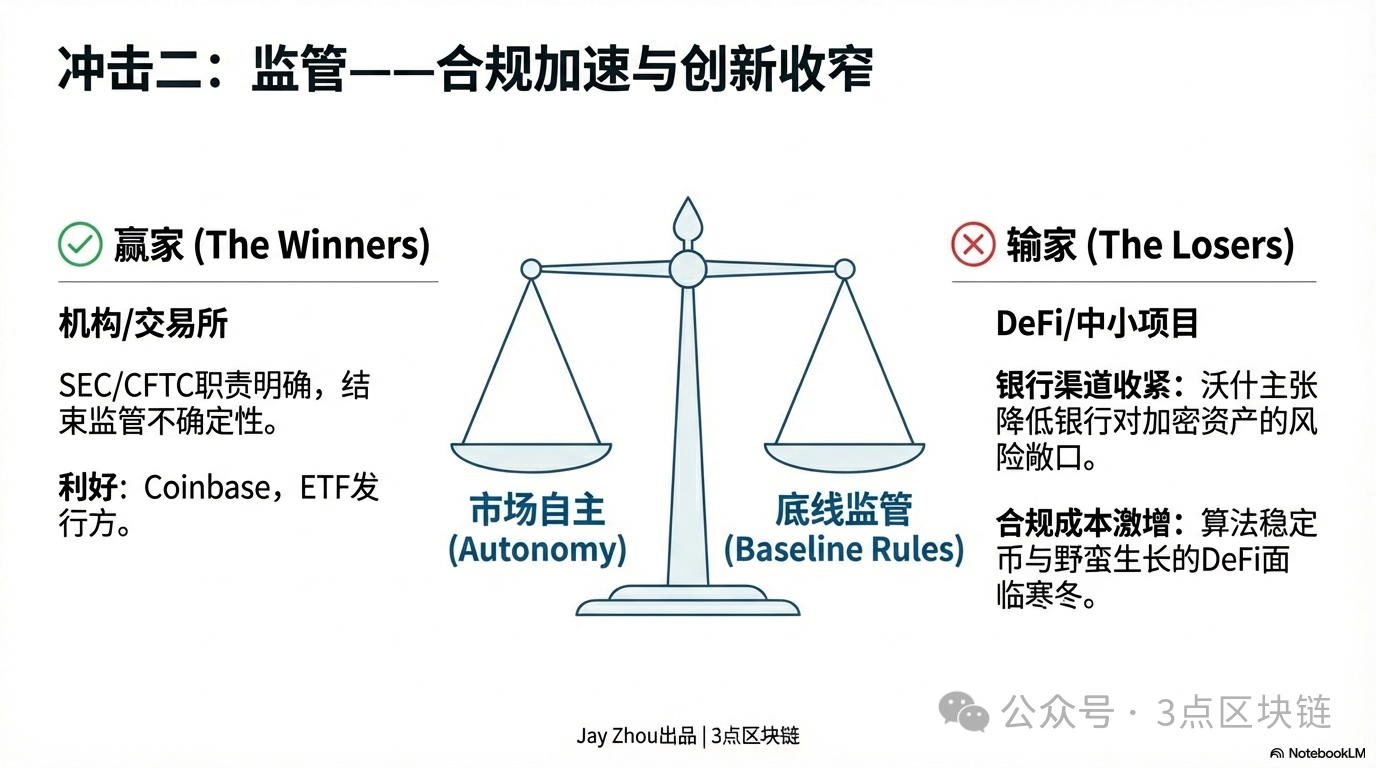

4.2 Regulatory Restructuring: Accelerated Compliance and Narrowed Innovation Space

Warsh’s policy stance will not only reshape crypto liquidity but also accelerate industry compliance.

As a Fed governor, Warsh earned renown for “prioritizing financial stability.” He repeatedly warned that unregulated financial innovation risks systemic instability. On crypto regulation, his core view is “market-led development + baseline oversight”—opposing excessive government intervention in crypto innovation, yet insisting crypto assets comply with foundational regulatory rules like anti-money laundering (AML) and countering terrorist financing (CTF).

In the short term, Warsh’s regulatory philosophy may offer crypto markets “breathing room.” Compared to Powell’s Fed, Warsh favors market-led—not government-led—crypto development. He may oppose direct Fed regulation of cryptocurrencies, instead urging existing agencies—like the SEC and CFTC—to clarify crypto assets’ legal status and regulatory frameworks. This would resolve current “regulatory uncertainty,” attracting more institutional capital.

Long term, however, Warsh’s regulatory stance will drive “shakeout and differentiation” across the crypto industry. First, accelerated compliance will compel leading entities—exchanges and stablecoin issuers—to strengthen risk controls and follow regulations. For example, Coinbase and Binance may need higher transparency, disclosing more user data and transaction records; USDT and USDC may face stricter reserve audits to guarantee their 1:1 USD peg.

Second, rising compliance costs will squeeze survival space for small-to-mid crypto projects. Warsh’s push to “lower bank reserve requirements via regulatory reform” implies banks will scrutinize crypto project financing more strictly. Smaller projects may struggle to obtain bank loans, relying solely on venture capital or ICOs—making fundraising vastly harder. Meanwhile, Warsh adopts a cautious stance toward innovations like “algorithmic stablecoins” and “DeFi,” potentially constraining innovation in these areas.

For crypto investors, this means “blue-chip dominance” will intensify. Highly compliant, liquid mainstream assets—Bitcoin and Ethereum—will become top institutional allocation choices. Meanwhile, altcoins lacking real-world use cases and carrying high compliance risks may get phased out—and ultimately zero out.

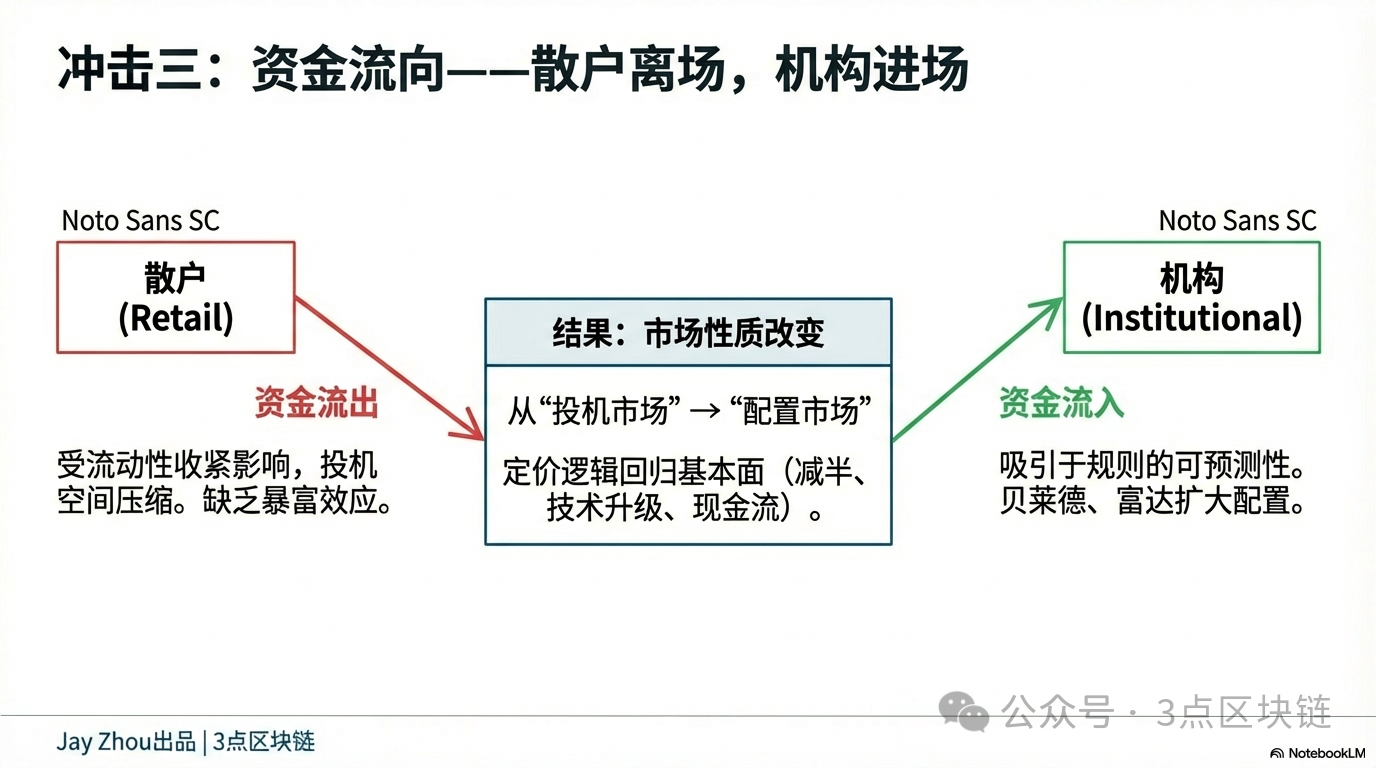

4.3 Capital Flow Shifts: Institutional Influx vs. Retail Exodus

Under Warsh’s Fed, crypto capital flows will bifurcate—accelerating institutional inflows while driving retail outflows.

For institutional capital, Warsh’s “rule-driven” policy will boost market predictability, attracting more traditional financial institutions to allocate to crypto. For instance, BlackRock and Fidelity may expand Bitcoin ETF holdings, integrating crypto into long-term portfolios; JPMorgan and Goldman Sachs may launch more crypto derivatives to meet institutional hedging needs.

Institutional inflows will bring two notable changes: First, crypto market volatility will further decline. Institutions favor long-term holding over short-term speculation—reducing price swings. For example, Bitcoin’s intraday volatility may fall from ~3% to 1–2%, aligning with gold and equities. Second, crypto’s pricing logic will grow more rational. Institutions focus on fundamentals—Bitcoin’s scarcity, Ethereum’s tech upgrades, crypto projects’ profitability—not sentiment or speculation.

For retail capital, Warsh’s balance-sheet reduction will persistently tighten liquidity, squeezing retail speculative space. The 2022 crypto bear market proved that when liquidity dries up, retail investors suffer most—they buy high, sell low, and lose everything. Under Warsh, the long-term, predictable nature of balance-sheet reduction will make short-term retail speculation unviable—forcing retail to exit and wait on the sidelines.

This capital flow split will shift crypto markets from “retail-dominated speculation” to “institution-dominated allocation.” This marks crypto’s maturation—and deeper integration with traditional finance. Yet for retail investors, it also means fewer “get-rich-quick” opportunities, demanding more professional knowledge and longer-term perspectives.

V. Conclusion: Farewell to the Policy-Driven Market, Hello to Fundamentals

Kevin Warsh’s nomination signals a new era for Fed monetary policy. This “cross-disciplinary practitioner”—spanning regulation, investment, and academia—and his complex ties to Trump will be pivotal variables shaping U.S. monetary policy. For crypto markets, this policy transformation presents both challenges and opportunities.

The challenge lies in Warsh’s “rate cuts alongside balance-sheet reduction” possibly sustaining liquidity contraction—further extending the crypto bear market. The traditional “policy-driven market” logic will fade, and crypto asset pricing will depend more on fundamentals—not Fed policy pivots.

The opportunity lies in Warsh’s “rule-driven” policy enhancing market predictability, attracting institutional capital, and shifting crypto from a “retail-dominated speculative market” to an “institution-dominated allocation market.” This may well be crypto’s necessary maturation—and the start of crypto assets truly returning to intrinsic value.

In the Warsh era, crypto investors must abandon “buy-the-dip-and-rebound” speculation—focusing instead on long-term value: Bitcoin’s halving cycles, Ethereum’s upgrade progress, and crypto projects’ real-world applications. These factors—not fleeting policy shifts—will determine crypto’s future trajectory. Only by respecting the market and adhering to value can investors navigate this monetary policy transformation, endure the bear market, and await the dawn.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News