On the Eve of Fed Policy Decision: A Dual Test of "Billions in Tariff Rulings" and the Non-Farm Payrolls Report

TechFlow Selected TechFlow Selected

On the Eve of Fed Policy Decision: A Dual Test of "Billions in Tariff Rulings" and the Non-Farm Payrolls Report

This weekend, there are many major events.

Author: Wall Street Insights

This weekend is set to be anything but quiet.

Markets are bracing for a true "stress test." From the Supreme Court's potential ruling on "billion-dollar tariffs," to the looming "tariff hammer" on metals, and forced selling by passive funds, markets this week sit at the epicenter of multiple converging storms.

These three pivotal events unfolding in rapid succession will profoundly reshape market direction and directly impact pricing logic across U.S. equities, Treasuries, and precious metals.

Additionally, at 21:30 Beijing time on Friday, January 9, the U.S. Bureau of Labor Statistics (BLS) will release the December nonfarm payrolls report.

After weeks of data drought due to government shutdowns, this report will serve as a “reliable readout” of economic health and the most decisive reference ahead of the Federal Reserve’s January FOMC meeting—directly influencing whether policymakers remain on hold or continue cutting rates.

At this critical juncture, buckling up and guarding against volatility may be the best strategy.

Below, we break down these major shifts now underway.

01 Over 1,000 Companies Sue the White House: Will $100 Billion in Tariffs Be Reversed?

Washington is witnessing an unprecedented legal offensive.

According to recent reports, more than 1,000 companies have formally filed lawsuits seeking to overturn existing tariff policies and demand refunds totaling up to $100 billion in paid duties.

The list includes major publicly traded giants such as Costco and Goodyear Tire & Rubber Co. Dozens of additional entities joined the litigation in just the first few days of 2026.

The central issue hinges on the upcoming final ruling by the U.S. Supreme Court regarding the legality of the sweeping tariff program introduced under former President Trump.

As reported by CCTV News, the Supreme Court has scheduled its opinion release for this Friday, Eastern Time. While it remains unconfirmed whether the tariff case will be included, markets widely expect a decision as early as this week.

What happens if the Court rules the tariffs illegal?

- Equity bullish: Ohsung Kwon, Chief Equity Strategist at Wells Fargo, estimates that if tariffs are overturned, EBITDA for S&P 500 constituents could rise approximately 2.4% in 2026 versus the prior year. Removing tariffs would directly boost corporate profits, benefiting stocks.

- Treasury bearish: On the flip side, eliminating tariffs would remove a key government revenue stream, heightening concerns over federal deficits and potentially triggering Treasury selloffs.

- Policy complications: If refund-driven cash influx acts as an unplanned fiscal stimulus, the Fed’s path toward rate cuts becomes significantly more complex.

Even if the Supreme Court rules the tariffs illegal, the actual refund process—covering around $133 billion—would likely require resolution through lower courts. Moreover, the White House could invoke alternative legal authorities to reimpose restrictions, meaning policy uncertainty could persist long-term.

02 Countdown on Critical Mineral Tariffs: Silver and Platinum Face “Moment of Truth”

Beyond the broad tariff litigation, the outcome of the U.S. Section 232 investigation into critical minerals is expected to be announced this Saturday, January 10. This decision will directly determine the fate of Comex silver and platinum-group metals.

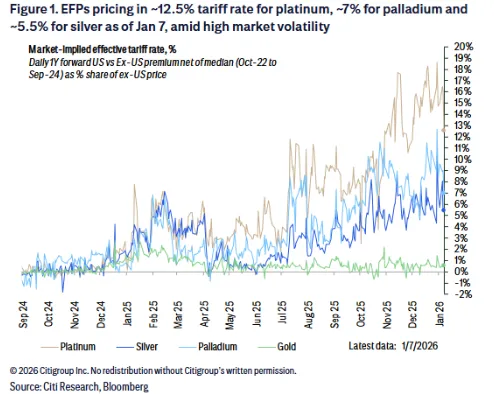

Citi Research has laid out detailed scenario analyses:

If tariffs are imposed: A roughly 15-day implementation window would trigger a short-term rush to “ship into the U.S.,” pushing up domestic benchmark prices and futures premium (EFP).

As of January 7, EFP pricing implies market expectations of a ~12.5% tariff on platinum, ~7% on palladium, and ~5.5% on silver. These implied rates reflect heightened market uncertainty amid volatile conditions.

(Implied Tariff Rates Based on EFP Pricing)

If no tariffs are imposed: Metals would flow out of the U.S. to other global regions, easing pressure on London spot prices and possibly leading to price corrections.

How do individual metals look?

- Silver (likely safe): Given the U.S.’s heavy reliance on imported silver, Citi believes no tariffs represent the base case. Even if levied, exemptions for Canada and Mexico are likely. However, in a “no-tariff” scenario, silver prices may face temporary downward pressure.

- Palladium (high risk): Most likely to face tariffs (e.g., 50%). Imposition would sharply raise import costs domestically, fueling higher futures prices.

- Platinum (coin toss): Uncertainty remains extremely high on whether tariffs will apply.

The investigation was originally due to submit findings by October 12, 2025, giving President Trump 90 days to act—making the deadline around January 10 (this Saturday). However, Citi believes that given the large number of products involved, presidential action could be indefinitely delayed. In that case, silver and platinum-group metal prices could continue rising during the extended uncertainty period.

03 Technical Selloff Underway: The “Bloody Week” of Commodity Index Rebalancing

Beyond fundamental developments, a “passive storm” in capital flows has already begun.

The highly watched Bloomberg Commodity Index (BCOM) annual rebalancing took effect after trading closed on January 8 and will continue through January 14. To comply with diversification rules limiting any single commodity to no more than 15% weight, this adjustment exerts significant selling pressure—especially on precious metals.

Gold: Weight reduced from 20.4% to 14.9%, facing sell orders equivalent to 3% of total holdings.

Silver: Facing even greater pressure! Weight slashed from 9.6% to 3.94%, with estimated sell-offs reaching up to 9% of total holdings.

This “non-fundamental,” rule-driven selloff forces speculative capital to step back and watch from sidelines, amplifying short-term volatility.

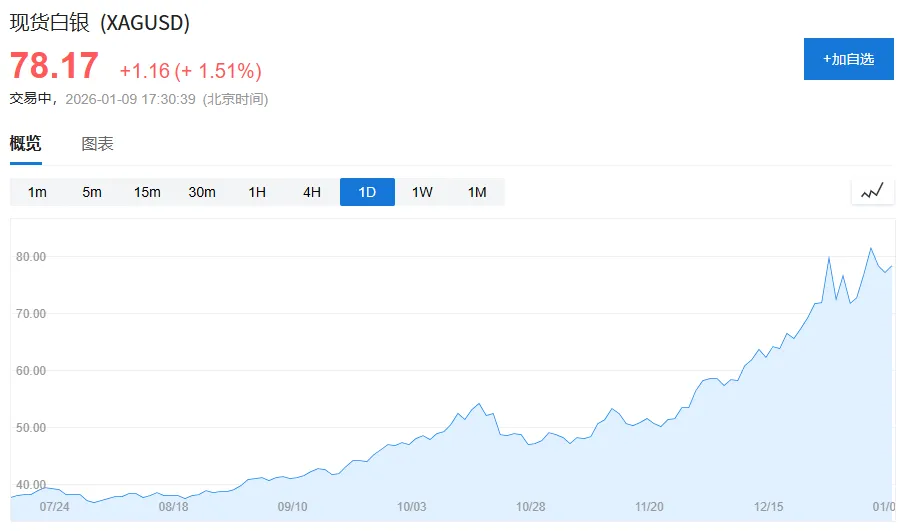

Notably, the pullback in gold and silver follows a rare, historic rally. Spot gold gained over 70% in 2025 alone, while silver surged nearly 150%, entering a parabolic phase from December 23 onward and setting consecutive all-time highs. Such massive short-term profit accumulation makes the market particularly vulnerable when hit by liquidity shocks.

While Goldman Sachs analysts argue that so long as tightness in London inventories persists, liquidity—not fundamentals—will drive prices, investors must remain on high alert in the near term given the scale of this passive fund rotation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News