Big short investor Burry warns: Fed's RMP aims to conceal banking system fragility, essentially a QE restart

TechFlow Selected TechFlow Selected

Big short investor Burry warns: Fed's RMP aims to conceal banking system fragility, essentially a QE restart

Continued volatility in the repo market and widening term premium spreads have intensified concerns over year-end funding tightness, highlighting underlying systemic fragility.

Author: Zhang Yaqi

Source: Wall Street Insights

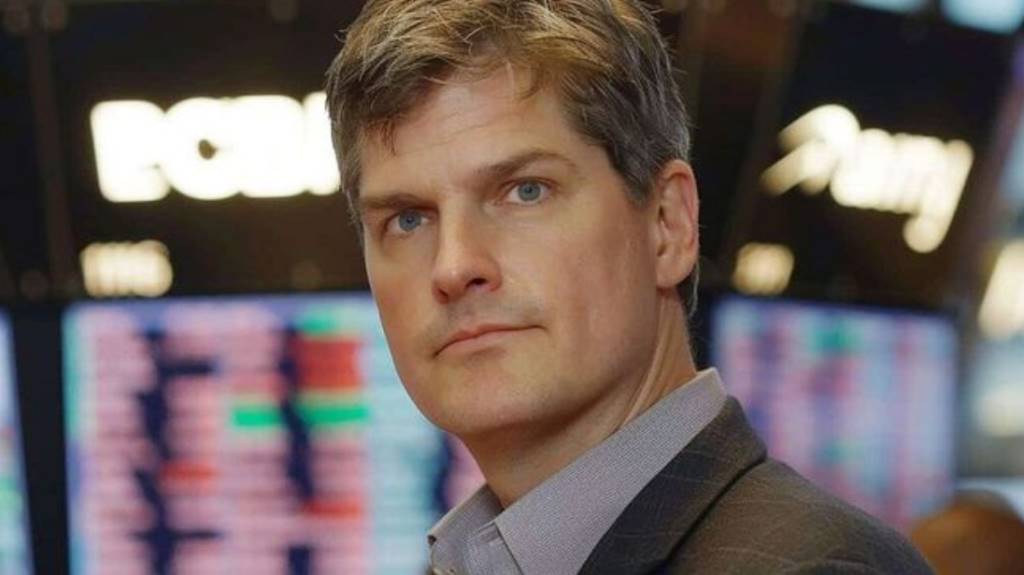

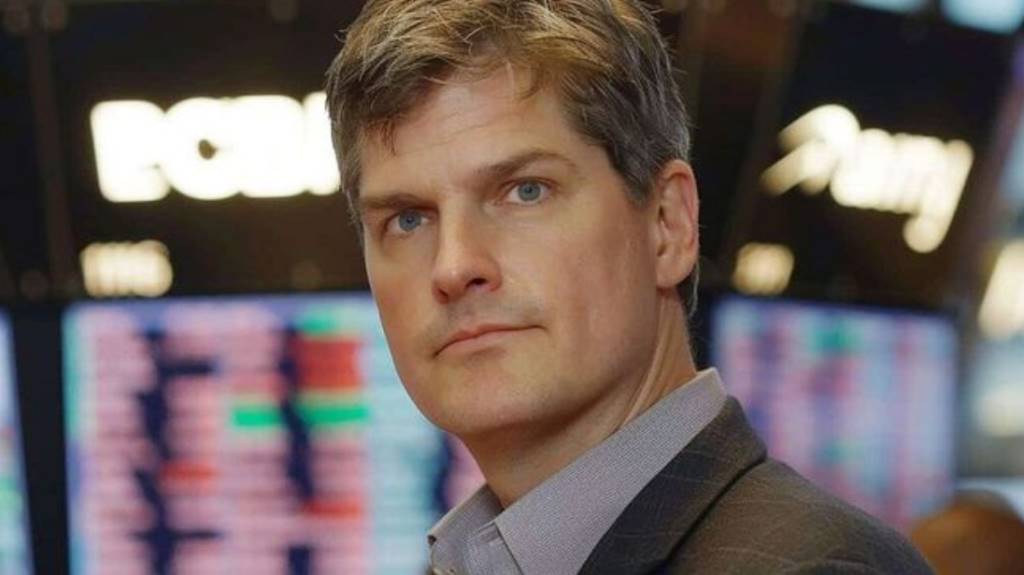

Michael Burry, the real-life inspiration behind the movie "The Big Short," has issued a sharp warning about the Federal Reserve's latest bond-buying program, pointing out that its so-called "Reserve Management Purchases" (RMP) actually reveals deep vulnerabilities in the U.S. banking system. He argues this move is essentially a reactivation of quantitative easing (QE), aimed at masking liquidity strains within the banking sector rather than being the routine operation the Fed claims it to be.

As previously reported by Wall Street Insights, the Fed announced overnight that it would begin purchasing short-term Treasuries as needed to maintain ample reserve levels. The New York Fed simultaneously released a statement indicating plans to buy $40 billion in short-term Treasury securities over the next 30 days—the latest step following last week’s official end of balance sheet normalization. This action comes amid unsettling interest rate volatility in the massive $12 trillion U.S. repo market, with ongoing turbulence in money markets forcing the Fed into quicker intervention.

However, Burry believes this very action shows the banking system still hasn't fully recovered from the aftermath of the 2023 regional banking crisis. He warns that if banks require central bank “lifelines” even while holding over $3 trillion in reserves, it is not a sign of strength but a strong signal of systemic fragility.

Burry further analyzes that each crisis appears to force the Fed into permanently expanding its balance sheet, otherwise risking a breakdown in bank funding. Market reactions quickly confirmed tightening financial conditions: yields on two-month U.S. Treasuries surged, while those on 10-year notes declined. At the same time, persistent volatility in the repo market has raised concerns about year-end funding crunches, prompting investors to reassess the stability of the financial system.

Clandestine Quantitative Easing and a Fragile Banking System

Burry questions the Fed's use of the term "Reserve Management Purchases," interpreting it as a veiled measure designed to prop up an industry still struggling. According to FRED data, prior to the 2023 crisis, U.S. bank reserves stood at just $2.2 trillion, but have now climbed above $3 trillion.

Burry issued a warning:

"If the U.S. banking system cannot function without more than $3 trillion in reserves or Fed 'life support,' that is not strength—it is a sign of fragility."

He added that the current pattern seems to evolve into a permanent expansion of the Fed's balance sheet after every crisis, otherwise facing the risk of bank funding collapses. While this mechanism partly explains strong stock market performance, it also exposes the financial system’s extreme dependence on central bank liquidity.

Policy Misalignment and Risk-Aversion Strategies

From an operational standpoint, Burry highlights a notable strategic shift between the U.S. Treasury and the Federal Reserve: the Treasury increasingly favors issuing more short-term bills, while the Fed concentrates on buying them. This strategy helps avoid pushing up 10-year Treasury yields. As expected in markets, after the Federal Open Market Committee (FOMC) meeting, yields on two-month U.S. Treasuries rose, while those on 10-year notes fell.

Given continued volatility in the repo market, some analysts expect the Fed may need to take more aggressive steps to prevent a year-end liquidity squeeze. In this context, Burry sees it as further evidence of underlying weakness in the financial system. He cautions investors against misleading Wall Street advice to buy bank stocks and reveals that for funds exceeding the FDIC insurance limit of $250,000, he prefers holding Treasury money market funds as a risk-avoidance strategy.

It should be noted that the primary goal of quantitative easing (QE) is to lower long-term interest rates by purchasing long-dated Treasuries and MBS, thereby stimulating economic growth. In contrast, RMP is more technical in nature, focusing on buying short-term Treasuries to ensure sufficient liquidity within the financial system's "plumbing" and prevent unexpected disruptions. Bank of America notes that based on 2019 experience, liquidity injections will rapidly push down the Secured Overnight Financing Rate (SOFR), while the federal funds rate (FF) reacts with a lag—this "time gap" could create significant arbitrage opportunities for investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News