The Evolution of Lending Markets: How Morpho Achieves Its Second Leap

TechFlow Selected TechFlow Selected

The Evolution of Lending Markets: How Morpho Achieves Its Second Leap

Morpho believes that a smooth operational history is crucial for building a security brand in lending protocols.

Author: Kevin, BlockBooster

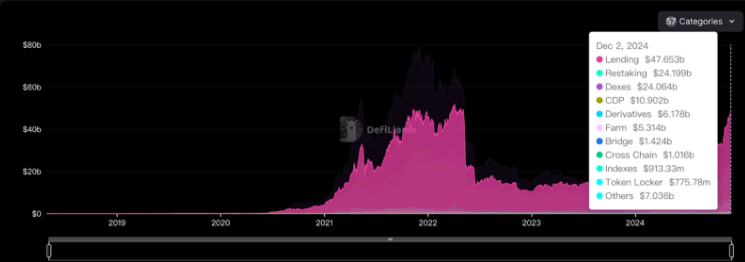

Lending protocols rank first in capital capacity among DeFi sectors, making them the largest capital-absorbing segment within DeFi. Lending is a market with proven demand, healthy business models, and relatively concentrated market share.

Source: defillama

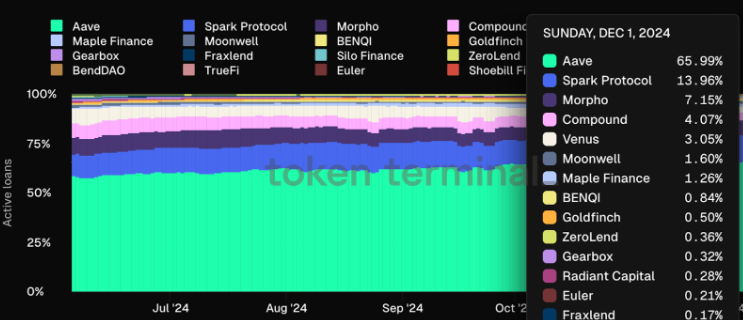

The moat in decentralized lending markets is evident: Aave's market share has further increased, stabilizing between 50-60% in 2023 and now rising to the 65-70% range.

Source: https://tokenterminal.com/explorer/markets/lending

After years of accumulation, Aave has gradually reduced its token incentives. However, apart from Aave, other lending protocols still require substantial additional token incentives—including Morpho. Observing Aave’s development trajectory reveals the core advantages behind its current market dominance:

- Long-term robust security performance: While there are many forked projects based on Aave, most have quickly halted due to theft or bad debt incidents. In contrast, Aave has maintained a relatively strong security record, providing depositors with an irreplaceable foundation of trust. In comparison, although some emerging lending protocols may offer innovative concepts or higher short-term yields, they often struggle to gain user confidence—especially from large-capital participants—without having endured years of market testing.

- Greater investment in security: Leading lending protocols leverage higher revenues and well-funded treasuries to strongly support security audits and risk management. This budgetary advantage not only ensures the safety of new feature developments but also lays a solid foundation for integrating new assets—critical for long-term protocol growth.

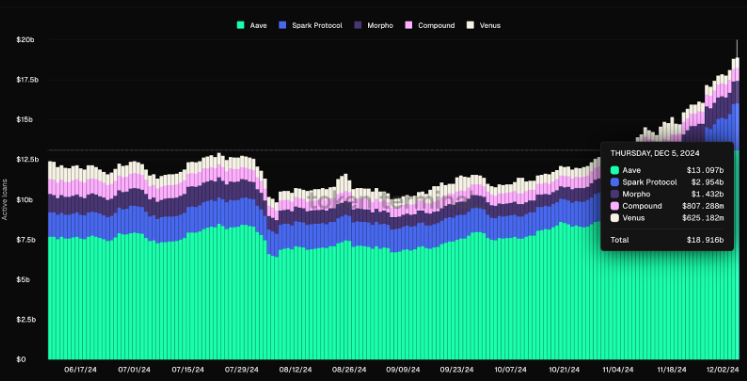

Since securing funding from a16z in the second half of 2022, Morpho has achieved a breakthrough in the lending sector over the past two years. As shown below, Morpho currently has $1.432 billion in lent assets, ranking third after Aave and Spark.

Source: https://tokenterminal.com/explorer/markets/lending

Morpho's success can broadly be divided into two phases—its market share steadily rose through these two stages of accumulation.

First Leap: Optimizing Aave and Compound for Rapid Growth

Morpho's initial business model focused on improving capital utilization efficiency in lending protocols, particularly addressing the mismatch between deposits and loans in pool-based models like Aave and Compound. By introducing a peer-to-peer matching mechanism, Morpho offers users better interest rates—higher deposit rates and lower borrowing rates.

The core limitation of pool-based models lies in the fact that total deposits often far exceed total borrowings, creating inefficiencies: depositors' interest is diluted by idle funds, while borrowers must pay interest on the entire pool rather than just the portion they use.

Morpho solves this with a new workflow: user deposits and collateral are allocated to Aave and Compound, ensuring baseline interest accrual. Meanwhile, Morpho uses a peer-to-peer matching engine to prioritize large orders, directly pairing lenders with borrowers to reduce idle capital. This way, all deposited funds are utilized, and borrowers only pay interest on the exact amount they draw, achieving interest rate optimization.

This matching mechanism eliminates traditional inefficiencies:

- Depositors earn higher returns, borrowers pay less interest, and both rates converge, significantly enhancing user experience.

- Morpho operates atop Aave and Compound, leveraging their infrastructure as liquidity buffers, thus maintaining risk levels comparable to these mature protocols.

For users, this model is highly attractive:

- Regardless of whether a match occurs, users receive at least the same rate as on Aave or Compound; if matched, their yield or cost improves further.

- Built on established protocols, Morpho inherits their risk control and fund management frameworks, greatly reducing trust barriers for users adopting a new platform.

Through innovative design, Morpho skillfully leverages DeFi composability to attract more capital under low-risk conditions, delivering more efficient interest rate optimization services.

Second Leap: Transitioning from Application to Decentralized Infrastructure, Isolating Risk and Building an Independent Ecosystem

As previously mentioned, Morpho Optimizer represented only the first leap—allowing Morpho to stand out among lending protocols and become a significant player. However, in terms of product architecture, protocol positioning, and ecosystem openness, the optimizer alone offered limited room for expansion. First, the growth of optimizers is constrained by the design of underlying lending pools, heavily relying on its DAO and trusted contractors to manually monitor and update hundreds of risk parameters daily or upgrade large smart contracts. Without evolution, Morpho would fail to attract broader developers and native protocols, remaining merely an ecosystem project of Aave and Compound. Therefore, Morpho adopted a product philosophy akin to Uniswap V4—focusing solely on building a foundational layer for major financial services, then opening up all modules above it. The team calls this minimalistic approach a “primitive,” minimizing product scope while permissionlessly exposing all lending parameters to individuals and ecosystem protocols. By shifting risks to third parties, Morpho enhances its own ecosystem value over time.

Why does Morpho aim to become a minimal component and open risk parameters to third parties?

- Risk isolation: Lending markets operate independently. Unlike multi-asset pools, each market’s liquidation parameters can be set without considering the highest-risk asset in a basket. Morpho’s smart contract consists of only 650 lines of Solidity code, is immutable, simple, and secure.

- Customizable vaults: For example, suppliers can lend at higher loan-to-value (LLTV) ratios while bearing the same market risk as supplying to lower-LLTV multi-asset pools. Any combination of collateral, loan assets, and risk-parameterized markets can be created.

- Cost reduction: Morpho is fully autonomous, eliminating fees needed to pay for platform maintenance, risk managers, or code security experts. The singleton contract based on minimal code reduces gas costs by up to 70%.

- Lego-like base layer: Third-party protocols or individuals are allowed to build additional logic layers on top of Morpho. These layers can enhance core functionality through risk management and compliance tools or simplify the experience for passive lenders. For instance, risk specialists can create non-custodial curated vaults where lenders passively earn yield—essentially reconstructing today’s multi-collateral lending pools.

- Bad debt handling design: Morpho adopts a different approach to bad debt compared to conventional lending protocols. Specifically, if an account still has outstanding debt after liquidation with no remaining collateral to cover it, the loss is shared pro-rata among all lenders in that market. Thus, Morpho cannot go bankrupt due to bad debt; even if losses occur, they only affect specific isolated markets. Unless multiple markets simultaneously fail, Morpho’s overall ecosystem value remains intact.

- Developer-friendly: Account management supports gasless interactions and account abstraction, while free flash loans allow anyone to access assets across all markets in a single call.

The Morpho platform provides users with complete autonomy to build. Any individual or institution can design and implement their own lending risk management mechanisms on the platform. Professional financial institutions can also collaborate with other market participants via the platform, earning fees by offering management services. Its permissionless nature allows flexible parameter settings, enabling independent creation and deployment of isolated lending markets without relying on external governance for asset additions or rule adjustments. This flexibility grants market creators high degrees of freedom to independently manage risk and return profiles according to their own assessments, meeting diverse user needs across risk preferences and use cases.

However, deeper analysis shows that the trustless design ultimately serves to accumulate reputation and TVL at low cost. Currently, Morpho hosts hundreds of vaults, but those listed on the Morpho Interface are mostly designed by risk management experts. By allowing anyone to create vaults, Morpho can grow TVL risk-free—even if most vaults fail, the impact is contained. Yet, exceptionally well-run vaults will stand out, eventually gaining recognition as expert-level risk managers and benefiting from the user base brought by the Morpho platform. Before reaching that stage, individually created vaults must undergo prolonged operation and validation.

How Does MorphoVault Work?

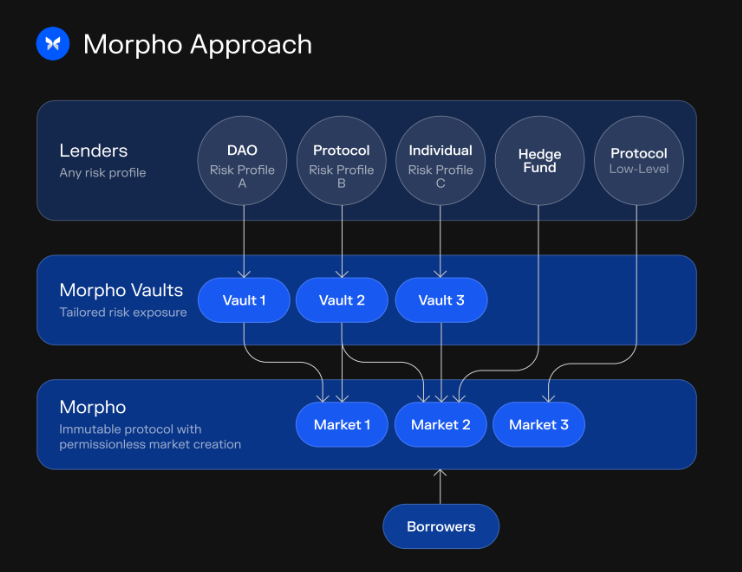

Morpho Vault is a lending vault system built on the Morpho protocol, specifically designed for managing lent assets. Whether it’s a DAO, protocol, individual investor, or hedge fund, any entity can freely create and manage vaults on Morpho Vault. Each vault focuses on one lending asset and supports customized risk exposure, capable of allocating funds to one or more Morpho markets.

Source: Morpho

This design significantly optimizes the lending process, enhances overall user experience, and effectively aggregates market liquidity. Users can not only participate in independent markets and lending pools but also easily provide liquidity to earn interest passively.

Another key feature is Morpho Vault’s highly flexible risk management and fee structure. Each vault can flexibly adjust risk exposure and performance fees according to strategy. For example, a vault focused on LST assets will only involve relevant risks, while one dedicated to RWA assets will concentrate on that category. This customization enables users to select the most suitable vault based on their personal risk tolerance and investment goals.

Since late November, Morpho has passed a proposal enabling token transferability. For its current model—which relies on Morpho token subsidies to attract users—making the token tradable can bring in more participants. Moreover, since launching on Base in June, Morpho’s metrics have consistently risen, establishing it as a leading DeFi protocol within the Base ecosystem. With growing speculation around ETH ETF staking possibilities and increasing discussions about RWAs, Morpho has launched the first RWA vault on Base certified by Coinbase. Curated by SteakhouseFi and Re7Capital, these vaults will support multiple RWA collateral options, placing Morpho in a unique position within the Base ecosystem.

Looking back at Morpho’s development history, what stands out—and what other lending protocols can learn—is the effort Morpho invested in building its reputation. Starting with the Morpho Optimizer, it used Aave and Compound as capital buffers, leveraging their historical security assumptions to rapidly establish its brand. When the time was right to evolve into an independent protocol, Morpho opened up lending dimensions to third parties, significantly reducing its own risk exposure while developing its ecosystem at low cost and fostering native applications within its ecosystem. Morpho clearly understands that for lending protocols, a stable operational history is crucial for building a security-focused brand—and this is precisely the foundation of its success.

Disclaimer: This article/blog is for informational purposes only and represents the author’s personal views, not necessarily those of BlockBooster. It is not intended to provide: (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risk, with significant price volatility and the potential for total loss. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific questions, please consult your legal, tax, or investment advisor. Information provided herein (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling such data and charts, but no responsibility is accepted for any factual errors or omissions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News