Is Ethereum's staking bottleneck approaching?

TechFlow Selected TechFlow Selected

Is Ethereum's staking bottleneck approaching?

This fall, the four major sources of Ethereum staking demand are expected to converge on the network simultaneously.

Author: Leeor Shimron

Translation: Saoirse, Foresight News

Ethereum holders who wish to stake their tokens may want to start lining up, as staking demand could surge dramatically in the coming weeks.

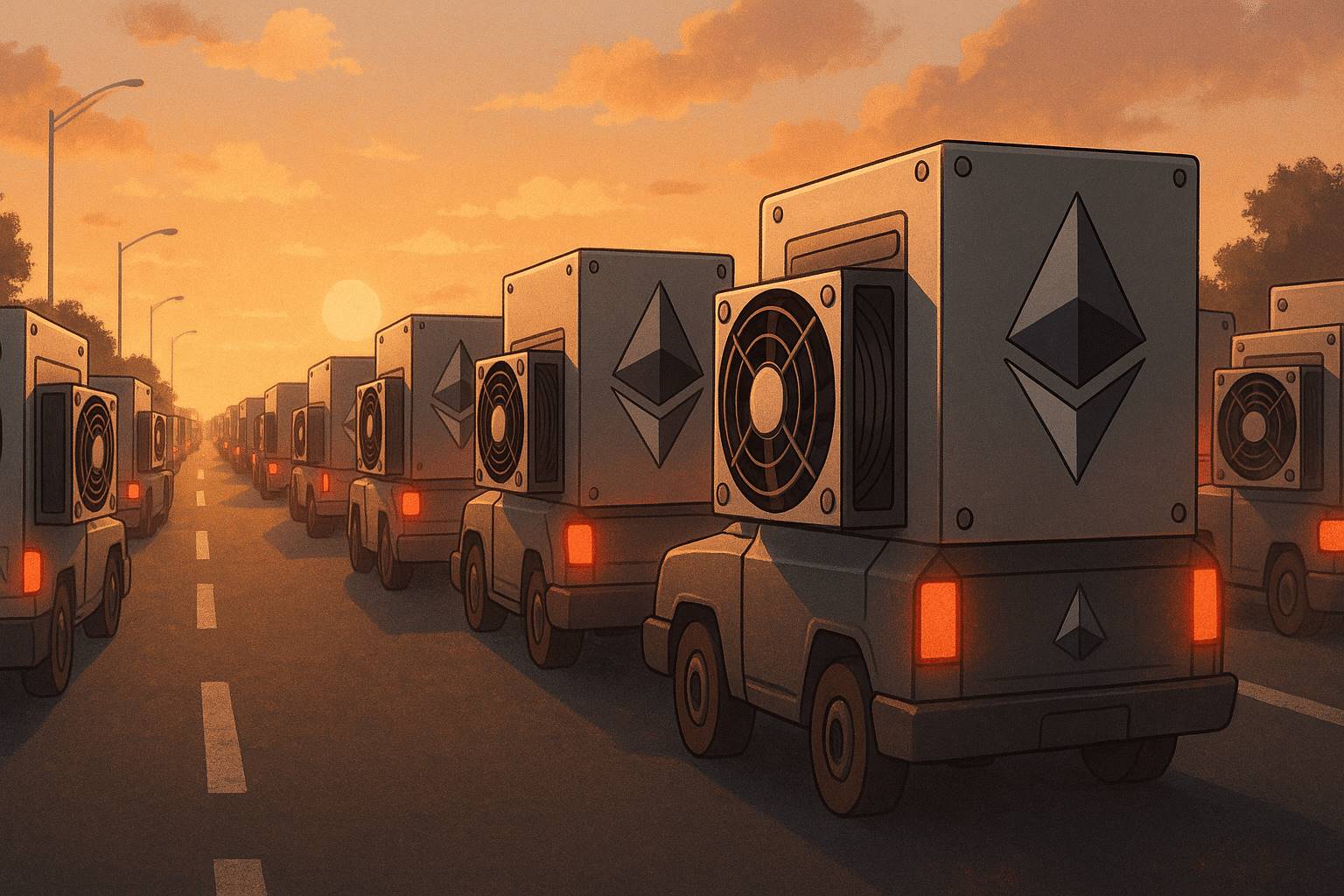

As of September 18, the Ethereum network’s validator entry queue contained 422,143 ETH, worth approximately $1.94 billion at current prices. While this is down from 986,824 ETH in August, it remains a historical high for the network since "The Merge" in September 2022—the event that officially transitioned Ethereum to its PoS consensus mechanism.

(Validator queue data chart)

But don’t be misled by the apparent decline in the staking queue shown in the chart above—although this trend has shortened staking wait times from 16 days to 8 days, the queue is expected to swell again soon.

Why?

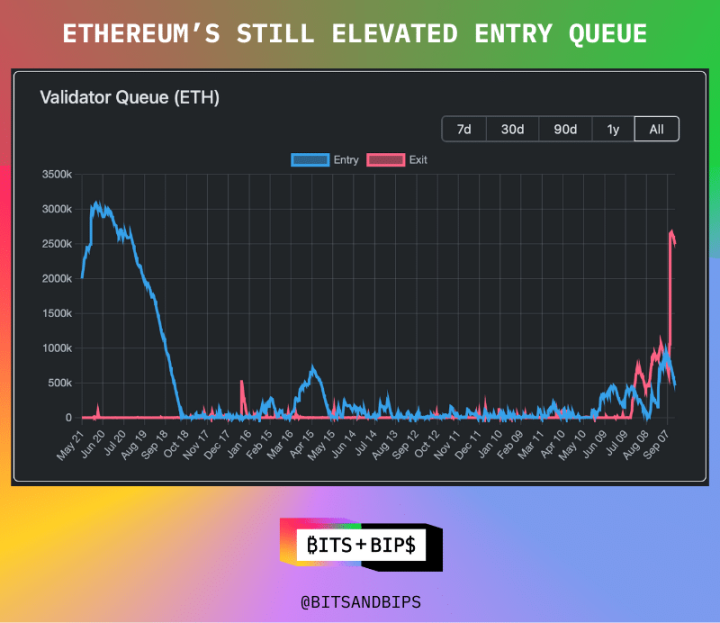

On September 9, Kiln, a staking provider managing $1.5 billion in assets and securing multiple proof-of-stake networks, experienced a security incident. As a precaution, Kiln proactively un-staked all of its ETH holdings. For context, Kiln is currently the fifth-largest ETH staker, managing over 1.6 million ETH. As shown in the chart above, this action caused the Ethereum "exit queue" (ETH awaiting withdrawal) to spike from just over 500,000 to more than 2.5 million ETH.

(Dune Analytics)

However, after “exiting,” there will inevitably be a “return”—once Kiln determines the network is secure, all previously unstaked ETH will re-enter the staking queue. This “return” could coincide precisely with surging demand from three other major sources, potentially leading to significantly extended staking wait times on Ethereum.

Other Key Demand Sources

Digital Asset Treasuries (DATs)

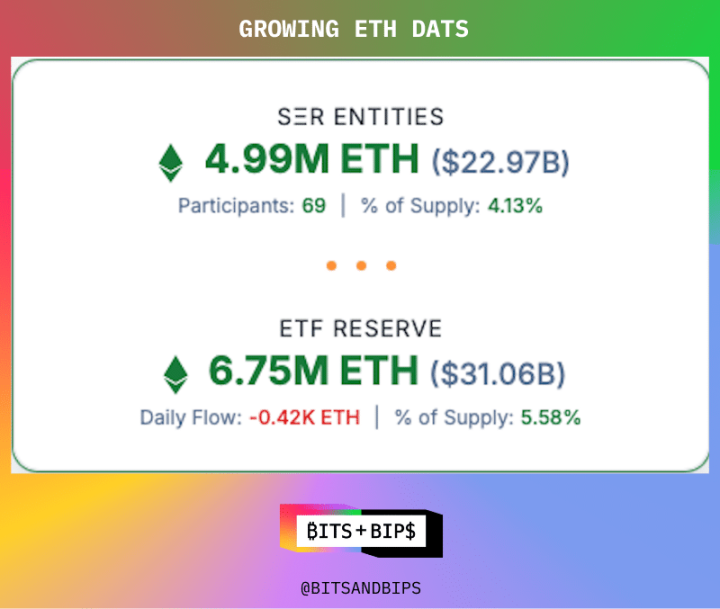

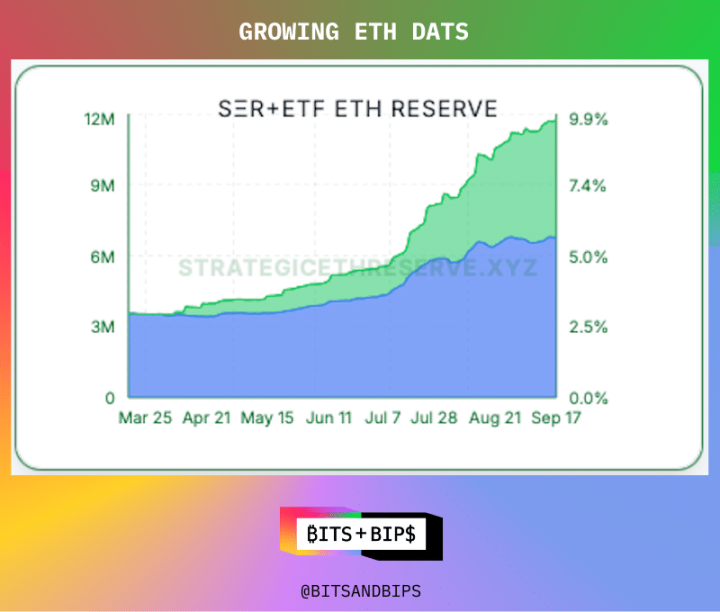

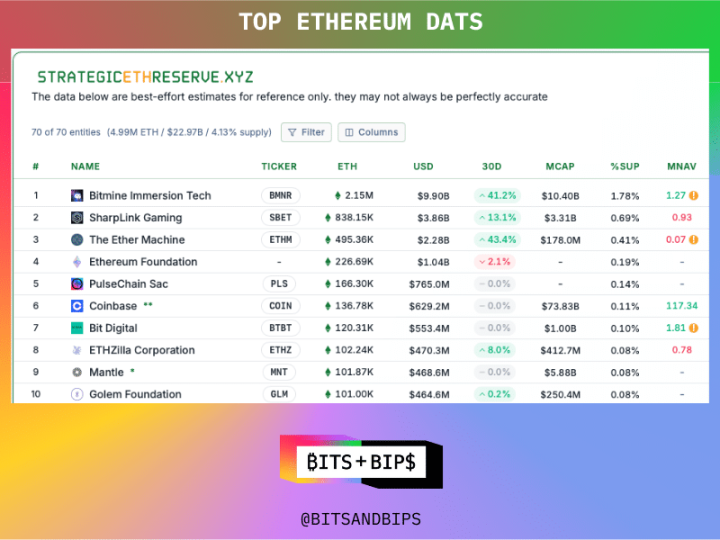

If 2024 was the year of ETFs, then 2025 is undoubtedly the year of digital asset treasury (DAT) companies. Beyond Bitcoin, ETH is the highest-value asset held in digital asset treasuries. According to data aggregator “Strategic ETH Reserves,” companies such as Bitmine Immersion, Ether Machine, and Sharplink Gaming collectively hold 499,000 ETH, valued at $22.97 billion (see chart below). These firms’ ETH holdings are growing rapidly, approaching the scale of ETH spot ETF holdings—currently totaling 675,000 ETH, worth slightly over $31 billion.

(Strategic ETH Reserves)

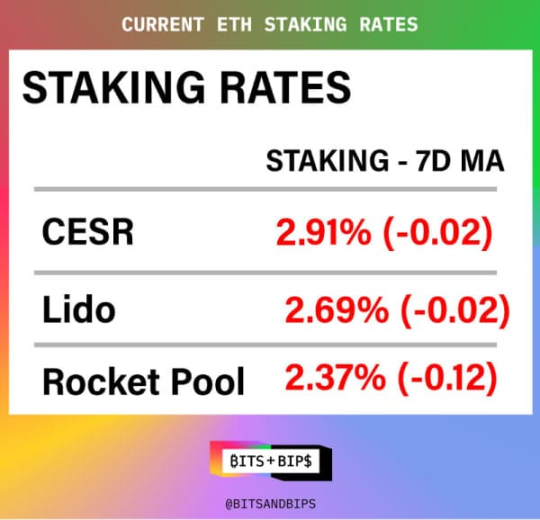

Ethereum supporters argue that ETH is better suited for corporate crypto reserves because these companies can earn passive yield through staking. Currently, the Compound Ethereum Staking Rate (CESR)—a daily benchmark rate representing the average annualized staking yield across Ethereum validators—stands at 2.91%. However, this yield fluctuates based on ETH price movements and the total amount staked at any given time. Chris Perkins from Coinfund notes this “yield” functions similarly to the London Interbank Offered Rate (LIBOR) within the Ethereum ecosystem, serving as its “risk-free rate.” It should be noted that actual yields using liquid staking solutions like Lido or Rocket Pool will be lower than 2.91% due to platform fees.

(Rho Protocol)

Additionally, unlike Bitcoin—which remains inflationary despite its 21 million cap—Ethereum’s current mechanism is designed to make it deflationary when network usage is sufficiently high.

As digital asset treasury companies race to accumulate ETH (with Bitmine Immersion, led by Tom Lee, leading the pack with $9.9 billion in ETH), they quickly stake newly acquired ETH to begin earning yield as soon as possible. Given that most of these companies raised capital during the summer, this “buy-and-stake” behavior was likely a key driver behind the recent expansion of Ethereum’s staking queue.

Kam Benbrik, Research Lead at institutional staking provider Chorus One, noted: “A significant portion of new staking volume comes from digital asset treasuries like Sharplink—Sharplink is the second-largest DAT, holding around $3.6 billion in ETH, and has publicly stated it plans to stake ‘close to 100%’ of its holdings. We expect the staking queue to grow further, with Bitmine being one of the main catalysts. On-chain data shows Bitmine hasn’t started staking its ETH yet; as the largest ETH holder among DATs, once it begins staking, it will have a substantial impact on the Ethereum staking queue.” (Editor’s note: The article’s author, Leeor, currently serves as Head of U.S. Markets at Chorus One.)

(Strategic ETH Reserves)

With these digital asset treasury companies planning to raise additional funds, similar growth in Ethereum’s staking queue is highly likely in the future.

However, it is still not entirely clear what proportion of these companies’ holdings have already been staked. In response to inquiries from Unchained, Sharplink stated that “close to 100% of its ETH is staked,” while Ether Machine reported “over 90% staked.” Bitmine’s staking status remains unclear—the company declined to provide specific figures in an interview with Unchained, suggesting only to refer to its official website.

Mara Schmeidt, CEO of institutional staking provider Alluvial, also believes a large amount of ETH held by digital asset treasuries remains “idle and unstaked.” She said: “Several well-known DAT companies have acquired ETH but haven’t staked it yet—these are names everyone in the industry recognizes. We estimate the scale of idle ETH could reach several billion dollars.”

Staking-enabled ETFs

The second major source of demand is “staking-enabled Ethereum ETFs”—products expected to gain SEC approval this fall and begin staking ETH. Although the SEC has delayed decision deadlines for several staking ETF applications from September 10 to October, final rulings are drawing near. Bloomberg analyst James Seyffart expects these ETFs could be approved by mid-to-late October.

Mara Schmeidt agrees with Seyffart, stating: “So far, the main hurdles for staking ETFs haven’t come from the SEC, but rather tax or grantor trust issues. I’m highly confident that by October, the path for ETFs to begin staking will be fully clear—this will clearly be the most impactful event, triggering a sharp rise in ETH staking participation. Capital inflows could be massive, so staking queues on Ethereum aren’t going away anytime soon.”

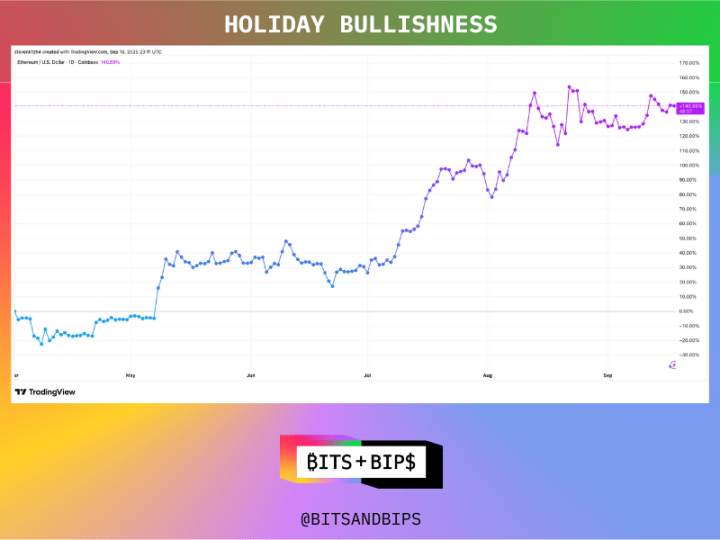

Seasonal Optimism

Moreover, although ETH has already seen strong gains this year (up 36.6% year-to-date, and 140.59% since April 1), the fourth quarter historically represents a bullish period in the crypto industry, suggesting another potential price surge for ETH later this year.

(TradingView)

In past cycles, ETH has performed particularly well in Q4: returning 142.81% in Q4 2017 and 22.59% in Q4 2021. If history repeats, increased ETH demand would drive further expansion of the staking queue.

(Coinglass)

Back to Kiln: Returning Staking Demand

In absolute terms, Kiln and its 1.6 million ETH may not seem overwhelming. But the critical point is that capital from these four major demand sources will converge into the same staking queue around the same time. Unchained has attempted to contact Kiln to ask when it plans to restart ETH staking but had not received a response at the time of publication.

Furthermore, this concentrated influx of demand will drastically reduce available buffer space in the staking queue—any additional large staker entering could further extend wait times. A notable example occurred in early September when a “dormant ICO-era wallet” suddenly staked 150,000 ETH (worth $646 million).

Winners: Projects and Tokens in Focus

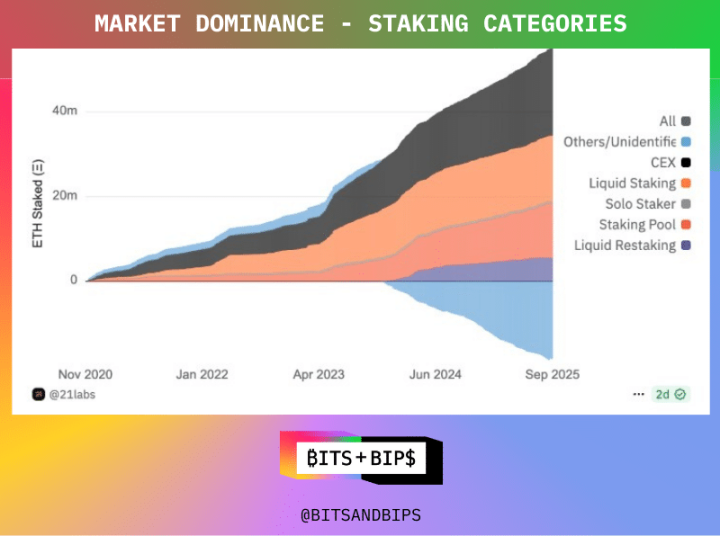

Assuming users can endure long staking wait times, increased queue activity will benefit Ethereum’s liquid staking and restaking ecosystems, as users seek efficient, yield-optimized staking solutions.

In the liquid staking space, leading projects Lido (token: stETH) and Rocket Pool (token: rETH) will directly benefit from growing demand for enhanced yields and liquidity. Lido controls about 24% of the ETH staking market share, with $37 billion in total value locked (TVL), reflecting consistent and stable demand. Rocket Pool’s rETH has $2.8 billion in TVL, with a core advantage in higher decentralization—featuring more individual stakers compared to institutional operators like those in Lido.

Restaking protocols may also experience explosive growth. By leveraging “Actively Validated Services” (AVSs)—essentially borrowing security from already-staked ETH—these protocols offer compounded yields (around 3.5%-5.5%), significantly higher than native staking (~2.8%). Leading projects in the restaking space include:

-

EigenLayer: $19 billion TVL, industry leader;

-

Ether.fi: Over $11 billion TVL, with innovative strategies boosting growth potential for its native token ETHFI;

-

Renzo (token: ezETH): $1.5 billion TVL.

As restaking demand grows, native tokens of these protocols (EIGEN, ETHFI, REZ) may see upward price pressure.

(Dune)

Despite recent short-term outflows, over the past few months, participation in liquid staking, liquid restaking, and staking pools on Ethereum has trended upward, indicating sustained momentum in these on-chain activities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News