With 51% market share and $18 billion in genuine lending volume, how did the "Aave Effect" spread across every corner of DeFi?

TechFlow Selected TechFlow Selected

With 51% market share and $18 billion in genuine lending volume, how did the "Aave Effect" spread across every corner of DeFi?

In the DeFi space, network effects determine success or failure, and no one does it better than Aave.

Author: Kolten

Translation: Tim, PANews

In DeFi, network effects determine success—and no one executes them better than Aave. With five years of market presence, a user base in the millions, and the deepest liquidity in DeFi, projects built on Aave gain access to unmatched scale and network effects—an irreplicable advantage other platforms simply can't match.

Partners instantly gain infrastructure, users, and liquidity that would otherwise take years to build independently. This is what we call the "Aave Effect."

Some Numbers

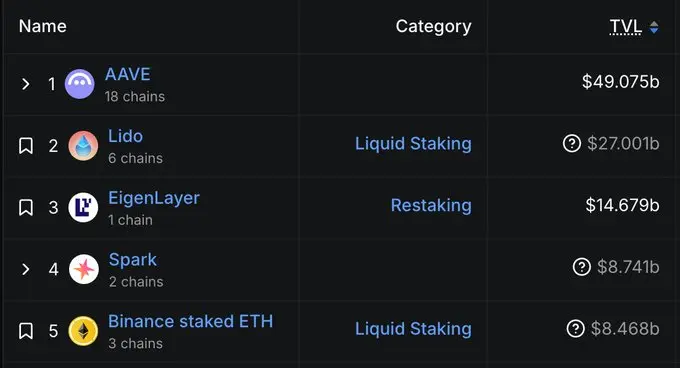

Source: DeFiLlama

Aave is currently the largest protocol in DeFi—and more accurately, the largest in DeFi history. It accounts for 21% of total DeFi TVL, holds 51% of the lending market share, and has surpassed $49 billion in net deposits. While these figures are impressive, the true strength lies in Aave’s market penetration. For example:

-

After Ethena scaled sUSDe on Aave, deposits surged from $2 million to $1.1 billion in just two months.

-

Within weeks of Pendle being added to Aave, users deposited $1 billion worth of PT tokens. That figure has since doubled to $2 billion, making Aave the largest supply market for Pendle tokens.

-

KelpDAO’s TVL skyrocketed from 65,000 ETH to 255,000 ETH—quadrupling—in just four months after rsETH was listed on Aave.

The examples go on. Aave handles nearly 50% of active stablecoin volume and serves as the primary circulation hub for Bitcoin in DeFi. Notably, Aave maintains nearly $1 billion in TVL across four independent blockchain networks—a depth of deployment rarely seen.

How Is the Aave Effect Created?

Anyone can incentivize deposits and grow supply through token rewards and yield mining programs. That’s why, on the surface, TVL isn’t always a meaningful metric. Today, attracting capital supply is considered a solvable problem. But creating real demand for asset usage is far more difficult—unless you’re a platform like Aave.

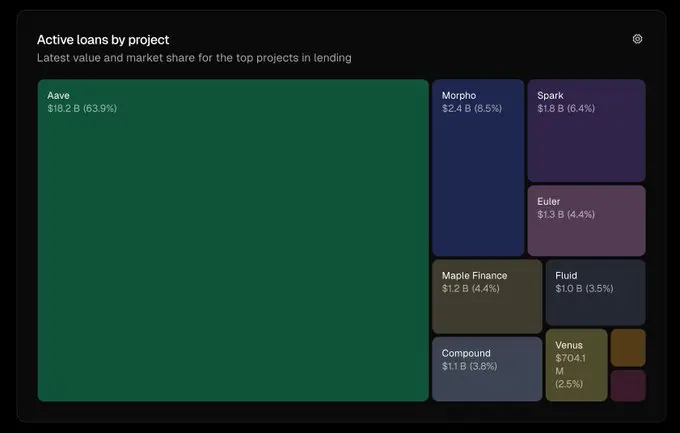

Source: https://tokenterminal.com/explorer/markets/lending/metrics/active-loans

Aave has over $18 billion in active loans—more than all its competitors combined. The protocol is not merely a sophisticated staking contract. When users deposit assets into Aave, those assets are either lent out or used as collateral to borrow other assets. In other words, capital never sits idle.

This creates a self-reinforcing cycle of sustained demand. Whenever an asset is listed on Aave or a developer builds upon it, they benefit from this demand. Ultimately, everyone benefits from the real economic activity generated by a massive, active user base.

This is crucial for teams building on Aave. The protocol has been battle-tested for five years, surviving multiple market cycles and consistently earning the trust of developers and users alike. It operates at a scale of billions of dollars—far exceeding many emerging protocols today.

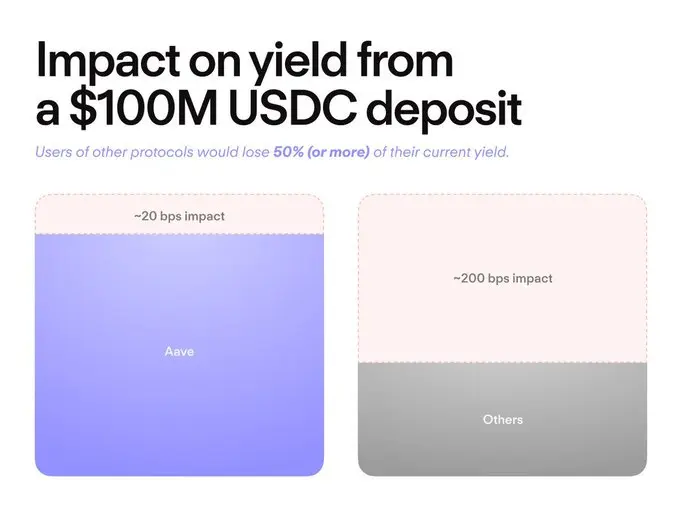

Source: Block Analitica

Beyond this, developers on Aave are not constrained by "scale." Compared to other protocols, Aave supports deposit and borrowing volumes tens of millions of dollars higher. This enables robust development for fintech applications of any size—retail, institutional, or both.

Outlook

When Aave V4 launches, the core engine behind the Aave Effect will evolve further. Its new architecture will offer builders and users unprecedented access to assets and unique lending strategies. (Read more: Inside Aave V4: How the Lending Leader Reinvents Its Moat)

All the factors that make Aave valuable to DeFi today will become even more pronounced in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News