Aave Effect: The Ultimate Paradigm for DeFi Distribution

TechFlow Selected TechFlow Selected

Aave Effect: The Ultimate Paradigm for DeFi Distribution

Reasons why AAVE could rise to $1,000.

Author: Kolten, Aave, Avara

Translation: Alex Liu, Foresight News

In the decentralized finance (DeFi) space, distribution capability is everything—and no one does it better than Aave. With five years of market experience, millions of users, and the deepest liquidity in DeFi, projects built on Aave gain access to unmatched scale and network effects that cannot be replicated elsewhere.

By simply integrating with Aave, project teams instantly gain infrastructure, user base, and liquidity support that would otherwise take years to build—this is what's known as the "Aave Effect."

Key Data Points

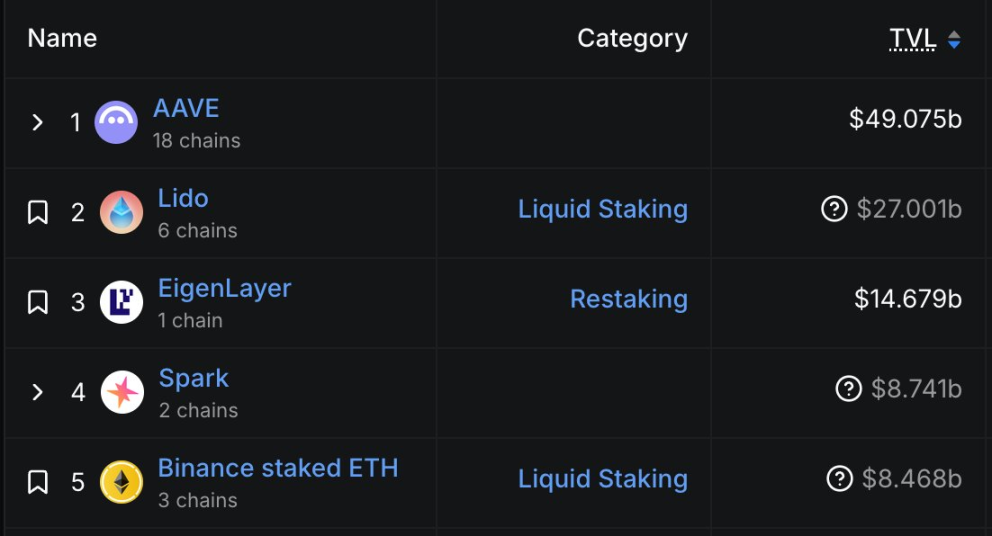

Source: DefiLlama

Aave is currently the largest protocol in DeFi—and arguably the largest in its history—accounting for 21% of total value locked (TVL) across all DeFi, 51% of TVL among lending protocols, and over $49 billion in net deposits. (Translator’s note: This has now exceeded $50 billion)

While these figures are impressive on their own, even more significant is Aave’s distribution power. For example:

-

Ethena’s stablecoin sUSDe saw deposits on Aave surge from $2 million to $1.1 billion within two months after prioritizing integration with Aave;

-

Pendle achieved $1 billion in deposits within weeks after its PT tokens were listed on Aave, and this figure has since grown to $2 billion, making Aave the largest supply market for Pendle tokens;

-

KelpDAO’s rsETH grew its TVL from 65,000 ETH to 255,000 ETH after integrating with Aave, achieving a fourfold increase in just four months.

In addition, Aave hosts over 50% of active stablecoin assets, serves as the largest BTC destination in DeFi, and is the only protocol with over $1 billion in TVL across four separate networks. This level of distribution capability is unmatched.

Why Is This Happening?

Any protocol can attract deposits through incentives such as token rewards or liquidity mining to boost asset supply, so TVL alone isn’t sufficient to gauge true activity. Attracting deposits is now a well-understood challenge; stimulating real demand for asset usage, however, remains extremely difficult—unless you’re Aave.

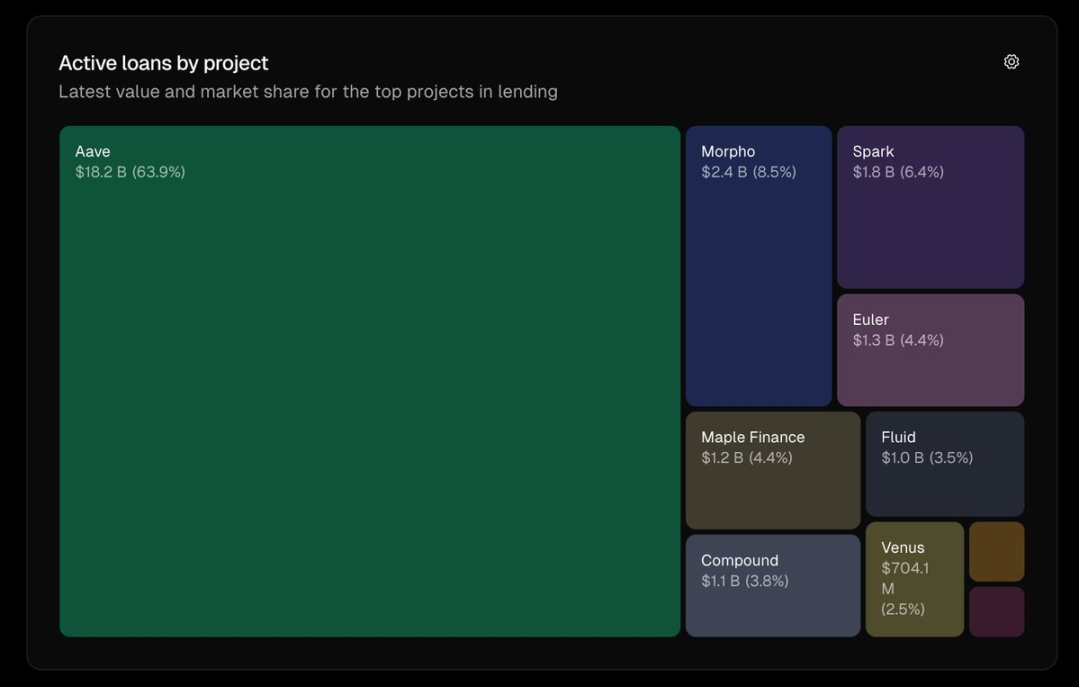

Active borrowing volume, source: Token Terminal

Aave currently has over $18 billion in active borrowing—surpassing the combined totals of all competitors. Aave is not merely a staking platform; assets deposited by users are actively lent out or used as collateral to borrow other assets, rather than simply sitting idle in pools.

This creates a self-reinforcing cycle of sustained demand. When an asset is added to Aave or a project builds on top of it, they immediately benefit from this genuine market demand. All ecosystem participants gain from the real economic activity driven by an active user base.

This is especially critical for development teams building products on Aave. Aave has endured multiple market cycles, earning consistent trust from developers and users over five years while managing billions of dollars in assets—long before many current popular protocols even existed.

More importantly, developers building on Aave are not constrained by capacity limits. In contrast, Aave can support significantly higher levels of supply and borrowing volume compared to competitors, making it highly viable for financial applications of any scale—whether targeting retail, institutions, or both.

Looking Ahead

With the upcoming launch of Aave V4, this "effect engine" will expand further. The new architecture will bring developers and users expanded asset support and novel lending strategies.

All core elements that constitute Aave’s current value—its distribution power, foundation of trust, and high utilization rates—will be further strengthened in V4. For those interested, we recommend reading the article "Understanding Aave V4’s Architecture" to learn more about the upcoming updates.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News