Beware of Discount Rate Risk: The Mechanism and Risks of Leveraged Yield Flywheels in AAVE, Pendle, and Ethena's PT

TechFlow Selected TechFlow Selected

Beware of Discount Rate Risk: The Mechanism and Risks of Leveraged Yield Flywheels in AAVE, Pendle, and Ethena's PT

The leveraged mining strategy involving AAVE+Pendle+Ethena's PT is not a risk-free arbitrage strategy; participants must objectively assess and control their leverage ratio to avoid liquidation.

Author: @Web3_Mario

Summary: Work has been slightly busy recently, causing a delay in updates. Now resuming weekly updates and thank you all for your continued support. This week, an interesting strategy in the DeFi space has gained widespread attention and discussion—leveraging sUSDe, Ethena's staking yield token, as a yield source through PT-sUSDe (the fixed-rate yield token on Pendle), while using AAVE as the funding source to perform interest rate arbitrage and obtain leveraged returns. Some DeFi KOLs on X have expressed optimistic views about this strategy, but I believe certain underlying risks have been overlooked by the market. Here are some insights to share. In short, the AAVE+Pendle+Ethena PT leveraged yield strategy is not a risk-free arbitrage; discount rate risk associated with PT assets still exists. Participants should objectively assess risks, control leverage ratios, and avoid liquidation.

Mechanism of PT Leveraged Yield

First, let’s briefly introduce how this yield strategy works. Those familiar with DeFi know that DeFi, as a decentralized financial service, has a core advantage over TradFi: the so-called "interoperability" enabled by smart contracts handling core operations. Most DeFi experts—or DeFi degens—typically focus on three tasks:

-

Finding arbitrage opportunities across DeFi protocols;

-

Identifying sources of leveraged capital;

-

Discovering high-yield, low-risk yield scenarios.

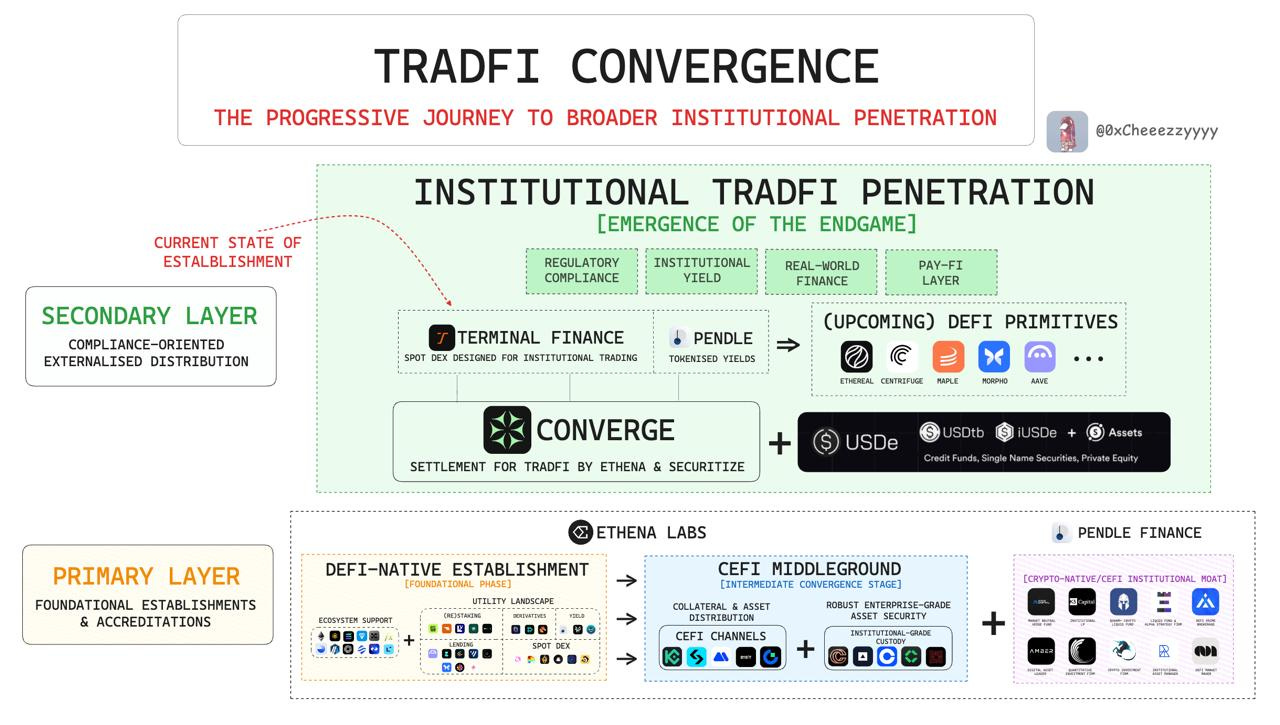

The PT leveraged yield strategy comprehensively reflects these three characteristics. It involves three DeFi protocols: Ethena, Pendle, and AAVE—all currently popular projects in the DeFi space, introduced here briefly. Ethena is a yield-generating stablecoin protocol that uses a Delta Neutral hedging strategy to capture, with relatively low risk, the funding fees from perpetual futures markets on centralized exchanges. During bull markets, retail investors' strong long demand leads them to accept higher funding costs, resulting in higher yields for this strategy. sUSDe is its yield-bearing token. Pendle is a fixed-rate yield protocol that uses synthetic assets to split floating-yield tokens into Principal Tokens (PT), similar to zero-coupon bonds, and Yield Tokens (YT). If investors are bearish on future rate changes, they can lock in future rates by selling YT (or equivalently, buying PT). AAVE is a decentralized lending protocol allowing users to deposit specified cryptocurrencies as collateral and borrow other cryptocurrencies, enabling leverage, hedging, or shorting.

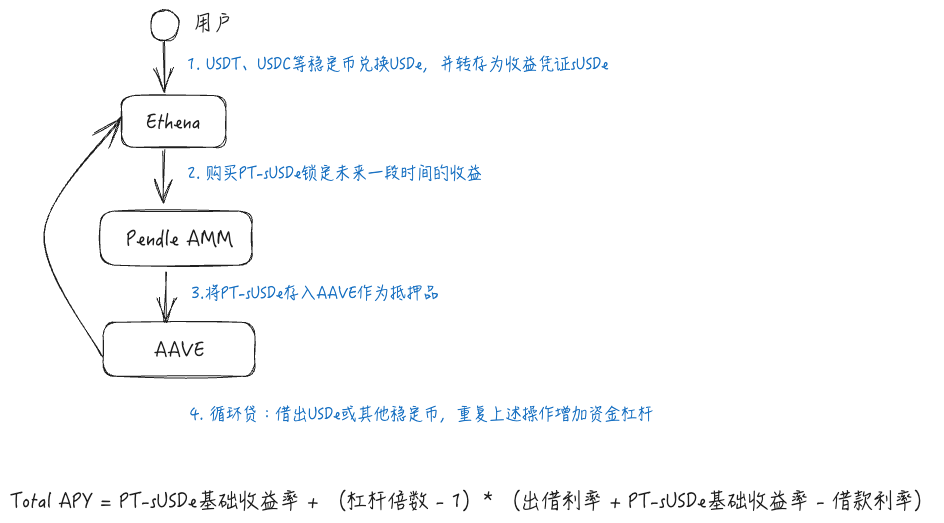

This strategy integrates all three protocols: using sUSDe from Ethena as the yield source via PT-sUSDe on Pendle, and leveraging AAVE as the funding source to conduct interest rate arbitrage and gain leveraged yield. The process is as follows: users first obtain sUSDe from Ethena, then fully convert it into PT-sUSDe on Pendle to lock in the rate. Next, deposit PT-sUSDe into AAVE as collateral and use looping loans to borrow USDe or other stablecoins, repeating the process to increase leverage. The yield is determined mainly by three factors: the base yield of PT-sUSDe, the leverage multiple, and the interest rate spread on AAVE.

Market Status and User Participation

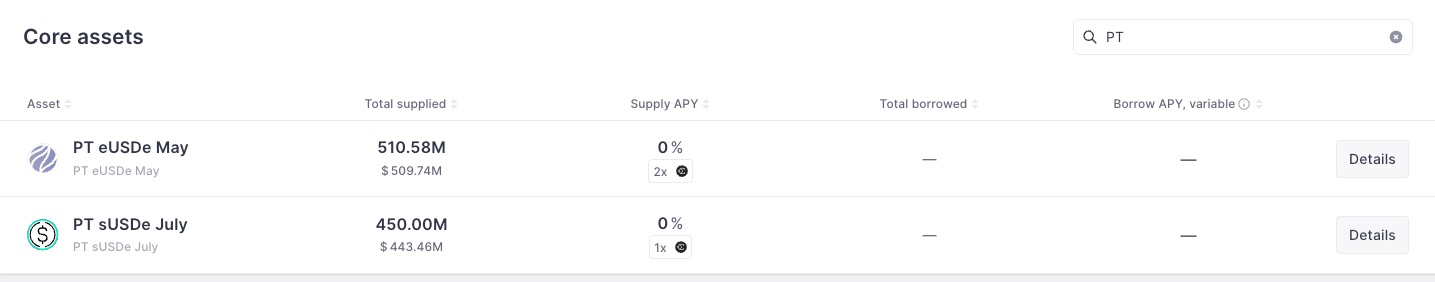

The popularity of this strategy traces back to AAVE—the largest lending protocol by funds—recognizing PT assets as collateral, unlocking their financing potential. Prior to this, other DeFi protocols like Morpho and Fluid already supported PT assets as collateral, but AAVE, with deeper liquidity and lower borrowing rates, amplified the strategy’s yield. Moreover, AAVE’s decision carries greater symbolic weight.

Since AAVE began supporting PT assets, staked capital has rapidly increased, indicating acceptance among DeFi users, especially large whales. Currently, AAVE supports two PT assets: PT sUSDe July and PT eUSDe May, with total supply reaching approximately $1B.

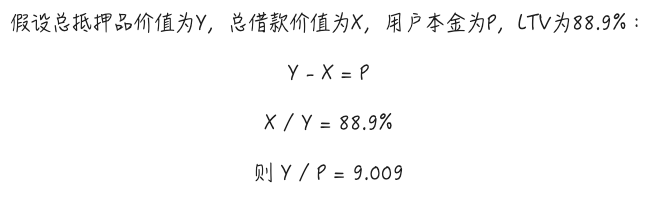

The maximum available leverage can be calculated based on E-Mode Max LTV. For example, PT sUSDe July has a Max LTV of 88.9% under E-Mode, meaning theoretically up to ~9x leverage via looping loans. As shown in the diagram below, at maximum leverage and excluding gas, flash loan, or exchange costs, the theoretical yield for the sUSDe strategy could reach 60.79%—not including Ethena incentive rewards.

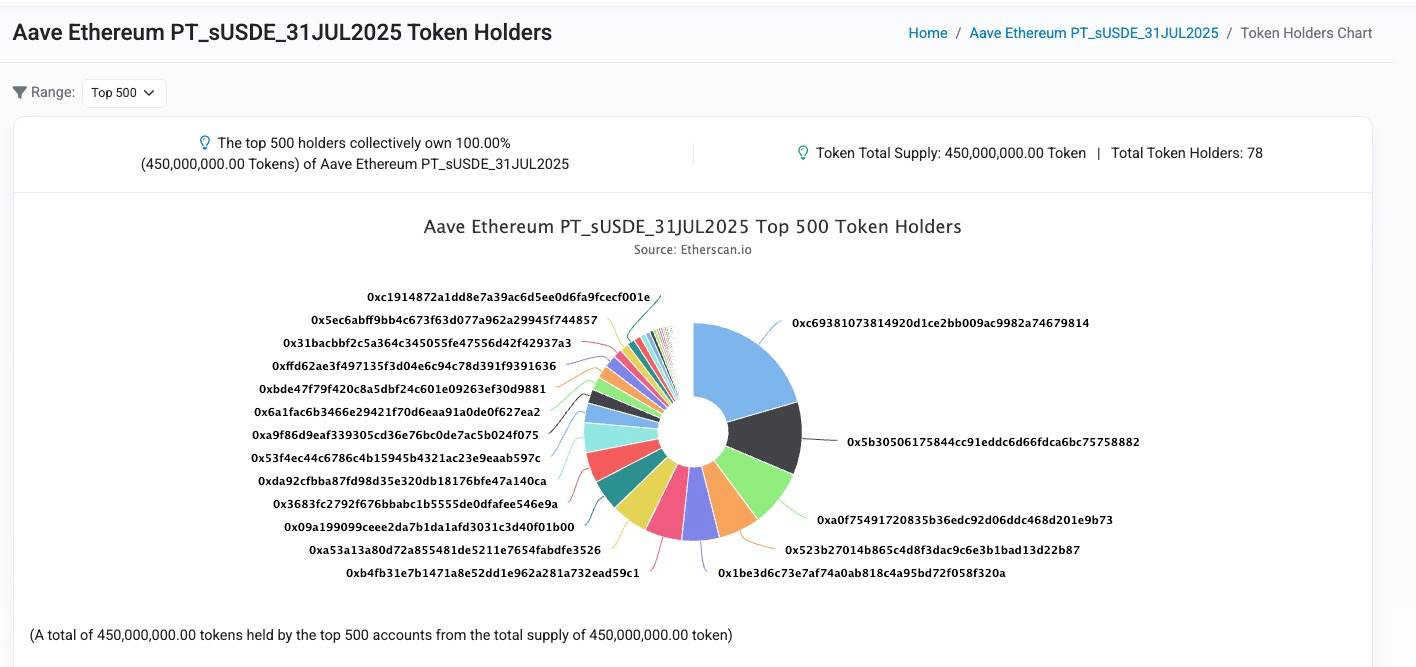

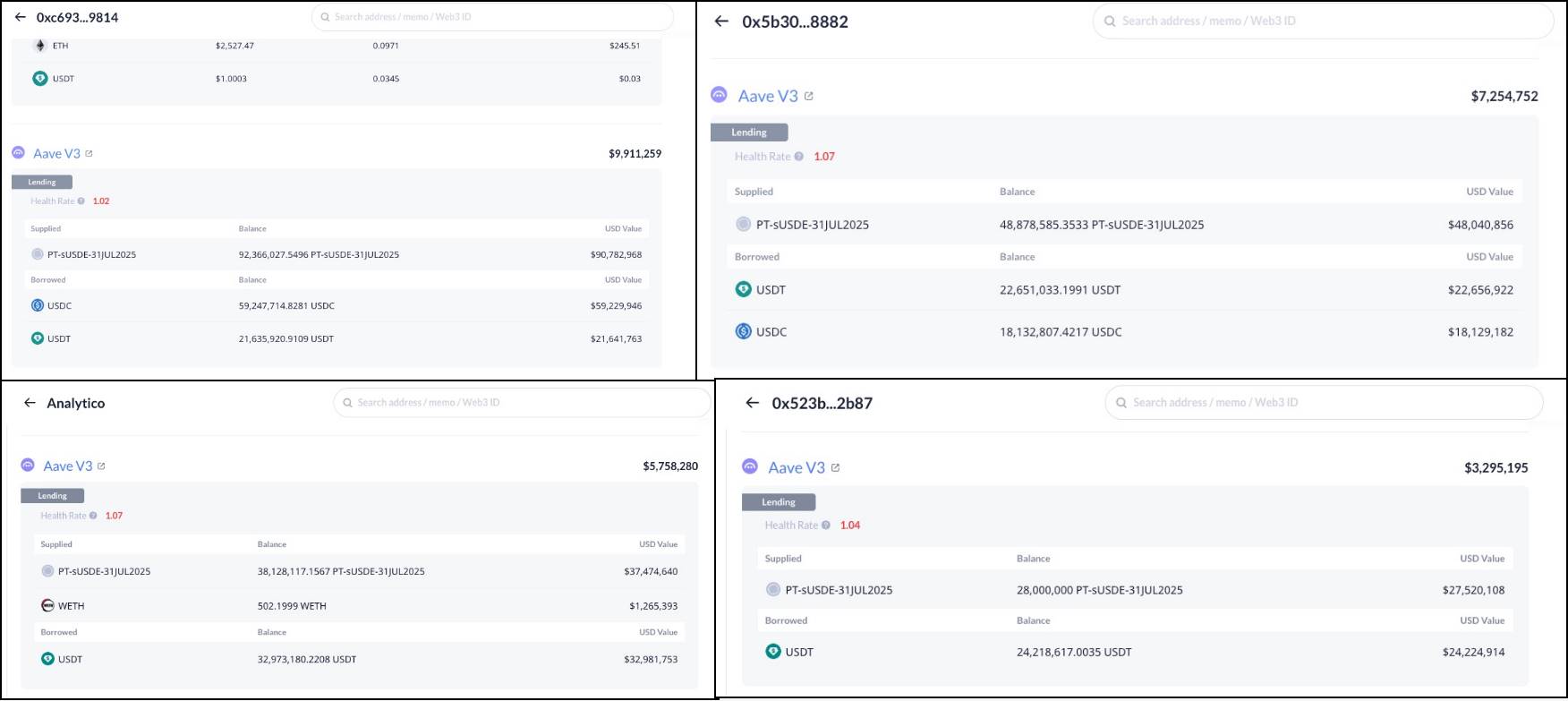

Now let’s examine actual participant distribution, using the PT-sUSDe pool on AAVE as an example. A total supply of 450M is provided by 78 investors, indicating high whale concentration and significant leverage usage.

Looking at the top four addresses: the first address 0xc693...9814 has 9x leverage with ~$10M principal; the second, 0x5b305...8882, has 6.6x leverage with ~$7.25M; the third, analytico.eth, has 6.5x leverage with ~$5.75M; and the fourth, 0x523b27...2b87, has 8.35x leverage with ~$3.29M.

It’s clear most investors are applying high leverage to this strategy. However, I believe market sentiment may be overly aggressive and optimistic. Such bias in risk perception could easily lead to mass cascading liquidations. Therefore, we now analyze the risks involved.

Discount Rate Risk Cannot Be Ignored

Most DeFi analysis accounts emphasize the low-risk nature of this strategy, even labeling it as risk-free arbitrage. But this is inaccurate. We know leveraged yield strategies primarily face two risks:

-

Exchange rate risk: When the exchange rate between collateral and borrowed asset declines, liquidation risk arises. This is straightforward—as the ratio drops, collateralization weakens.

-

Interest rate risk: If borrowing rates rise, the overall strategy yield could turn negative.

Many analyses argue exchange rate risk is minimal here because USDe, being a mature stablecoin, has passed market tests and has low depeg risk. Thus, if the borrowed asset is a stablecoin, exchange rate risk is low. Even if depeg occurs, choosing USDe as the borrowed asset ensures the relative exchange rate won’t drop drastically.

However, this view overlooks the unique nature of PT assets. Lending protocols must enable timely liquidation to prevent bad debt. But PT assets have a maturity period; before maturity, redeeming principal early requires selling on Pendle’s AMM secondary market at a discount. Thus, trading impacts PT asset prices—or equivalently, PT yields—and PT prices fluctuate over time, gradually converging toward 1.

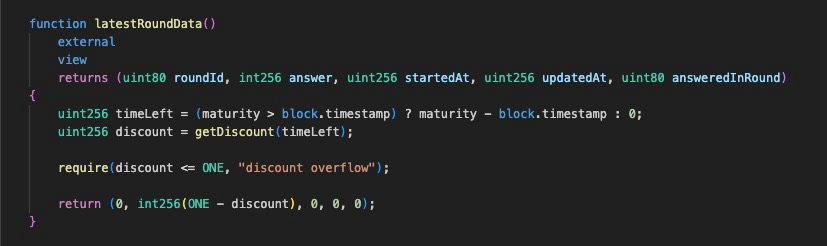

Understanding this, let’s examine AAVE’s oracle design for PT asset pricing. Before AAVE supported PT assets, this strategy mainly used Morpho for leverage. Morpho employed a pricing oracle called PendleSparkLinearDiscountOracle. Simply put, Morpho assumes PT assets earn a fixed yield over their term, ignoring market trading impacts. Thus, the exchange rate between PT and its underlying asset grows linearly, making exchange rate risk negligible.

However, during AAVE’s research on PT oracles, they concluded this approach was suboptimal. Locking in a fixed yield throughout the term means the model cannot reflect market trading dynamics or structural changes in underlying yields. If market sentiment turns bullish on rates or underlying yields structurally rise (e.g., due to surging incentive token prices or new reward distributions), Morpho’s oracle price could significantly exceed the true market price, increasing bad debt risk. To mitigate this, Morpho often sets a baseline rate much higher than market rates—effectively undervaluing PT assets—to create a larger safety buffer, but this reduces capital efficiency.

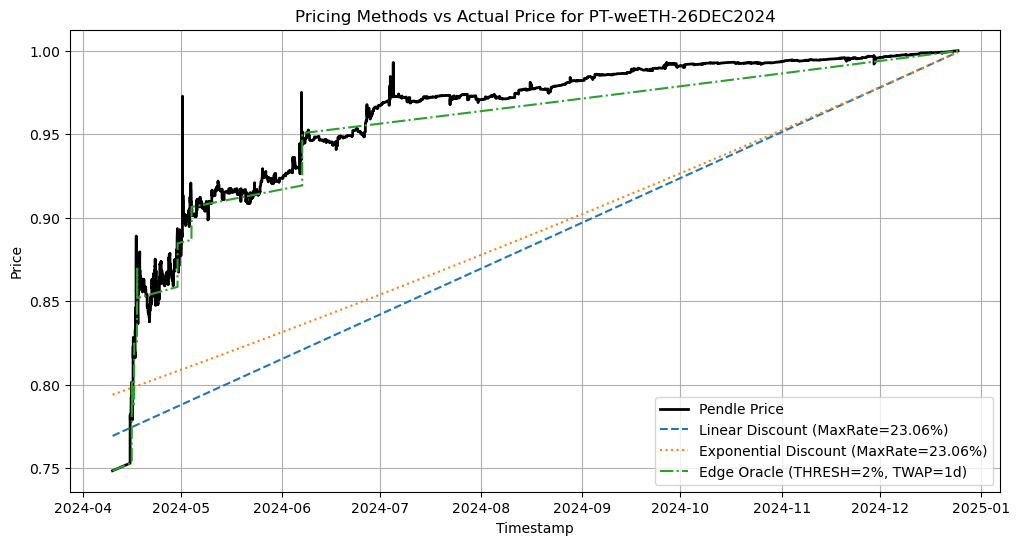

To optimize this, AAVE adopted an off-chain pricing solution, aiming to align oracle prices with structural shifts in PT yields while minimizing short-term manipulation risks. We won’t dive into technical details here—there’s dedicated discussion on AAVE’s forum—but interested readers can discuss further with me on X. Below, we illustrate how AAVE’s PT oracle price might track market movements. As shown, AAVE’s oracle behaves like a piecewise function, tracking market rates. Compared to Morpho’s linear model, this improves capital efficiency and better mitigates bad debt risk.

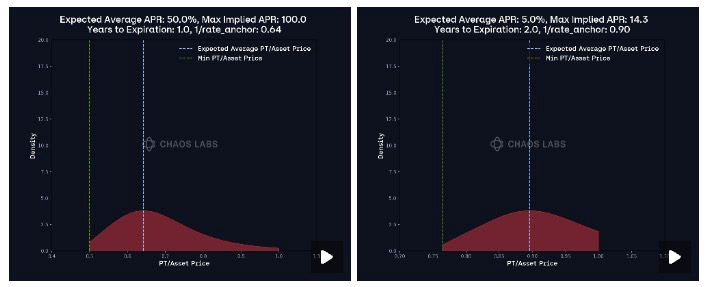

This means when PT yields undergo structural adjustments, or when market sentiment shifts uniformly on rate expectations, AAVE’s oracle will follow suit—introducing discount rate risk. For example, if PT yields rise for any reason, PT asset prices fall, potentially triggering liquidation under high leverage. Therefore, understanding AAVE’s PT asset pricing mechanism is essential for rationally adjusting leverage and balancing risk and return. Below are key features to consider:

1. Due to Pendle’s AMM design, as time progresses, liquidity concentrates around the current rate, making price impact from trading increasingly muted—slippage decreases. Thus, as maturity approaches, market-driven price changes diminish. To reflect this, AAVE’s oracle implements a "heartbeat" mechanism indicating price update frequency: the closer to maturity, the longer the heartbeat, the less frequent the updates—meaning lower discount rate risk.

2. AAVE’s oracle uses a 1% rate deviation as another trigger for price updates. When the market rate differs from the oracle rate by 1% for longer than the heartbeat duration, a price update is triggered. This provides a window to adjust leverage proactively and avoid liquidation. Hence, users of this strategy should actively monitor rate changes and dynamically manage leverage.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News