Boros: Consuming DeFi, CeFi, and TradFi to Unlock Pendle's Next 100x Growth Engine

TechFlow Selected TechFlow Selected

Boros: Consuming DeFi, CeFi, and TradFi to Unlock Pendle's Next 100x Growth Engine

With the release of Boros 1.0, the launch of the referral program, and expansion into more markets, perhaps Boros' takeover of the yield world is officially beginning through funding rates.

If you were to nominate the most innovative DeFi protocol, who would make your list?

Pendle would undoubtedly be among them.

In 2021, Pendle emerged as the first DeFi protocol to focus on the "interest rate swap" market, single-handedly opening up a billion-dollar-scale yield trading market and becoming the undisputed leader in the yield trading sector.

Then in August 2025, Pendle’s pioneering innovation spirit continued with the launch of Boros, venturing into the previously uncharted territory of “funding rates” on-chain, introducing for the first time mechanisms for trading, hedging, and arbitraging funding rates within the DeFi ecosystem—sparking widespread discussion and a surge in capital participation.

According to the latest data from Pendle, just two months after its launch, Boros has achieved over $950 million in cumulative notional trading volume, more than $61.1 million in open interest, over 11,000 users, and annualized revenue exceeding $730,000.

In merely one month, it has already reached milestones that many projects take years to achieve. Meanwhile, many participants enthusiastically noted: mastering Boros can yield even higher returns than meme coins.

So, what exactly is Boros? How does it work, and what are its future plans?

You may have noticed that Boros frequently features a giant whale consuming everything in its branding. The term "Boros" itself means "to devour" in ancient Greek. With the release of Boros 1.0, the rollout of its referral program, and the introduction of new markets, perhaps Boros’ consumption of the yield world through funding rates has officially begun.

Why Did Boros Choose “Funding Rates” to Build Its Product Reputation?

As a structured interest rate derivatives platform, Boros currently focuses primarily on funding rates, aiming to transform funding rates into tradable standardized assets.

Most perpetual contract traders are likely familiar with funding rates—they act like an "invisible hand" in the futures market, balancing perpetual contract prices against spot prices. Their mechanism can be simply understood as follows:

-

When the funding rate is positive, it indicates that most market participants expect prices to rise, long positions dominate, and contract prices exceed spot prices. Longs must pay the funding rate to shorts, curbing excessive bullishness.

-

When the funding rate is negative, it indicates bearish sentiment prevails, short positions dominate, and contract prices fall below spot prices. Shorts must pay the funding rate to longs, curbing excessive pessimism.

As a key mechanism balancing long and short forces, funding rates also serve as a crucial indicator of market sentiment.

Prior to Boros, traders passively accepted the regulatory role of funding rates without ever imagining they could become standalone tradable assets.

So why did Boros choose funding rates as its starting point to establish product credibility?

The unique characteristics of high scale, high volatility, and high yield inherent to funding rates are precisely why Pendle believes this area holds immense potential.

-

High Scale:

The derivatives market has long surpassed the spot market in size, and as long as perpetual contracts operate, funding flows continuously.

According to CoinGlass reports, total perpetual contract trading volume reached $12 trillion in Q2 2025, averaging around $130 billion daily. Based on most exchanges' settlement rules of 0.01% every 8 hours, the daily funding rate market easily exceeds tens of millions—and can surpass hundreds of millions during extreme market conditions.

Better utilization of this massive and stable market could catalyze the next major financial innovation.

-

High Volatility:

A token surging or plunging sharply within a day often becomes headline news in the spot market—but such swings are routine in the funding rate market.

For example, according to Coinmarketcap data, MYX Finance ($MYX) surged over 168.00% on September 8, 2025, topping gains among top 100 cryptocurrencies by market cap and quickly becoming a market talking point. Yet under the tug-of-war between bulls and bears, funding rates constantly fluctuate. For many altcoins, these fluctuations can reach four to five times—or even greater. Take $TRUMP, for instance: some traders reportedly paid an annualized funding rate as high as 20,000% to maintain long positions.

Taming this volatile beast not only helps users refine trading strategies but also unlocks significant profit opportunities.

-

High Yield:

The core logic is clear: volatility creates ideal conditions for generating returns.

Volatility enables opportunities to buy low and sell high. A highly volatile funding rate market thus becomes a valuable avenue for capturing yield.

But turning funding rates into standardized assets capable of supporting trading, profit-taking, hedging, and arbitrage poses a major challenge in product design.

How Does Boros Enable Bets on Future Funding Rate Movements?

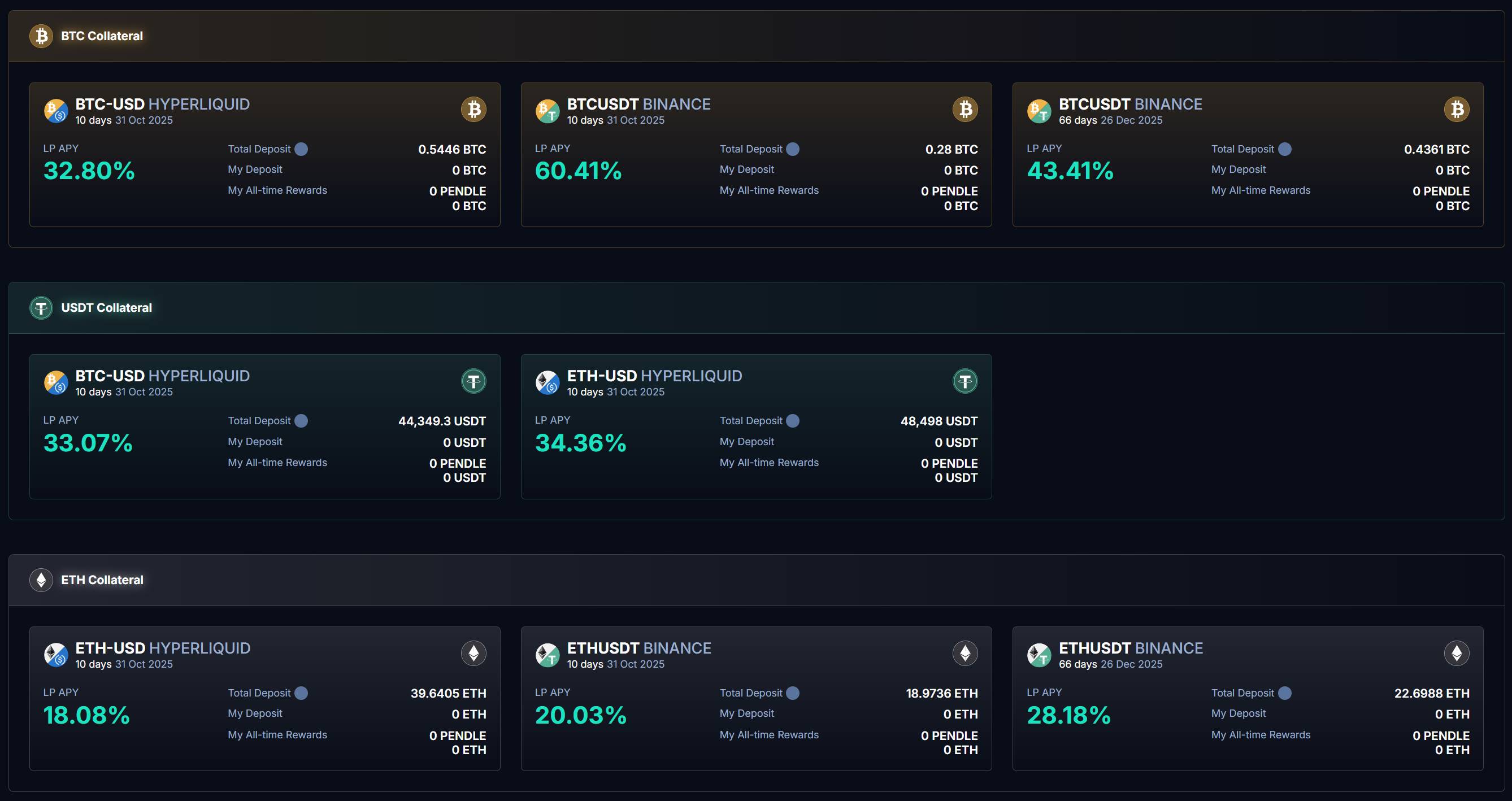

Upon visiting the Boros interface, you’ll see that Boros has already launched multiple markets for BTC, ETH, and USDT on Binance and Hyperliquid:

As mentioned earlier, funding rates are a key barometer of market sentiment. In other words, if you can accurately gauge market sentiment, you can profit from funding rate trades on Boros.

But how do you turn such market predictions into tangible profits?

Boros works by locking in the current market funding rate and enabling users to bet on whether future rates will rise or fall: if the rate increases, long-side participants profit; if it decreases, short-side participants profit.

This is made possible through YU.

Users connect their wallets, deposit funds, post collateral, and purchase YU.

YU is the core instrument transforming funding rates into standardized assets, representing the right to earn funding rate income over a future period. Simultaneously, YU serves as the smallest tradable unit of quantified funding rates. For example, purchasing 1 YU BTCUSDT Binance means owning the funding rate earnings from a 1 BTC position on Binance's BTCUSDT perpetual contract.

We know that profit = income minus cost. Calculating YU returns relies on three core metrics: Implied APR, Fixed APR, and Underlying APR.

Purchasing YU is equivalent to opening a position, which involves two costs:

First, Implied APR is the locked-in rate at the time of entry, effectively acting as the price of YU—an annualized fixed rate until expiration. It serves as a benchmark for expected changes in future market funding rates.

Second, there is a transaction fee associated with opening the position. Combined with the Implied APR, this forms the Fixed APR—the total entry cost.

With costs defined, we now calculate income.

By using YU, we fix a funding rate, while the actual funding rate on external exchanges is represented by Underlying APR.

When purchasing YU, users have two options to go long or short on funding rates:

-

Buy Long YU (go long on funding rate): During the holding period, the user pays Implied APR and receives Underlying APR

-

Buy Short YU (go short on funding rate): During the holding period, the user pays Underlying APR and receives Implied APR

Profit is therefore derived from the difference between income and cost—specifically, the gap between Fixed APR and Underlying APR.

-

When Fixed APR < Underlying APR—that is, when the floating market rate exceeds the fixed rate—Long YU holders profit

-

When Fixed APR > Underlying APR—that is, when the floating market rate exceeds the fixed rate—Short YU holders profit

This leads to:

-

Going long on funding rates: Buy Long YU

-

Going short on funding rates: Buy Short YU

Regarding profit settlement, Boros aligns with the settlement cycles of perpetual contract platforms.

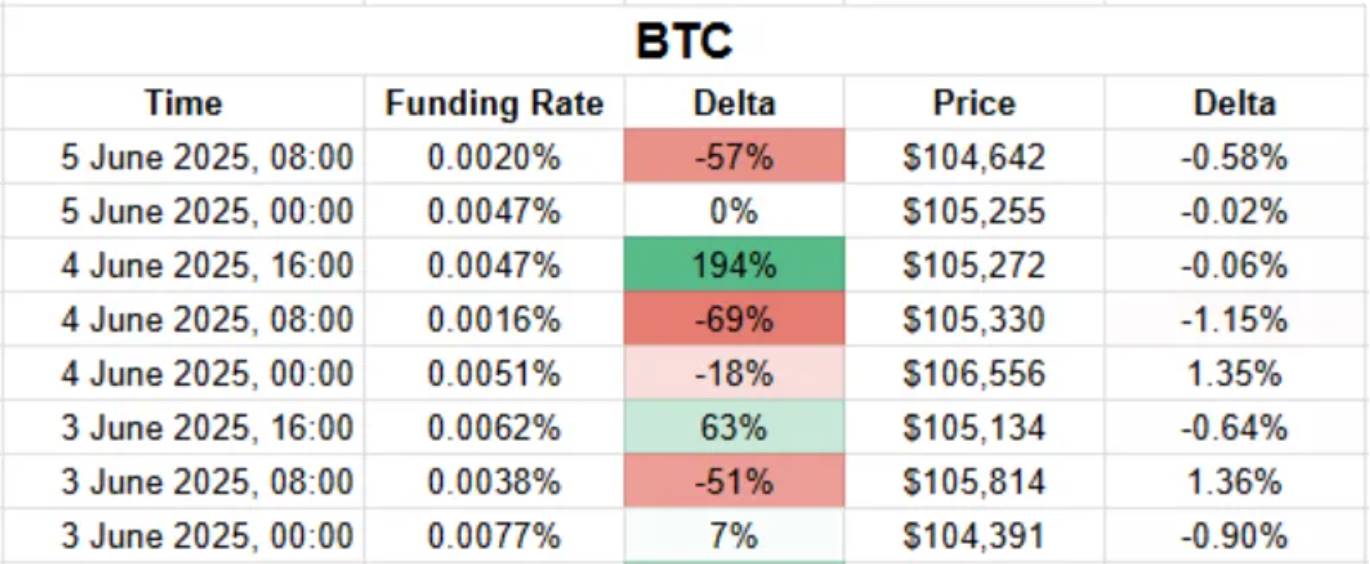

Take the currently listed BTCUSDT Binance product: since Binance settles funding rates every 8 hours, Boros also settles the BTCUSDT Binance pair every 8 hours.

At each settlement, Boros calculates the difference between Fixed APR and Underlying APR:

-

When Fixed APR < Underlying APR: deduct collateral from Short YU and distribute profits to Long YU holders.

-

When Fixed APR > Underlying APR: deduct collateral from Long YU and distribute profits to Short YU holders.

Recall that YU represents the right to funding rate income over a future period. This entitlement is settled every 8 hours (or 1 hour) per exchange rules. In other words, the value of YU diminishes with each settlement and eventually reaches zero upon expiry, having fulfilled its purpose of predicting rate movements.

Naturally, to unlock greater profit potential, Boros also offers a leverage tool of up to 3x, allowing users to open larger positions with less collateral. However, higher leverage also brings increased liquidation risk. Users must regularly monitor their health factor and adjust collateral accordingly to avoid liquidation.

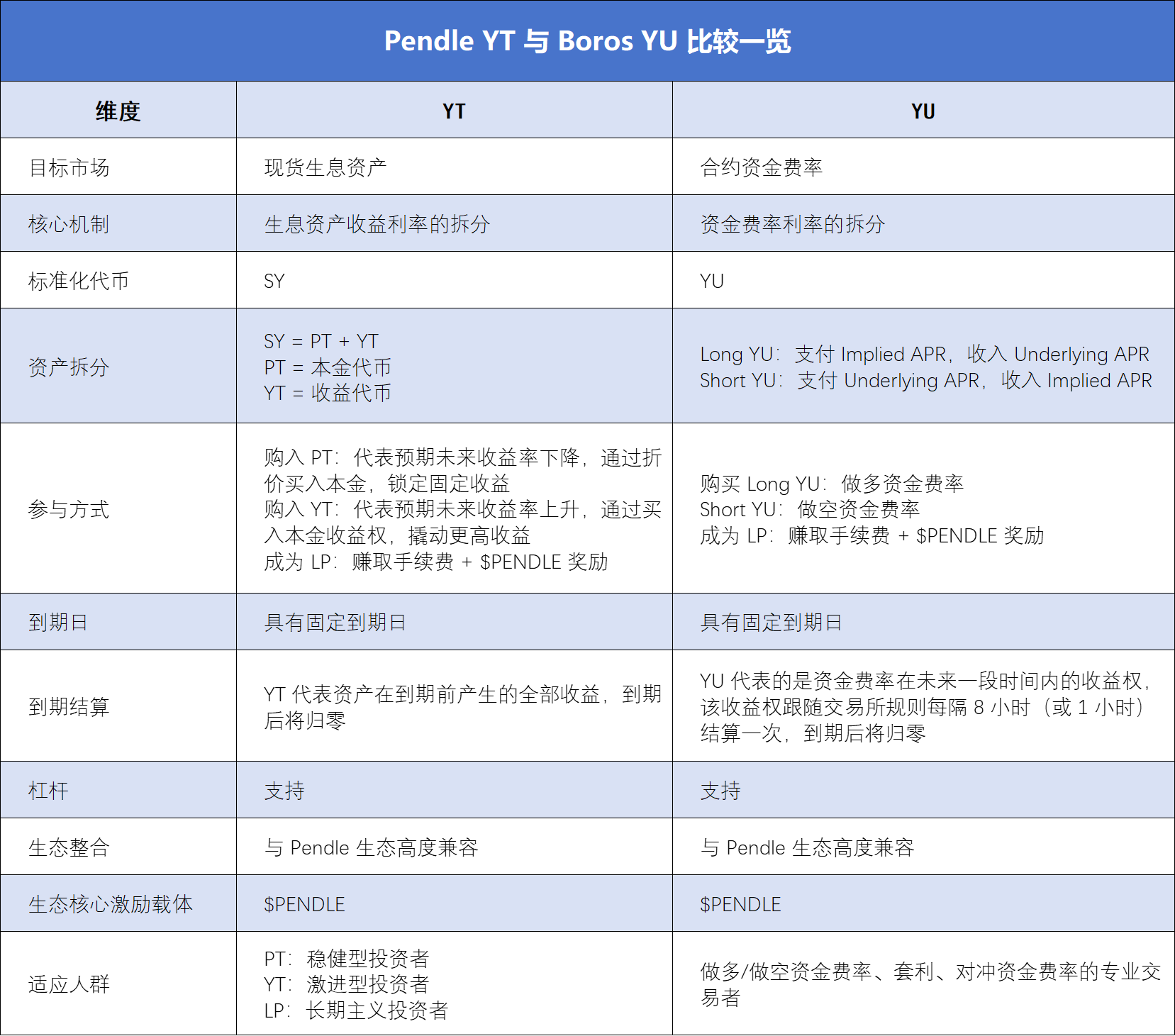

For those familiar with Pendle’s YT mechanics, the similarities between YT and YU can aid understanding. However, there are fundamental differences between the two, as illustrated clearly in the table below:

From Hedging to Arbitrage: Boros Becomes a Tool for Trader Efficiency

Since its launch, Boros’ mechanism for betting on funding rate movements has sparked active discussions among perpetual contract traders, institutions, and professional DeFi users, who are exploring its practical applications.

The most direct way to participate is buying YU to speculate on funding rate direction:

By choosing between Long YU and Short YU, users earn the spread between fixed and floating rates. On September 12, 2025, Boros launched funding rate trading for Hyperliquid. Compared to Binance, Hyperliquid exhibits greater funding rate volatility, offering users enhanced excitement in directional betting.

For long-term position holders, Boros’ greatest utility lies in hedging funding rate exposure in volatile environments: taking an opposite funding rate position on Boros relative to a CEX perp position offsets the risk of fluctuating funding payments, thereby locking in costs or revenues at a fixed level.

For example, if a user holds a long perp position on a CEX and pays floating funding fees, simultaneously buying Long YU on Boros offsets the CEX payment with income earned from Boros’ floating rate receipts.

Conversely, if a user holds a short perp position on a CEX and pays floating funding fees, buying Short YU on Boros offsets the CEX payment with fixed-rate income from Boros.

This makes derivative trading risks and costs more predictable—a highly attractive feature, especially for institutional traders. A clear example is Ethena: as a representative delta-neutral strategy project, Ethena’s primary income comes from positive funding rates. Thus, when funding rates become highly volatile, Ethena faces significant uncertainty in earnings, potentially threatening its sustainability.

Using YU on Boros, Ethena can lock in fixed rates on-chain, achieving predictable returns and enhancing protocol profitability and stability.

Meanwhile, the addition of the Hyperliquid market has unlocked new cross-exchange arbitrage opportunities:

Arbitrage thrives on price discrepancies across markets. Currently, among the two major exchanges supported by Boros, Binance hosts more large institutions and uses an 8-hour settlement cycle, resulting in relatively stable funding rates. In contrast, Hyperliquid attracts more retail traders, settles every hour, and experiences faster capital flows, leading to significantly higher funding rate volatility—creating ample room for cross-exchange arbitrage.

Beyond cross-exchange arbitrage, Boros now offers products with different expiration dates, enabling traders to engage in calendar spread arbitrage: if the Implied APR of an earlier-expiring YU is lower than that of a later-expiring YU, it suggests the market expects lower short-term rates and higher long-term rates. Traders can then buy the earlier YU and sell the later one—or vice versa.

And if directional speculation isn’t your strength, you can opt to become an LP instead:

Boros allows users to deposit funds via Vaults to become liquidity providers (LPs), supplying liquidity for YU trading while earning swap fees and $PENDLE rewards. On the Boros Vaults page, BTCUSDT Binance Vaults show an APY as high as 60.41%.

However, note that Boros Vaults operate similarly to Uniswap V2, where LP positions consist of a “YU + collateral” combination influenced by Implied APR. Therefore, being an LP is essentially a slight bullish bet on YU. When Implied APR declines, LPs may face significant impermanent loss.

Additionally, due to Boros’ high popularity, Vault capacity has become highly competitive. But as Boros transitions from soft launch to rapid growth, Vault limits are expected to gradually increase.

All Resources Flow Back to Pendle: Referral Program Kicks Off Next Growth Phase

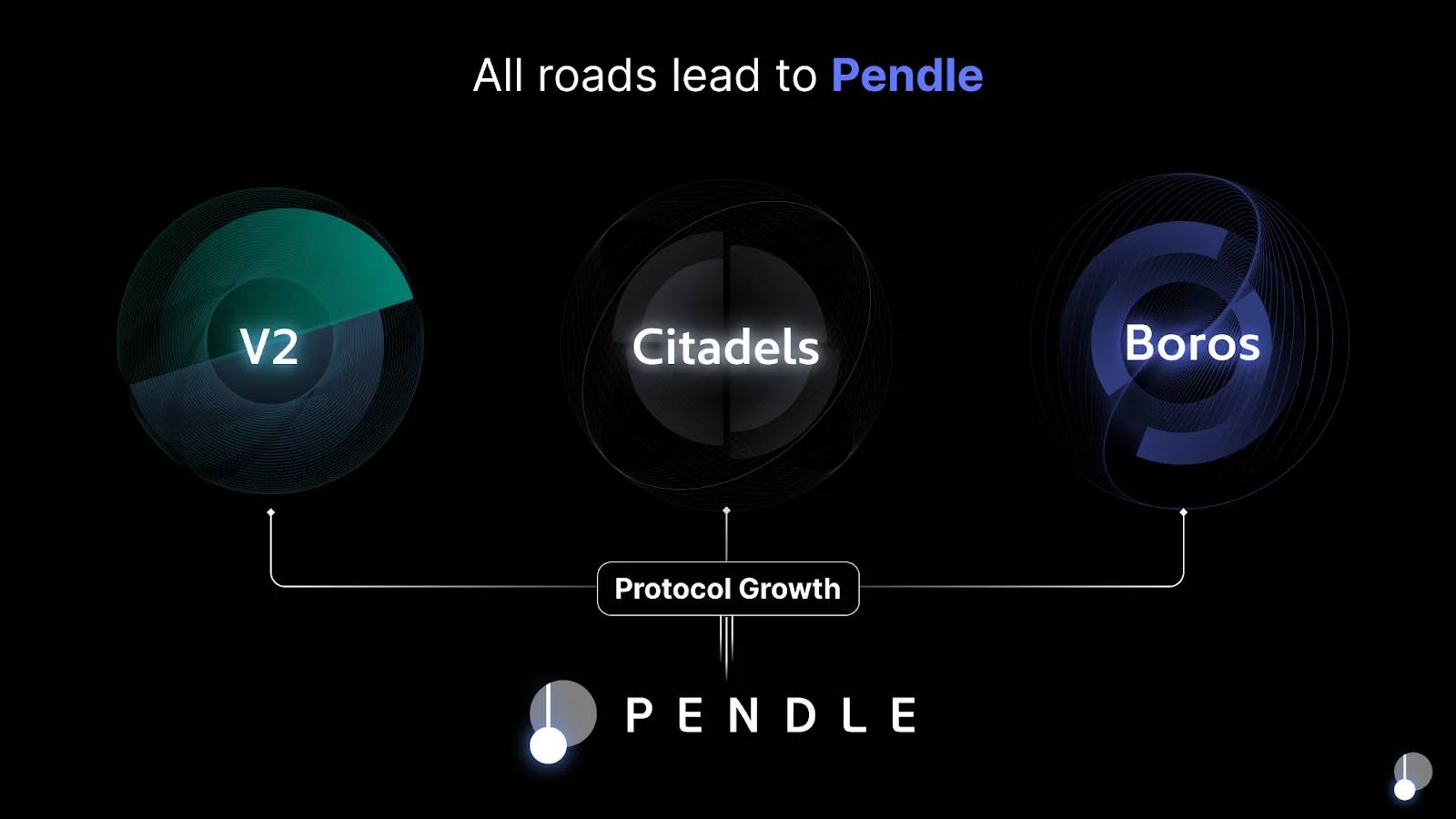

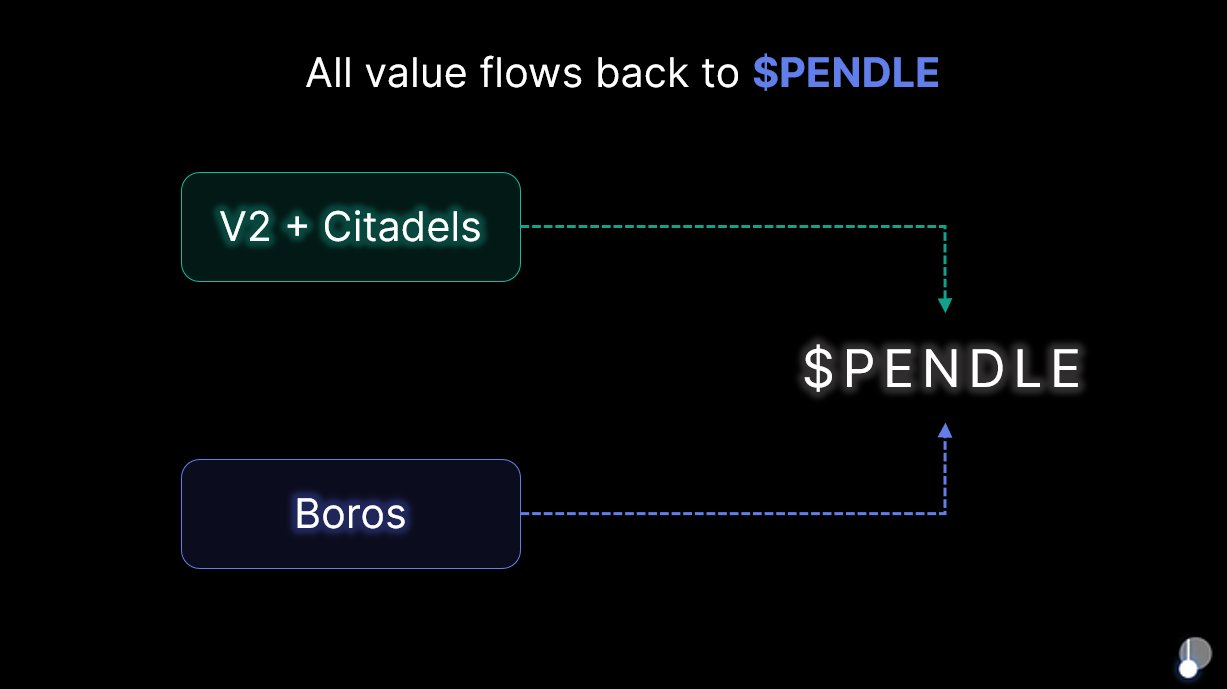

As a flagship product in Pendle’s 2025 roadmap, Boros plays a pivotal role not only within the Pendle ecosystem but also drives overall growth through innovative mechanisms and market expansion.

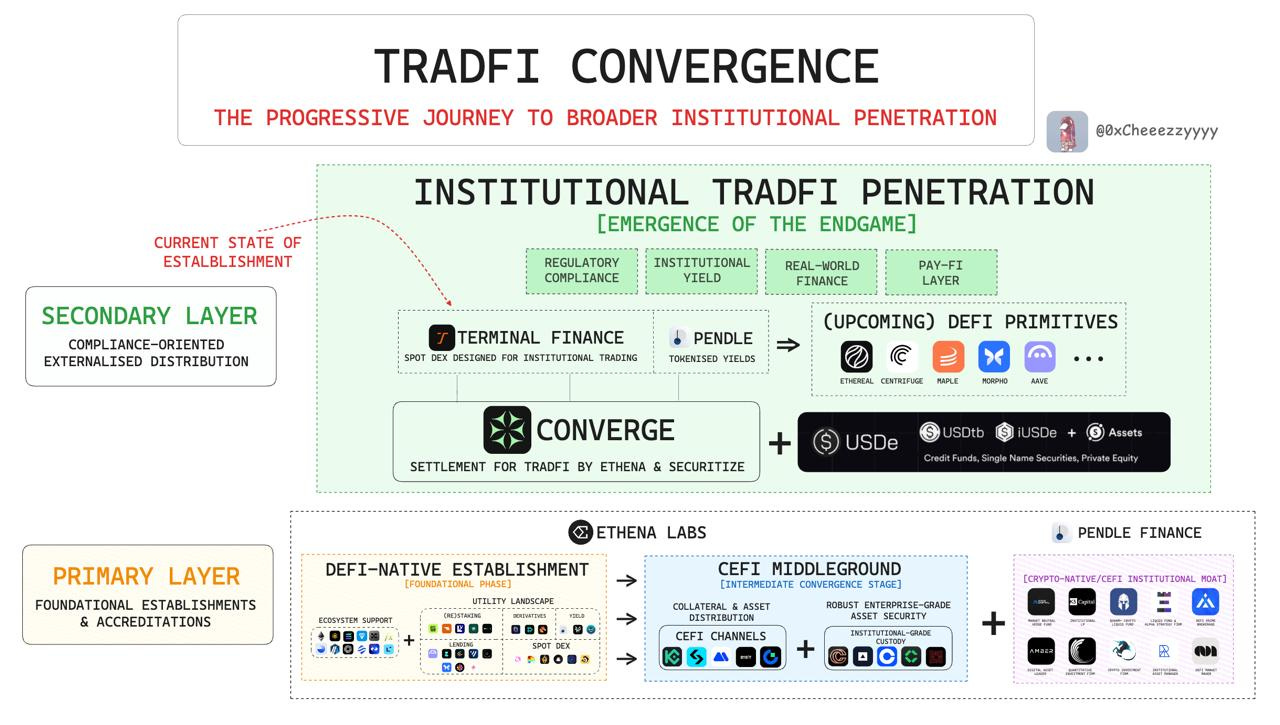

Pendle’s ultimate vision is to become an “all-in-one yield trading gateway.” Boros extends Pendle’s legacy of yield tokenization while pioneering access to the high-scale, high-volatility funding rate market. By converting CEX and DEX funding rates into standardized YU assets, Boros expands Pendle’s reach from on-chain DeFi into off-chain CeFi.

Moreover, during the official announcement of Boros 1.0, it was explicitly stated that Boros will not issue a new token upon launch. All protocol revenue will flow back to benefit $PENDLE and $vePENDLE, ensuring that $PENDLE remains the ultimate beneficiary of all value created by both Pendle V2 and Boros. Furthermore, shortly after Boros launched on August 6, 2025, $PENDLE surged over 40% within a week—validating market confidence in Boros’ potential.

Truly game-changing innovations often stem from rediscovering values long overlooked. Boros’ focus on funding rates reveals a vast, hidden treasure buried beneath the perpetual contract market—massive in scale yet largely untapped.

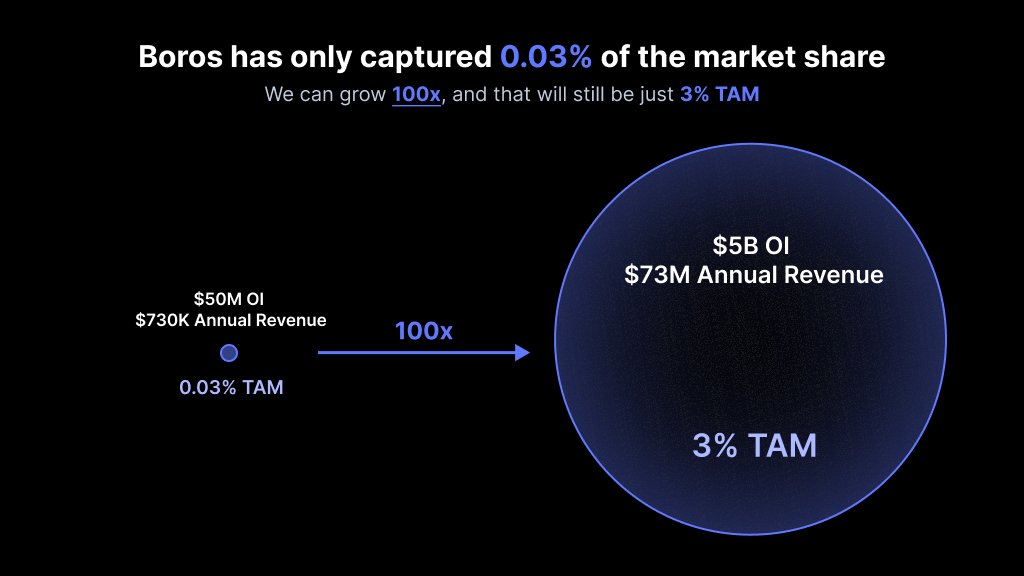

Today, the perpetual contract market sees over $200 billion in daily open interest and processes more than $250 billion in daily trading volume. Within just two months, Boros has achieved nearly $1 billion in notional trading volume and over $730,000 in annualized revenue. Yet even so, this represents only 0.03% of the total market.

In other words, this is a massive market with enormous unrealized potential: as the first protocol focused on funding rate trading, if Boros grows its share to just 3%, it would represent a 100x expansion.

Facing this multi-billion-dollar opportunity, Boros has already rolled out several strategic initiatives to prepare for future growth.

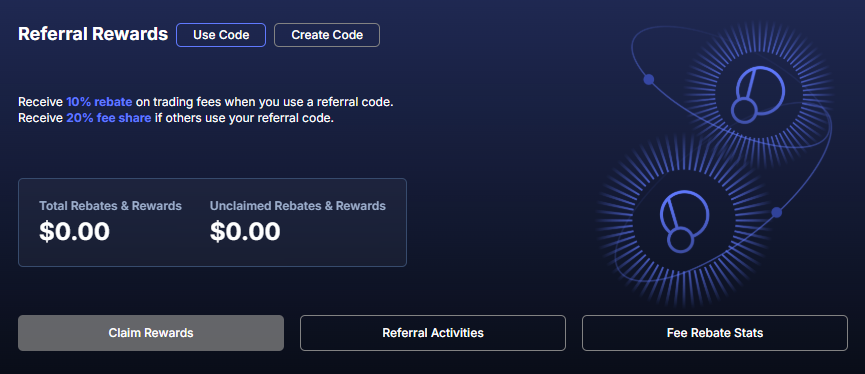

On one hand, after over a month of refinement, testing, and trader feedback, Boros has officially launched Boros 1.0 and initiated its referral program—marking its transition from soft launch to full-scale development. Under the program, new addresses with over $100,000 in notional trading volume receive a referral code. Referrers earn 20% of the referred user’s settlement fees and 20% of their trading fees, while referees enjoy a 10% discount on trading fees.

Each referral code is valid for one year. If the referred address accumulates over $1 billion in notional trading volume during this period, the 10% discount will no longer apply.

On the other hand, Boros will continue optimizing its functionality and product offerings, supporting more assets, more trading platforms, and higher leverage capabilities: currently supporting BTC and ETH, Boros plans to add SOL, BNB, and more; currently live on Binance and Hyperliquid, future integrations include Bybit and OKX; as the market matures, higher leverage options will be introduced to enable more users to generate higher returns at lower cost. Additional measures include raising OI caps and increasing vault capacities.

Beyond product enhancements, Boros’ extensible architecture deserves special attention:

Beyond funding rates, Boros’ framework can support any form of yield—including returns from DeFi protocols, TradFi, bonds, stocks, and other RWAs. This implies that after capturing the vast funding rate market, Boros could expand into DeFi, CeFi, and TradFi across multiple dimensions.

This further aligns with Pendle’s mission: “Wherever there is yield, there is Pendle.” As Pendle’s flagship 2025 product, Boros is poised to bridge crypto finance with traditional finance. Coupled with the ongoing rollout of Citadels’ compliant PT initiative, Pendle is rapidly advancing toward its vision of becoming a comprehensive, unified yield trading gateway.

Standing at the beginning of this all-consuming pursuit of yield sources, as Boros continues to evolve, we are witnessing the emergence of a super-yield platform encompassing all yield types and serving all user segments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News