DeFi Beginner's Guide (Part 3): Boros Arbitrage Guide for Pendle's New Product

TechFlow Selected TechFlow Selected

DeFi Beginner's Guide (Part 3): Boros Arbitrage Guide for Pendle's New Product

At the current market stage, shorting Boros' funding rate is a choice with higher returns than risks.

Author:@Web3Mario

Summary: In this article, we analyze an emerging opportunity within a recently popular protocol—Boros, Pendle's new market for derivatives based on CEX perpetual contract funding rates. I will comprehensively examine the platform from perspectives including its fundamental mechanics, opportunities, and risks, and share an advanced interest rate arbitrage strategy that I believe is effective. Overall, in the current market environment, shorting funding rates on Boros presents a favorable risk-reward profile. By combining Binance, Hyperliquid, and Boros, one can construct a Delta Neutral fixed-income arbitrage portfolio yielding up to 30%.

How Is the 100% Long/Short Rate ROI Shown on Boros' Homepage Calculated?

Upon opening the Boros homepage, you’re greeted with a Market List. For those unfamiliar with Boros, the most immediate question is likely how the extremely high ROI figures in the rightmost column are derived. Let’s use this as a starting point to explain Boros.

Boros creates a derivatives trading market for off-chain yields, enabling users to leverage, hedge, or speculate on such yield derivatives without directly participating in the native yield-generating activities. Currently, it primarily focuses on funding rate derivatives from CEX perpetual markets.

This addresses a key challenge in the perpetual contract funding rate arbitrage space: the uncertainty in returns caused by rate volatility. For example, Ethena’s core mechanism relies on a Delta Neutral arbitrage strategy—going long on crypto spot assets while shorting corresponding perpetual contracts to capture funding rates, distributing these earnings to sUSDe holders. This means fluctuations in funding rates directly impact sUSDe’s yield, thereby affecting the protocol’s attractiveness to users. We can clearly observe this volatility on the official dashboard.

For arbitrageurs like Ethena, funding rate fluctuations are uncontrollable—they depend largely on overall market participants’ trading preferences. Only during bull markets do perpetual traders willingly pay higher funding rates for long positions; in sideways or bear markets, rates drop significantly, even turning negative. This introduces substantial risk into arbitrage strategies. Hence, hedging against rate volatility is a major pain point—and Boros offers a solution. Simply put, you can trade funding rate derivatives on Boros to hedge against such volatility.

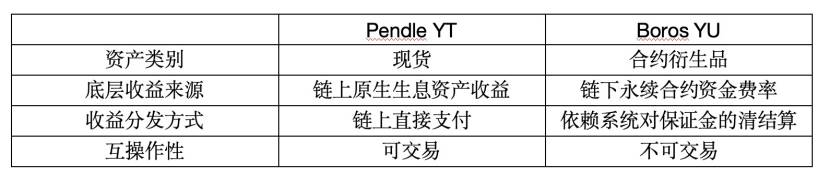

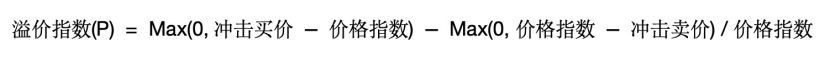

But how exactly does this work? Let’s dive into Boros’ core mechanics. Boros introduces a new asset class called YU. It works similarly to YT tokens in Pendle, with a key difference: YT behaves like a native on-chain crypto spot asset whose yield settlements occur automatically via smart contracts, whereas YU is a derivative tied to off-chain yield scenarios, relying on margin account settlements between counterparties to track off-chain yields.

Here’s how YU works. For buyers, purchasing YU grants the right to receive the funding rate of the corresponding perpetual contract over its lifetime. Each unit of YU corresponds to one unit of the underlying asset, and these earnings are settled from the seller’s margin account through Boros’ clearing system—this yield is displayed as Underlying APR. The interest rate agreed upon at purchase—the Implied APR—represents the fixed rate the buyer pays to the seller throughout the term, also enforced via the clearing mechanism.

Let’s illustrate with an example. Suppose a trader buys 5 long YU positions in the ETHUSDT-Binance market with an expiry date of December 25, 2026. From now until expiry, they will continuously earn the funding rate generated by being short 5 ETH in the perpetual market. These earnings are settled every 8 hours from the YU seller’s margin account, aligned with Binance’s funding intervals. Simultaneously, the buyer pays interest to the seller at the Implied APR locked at entry. At expiry, if the total interest paid is less than the funding earned, the trade yields a positive ROI; otherwise, it results in a loss. If the position is closed early, profitability also depends on the Implied APR at exit.

With this understanding, let’s assess Boros’ current state. Shorting YU currently offers very high ROI—especially in longer-dated markets, where final ROI can easily exceed 100%. This implies that, assuming Implied APR remains near current levels relative to Underlying APR, your return at expiry could reach 100%. This stems from recent market shifts: after the Fed’s September rate decision, Powell’s “hawkish dovish cut” speech and the dot plot indicating committee members’ conservative stance on aggressive rate cuts shifted market sentiment from pre-decision greed back to neutrality. Consequently, funding rates have dropped sharply—even turning negative. Thus, shorting YU means paying interest at the (negative) Underlying APR while earning the (higher) Implied APR. With Underlying APR negative, you effectively earn on both sides, explaining why instantaneous returns exceed 100%. If this rate differential persists, actual final returns will remain attractive.

The root cause lies in Boros’ early stage: liquidity is still low, leading to significant potential slippage, which deters speculative activity. This manifests as Implied APR failing to track Underlying APR efficiently. However, for small-capital traders, this widened spread represents an opportunity. Since Boros allows up to 3x leverage, entering positions when slippage and Implied APR are favorable can yield substantial returns. That said, using leverage requires careful consideration of liquidation risks due to Implied APR volatility.

Additionally, Boros features a Vault function designed to enhance liquidity. Using a DeFi model similar to Uniswap V2, it offers users a familiar LP staking pool experience, lowering the learning curve. As official documentation on this feature remains limited, we won’t delve deeper here. However, I suspect the design involves distributing staked funds across the order book via an AMM-style bonding curve to supplement order depth. Providing liquidity in such a market may expose participants to impermanent loss, so I recommend waiting for more detailed disclosures before participation.

Sharing an Advanced Interest Rate Arbitrage Strategy: Achieving 30% Yield with Delta Neutral Fixed-Income Arbitrage

Having covered Boros’ fundamentals, I’d like to share an advanced interest rate arbitrage strategy leveraging Binance, Hyperliquid, and Boros to achieve Delta Neutral fixed-yield returns. Recently, Boros launched YU markets for BTC and ETH perpetuals on Hyperliquid, making this strategy feasible.

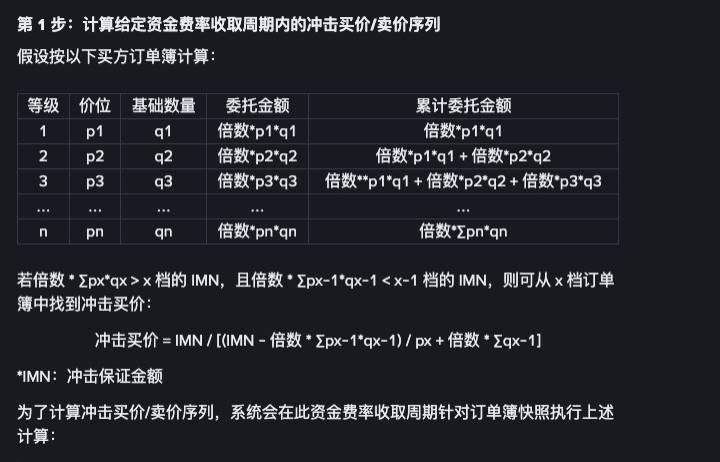

From the chart below, we can see that Hyperliquid’s funding rate is noticeably higher than Binance’s. What causes this discrepancy? Is it a temporary anomaly or a sustained trend? To answer this, we need to revisit how CEX perpetual markets calculate funding rates.

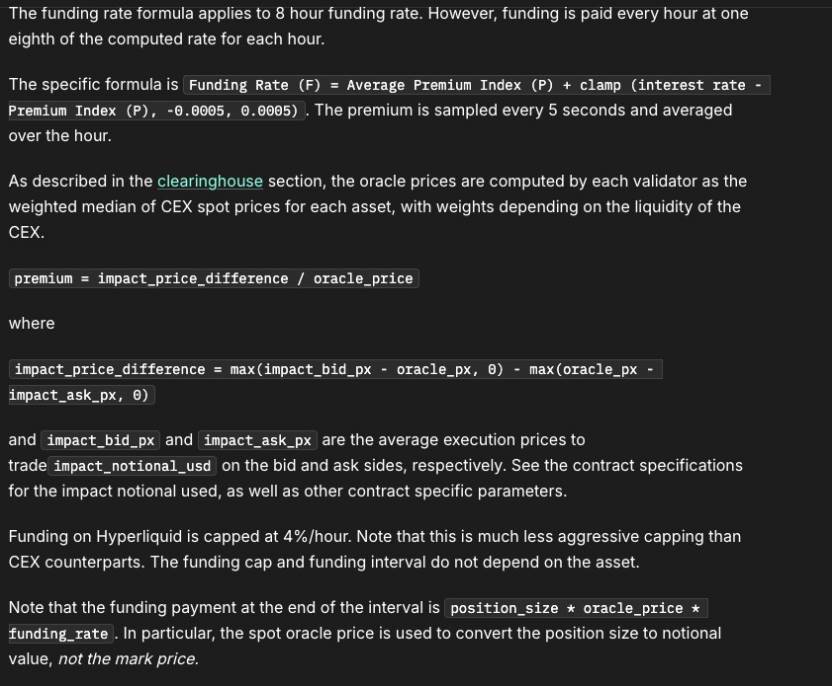

Intuitively, when the spot index price exceeds the perpetual contract’s mark price, the market is in backwardation, and shorts pay longs funding; the reverse holds true otherwise. But this isn’t always accurate—order book depth plays a crucial role in funding rate calculations. Let’s compare the funding rate documentation from both exchanges.

In simple terms, both exchanges use a similar funding rate formula:

The differences lie in MAX_RATE and MIN_RATE settings and slight variations in premium index calculation, which readers can think of as a bounded piecewise function. The premium index incorporates order book depth, particularly through impact_bid_px and impact_ask_px. These values are calculated by simulating a predefined trade size against the current order book to determine the effective execution price under market impact. These snapshots are taken periodically, and a time-weighted average is computed. Regarding price indices, Binance uses its own spot market prices, while Hyperliquid uses an oracle-derived multi-exchange weighted price—reasonable given differing liquidity depths across spot markets.

So why does Hyperliquid maintain a relatively high funding rate while Binance’s turns negative? The answer lies in differing order book depths: at this moment, Hyperliquid has weaker sell-side depth, causing impact prices to exceed the index price, resulting in a higher premium index. This aligns with each platform’s respective market phase. Therefore, we can conclude this rate divergence is likely to persist rather than being a fleeting condition.

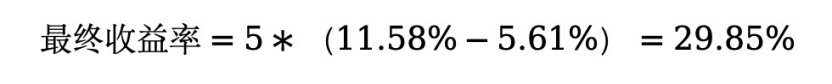

Can we exploit this spread via an arbitrage strategy? Yes. By going long on Binance (where rates are lower) and short on Hyperliquid (where rates are higher), we establish a Delta Neutral interest rate arbitrage. Where does Boros fit in? It locks in the rate differential. By using Boros to fix both variable rates, we convert this into a fixed-rate Delta Neutral arbitrage. Based on current data, assuming 5x leverage on ETH-USD positions on both exchanges and locking rates via Boros, the outcome is:

Of course, finer details such as Boros’ margin requirements and maintaining balance between Binance and Hyperliquid positions must be considered to avoid one-sided liquidations. Readers interested in further discussion are welcome to reach out.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News