Deep Dive: How Pendle Is Reshaping the DeFi Fixed-Income Landscape?

TechFlow Selected TechFlow Selected

Deep Dive: How Pendle Is Reshaping the DeFi Fixed-Income Landscape?

As the stablecoin market grows and tokenized assets multiply, Pendle is well-positioned to become the fixed-income layer powering the next wave of asset issuance.

Author: Greythorn

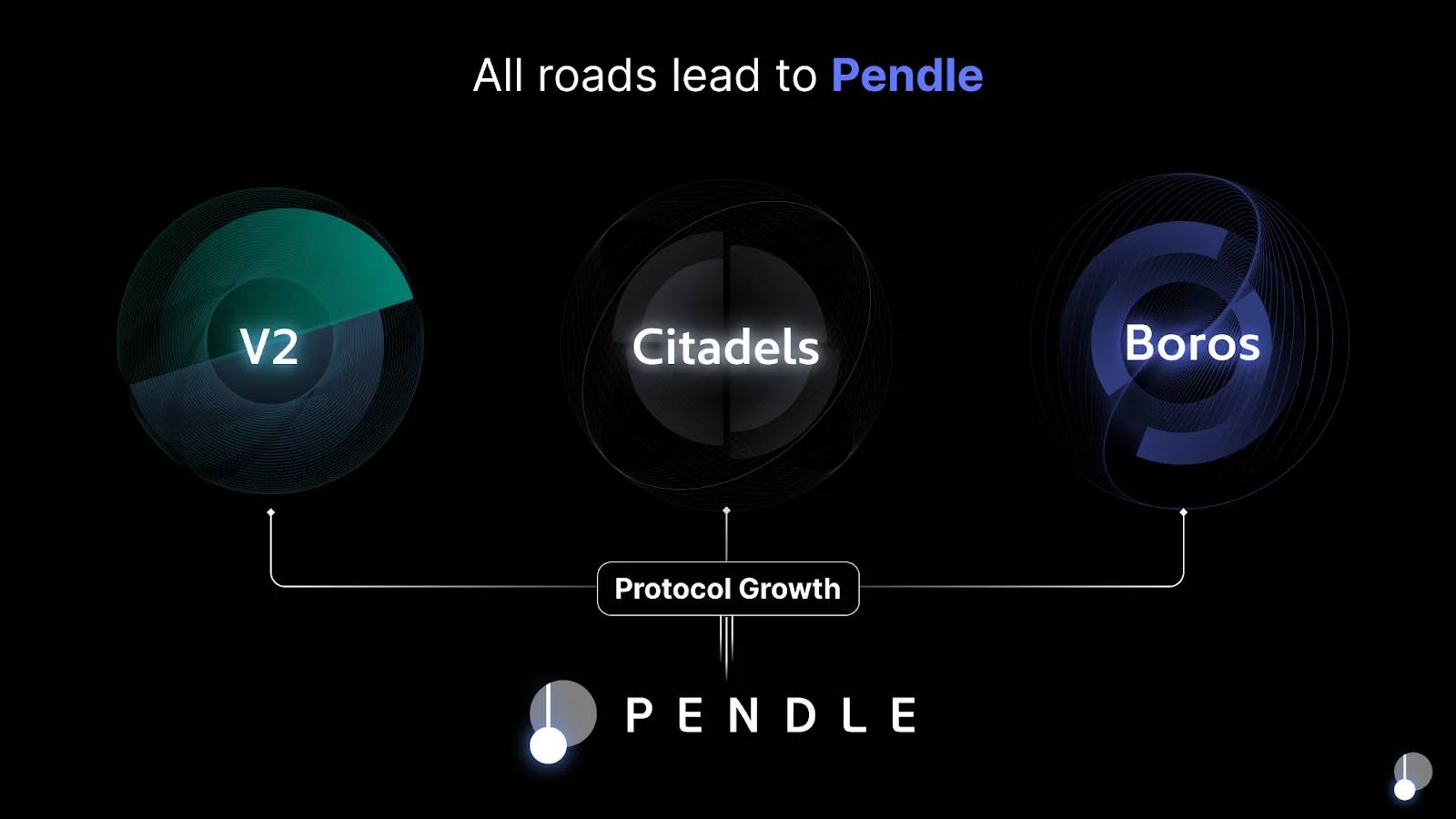

Pendle Finance ($PENDLE) has emerged as the dominant fixed-income protocol in DeFi, enabling users to trade future yields and lock in predictable on-chain returns. In 2024, it powered key narratives such as LSTs, restaking, and yield-bearing stablecoins, cementing its position as a launch platform for asset issuers.

In 2025, Pendle will expand beyond its Ethereum roots to become a full-stack fixed-income layer for DeFi, targeting new markets, products, and user bases across both crypto-native and institutional capital.

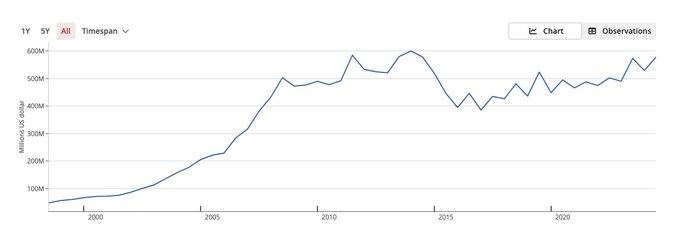

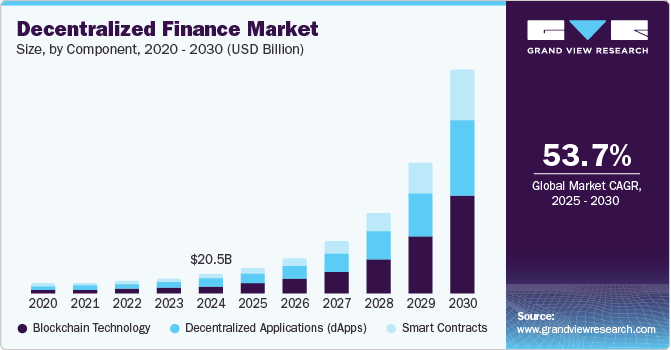

The market for on-chain yield derivatives mirrors one of TradFi’s largest segments: interest rate derivatives—a $500+ trillion market. Even modest on-chain adoption represents a multibillion-dollar opportunity.

Source: Bank for International Settlements (BIS)

While most DeFi platforms offer only variable yields, exposing users to market volatility, Pendle introduced fixed-rate products through a transparent and composable system.

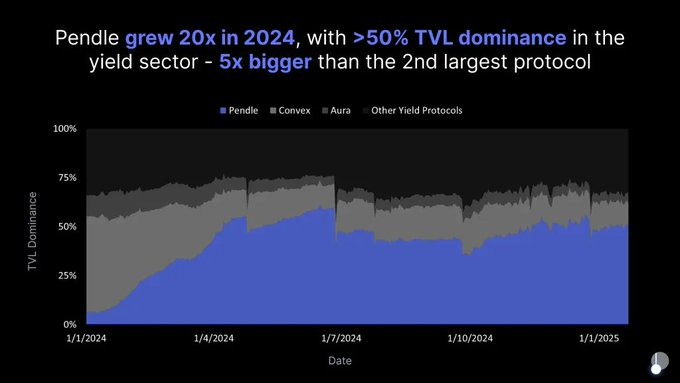

This innovation is reshaping the $120 billion DeFi landscape, positioning Pendle as the dominant yield protocol. In 2024 alone, it grew 20x, capturing over 50% of TVL in the yield sector—five times that of its nearest competitor.

Source: Pendle (Medium)

Pendle is more than just a yield protocol—it has evolved into core DeFi infrastructure and a critical liquidity engine for some of the ecosystem's largest protocols.

Achieving Product-Market Fit: From LSTs to Restaking

Pendle gained early traction by addressing a critical issue in DeFi: unstable and unpredictable yields. Unlike Aave or Compound, it allows users to lock in fixed returns by separating principal from yield.

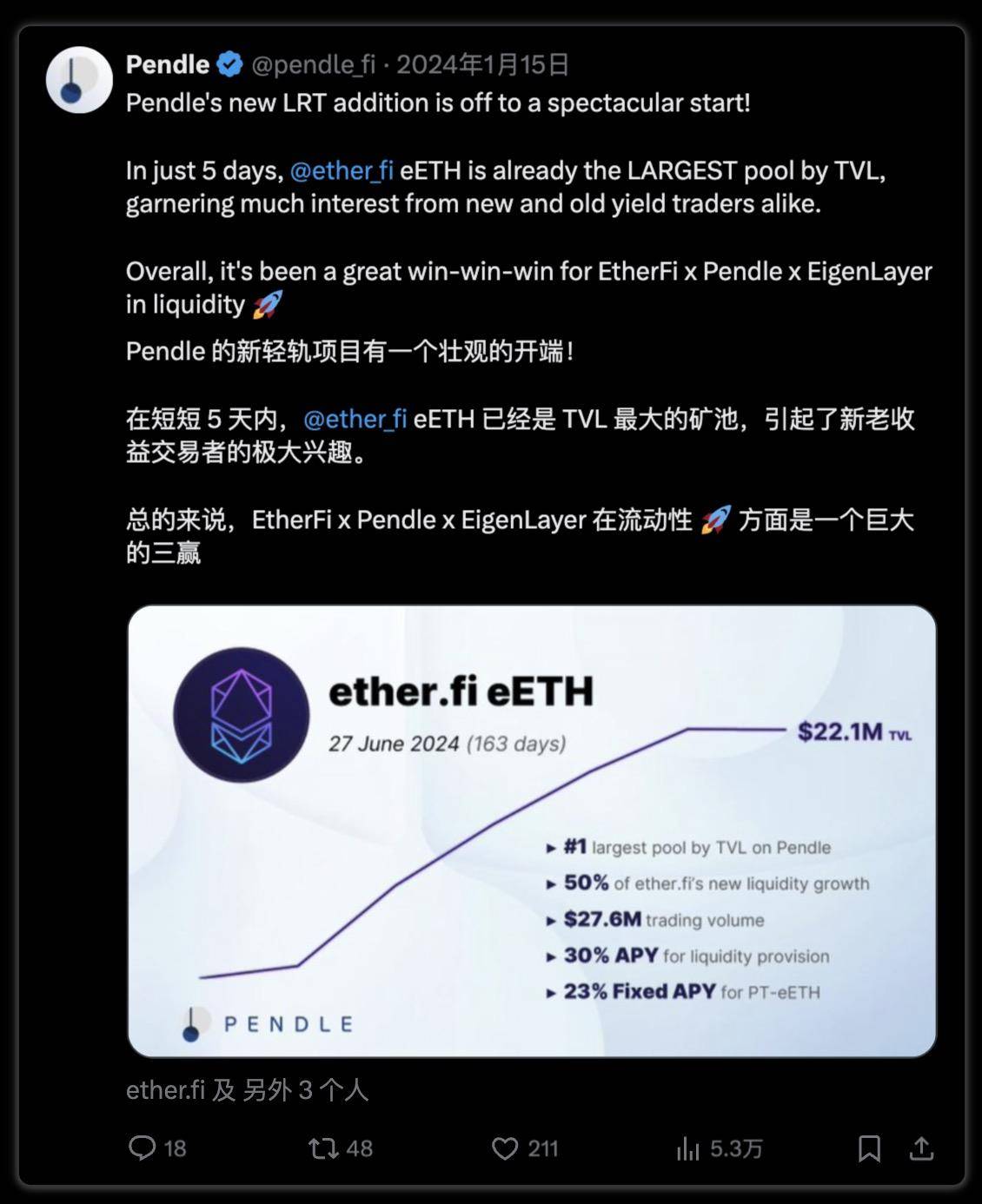

Its adoption surged with the rise of LSTs, helping users unlock liquidity from staked assets. In 2024, Pendle captured the restaking narrative—its $eETH pool became the platform’s largest within days of launch.

Pendle’s infrastructure now plays a pivotal role across the yield ecosystem. Whether providing hedging tools against volatile funding rates or serving as a liquidity engine for yield-bearing assets, Pendle is uniquely positioned to benefit from growing segments like LRTs, RWAs, and on-chain money markets.

Pendle V2: Infrastructure Upgrade

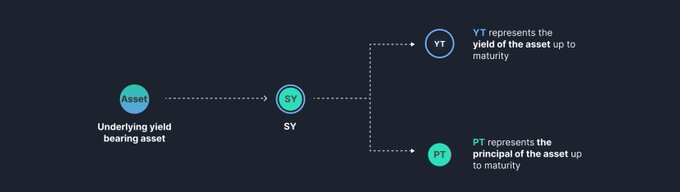

Pendle V2 introduced Standardized Yield (SY) tokens to unify the wrapping of yield assets. This replaced V1’s fragmented custom integrations and enabled seamless minting of Principal Tokens (PT) and Yield Tokens (YT).

Source: Pendle Finance. "How SY tokens are split into PT and YT tokens." Pendle Documentation

The AMM in V2 is purpose-built for PT-YT trading, offering higher capital efficiency and better pricing. While V1 used a generalized AMM model, V2 introduces dynamic parameters like rateScalar and rateAnchor to adjust liquidity over time. This results in tighter spreads, improved yield discovery, and lower slippage.

For liquidity providers, V2 offers stronger protection. Pools now consist of highly correlated assets, and the AMM design minimizes impermanent loss, especially for LPs holding to maturity. In V1, LP outcomes were harder to predict due to less specialized mechanisms.

Breaking Beyond EVM: Solana, Hyperliquid, and TON

Pendle’s planned expansion to Solana, Hyperliquid, and TON marks a major inflection point in its 2025 roadmap. Until now, Pendle has been confined to EVM-based ecosystems, where it already dominates the fixed-income space with over 50% market share.

The next wave of crypto growth is multi-chain—and Pendle’s move to break EVM silos via its Citadel deployments enables access to entirely new pools of capital and users.

Source: Pendle (Medium)

Solana has become a major hub for DeFi and trading activity, with over $14B in TVL in January and a strong retail base alongside a rapidly growing LST market.

Source: DeFiLlama (defillama.com)

Hyperliquid, with its vertically integrated perpetuals infrastructure, and TON, with its Telegram-native user funnel, present high-growth opportunities underserved by sophisticated yield infrastructure. Pendle can fill this gap.

If successful, these deployments could significantly expand Pendle’s total addressable market. Capturing fixed-income flows on non-EVM chains could translate into hundreds of millions in incremental TVL. More importantly, it would reinforce not only Pendle’s status as an Ethereum-native protocol but also its role as DeFi’s fixed-income layer across major chains.

Source: Grand View Research

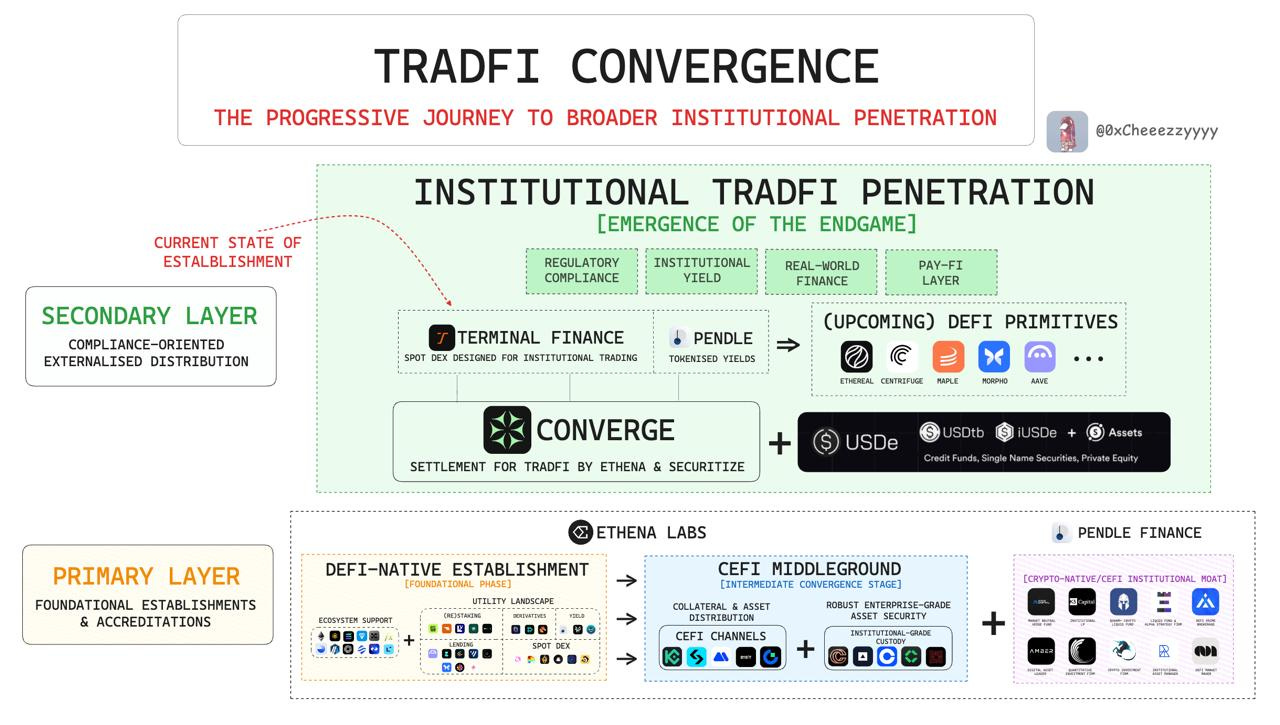

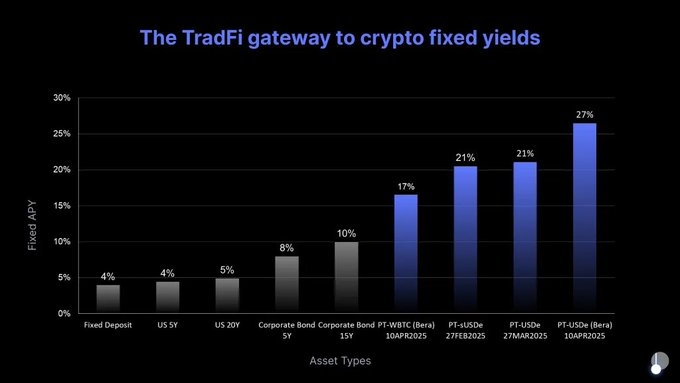

Citadel for TradFi: Building Regulated Yield Access

Another key catalyst in Pendle’s 2025 roadmap is the launch of KYC-compliant Citadels designed for institutional capital. The goal is to bridge on-chain yield opportunities with regulated capital markets by offering structured, compliant, crypto-native fixed-income products.

Source: Pendle (via Medium publication)

The initiative involves partnering with protocols like Ethena to create segregated SPVs managed by regulated investment managers. This setup eliminates key friction points around custody, compliance, and on-chain execution, allowing institutions to access Pendle’s yield products through familiar legal structures.

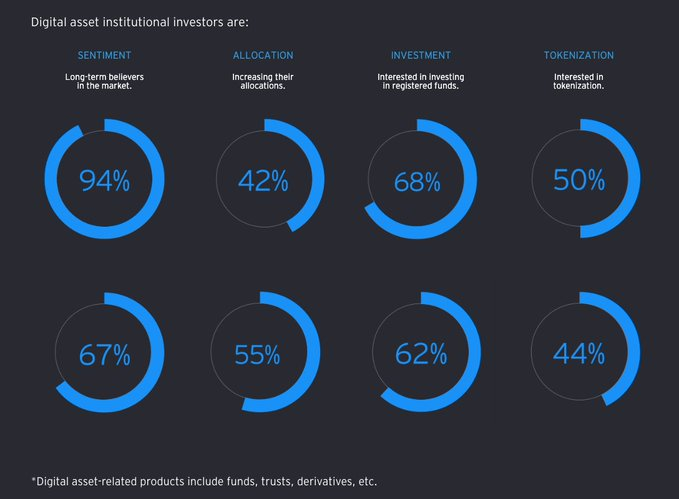

With the global fixed-income market exceeding $100 trillion, even a small shift toward on-chain adoption could result in billions in inflows. A 2024 EY-Parthenon survey found that 94% of institutional investors believe in the long-term value of digital assets, with over half increasing their allocations.

Source: EY-Parthenon, “Changing Sentiment on Digital Assets,” 2024.

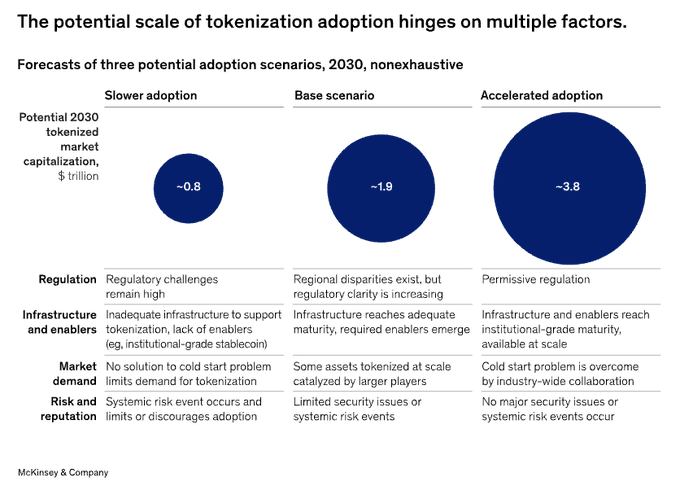

McKinsey estimates that tokenized markets could reach $2–4 trillion by 2030. While Pendle is not a tokenization platform, it plays a crucial role in the stack by enabling price discovery, hedging, and secondary trading for tokenized yields. Whether tokenized treasuries or yield-bearing stablecoins, Pendle can serve as the fixed-income layer for institutional-grade strategies.

Source: McKinsey & Company, "What is Tokenization?," 2024.

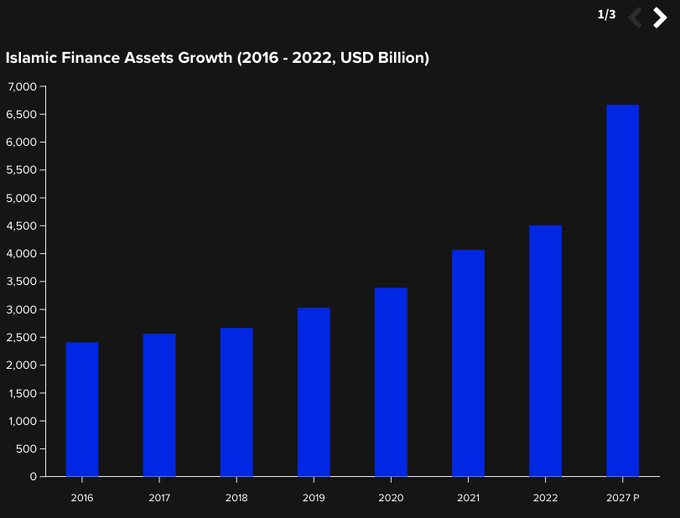

Islamic Finance Citadel: A $4.5T Market Opportunity

Pendle also plans to launch a Sharia-compliant Citadel to serve the global Islamic finance market—an industry estimated at $4.5 trillion, operating across more than 80 countries. It has grown at a 10% CAGR over the past decade, particularly in Southeast Asia, the Middle East, and Africa.

Source: ICD-LSEG, “Islamic Finance Development Report,” 2023.

Strict religious restrictions have historically limited Muslim investors’ access to DeFi. However, Pendle’s PT/YT architecture offers flexibility to develop yield products aligned with Sharia principles, potentially resembling Sukuk (Islamic bonds).

If successful, this Citadel would not only expand Pendle’s geographic reach but also demonstrate DeFi’s ability to adapt to diverse financial systems—solidifying Pendle’s role as global fixed-income infrastructure for on-chain markets.

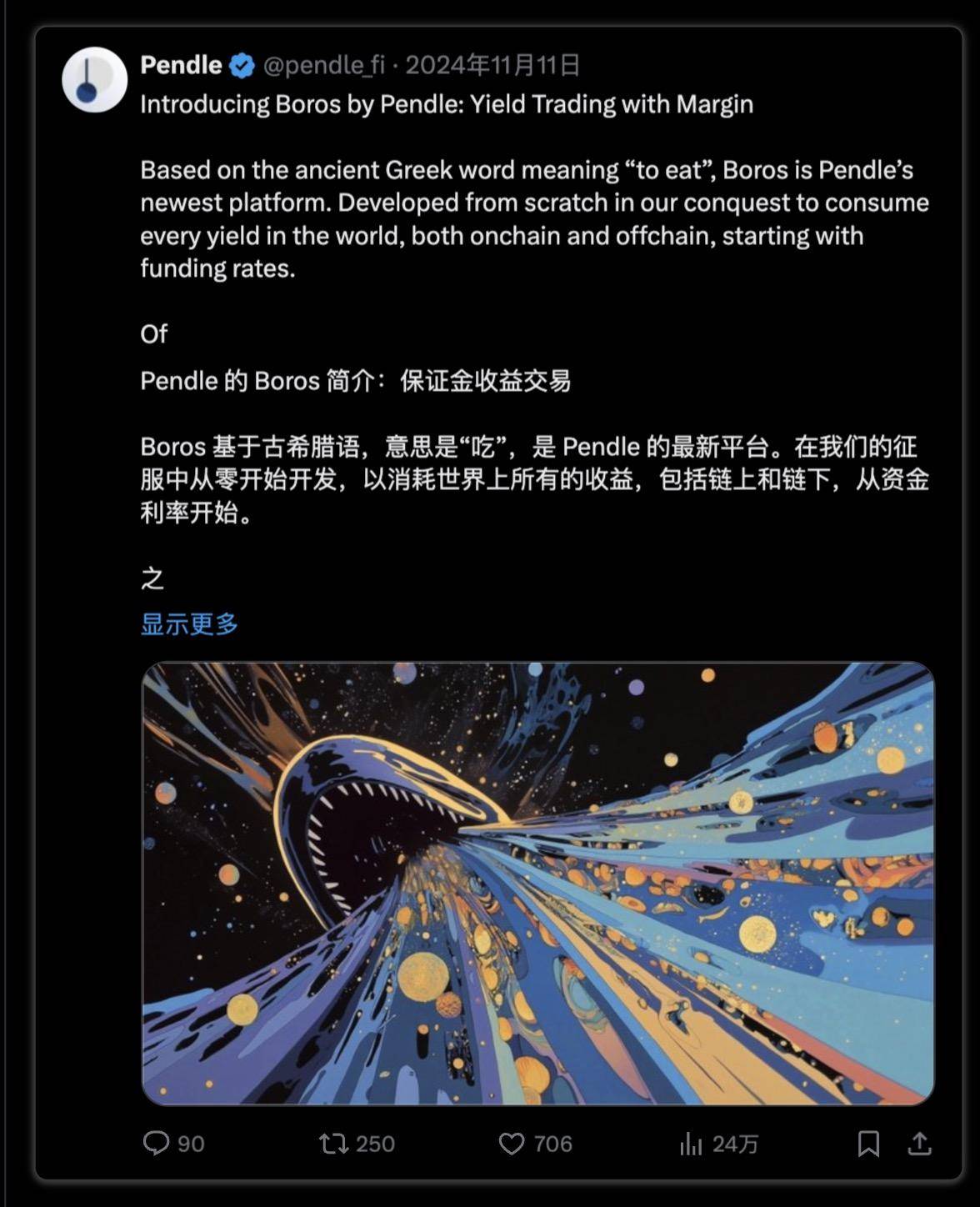

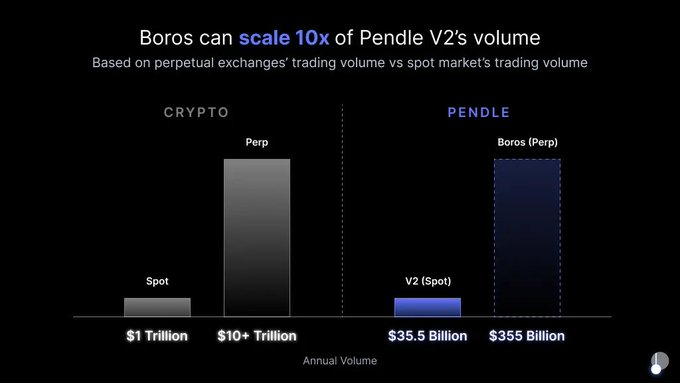

Pendle’s Strategic Move Into Perpetual Yield Markets

One of the most significant catalysts in Pendle’s 2025 roadmap is Boros—a new vertical bringing fixed-rate trading to perpetual funding yields. While Pendle V2 established the protocol as the leader in spot yield tokenization, Boros extends its influence into crypto’s largest and most volatile yield source: perpetual contract funding. With over $150B in open interest and daily volumes exceeding $200B, this is a massive yet under-hedged segment.

Boros supports fixed funding rates, providing critical stability for protocols like Ethena. This is essential for institutions managing large-scale strategies.

Source: Pendle (via Medium publication)

The benefits for Pendle are substantial. Boros opens up a multibillion-dollar market previously out of reach. It also transforms Pendle’s narrative—from a DeFi yield application to an on-chain equivalent of a traditional finance interest rate desk, akin to those offered by CME or JPMorgan.

Boros also strengthens Pendle’s long-term moat. Rather than chasing trends, Pendle is building foundational infrastructure for future yield markets. Through use cases like funding rate arbitrage and cash-and-carry strategies, it provides real utility for traders and treasuries alike.

And because there is currently no scalable solution for funding rate hedging—neither in DeFi nor CeFi—Pendle holds a clear first-mover advantage.

If successful, Boros could significantly expand Pendle’s market share, attract new user segments, and solidify its position as DeFi’s fixed-income layer.

Leadership and Strategic Partnerships

Pendle Finance was founded in mid-2020 by a pseudonymous team known publicly as @tn_pendle, GT, YK, and Vu. Since inception, it has attracted backing from prominent investors including Bitscale Capital, Crypto.com Capital, Binance Labs, and The Spartan Group.

Source: Pendle Finance Official Website

To support its growth and expansion, Pendle has completed several key funding rounds and strategic initiatives:

● Private Token Sale (April 2021): Raised $3.7 million from investors including HashKey Capital, Mechanism Capital, and Crypto.com Capital.

● Initial DEX Offering (IDO) (April 2021): Raised $11.83 million at a token price of $0.797.

● Binance Launchpool (July 2023): Distributed 5.02 million PENDLE tokens (1.94% of total supply) through Binance’s Launchpool program.

● Strategic Investment by Binance Labs (August 2023): Received a strategic investment from Binance Labs to accelerate ecosystem growth and cross-chain expansion. Amount undisclosed.

● Arbitrum Foundation Grant (October 2023): Awarded a $1.61 million grant from the Arbitrum Foundation to support development on Arbitrum.

● Strategic Investment from The Spartan Group (November 2023): Secured strategic funding from The Spartan Group to strengthen long-term growth and institutional adoption. Amount undisclosed.

Pendle actively collaborates with leading protocols to expand its ecosystem and bring fixed-yield trading to broader assets and networks. Key partnerships include:

● Base (Coinbase L2): Deployment on Base unlocks access to Base-native assets and extends Pendle’s fixed-income infrastructure to a growing user base.

● Anzen (sUSDz): Listed sUSDz, an RWA-backed stablecoin, on Pendle Base, enabling fixed-yield trading linked to real-world yields—marking Pendle’s first integration with real-world assets upon community listing.

● Ethena (USDe/sUSDe): Integrated USDe and sUSDe with high APY and incentive rewards, bringing crypto-native stablecoin yields to Pendle and strengthening alignment with one of DeFi’s fastest-growing protocols.

● Ether.fi (eBTC): Launched the first BTC-native yield pool via eBTC, extending Pendle’s reach beyond ETH-based assets and enabling fixed-yield exposure to Bitcoin.

● Berachain (iBGT/iBERA): Recently launched native infrared LSTs on Berachain, establishing core fixed-income infrastructure to bootstrap Berachain’s DeFi ecosystem from day one.

Tokenomics

The $PENDLE token is central to Pendle Finance, enabling governance and interaction across the protocol. By allowing users to split yield-generating assets into principal and yield components, Pendle creates novel yield management strategies—while $PENDLE provides the toolset to access and shape this ecosystem.

As of March 31, 2025:

● Price: $2.57

● Market Cap: $410.6 million

● Fully Diluted Valuation: $725.2 million

● Circulating Supply: 161.31 million (57.3% of max supply)

● Max/Total Supply: 281,527,448 PENDLE

Since September 2024, $PENDLE emissions have decreased by 1.1% weekly, starting from 216,076 tokens per week. After 29 weeks, the emission rate has declined to approximately 156,783 tokens per week. This reduction schedule will continue until April 2026, after which the protocol will transition to a terminal inflation rate of 2% annually to sustain long-term incentives.

Source: Pendle Tokenomics – Emission & Supply Schedule

Enhancing Utility via vePENDLE

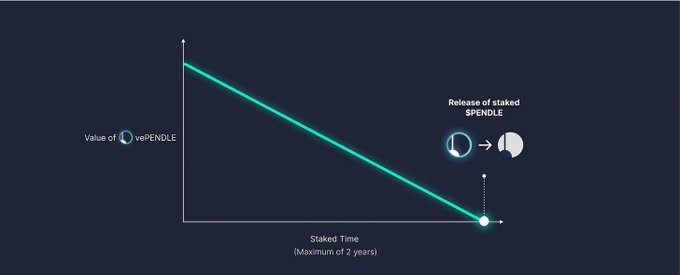

Pendle improves governance and decentralization through $vePENDLE, the vote-escrowed version of the $PENDLE token. Users receive $vePENDLE by locking their tokens for up to two years. The longer and larger the lock, the more $vePENDLE they receive. Over time, $vePENDLE linearly decays to zero, at which point the locked $PENDLE is unlocked.

Source: Pendle Tokenomics

This locking mechanism reduces circulating supply, supports price stability, and aligns long-term incentives across the ecosystem.

Benefits of vePENDLE

● Voting rights in protocol decisions

● Share of yield fee distributions

● Exclusive rewards and airdrops

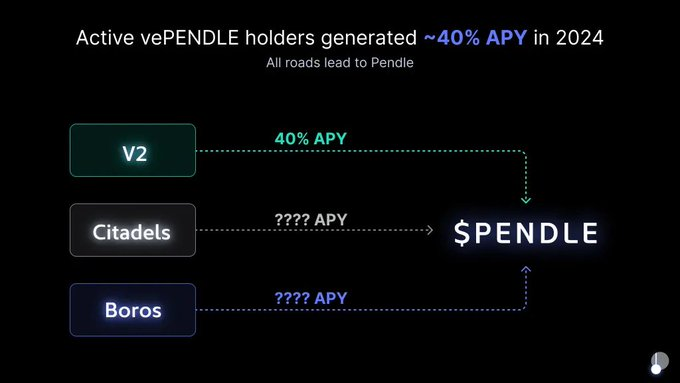

By 2024, active vePENDLE holders earned an average ~40% APY, excluding a $6.1M airdrop distributed solely in December.

Source: Pendle (via Medium publication)

The Pendle Protocol generates value primarily through:

● Yield Trading (YT) Fees: 3% fee on accrued yield from yield-bearing tokens.

● Swap Fees: 10 to 30 basis points (bps) per trade, depending on the specific liquidity pool.

● Expired PT Yields: Portion of yields from expired but unredeemed Principal Tokens (PT) distributed proportionally among vePENDLE holders.

Currently, Pendle distributes 100% of its protocol revenue directly to vePENDLE holders, with no reserve allocated to the Pendle treasury. However, this distribution model may evolve to include future treasury contributions.

As Pendle continues to scale through V2, Citadels, and Boros, vePENDLE holders stand to benefit from increased value accrual, reinforcing the central role of vePENDLE within the Pendle ecosystem.

Key Risks and Challenges

Despite its strong position in the DeFi ecosystem, Pendle faces several risks. Its complexity remains a barrier to broader adoption—especially for users unfamiliar with yield-trading mechanics. Unlocking the next wave of growth will require sustained efforts to simplify the user experience and reduce the learning curve around PTs, YTs, and fixed-yield strategies.

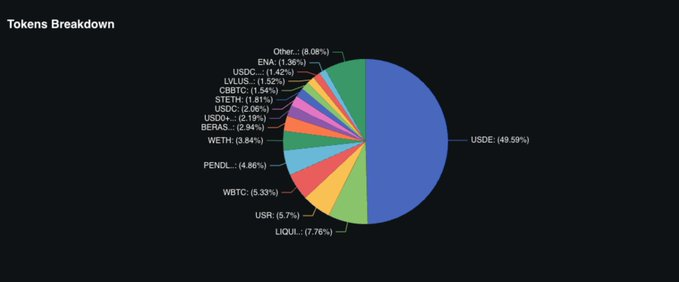

The current high concentration of Pendle’s TVL in Ethena pools could also be seen as a risk without proper context. Nevertheless, Pendle’s role as a yield-focused DEX allows it to remain agile and responsive to shifting market narratives. In 2024, over 60% of Pendle’s TVL was allocated to ETH liquid restaking tokens (LRT). By 2025, this composition shifted, with over 60% now concentrated in stablecoin and synthetic dollar pools, reflecting evolving market demand.

Source: DeFiLlama (defillama.com)

Other considerations include smart contract risk, oracle reliability, and market volatility of underlying assets. Low liquidity in certain pools may also lead to slippage or reduced capital efficiency for users exiting positions.

Finally, Pendle’s recent growth has been partly driven by airdrops and points-based incentives. As these programs phase out, sustained momentum will depend more heavily on the protocol’s core utility, diversified yield sources, and continued product rollouts such as Boros and multi-chain Citadels.

Conclusion

While market cycles often drive fluctuations in investor sentiment and attention, Pendle continues to build with a long-term vision. Its ability to offer customizable fixed-yield strategies places it at the forefront of DeFi innovation—enabling users to manage volatility, hedge effectively, and unlock predictable returns. This positions Pendle as a natural bridge between the complexity of traditional finance and the composability of on-chain markets.

Looking ahead, the 2025 roadmap lays the foundation for broader adoption and deeper liquidity. Sustained success will depend on simplifying the user experience and moving beyond short-term narratives.

As stablecoin markets grow and tokenized assets multiply, Pendle is well-positioned to become the fixed-income layer powering the next wave of asset issuance. Its recent momentum reflects both demand and market conviction. If execution proceeds as planned, Pendle could emerge as a cornerstone of DeFi’s fixed-income future.

To stay updated on developments in the Pendle ecosystem, here are some key accounts to follow:

@pendle_fi @imkenchia @PendleIntern @crypto_linn @degens_grandma @tn_pendle @DeFi_Perryy

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News