25-Year Push into TradFi: Pendle, the Yield Trading Unicorn's New Growth Curve

TechFlow Selected TechFlow Selected

25-Year Push into TradFi: Pendle, the Yield Trading Unicorn's New Growth Curve

From DeFi, CeFi to TradFi convergence, stepping into Pendle's 2025 roadmap.

Author: TechFlow

The birth of a unicorn often stems from identifying a market with massive demand that has long remained underserved. Pendle, the largest yield trading platform in crypto, is a prime example.

While the global interest rate derivatives market exceeds trillions of dollars, the crypto-based interest rate swap market remains in its infancy. As a serial entrepreneur in the crypto space, TN Lee and his team敏锐ly identified this gap. Focusing on yield trading, Pendle emerged as a leader—achieving a 20x increase in TVL in 2024 and becoming the undisputed frontrunner in the crypto yield trading sector.

With clearer crypto regulations emerging, escalating tariff wars, and institutions flooding into blockchain, 2025 is poised to be a pivotal year for on-chain finance. For Pendle, this macro shift brings a new challenge: how to integrate these opportunities into product innovation for another leap forward.

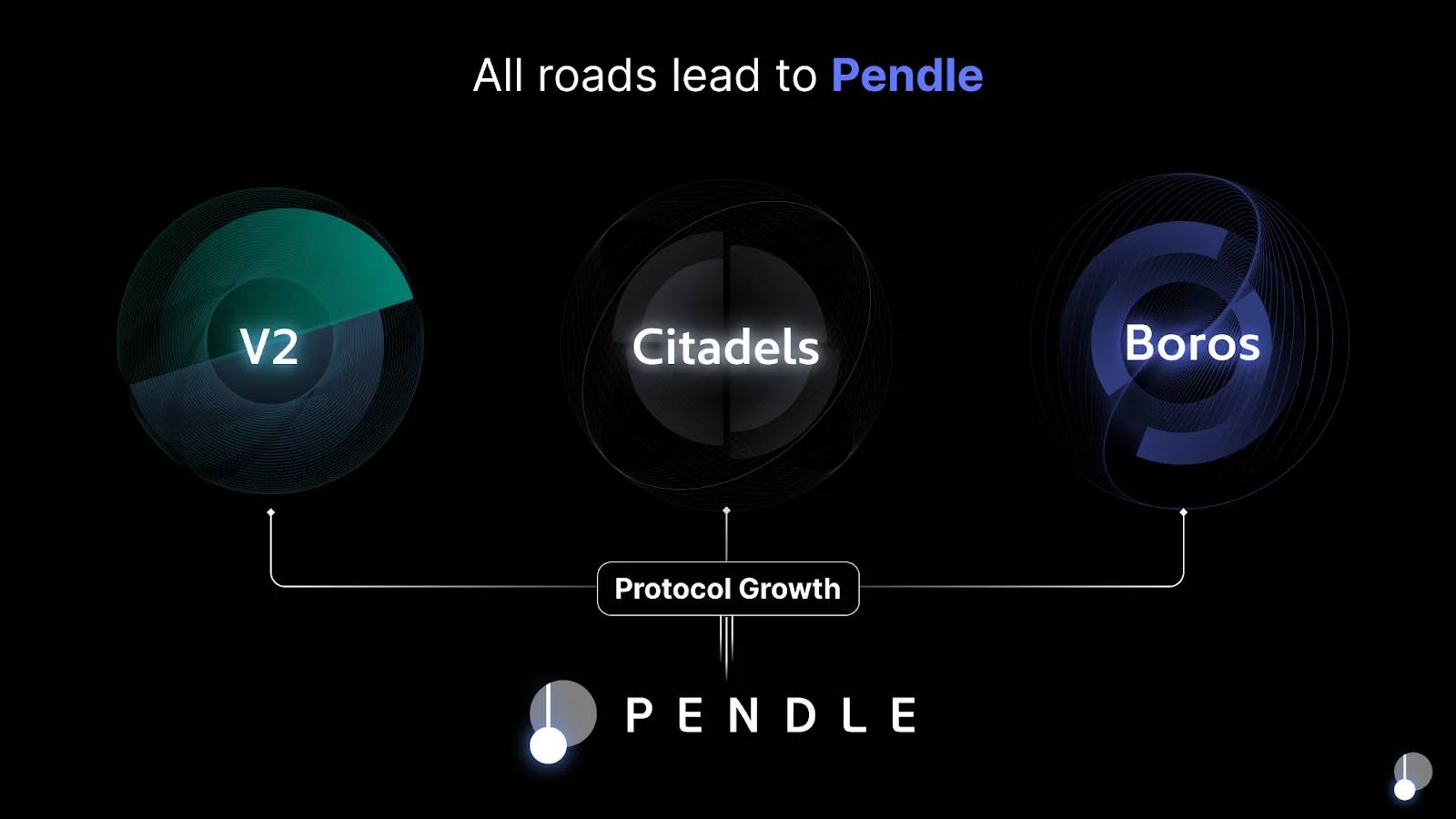

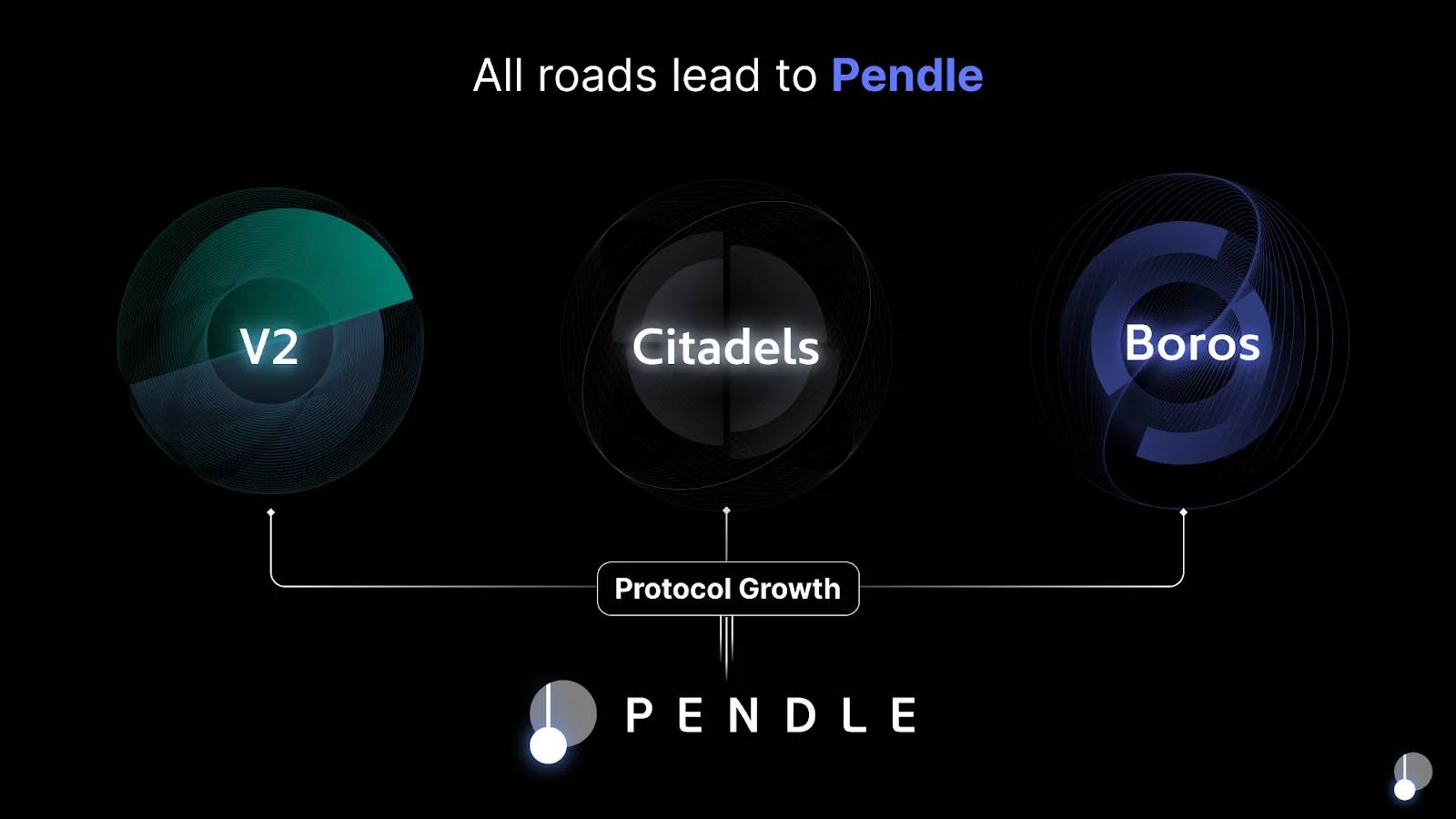

Yet from Pendle’s early 2025 roadmap publication, “Pendle 2025: Zenith,” we can glimpse an ambitious vision—through product enhancements, the Citadels fixed-income expansion initiative, and new products like Boros—Pendle aims to become a unified gateway for yield across on-chain and off-chain, DeFi, CeFi, and even TradFi.

As short-term speculation fades and attention turns toward sustainable value, can Pendle continue its momentum with simpler participation, more efficient capital flows, and richer yields?

Let’s explore the truth behind the vision by diving into Pendle’s product roadmap.

On the Brink of TradFi Breakout: Pendle Poised for Exponential Growth

In traditional finance, the interest rate derivatives (IRD) market where Pendle operates is highly mature—and vastly larger than most realize:

According to the BIS (Bank for International Settlements) report “OTC derivatives statistics at end-June 2024,” the IRD market stands at approximately $579 trillion, making it the largest segment of the derivatives market.

Within IRDs, interest rate swaps are the most significant and liquid component.

In contrast, the crypto landscape tells a different story: data from DeFi Pulse shows that interest rate swaps account for less than 10% of the DeFi market.

This stark disparity highlights a widely recognized high-growth niche within DeFi. By focusing on yield-bearing assets, Pendle fills the void in crypto’s interest rate swap market—and achieved exponential growth over the past year:

Data from DeFi Llama shows Pendle’s TVL rose from ~$230 million on January 1, 2024, to ~$4.4 billion by December 31, 2024—an increase of about 20x—with peaks reaching $6.7 billion.

Additionally, according to Pendle’s internal reports, daily trading volume surged from $1.1 million in 2023 to $96.4 million in 2024—an almost 100x increase.

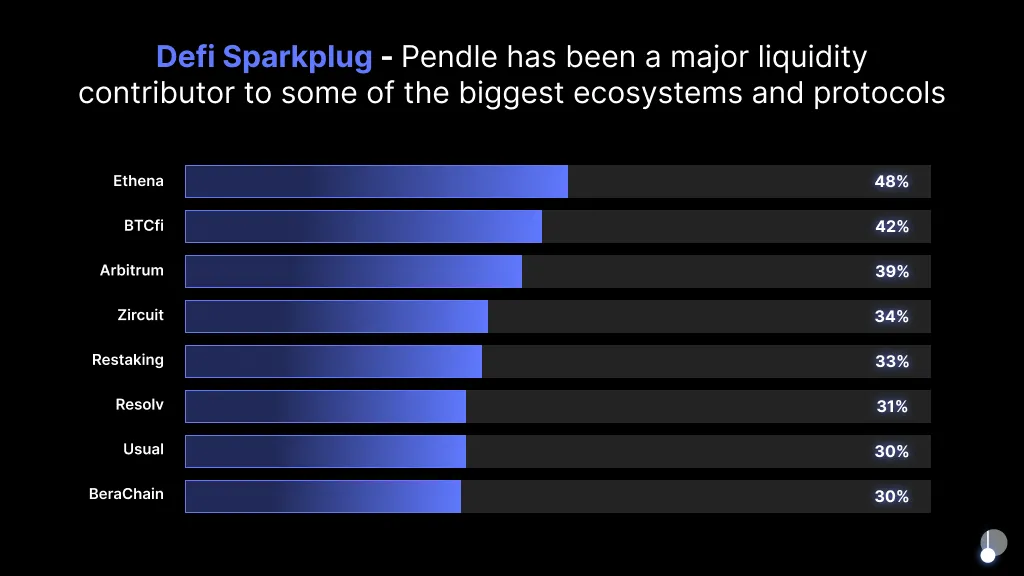

While maintaining leadership in DeFi yield trading by both TVL and volume, Pendle has also proven instrumental in revitalizing projects, enhancing liquidity, and boosting yields through collaborations:

Data indicates that in 2024, Pendle launched over 200 Markets across 60+ protocols on five major blockchains including Arbitrum and Zircuit. Notably, 48% of Ethena’s TVL was attributed to Pendle; 39% of Arbitrum’s TVL stemmed from Pendle; and in BTCFi, 42 out of every 100 re-staked BTC were deposited via Pendle.

We can further validate Pendle’s dominance through Binance Research’s May 2024 report, “Breakthrough DeFi Markets,” which noted that the yield market’s TVL grew 148.6% to reach $9.1 billion—a trajectory closely aligned with Pendle’s explosive growth.

After such remarkable achievements, the harder question arises: how does Pendle sustain momentum moving forward?

As Pendle co-founder TN Lee pointed out: despite ranking among the top ten DeFi protocols and being the largest on-chain yield trading platform, Pendle’s 2024 trading volume accounted for only 0.007% of global interest rate swap volume.

2025 presents both opportunity and challenge. From a DeFi micro perspective, data shows the annual yield in on-chain markets totals ~$17.7 billion, of which only 4.97% has been traded via Pendle—providing the first major driver for continued high growth.

From a macroeconomic standpoint:

On one hand, key economic centers like the U.S. are advancing measures such as establishing a crypto strategic reserve, overturning the IRS DeFi broker rule, and accelerating stablecoin regulatory frameworks—ushering in clearer, more open regulations. This compliance-driven environment will attract more institutional capital and users to on-chain platforms, offering Pendle—already the largest on-chain yield marketplace—a critical growth window.

On the other hand, escalating trade tariffs introduce greater market uncertainty, fueling investor demand for stable assets (fixed price) paired with fixed income. Stablecoin fixed-yield strategies are central to this trend. Compared to traditional finance’s ~3% fixed annual returns, Pendle offers comparable products yielding 8–12%, creating another powerful growth catalyst.

How does Pendle, praised by crypto OGs, smart money, and veteran DeFi players alike, achieve its edge in “more efficient risk management and yield optimization”?

And in 2025—a year when DeFi yield scales grow and TradFi-DeFi convergence accelerates—what concrete steps will Pendle take to better absorb users, capital, and traffic?

Yield Trading Unicorn: Understanding Pendle’s Core Logic

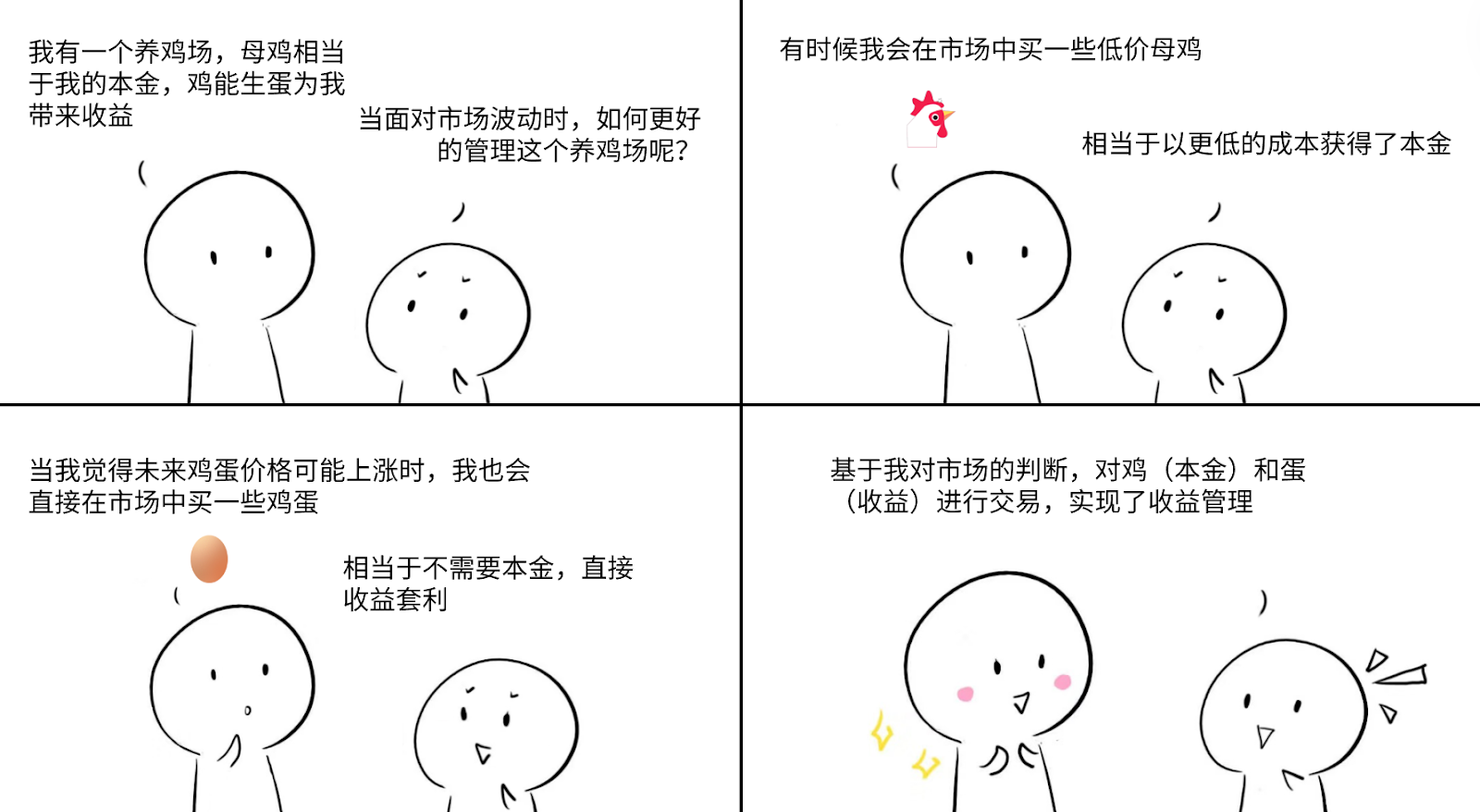

For newcomers, Pendle may initially seem complex. Let’s start with a simple analogy:

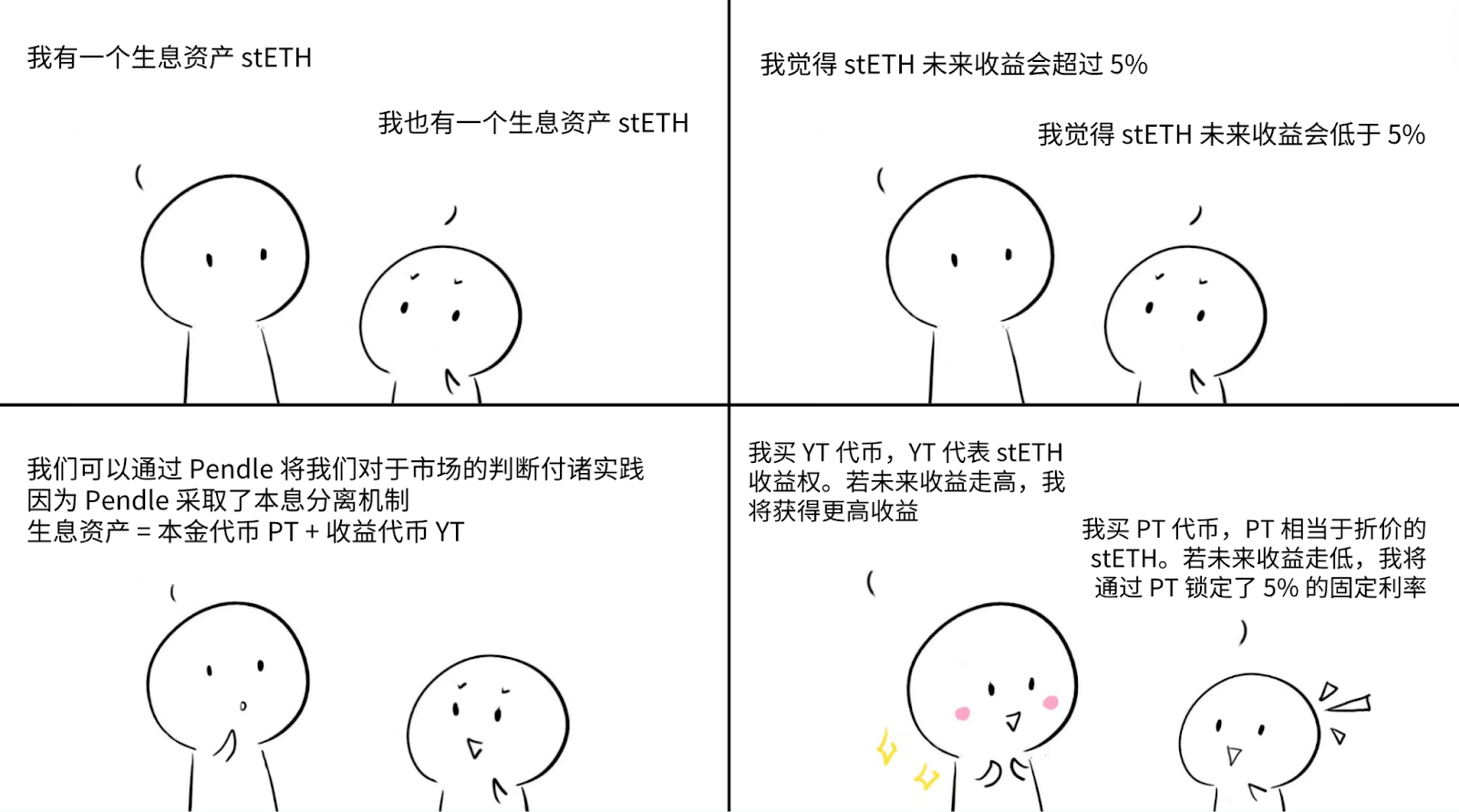

With this metaphor, grasping Pendle’s “yield trading” logic becomes straightforward:

Pendle focuses on yield-bearing assets, each generating principal + yield over time.

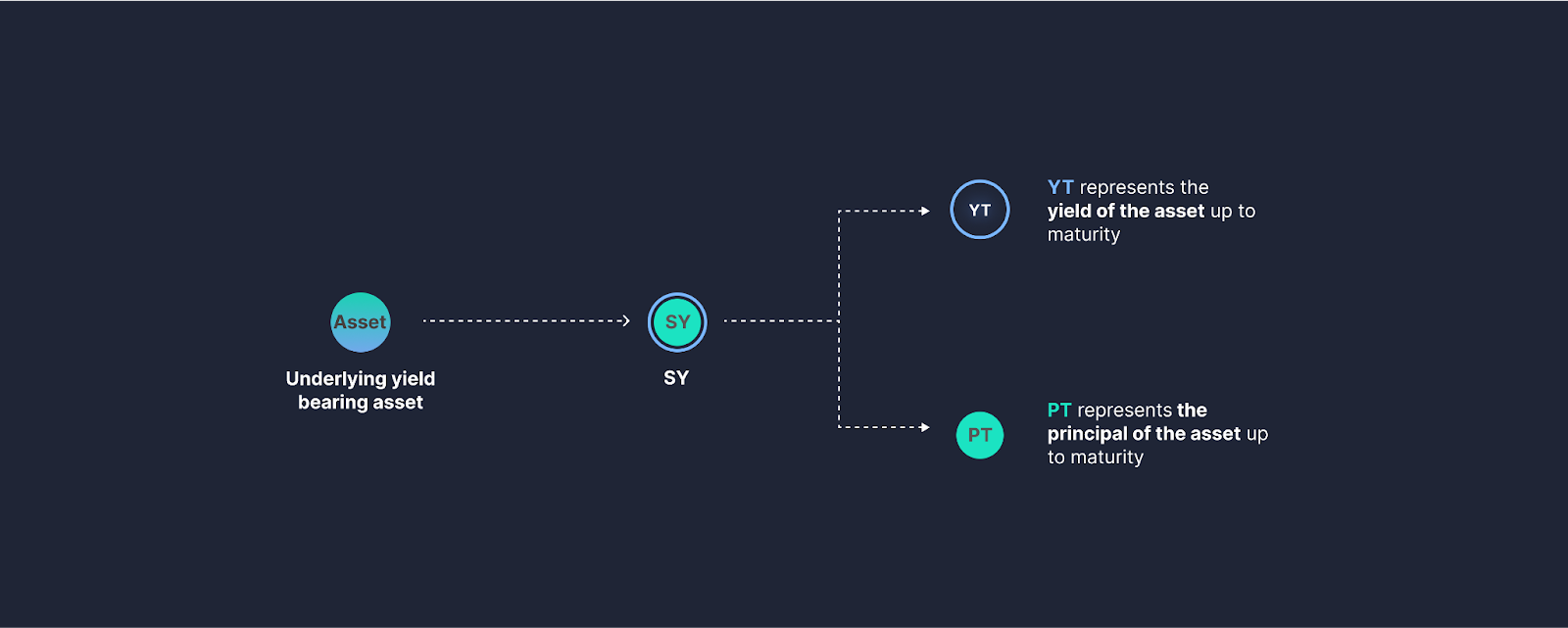

Pendle enables principal-yield separation: yield-bearing assets are tokenized into SY tokens, which can then be split into two components—Principal Tokens (PT) and Yield Tokens (YT)—and traded via Pendle’s AMM for interest rate exposure.

Hen = PT, Principal Token

Egg = YT, Yield Token

Why separate principal and yield? Because markets fluctuate, so do yields. To manage volatility:

Principal Tokens (PT) act as tools to hedge against market swings and lock in fixed returns. PT trades below the underlying asset’s price—the discount representing the fixed yield. Users buying PT typically believe future yields will decline, so they lock in current rates. Currently, Pendle’s PT market totals $1.2 billion, consistently delivering stable 10–20% APY regardless of market conditions.

Yield Tokens (YT) serve as leveraged bets on future yield changes. Users don’t need to own the full yield-bearing asset—holding YT gives them rights to its yield. If future yields fall, YT holders lose; if yields rise, they gain amplified returns. Thus, users can adjust YT holdings based on yield outlook.

Take the recently popular Sonic ecosystem aUSDC pool as an example:

If a user believes current yields are attractive, they can buy PT at a $0.974 discount on Pendle. Upon maturity on August 14, 2025, they receive 1 USDC, locking in an 8.741% return.

If they expect higher future yields, they can purchase YT for $0.02601. Each YT represents the yield from 1 USDC principal—effectively providing 38x leverage on yield gains, with no liquidation risk.

In this way, Pendle’s principal-yield split functions as a tool for going long or short on yields, creating new strategic dimensions. Both conservative investors and yield chasers can use PT and YT to tailor their risk-return profiles.

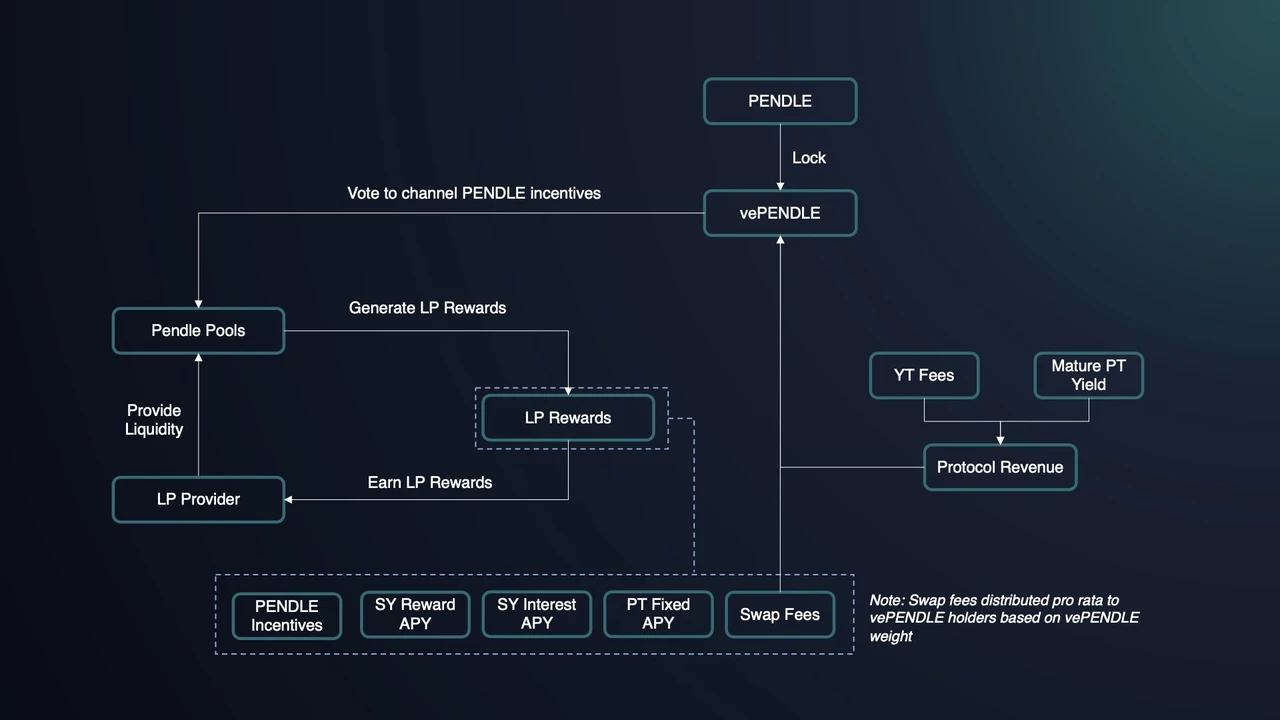

Beyond basics, Pendle—celebrated by crypto OGs, DeFi veterans, and smart money—offers advanced features: Providing LP liquidity with PT + SY, staking PENDLE to mint vePENDLE for protocol revenue shares, and combining points, airdrops, and incentives for flexible, high-efficiency, maximized yield participation.

Again using Pendle’s Sonic pools: current PT yields range between 7%–10%. By supplying liquidity with Aave’s aUSDC, LPs can achieve ~23% APY. More advanced users who buy YT-stkscUSD to amplify leverage, combined with 24x Sonic points, airdrop expectations, Rings, and Veda rewards, can reach up to 150% APY.

As a DeFi yield optimizer, Pendle creates additional arbitrage opportunities for the Sonic ecosystem. This combo of high yield, high leverage, and potential airdrops drove Pendle’s TVL on Sonic past $100 million rapidly.

There are now numerous Pendle tutorials online, and the official team provides a clear and accessible Chinese beginner’s guide, covering everything from intuitive examples to step-by-step operations. Interested readers are encouraged to explore it—this article won’t delve deeper here.

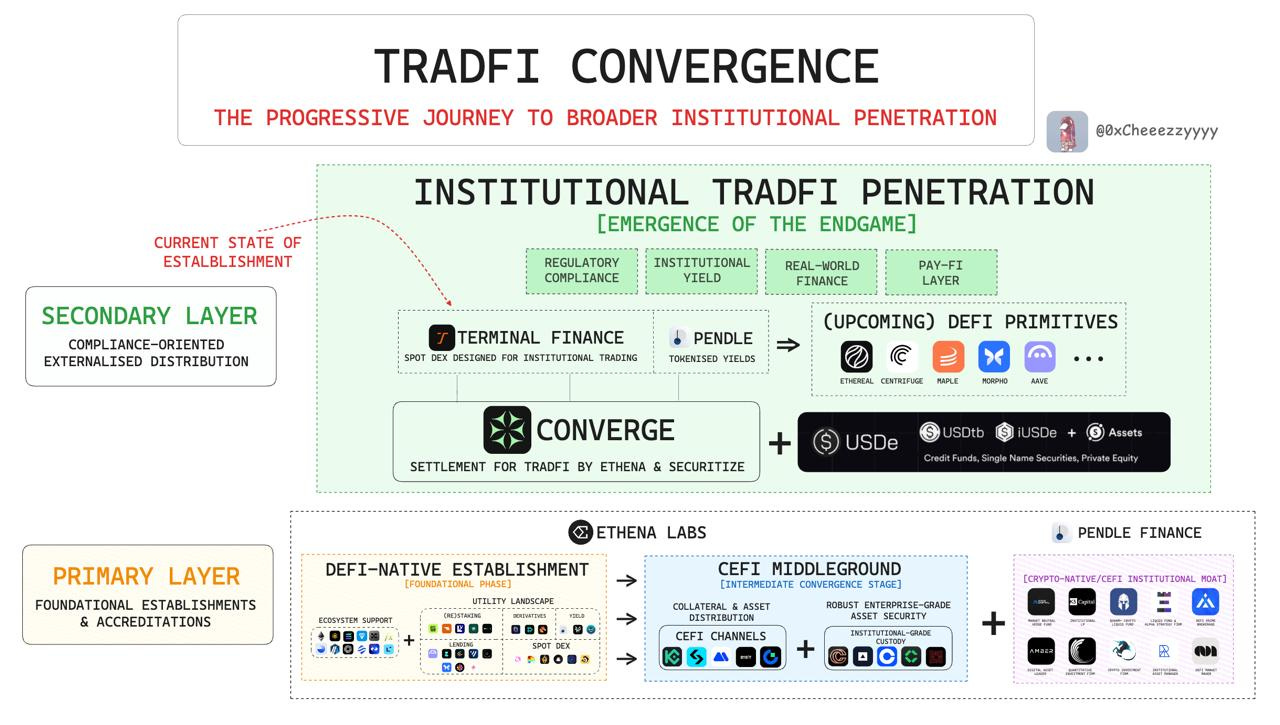

From DeFi, CeFi to TradFi Convergence: Inside Pendle’s 2025 Vision

Facing the 2025 surge in on-chain finance, unprecedented growth opportunities come hand-in-hand with rigorous demands on product design and long-term planning.

As the yield trading leader, Pendle has unveiled a new vision: “A comprehensive, integrated gateway for yield trading.”

Pendle aims to provide tools enabling anyone to access, interact with, and participate in yield markets in a decentralized, permissionless manner—whether in DeFi, CeFi, or TradFi. Wherever there is yield, Pendle will be there.

To realize this vision, convergence across DeFi, CeFi, and TradFi is inevitable. In its “Pendle 2025: Zenith” roadmap, Pendle outlines a clear path forward.

Citadels Fixed-Income Expansion Initiative

Why is the Citadels initiative—one of Pendle’s 2025 priorities—focused on the PT fixed-income market?

First, fixed income is a cornerstone of investment portfolios in both traditional and crypto finance, serving as a key entry point for traditional institutions entering crypto.

Second, market uncertainty caused by tariff shocks increases demand for fixed income. Through PT, Pendle offers a secure, stable fixed-income channel—especially through stablecoin + fixed yield strategies.

Thus, the Citadels initiative includes:

-

Stablecoins

Pendle’s stablecoin pools offer investors a more stable option while delivering higher yields than traditional finance—making them a vital bridge to attract TradFi users on-chain.

Currently, over 35 stablecoin pools operate on Pendle, with plans to expand coverage aggressively in the coming months. Beyond curated launches, stablecoin projects will soon be able to use a permissionless listing portal to build their own yield and points markets—positioning Pendle as the go-to hub for stablecoin yields.

-

Expansion Beyond EVM Ecosystems

Currently, Pendle serves only EVM-based DeFi users, leaving vast active markets like Solana and TON untapped. The Citadels initiative will extend support to non-EVM ecosystems, broadening user reach and increasing market share in the interest rate swap space.

-

Compliant PT: Accelerating DeFi, CeFi, and TradFi Integration

Regulatory compliance is essential for institutional adoption. Through Citadels, Pendle will launch compliant PT offerings, delivering crypto-native optimal fixed-income solutions to traditional financial institutions.

Pendle has already announced partnerships with entities like Ethena to jointly launch SPVs managed by regulated asset managers, opening Pendle’s access to traditional finance clients.

A key milestone in advancing Citadels is Fasanara Digital’s adoption of Pendle’s fixed-income suite. As the digital asset arm of Fasanara Capital—a firm managing $4.5 billion—Fasanara Digital brings deep liquidity, diversified structured products, and high-yield services, extending Pendle’s influence to more institutional partners.

Additionally, Pendle will establish a Citadel focused on Sharia-compliant principles, enabling Islamic funds to operate compliantly on-chain via PT. The Islamic finance market, valued at over $3.9 trillion and spanning 80+ countries, presents a significant growth vector. Through collaboration with Islamic funds, Pendle will develop Sharia-compliant PT products, deepening its penetration into global finance.

Boros Arrives: Focusing on Funding Rates, Building the Ultimate On-Chain/Off-Chain Yield Gateway

Alongside multi-dimensional market expansion, Pendle is developing a paradigm-shifting product designed to unify premium yield trading experiences across DeFi, CeFi, and TradFi.

This product is Boros.

The community has speculated widely about Boros, with many believing it could be Pendle’s most important 2025 release.

Why?

One key reason lies in a fundamental principle stated earlier: explosive product growth often comes from addressing large, unmet demand—and Boros targets the funding rate market.

This is undeniably a massive market. While Pendle previously focused on spot markets, perpetual markets offer far greater scale—due to high leverage, flexibility, and liquidity, they are dozens of times larger than spot. Funding rates in perpetual markets have become the largest source of yield in crypto. By targeting this segment, Boros opens up tens of times more growth potential for Pendle.

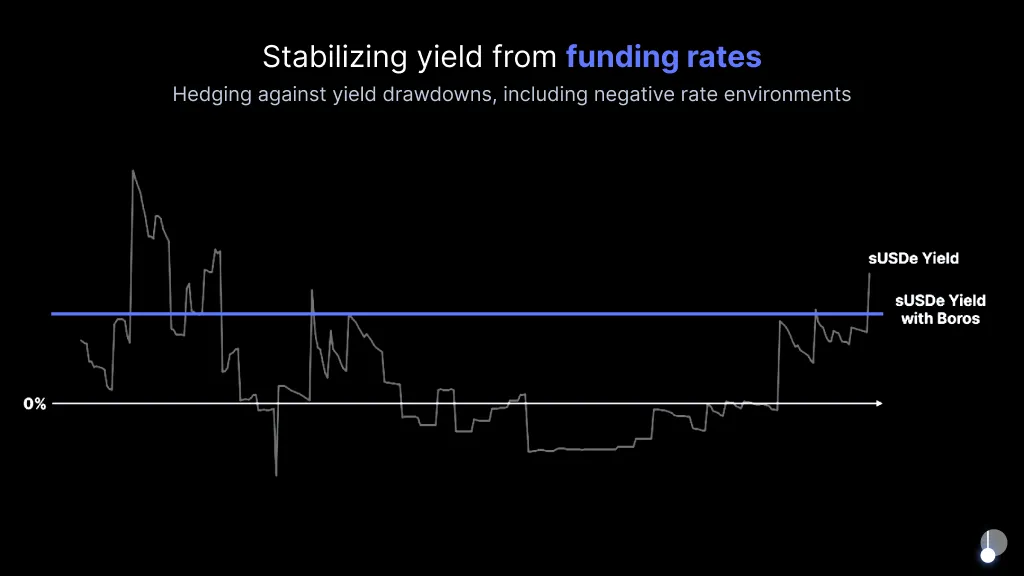

It's also a market ripe for improvement. Funding rates are often highly volatile, serving as a direct indicator of market sentiment. This volatility introduces uncertainty and, in extreme cases, severely limits traders’ profits.

Recall the intense FOMO sparked by the $TRUMP meme coin—when $TRUMP launched on perpetual platforms, some traders paid annualized funding rates as high as 20,000% to maintain long positions.

Previously, there was no reliable way to hedge such extreme funding rates. Now, Boros aims to deliver a groundbreaking solution.

Boros tackles funding rates head-on, making them tradable in a transparent, trustworthy manner—while offering users stronger risk controls and more diverse trading strategies.

Specifically, Boros tokenizes future funding rates and enables their trading, transforming floating payments into fixed ones, and unlocking new opportunities for cash-settled and arbitrage strategies.

Using $TRUMP as an example: users can trade tokenized funding rate instruments to lock in current rates during periods of extreme FOMO.

A more direct case is Ethena: a major portion of Ethena’s yield comes from perpetual funding rates. Without effective tools to manage this volatility, its business model faces significant risk. With Boros, Ethena can hedge against declining funding rate income, while active users can leverage rate fluctuations to double their returns.

For protocols and users reliant on funding rate income like Ethena, Boros offers a powerful risk management solution.

Under Pendle’s vision of a “comprehensive, integrated yield trading gateway,” Boros serves as a critical bridge connecting DeFi, CeFi, and TradFi—and a key carrier for cross-chain capital and users.

Guided by the principle “Wherever there is yield, there is Pendle,” Boros will transcend DeFi boundaries, supporting any form of yield—including LIBOR or mortgage rates—from DeFi, CeFi, and TradFi markets.

As a next-generation yield trading product, Boros leverages blockchain’s decentralization, transparency, and efficiency to deliver capabilities beyond traditional finance—addressing chronic issues like low liquidity, poor transparency, and closed markets—thereby attracting widespread TradFi participation and deeper integration on-chain.

According to Pendle’s latest roadmap, Boros is expected to launch mid-2025. With its arrival, Pendle will not only absorb more capital and users for exponential growth but also propel on-chain finance into a new era.

Job’s Not Done: Pendle Leading the Return to Value-Centric Principles

Beyond horizontal expansion, Pendle is committed to continuous product iteration to enhance user experience—fostering more permissionless access, open markets, and superior yield trading—laying the foundation for handling large-scale capital and users.

Permissionlessness is a core advantage of DeFi over traditional finance, enabling greater transparency, freedom, openness, and composability. Pendle will amplify this strength by enabling permissionless deployment of yield pools, allowing anyone or any protocol to build their own yield markets on Pendle. The existing “Community Launch” feature has already driven community-led growth.

Dynamic fee optimization is another focus: refining the dynamic fee rebalancing mechanism ensures pools remain optimally balanced amid rate fluctuations, preserving healthy alignment between LPs, users, and the protocol.

Additionally, Pendle uses a ve model: $PENDLE is the utility token, $vePENDLE is the governance token. $vePENDLE holders vote to direct $PENDLE rewards to specific liquidity pools, giving rise to bribe platforms like Penpie and Equilibria—and enabling $vePENDLE holders to earn multiple yields: base APY, voting APY, and LP rewards.

Going forward, Pendle will improve vePENDLE accessibility, opening participation channels to all users regardless of size, fostering broader ecosystem engagement and strengthening vePENDLE’s role as a flywheel for growth.

Many have felt it: during the recent volatile bull run, most projects chased fleeting trends, and most users operated in fast-in, fast-out cycles—few truly focused on long-term value or delivered sustainable products.

Before regulation improves and institutions drive broad on-chain growth, projects like Pendle—with robust products, strong metrics, and a clear roadmap—may represent not just a beacon of confidence for users, but also a turning point for the industry—from FOMO to rationality, from short-term hype to lasting value.

With ongoing product refinements, the advancement of the Citadels initiative, and the upcoming launch of Boros—can Pendle rapidly evolve from a yield-focused innovator into a transformative bridge linking DeFi, CeFi, and TradFi?

As the Pendle team often says:

Job’s not done, but it’ll be.

As Pendle’s 2025 roadmap unfolds, let’s look ahead to a resurgence of value-centric principles—and the breakout of on-chain finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News