Pendle’s Algorithmic Incentive Model (AIM) will officially launch on January 29, significantly enhancing incentive efficiency.

TechFlow Selected TechFlow Selected

Pendle’s Algorithmic Incentive Model (AIM) will officially launch on January 29, significantly enhancing incentive efficiency.

This model is expected to reduce $PENDLE emissions by approximately 30% while significantly improving incentive efficiency.

Author: Pendle

Key Takeaways

- The Algorithmic Incentive Model (AIM) will officially launch on January 29, 00:00 UTC, immediately following the conclusion of the final vePENDLE voting cycle.

- The model is projected to reduce $PENDLE emissions by approximately 30% while significantly improving incentive efficiency.

- Emissions will be automatically allocated based on liquidity providers’ (LPs’) real-market contributions to the protocol and its users, with weights determined by Total Value Locked (TVL) and swap fee generation.

- LPs will receive higher TVL-based incentives during the initial liquidity-building phase; as pools mature, the incentive focus will gradually shift toward fee generation.

- The protocol can amplify rewards via external incentives, with Pendle providing co-incentives—enabling up to $1.40 in total incentives for every $1 invested.

- With the removal of the previous ve-boost mechanism, LP APRs are expected to rise across the board, especially in high-volume pools.

Introduction

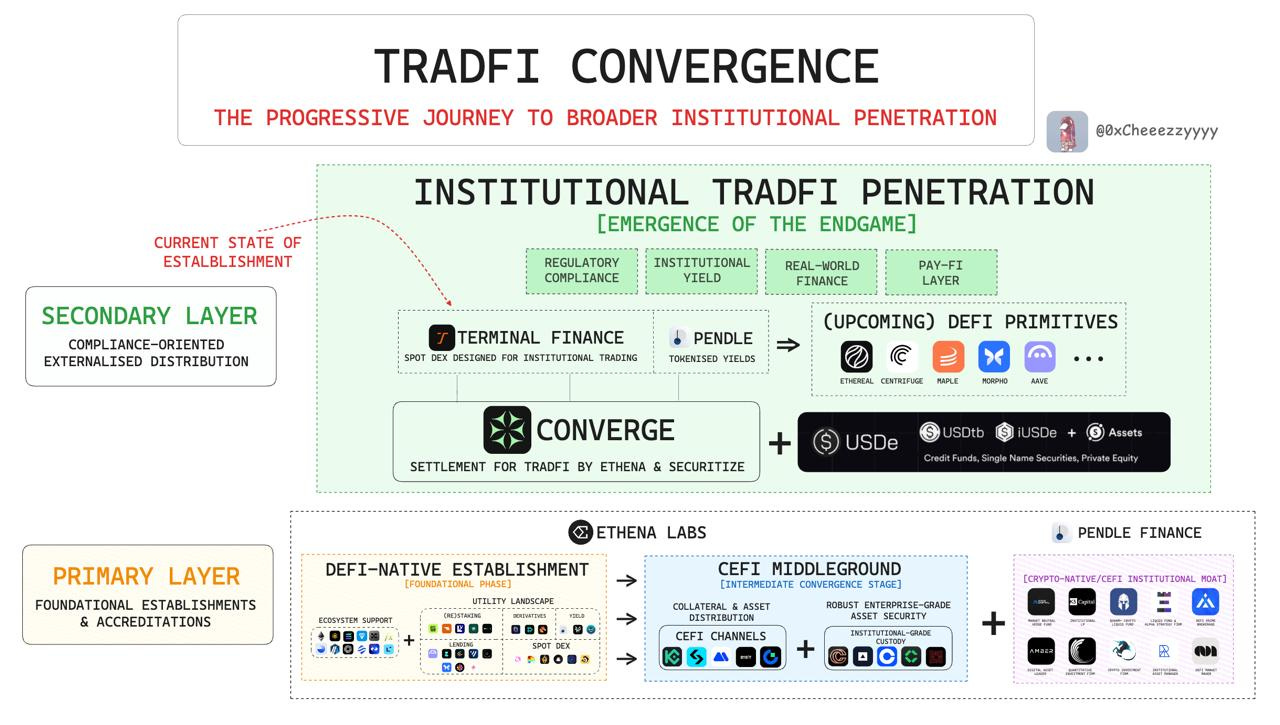

In the legacy system, $PENDLE emissions were determined through manual voting. While functional, historical data analysis reveals this approach was highly inefficient.

Over 50% of emissions were allocated to the 10 least profitable pools. In short, a large portion of emissions was wasted rather than truly “earned”:

This upgrade is expected to reduce overall $PENDLE emissions by ~30% and automate reward distribution, guided by liquidity and trading volume.

Algorithmic Incentive Model (AIM)

The Algorithmic Incentive Model (AIM) allocates emissions based on each pool’s actual contribution to Pendle, measured by:

- Total Value Locked (TVL)

- Swap Fees

AIM abandons a one-size-fits-all incentive structure, recognizing that incentive logic must evolve alongside a pool’s lifecycle.

The resulting system aims to:

Accelerate liquidity growth early on, then progressively shift toward a fee-driven incentive mechanism as pools mature.

Input data uses a 2-week weighted historical average, assigning greater weight to more recent data. For simplicity, we refer to this collectively as “historical data” below.

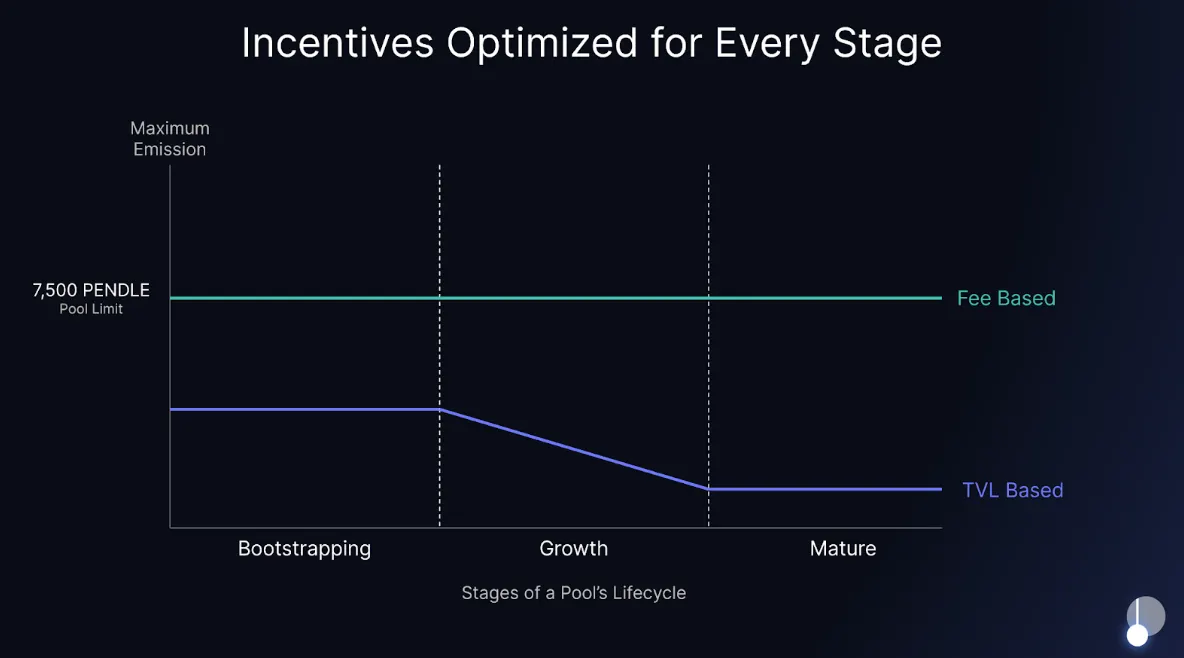

Stage-Tailored Incentives for Protocol Launch Phases

1. Bootstrapping Phase: Building Liquidity

When a new pool launches, insufficient liquidity is its biggest challenge. AIM addresses this by front-loading TVL-based incentives early on, helping pools accelerate critical initial growth.

- A pool’s TVL directly determines its share of emissions.

- In the early stage, each $1 of TVL earns a higher reward.

As the pool matures, TVL-based incentives gradually taper off, requiring pools to rely on fee generation to sustain their reward allocation.

Important note: Fee-based incentives are not constrained by pool age.

Whether Day 1 or Day 100, a pool with strong fee performance can earn up to the per-pool cap of 7,500 $PENDLE solely from fees—ensuring high-performing LPs are rewarded throughout the entire lifecycle.

2. Growth & Maturity Phase: Incentives Based on Real Contribution

Once a pool achieves stable liquidity, incentives shift toward long-term value demonstration.

A truly sustainable pool is not just “idle TVL”, but one that:

- Drives trading activity

- Generates consistent fee revenue for both the protocol and users

To align incentives with sustained contribution, the fee-based incentive cap is set at four times the pool’s historical fee revenue, calculated using time-weighting (for further details on “time-weighting”, please refer to the official documentation). This prevents excessive rewards from one-off trading spikes and ensures incentives reflect stable, ongoing performance.

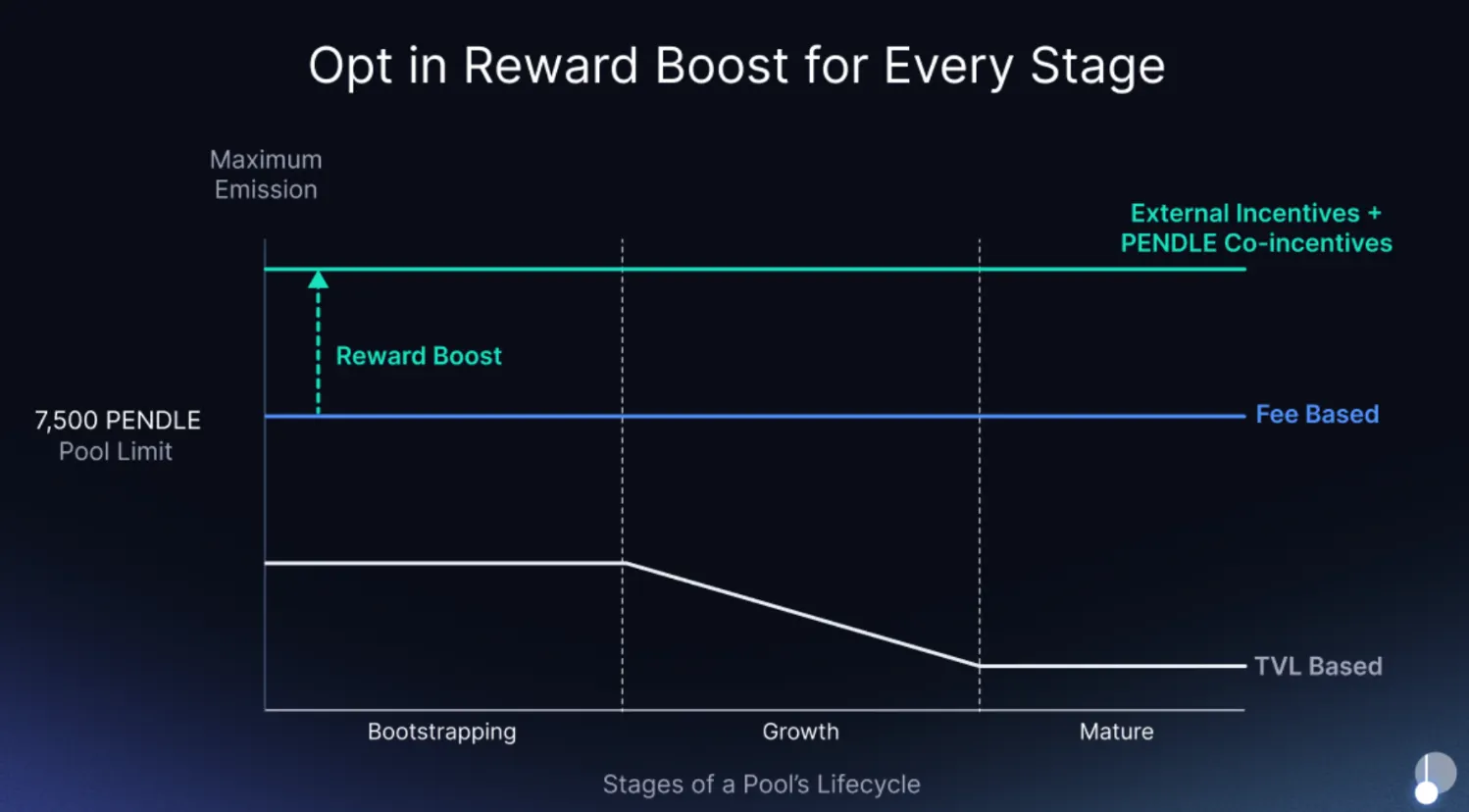

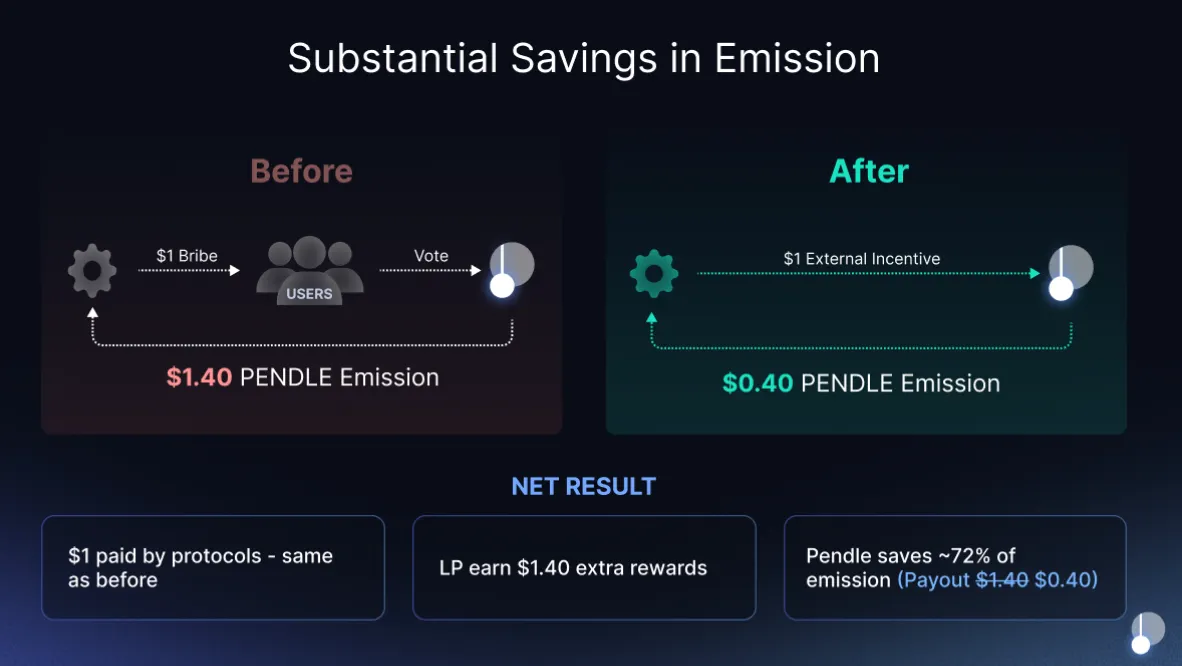

Co-Incentives: Reward Amplification Across All Stages

External protocols can further amplify market rewards by running External Incentive Campaigns (EICs), directly distributing incentives to Pendle LPs or YT holders.

For every $1 invested by an external protocol:

- If the incentive is denominated in $PENDLE → Pendle matches with an additional $0.40 worth of $PENDLE

- If the incentive is denominated in another token → Pendle matches with an additional $0.30 worth of $PENDLE

This means:

Every $1 invested by a protocol can unlock up to $1.40 in total incentives.

This structure substantially reduces $PENDLE emissions while delivering more predictable, up-to-1.4x capital efficiency for protocols.

EICs and co-incentives empower protocols to directly steer their market strategy at any stage:

- Accelerating liquidity at launch

- Driving trading volume during growth

All such enhancements operate on top of AIM’s base allocation.

The weekly total budget for co-incentives is 9,000 $PENDLE (shared across all pools); if demand exceeds this cap, allocations are distributed proportionally.

Conclusion

The Algorithmic Incentive Model (AIM) will officially launch on January 29, 2026, at 00:00 UTC—immediately following the end of the final vePENDLE cycle. Thereafter, pools will automatically receive emissions based on their quantifiable, real-world contributions to Pendle and its users.

By eliminating waste and deploying incentives only where they are most effective, AIM will:

- Reduce Pendle’s operational costs

- Increase overall returns for both the protocol and its users

This marks Phase 1 of incentive-system redesign. As more performance data accumulates, model weights will be continuously refined to further enhance logical soundness and efficiency.

Last year, limit orders generated $23 billion in trading volume—45% of Pendle’s total volume. For high-volume pools like Ethena’s USDe and sUSDe, that share exceeded 90%. Limit orders have been instrumental in enabling smooth execution of large trades—and still hold significant room for efficiency gains.

Phase 2 will maximize limit-order effectiveness through targeted incentives, guiding liquidity into Strategic Liquidity Concentration. Backtesting shows capital efficiency could improve up to 130x.

More details coming soon—stay tuned!

We remain committed to continuous iteration, optimization, and raising the bar—building Pendle into the world’s leading fixed-income infrastructure.

For more information, see the official documentation.

📍Announced parameters represent initial values. Pendle will actively monitor real-world performance and refine and adjust variables as needed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News