Interview with Pendle Co-founder: Yield is the Core Competitiveness, Stablecoins Are the Current Focus

TechFlow Selected TechFlow Selected

Interview with Pendle Co-founder: Yield is the Core Competitiveness, Stablecoins Are the Current Focus

Gain deep insights into the product, market strategy, and future plans behind Pendle's sustainable growth.

Written by: TechFlow

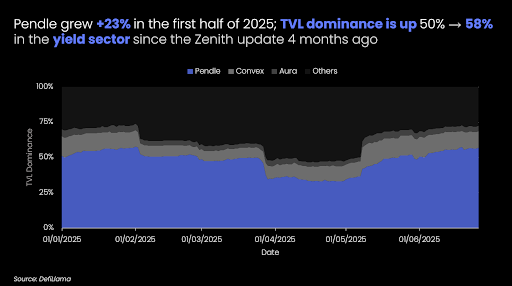

This week, Pendle co-founder TN LEE published a post reviewing Pendle’s key achievements in the first half of 2025:

-

TVL grew by 23%, reaching a new high of $5.29 billion;

-

Over 70,000 new users joined the platform;

-

Trading volume exceeded $16 billion;

-

vePENDLE holders directly benefited from Pendle’s growth, earning $13.1 million in fees…

As the leader in yield trading, Pendle continues to solidify its dominant position with a series of strong growth metrics, capturing over 58% of the market share.

At this pivotal moment—reflecting on H1 achievements and outlining plans for the second half—we engaged in an in-depth conversation with TN LEE to explore the core logic behind Pendle’s success and its future direction.

When asked about the core value that drives user participation behind these impressive numbers,TN LEE responded without hesitation:

Yield. I believe the core competitiveness of any protocol comes from strong and sustainable yield. Advanced strategies across different pools now achieve APYs exceeding triple digits. As the world’s largest yield trading platform, Pendle enables users to freely participate in yield trading from the most popular protocols, allowing them to earn money more intelligently.

Amid the stablecoin boom, many have observed that Pendle’s TVL composition is heavily weighted toward stablecoins, with over 87% denominated in stable assets. On his views about stablecoins,TN LEE said candidly:

The stablecoin sector is currently Pendle’s top focus. For DeFi to continue growing, it must connect with traditional finance. Stablecoins not only drive DeFi toward greater maturity but also serve as one of the few critical bridges linking DeFi with traditional financial systems. Pendle has already launched over 100 stablecoin-based pools. With our accelerated community listing mechanism, we aim to onboard even more stablecoin pools going forward.

In this feature, join us as TN LEE shares deep insights into the product and market strategies powering Pendle’s sustainable growth—and explores what’s next amid the accelerating convergence between on-chain and traditional finance.

DeFi Is Maturing—Users Increasingly Need Yield Trading

TechFlow: We’re delighted to have this opportunity for an in-depth discussion. To begin, could you briefly introduce yourself?

TN LEE:

Thank you for having me, TechFlow.

I’m TN LEE, one of the co-founders of Pendle. My team and I launched the Pendle protocol back in 2021.

TechFlow: From toddlers to octogenarians—how would you explain what Pendle does in just one sentence?

TN LEE:

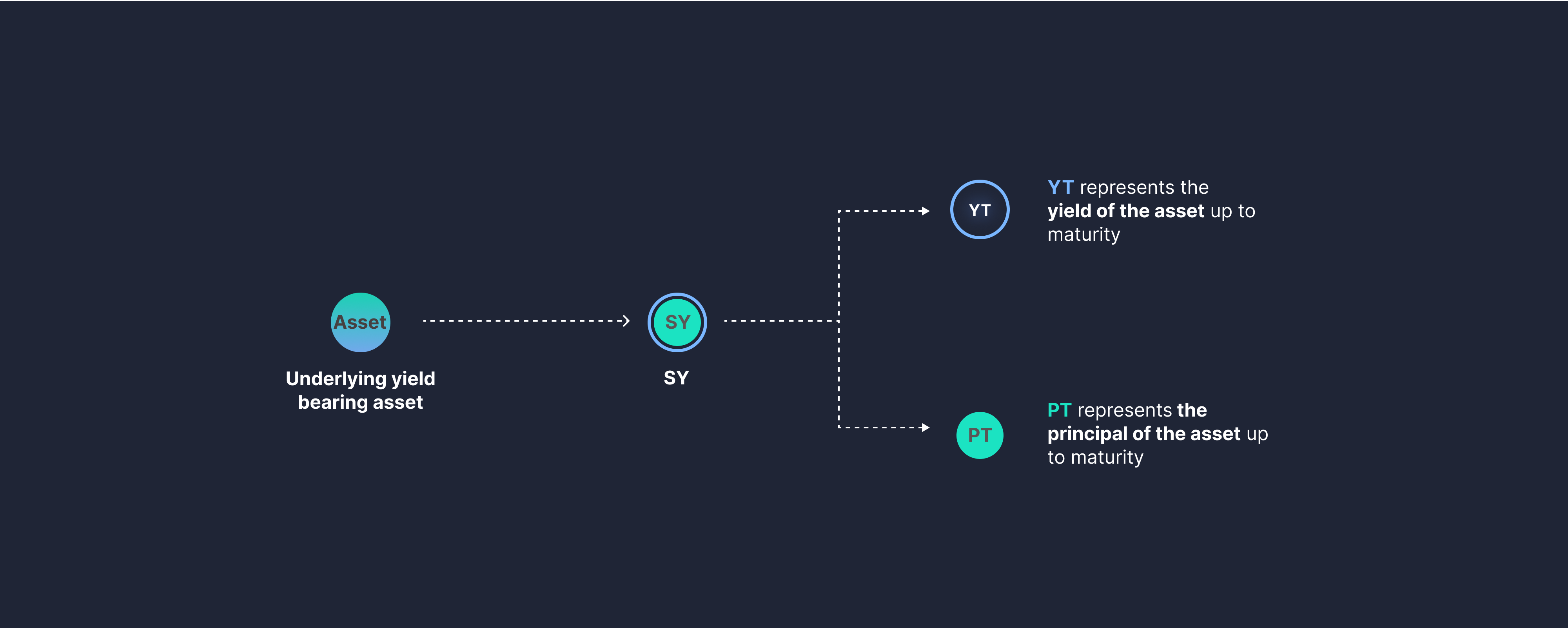

Pendle is the world’s largest yield trading platform. Imagine you own a house—Pendle allows you to separate the “ownership of the house (principal)” from “future rental income (yield).” You can choose to hold the house (the principal portion), or turn the future rent (yield) into a contract and lease it out for cash today—or conversely, buy someone else’s future rent to earn yield.

That’s how Pendle works—splitting assets into PT (Principal Tokens) and YT (Yield Tokens), enabling users to engage with the most popular protocols using investment approaches tailored to their preferences.

TechFlow: In your space, competition has always been limited. Why do you think that is? While yield trading may have a learning curve for average users, Pendle has still risen to become the #1 yield protocol by TVL (per DeFi Llama data). From a product design perspective, what do you think Pendle got right?

TN LEE:

We’ve always had strong conviction in the yield trading space. In traditional finance, nearly 100% of yields are tradable—but in DeFi, only around 3%. This area may have been overlooked before, but as DeFi matures, users increasingly demand more sophisticated investment tools, strategies aligned with individual risk profiles, and greater flexibility.

Rome wasn’t built in a day, and neither was Pendle. Bringing yield trading to DeFi requires highly refined and efficient product design to make the concept practically usable. Before the widely recognized Pendle V2, we went through experimental phases.

Since founding Pendle in 2021, we’ve relentlessly optimized our product and protocol. Our team maintains a mindset of humility toward the market, coupled with unwavering belief and passion for this space, striving to seize opportunities at the right time. The rise of LRTs and points farming gave us our first explosive growth phase.

We’re now accelerating community listings, further advancing toward Permissionless access so users can trade yields from all promising protocols in the ecosystem.

We also expect more protocols will enter this space, collectively increasing the proportion of tradable yield in DeFi—from 10% to 20%, 50%, or beyond.

TechFlow: On social media, we often see DeFi OGs praising Pendle. Some say those who truly master Pendle are mostly financial elites. What’s your take on this? Why do you think this perception exists?

TN LEE:

Experienced users from traditional finance might grasp Pendle more quickly—after all, yield trading is common there. But DeFi adoption takes time, especially when embracing relatively novel and unique models like ours.

But great products speak for themselves, and we’ve invested significantly in community building and education.

At every stage of Pendle’s growth, we’ve seen more and more new users willing to take the time to learn and think critically, investing more rationally.

Meanwhile, we’ll keep improving our product, launching new features, nurturing our community, and expanding educational efforts—so more people can benefit from the advantages of yield trading.

Yield Is the Core Competitiveness—Pendle Enables Triple-Digit APYs

TechFlow: Given what Pendle does, what is the core value that attracts users to participate?

TN LEE:

Yield.

I believe the strongest competitive edge for any protocol lies in powerful and sustainable yield. Through yield trading, Pendle users can freely choose investment methods that match their understanding and risk tolerance, while leveraging various strategies to optimize final returns.

TechFlow: If a complete beginner—someone who’s been in DeFi for less than a month—wants to start exploring Pendle, what would be your recommended first step? After completing that “newbie journey,” could you share what the highest possible yield is in the Pendle ecosystem today? And how can one achieve it?

TN LEE:

For beginners, thoroughly studying Pendle’s educational materials is the most important first step before investing. Once familiar with the processes, users can develop strategies based on their risk appetite and capital size.

Beyond Pendle’s official guides, many skilled KOLs on X regularly share insights—ranging from simple fixed-yield via PT, providing liquidity to pools, speculating on YT, to advanced leveraged PT looping strategies.

While early yields were double-digit, today’s advanced strategies across different pools can achieve APYs exceeding triple digits.

Ultimately, the key for every user—regardless of experience—is finding the strategy that best fits their personal investment style.

Focusing on Stablecoins—Boros Combines CeFi and DeFi Advantages

TechFlow: Stablecoins have become a major topic this year. Recently, Pendle has increased its collaborations around stablecoins. What strategic considerations drive this? Do you have specific plans?

TN LEE:

Following Ethena’s success, stablecoins have emerged in recent years as one of the most popular and increasingly mature sectors.

Pendle has already launched over 100 stablecoin-related pools. Amid current market volatility, we believe stablecoins represent one of the most significant narratives in this cycle. This fiercely contested sector not only promotes greater maturity in DeFi but also serves as one of the few viable bridges to traditional finance.

One of Pendle’s key functions—as the world’s largest yield trading platform—is enabling users to freely participate in yield trading from the most sought-after protocols, helping them earn smarter.

With our accelerated community listing mechanism, we aim to launch even more stablecoin pools in a faster and more efficient manner.

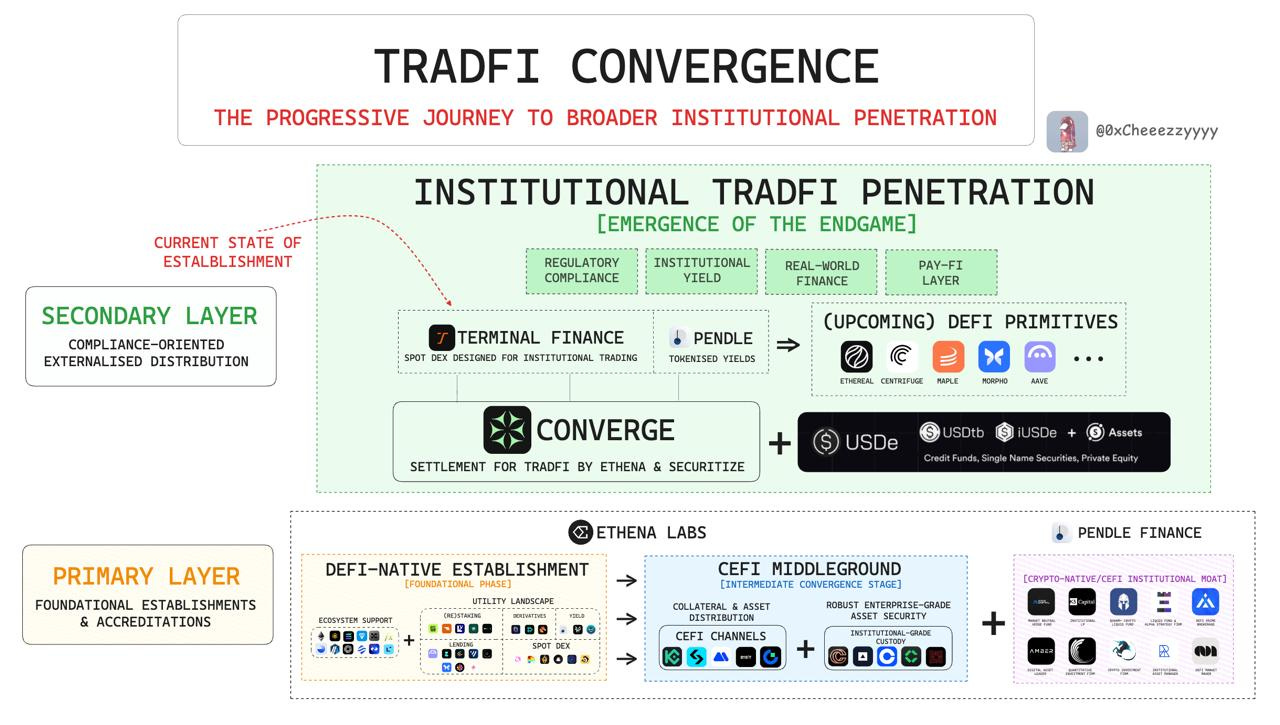

TechFlow: Pendle’s breakout was closely tied to the restaking wave. Entering a new cycle, what do you see as the next catalyst that could drive another explosive growth phase for Pendle? In today’s environment, where more individuals and teams are focusing on on-chain activity, what preparations should crypto-financial projects make to capture institutional onboarding? What industry shifts do you foresee in this trend?

TN LEE:

Right now, our primary focus is stablecoins.

Markets are inherently unpredictable, but our team closely monitors every emerging narrative.

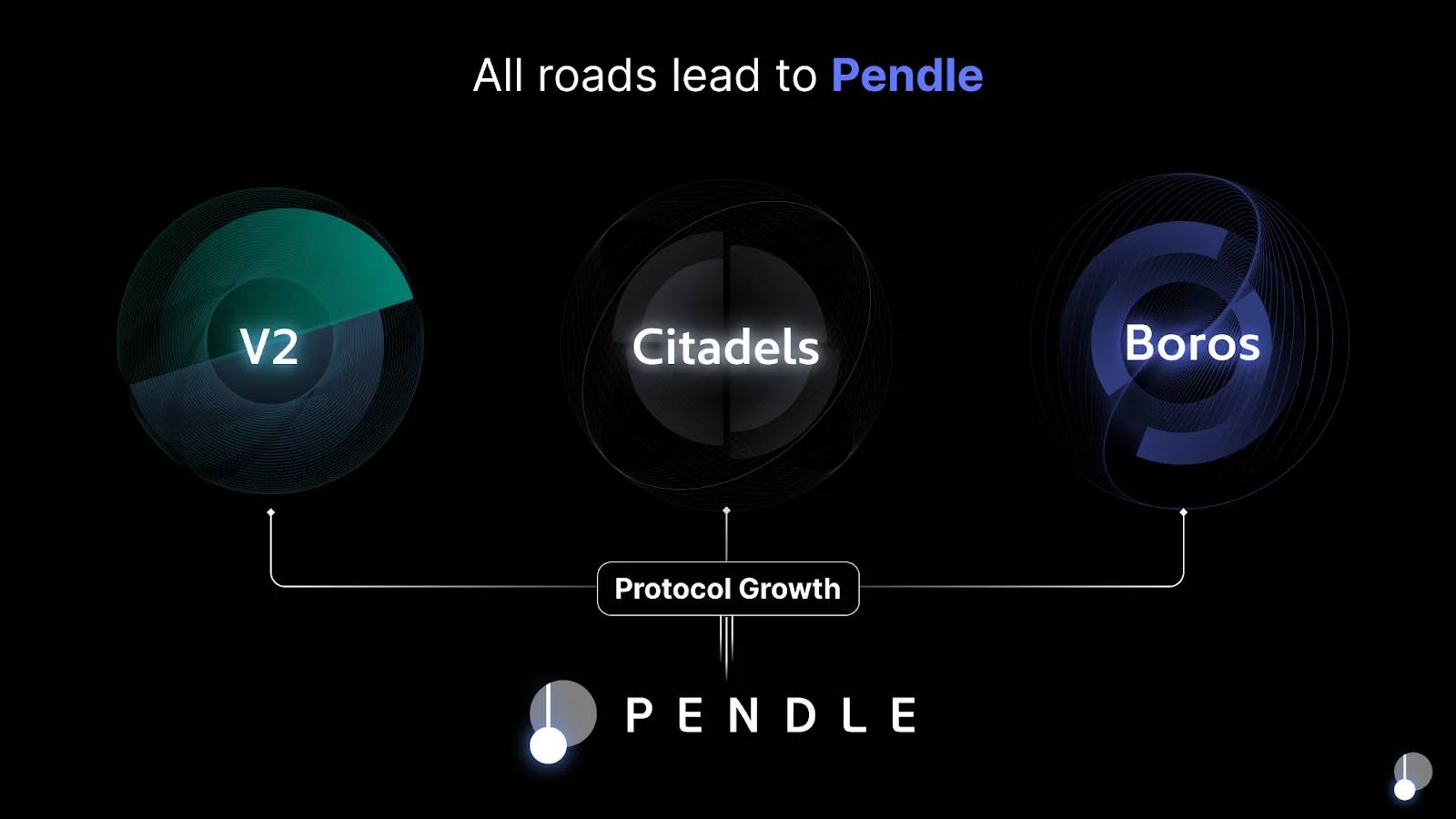

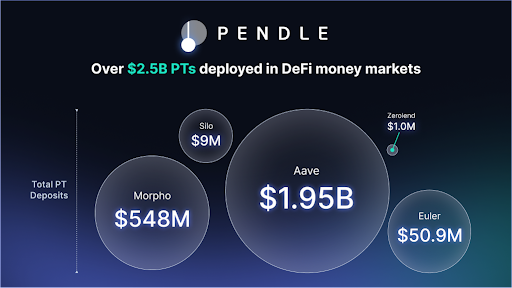

Regarding institutional integration, one of Pendle’s key initiatives in the 2025 roadmap is the Citadels project. This includes our strategic vision for Pendle PT as the most robust fixed-income product—Pendle PT has already reached an ATH of $2.5 billion across major lending ecosystems. We’re actively developing more institutional-grade products to welcome diverse institutional investors.

We believe that for DeFi to sustain long-term growth, integration with traditional finance is essential. Institutional participation raises the bar for DeFi protocols across multiple dimensions—depth of liquidity, security, and compliance—all of which are necessary next steps for any serious protocol.

TechFlow: We heard Boros is undergoing closed beta testing. What kind of product is it?

TN LEE:

In short, Boros—like Pendle—is a yield trading product.

Boros’ biggest innovation is combining the strengths of CeFi and DeFi, unlocking funding rates as a yield source and offering users a dedicated trading platform. The volatility and reliability of funding rates make them one of the largest sources of yield in crypto.

Boros will also be simpler to understand: if users believe funding rates will rise, they go long; if they expect a drop, they go short.

We’re currently finalizing smart contract audits and internal testing, and hope to open access to more users soon.

Behind the Growth: Unwavering DeFi Belief, Hunger, and Adaptability

TechFlow: From a macroeconomic standpoint—considering tariffs, interest rate cuts, etc.—are you concerned about DeFi’s future, or more confident? What keeps you committed to building in this space?

TN LEE:

I’ve always had strong faith in DeFi.

During times of market and political uncertainty, we naturally exercise greater caution. But my team and I firmly believe yield trading is a crucial frontier for DeFi’s evolution, and we remain highly optimistic about our growth trajectory.

DeFi cycles come and go—shiny things appear and fade. I believe that as long as our PMF (product-market fit) is solid, and we maintain relentless momentum and respect for the market, Pendle will continue growing steadily.

Anxiety won’t change market movements. All we can do is stay grounded, adapt our mindset flexibly, and proactively face every future challenge.

TechFlow: Sometimes early Pendle observers say it hasn’t been easy getting here. Despite past hardships, you’ve persevered and now shine brightly. Could you share some of the challenges Pendle faced during its journey, and your reflections at different stages?

TN LEE:

Indeed, from founding Pendle in 2021 to today, we’ve faced countless tests. We understand that different growth stages bring different challenges—from surviving as a new protocol to maintaining excellence as a mature one. There’s no room for complacency. During Pendle’s toughest periods, I often wondered how we made it through—especially during extremely harsh market conditions.

Today, launching a protocol is cheaper than ever—almost anyone can start a company. But what matters more than difficulty is problem-solving ability—not everyone can endure and survive. Sometimes it’s not about complexity, but about maintaining the right mindset to confront adversity head-on.

Pendle has maintained a lean team structure and strict cost discipline, ensuring we retain sufficient capital to support our future growth.

TechFlow: As a DeFi OG and a builder who’s stayed committed throughout, what qualities do you believe are most essential for entrepreneurship in crypto?

TN LEE:

Persistence.

When Pendle first launched in 2021, we didn’t immediately find PMF. It took us over two years of iteration until Pendle V2 gained real traction during the early LST phase. But beyond individual traits, I believe the key is embedding this persistence into the entire team’s DNA—maintaining hunger, pursuing excellence, and moving forward together toward a shared mission. Only then can we remain unstoppable.

Another crucial quality in crypto is adaptability. The industry moves incredibly fast, with its own unique rules, rhythms, and culture. The ability to pivot quickly—whether optimizing products based on current narratives or adjusting market strategies to resonate with crypto-native users—often makes the difference between success and failure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News