Pendle's new product,利好 for ENA?

TechFlow Selected TechFlow Selected

Pendle's new product,利好 for ENA?

Is Boros actually a potential hedging powerhouse? Which other protocols will pay for it?

Author: Alex Liu, Foresight News

PENDLE's token price has recently shown strong momentum, reaching a nearly seven-month high. Beyond the solid fundamentals of Pendle V2 itself, the market sees Boros—the team’s latest product developed over two years—as the next growth catalyst. (For more on Pendle itself, recommended reading: Pendle Is Hard to Understand, But Not Understanding It Is Your Loss)

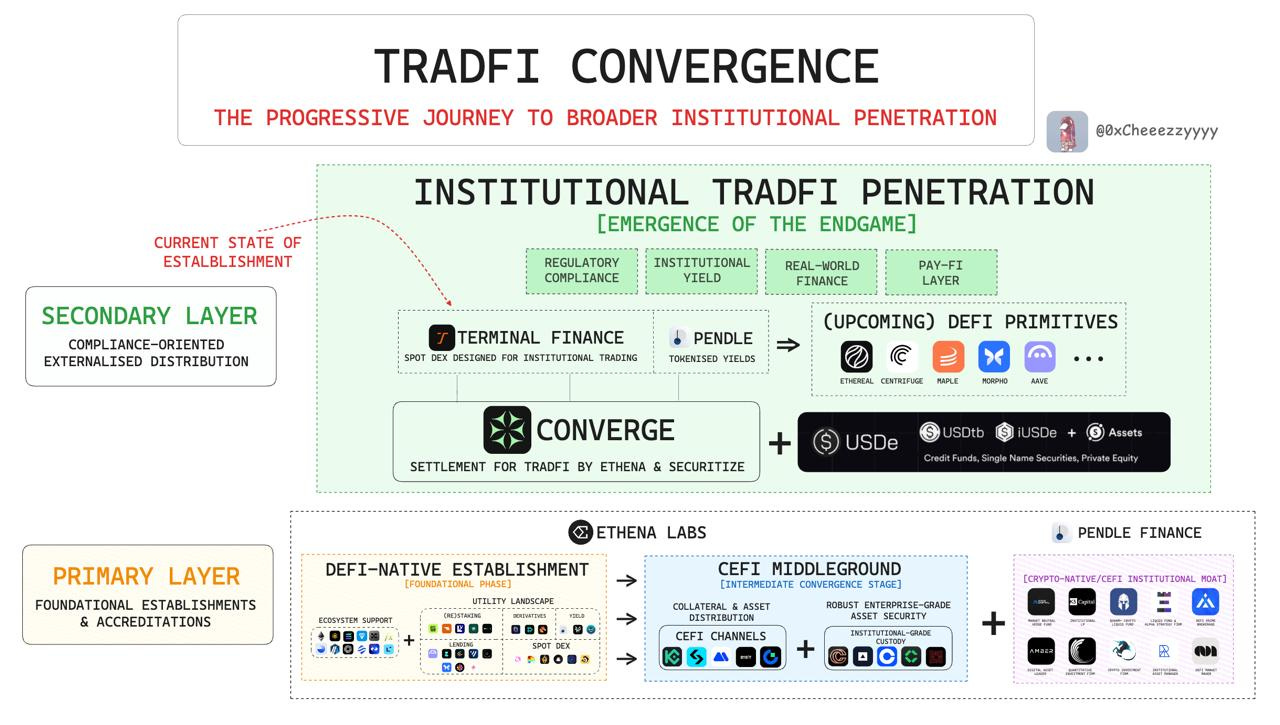

Boros enables traders to go long or short on funding rates. The author believes that beyond serving as a speculative tool, it is also a potential "hedging powerhouse," benefiting third-party protocols such as Ethena and Neutrl.

In other words, Pendle’s new product will benefit ENA. To fully understand the cause and effect, we must first clarify: what exactly is a funding rate?

Funding Rate

Funding fees arise in perpetual contract trading to prevent significant divergence between contract prices and spot prices. When long positions outnumber short positions, the contract price exceeds the spot price, resulting in a positive funding rate—longs must pay shorts a fee at regular intervals (typically every 1–8 hours). Conversely, when short positions outnumber longs, shorts pay the funding fee to longs.

The funding rate reflects market sentiment. For example, a negative funding rate (i.e., shorts paying longs) indicates bearish market outlook. Notably, when market sentiment is neutral, the funding rate tends to be positive because longs usually outnumber shorts.

Ethena’s Mechanism and Pain Points

The primary revenue source for Ethena’s synthetic dollar stablecoin is “funding rate arbitrage.” For instance, Ethena uses part of users’ deposited stablecoins to purchase and stake ETH, while simultaneously opening an equivalent short position on exchanges. This offsets gains and losses between spot and derivatives, achieving risk neutrality (returns independent of price fluctuations).

In this scenario, the spot ETH position earns approximately 3% annualized staking yield, and under neutral or bullish sentiment, the short perpetual position continuously collects funding fees paid by longs. Leveraging these combined returns, Ethena’s sUSDe delivered over 10% annual returns during the steady bull run of 2024, offering attractive risk-adjusted yields.

The flaw in this model is evident: during bear markets, when shorts must pay funding fees, Ethena incurs losses and must halt the strategy, withdrawing capital to safer but lower-yielding protocols like Sky. For example, sUSDe’s APY dropped from 12% two weeks ago to below 5% following last week’s market correction.

If Ethena could short funding rates when they are high—effectively hedging the funding rate exposure—it could lock in its high APY, solving this pain point decisively.

And isn’t shorting funding rates exactly what Boros offers?

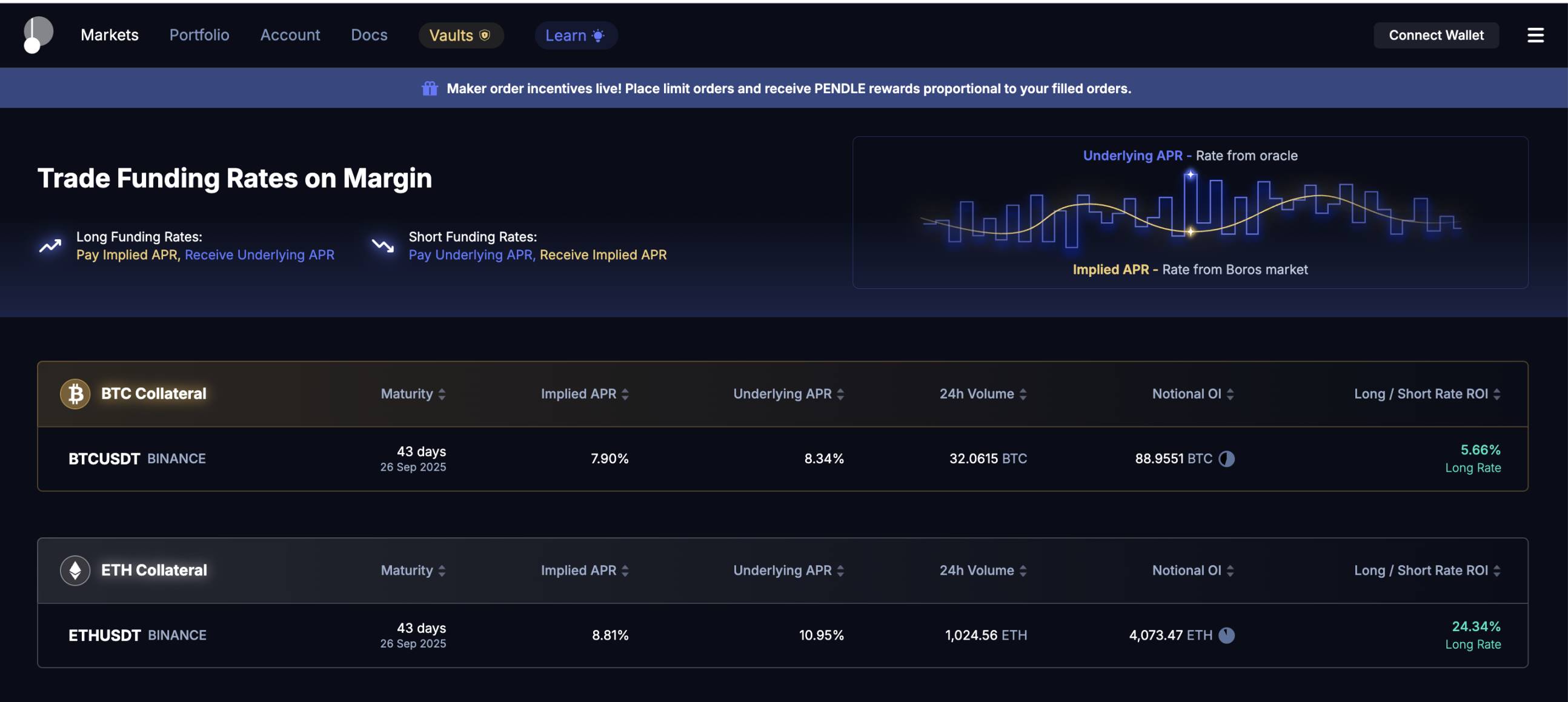

How Boros Works

Boros abstracts the funding fees that a unit of underlying asset will generate over a period in a perpetual exchange into a Yield Unit (YU). Users who expect funding rates to rise go long YUs; those expecting them to fall go short YUs. Positions require collateral, making the mechanism straightforward.

Let’s introduce a few terms. The current market price of the traded funding rate is called the Implied APR (implied annual rate), while the actual annualized funding rate is the Underlying APR. Going long YUs means committing to pay a fixed funding rate based on the Implied APR at entry, while receiving the variable actual funding fees based on the fluctuating Underlying APR. Going short YUs is the reverse.

Thus, Ethena can simply short YUs corresponding to its short perpetual positions when funding rates are relatively high, locking in desirable funding income.

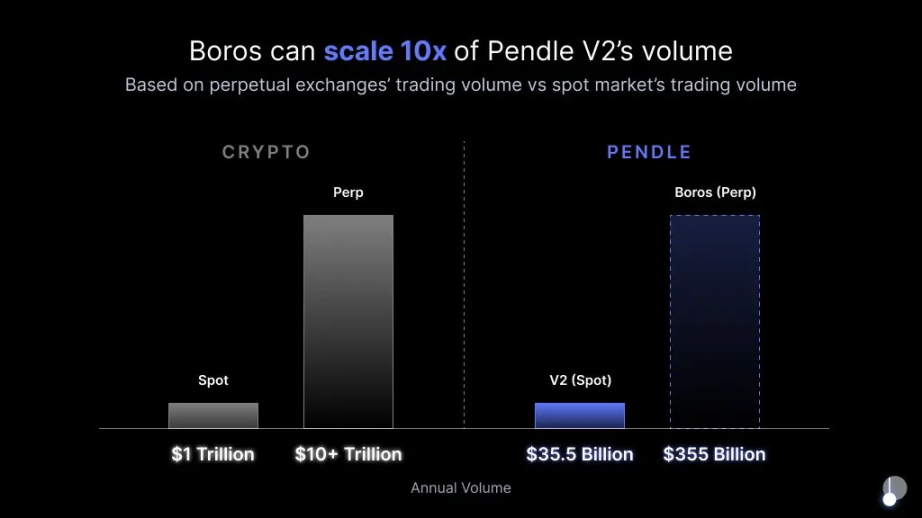

Boros has shown impressive early data, achieving $15 million in open interest and $36 million in notional trading volume on its first day. The Pendle team holds high hopes for its potential, believing it could reach 10x the trading volume of its flagship product Pendle V2, given that perpetual trading volume in crypto already exceeds spot volume by over 10x—and Pendle V2 and Boros mirror this spot-versus-perpetual relationship.

Neutrl, Another Potential Client

Boros’ ability to short funding fees makes it a powerful hedging tool. Besides Ethena, which other protocols might adopt it?

Consider Neutrl. Neutrl is another synthetic dollar stablecoin protocol currently in closed testing, with total value locked exceeding $50 million. Its revenue model involves purchasing locked tokens at OTC discounts, then hedging by shorting equivalent amounts of the same tokens, thus capturing OTC discount arbitrage. (For more on Neutrl, recommended reading: Quick Look at Neutrl: You Deposit Stablecoins, I’ll Help You Short VC Tokens)

One of Neutrl’s biggest risks is uncontrollable funding rates—extreme rates during volatile conditions could lead to losses. Here again, Boros finds its PMF (product-market fit).

Current Limitations of Boros

Boros is newly launched and still in its earliest stages, facing many limitations. Many of the use cases discussed above remain theoretical, awaiting Boros’ further development to turn these potential clients into reality.

First is scale. Ethena’s short positions exceed several billion dollars, making it a prime potential client. However, whether Boros’ funding rate perpetual market can provide sufficient liquidity to absorb such volume remains to be seen.

Second is asset coverage. Currently, Boros only supports funding rates for BTC and ETH. While Ethena focuses on major assets, turning Neutrl into a client would require supporting more “VC” tokens and ensuring adequate liquidity for relatively obscure assets.

Conclusion

Boros undoubtedly faces many limitations at launch, but its underlying design opens vast possibilities for future applications. Wherever there is opportunity, there will be volume; wherever there is volume, there will be fees.

Pendle’s new product benefits ENA. As it creates synergies with third-party protocols and drives massive trading volume, protocol fees will flow back to Pendle. Pendle’s new product aims to become foundational DeFi infrastructure, benefiting various related protocols and ultimately boosting the PENDLE token.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News